Market Overview:

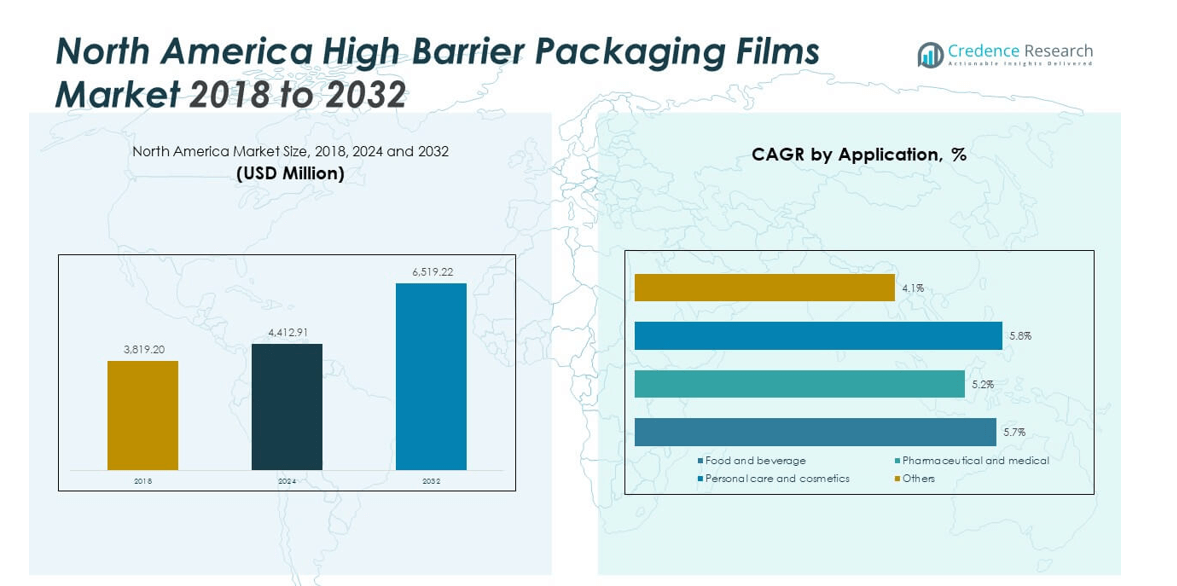

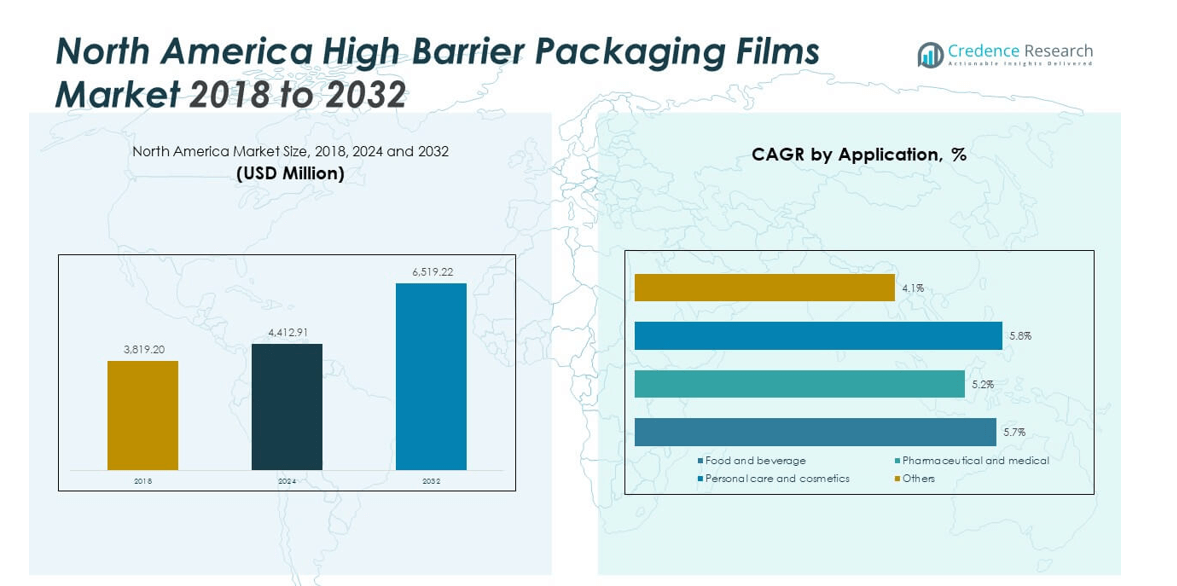

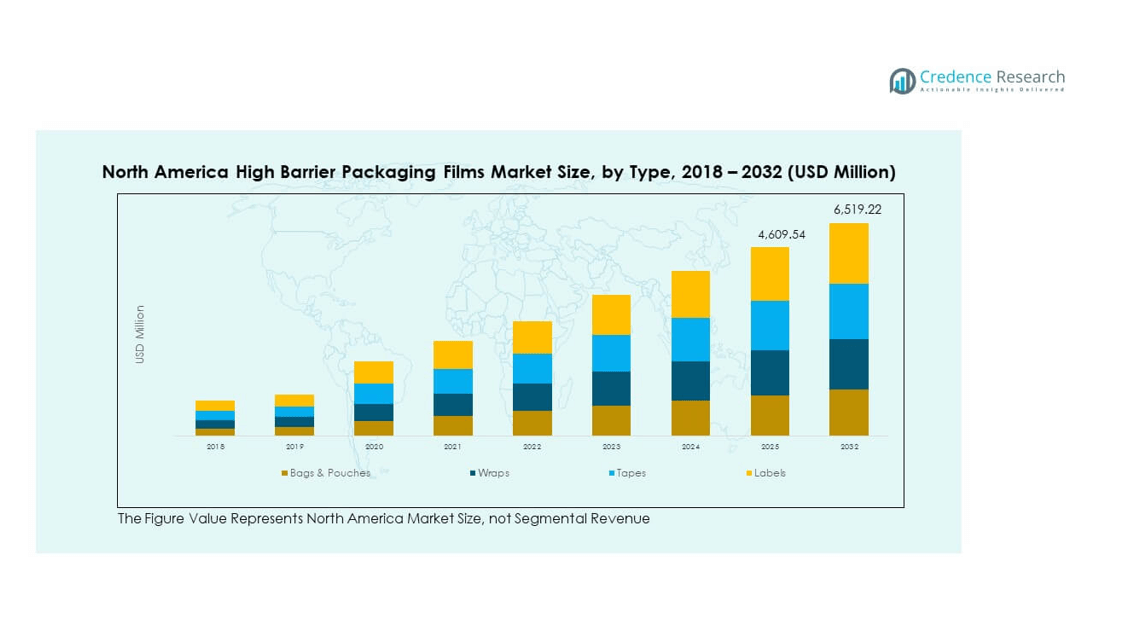

The North America High Barrier Packaging Films Market size was valued at USD 3,819.20 million in 2018 to USD 4,412.91 million in 2024 and is anticipated to reach USD 6,519.22 million by 2032, at a CAGR of 4.95% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| North America High Barrier Packaging Films Market Size 2024 |

USD 4,412.91 million |

| North America High Barrier Packaging Films Market, CAGR |

4.95% |

| North America High Barrier Packaging Films Market Size 2032 |

USD 6,519.22 million |

The market is expanding due to rising demand for extended shelf life and food safety. Growing consumer preference for convenient, ready-to-eat meals drives the need for packaging that prevents moisture, oxygen, and light penetration. Increasing use in pharmaceuticals and pet food packaging further accelerates adoption, as manufacturers seek solutions that preserve product integrity while meeting stringent regulatory standards. In addition, technological advancements in multilayer film production strengthen material performance, supporting broader industry uptake.

In North America, the United States dominates the market due to its advanced food processing sector and strong retail infrastructure. Canada follows closely, supported by a rising focus on sustainable packaging and health-conscious consumption trends. Mexico is emerging as a key growth hub, driven by expanding manufacturing capabilities and increasing packaged food demand. Regional growth is further reinforced by evolving consumer lifestyles and investments in innovative packaging technologies across the continent.

Market Insights:

- The North America High Barrier Packaging Films Market was valued at USD 3,819.20 million in 2018, reached USD 4,412.91 million in 2024, and is expected to hit USD 6,519.22 million by 2032, growing at a CAGR of 4.95%.

- The United States leads with 68% share, driven by advanced food processing, retail expansion, and pharmaceutical packaging compliance.

- Canada holds 19% share, supported by sustainability policies and strong demand for recyclable films, while Mexico accounts for 13% and is the fastest-growing region due to urbanization and rising packaged food consumption.

