Market Overview:

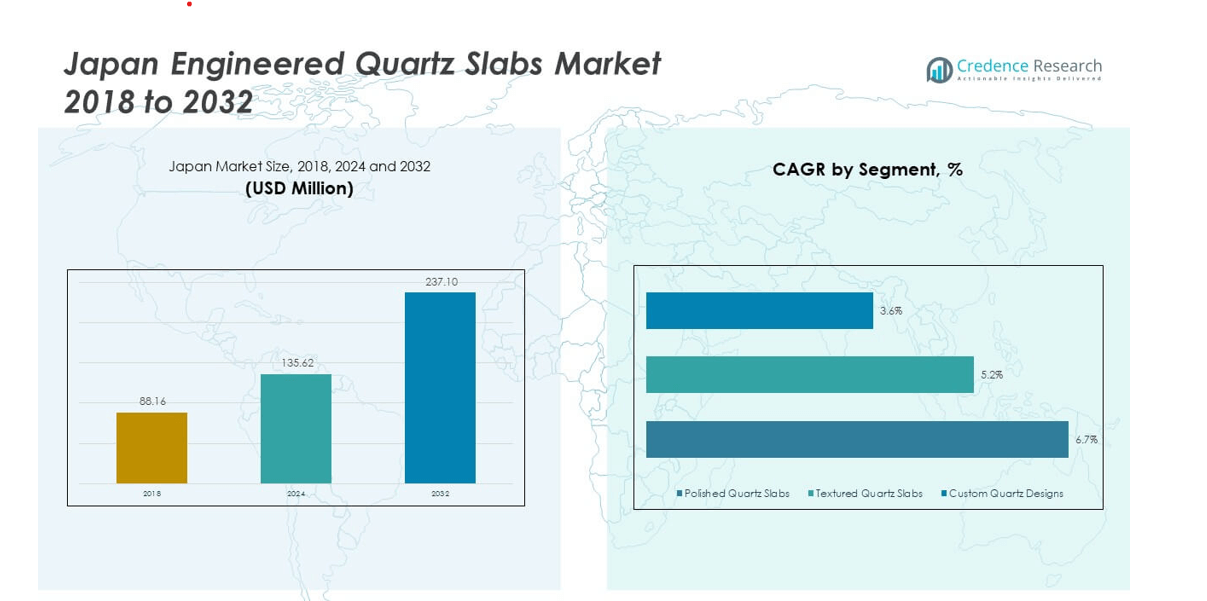

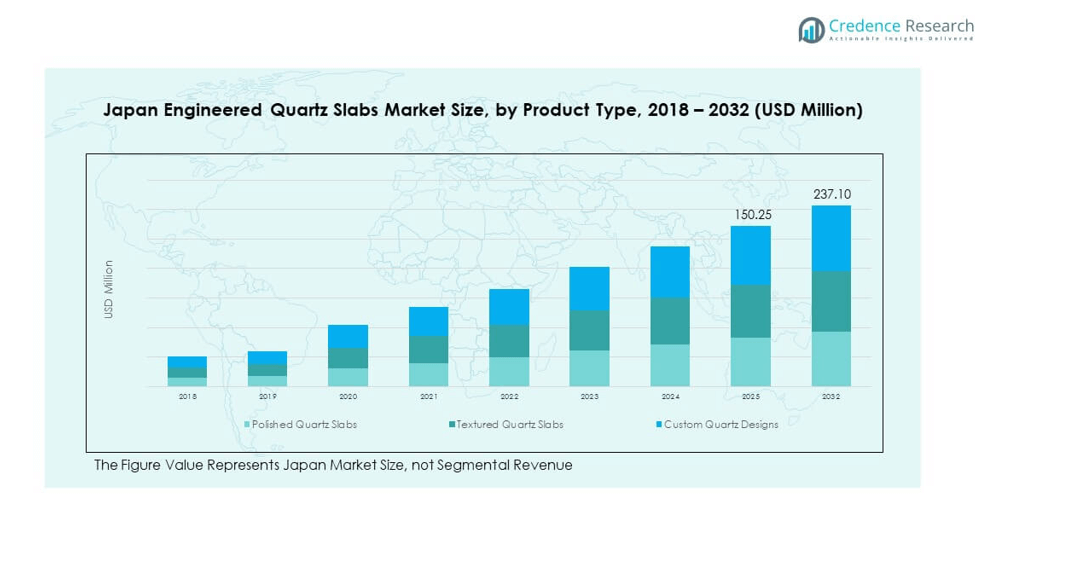

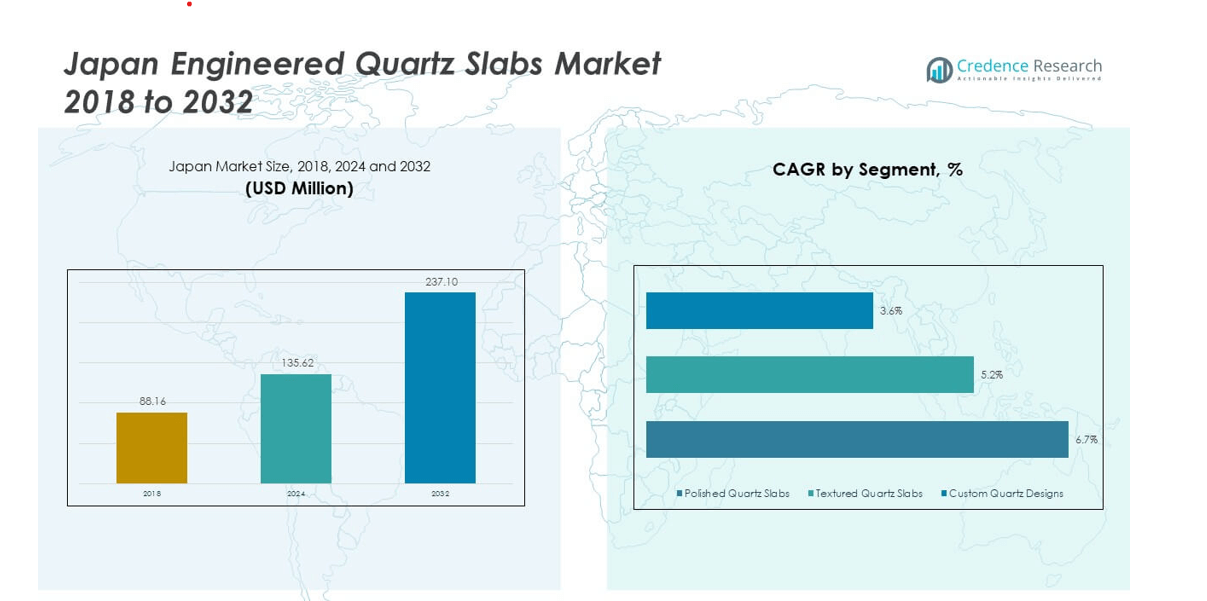

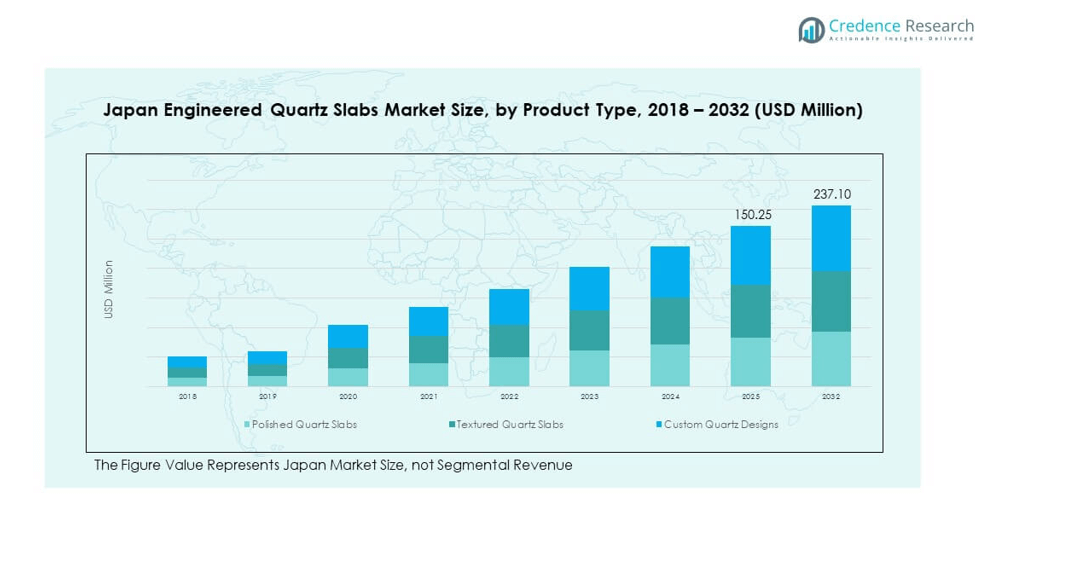

The Japan Engineered Quartz Slabs Market size was valued at USD 88.16 million in 2018 to USD 135.62 million in 2024 and is anticipated to reach USD 237.10 million by 2032, at a CAGR of 6.73% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Japan Engineered Quartz Slabs Market Size 2024 |

