Market Overview

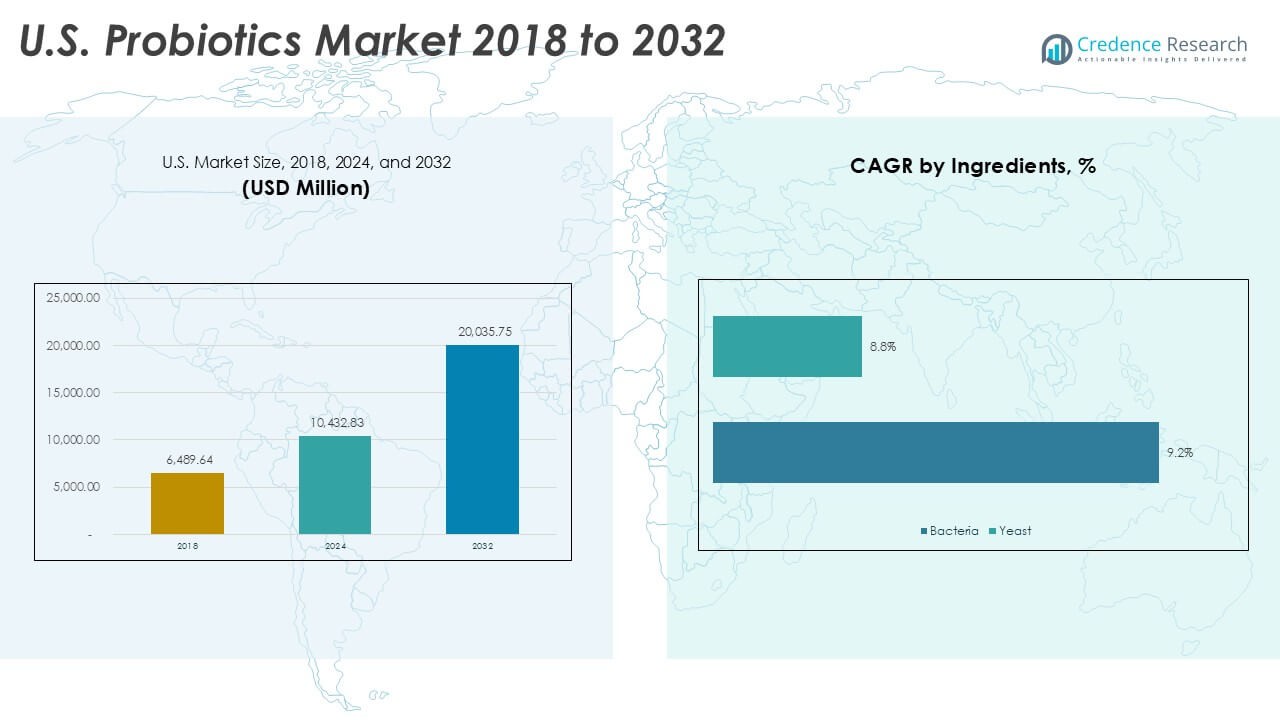

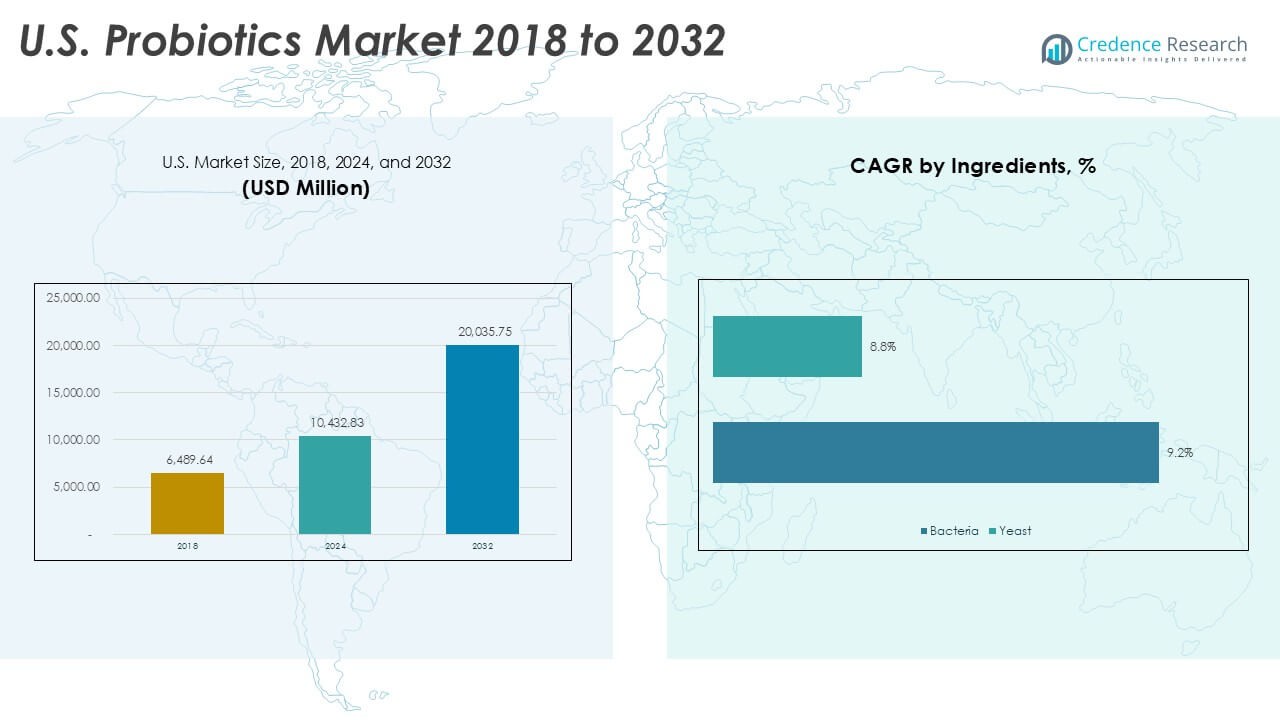

U.S. Probiotics market size was valued at USD 6,489.64 million in 2018 and grew to USD 10,432.83 million in 2024. It is anticipated to reach USD 20,035.75 million by 2032, at a CAGR of 8.35% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| U.S. Probiotics Market Size 2024 |

USD 10,432.83 Million |

| U.S. Probiotics Market, CAGR |

8.35% |

| U.S. Probiotics Market Size 2032 |

USD 20,035.75 Million |

The U.S. probiotics market is led by global and regional players such as Nestlé S.A., Danone S.A., Yakult Honsha Co., Ltd., Kerry Group, ADM, Lifeway Foods Inc., Lallemand Inc., Chr. Hansen A/S, and International Flavors & Fragrances Inc. These companies dominate through strong product portfolios in probiotic foods, beverages, and dietary supplements, supported by continuous innovation and clinical validation of strains. Regionally, the West holds 30% share, driven by California’s strong health and wellness culture, while the South leads with 28% share, supported by large populations and robust retail penetration. The Northeast and Midwest follow with 22% and 20% shares, respectively, reflecting growing adoption of functional foods and supplements. Together, these regions highlight a balanced but competitive market landscape.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The U.S. probiotics market was valued at USD 10,432.83 million in 2024 and is projected to reach USD 20,035.75 million by 2032, growing at a CAGR of 8.35% during the forecast period.

- Rising consumer focus on preventive healthcare and digestive wellness is a key driver, with probiotics increasingly integrated into daily diets through foods, beverages, and supplements.

- Plant-based and non-dairy probiotics are gaining traction alongside personalized nutrition solutions, while innovation in strain-specific formulations is expanding applications across infant formula, women’s health, and animal feed.

- Leading players such as Nestlé, Danone, Yakult Honsha, Kerry Group, ADM, and Lifeway Foods dominate the competitive landscape, supported by strong R&D and product diversification, though regulatory complexities and high R&D costs act as restraints.

- Regionally, the West holds 30% share, the South leads with 28%, the Northeast accounts for 22%, and the Midwest contributes 20%, while probiotic food and beverages remain the dominant product segment with over 65% share.

