Market Overview

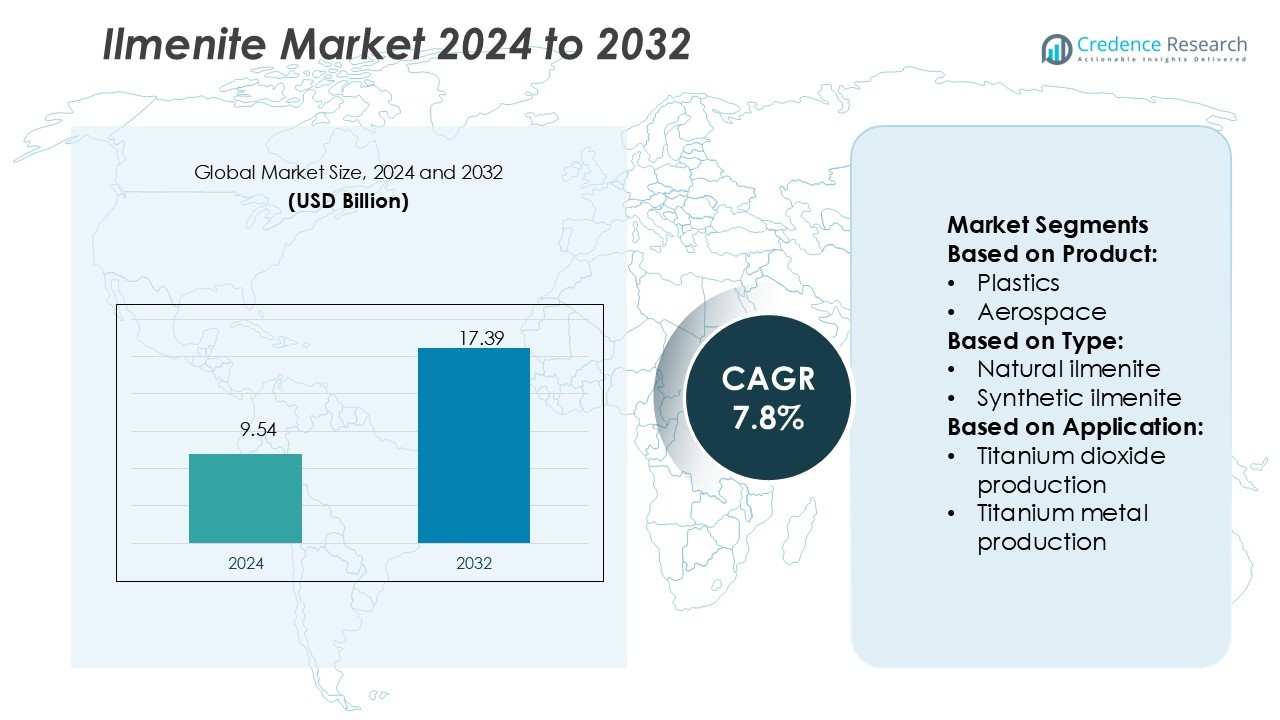

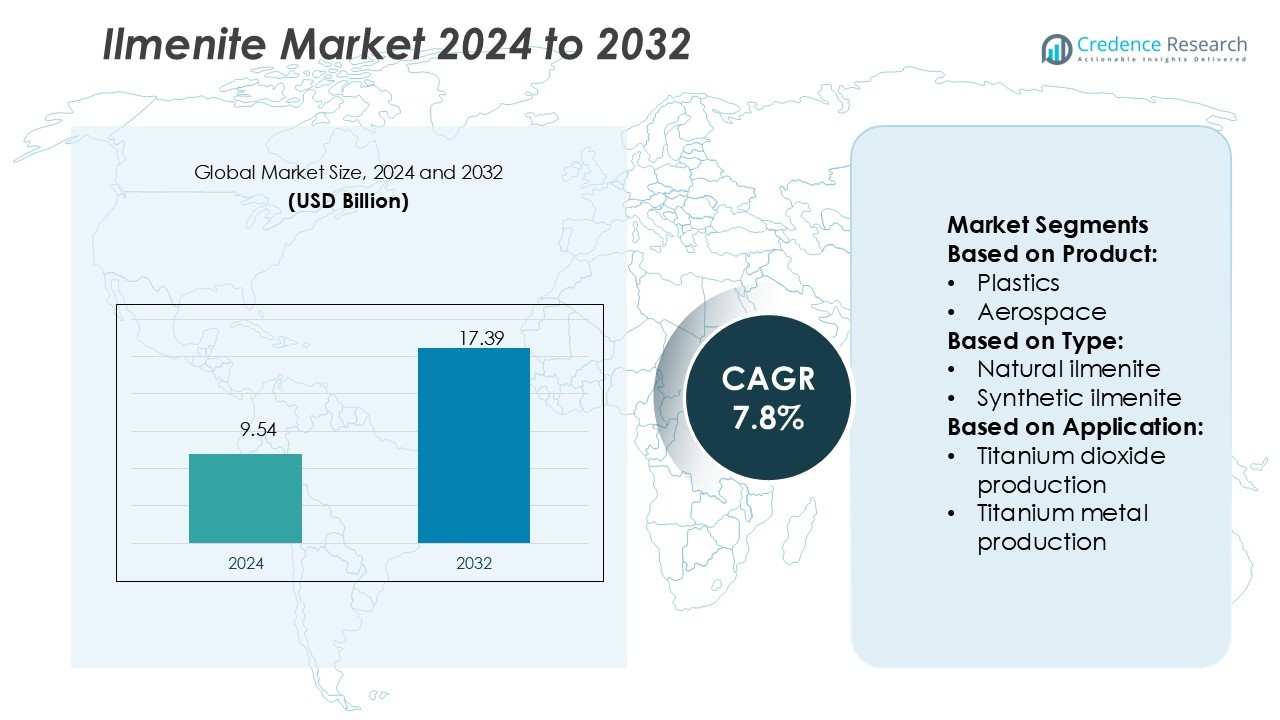

Ilmenite Market size was valued USD 9.54 billion in 2024 and is anticipated to reach USD 17.39 billion by 2032, at a CAGR of 7.8% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Ilmenite Market Size 2024 |

USD 9.54 Billion |

| Ilmenite Market, CAGR |

7.8% |

| Ilmenite Market Size 2032 |

USD 17.39 Billion |

The Ilmenite Market is shaped by prominent players including Rio Tinto, Iluka Resources, Kenmare Resources, Eramet, Base Resources, Mineral Commodities, GMA Garnet, Salgo Minerals, Peekay Agencies, and Devidayal Chemical Industries. These companies focus on large-scale mining, advanced processing, and global distribution to serve diverse end-use industries such as paints, coatings, plastics, aerospace, and construction. Strategic expansions, sustainability initiatives, and partnerships strengthen their competitive positioning in key markets. Regionally, Asia Pacific leads the industry with a commanding 43% market share, supported by vast mineral reserves, robust mining operations in Australia, and high demand from China and India’s rapidly growing industrial sectors.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Ilmenite Market size was valued at USD 9.54 billion in 2024 and is expected to reach USD 17.39 billion by 2032, registering a CAGR of 7.8% during the forecast period.

- Rising demand for titanium dioxide in paints, coatings, plastics, and paper industries is a primary market driver, supported by growth in construction, automotive, and consumer goods.

