Market Overview

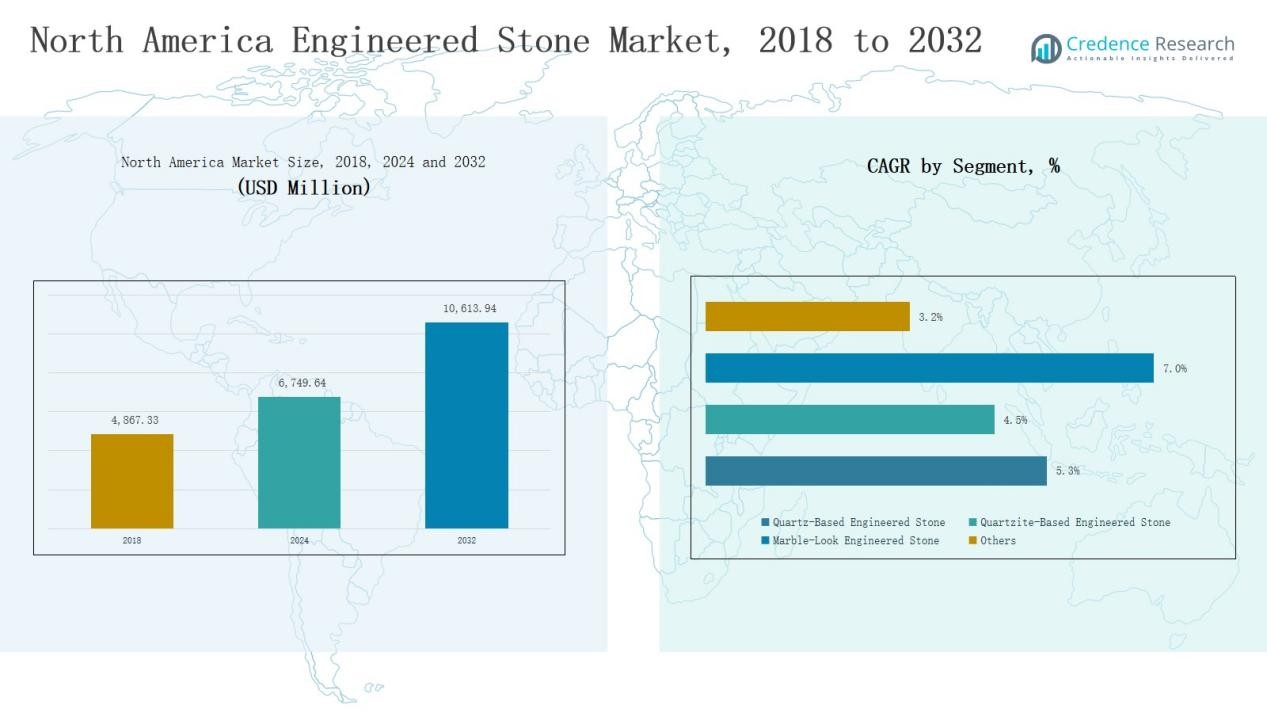

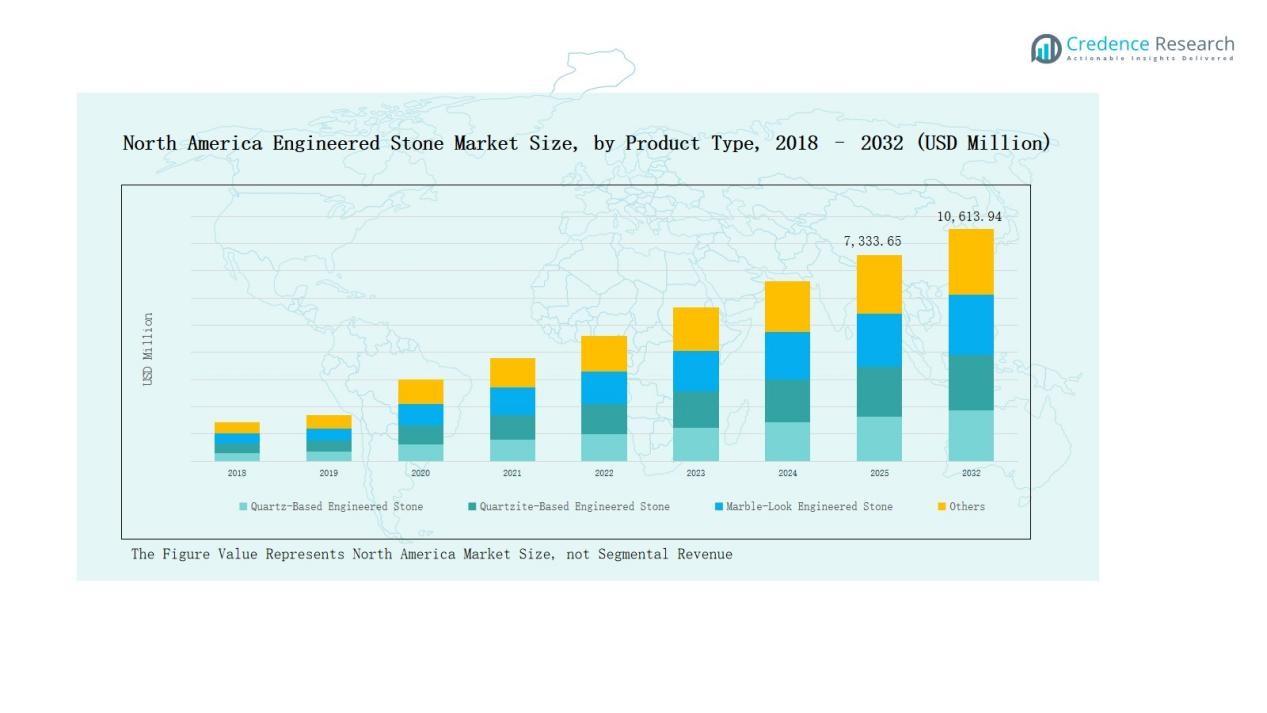

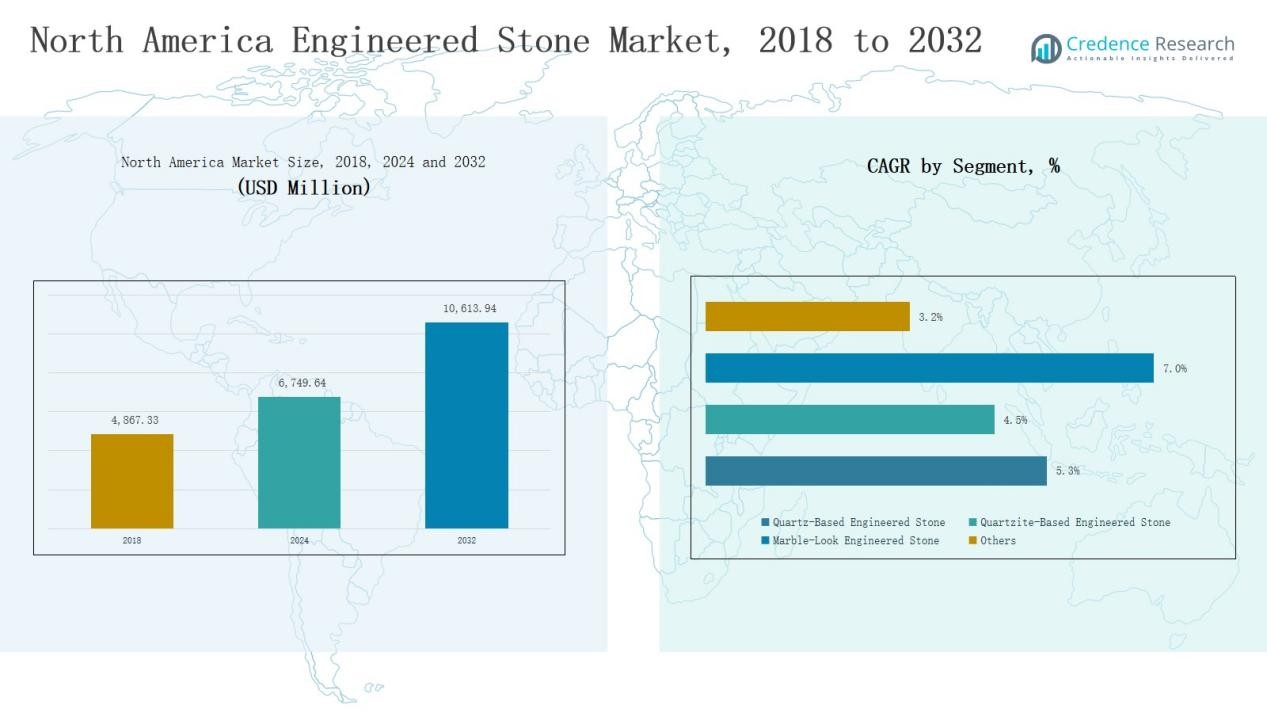