Market Segmentation Analysis:

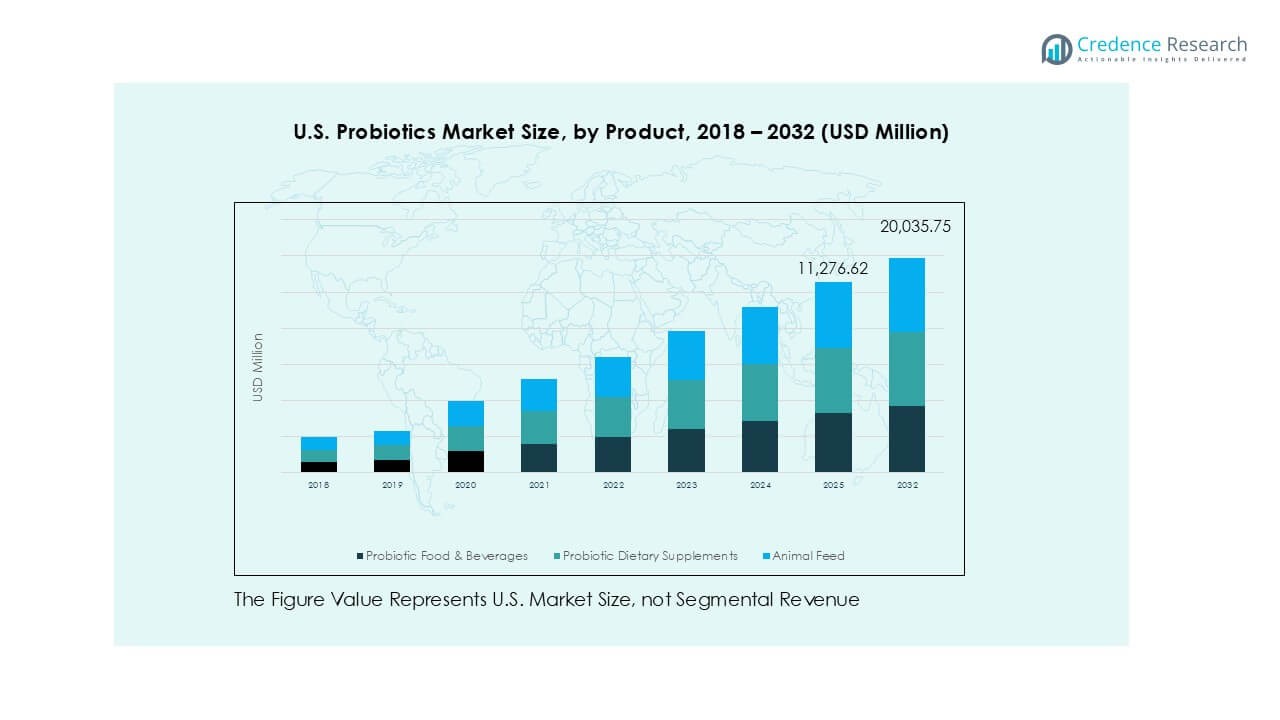

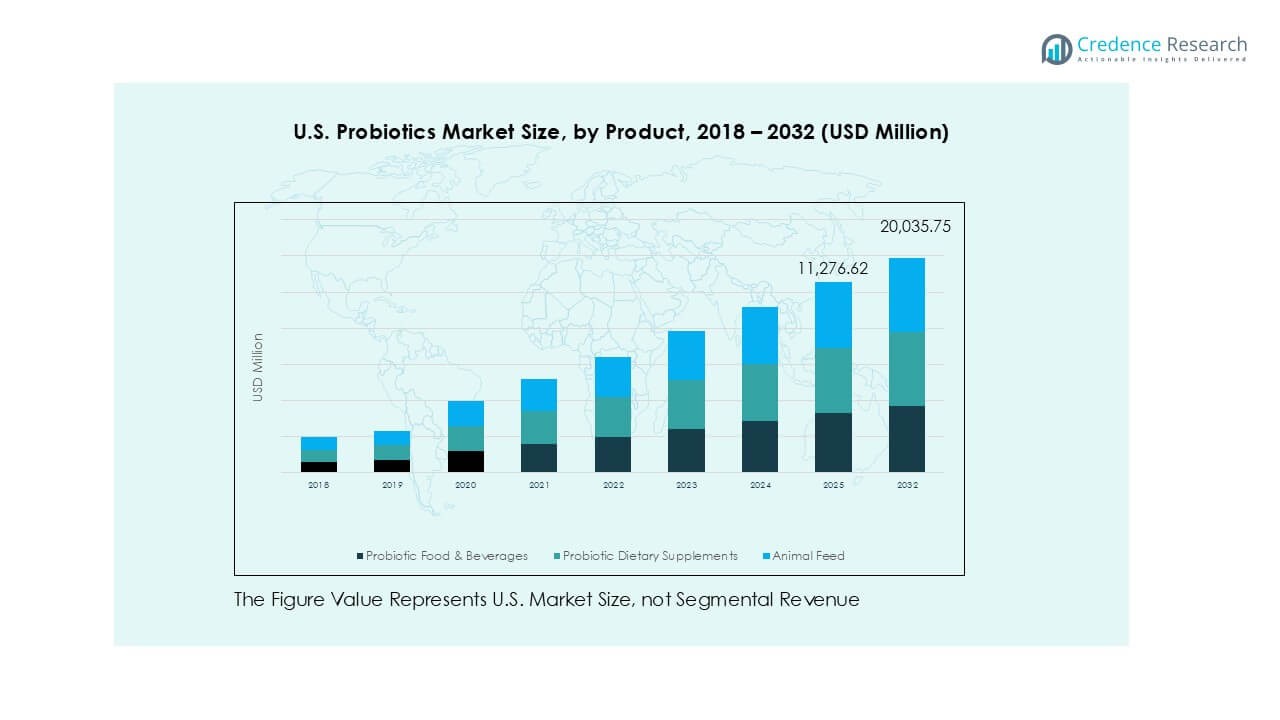

By Product

Probiotic food and beverages held the dominant share of the U.S. probiotics market in 2024, accounting for over 65% of total revenue. Dairy products such as yogurt, kefir, and drinkable cultures drive this leadership due to widespread consumer acceptance and rising demand for digestive health solutions. Functional foods like cereals and baked goods are also gaining traction, supported by product innovation and fortified formulations. Dietary supplements follow as a strong secondary segment, led by probiotic capsules and infant formulas. Growing awareness of preventive health is fueling demand across these product categories.

- For instance, Danone’s Activia yogurt contains ≥1×10⁷ CFU/g of Bifidobacterium animalis DN-173 010, supporting digestive benefits.

By Ingredient

Bacteria-based probiotics remained the leading segment, representing more than 80% of the U.S. market share in 2024. Lactobacillus strains drive the largest portion, widely used in both food and dietary supplements for improving gut health and immunity. Bifidobacterium also contributes significantly, often included in infant formulas and digestive support products. Streptococcus and other strains continue to support niche formulations in specialized health products. Yeast-based probiotics, led by Saccharomyces boulardii, hold a smaller but expanding share due to their effectiveness in managing gastrointestinal issues and antibiotic-associated diarrhea.

- For instance, Chr. Hansen supplies LGG® (Lactobacillus rhamnosus GG), standardized at 2×10¹¹ CFU/g for integration into supplements and foods.

By End User

