Market Overview:

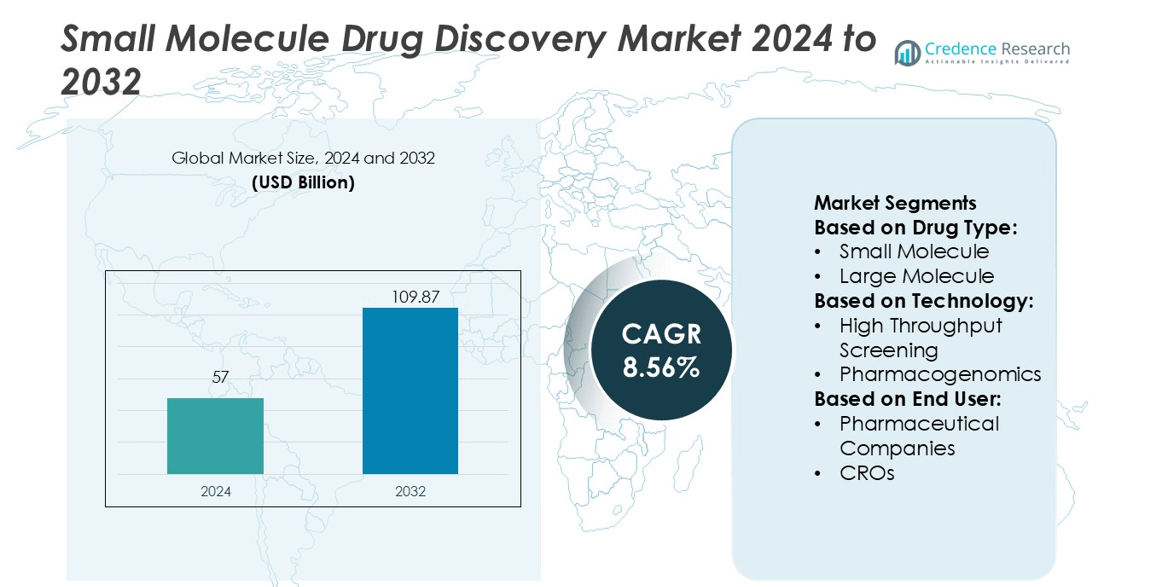

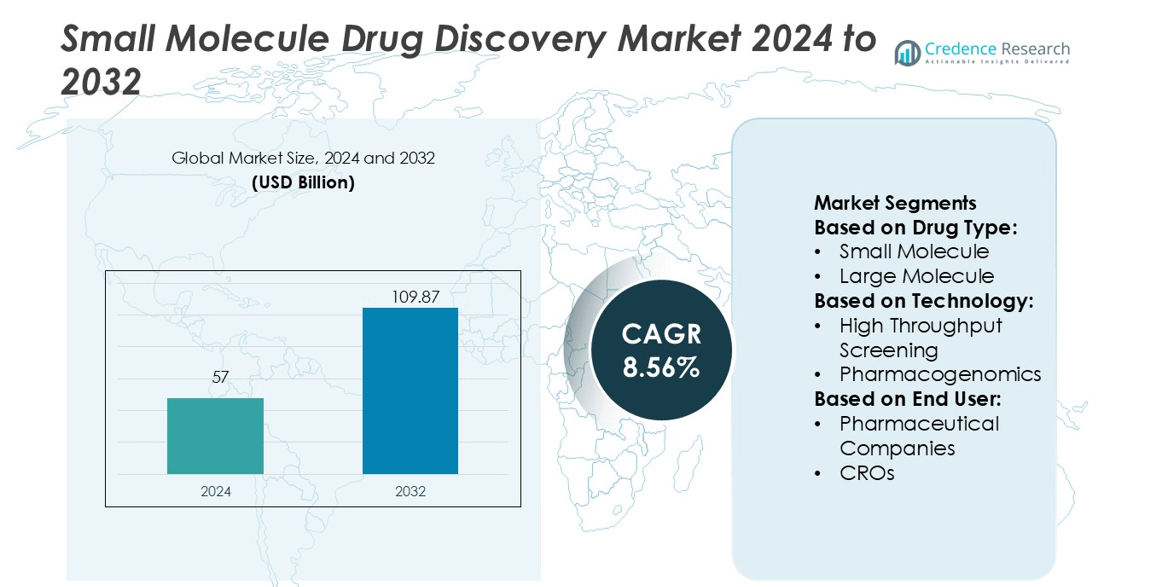

Small Molecule Drug Discovery Market size was valued USD 57 billion in 2024 and is anticipated to reach USD 109.87 billion by 2032, at a CAGR of 8.56% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Small Molecule Drug Discovery Market Size 2024 |

USD 57 billion |

| Small Molecule Drug Discovery Market, CAGR |

8.56% |

| Small Molecule Drug Discovery Market Size 2032 |

USD 109.87 billion |

The Small Molecule Drug Discovery Market is driven by leading players such as AstraZeneca, F. Hoffmann-La Roche Ltd, PTC Therapeutics, Inc., LES LABORATOIRES SERVIER, Ribometrix, Arrakis Therapeutics, Expansion Therapeutics, Skyhawk Therapeutics, Anima Biotech Inc., and Epics Therapeutics. These companies focus on AI-driven molecular modeling, RNA-targeted therapies, and advanced screening technologies to accelerate discovery efficiency. AstraZeneca and Roche lead global portfolios through strategic investments in oncology and cardiovascular drugs, while emerging biotechs drive innovation in RNA modulation and structure-guided design. North America leads the market with a 38% share, supported by strong research infrastructure, high R&D investments, and early adoption of digital drug discovery tools.

Market Insights

- The Small Molecule Drug Discovery Market was valued at USD 57 billion in 2024 and is projected to reach USD 109.87 billion by 2032, growing at a CAGR of 8.56%.

- Growing prevalence of chronic diseases and rising demand for targeted therapies drive continuous innovation and investment in small molecule R&D.

- Increasing adoption of AI-based screening, automation, and computational chemistry accelerates discovery processes and enhances molecular precision.

- Key players focus on expanding oncology and RNA-targeted drug pipelines, while partnerships and acquisitions strengthen their global competitiveness.

