Market Overview:

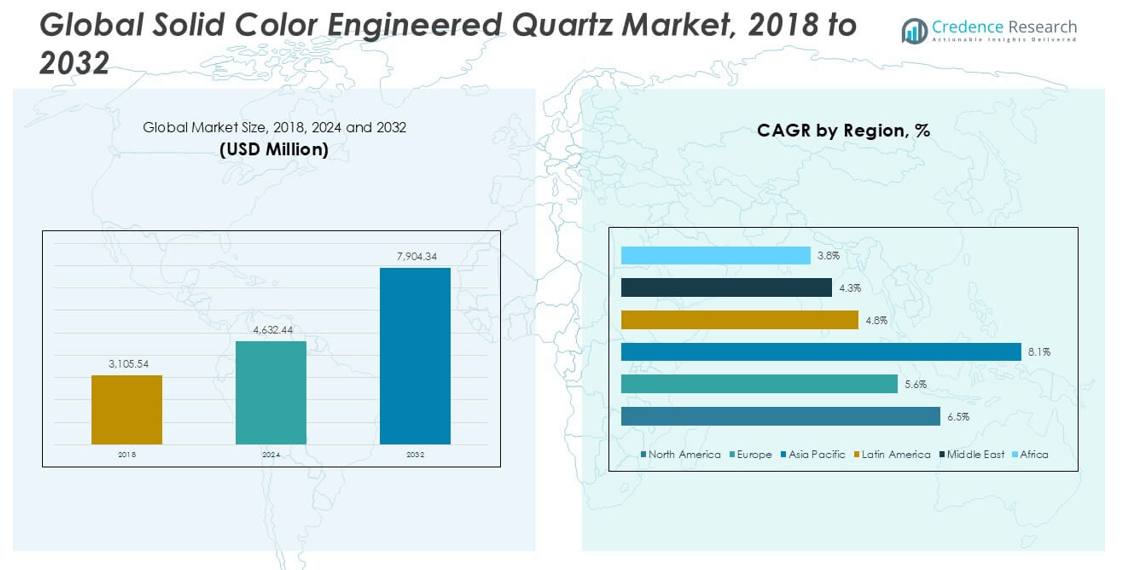

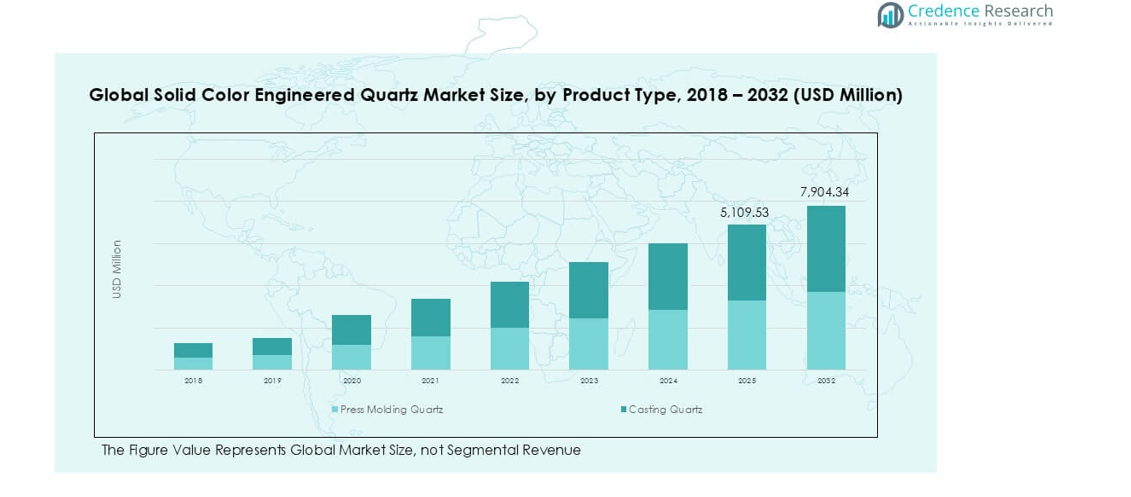

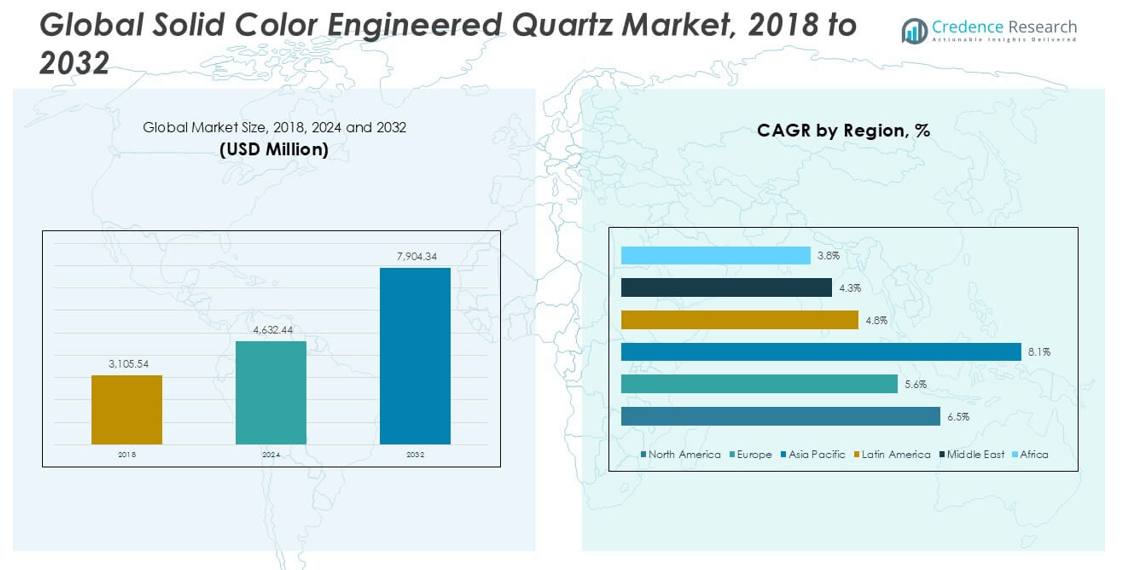

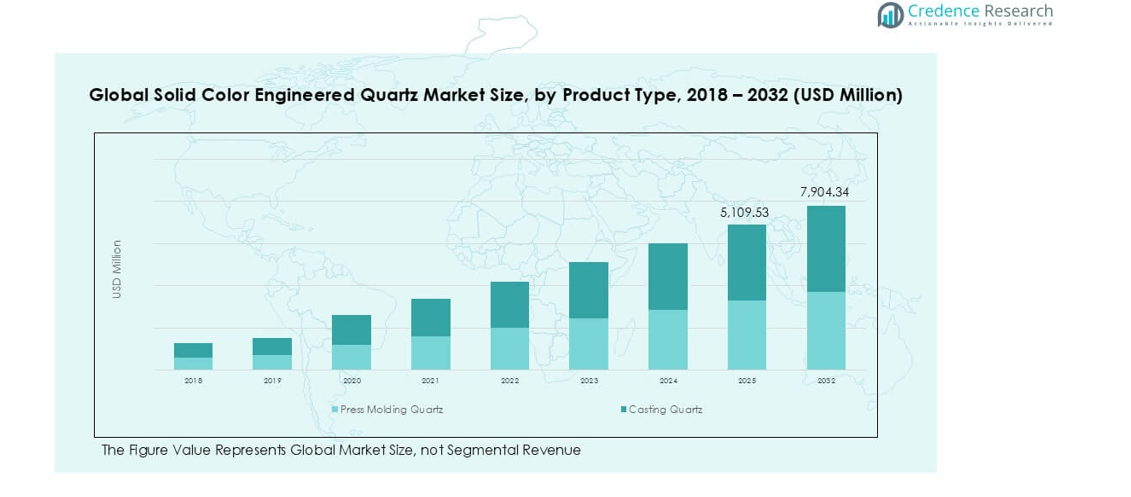

The Solid Color Engineered Quartz market size was valued at USD 3,105.54 million in 2018, increased to USD 4,632.44 million in 2024, and is anticipated to reach USD 7,904.34 million by 2032, growing at a CAGR of 6.43% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Solid Color Engineered Quartz Market Size 2024 |