Human probiotics dominated the U.S. market in 2024, securing more than 75% share. Adults represent the largest consumer group, driven by rising adoption of probiotics for digestive wellness, immune health, and chronic condition management. Children-focused probiotics are expanding steadily, supported by parental demand for gut-friendly infant formulas and supplements. On the other hand, animal probiotics are growing in significance within livestock, poultry, and aquaculture sectors. This growth is propelled by the reduction of antibiotic use in animal farming and the adoption of probiotics to enhance growth, immunity, and feed efficiency.

Key Growth Drivers

Rising Health Awareness and Preventive Healthcare Adoption

One of the strongest growth drivers for the U.S. probiotics market is the increasing focus on preventive healthcare. Consumers are shifting toward functional foods and supplements that not only provide nutrition but also support digestive health and immunity. Probiotic-rich products such as yogurt, kefir, and dietary supplements have gained significant traction due to their scientifically backed benefits in gut health, metabolic balance, and overall wellness. The growing burden of lifestyle-related conditions, including obesity and gastrointestinal disorders, has also encouraged greater acceptance of probiotics as daily essentials rather than occasional dietary choices. Additionally, the influence of digital health platforms, fitness trends, and wellness campaigns has strengthened consumer awareness about the role of probiotics in maintaining a healthy microbiome. This consumer-led movement, coupled with expanding product innovation by food and beverage manufacturers, has substantially fueled demand for probiotics across diverse demographics in the U.S.

