Market Overview:

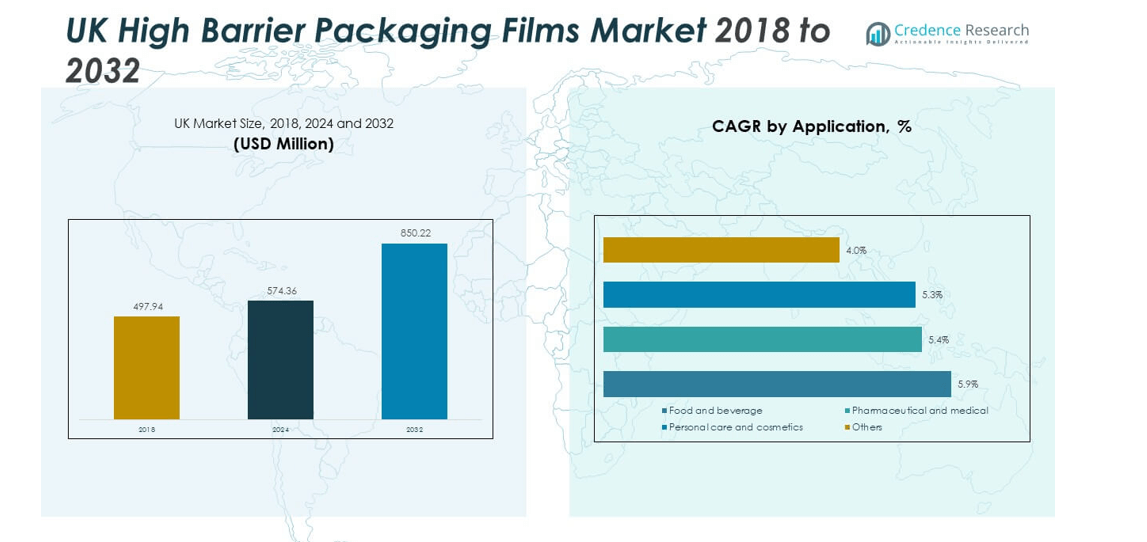

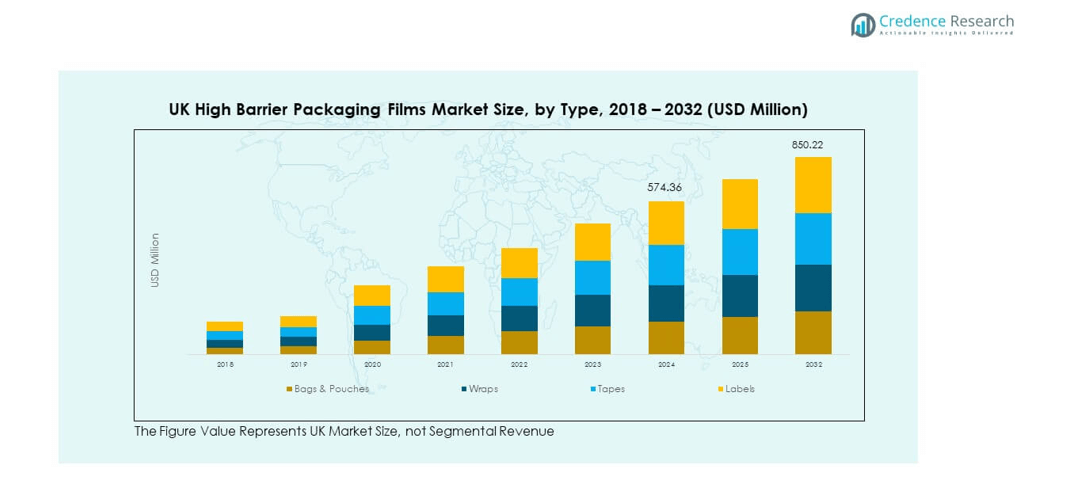

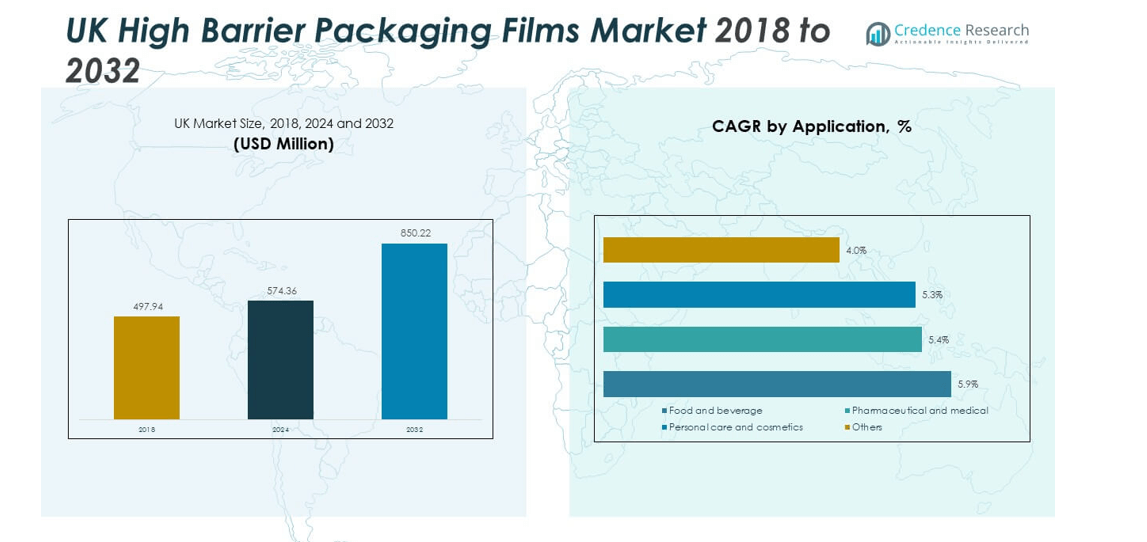

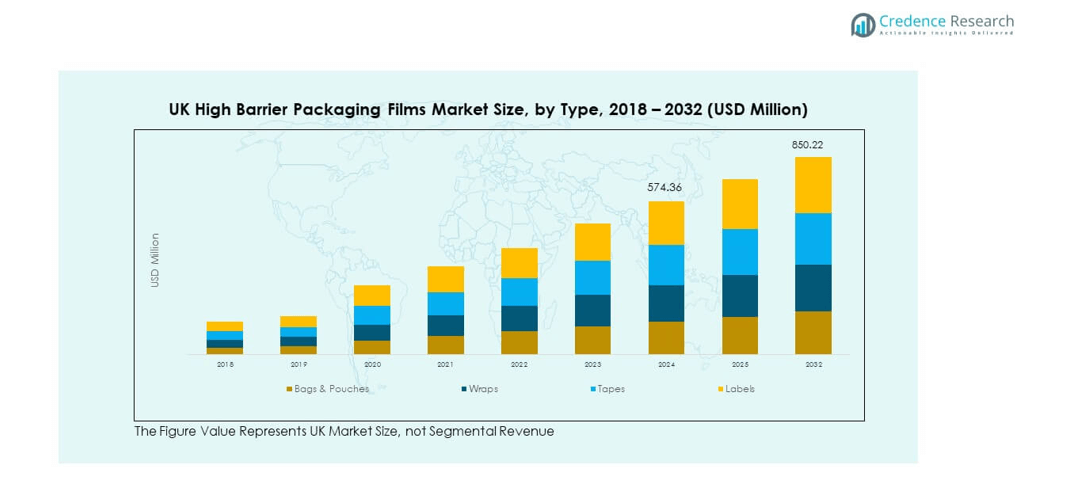

The UK High Barrier Packaging Films Market size was valued at USD 497.94 million in 2018, reached USD 574.36 million in 2024, and is anticipated to reach USD 850.22 million by 2032, at a CAGR of 5.03% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| UK High Barrier Packaging Films Market Size 2024 |

USD 574.36 million |

| UK High Barrier Packaging Films Market, CAGR |

5.03% |

| UK High Barrier Packaging Films Market Size 2032 |

USD 850.22 million |

Rising consumer preference for longer shelf-life products and the strict regulatory focus on food safety are key drivers in this market. Manufacturers are innovating with multi-layer films that combine high barrier properties with recyclability, addressing both sustainability and performance needs. Increasing adoption of ready-to-eat meals, online grocery shopping, and packaged pharmaceuticals further accelerates demand. Moreover, the push for lightweight materials with strong protection features supports growth, as companies aim to reduce logistics costs while ensuring product quality and safety.

