Market overview

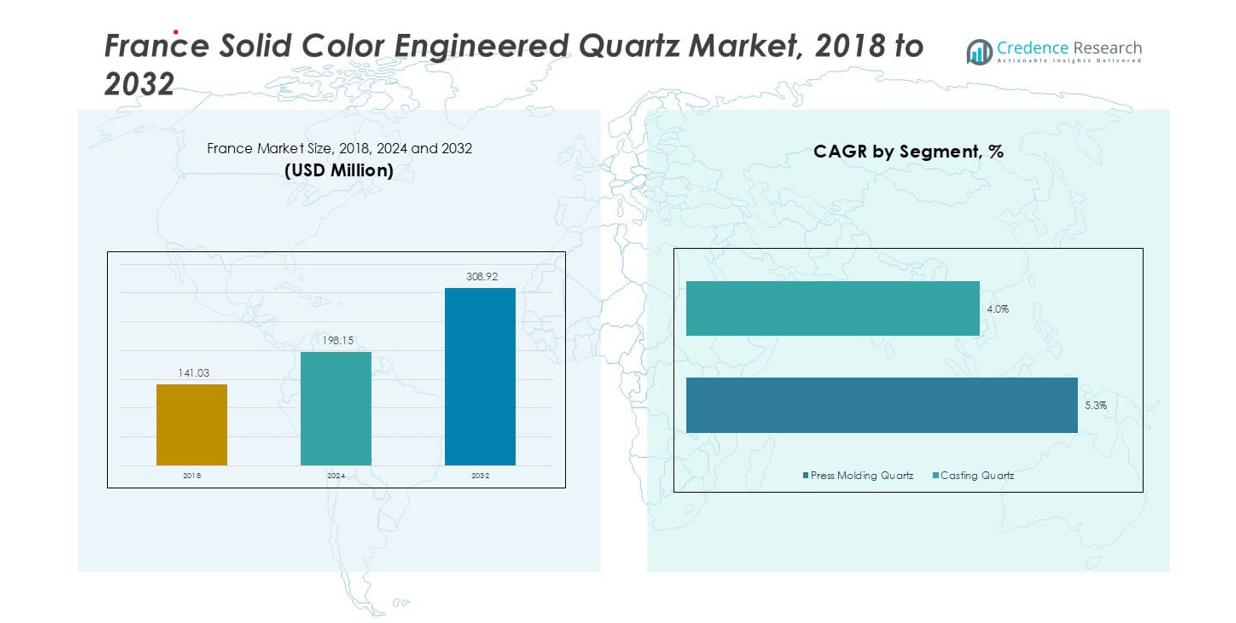

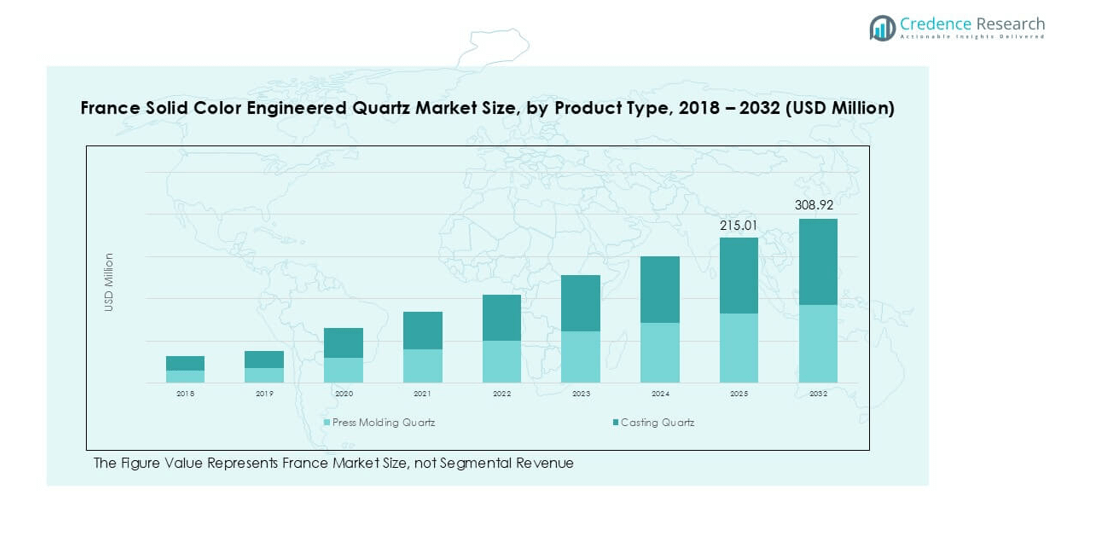

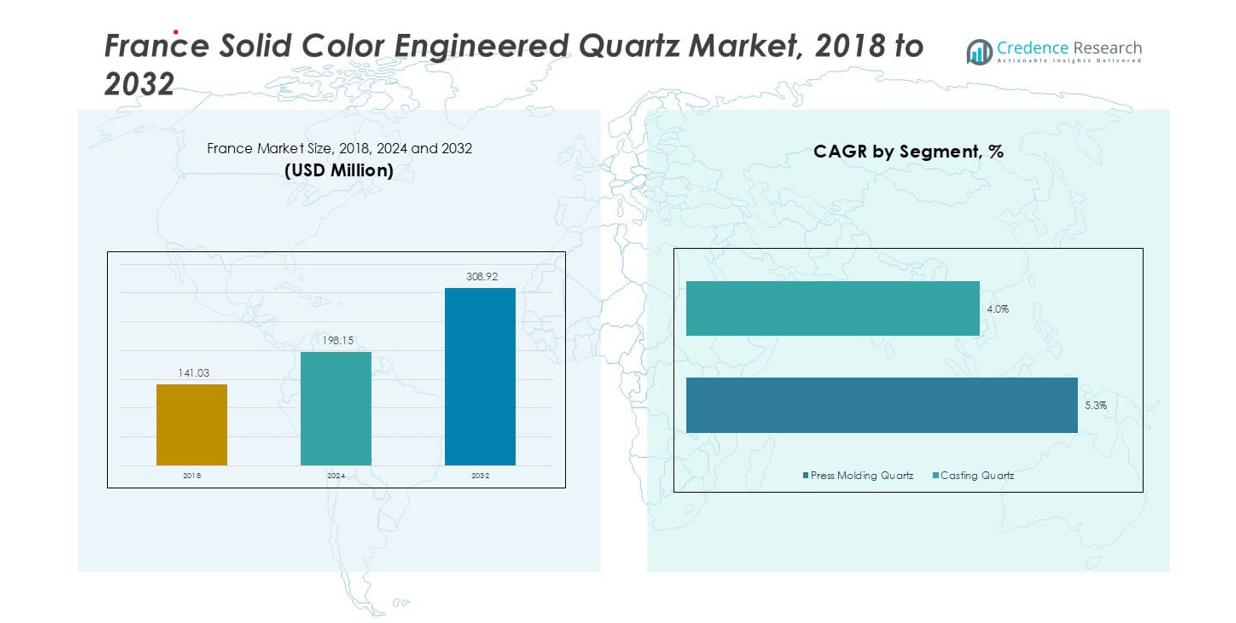

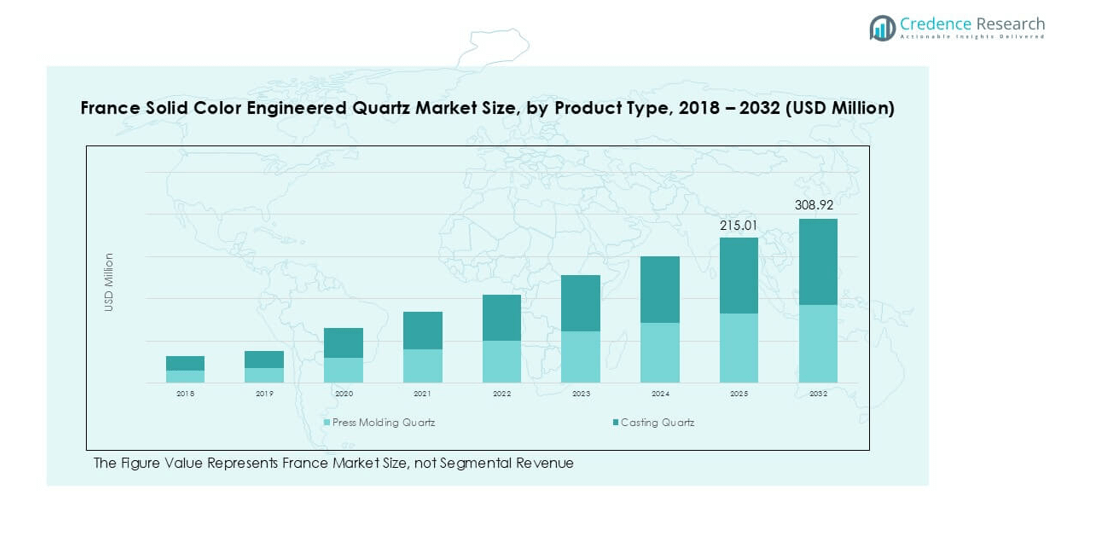

France Solid Color Engineered Quartz market size was valued at USD 141.03 million in 2018 and grew to USD 198.15 million in 2024. It is anticipated to reach USD 308.92 million by 2032, at a CAGR of 5.31% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| France Solid Color Engineered Quartz Market Size 2025 |

USD 198.15 million |

| France Solid Color Engineered Quartz Market, CAGR |

5.31% |

| France Solid Color Engineered Quartz Market Size 2032 |

USD 308.92 million |

The France solid color engineered quartz market is led by prominent players including Cosentino, Caesarstone, Compac, Quarella, Lapitec, Silestone, Technistone, Wilsonart, Breton, and Stone Italiana. These companies compete through diverse product portfolios, advanced surface technologies, and strong brand positioning in both residential and commercial segments. Cosentino and its Silestone brand maintain a dominant presence with wide design options and sustainable production practices, while Caesarstone and Compac strengthen competition with innovative