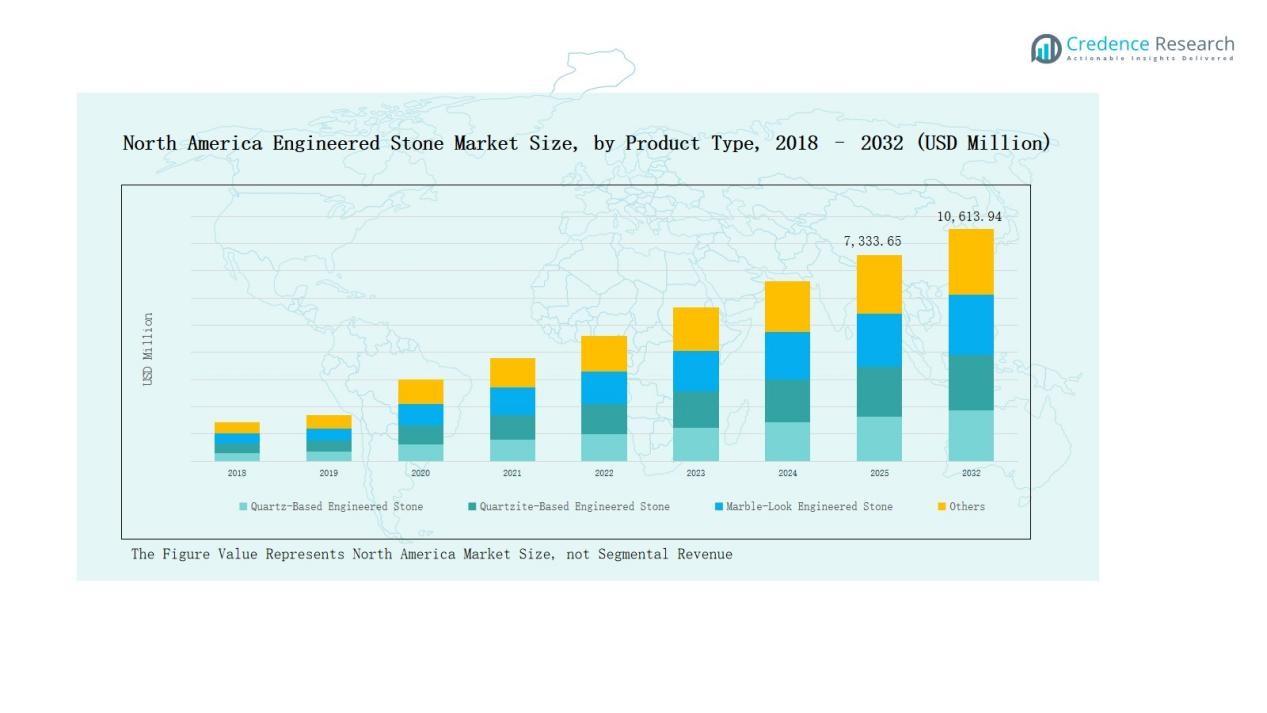

North America Engineered Stone Market size was valued at USD 4,867.33 million in 2018, reached USD 6,749.64 million in 2024, and is anticipated to reach USD 10,613.94 million by 2032, at a CAGR of 5.4% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| North America Engineered Stone Market Size 2024 |