Regionally, the UK leads the adoption of high barrier packaging films in Europe, supported by strong food processing, retail, and healthcare industries. While established urban areas such as London and Manchester dominate demand due to dense retail networks and high consumption rates, smaller regions are emerging as new growth hubs. This trend is influenced by expanding e-commerce penetration and rising packaged food consumption in semi-urban and rural markets. The UK’s advanced supply chains and stringent packaging standards further strengthen its role as a regional leader.

Market Insights:

- The UK High Barrier Packaging Films Market was valued at USD 497.94 million in 2018, reached USD 574.36 million in 2024, and is projected to reach USD 850.22 million by 2032, at a CAGR of 5.03%.

- England led with a 56% share in 2024, supported by strong food, retail, and pharmaceutical industries. Scotland followed with 22%, driven by eco-friendly packaging adoption, while Wales and Northern Ireland jointly accounted for 22% through demand in food and healthcare.

- Scotland is the fastest-growing region, holding 22% share in 2024, fueled by strict environmental policies, food exports, and investments in sustainable packaging innovations.

- Bags & pouches accounted for 34% of the product segment in 2024, reflecting their dominance across food and beverage applications.

- Wraps and tapes together represented 41% of the product segment, highlighting their critical role in retail-ready and industrial packaging solutions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Consumer Preference For Longer Shelf Life And Food Safety Standards

The UK High Barrier Packaging Films Market is driven by consumer demand for extended product shelf life and compliance with strict food safety regulations. Food retailers rely on advanced barrier films to minimize spoilage and preserve freshness. Consumers increasingly choose packaged products that ensure safety, hygiene, and durability. Government regulations push companies to maintain high standards in packaging, encouraging the use of innovative barrier films. The demand for vacuum-sealed and modified atmosphere packaging continues to grow. It supports both convenience and quality assurance for packaged food. Manufacturers invest in film technologies that combine durability with flexibility. This driver strengthens the adoption of advanced packaging solutions across industries.

- For instance, Amcor’s AmLite Recyclable high-barrier packaging doubled the shelf life of Popcorn Shed’s premium popcorn from six months to twelve months, making the product viable for export and extended distribution in the UK.

Increasing Demand From Ready-To-Eat Meals And Online Grocery Channels

Convenience-focused lifestyles are boosting demand for ready-to-eat meals and online grocery orders in the UK. High barrier packaging films provide secure sealing and product protection across these categories. Supermarkets and e-commerce retailers use them to ensure safe delivery and extended shelf stability. Growth in online food delivery platforms enhances the relevance of these films. It helps minimize damage risks during storage and transportation. Packaging manufacturers design lightweight yet strong materials for logistics efficiency. Rising adoption of chilled and frozen meals also supports growth. Consumer trust in safe packaging enhances brand loyalty for food producers.

- For instance, Sealed Air’s Cryovac FlexPrep pouches enabled UK foodservice operators to cut shipping case sizes by 35% for equivalent volumes, improving logistics efficiency and ensuring product integrity during transportation.

Technological Innovation In Multi-Layer And Sustainable Packaging Films

Innovation in barrier film technology fuels market expansion across the UK packaging sector. Companies develop multi-layer structures that combine superior barrier strength with sustainability. Films integrate oxygen, moisture, and UV resistance to protect sensitive goods. It enables brands to maintain quality while reducing waste. Adoption of recyclable and bio-based materials responds to eco-conscious consumers. Flexible formats such as pouches and wraps add convenience. Research investments ensure continuous improvements in durability and performance. Innovation keeps the market competitive while meeting evolving environmental standards.

Expansion Of Pharmaceutical And Healthcare Packaging Requirements

The healthcare and pharmaceutical sectors play a vital role in driving this market. Medical products require packaging that ensures sterility, stability, and protection from contamination. The UK High Barrier Packaging Films Market benefits from rising prescription drug consumption and healthcare advancements. It meets strict regulatory standards for medicine safety. Demand for blister packs, sachets, and sterile wraps continues to grow. Increasing exports of healthcare products require robust packaging solutions. Pharmaceutical companies prefer lightweight films that reduce storage and transport costs. This driver strengthens the market’s expansion beyond the food industry.