finishes and durable offerings. Regionally, North France leads the market with over 30% share in 2024, supported by high urbanization, premium housing demand, and extensive commercial real estate projects. South France follows with more than 22% share, driven by luxury housing and hospitality developments. Together, these regions account for over half of the national market, underscoring their importance as primary growth hubs.

Market Insights

- The France solid color engineered quartz market was valued at USD 198.15 million in 2024 and is projected to reach USD 308.92 million by 2032, growing at a CAGR of 5.31%.

- Rising demand for premium home renovations and expanding commercial real estate developments are the key drivers, with strong adoption in countertops that held over 45% segment share in 2024.

- Market trends highlight growing preference for minimalist solid color aesthetics and eco-certified quartz surfaces, supported by technological advances in press molding and sustainable production.

- Competition remains intense with global players such as Cosentino, Caesarstone, Compac, and Silestone leading, while regional players like Quarella and Stone Italiana emphasize luxury finishes to capture niche markets.

- Regionally, North France leads with over 30% share, followed by South France at 22%, while West and Eastern France each hold about 15–18%, and Central France contributes around 15%, together shaping balanced national growth.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product Type

Press molding quartz dominated the France solid color engineered quartz market in 2024, accounting for over 60% share. Its leadership stems from superior density, durability, and consistent texture, making it highly suitable for premium interior surfaces. The process ensures low porosity, which enhances stain and scratch resistance, a critical requirement in modern residential and commercial projects. Casting quartz is steadily gaining traction due to its design flexibility and ability to create customized patterns, though its higher production costs limit its penetration compared to press molding technology.

- For instance, Breton S.p.A., the key supplier of quartz press molding technology, has installed more than 120 Bretonstone® plants worldwide, including multiple European facilities supplying the French market, each capable of producing slabs up to 330 cm × 165 cm in size with uniform density.