USD 4,632.44 million |

| Solid Color Engineered Quartz Market, CAGR |

6.43% |

| Solid Color Engineered Quartz Market Size 2032 |

USD 7,904.34 million |

The solid color engineered quartz market is led by established players such as Cosentino S.A., Caesarstone Ltd., Cambria Company LLC, Hanwha Corporation, , RAK Ceramics, Levantina Group, Q Holdings PLC, and Stone Italiana S.p.A. These companies dominate through extensive product portfolios, global distribution, and investments in sustainable innovations. North America remains the largest regional market, holding 43% share in 2024, valued at USD 2,022.98 million, driven by high adoption in residential remodeling and commercial interiors. Europe follows with a 26% share, supported by demand for sustainable, design-driven surfaces, while Asia Pacific, at 20% share, is the fastest-growing region, fueled by rapid urbanization and rising middle-class housing projects.

Market Insights

- The solid color engineered quartz market was valued at USD 3,105.54 million in 2018, reached USD 4,632.44 million in 2024, and is projected to hit USD 7,904.34 million by 2032 at a CAGR of 6.43%.

- Rising demand from residential and commercial construction is a key driver, supported by growing remodeling projects, premium interiors, and the durability of quartz compared to natural stones.

- Market trends highlight strong adoption of countertops with over 45% share, while press molding quartz dominates product type with more than 60% share, driven by design flexibility and cost efficiency.

- Leading players such as Cosentino S.A., Caesarstone Ltd., Cambria Company LLC, and Hanwha Corporation strengthen their position through innovation, sustainability, and expanded distribution, while regional manufacturers target niche demand.

- Regionally, North America leads with 43% share, followed by Europe at 26% and Asia Pacific at 20%, where rapid urbanization drives the fastest growth at 8.1% CAGR.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product Type

The solid color engineered quartz market by product type is dominated by press molding quartz, which accounted for over 60% of revenue share in 2024. This dominance stems from its superior durability, consistent texture, and ability to withstand heavy use in both residential and commercial settings. Press molding technology offers greater design flexibility and cost efficiency, making it the preferred choice for large-scale projects. Casting quartz, while growing at a steady pace, holds a smaller share due to higher production complexity but appeals to niche applications demanding customized finishes.

- For instance, in 2023, Cosentino completed a milestone in its sustainable manufacturing strategy for Silestone, with 85% of its production containing less than 40% crystalline silica. This is a result of the company’s HybriQ technology, which uses a sustainable process including 99% reused water and 100% renewable electric energy.

By Application

Countertops emerged as the leading application segment in 2024, capturing more than 45% of the market share. Their dominance is driven by rising demand for premium kitchen and bathroom designs, coupled with engineered quartz’s superior resistance to scratches, stains, and heat. Flooring also represents a significant segment, supported by growing adoption in high-traffic commercial areas where longevity and easy maintenance are essential. Applications such as walls, door jambs, and other custom uses contribute steadily, reflecting expanding architectural and interior design trends favoring modern, seamless aesthetics.

- For instance, in 2023, Cambria maintained its status as a major U.S.-based quartz countertop manufacturer, contributing to strong residential demand in the North American market

By End User

The residential sector led the market in 2024, accounting for nearly 65% of total revenue share. Rising consumer preference for durable and stylish interiors has fueled adoption across kitchens, bathrooms, and flooring applications. Home renovation projects and urban housing developments further support this segment’s leadership. The commercial sector, while smaller, is experiencing rapid growth due to increasing use of engineered quartz in hospitality, office spaces, and retail interiors. Its expansion is primarily driven by the need for materials that combine aesthetic appeal with long-term performance and cost efficiency.

Key Growth Drivers

Rising Demand in Residential and Commercial Construction

The increasing pace of residential and commercial construction is a primary driver of the solid color engineered quartz market. In the residential sector, the surge in kitchen remodeling, bathroom upgrades, and flooring replacements has fueled demand for durable and aesthetically pleasing materials. Urbanization trends and expanding housing projects, especially in Asia-Pacific and North America, continue to support steady consumption. In commercial spaces, such as offices, hotels, and retail outlets, engineered quartz is preferred due to its resistance to wear and low maintenance costs. The combination of functionality, durability, and modern design appeal positions engineered quartz as the material of choice in both new constructions and renovation projects.