Market Trends:

Adoption Of Smart Packaging Solutions For Enhanced Product Tracking And Safety

The UK High Barrier Packaging Films Market is witnessing strong adoption of smart packaging features. Companies integrate QR codes, NFC tags, and sensors into films for improved traceability. These solutions help track food freshness, storage conditions, and supply chain movements. It improves transparency between producers and consumers. Retailers benefit from reduced waste through real-time monitoring systems. The demand for intelligent packaging aligns with increasing regulatory focus on food safety. Smart films also strengthen brand reputation by offering trust and authenticity. This trend is reshaping how products are marketed and consumed.

- For instance, Mondi expanded its FunctionalBarrier Paper Ultimate range in August 2025, delivering an oxygen transmission rate below 0.5 cm³/sqm per day, supporting advanced food product tracking and significantly preserving freshness for UK brands.

Growth Of Flexible Packaging Formats In Retail And E-Commerce Applications

Flexible packaging solutions are gaining momentum in the UK’s retail and e-commerce channels. Pouches, wraps, and resealable packs dominate categories like snacks, beverages, and ready meals. The UK High Barrier Packaging Films Market leverages flexibility to reduce logistics costs. It provides convenience for consumers seeking portion control and portability. Online retailers prefer lightweight films for efficient delivery and storage. Flexible packaging also supports sustainability through material reduction. Consumer lifestyles encourage adoption of packaging formats that combine convenience and quality. This trend continues to expand across multiple product categories.

- For instance, Amcor collaborated with Nestlé on a world-first recyclable retort pouch using AmLite HeatFlex Recyclable, achieving up to 60% lower environmental footprint and compliant shelf life for wet pet food across retail channels in the UK.

Increased Focus On Recyclable And Bio-Based Film Alternatives

Sustainability goals are driving demand for recyclable and bio-based barrier films. Manufacturers are shifting toward materials that comply with circular economy standards. It helps brands meet government and consumer expectations for eco-friendly products. High-performance recyclable films protect products while reducing environmental impact. Companies invest in bio-polymers and advanced coatings to maintain functionality. Retailers adopt eco-labels to highlight green credentials to consumers. Rising awareness about plastic waste accelerates adoption of sustainable alternatives. This trend aligns with global sustainability frameworks shaping the packaging industry.

Rising Importance Of Aesthetic Appeal And Branding In Packaging Design

Brand differentiation through packaging design is becoming increasingly important. The UK High Barrier Packaging Films Market responds with films offering clarity, printability, and advanced finishes. Transparent and high-quality visuals improve shelf presence. It supports premiumization strategies in food, beverage, and personal care categories. Attractive packaging increases consumer engagement and loyalty. Companies invest in films that accommodate advanced printing technologies. Customized graphics and designs highlight product quality and brand values. This trend strengthens the role of packaging as a marketing tool.

Market Challenges Analysis:

High Production Costs And Complex Recycling Processes For Barrier Films

The UK High Barrier Packaging Films Market faces challenges from high production costs and recycling difficulties. Multi-layer structures enhance protection but complicate recyclability. It requires specialized technologies to separate layers and ensure reuse. Rising raw material costs increase the overall expense of manufacturing films. Small and medium enterprises struggle with the capital investment required for innovation. Recycling infrastructure remains limited in handling complex packaging. Environmental regulations put added pressure on producers to improve recovery systems. These factors slow down rapid adoption in certain industries despite strong demand.

Intense Competition And Pressure To Meet Evolving Sustainability Standards

Competition in the market is increasing with both domestic and international players expanding their presence. Companies must balance innovation, cost efficiency, and sustainability. The UK High Barrier Packaging Films Market faces pressure to meet regulatory demands for eco-friendly solutions. It forces producers to invest in R&D for recyclable and bio-based alternatives. Rapidly shifting consumer expectations create uncertainty in packaging choices. Businesses face challenges in achieving compliance without sacrificing performance. Market saturation in certain segments intensifies price competition. These dynamics create hurdles for long-term profitability and growth.