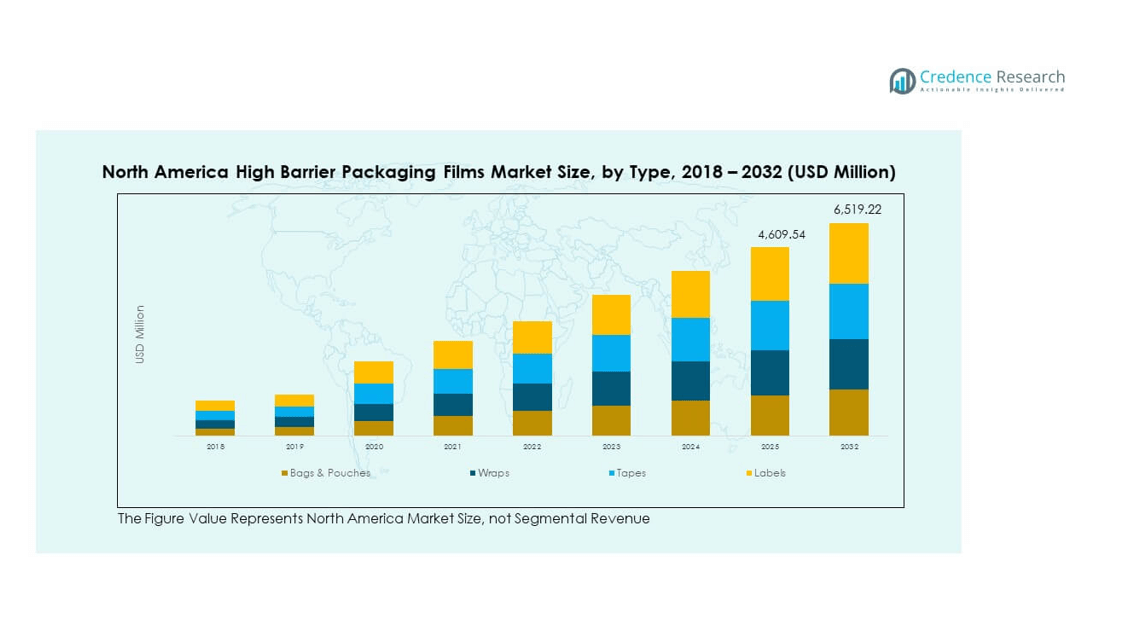

- Bags & pouches represent around 34% share in 2024, making them the dominant product segment in the North America High Barrier Packaging Films Market.

- Wraps contribute nearly 27% share, followed by tapes at 22% and labels at 17%, reflecting their combined importance across food, healthcare, and personal care packaging.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Demand For Extended Shelf Life And Food Safety:

The North America High Barrier Packaging Films Market is driven by the strong need to preserve food products for longer periods. Growing consumer dependence on packaged meals has increased the demand for materials that block oxygen, moisture, and light penetration. It is being increasingly adopted by food manufacturers to reduce waste and meet strict safety standards. The rising concerns over contamination also make these films a preferred choice for sensitive goods. Expanding applications in dairy, snacks, and frozen foods further strengthen adoption. Advancements in barrier technologies improve resistance and extend freshness. This combination of consumer preferences and regulatory compliance drives consistent demand across industries.

- For example, in December 2021, Amcor Flexibles North America announced a high-barrier, high-speed, recycle-ready liquid pouch solution. In April 2022, Amcor expanded its AmPrima range to include solutions for coffee and cheese in Europe. Specific Oxygen Transmission Rate (OTR) and Moisture Vapor Transmission Rate (MVTR) values like 0.06 cc/m²/day and 0.12 g/m²/day have not been publicly verified.

Growing Adoption In Pharmaceutical And Healthcare Packaging:

Healthcare industries are playing a significant role in market expansion through adoption of barrier films. It is being used for blister packs, pouches, and sterile medical products requiring safe protection. Rising healthcare spending and expanding pharmaceutical exports have accelerated film adoption. These films ensure product stability, extend medicine shelf life, and reduce spoilage risks. The trend of personalized medicine and small-dose packaging also fuels higher usage. Hospitals and clinics are prioritizing reliable packaging to maintain sterility. Strong regulations on drug safety reinforce the reliance on such advanced films in the region.