USD 135.62 million |

| Japan Engineered Quartz Slabs Market, CAGR |

6.73% |

| Japan Engineered Quartz Slabs Market Size 2032 |

USD 237.10 million |

Growth in this market is strongly driven by rising demand from residential and commercial construction projects. Consumers increasingly prefer engineered quartz slabs due to their durability, low maintenance, and wide design choices. The hospitality sector also boosts adoption, as hotels and restaurants favor premium surfaces for aesthetics and performance. Growing awareness of hygiene and non-porous surfaces further supports demand. Continuous product innovation, including eco-friendly and recycled material-based slabs, strengthens market penetration. Urbanization, coupled with remodeling trends, expands usage in kitchens and bathrooms. Rising disposable incomes also encourage adoption of premium interior solutions.

Regionally, Japan leads the demand due to strong construction activities and high consumer preference for premium interiors. North America follows with growing use in residential remodeling projects and sustained demand in commercial spaces. Europe remains a significant market, supported by modernization in home improvement. Emerging economies in Asia-Pacific, including China and India, are witnessing rising adoption driven by rapid urbanization and evolving lifestyle choices. Middle East markets also show potential, supported by large-scale construction and luxury developments. Latin America remains in an early stage but presents opportunities as awareness and disposable incomes increase.

Market Insights:

- The Japan Engineered Quartz Slabs Market was valued at USD 41.02 million in 2018, projected at USD 150.25 million in 2024, and expected to reach USD 237.10 million by 2032, with a CAGR of 5.9%.

- North America led with 34.5% share, driven by high adoption in residential and commercial spaces. Europe followed with 28.3%, supported by strong demand in modern interior design. Asia-Pacific held 24.7% share, boosted by urbanization and rising construction projects.

- Asia-Pacific is the fastest-growing region, fueled by expanding real estate, rising consumer incomes, and preference for durable surfaces.

- Polished quartz slabs dominate with nearly 48% of the market share, reflecting high use in kitchens and bathrooms.

- Custom quartz designs account for about 32% share, highlighting demand for aesthetic and personalized surfaces.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Demand from Residential Construction and Renovation Projects

The Japan Engineered Quartz Slabs Market benefits strongly from growing demand in residential construction and remodeling activities. Homeowners prefer quartz slabs over traditional materials because of their durability, stain resistance, and low maintenance. Increasing disposable income allows households to invest in premium kitchen countertops, flooring, and wall cladding. Urban housing projects in Japan also incorporate engineered quartz to match modern design standards. The demand for hygienic, non-porous surfaces has further fueled adoption across new builds. Aesthetic versatility with multiple patterns and finishes enhances customer preference. It continues to gain traction in high-end interior design due to its blend of functionality and style.

Growing Use of Engineered Quartz in Commercial Infrastructure

Commercial infrastructure development fuels strong demand for engineered quartz slabs in Japan. Offices, hotels, restaurants, and retail outlets increasingly choose quartz for surfaces that combine durability with visual appeal. Quartz slabs are widely installed in reception areas, lobbies, and dining spaces due to their resistance to wear and ease of cleaning. Hospitality businesses prefer quartz for delivering a premium look while ensuring long-term reliability. The construction of new commercial complexes across urban centers accelerates demand further. Developers prioritize quartz to align with sustainability and modern design requirements. It positions itself as a cost-effective alternative to natural stone while ensuring consistent quality.

- For instance, LIXIL achieved Science Based Targets initiative (SBTi) Net-Zero approval in March 2024 and has been featured for equipping major Japanese hotel and commercial projects with engineered quartz solutions as part of its sustainability initiatives, aligning commercial slab adoption with strict environmental criteria.