- North America dominates with a 38% share, followed by Europe at 29%, supported by strong research networks; the small molecule segment leads by drug type with a 67% share, driven by its cost efficiency and high cell permeability advantages.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Drug Type

The small molecule segment dominates the Small Molecule Drug Discovery Market with a 67% share. Its dominance stems from ease of synthesis, oral bioavailability, and lower production costs compared to large molecules. Small molecules also exhibit high cell permeability and target specificity, driving widespread use in oncology and cardiovascular therapies. Continuous advancements in computational chemistry and structure-based design enhance discovery efficiency. The large molecule segment, though smaller, is gaining momentum due to its role in precision medicine and biologics development.

- For instance, Roche’s internal review found that from 2009 to 2020, the combined research organisations at Roche and its subsidiary Genentech, Inc. generated more than 2,000 small-molecule lead series across high-throughput screening, fragment-based design, DNA-encoded library and structure-based methods.

By Technology

High Throughput Screening (HTS) holds the largest market share at 42% within the technology segment. HTS accelerates compound identification through automation and miniaturization, significantly reducing discovery time. Its integration with AI-driven predictive modeling and advanced robotics enhances hit identification accuracy. Pharmaceutical firms invest heavily in HTS platforms to boost pipeline efficiency and reduce attrition rates. Other technologies such as combinatorial chemistry and pharmacogenomics support personalized therapy design and drug-target validation, strengthening the overall drug discovery ecosystem.

- For instance, Expansion Therapeutics leverages its proprietary RNA-targeting small molecule platform that has executed over 25 separate RNA-target screening campaigns to date, each of which processed libraries of more than 1,000 unique small-molecule scaffolds drawn from its internal chemistry collections.