By Application

Countertops emerged as the leading application segment, holding more than 45% market share in 2024. Their dominance is supported by growing demand for durable, low-maintenance, and aesthetic kitchen and bathroom solutions in France’s urban households. Rising renovation projects and consumer preference for seamless designs drive adoption. Flooring and wall applications are expanding gradually, benefiting from advancements in surface finishing that enhance visual appeal and resistance to heavy usage. Door jambs and other niche applications represent a smaller portion but are expanding as designers explore new architectural uses.

- For instance, in 2023, Caesarstone reported revenues of $565.2 million, a decrease attributed to lower sales volume stemming from challenging economic conditions. Its sales to the Europe, Middle East, and Africa (EMEA) region accounted for 9.2% of its total revenue during that year, indicating that the European market, including France, received a relatively small percentage of the company’s overall

By End User

The residential sector held the dominant position with over 55% share in 2024, driven by rising homeownership, renovation activity, and premium housing trends. Consumers increasingly favor engineered quartz for its durability, stain resistance, and variety of solid color finishes, making it a preferred choice for kitchens and bathrooms. The commercial segment is growing at a steady pace, fueled by investments in hotels, restaurants, and corporate spaces, where engineered quartz is valued for its aesthetic consistency and long service life. Sustainability certifications also encourage adoption across both end-user categories.

Key Growth Drivers

Rising Demand for Premium Home Renovations

The France solid color engineered quartz market is strongly driven by the rise in home renovation and remodeling projects, particularly in urban regions. Increasing disposable incomes and consumer preferences for durable, low-maintenance surfaces support this demand. Engineered quartz offers superior stain, scratch, and heat resistance compared to natural stone, making it highly suitable for kitchens and bathrooms. French consumers are also leaning toward minimalist aesthetics, where solid colors enhance modern interior designs. This preference has boosted adoption of quartz countertops and flooring. Additionally, government incentives promoting energy-efficient and sustainable housing indirectly support quartz adoption, as homeowners upgrade interiors alongside broader renovations. The steady rise in premium housing units, especially in Paris, Lyon, and Marseille, continues to anchor this demand, ensuring consistent growth in residential applications over the forecast period.

- For instance, Cosentino’s Silestone brand is a prominent player in the engineered countertop market, with a strong distribution presence in France, including a ‘Cosentino City’ showroom in Paris. The brand’s success is supported by increasing disposable incomes and a strong consumer preference for durable, low-maintenance surfaces like engineered quartz.

Growth of the Commercial Real Estate Sector

Expanding commercial construction is another critical driver of the France solid color engineered quartz market. Hotels, office complexes, retail chains, and healthcare facilities are investing in durable and visually appealing surface materials. Engineered quartz stands out due to its consistent appearance, low porosity, and ability to withstand heavy usage in high-traffic environments. Large-scale hospitality chains are increasingly specifying quartz surfaces for lobbies, guest rooms, and dining areas due to its long service life and reduced maintenance costs. Similarly, the healthcare sector favors quartz for hygienic surfaces in laboratories and patient rooms. France’s real estate development pipeline, supported by foreign investments and urban expansion projects, has significantly boosted demand. The ongoing trend of designing modern, sustainable, and upscale commercial spaces will continue to provide steady momentum for quartz adoption across diverse applications.

- For instance, Caesarstone reported a significant decrease in revenue for 2023, reflecting a global reduction in market volume and challenging economic conditions. As a global leader in premium surfaces, a portion of its quartz products was allocated to both residential and commercial installations, including markets in Europe.

Technological Advancements in Manufacturing

Advances in quartz manufacturing technology are further accelerating market growth in France. Press molding and advanced casting techniques now allow manufacturers to deliver higher density, defect-free slabs with improved mechanical strength. Automated polishing and cutting systems ensure precise finishes, aligning with customer demand for sleek, consistent surfaces. Enhanced coloring technologies have broadened the availability of solid shades, catering to modern design preferences. Digitalized production lines also reduce waste and energy consumption, supporting sustainability goals. Furthermore, manufacturers are investing in recycling technologies to incorporate post-industrial quartz waste into new slabs, reducing costs and environmental impact. These innovations have not only improved product performance but also expanded end-use versatility. With French consumers and businesses increasingly valuing sustainability and design flexibility, technological improvements in production will remain a strong driver of growth for the engineered quartz sector.

