Market overview

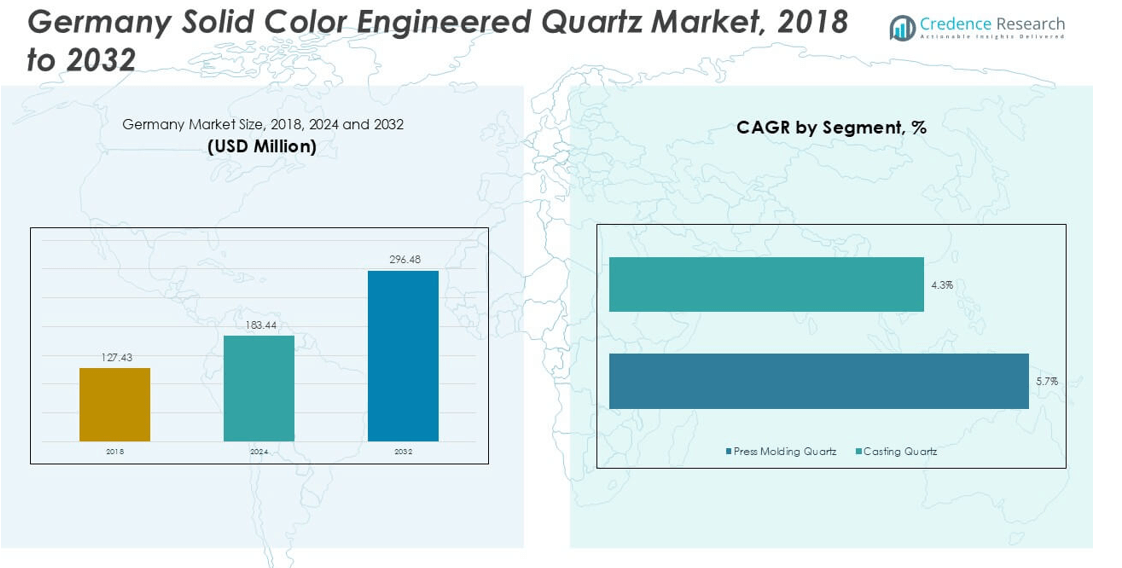

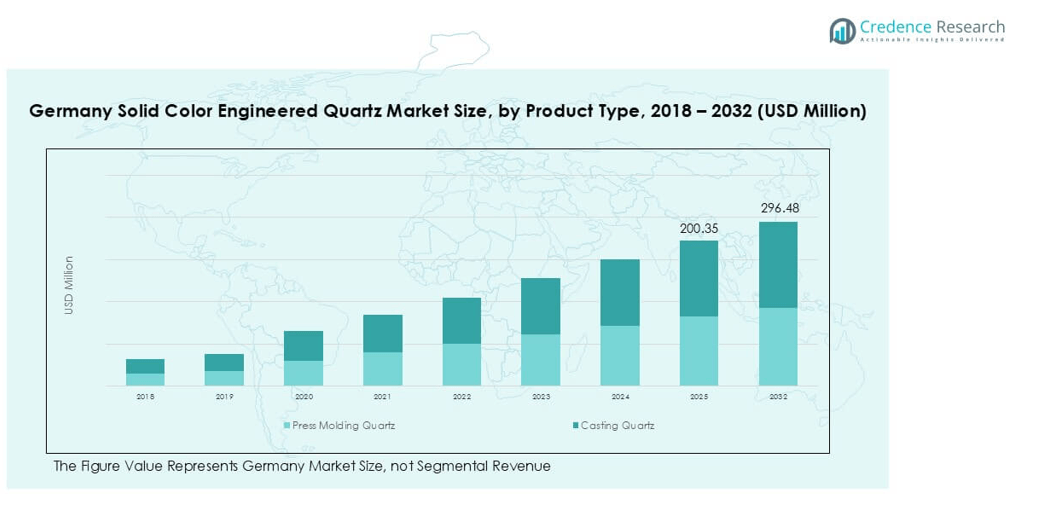

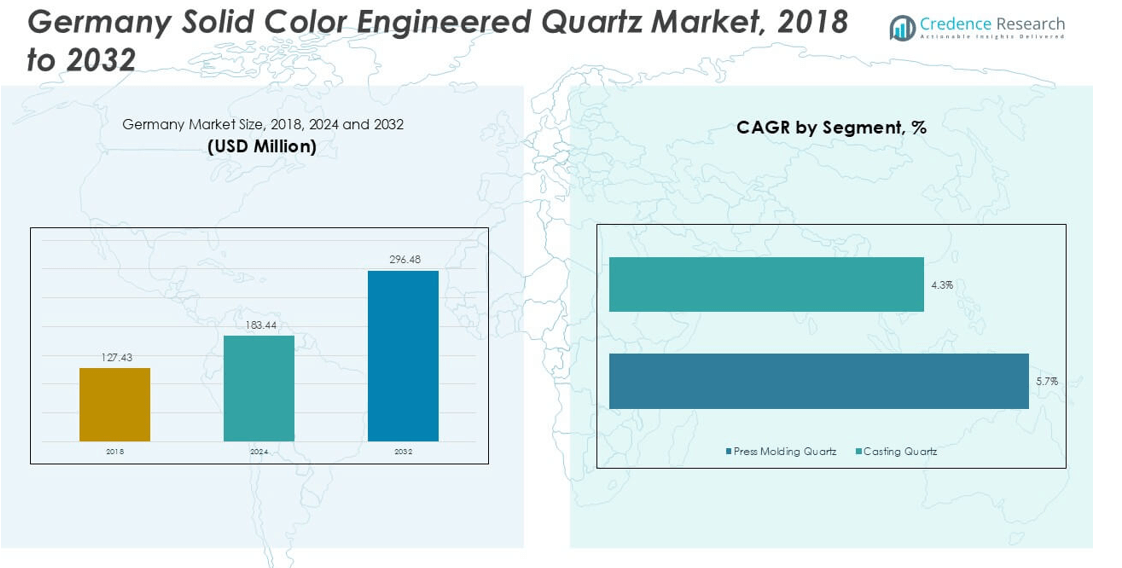

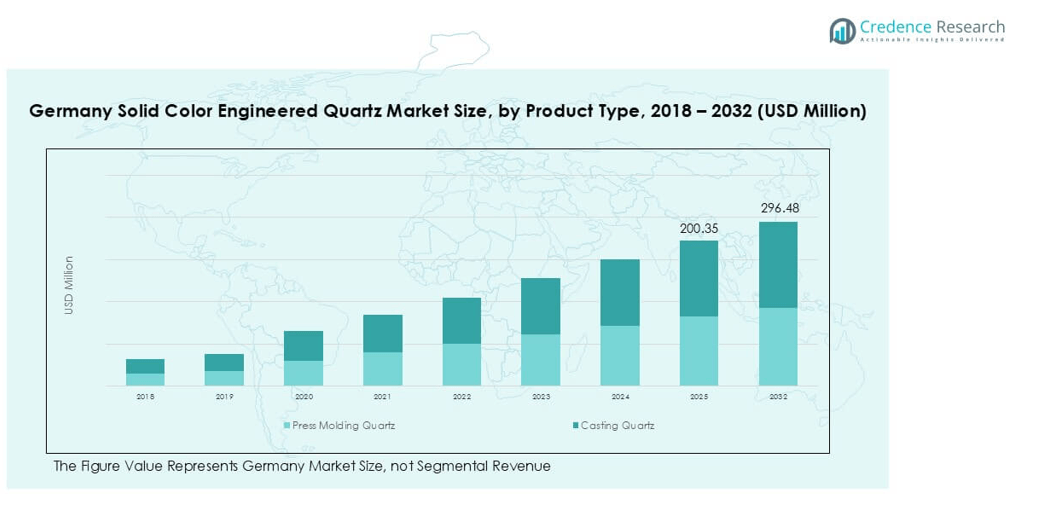

Germany Solid Color Engineered Quartz Market size was valued at USD 127.43 million in 2018 and grew to USD 183.44 million in 2024. It is anticipated to reach USD 296.48 million by 2032, at a CAGR of 5.76% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Germany Solid Color Engineered Quartz Market Size 2025 |