By End User

Pharmaceutical companies lead the market with a 59% share in the end-user segment. Their dominance results from large-scale R&D investments, robust drug pipelines, and adoption of AI and machine learning in discovery workflows. These companies utilize integrated platforms to streamline lead identification and clinical translation. Contract Research Organizations (CROs) follow closely, offering cost-effective outsourcing options and specialized discovery services. The “Others” category, including academic institutions and biotech firms, contributes to innovation through early-stage research collaborations and advanced screening methodologies.

Key Growth Drivers

Increasing Prevalence of Chronic and Infectious Diseases

The rising burden of chronic illnesses such as cancer, cardiovascular diseases, and diabetes significantly drives small molecule drug discovery. These drugs offer targeted mechanisms of action, enabling effective disease management and faster clinical translation. Their ability to penetrate cell membranes and modulate intracellular pathways enhances therapeutic outcomes. Continuous demand for oral and cost-effective treatments further supports research funding and clinical trials. Pharmaceutical companies are expanding small molecule pipelines to address growing unmet medical needs across oncology and metabolic disorders.

- For instance, Skyhawk’s investigational oral small molecule SKY‑0515, developed via its proprietary SkySTAR® RNA-splicing platform, achieved a 62 % reduction in mutant huntingtin (mHTT) protein at Day 84 with a 9 mg dose in its Phase 1 study.

Advancements in Computational and AI-Driven Drug Design

The integration of artificial intelligence, molecular modeling, and computational chemistry has transformed small molecule discovery. AI algorithms accelerate hit identification, predict compound toxicity, and optimize molecular structures, cutting discovery time and cost. Companies leverage deep learning models to analyze large chemical datasets and identify promising candidates early in the pipeline. This technological evolution improves precision in target validation and compound screening, driving higher R&D productivity. Collaborative partnerships between pharma firms and AI technology providers are further amplifying innovation in drug design.

- For instance, AstraZeneca reports that more than 90% of its small‑molecule discovery pipeline is now AI‑assisted, enabling faster candidate selection.

Expanding Investment in R&D and Precision Medicine

Growing global R&D expenditure and precision medicine initiatives strengthen small molecule research. Governments and private investors support the development of targeted therapies addressing genetic and molecular disease variations. Precision medicine enables customization of small molecules for specific patient profiles, improving efficacy and reducing adverse effects. Pharmaceutical companies are prioritizing research in oncology, neurology, and immunology, where targeted small molecules show strong clinical success. This strategic investment landscape accelerates drug approvals and commercial expansion across major therapeutic areas.

Key Trends & Opportunities

Rising Adoption of High-Throughput Screening and Automation

Automation and high-throughput screening technologies are streamlining early drug discovery processes. These systems enable rapid testing of thousands of compounds against biological targets, reducing manual intervention and increasing data accuracy. Integration with AI and cloud platforms enhances analysis efficiency and decision-making speed. Pharmaceutical firms are adopting automated laboratories to improve productivity and shorten development timelines. This shift toward digital and robotic systems offers significant opportunities for innovation and competitive differentiation in drug discovery.

- For instance, Servier’s platform enabled analysis of nearly 200 molecules in parallel within two hours, compared to previous week‑long timelines for equivalent throughput.

Emergence of Fragment-Based and Structure-Guided Drug Design

Fragment-based and structure-guided methods are gaining traction as efficient approaches for small molecule optimization. These techniques allow researchers to identify and assemble small fragments binding to target sites, improving compound selectivity and potency. Advances in X-ray crystallography and cryo-electron microscopy enable visualization of drug-target interactions at the atomic level. The trend supports rational drug design, reducing trial-and-error approaches. Pharmaceutical companies increasingly integrate these methods into pipelines to enhance discovery accuracy and reduce development costs.

- For instance, PTC518, where a dosing of 10 mg achieved a 43% reduction in mutant huntingtin (mHTT) protein in a Phase 2 trial after 12 months of treatment.