Market Opportunities:

Expansion Of Eco-Friendly Packaging Solutions To Meet Sustainability Goals

The UK High Barrier Packaging Films Market offers opportunities in eco-friendly innovation. Brands focus on recyclable and bio-based films to align with consumer expectations. It supports companies aiming to reduce carbon footprints and comply with regulations. Development of high-barrier compostable films expands growth potential. Retailers adopt green packaging to strengthen brand loyalty. Demand for sustainable materials creates space for new entrants. This opportunity positions eco-friendly solutions as a key differentiator in the market.

Rising Role Of E-Commerce And Export Activities In Driving Packaging Demand

E-commerce growth and rising exports create significant opportunities for packaging manufacturers. The UK High Barrier Packaging Films Market benefits from strong demand for secure and lightweight solutions. It addresses requirements for safe long-distance transport. Exporters seek high-barrier films that preserve product integrity during global shipping. Online platforms increase demand for durable films that ensure freshness. Businesses investing in packaging innovations capture new customer segments. This opportunity highlights the importance of logistics and global trade in shaping demand.

Market Segmentation Analysis:

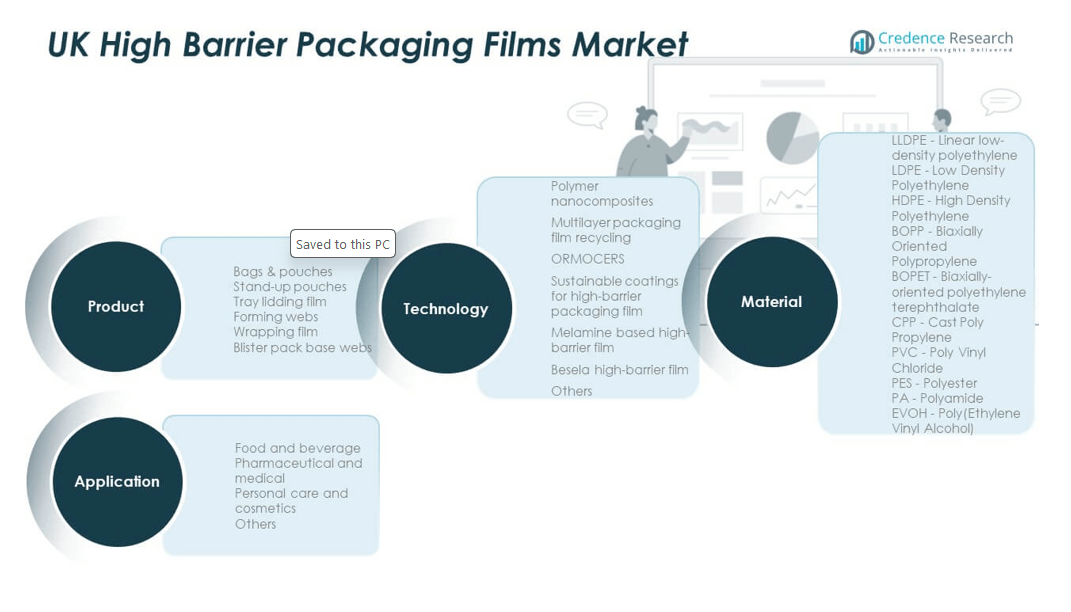

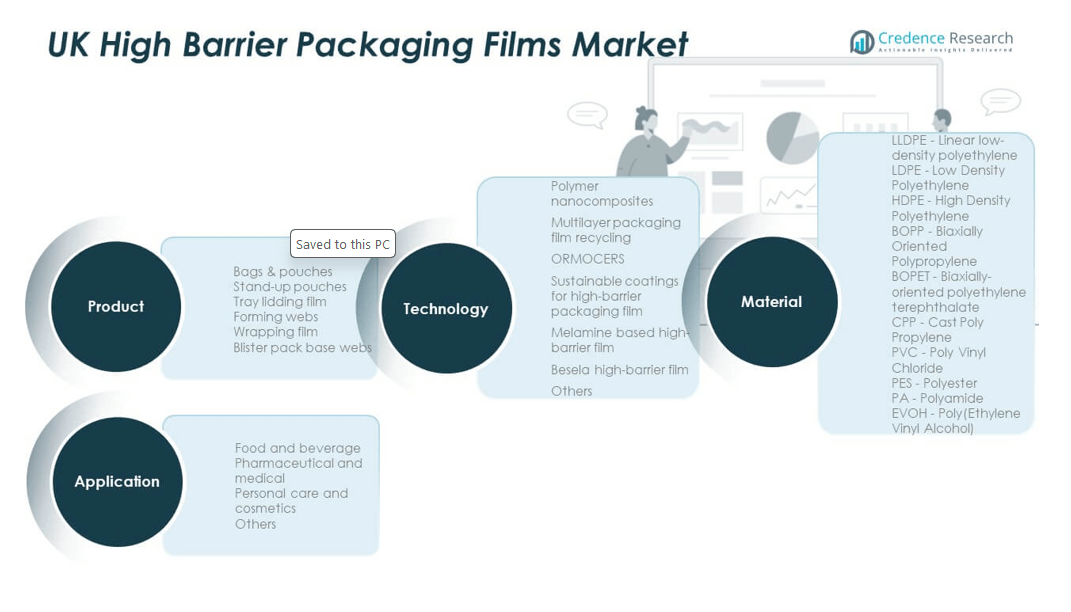

By Product Segment

The UK High Barrier Packaging Films Market is strongly driven by bags and pouches, which dominate due to convenience, versatility, and compatibility with food and beverage packaging. Stand-up pouches gain traction in retail for their branding appeal and shelf presence. Tray lidding films support ready-to-eat and frozen meals, reflecting rising consumer demand for convenience foods. Forming webs and wrapping films provide protection and durability across multiple applications. Blister pack base webs remain essential in pharmaceutical packaging for secure sealing and product safety.

- For instance, stand-up pouches in the UK saw robust growth, with market research reporting enhanced product shelf life and providing extended freshness through advanced barrier layers for packaged snacks and beverages.

By Application Segment

Food and beverage lead the application segment with high demand for extended shelf life and contamination prevention. Pharmaceutical and medical packaging follows with a focus on sterility and product stability. Personal care and cosmetics use advanced films to ensure product integrity and branding differentiation. Others, including industrial and household goods, adopt these films for secure, cost-effective packaging solutions. Each application segment underscores the importance of protection and functionality.