- For instance, Quartz countertops remained a popular choice for kitchen renovation projects throughout 2023. Major home improvement retailers like Home Depot sell a variety of quartz products and services to meet this demand.

Superior Material Properties Enhancing Adoption

Engineered quartz offers unique benefits such as non-porosity, resistance to stains and scratches, and uniform color consistency, making it highly attractive across end-use industries. These technical advantages outperform natural stones like granite and marble, which often require regular sealing and carry inconsistencies in texture. Consumers and designers prefer solid color engineered quartz for its reliable performance in heavy-use applications, including countertops and flooring. The material’s heat resistance also supports its use in modern kitchens and commercial facilities. Additionally, technological advancements in press molding and surface finishing enhance product quality and availability. As awareness of these features grows, adoption rates increase, strengthening the market’s growth trajectory over the forecast period.

- For instance, Quartz countertops, like Hanwha’s HanStone Quartz, are highly durable and heat-resistant. To prevent damage from thermal shock, the manufacturer and other quartz experts recommend using trivets or hot pads when placing searing-hot objects on the surface.

Growing Consumer Preference for Aesthetics and Sustainability

Consumer preferences are shifting toward materials that combine style, durability, and environmental responsibility. Solid color engineered quartz aligns with these demands by offering sleek, modern designs that integrate seamlessly with contemporary interiors. The material’s ability to mimic natural stone while maintaining color uniformity appeals to homeowners and commercial designers seeking premium finishes. At the same time, manufacturers are emphasizing sustainable production processes, such as recycling industrial waste and reducing energy consumption during manufacturing. Growing awareness of green building certifications and sustainable interior materials further boosts demand. As the construction industry adopts eco-friendly practices, engineered quartz is well-positioned to meet both regulatory requirements and consumer expectations for sustainable, stylish solutions.

Key Trends & Opportunities

Expansion in Customization and Design Innovation

A major trend shaping the market is the growing demand for customization and design flexibility in engineered quartz products. Manufacturers are focusing on offering a wide range of solid colors, finishes, and textures to cater to evolving consumer tastes. Digital design tools and advanced casting techniques allow companies to produce quartz surfaces tailored for unique applications such as walls, furniture, and door jambs. This trend is particularly strong in premium residential and luxury commercial spaces, where clients seek personalized aesthetics. As customization capabilities expand, opportunities emerge for suppliers to capture niche markets and enhance brand value.

- For instance, in 2023, Cosentino launched two new Silestone collections, Le Chic and Urban Crush, which included a total of 10 new colors inspired by fashion, industrial style, and urban textures.

Rising Adoption in Emerging Economies

Emerging markets present significant growth opportunities due to rapid urbanization, increasing disposable incomes, and expanding infrastructure projects. In regions like Asia-Pacific, large-scale residential construction and commercial developments are driving demand for cost-effective yet durable interior materials. Government initiatives promoting affordable housing and urban development further accelerate adoption. Solid color engineered quartz, with its balance of affordability, durability, and premium aesthetics, aligns well with these regional demands. Companies expanding distribution networks in these high-growth economies stand to benefit from the rising adoption and broader customer base.

Key Challenges

High Production Costs and Price Sensitivity

One of the major challenges in the market is the relatively high production cost of engineered quartz compared to traditional surface materials. The costs associated with advanced processing technologies, resin additives, and precision manufacturing make quartz products more expensive than alternatives like laminates or ceramic tiles. In price-sensitive markets, this limits adoption, particularly in budget residential projects. Furthermore, fluctuations in raw material prices can impact profitability for manufacturers. Balancing cost efficiency while maintaining product quality remains a critical challenge for sustaining competitiveness in both developed and emerging markets.

Competition from Alternative Materials

The solid color engineered quartz market faces growing competition from alternative surface materials, such as natural stones, ceramics, and innovative composites. Materials like porcelain slabs and high-performance laminates offer comparable aesthetics at lower costs, making them attractive for cost-conscious consumers. Additionally, the prestige of natural marble and granite still appeals to a segment of premium buyers. To overcome this challenge, engineered quartz manufacturers must emphasize the durability, consistency, and sustainability of their products while investing in design innovations. Failure to differentiate effectively may restrict market expansion, especially in competitive, design-driven segments.