Growing Collaboration Between Pharma and CROs

Strategic partnerships between pharmaceutical companies and Contract Research Organizations (CROs) are increasing to optimize discovery efficiency. CROs offer specialized expertise, advanced screening technologies, and cost-effective R&D support. This collaboration model allows pharma firms to focus on core activities like late-stage development and commercialization. The growing outsourcing trend expands global access to innovation and accelerates time-to-market for small molecule drugs. Emerging markets with skilled scientific talent are becoming key outsourcing hubs in this evolving ecosystem.

Key Challenges

High Attrition Rates in Drug Development

Small molecule drug discovery faces persistent challenges from high attrition rates during preclinical and clinical stages. Many promising compounds fail due to poor bioavailability, safety issues, or lack of efficacy. The complex nature of disease pathways increases the difficulty of identifying viable drug candidates. This inefficiency results in substantial financial losses and prolonged development timelines. To mitigate these risks, companies are integrating predictive toxicology and early pharmacokinetic modeling to improve candidate selection and reduce late-stage failures.

Rising Regulatory and Compliance Complexities

Stringent global regulatory requirements create significant barriers for small molecule development and approval. Agencies demand extensive safety, efficacy, and quality data, increasing time and cost burdens. Frequent changes in guidelines across regions further complicate global market access. Compliance with Good Manufacturing Practices (GMP) and data integrity standards also adds operational strain. Pharmaceutical companies must adopt advanced documentation and digital quality management systems to streamline regulatory submissions and maintain compliance in an increasingly complex global environment.

Regional Analysis

North America

North America dominates the Small Molecule Drug Discovery Market with a 38% share. The region benefits from strong pharmaceutical R&D infrastructure, high healthcare spending, and the presence of major players such as Pfizer, Merck, and Eli Lilly. The U.S. leads with advanced drug design technologies, extensive clinical trial networks, and early adoption of AI-driven discovery platforms. Supportive government initiatives and FDA regulatory efficiency accelerate new drug approvals. Continuous investments in oncology and neurological disorder research further strengthen North America’s position as the global innovation hub for small molecule development.

Europe

Europe holds a 29% share of the Small Molecule Drug Discovery Market, supported by robust biotechnology ecosystems and strong academic-industry collaborations. Countries like Germany, the U.K., and Switzerland are leading contributors, driven by precision medicine research and advanced chemical synthesis technologies. The European Medicines Agency (EMA) provides a well-defined framework that encourages innovation while ensuring drug safety. Increasing adoption of digital drug discovery tools and sustainable manufacturing practices also boost growth. Collaborative R&D projects under Horizon Europe programs enhance competitiveness and accelerate new molecule development across therapeutic areas.

Asia-Pacific

Asia-Pacific accounts for a 24% market share and is the fastest-growing region in the Small Molecule Drug Discovery Market. Rapid expansion of pharmaceutical manufacturing, supportive government funding, and cost-effective clinical trials drive regional momentum. China, India, and Japan lead in research outsourcing, AI-based compound screening, and bioscience innovation. Local companies are forming partnerships with global firms to access cutting-edge discovery platforms. Rising healthcare expenditure and a growing prevalence of chronic diseases increase demand for affordable small molecule therapies. The region’s strong scientific workforce and expanding CRO networks sustain long-term market growth.

Latin America

Latin America captures a 6% share in the global Small Molecule Drug Discovery Market. The region is witnessing steady progress through increased R&D investments and collaboration with multinational pharmaceutical companies. Brazil and Mexico dominate due to improvements in healthcare infrastructure and favorable regulatory reforms. Local universities and biotech startups are contributing to early-stage discovery research. Government initiatives promoting clinical trials and pharmaceutical innovation enhance market potential. Despite funding limitations, the growing burden of chronic diseases continues to drive demand for cost-effective small molecule treatments in the region.