USD 6,749.64 Million |

| North America Engineered Stone Market, CAGR |

5.4% |

| North America Engineered Stone Market Size 2032 |

USD 10,613.94 Million |

The North America Engineered Stone Market is shaped by prominent players including Cambria Company LLC, Caesarstone US, Daltile, MSI Surfaces, Silestone, Hanstone Quartz US, Meta Surfaces, Vadara Quartz, Stone Panels International LLC, and Absolute Marble & Granite. These companies compete through extensive product portfolios, sustainable production methods, and strong distribution networks that ensure widespread availability across residential and commercial projects. The United States emerged as the leading regional market, holding a 72% share in 2024, driven by high residential remodeling activity, commercial construction expansion, and the strong presence of major manufacturers.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The North America Engineered Stone Market grew from USD 4,867.33 million in 2018 to USD 6,749.64 million in 2024 and is projected to reach USD 10,613.94 million by 2032, at a CAGR of 5.4%.

- Leading players include Cambria Company LLC, Caesarstone US, Daltile, MSI Surfaces, Silestone, Hanstone Quartz US, Meta Surfaces, Vadara Quartz, Stone Panels International LLC, and Absolute Marble & Granite, competing through strong portfolios and sustainable practices.

- Quartz-Based Engineered Stone held the dominant position with 56% share in 2024, supported by durability, stain resistance, design variety, and increasing adoption in both residential and commercial applications.

- Residential applications led with 61% share in 2024, driven by growing home renovation projects, modern kitchen and bathroom installations, and strong preference for affordable, durable, and low-maintenance surfaces.

- The United States commanded 72% share in 2024, followed by Canada with 18% and Mexico with 10%, with Mexico identified as the fastest-growing regional market.

Market Segment Insights

By Product Type

Quartz-Based Engineered Stone dominated the North America market with over 56% share in 2024. Its leadership is attributed to superior durability, stain resistance, and wide design options, making it the preferred choice for both residential and commercial projects. Growing awareness of low-maintenance surfaces and the ability to replicate natural aesthetics without high costs further strengthen demand. Sustainability initiatives promoting recycled quartz in production also support expansion, positioning quartz-based products as the most resilient segment in the region.

- For instance, MSI Surfaces added new Calacatta-inspired quartz designs, such as Calacatta Miraggio Cove, targeting demand for premium yet low-maintenance kitchen and bath applications.

By Application

Residential applications led the North America Engineered Stone Market with 61% share in 2024. Rising investments in housing projects, coupled with growing demand for modern kitchens and bathrooms, drive adoption. Homeowners prefer engineered stone for countertops, flooring, and wall cladding due to its affordability and ease of maintenance compared to natural stone. The surge in renovation activities and increasing preference for contemporary interior finishes further boost residential demand, ensuring this segment maintains a strong lead over commercial usage.

- For instance, Cambria introduced new quartz designs under its Luxury Series, emphasizing high-performance surfaces for residential kitchen and bath renovation projects.

By End-Use Industry

Construction and Infrastructure emerged as the leading end-use industry, accounting for 58% share in 2024. Large-scale urbanization, commercial complexes, and public infrastructure projects continue to fuel growth. Contractors and developers value engineered stone for its cost efficiency, durability, and compliance with sustainability codes in green building certifications. Expansion of smart cities and government investments in modern infrastructure further elevate the use of engineered stone, reinforcing construction and infrastructure as the dominant driver of market revenue in North America.

Key Growth Drivers

Rising Demand for Residential Remodeling

The surge in home renovation projects strongly supports market expansion. Homeowners increasingly prefer engineered stone for countertops, flooring, and wall cladding due to durability and low maintenance. Rising disposable incomes and growing interest in modern interiors accelerate replacement of traditional materials. The ability of engineered stone to replicate marble and granite aesthetics at lower cost further boosts adoption. Strong residential demand ensures steady revenue, making remodeling a central driver of growth across U.S., Canada, and Mexico housing markets.

- For instance, Cambria expanded its production facility in Minnesota to meet the rising residential demand for engineered quartz countertops, strengthening its supply capacity across North America.