- For instance, Danone’s Activia yogurt delivers more than 1×10⁷ CFU/g of Bifidobacterium animalis DN-173 010, which has been clinically validated for digestive benefits.

Expansion of Functional Food and Beverage Offerings

The rapid expansion of probiotic-enriched food and beverages is another major driver. U.S. consumers are increasingly adopting functional dairy, fortified cereals, and probiotic drinks as part of their daily routines. Dairy-based products like yogurt remain the most consumed, but companies are innovating with non-dairy alternatives, including oat, almond, and soy-based probiotic beverages, to meet demand from lactose-intolerant and vegan populations. Food manufacturers are incorporating probiotics into snacks, protein bars, and baked goods, offering convenient formats aligned with busy lifestyles. Retailers are also dedicating more shelf space to probiotic-enriched items, making them accessible to mainstream consumers. The entry of global food companies and startups has intensified competition, leading to aggressive product launches and marketing strategies. This trend highlights how probiotics are no longer confined to traditional categories but have become a mainstream wellness component integrated into everyday diets, ensuring continuous growth in the sector.

- For instance, Chobani introduced its Probiotic Oat Drink line with a guaranteed 6 billion CFU of Lactobacillus and Bifidobacterium strains per serving, targeting non-dairy consumers.

Advancements in Clinical Research and Product Development

Scientific validation of probiotic benefits is significantly accelerating adoption in the U.S. market. Clinical research has established strong evidence linking probiotic strains to improved digestive health, immune support, mental well-being, and metabolic regulation. For instance, strains of Lactobacillus and Bifidobacterium have demonstrated effectiveness in reducing gastrointestinal issues, while Saccharomyces boulardii has shown benefits in preventing antibiotic-associated diarrhea. Such evidence is driving greater confidence among healthcare professionals, leading to higher recommendations of probiotic supplements and foods. Companies are investing heavily in R&D to develop strain-specific formulations targeting conditions like irritable bowel syndrome, allergies, and women’s health. Personalized probiotics, tailored to individual microbiome profiles, are emerging as an advanced offering in the market. Furthermore, partnerships between biotechnology firms, universities, and nutraceutical companies are enhancing product innovation and expanding the application of probiotics into pharmaceuticals, infant nutrition, and functional wellness products, thereby strengthening long-term market growth.

Key Trends & Opportunities

Shift Toward Plant-Based and Non-Dairy Probiotics

A key trend in the U.S. probiotics market is the strong demand for plant-based and non-dairy options. With the rise of vegan lifestyles and increasing lactose intolerance cases, consumers are seeking alternative sources of probiotics beyond traditional dairy formats. This has led to the launch of probiotic-infused plant-based drinks, snacks, and yogurts using oat, almond, coconut, and soy bases. The trend also aligns with the broader sustainability movement, as plant-based products are perceived as eco-friendly and ethically responsible. Companies are actively investing in formulations that ensure probiotic stability in these non-dairy matrices. The opportunity for brands lies in tapping into younger, health-conscious demographics who are more likely to adopt plant-based diets. This segment is expected to witness rapid expansion as innovation improves the taste, texture, and effectiveness of non-dairy probiotic products, making them competitive with conventional dairy-based probiotics.

- For instance, Chobani’s Probiotic Oat Drink contains 6 billion CFU of Lactobacillus and Bifidobacterium strains per 10 oz serving, designed specifically for dairy-free consumers.

Integration of Probiotics into Personalized Nutrition Solutions

The U.S. probiotics market is experiencing strong momentum from the rise of personalized nutrition. Advances in microbiome sequencing and digital health platforms have enabled tailored dietary recommendations that incorporate probiotics suited to an individual’s gut health profile. Companies are now developing customized probiotic supplements, subscription services, and at-home microbiome test kits to provide individualized solutions. This trend resonates with consumers who prioritize targeted and evidence-based wellness strategies. Personalized probiotics also create opportunities for companies to differentiate their offerings and build stronger customer loyalty. The integration of artificial intelligence and data analytics in product design is expected to further enhance this market segment. With consumers increasingly willing to pay for health products that deliver measurable outcomes, personalized probiotics represent a high-value growth avenue, especially as partnerships between biotech firms and consumer health brands expand.