Increasing Consumer Shift Toward Convenience And Ready-To-Eat Meals:

The changing lifestyle of consumers has created a greater demand for convenient packaging solutions. Busy urban households are choosing products with longer shelf life and easier storage. The North America High Barrier Packaging Films Market benefits from this shift by offering solutions for frozen, chilled, and microwaveable foods. It is becoming essential in enabling easy handling and reliable storage for end users. The films help retain aroma, taste, and freshness, aligning with consumer expectations. Growing participation of quick-service restaurants further accelerates adoption. Strong retail expansion and e-commerce growth also support the surge in packaged food distribution.

Advancements In Multilayer Film Technology And Material Innovation:

Technological innovation is enhancing the overall performance of high barrier packaging films. It is being developed using multilayer structures that improve mechanical strength and resistance to external elements. Manufacturers are focusing on recyclable and sustainable solutions to meet regulatory guidelines. Improved sealing properties and flexibility also make these films adaptable for diverse uses. Strong R&D investment supports better oxygen and moisture barrier properties. Industries such as pet food and beverages benefit from these advances. Continuous improvement in material science positions barrier films as a leading solution in packaging.

Market Trends:

Growing Emphasis On Sustainability And Eco-Friendly Packaging:

The North America High Barrier Packaging Films Market is witnessing a steady shift toward sustainable materials. It is influenced by strict environmental regulations and consumer preferences for recyclable solutions. Companies are investing in biodegradable and compostable barrier films to minimize ecological impact. The trend reflects increased awareness among consumers regarding plastic waste reduction. Retailers and brand owners prefer packaging that aligns with green initiatives. Innovative material blends reduce dependency on traditional plastics. This trend not only addresses sustainability but also enhances corporate responsibility.

- For instance, Berry Global Group launched its RecyClass-certified Sustane™ PCR high-barrier films with 50% post-consumer recycled content, resulting in the elimination of 1,700 metric tons of virgin plastic within one quarter.

Integration Of Smart And Functional Packaging Solutions:

Smart packaging is emerging as a defining trend in the industry. It is being adopted to provide freshness indicators, QR codes, and real-time tracking features. These films are now integrated with intelligent elements that improve consumer engagement. Food and pharmaceutical companies use functional films to provide safety and authenticity. The trend also supports supply chain visibility, which is essential in exports. Rising consumer interest in transparent and interactive packaging solutions drives this adoption. Companies investing in functional barrier films gain a strong competitive edge.

Expansion Of E-Commerce And Direct-To-Consumer Food Channels:

E-commerce growth has created fresh opportunities for packaging solutions. The North America High Barrier Packaging Films Market benefits from the surge in direct-to-consumer delivery models. It is required to ensure safe and durable transportation of perishable goods. Online grocery platforms rely on films that provide strong barrier properties. The films help maintain product integrity during long distribution cycles. Rising consumer preference for home deliveries increases the volume demand. The trend also promotes investments in lightweight, flexible packaging optimized for e-commerce logistics.

Innovation In High-Performance Flexible Packaging Formats:

Flexible packaging formats are becoming more advanced across the region. It is driven by rising use in pouches, sachets, and resealable packs. Consumers appreciate lightweight, resealable solutions that ensure convenience and freshness. The trend supports brand differentiation through improved aesthetics and printing capabilities. Growing adoption across snacks, beverages, and pet food highlights the trend’s impact. High-performance flexible packaging improves cost efficiency for manufacturers. This ongoing shift toward advanced flexible formats strengthens the overall market momentum.

Market Challenges Analysis:

High Costs Of Production And Material Limitations:

The North America High Barrier Packaging Films Market faces cost challenges due to complex material requirements. It is manufactured using multilayer films and advanced polymers, which increase production costs. Rising raw material prices, particularly for specialty plastics, add further pressure. Many small and mid-sized manufacturers struggle to compete on pricing. Limited recycling infrastructure also creates hurdles in adopting sustainable barrier films. The need for high-performance features makes cost reduction difficult. These constraints can affect adoption rates among cost-sensitive industries in the region.

Stringent Regulatory Frameworks And Recycling Barriers:

Regulatory restrictions present another challenge to the market’s growth. It is required to comply with food safety and environmental regulations across North America. Compliance increases production costs and extends development timelines for new products. Recycling high barrier multilayer films remains technically difficult due to material composition. Limited end-of-life solutions reduce overall sustainability, creating regulatory scrutiny. Consumer demand for eco-friendly alternatives is outpacing recycling technology. Manufacturers must balance compliance and cost efficiency while ensuring high product performance. These barriers restrict wider adoption in certain end-user industries.