USD 183.44 million |

| Germany Solid Color Engineered Quartz Market, CAGR |

5.76% |

| Germany Solid Color Engineered Quartz Market Size 2032 |

USD 296.48 million |

The Germany solid color engineered quartz market is shaped by leading players such as Cosentino, Caesarstone, Compac, Quarella, Lapitec, Technistone, Breton, Stone Italiana, Wilsonart, and Quartzforms. These companies compete through product innovation, sustainability initiatives, and expanding distribution networks tailored to Germany’s design-conscious consumers. Cosentino and Caesarstone dominate the premium countertop and flooring segments, while Compac and Technistone strengthen mid-range offerings. Regional analysis shows North Germany leading with 32% market share in 2024, driven by strong residential remodeling and commercial projects. South Germany follows with 29%, supported by luxury housing and hospitality demand, while West Germany holds 21% and East Germany 18%, reflecting steady but comparatively smaller contributions.

Market Insights

- The Germany solid color engineered quartz market was valued at USD 183.44 million in 2024 and is projected to reach USD 296.48 million by 2032, expanding at a CAGR of 5.76%.

- Rising demand for durable, low-maintenance, and aesthetic surfaces in residential remodeling and commercial construction drives market growth, supported by increasing consumer preference for modern interiors.

- Minimalist and monochrome design trends dominate, with solid color quartz gaining popularity in countertops, which accounted for 45% share in 2024 as the leading application segment.

- The market is highly competitive, with top players such as Cosentino, Caesarstone, Compac, and Technistone focusing on innovation, sustainable production, and expanding their distribution networks to strengthen market presence.

- Regionally, North Germany leads with 32% share, followed by South Germany at 29%, West Germany at 21%, and East Germany at 18%, highlighting strong growth opportunities across both residential and commercial applications.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product Type

Press molding quartz dominated the Germany solid color engineered quartz market in 2024, accounting for over 60% share. Its strong position is driven by consistent demand in residential and commercial projects where durability and uniformity are critical. Press molding technology ensures superior density, scratch resistance, and visual consistency, making it ideal for high-use applications. In contrast, casting quartz holds a smaller share, serving niche decorative and specialized needs. The dominance of press molding quartz is reinforced by its cost efficiency, scalability, and suitability for large-scale production aligned with construction growth.

- For instance, Cosentino’s Bretonstone® engineered stone production lines, primarily located in Spain, operate using advanced automated vibro-compression technology to ensure consistent density and uniform finishes.

By Application

Countertops held the leading position in 2024 with more than 45% share of the Germany solid color engineered quartz market. This dominance comes from rising demand in kitchens and bathrooms, where quartz provides durability, low maintenance, and stain resistance. Consumer preference for seamless finishes and modern designs has fueled the segment’s growth across residential and commercial interiors. Flooring and walls follow as significant applications, while door jambs and others remain limited to customized installations. The dominance of countertops is further supported by Germany’s renovation trends and preference for premium surfacing solutions.

- For instance, Caesarstone reported in its sustainability disclosures that its engineered quartz plants produced over 12 million square meters of quartz slabs in 2023, a large portion directed toward countertop installations across Europe.

By End User

The residential sector accounted for the largest market share, exceeding 55% in 2024, in Germany’s solid color engineered quartz market. The demand is largely fueled by increasing kitchen remodeling, urban apartment construction, and consumer preference for aesthetic yet durable materials. Engineered quartz offers a balance of functionality and design appeal, making it highly suitable for households. The commercial segment, including hotels, offices, and retail spaces, is growing steadily, driven by investments in premium interior design. However, residential demand continues to dominate due to sustained growth in home improvement and replacement projects across Germany.

Key Growth Drivers

Rising Demand for Premium Interior Surfaces

The preference for engineered quartz in Germany is driven by its superior durability, aesthetic appeal, and low maintenance compared to natural stones. Homeowners and developers increasingly opt for solid color quartz surfaces in kitchens, bathrooms, and living areas due to their consistent patterns and stain resistance. Renovation projects across German households have also surged, with consumers favoring quartz for its ability to combine design flexibility with functional strength. The premium perception of engineered quartz, coupled with growing disposable incomes and focus on modern interiors, continues to drive its adoption in both residential and commercial segments.

- For instance, in 2023, Cosentino invested significantly in sustainability and technology. This included over €110 million in general investment, with a focus on its industrial park and advancements like its wastewater regeneration station.