Key Trends & Opportunities

Sustainability and Eco-Friendly Product Demand

One of the most prominent trends in the France solid color engineered quartz market is the rising demand for sustainable and eco-certified products. With heightened awareness around carbon emissions and circular economy principles, both residential and commercial buyers are seeking low-impact materials. Manufacturers are responding by introducing quartz slabs that incorporate recycled glass, recycled quartz, and water-efficient production methods. Certifications such as LEED and GREENGUARD are becoming key differentiators in the French market, particularly for commercial projects. This shift creates opportunities for companies that invest in green manufacturing and marketing strategies, as sustainability is increasingly seen not just as compliance but as a value-added feature for premium projects.

- For instance, Cosentino’s Silestone brand launched the Sunlit Days line using HybriQ+ technology, which incorporates at least 20 units of recycled content (mainly glass) per batch and uses 99 units of recycled water in manufacture.

Growing Popularity of Minimalist and Solid-Color Aesthetics

The French interior design landscape is witnessing a strong shift toward minimalist themes, where solid color quartz slabs are gaining rapid acceptance. Consumers prefer clean lines, seamless finishes, and bold yet simple shades that complement modern interiors. Solid white, black, and grey tones are especially popular for kitchens, bathrooms, and office spaces. This design-driven trend opens opportunities for manufacturers to expand their color palette and offer customizable options for architects and designers. With the growth of e-commerce platforms and virtual showrooms, customers can easily explore these designs, further strengthening adoption. The aesthetic appeal of solid color quartz aligns with the evolving demand for contemporary spaces in France’s urban regions.

Key Challenges

High Cost Compared to Alternatives

Despite its advantages, the high cost of solid color engineered quartz remains a challenge in the France market. Competing materials like laminate, ceramic tiles, or natural stone options such as granite and marble often come at lower price points. Budget-conscious residential buyers may opt for these substitutes, particularly in mid-tier renovation projects. The cost barrier also limits penetration in certain commercial developments where large surface areas require cost-efficient solutions. Although technological advances are gradually reducing manufacturing expenses, pricing remains a critical concern. Manufacturers must balance premium positioning with affordability strategies, such as offering modular sizes or targeting niche high-value applications.

Dependence on Imported Raw Materials

Another significant challenge for the France solid color engineered quartz market is reliance on imported raw materials such as quartz crystals and high-grade resins. Limited domestic availability increases exposure to global supply chain disruptions and currency fluctuations. Events like the COVID-19 pandemic highlighted vulnerabilities in sourcing and logistics, affecting delivery timelines and project schedules. Dependence on imports also inflates costs, reducing competitiveness against local alternatives. French manufacturers are increasingly exploring regional supply agreements and recycling-based solutions to mitigate these risks. However, until domestic sourcing options are strengthened, reliance on imports will continue to pose a challenge to consistent market growth.

Regional Analysis

North France

North France accounted for over 30% market share in 2024, emerging as the leading regional market. The dominance stems from the concentration of urban centers such as Paris and Lille, where residential renovations and premium housing projects are widespread. The region’s commercial real estate sector, particularly offices and hospitality, also supports strong adoption of engineered quartz for countertops, flooring, and walls. Demand is further strengthened by government-backed urban redevelopment programs and consumer preference for minimalist solid color designs. The region’s well-developed distribution networks and high spending capacity ensure continued leadership during the forecast period.

West France

West France held around 18% share in 2024, driven largely by its growing tourism and hospitality industries. Cities such as Nantes and Rennes are witnessing investments in hotels and commercial spaces that increasingly specify durable quartz surfaces for aesthetic consistency. Residential adoption is also rising, supported by suburban housing projects and coastal renovations targeting modern interiors. The cultural preference for sustainable and eco-friendly materials aligns well with quartz’s recyclability and low maintenance. While smaller than northern markets, West France presents strong growth potential through expanding mid-tier urban developments and coastal hospitality projects.