Expansion of Commercial Infrastructure

Rapid growth in commercial real estate projects, including offices, hotels, and retail spaces, drives adoption of engineered stone. Developers favor engineered stone surfaces for their high resistance to wear, cost-effectiveness, and design flexibility in high-traffic environments. Increased foreign investment in urban projects and corporate expansions across major cities amplify demand. Sustainability certifications in commercial construction also promote engineered surfaces as eco-friendly alternatives. The combination of durability and aesthetics makes engineered stone the material of choice for commercial infrastructure.

Technological Advancements in Manufacturing

Innovation in engineered stone manufacturing significantly enhances market potential. Advancements in resin binders, surface finishes, and recycled content integration improve product strength, eco-friendliness, and design variety. Producers now offer non-silica and antimicrobial surfaces that appeal to health-conscious and environmentally aware consumers. Automation in production facilities further increases efficiency and consistency, reducing costs. These improvements not only broaden product appeal but also address sustainability concerns, enabling manufacturers to tap into premium markets and meet stringent regulatory and design standards.

- For instance, Cosentino launched its Silestone XM series, featuring hybrid mineral composite technology with 20% recycled materials, engineered to lower environmental impact while maintaining versatility in surface designs.

Key Trends & Opportunities

Growing Preference for Sustainable Surfaces

Sustainability is a rising trend shaping market demand. Consumers and builders increasingly prefer eco-friendly materials, driving adoption of engineered stone with recycled quartz content and lower environmental impact. Green building standards in North America promote sustainable products in residential and commercial projects. Manufacturers are introducing water-efficient and low-emission production methods to align with environmental regulations. This shift creates strong opportunities for companies that can offer durable, stylish, and sustainable engineered stone products aligned with eco-conscious consumer expectations.

- For instance, Cosentino introduced new Dekton collections manufactured with 100% renewable electricity and recycled water, reducing its production-related carbon footprint significantly.

Increased Customization and Design Innovation

Customization is emerging as a key opportunity for growth in the market. Consumers demand unique designs, finishes, and textures, ranging from marble-look surfaces to modern matte and bold color palettes. Advances in digital imaging and surface engineering enable manufacturers to replicate natural stone aesthetics with high precision. Architects and interior designers increasingly recommend engineered stone for personalized projects in both residential and commercial spaces. The ability to deliver customized, high-value surfaces creates new revenue streams and competitive differentiation.

- For instance, LX Hausys launched new HIMACS Solid Surfaces featuring on-demand textures and thermoformable qualities, allowing architects to create custom curved or seamless structures for commercial spaces.

Key Challenges

High Silica Content and Health Concerns

Concerns over crystalline silica exposure pose a major challenge. Engineered stone production and fabrication processes release fine silica dust, linked to respiratory diseases like silicosis. Growing regulatory scrutiny and stricter workplace safety standards in the U.S. and Canada increase compliance costs for manufacturers and fabricators. Public health campaigns further highlight risks, affecting consumer perception. Addressing silica-related concerns requires investment in safer formulations, improved worker protection, and innovative product alternatives, without which long-term market growth may face limitations.

Rising Competition from Alternative Materials

The market faces stiff competition from substitutes such as natural stone, ceramics, laminates, and solid surfaces. Many consumers still perceive natural stone as more prestigious, while ceramics offer cost advantages and versatility. Rapid advancements in alternative materials, including lightweight porcelain slabs and hybrid composites, intensify competitive pressure. Builders and designers may shift preferences toward these alternatives when cost or design specifications align. To sustain growth, engineered stone suppliers must differentiate through innovation, branding, and highlighting performance benefits.

Volatility in Raw Material Prices

Fluctuating costs of raw materials, particularly quartz, resin, and pigments, create challenges for manufacturers. Price instability disrupts production planning and profitability, especially for mid-scale players with limited procurement leverage. Global supply chain disruptions further exacerbate shortages and delays in sourcing. These fluctuations force companies to either absorb higher costs or pass them on to consumers, potentially affecting demand. Managing raw material volatility through diversified sourcing strategies and vertical integration becomes crucial for maintaining competitiveness in the market.