Key Challenges

Regulatory Complexities and Labeling Standards

One of the major challenges in the U.S. probiotics market is navigating regulatory frameworks. Probiotics are marketed as food, dietary supplements, or pharmaceuticals, each requiring different compliance standards. The FDA does not recognize probiotics as a drug category unless specific therapeutic claims are made, creating ambiguity for manufacturers on permissible health claims. Misleading or unsubstantiated labeling risks regulatory action and damages consumer trust. Strain-specific efficacy further complicates labeling, as benefits cannot always be generalized across categories. This regulatory uncertainty increases costs for companies in terms of testing, documentation, and approvals. It also slows the speed of product innovation and commercialization. Companies must strike a balance between promoting scientifically validated benefits and complying with strict marketing guidelines. Failure to do so can undermine brand credibility and restrict wider adoption of probiotic-based products in the U.S. market.

High Costs of Research, Development, and Product Stability

Developing effective probiotic formulations remains a resource-intensive challenge. Strains must survive manufacturing, storage, and digestive processes to remain effective, requiring advanced encapsulation and stabilization technologies. This increases production costs, particularly for small and mid-sized companies. Clinical validation of probiotic benefits further demands significant investment in long-term studies, adding to financial barriers. Additionally, maintaining product shelf stability without compromising viability poses technical hurdles that impact distribution and retail presence. Consumers increasingly expect high-quality, scientifically backed products at affordable prices, putting pressure on manufacturers to balance innovation with cost-efficiency. Intense competition from both multinational corporations and startups further heightens pricing challenges. Unless companies can streamline production and leverage advanced technologies for stability and scalability, the high costs associated with probiotic development may limit wider accessibility and slow market penetration in the U.S.

Regional Analysis

Northeast

The Northeast held nearly 22% share of the U.S. probiotics market in 2024, supported by strong consumer awareness and higher disposable incomes. Cities such as New York and Boston drive demand through premium retail outlets and health-focused food chains. The region has a large population of health-conscious consumers adopting probiotic-rich dairy products, supplements, and plant-based alternatives. Universities and biotech hubs also encourage clinical research and product trials, enhancing trust in probiotic efficacy. Expansion of e-commerce and urban wellness programs continues to fuel consumption, ensuring steady growth in both food and dietary supplement segments across the Northeast.

Midwest

The Midwest accounted for around 20% share of the U.S. probiotics market in 2024, led by its strong agricultural and food processing base. States like Illinois and Minnesota play a central role in dairy production, supporting the supply of probiotic-enriched yogurts, cheeses, and beverages. Growing consumer interest in preventive healthcare and wellness supplements is boosting adoption in both urban and rural populations. Retail chains in the Midwest increasingly feature probiotic dietary supplements and functional foods, expanding accessibility. Livestock probiotics also contribute significantly in this region, reflecting the strength of its farming and animal nutrition industries.

South

The South represented about 28% share of the U.S. probiotics market in 2024, making it the leading regional contributor. States like Texas and Florida drive demand with large populations and rising health-conscious lifestyles. The region benefits from robust distribution networks, supermarkets, and pharmacies offering diverse probiotic supplements and fortified foods. A high prevalence of digestive health issues and chronic diseases has accelerated acceptance of probiotics for preventive care. Additionally, increasing pet ownership and animal farming support growth in animal probiotics. Expanding e-commerce penetration and growing Hispanic populations further encourage product diversity, strengthening the South’s dominant position.

West

The West captured nearly 30% share of the U.S. probiotics market in 2024, positioning it as the second-largest region. California leads with its strong health and wellness culture, vegan-friendly food ecosystem, and high adoption of plant-based probiotics. The region’s tech-driven consumer base shows strong interest in personalized nutrition, fueling demand for advanced probiotic supplements and microbiome-focused solutions. Large retail chains, organic food stores, and direct-to-consumer channels ensure widespread product availability. Innovation hubs in California and Washington further support product development in non-dairy probiotics. Growing awareness of sustainable and functional foods continues to drive Western U.S. leadership in probiotics adoption.