By Technology Segment

Technology innovation plays a crucial role, with polymer nanocomposites providing superior barrier performance. Multilayer packaging film recycling is gaining importance to meet sustainability targets. ORMOCERS and sustainable coatings enhance durability while aligning with eco-friendly standards. Melamine-based and Besela high-barrier films support niche packaging needs. Other emerging technologies reflect continuous R&D investment aimed at performance improvement and regulatory compliance.

By Material Segment

Materials define functionality, with LLDPE, LDPE, and HDPE widely used for flexibility and durability. BOPP and BOPET dominate due to strength and cost-efficiency. CPP and PVC serve niche markets where clarity and sealing properties are critical. PES and EVOH enhance oxygen and moisture resistance, strengthening overall market adoption. Each material type ensures tailored solutions across industries.

Segmentation:

By Product

- Bags & Pouches

- Stand-up Pouches

- Tray Lidding Film

- Forming Webs

- Wrapping Film

- Blister Pack Base Webs

By Application

- Food and Beverage

- Pharmaceutical and Medical

- Personal Care and Cosmetics

- Others

By Technology

- Polymer Nanocomposites

- Multilayer Packaging Film Recycling

- ORMOCERS

- Sustainable Coatings for High-Barrier Packaging Film

- Melamine Based High-Barrier Film

- Besela High-Barrier Film

- Others

By Material

- LLDPE (Linear Low-Density Polyethylene)

- LDPE (Low-Density Polyethylene)

- HDPE (High-Density Polyethylene)

- BOPP (Biaxially Oriented Polypropylene)

- BOPET (Biaxially-Oriented Polyethylene Terephthalate)

- CPP (Cast Polypropylene)

- PVC (Polyvinyl Chloride)

- PES (Polyester)

- EVOH (Polyethylene Vinyl Alcohol)

Regional Analysis:

Dominance Of England In Market Share

England holds the largest share in the UK High Barrier Packaging Films Market, accounting for nearly 56% in 2024. Its dominance is supported by a strong food and beverage industry, advanced retail networks, and robust pharmaceutical manufacturing. High consumer demand for packaged food and convenience products drives adoption of advanced barrier films across supermarkets and online platforms. It also benefits from the concentration of packaging innovation centers and R&D investments. Rising healthcare expenditure fuels growth in pharmaceutical packaging applications. England’s established supply chains and focus on sustainable packaging practices further strengthen its leadership.