Regional Analysis

North America

North America dominated the solid color engineered quartz market in 2024, accounting for over 43% share with a market size of USD 2,022.98 million, up from USD 1,370.27 million in 2018. The region is projected to reach USD 3,461.30 million by 2032, expanding at a CAGR of 6.5%. Growth is driven by strong demand from the U.S. and Canada for premium countertops and flooring in residential remodeling and commercial projects. Rising investments in luxury housing, coupled with consumer preference for durable and stylish interiors, continue to reinforce North America’s leadership in the global market.

Europe

Europe captured nearly 26% of the global market share in 2024, with revenue of USD 1,232.26 million, compared to USD 857.86 million in 2018. The market is expected to reach USD 1,976.14 million by 2032, at a CAGR of 5.6%. Demand is supported by widespread adoption of engineered quartz in kitchens, bathrooms, and commercial spaces, especially in Germany, France, and the UK. Increasing focus on sustainable building materials and stringent EU regulations are accelerating the shift from natural stones to engineered quartz. The region’s design-driven consumer base also favors solid color quartz for its aesthetic consistency.

Asia Pacific

Asia Pacific is the fastest-growing regional market, accounting for around 20% share in 2024, with a size of USD 946.73 million, rising from USD 584.57 million in 2018. It is projected to reach USD 1,833.88 million by 2032, registering the highest CAGR of 8.1%. Growth is fueled by rapid urbanization, expanding middle-class housing, and large-scale commercial projects across China, India, and Southeast Asia. Government-backed infrastructure and residential development programs also support demand. The region’s consumers increasingly prefer engineered quartz for its affordability, durability, and modern appeal, making Asia Pacific a key growth hub for global manufacturers.

Latin America

Latin America represented about 5% of the global market in 2024, with revenue of USD 215.57 million, compared to USD 146.34 million in 2018. The market is expected to reach USD 325.47 million by 2032, growing at a CAGR of 4.8%. Brazil and Mexico drive the majority of regional demand, supported by rising adoption of quartz in urban housing and hospitality projects. Economic recovery and investments in real estate are gradually boosting consumer spending on premium interior materials. However, price sensitivity remains a challenge, making solid color engineered quartz more popular in upper-middle income residential and commercial projects.

Middle East

The Middle East accounted for nearly 3% share of the global market in 2024, with revenue of USD 123.76 million, up from USD 90.44 million in 2018. It is anticipated to reach USD 179.56 million by 2032, at a CAGR of 4.3%. The market benefits from extensive investments in luxury residential and commercial infrastructure, particularly in the UAE and Saudi Arabia. Growing demand for high-end interior finishes in hospitality, retail, and housing projects supports adoption. However, reliance on imported materials and economic fluctuations limit wider market penetration, though premium solid color quartz remains in steady demand.

Africa

Africa held a modest 2% share of the global market in 2024, generating USD 91.13 million, up from USD 56.06 million in 2018. The market is projected to grow to USD 127.99 million by 2032, registering a CAGR of 3.8%. Demand is primarily driven by urban housing developments and commercial real estate expansion in countries like South Africa and Nigeria. However, limited purchasing power and competition from low-cost alternatives restrain wider adoption. Despite these challenges, increasing urbanization and gradual growth in the middle-class population are expected to create opportunities for steady market expansion over the forecast period.