Central France

Central France contributed nearly 15% market share in 2024, supported by demand from mid-sized urban areas and ongoing residential renovations. Although less industrialized than other regions, its housing modernization programs and affordable residential projects drive adoption of engineered quartz, particularly in countertops and flooring. Growth in Central France is also fueled by gradual investments in commercial infrastructure, including healthcare and educational facilities. Limited competition in the region allows suppliers to capture steady demand. However, purchasing power remains lower compared to North and South France, positioning Central France as a moderate but stable contributor to the national market.

South France

South France represented over 22% market share in 2024, ranking as the second-largest region after the North. The region benefits from its strong real estate sector, particularly in cities such as Marseille, Nice, and Montpellier, where luxury residential and holiday homes dominate demand. The popularity of quartz in premium housing projects, coupled with thriving tourism and hospitality industries, reinforces its high adoption. Strong architectural trends emphasizing sleek designs and vibrant interiors further fuel the preference for solid color quartz surfaces. South France’s affluent consumer base and extensive renovation activity make it a key growth driver for the national market.

Eastern France

Eastern France captured around 15% share in 2024, supported by its industrial base and expanding commercial construction. Cities such as Strasbourg and Lyon are central to this growth, where offices, hotels, and retail projects increasingly integrate quartz surfaces for durability and style. Residential demand is also expanding, driven by urban redevelopment and rising consumer preference for modern interiors. Cross-border trade with Germany and Switzerland facilitates quicker supply and distribution of quartz materials, enhancing regional competitiveness. While smaller in scale compared to North and South France, Eastern France remains a strategic growth hub due to its cross-European connectivity and urban expansion.

Market Segmentations:

By Product Type

- Press Molding Quartz

- Casting Quartz

By Application

- Flooring

- Walls

- Countertops

- Door Jambs

- Others

By End User

By Geography

- North France

- West France

- Central France

- South France

- Eastern France

Competitive Landscape

The France solid color engineered quartz market is characterized by the presence of leading international and regional players competing on product innovation, design variety, and sustainability. Companies such as Cosentino, Caesarstone, Compac, and Technistone hold strong positions through established distribution networks and extensive product portfolios tailored to residential and commercial applications. Italian players like Quarella, Lapitec, and Stone Italiana emphasize premium designs and advanced production technologies, catering to luxury housing and hospitality projects. Silestone, a brand under Cosentino, continues to dominate the solid color segment with broad offerings in contemporary shades. Breton, recognized for its patented quartz manufacturing technology, supplies machinery and solutions that strengthen industry capabilities across France. Wilsonart is expanding its footprint by targeting the mid-tier residential sector with competitively priced products. Strategic growth in this market is further supported by investments in sustainable production, recycled raw materials, and certifications that appeal to eco-conscious French consumers.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In July 2025, Caesarstone launched ICON™, a revolutionary crystalline silica-free solid surface (less than 1% silica) with approximately 80% recycled content, prioritizing both safety for fabricators and sustainability for consumers.

- In July 2025, Vicostone launched 10 new quartz colors for the fall season, focusing on inspirations from natural elements and aesthetics.

- In May 2025, RAK Ceramics commissioned its new next-generation slab production facility using Continua+ PCR 2180 technology, marking a significant technological leap in large-format engineered quartz and ceramic surfaces.

- In May 2024, WK Stone partnered with Eight Homes to offer Quantum Zero, a recycled surface as a safe alternative to high-silica engineered stone.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Application, End User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will continue to expand steadily with strong demand from both residential and commercial sectors.

- Countertops will remain the leading application, supported by rising renovation and premium housing projects.

- Press molding quartz will sustain dominance due to its durability and wide acceptance across applications.

- Growing focus on eco-friendly and recycled raw materials will influence product innovation.

- Minimalist and solid color design trends will drive consumer preferences in urban housing.

- North France will retain leadership, followed by South France as the second major growth hub.

- Commercial real estate and hospitality projects will increasingly specify quartz surfaces for durability and aesthetics.

- Technological advances in casting and finishing will improve quality and expand product diversity.

- Competitive rivalry will intensify as global and regional brands strengthen distribution and marketing.

- Long-term growth will benefit from sustainability certifications and alignment with France’s green building initiatives.