Market Opportunities:

Rising Investments In Sustainable Packaging And Circular Economy:

The North America High Barrier Packaging Films Market is positioned to benefit from growing sustainability investments. It is being supported by increasing government initiatives to encourage recycling and eco-friendly practices. Companies are developing recyclable multilayer films to align with green procurement strategies. Growing consumer awareness about environmental safety accelerates demand for sustainable packaging. Partnerships with recycling firms are opening new growth avenues. This creates opportunities for innovation in renewable material sourcing. Strong collaboration between regulators and producers strengthens long-term growth prospects.

Expanding Applications Across Emerging End-Use Sectors:

Diversification into emerging end-use industries presents major opportunities for market players. It is being applied in cosmetics, pet care, and nutraceuticals, expanding beyond traditional food and beverage sectors. Rising product launches in these industries increase demand for high barrier protection. Growth in healthcare packaging also strengthens opportunities due to strict safety standards. The adaptability of films to new applications creates strong value potential. Companies focusing on customization and innovation will gain a competitive advantage. This opportunity is enhanced by increasing consumer interest in premium packaging solutions.

Market Segmentation Analysis:

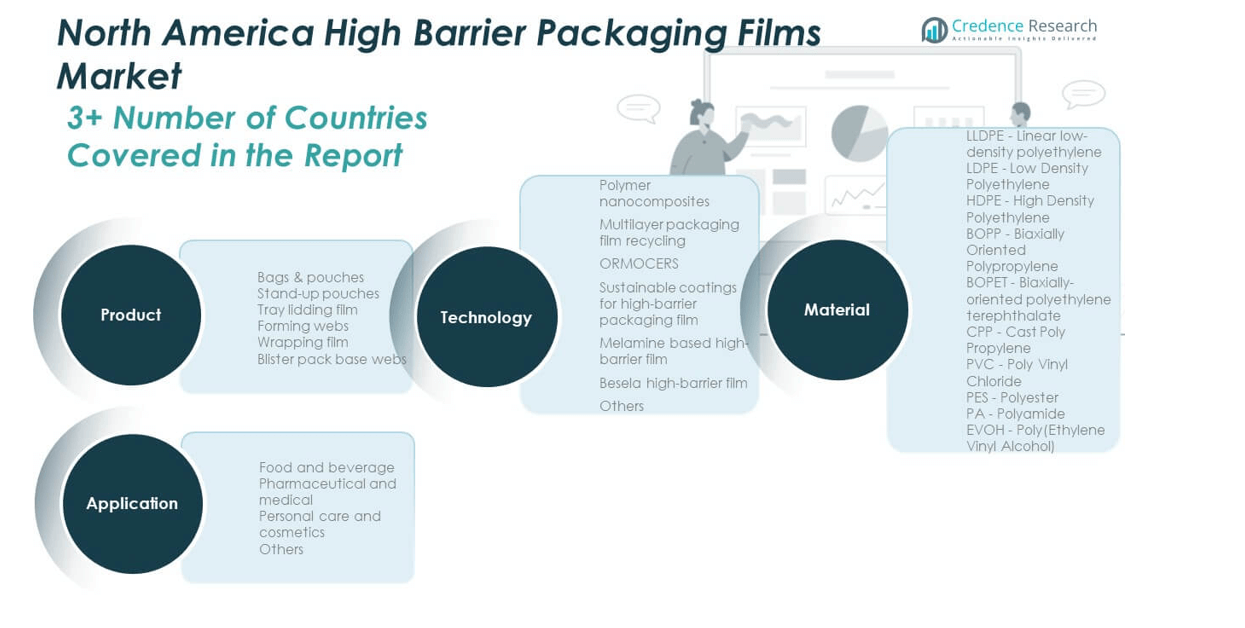

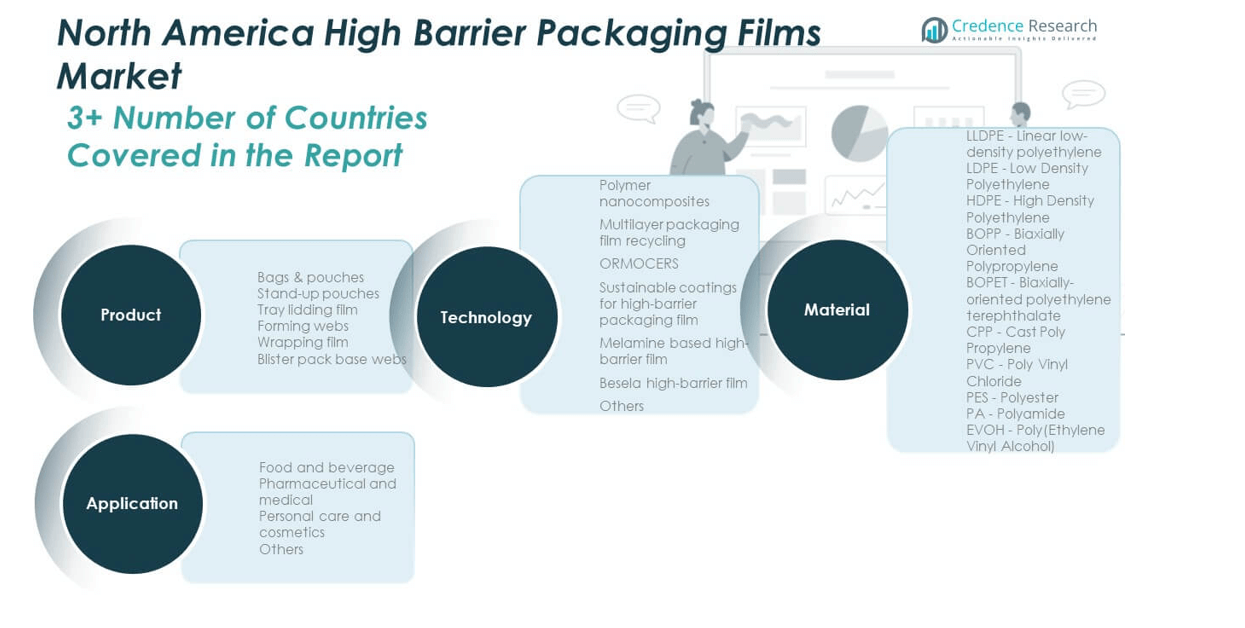

By Product

The North America High Barrier Packaging Films Market is segmented into bags & pouches, stand-up pouches, tray lidding film, forming webs, wrapping film, and blister pack base webs. Bags & pouches and stand-up pouches dominate due to high demand in food and beverage packaging. Tray lidding films and forming webs are used extensively in fresh produce and meat packaging. Wrapping films continue to grow with rising consumption of ready-to-eat meals. Blister pack base webs remain crucial in pharmaceutical packaging, ensuring product safety and compliance.