Market Segmentations:

By Product

- Probiotic Food & Beverages

-

-

- Dairy Products

- Cereals

- Baked Food

- Fermented Meat

- Dry Foods

- Others

- Probiotic Dietary Supplements

-

-

- Food Supplements

- Infant Formula

- Others

By Ingredient

-

-

- Lactobacillus

- Bifidobacterium

- Streptococcus

- Others

By End User

-

-

- Livestock

- Poultry

- Aquaculture

By Distribution Channel

- Hypermarkets/Supermarkets

- Pharmacies/Drugstore

- Specialty Stores

- Online Stores

By Geography

- Northeast

- Midwest

- South

- West

Competitive Landscape

The U.S. probiotics market is highly competitive, marked by the presence of multinational corporations, regional players, and specialized probiotic developers. Leading companies such as Nestlé S.A., Danone S.A., Yakult Honsha, Kerry Group, and ADM dominate through extensive product portfolios in probiotic foods, beverages, and supplements. Lifeway Foods has strengthened its niche in dairy-based probiotic drinks, while Winclove Probiotics, Probi, and SYNformulas focus on strain-specific innovation and customized solutions. Lallemand Inc. and Chr. Hansen A/S emphasize microbial expertise, supplying high-quality ingredients for both human and animal probiotics. International Flavors & Fragrances Inc. has enhanced its probiotic offerings through acquisitions and R&D investment, further intensifying competition. Companies are leveraging clinical research, partnerships, and advanced formulations to differentiate products and expand applications in personalized nutrition, infant formula, and animal health. The competitive environment is further shaped by innovation in plant-based alternatives, aggressive marketing, and increasing consumer trust in science-backed probiotic benefits.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- ADM

- Lifeway Foods Inc

- Nestle S.A.

- Danone S.A.

- Yakult Honsha Co., Ltd.

- Winclove Probiotics

- Kerry Group

- Lallemand Inc

- SYNformulas

- Probi

- Hansen A/S

- International Flavors & Fragrances Inc.

- Other Key Players

Recent Developments

- In October 2024, Probi launched clinically-supported probiotic solution for metabolic health.

- In August 2024, AB-Biotics launched probiotic solutions Gyntima Menopause (complex probiotic made of Lacotobacillus crispatus KABP™ Lactobacillus plantarum KABP™ 051 (CECT 7481), and Lactococcus lactis KABP™ 021 (CECT 7483). It helps to regulate estrogen level by reactivating it through β-glucuronidase (GUS) activity in women suffering from perimenopausal symptoms.

- In August 2024, ZBiotics announced the completion of venture series A (amounting to USD 12 million) in order to support the commercialization of genetically engineered probiotics.

- In February 2024, AB Biotics SA (Netherlands) expands its presence in Asia, partnering with Wonderlab for their globally marketed product, AB-LIFE. The collaboration introduces Shape100, a probiotic blend focusing on cardiometabolic health, to the Chinese market. This strategic move aims to address cholesterol-related concerns through evidence-based solutions.

- In November 2023, Nestlé (Switzerland) launched N3 milk, a breakthrough in nutritional innovation. Incorporating prebiotic fibers and reduced lactose, it enriches gut health and boasts over 15% fewer calories. Tailored for diverse dietary needs, N3 supports bone health, muscle growth, and immunity.

- In April 2022, Symrise, a r producer of cosmetic ingredients, launched SymFerment, a cutting-edge ingredient designed to enhance skin care with its moisturizing and smoothing properties. Developed in collaboration with Probi, a leading manufacturer of probiotics for the healthcare and food industries, SymFerment represents a significant advancement in sustainable cosmetic technology.

Report Coverage

The research report offers an in-depth analysis based on Product, Ingredient, End User, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The U.S. probiotics market will expand steadily with growing adoption in daily diets.

- Demand for probiotic-rich functional foods and beverages will continue to rise.

- Non-dairy and plant-based probiotic products will gain wider consumer acceptance.

- Personalized probiotics tailored to microbiome profiles will create new growth opportunities.

- Clinical research will strengthen consumer trust and drive healthcare professional recommendations.

- Probiotic supplements will grow rapidly, especially in infant and women’s health categories.

- Animal probiotics use will increase as farming shifts away from antibiotics.

- E-commerce channels will boost product accessibility and consumer engagement.

- Innovation in encapsulation technologies will improve product stability and shelf life.

- Competitive intensity will rise as global players and startups invest in advanced formulations.