Regional Analysis

United States

The United States dominated the North America Engineered Stone Market with 72% share in 2024. Strong residential remodeling activity and high adoption of premium kitchen and bathroom surfaces drive growth. Consumers prefer quartz-based products for their durability, low maintenance, and ability to replicate natural stone at competitive cost. Rapid urbanization, expanding commercial construction, and investments in retail and hospitality spaces further increase demand. The country’s advanced distribution networks and presence of leading manufacturers strengthen supply capabilities. It benefits from innovation in silica-free surfaces, aligning with sustainability standards and health safety regulations.

Canada

Canada held 18% share in 2024, supported by steady demand from both residential and commercial sectors. Growth is driven by rising investments in urban housing projects and public infrastructure. Consumers increasingly favor engineered stone for modern interiors due to its resilience and wide design options. Developers adopt engineered stone in high-traffic spaces such as offices and shopping complexes. The market benefits from government initiatives encouraging sustainable construction practices. It remains an attractive destination for suppliers offering eco-friendly and customizable surface solutions.

Mexico

Mexico accounted for 10% share in 2024, with growth supported by expanding construction and infrastructure projects. Rising disposable incomes and increasing urban housing projects fuel residential adoption of engineered stone surfaces. The country sees growing use in commercial buildings, particularly hotels and retail outlets targeting international tourism. Domestic suppliers face challenges in matching the quality of imported premium brands, but demand continues to rise. Government focus on modern infrastructure development strengthens long-term opportunities. It remains the fastest-growing regional market due to rising investments and affordable housing demand.

Market Segmentations:

By Product Type

- Quartz-Based Engineered Stone

- Quartzite-Based Engineered Stone

- Marble-Look Engineered Stone

- Others

By Application

By End-Use Industry

- Construction and Infrastructure

- Interior Design and Decoration

- Others

By Region

Competitive Landscape

The competitive landscape of the North America Engineered Stone Market is characterized by the presence of established global brands and regional manufacturers competing on product quality, design variety, and distribution strength. Leading players such as Cambria Company LLC, Caesarstone US, MSI Surfaces, Silestone, and Hanstone Quartz US maintain strong positions through wide product portfolios, advanced finishes, and effective branding strategies. Companies emphasize sustainable production practices, including the use of recycled materials and reduced silica content, to address regulatory pressures and changing consumer preferences. Expansion into commercial projects, partnerships with contractors, and strong retail presence further enhance competitiveness. Emerging players like Meta Surfaces and Vadara Quartz are gaining traction with innovative designs and tailored solutions for niche customer segments. The market remains moderately concentrated, with top companies holding significant shares, but opportunities for differentiation exist in customization, eco-friendly offerings, and technological innovation.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Players

- Cambria Company LLC

- Caesarstone US

- Daltile

- MSI Surfaces

- Silestone

- Meta Surfaces

- Vadara Quartz

- Hanstone Quartz US

- Stone Panels International LLC

- Absolute Marble & Granite

Recent Developments

- In July 2025, Caesarstone introduced its Caesarstone ICON™, a crystalline-silica-free surface made with around 80% recycled materials.

- In July 2025, Cosentino expanded its footprint by opening new Cosentino City showrooms in Dallas, Honolulu, and Richmond.

- In April 2025, Vadara Quartz formed a distribution partnership with CRS Marble & Granite (USA) to expand its artisan quartz reach.

- In December 2024, Daltile launched new extra-large porcelain and quartz slab collections across North America.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Application, End Use Industry and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand will rise with continued growth in residential remodeling projects.

- Commercial infrastructure expansion will drive wider adoption of engineered stone.

- Sustainable and eco-friendly surfaces will gain stronger preference among buyers.

- Customization in colors, textures, and finishes will attract design-focused consumers.

- Technological innovation will improve product durability and reduce silica content.

- Distribution networks will expand through partnerships with contractors and retailers.

- Renovation trends in kitchens and bathrooms will support long-term market growth.

- Increased investments in hospitality and retail sectors will boost usage in high-traffic spaces.

- Competition from ceramics and natural stone will encourage stronger product differentiation.

- Government focus on sustainable building standards will enhance adoption across new projects.