- For instance, Winpak Ltd. progressed with the completion of a major expansion of its modified atmosphere packaging extrusion facility in Winnipeg during 2025, with new capacity targeting the dairy market starting in 2026.

By Application

Food and beverage leads the application segment, driven by rising packaged food consumption and retail expansion. Pharmaceutical and medical packaging also holds a significant share, supported by strict regulatory standards. Personal care and cosmetics use is expanding with growing demand for premium packaging. Other applications include pet care and household products, creating steady demand across diverse sectors.

- For instance, AptarGroup Inc. introduced a new Bio-based Nasal Spray pump in its pharmaceutical line in August 2025, and this move supports its commitment to reducing fossil-based materials in healthcare packaging.

By Technology

Key technologies include polymer nanocomposites, multilayer packaging film recycling, ORMOCERS, sustainable coatings, melamine-based films, and Besela high-barrier films. It is witnessing strong growth in sustainable coatings and multilayer recycling due to regulatory pressure and sustainability goals. Innovations in nanocomposites and ORMOCERS enhance strength, flexibility, and barrier properties, driving adoption.

By Material

Materials used include LLDPE, LDPE, HDPE, BOPP, BOPET, CPP, PVC, PES, and EVOH. BOPP and BOPET dominate due to durability, clarity, and superior barrier properties. EVOH is gaining traction in high-performance applications, especially in food and healthcare. Flexible polyethylene grades remain widely used for cost efficiency and adaptability.