Scotland’s Expanding Role In Sustainable Packaging

Scotland represents about 22% of the market share in 2024 and is steadily expanding. The region emphasizes eco-friendly packaging solutions, driven by strict environmental regulations and consumer preference for recyclable materials. Food exports, particularly seafood and beverages, rely heavily on barrier films to preserve quality during long-distance transport. It has growing investments in renewable materials and circular economy initiatives, which encourage manufacturers to adapt. Scotland’s rising tourism sector also supports demand for packaged goods and ready meals. The country continues to emerge as a hub for sustainable innovations in packaging films.

Growth Opportunities Across Wales And Northern Ireland

Wales and Northern Ireland collectively account for around 22% of the UK High Barrier Packaging Films Market in 2024. Wales benefits from a growing food processing sector and government-led sustainability programs encouraging recyclable packaging. Northern Ireland sees rising demand from pharmaceutical and healthcare packaging, with exports playing a key role in growth. Both regions face smaller consumer bases compared to England and Scotland but show strong adoption trends in specialized applications. It presents opportunities for companies targeting niche markets and regional partnerships. Increasing focus on local production and environmentally responsible practices drives further adoption of high barrier packaging films.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Amcor Limited

- Sealed Air Corporation (Cryovac)

- Winpak Ltd.

- ProAmpac

- Glenroy, Inc.

- Printpack

- Toray Plastics (America)

- Mitsubishi Chemical / Toray

- Taghleef Industries

- Jindal Films

Competitive Analysis:

The UK High Barrier Packaging Films Market is highly competitive, shaped by both global leaders and regional players. Companies such as Amcor, Sealed Air Corporation, Winpak, and ProAmpac focus on advanced materials, sustainable solutions, and multi-layer film technologies. It demonstrates strong emphasis on product innovation, lightweight designs, and recyclability to meet regulatory and consumer demands. Firms compete through strategic partnerships, acquisitions, and expansion into e-commerce and pharmaceutical packaging. The competitive landscape reflects intense rivalry, with companies leveraging R&D investments to strengthen brand positioning.

Recent Developments:

- In August 2025, Amcor Limited announced the completion of significant upgrades to its Heanor, UK recycling facility, boosting the company’s sustainability infrastructure and supporting the adoption of high-barrier, recycle-ready packaging films in the UK high barrier packaging market. This facility enhancement is set to accelerate Amcor’s offering of circular solutions, furthering its commitment to scalable, eco-friendly laminate and film products for food and medical applications across the region.

- In April 2025, Sealed Air Corporation (Cryovac) showcased its latest sustainability-driven innovations at IFFA 2025, introducing advanced recyclable meat packaging solutions under the CRYOVAC® brand for European markets, including the UK. These initiatives reflect Sealed Air’s ongoing strategy to align packaging design with circular economy principles, ensuring high barrier protection while supporting recycling stream integration for food processors and retailers.

- In April 2022, ProAmpac introduced its ProActive PCR retort high-barrier pouches, which incorporate post-consumer recycled (PCR) materials to reduce environmental impact while delivering robust barrier properties for the food and beverage sectors in the UK. This launch supports a shift toward recyclable, durable films—addressing both regulatory and market demands in the British high barrier packaging films industry.

Report Coverage:

The research report offers an in-depth analysis based on product, application, technology, and material segments. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Rising adoption of recyclable and bio-based films will transform packaging strategies.

- Food and beverage packaging will remain the dominant application segment.

- Healthcare packaging will expand with growing demand for sterile and secure solutions.

- E-commerce growth will increase the need for lightweight, protective films.

- Innovation in multi-layer technologies will strengthen performance across applications.

- Regulations on plastics will accelerate the shift toward sustainable packaging solutions.

- Smart packaging with tracking features will gain wider acceptance.

- Investments in regional production will reduce supply chain vulnerabilities.

- Advanced coatings will enhance durability and protection in premium packaging.

- Branding and shelf appeal will drive greater use of aesthetic, high-quality films.