Innovation in Sustainable and Recycled Quartz Slabs

Sustainability plays an important role in driving demand for quartz slabs across the Japanese market. Manufacturers are introducing eco-friendly slabs that use recycled materials without compromising quality or performance. Customers value slabs that provide a premium look while supporting environmental goals. Growing awareness of green construction practices encourages developers to adopt engineered quartz as a responsible choice. The market benefits from technological improvements in resin and production processes, enhancing product strength and design range. Demand from eco-conscious consumers strengthens overall adoption in urban housing. It remains an attractive solution for buyers seeking premium, durable, and sustainable surfaces.

Strong Influence of Lifestyle Trends and Consumer Preferences

Lifestyle trends in Japan increasingly favor modern and minimalistic interior designs, boosting quartz slab demand. Younger consumers view engineered quartz as an aspirational product, linking it to luxury and convenience. Kitchens and bathrooms remain prime application areas where style and performance matter most. The influence of global design trends also drives the adoption of innovative finishes and colors. Rising exposure to premium home improvement content across media strengthens consumer awareness. Interior designers and architects often recommend quartz for blending aesthetics with durability. It plays a central role in meeting evolving lifestyle preferences that prioritize elegance, hygiene, and functionality.

Market Trends:

Integration of Digital Tools and Customization in Design

The Japan Engineered Quartz Slabs Market is witnessing a strong trend of customization supported by digital tools. Consumers seek unique slab patterns, colors, and finishes to align with their personalized design preferences. Architects and builders leverage advanced software to simulate interior looks using quartz, creating a more immersive buying experience. Customization also allows better coordination between furniture, wall finishes, and flooring. Manufacturers focus on expanding digital catalogs that showcase wide design portfolios. Demand for tailor-made solutions drives innovation in product offerings. It gains momentum as customer expectations shift toward premium and personalized interiors.

- For instance, leading Japanese engineered quartz manufacturers now provide digital catalogs and 3D visualization tools for interior design, as seen in industry profiles and market outlooks highlighting the widespread integration of augmented-reality and 3D design software for client-driven slab visualization and customization in 2025.

Increased Adoption of Quartz in Smart and Sustainable Homes

The shift toward smart and sustainable homes has accelerated demand for engineered quartz across Japan. Builders and homeowners prioritize materials that align with energy-efficient and eco-friendly construction. Quartz meets these needs by offering durability, longevity, and minimal maintenance. It fits seamlessly into eco-conscious housing projects, reinforcing its value in modern architecture. Demand for sustainable slabs made with recycled content continues to rise. Integration with smart home designs enhances its role as a preferred material. Consumers recognize engineered quartz as a blend of innovation, sustainability, and modern lifestyle appeal.

- For instance, LIXIL’s 2025 sustainability initiatives support its commitment to “Zero Carbon and Circular Living” and are influencing specifications for new residential projects. LIXIL focuses on a range of material innovations and products for smart and eco-friendly residential developments, including the PremiAL R-series of recycled aluminum and the new circular material, revia, as well as high-performance, thermal insulating windows.

Growing Role of Quartz in Luxury and Hospitality Segments

Luxury residential projects and hospitality developments increasingly integrate engineered quartz into their interiors. Hotels and resorts use quartz for countertops, bathroom vanities, and lobby surfaces due to its premium look and resistance to wear. High-end restaurants prefer quartz for its hygiene benefits and visual appeal. Rising tourism and hospitality expansion in Japan contribute to stronger adoption. Luxury apartments also highlight quartz slabs as a selling feature for attracting buyers. Developers market quartz as a durable yet elegant material, reinforcing its presence in premium spaces. It remains central to positioning projects within the luxury segment.

Advancement in Manufacturing Technologies and Surface Innovation

Manufacturers in Japan are adopting advanced technologies to enhance quartz slab production and design quality. New processes allow greater precision in creating diverse colors, textures, and finishes. Innovations in resin technology improve slab durability, scratch resistance, and environmental performance. Automated production lines help scale output while maintaining consistent quality. Surface innovations, such as matte and textured finishes, cater to evolving consumer preferences. The ability to replicate natural stone appearances adds competitive advantage. Manufacturers aim to balance aesthetics with performance features. It strengthens overall market growth by aligning production with evolving architectural and design demands.