Segmentation:

By Product

- Bags & Pouches

- Stand-up Pouches

- Tray Lidding Film

- Forming Webs

- Wrapping Film

- Blister Pack Base Webs

By Application

- Food and Beverage

- Pharmaceutical and Medical

- Personal Care and Cosmetics

- Others

By Technology

- Polymer Nanocomposites

- Multilayer Packaging Film Recycling

- ORMOCERS

- Sustainable Coatings for High-Barrier Packaging Film

- Melamine Based High-Barrier Film

- Besela High-Barrier Film

- Others

By Material

- LLDPE (Linear Low-Density Polyethylene)

- LDPE (Low-Density Polyethylene)

- HDPE (High-Density Polyethylene)

- BOPP (Biaxially Oriented Polypropylene)

- BOPET (Biaxially Oriented Polyethylene Terephthalate)

- CPP (Cast Polypropylene)

- PVC (Polyvinyl Chloride)

- PES (Polyester)

- EVOH (Poly(Ethylene Vinyl Alcohol))

By Country

Regional Analysis:

United States

The United States holds the largest share of the North America High Barrier Packaging Films Market, accounting for 68%. It leads due to its advanced food processing industry, large-scale retail infrastructure, and strong demand for packaged goods. Pharmaceutical adoption is high, supported by strict regulatory standards for product safety and integrity. It benefits from significant investment in sustainable and recyclable materials, driven by both consumer preferences and government policies. Growth is reinforced by rising demand for ready-to-eat meals and e-commerce packaging. Innovation in multilayer film technology is also widely adopted by U.S. manufacturers, giving the region a strong competitive edge.

Canada

Canada represents 19% of the market share and shows steady expansion in sustainable packaging adoption. It is supported by a strong emphasis on eco-friendly policies and growing consumer preference for recyclable materials. The food and beverage sector dominates demand, particularly in frozen foods and fresh produce packaging. Canada’s pharmaceutical and healthcare industries also contribute significantly, requiring films that ensure sterility and extended shelf life. Investments in sustainable coatings and advanced polymers are gaining traction. It is witnessing a rise in collaboration between packaging producers and retail chains to strengthen supply chains and reduce waste.

Mexico

Mexico accounts for 13% of the North America High Barrier Packaging Films Market and is emerging as a high-growth region. Rapid industrialization and rising urbanization are fueling demand for packaged food and beverages. It is also gaining importance as a manufacturing hub, with global companies expanding operations to serve domestic and export markets. Pharmaceutical packaging is expanding steadily, supported by growing healthcare infrastructure. Mexico is also benefiting from rising demand for cost-effective and flexible packaging solutions across consumer goods. The increasing focus on modern retail formats further supports market penetration in the country.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

Competitive Analysis:

The North America High Barrier Packaging Films Market is highly competitive, with established multinational corporations and regional players vying for market share. It is characterized by continuous innovation in materials, multilayer film structures, and sustainable solutions. Companies such as Amcor, Bemis Company, Sealed Air, and Jindal Poly Films dominate the competitive landscape, leveraging strong product portfolios and extensive distribution networks. Strategic initiatives include mergers, acquisitions, and partnerships to expand geographic presence and strengthen capabilities. Many players are investing heavily in sustainable coatings, recyclable materials, and advanced technologies to meet regulatory and consumer demands. The competitive dynamics reflect a balance of innovation-driven growth and cost management strategies.

Recent Developments:

- In September 2025, Taghleef Industries launched its innovative detachable In-Mold Label Film Technology, setting a new standard for high-performance label films and improving recyclability for North American packaging manufacturers. This launch reinforces Taghleef’s commitment to sustainable solutions and advanced film technologies.

- In April 2025, Amcor Limited completed an all-stock combination with Berry Global, creating a global leader in consumer and healthcare packaging solutions for the North America market. This strategic acquisition is expected to deliver $650 million in annual synergy benefits and significantly enhance Amcor’s innovation and material science capabilities, elevating its product offerings in barrier packaging films.

Report Coverage:

The research report offers an in-depth analysis based on product, application, technology, material, and country. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Sustainable packaging will remain the most influential growth driver across industries.

- Demand for recyclable and bio-based barrier films will expand significantly.

- Food and beverage packaging will retain dominance due to strong retail penetration.

- Pharmaceutical packaging will grow faster with rising safety and compliance needs.

- Innovation in multilayer film technology will enhance material performance.

- E-commerce growth will increase demand for durable and flexible packaging formats.

- Mexico will emerge as a regional hub with expanding manufacturing capabilities.

- Partnerships and acquisitions will accelerate product development and market reach.

- Regulatory pressures will push firms toward eco-friendly production practices.

- Continuous R&D in nanocomposites and sustainable coatings will shape the next phase.