Middle East & Africa

The Middle East & Africa region holds a 3% market share, characterized by emerging pharmaceutical research capabilities and expanding healthcare access. Countries such as the UAE, Saudi Arabia, and South Africa are investing in biotechnology parks and innovation hubs. Partnerships with global pharmaceutical companies are improving local R&D efficiency and drug development expertise. Increasing government focus on non-communicable diseases and healthcare modernization supports small molecule demand. However, limited research infrastructure and funding remain challenges. Ongoing investments in digital health and clinical research collaborations are expected to improve regional competitiveness.

Market Segmentations:

By Drug Type:

- Small Molecule

- Large Molecule

By Technology:

- High Throughput Screening

- Pharmacogenomics

By End User:

- Pharmaceutical Companies

- CROs

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Small Molecule Drug Discovery Market features key players such as Ribometrix, F. Hoffmann-La Roche Ltd, Expansion Therapeutics, Skyhawk Therapeutics, AstraZeneca, LES LABORATOIRES SERVIER, Arrakis Therapeutics, PTC Therapeutics, Inc., Anima Biotech Inc., and Epics Therapeutics. The Small Molecule Drug Discovery Market is defined by rapid technological advancement, strategic partnerships, and a strong focus on innovation. Companies are increasingly investing in AI-driven molecular design, high-throughput screening, and structure-based drug discovery to accelerate lead identification and optimization. The adoption of computational modeling and machine learning enhances predictive accuracy, reducing development timelines and costs. Collaboration between pharmaceutical firms, biotech startups, and research institutions fosters shared expertise and access to advanced screening tools. Additionally, growing emphasis on RNA-targeted drug discovery, precision therapeutics, and automation is reshaping competitive strategies, enabling faster translation of research into clinical success.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Ribometrix

- Hoffmann-La Roche Ltd

- Expansion Therapeutics

- Skyhawk Therapeutics

- AstraZeneca

- LES LABORATOIRES SERVIER

- Arrakis Therapeutics

- PTC Therapeutics, Inc.

- Anima Biotech Inc.

- Epics Therapeutics

Recent Developments

- In March 2025, Arrakis Therapeutics presented preclinical data for its RNA-targeted small molecule drug program for the treatment of myotonic dystrophy type 1 (DM1) at the Muscular Dystrophy Association (MDA) conference in Dallas, Texas.

- In March 2025, Syngene International Limited mentioned acquiring its first biologics site in the USA, which includes several manufacturing lines for monoclonal antibodies (mAbs). The site was purchased from Emergent Manufacturing Operations in Baltimore, enhancing Syngene’s expanding global presence in the biologics sector and allowing the company to better serve clients in the human and animal health markets.

- In October 2024, Anima Biotech announced its machine learning platform, Lightning, which identifies mRNA drug targets and screens for potential small molecule therapies. The company had identified 20 therapeutic candidates across various disease areas.

- In October 2024, Samsung Biologics announced the launch of a high-concentration formulation platform to support the development and manufacturing of high-dose biopharmaceuticals. S-HiConTM can identify unintended pH changes, reduce viscosity, enhance efficacy, enhance formulation stability, and maximize drug delivery

Report Coverage

The research report offers an in-depth analysis based on Drug Type, Technology, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will continue to expand with growing adoption of AI and machine learning in drug design.

- Pharmaceutical companies will increase investments in RNA-targeted small molecule therapeutics.

- Advancements in computational modeling will accelerate lead optimization and screening efficiency.

- Precision medicine will drive development of personalized small molecule treatments.

- Strategic collaborations between pharma and biotech firms will enhance innovation pipelines.

- High-throughput screening and automation technologies will reduce discovery timelines.

- Expansion into rare and orphan disease research will open new therapeutic opportunities.

- Regulatory support for accelerated drug approvals will strengthen market growth.

- Integration of cloud-based platforms will improve data sharing and collaboration in discovery processes.

- Continued focus on sustainability and green chemistry will shape future manufacturing practices.