Market Challenges Analysis:

High Competition from Alternative Materials and Price Sensitivity Among Consumers

The Japan Engineered Quartz Slabs Market faces strong competition from natural stones such as granite and marble, as well as ceramic tiles and laminates. Many consumers in price-sensitive segments still opt for lower-cost materials despite quartz offering better durability and hygiene. Imported alternatives sometimes enter the market at competitive prices, creating additional pressure on local suppliers. Builders and contractors working on budget projects prefer traditional materials, slowing quartz adoption in mid-tier developments. The higher upfront cost of engineered quartz continues to act as a barrier for mass adoption. Awareness campaigns highlighting long-term value have helped, but challenges remain. It must balance premium positioning while addressing affordability concerns to strengthen its reach.

Supply Chain Constraints and Environmental Concerns in Manufacturing Processes

Manufacturers encounter challenges linked to raw material availability and production costs. Quartz slab production requires consistent supply of quartz crystals, resins, and pigments, which face occasional sourcing disruptions. Global supply chain issues can delay imports of essential components, impacting delivery timelines. Environmental concerns regarding resin-based production also influence public perception. Rising energy costs add to operational expenses, making manufacturing less cost-efficient. Smaller players struggle to match the scale of larger producers, limiting competitive capacity. Stringent regulations on emissions and waste management create additional compliance requirements. The market needs to adapt with sustainable practices while ensuring steady supply to remain competitive.

Market Opportunities:

Expansion of Premium Residential and Luxury Housing Projects Across Urban Areas

The Japan Engineered Quartz Slabs Market is well-positioned to benefit from rising demand in luxury housing and urban redevelopment projects. Homebuyers increasingly value premium interiors, driving preference for quartz slabs in kitchens, bathrooms, and living areas. Developers highlight quartz as a key feature in high-end residential units to attract buyers seeking elegance and functionality. Growing urban populations encourage apartment renovations and compact housing projects that rely on durable surfaces. It aligns with consumer expectations for modern design and low maintenance, making it a preferred choice in residential markets.

Growth Potential in Green Construction and Eco-Friendly Product Development

Sustainability-focused construction projects create new opportunities for quartz slab adoption in Japan. Manufacturers introducing eco-friendly slabs with recycled content appeal to environmentally conscious buyers. Builders prioritize materials that comply with green building certifications, supporting quartz demand. Opportunities exist in public sector projects where environmental standards are mandatory. The market also benefits from rising awareness among younger consumers seeking sustainable lifestyles. It positions itself as both a premium and eco-friendly product, enabling growth across multiple end-user segments.

Market Segmentation Analysis:

By Product Type

The Japan Engineered Quartz Slabs Market demonstrates strong demand across polished, textured, and custom quartz designs. Polished slabs dominate due to their glossy finish, durability, and suitability for both residential and commercial interiors. Textured slabs gain traction among buyers seeking natural stone aesthetics with modern functionality. Custom quartz designs appeal to premium consumers and interior designers who prioritize personalization and unique finishes. It reflects a balance between mass-market demand for polished slabs and rising interest in textured and customized options.

By Application

Engineered quartz slabs are widely adopted across residential and commercial construction projects. Residential construction remains the largest application, driven by demand for premium kitchen countertops and bathroom vanities. Commercial construction utilizes quartz in offices, hotels, and retail spaces for its durability and low maintenance. Kitchen and bathroom design represents a core area of usage, supported by remodeling trends. Interior design applications expand steadily with rising emphasis on aesthetics and sustainability. It continues to gain traction across diverse applications, enhancing both functional and decorative purposes.

- For instance, in 2025, engineered quartz slabs are in high demand for kitchen countertops in Japan, especially in renovation and new housing projects within the Tokyo-led Kanto region. This trend is fueled by consumer preference for durable, low-maintenance, and aesthetically modern materials in both residential and commercial kitchen and bathroom applications.

By Country (Within Japan Market Scope)

Country-level segmentation highlights distinct adoption patterns shaped by local construction and design preferences. Product type revenue share is led by polished slabs, with textured and custom options steadily increasing in demand. Application revenue share reflects strong growth in residential projects, supported by urban development and consumer lifestyle upgrades. It showcases resilience across different regions in Japan while aligning with evolving market preferences. The balance between product and application segments ensures consistent expansion opportunities across the value chain.