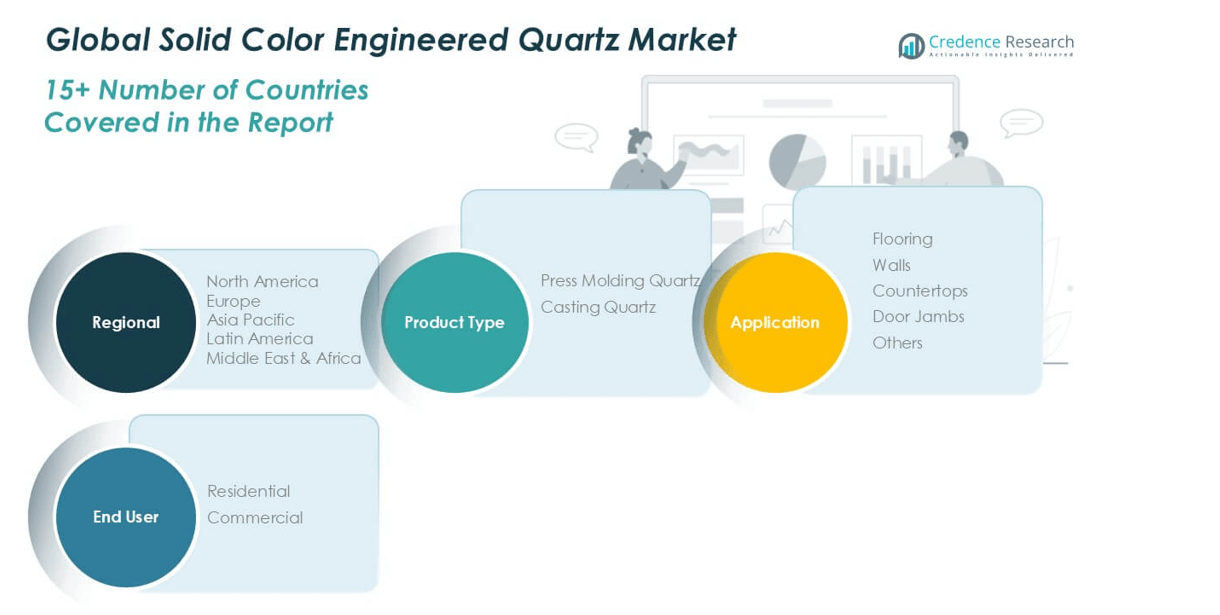

Market Segmentations:

By Product Type

- Press Molding Quartz

- Casting Quartz

By Application

- Flooring

- Walls

- Countertops

- Door Jambs

- Others

By End User

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the solid color engineered quartz market is characterized by the presence of established global players and regional manufacturers that compete on design, quality, and innovation. Companies such as Cosentino S.A., Caesarstone Ltd., Cambria Company LLC, and Hanwha Corporation hold significant market shares through their wide distribution networks and advanced product portfolios. These firms invest heavily in research and development to expand their range of finishes, textures, and eco-friendly products, aligning with rising demand for sustainable surfaces. Mid-sized players like Vicostone, , and RAK Ceramics leverage niche positioning and regional strength to capture growing opportunities. Strategic initiatives such as mergers, acquisitions, and capacity expansions remain common, with manufacturers also focusing on digital marketing and showroom experiences to build brand visibility. Overall, competition is intensifying as both international and regional companies target customization, design innovation, and cost efficiency to secure growth in a fragmented yet expanding market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Cosentino S.A.

- Caesarstone Ltd.

- Cambria Company LLC

- Hanwha Corporation

- Compac The Surfaces Company

- Vicostone

- RAK Ceramics

- Q Holdings PLC

- Levantina Group

- Stone Italiana S.p.A.

Recent Developments

- In July 2025, Caesarstone launched ICON™, a revolutionary crystalline silica-free solid surface (less than 1% silica) with approximately 80% recycled content, prioritizing both safety for fabricators and sustainability for consumers.

- In July 2025, Vicostone launched 10 new quartz colors for the fall season, focusing on inspirations from natural elements and aesthetics.

- In May 2025, RAK Ceramics commissioned its new next-generation slab production facility using Continua+ PCR 2180 technology, marking a significant technological leap in large-format engineered quartz and ceramic surfaces.

- In May 2024, WK Stone partnered with Eight Homes to offer Quantum Zero, a recycled surface as a safe alternative to high-silica engineered stone

Report Coverage

The research report offers an in-depth analysis based on Product Type, Application, End User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will continue expanding with steady demand from residential and commercial construction.

- Countertops will remain the leading application due to durability and premium interior demand.

- Flooring applications will grow as adoption rises in high-traffic commercial spaces.

- Press molding quartz will sustain dominance, supported by cost efficiency and design flexibility.

- Casting quartz will gain traction in niche applications requiring customization and aesthetics.

- Asia Pacific will witness the fastest growth, driven by urbanization and middle-class housing.

- North America will maintain leadership with strong remodeling and renovation activities.

- Europe will see stable growth supported by sustainability regulations and design-driven consumers.

- Companies will focus on eco-friendly production and recycled raw materials to align with green building trends.

- Competitive intensity will increase as global and regional players invest in product innovation and market expansion.