Strong Penetration in Residential Remodeling

Residential remodeling is a major growth driver, supported by Germany’s large urban housing base and government focus on sustainable building materials. Quartz countertops and flooring dominate renovation projects due to their long lifecycle and non-porous surfaces, which make them hygienic and easy to clean. The growing trend of open kitchens and minimalist designs further elevates demand for solid color quartz. German consumers also place high value on eco-friendly products, which aligns with quartz manufacturing that increasingly incorporates recycled content. These factors make residential remodeling a cornerstone of growth for the engineered quartz market.

- For instance, Caesarstone confirmed in its 2023 sustainability report that over 42% of the raw materials in its quartz slabs were sourced from recycled and reused inputs, directly aligning with demand in residential remodeling projects across Europe, including Germany.

Commercial Sector Expansion and Hospitality Demand

The commercial sector in Germany is rapidly embracing solid color engineered quartz for retail, office, and hospitality applications. Hotels, restaurants, and premium office spaces favor quartz for its resilience against heavy use, wide design options, and ability to maintain aesthetic consistency over time. Growth in Germany’s hospitality sector and investment in premium commercial spaces boost demand for quartz flooring, wall cladding, and reception surfaces. The increasing number of international hotel chains and luxury dining venues enhances the need for durable and attractive surfacing materials. This rising commercial demand complements residential adoption, ensuring steady long-term growth.

Key Trends & Opportunities

Growing Shift Toward Sustainable Quartz Production

Sustainability is emerging as a critical trend in the German engineered quartz market. Manufacturers are investing in eco-friendly production methods, such as using recycled quartz aggregates, water recycling systems, and low-emission resins. With Germany’s stringent environmental regulations, suppliers who adopt sustainable practices gain a competitive edge. The market also benefits from rising consumer awareness of environmentally responsible choices. This transition creates opportunities for companies to market quartz products as both durable and sustainable, appealing to eco-conscious residential buyers and developers aligned with green building certifications like LEED.

- For instance, Cosentino reported that over 90% of the water used in its Silestone® quartz production is recycled, amounting to more than 400,000 cubic meters annually

Rising Popularity of Minimalist and Monochrome Designs

A notable trend in Germany is the growing popularity of minimalist interiors and monochrome aesthetics. Solid color engineered quartz aligns perfectly with these preferences, as it delivers sleek, uniform finishes in neutral and bold tones. Designers and architects favor quartz for modern projects requiring consistency in texture and shade across large spaces. This design-driven opportunity is particularly strong in urban apartments, offices, and luxury retail stores, where style and uniformity play a vital role. As consumer lifestyles lean toward modern minimalism, solid color quartz is expected to see heightened demand across new construction and remodeling projects.

Key Challenges

High Competition from Natural Stones and Substitutes

Despite its advantages, solid color engineered quartz faces strong competition from natural stones such as granite and marble, as well as alternative surfacing materials like ceramics and laminates. Many German consumers still associate natural stone with prestige and tradition, which can influence purchase decisions. Cost competitiveness also remains a challenge, as quartz often commands higher upfront investment compared to substitutes. To overcome this, manufacturers must emphasize quartz’s longer lifecycle, hygiene benefits, and sustainability to justify the value proposition against competitive surface materials.

Price Sensitivity and Economic Uncertainty

The premium positioning of engineered quartz makes it vulnerable to shifts in consumer spending during periods of economic uncertainty. Price sensitivity in mid-income households may slow down adoption, particularly for large-scale applications such as flooring. Fluctuations in raw material and energy costs also put pressure on manufacturers’ margins, influencing final prices in the German market. Economic slowdowns, inflationary pressures, or reduced construction activity could further challenge growth momentum. To address this, suppliers need to expand affordable product lines and optimize supply chains to sustain competitiveness in both residential and commercial demand.

Regional Analysis

North Germany

North Germany held the leading position in the solid color engineered quartz market in 2024, accounting for 32% share. Strong demand from residential remodeling, particularly in Hamburg, Bremen, and Hanover, supports this dominance. The region benefits from a rising preference for modern interiors and quartz countertops in urban households. Growing investment in commercial real estate, including retail and hospitality projects, also drives adoption. North Germany’s proximity to major import ports further facilitates access to raw materials and finished products, enabling consistent supply. This combination of urban development and logistics advantage secures the region’s leading role.