Segmentation:

By Product Type

- Polished Quartz Slabs

- Textured Quartz Slabs

- Custom Quartz Designs

By Application

- Residential Construction

- Commercial Construction

- Kitchen & Bathroom Design

- Interior Design

- Others

By Country (within Japan market scope)

- Country-level segmentation

- Product Type revenue share

- Application revenue share

Regional Analysis:

Dominance of Kanto Region

The Kanto region holds the largest share of the Japan Engineered Quartz Slabs Market, accounting for nearly 35% of total revenue. Strong urbanization, high disposable incomes, and extensive real estate development drive product demand in this area. Tokyo and surrounding cities lead adoption in both residential and commercial projects, where premium interiors are highly valued. Kitchen and bathroom renovations are particularly strong in urban households, boosting polished slab sales. Luxury hotels and office towers in Tokyo prefer engineered quartz for its durability and modern appeal. It secures a leadership position in Kanto by aligning with high consumer expectations and robust construction activity.

Steady Growth in Kansai and Chubu Regions

The Kansai region contributes around 25% market share, supported by developments in Osaka, Kyoto, and Kobe. Demand is fueled by a blend of cultural heritage properties and modern infrastructure requiring premium surfaces. Residential projects drive strong uptake in suburban areas, while commercial expansion strengthens adoption in urban centers. Chubu accounts for about 20% of the market, with Nagoya leading industrial and housing growth. Local manufacturers in Chubu benefit from proximity to raw materials and logistics networks, supporting steady supply. It shows consistent growth in these regions through balanced adoption in housing, retail, and hospitality.

Emerging Demand from Kyushu, Hokkaido, and Other Areas

Kyushu represents nearly 12% of the Japan Engineered Quartz Slabs Market, with rising demand linked to residential upgrades and hotel projects. Regional tourism supports quartz adoption in hospitality facilities that require stylish and durable interiors. Hokkaido accounts for 8%, where adoption is growing in residential construction projects driven by lifestyle modernization. Smaller regions contribute the remaining share, expanding gradually with infrastructure and housing developments. Rural areas witness slower uptake due to cost sensitivity, but awareness campaigns and improved supply channels are creating opportunities. It continues to broaden its presence across these emerging regions, ensuring nationwide growth momentum.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- HanStone

- LG Hausys

- Vicostone

- Caesarstone

- Silestone

- Cosentino

- Technistone

- Compac

- Quarella

- SantaMargherita Quartz

Competitive Analysis:

The Japan Engineered Quartz Slabs Market is highly competitive, with established global and regional players actively shaping growth. Companies such as HanStone, LG Hausys, Vicostone, and Caesarstone lead through strong product portfolios and advanced manufacturing technologies. Cosentino, Silestone, and Technistone reinforce competition by focusing on innovative designs and sustainable solutions. Local players emphasize tailored offerings to align with domestic design preferences. It remains characterized by continuous product innovation, brand differentiation, and investments in eco-friendly materials. Firms compete on aesthetics, durability, and price positioning, ensuring a dynamic and evolving marketplace.

Recent Developments:

- In January 2025, Caesarstone rolled out its ICON™ Advanced Fusion surface, a market-first, silica-free quartz slab made with approximately 80% recycled materials and aimed at enhancing indoor air quality and eco-friendly design for Japanese customers seeking sustainable surfacing options.

- In July 2025, Vicostone officially launched 10 new quartz colors for the Fall 2025 season in Japan, inspired by the elements and aesthetics of the natural world, expanding surface design options and reinforcing its brand presence in the market.

- In February 2025, LX Hausys unveiled several new VIATERA quartz colors and technology upgrades, including the Cloud Ridge and Taj Duna collections, at KBIS 2025, with a clear focus on innovation and natural-inspired design suited to Japanese kitchen and bath applications.

Report Coverage:

The research report offers an in-depth analysis based on product type, application, and country-level segmentation. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The market will expand steadily, supported by strong residential construction and remodeling projects.

- Rising demand for premium interiors will strengthen adoption of polished quartz slabs.

- Textured and custom quartz designs will gain momentum among architects and designers.

- Eco-friendly slabs using recycled materials will see wider acceptance in urban markets.

- Commercial spaces such as hotels and offices will remain critical demand centers.

- Regional growth will be led by Kanto, with Kansai and Chubu showing steady contributions.

- Technological advancements in resin and surface finishing will enhance product quality.

- Local suppliers will expand offerings to meet specific domestic design preferences.

- Strategic partnerships and distribution networks will play a key role in market penetration.

- The market will benefit from sustained urbanization and evolving consumer lifestyle trends.