South Germany

South Germany captured around 29% share of the market in 2024, supported by robust demand in cities like Munich, Stuttgart, and Nuremberg. The region’s strong economy, higher disposable incomes, and luxury housing projects create sustained demand for quartz surfaces in kitchens, bathrooms, and flooring. Premium design trends and rising adoption in the hospitality sector reinforce growth. South Germany also benefits from the presence of specialized distributors and showrooms that promote premium quartz products. The strong link between affluent consumers and modern construction projects secures South Germany as the second-largest market for engineered quartz in Germany.

East Germany

East Germany accounted for 18% share of the Germany solid color engineered quartz market in 2024. Demand here is largely driven by residential renovations in cities such as Leipzig and Dresden, where modernization of older housing stock creates consistent opportunities. Growing investment in commercial projects, including office spaces and hotels, is gradually boosting adoption of engineered quartz for flooring and wall cladding. However, market penetration remains comparatively lower due to slower construction activity compared with western regions. Continuous government-led housing initiatives and urban redevelopment programs are expected to enhance East Germany’s contribution in the coming years.

West Germany

West Germany represented 21% share of the solid color engineered quartz market in 2024. The region benefits from dense urbanization and industrial hubs such as Cologne, Düsseldorf, and Frankfurt, which support strong commercial adoption. Office complexes, retail centers, and hospitality projects account for a significant share of demand, particularly for countertops and flooring. The residential segment also contributes steadily, with increasing preference for modern interior designs among homeowners. West Germany’s strategic location as a commercial center enhances accessibility to suppliers and distributors, supporting steady supply. This balanced mix of commercial and residential demand keeps West Germany a key growth region.

Market Segmentations:

By Product Type

- Press Molding Quartz

- Casting Quartz

By Application

- Flooring

- Walls

- Countertops

- Door Jambs

- Others

By End User

By Geography

- North Germany

- South Germany

- East Germany

- West Germany

Competitive Landscape

The Germany solid color engineered quartz market is highly competitive, with global and regional players focusing on innovation, design diversity, and distribution strength. Leading companies such as Cosentino, Caesarstone, and Compac dominate the market through extensive product portfolios and strong brand recognition in premium residential and commercial segments. European manufacturers like Quarella, Lapitec, and Stone Italiana emphasize design-driven offerings aligned with Germany’s demand for minimalist and monochrome aesthetics. Technistone and Quartzforms strengthen competition by expanding their presence in affordable mid-range products. Companies also invest in eco-friendly production processes and recycled quartz solutions to meet stringent German sustainability standards. Recent developments highlight partnerships with distributors, showroom expansions, and targeted marketing toward renovation projects, which continue to shape the market. Overall, competition is defined by the ability to balance premium quality with sustainability, alongside the capacity to scale production and cater to diverse end-user requirements across Germany’s regional markets.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Cosentino

- Caesarstone

- Quarella

- Lapitec

- Compac

- Technistone

- Breton

- Stone Italiana

- Wilsonart

- Quartzforms

Recent Developments

- In July 2025, Caesarstone launched ICON™, a revolutionary crystalline silica-free solid surface (less than 1% silica) with approximately 80% recycled content, prioritizing both safety for fabricators and sustainability for consumers.

- In July 2025, Vicostone launched 10 new quartz colors for the fall season, focusing on inspirations from natural elements and aesthetics.

- In May 2025, RAK Ceramics commissioned its new next-generation slab production facility using Continua+ PCR 2180 technology, marking a significant technological leap in large-format engineered quartz and ceramic surfaces.

- In May 2024, WK Stone partnered with Eight Homes to offer Quantum Zero, a recycled surface as a safe alternative to high-silica engineered stone.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Application, End User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will continue to grow steadily with strong demand in residential remodeling.

- Countertops will remain the dominant application due to durability and design flexibility.

- Commercial adoption will expand in hotels, offices, and retail projects across major cities.

- Sustainability and recycled quartz content will gain importance under strict German regulations.

- Minimalist and monochrome designs will drive preference for solid color quartz surfaces.

- North and South Germany will sustain leadership supported by urban housing and luxury projects.

- West Germany will see steady demand from commercial real estate development.

- East Germany will gradually expand with modernization of older housing stock.

- Leading players will invest in eco-friendly production and innovative surface designs.

- Competition will intensify as regional brands and global players target mid-range offerings.