- Key players including Rio Tinto, Iluka Resources, Kenmare Resources, and Eramet enhance competitiveness through large-scale mining, sustainable operations, and technological advancements in refining processes.

- Market restraints include environmental and regulatory pressures on mining operations, along with price volatility influenced by global supply chain disruptions and fluctuating demand.

- Asia Pacific dominates with 43% share led by Australia, China, and India, while North America holds 21% and Europe 18%; by product, paints and coatings remain the leading segment, accounting for the largest share of titanium dioxide consumption.

Market Segmentation Analysis:

By Product

In the Ilmenite Market, paints and coatings hold the dominant share, driven by titanium dioxide demand as a key pigment. This segment benefits from growth in construction and industrial applications, where whitening, opacity, and durability are essential. Plastics also represent a significant share, with ilmenite-based titanium dioxide used for strength and UV resistance in packaging and consumer goods. Aerospace and automotive sectors are expanding steadily, supported by lightweight, high-performance materials. Construction drives additional growth with infrastructure projects, while other niche applications contribute to steady adoption across specialized industries.

- For instance, Rio Tinto’s BlueSmelting™ pilot plant at its Sorel-Tracy site can process up to 40,000 tonnes of ilmenite ore annually, enabling production of high-grade TiO₂ feedstock with a reduction in greenhouse gas emissions of up to 95 percent compared to conventional reduction methods.

By Type

Natural ilmenite dominates the market, accounting for the largest share due to abundant availability and cost efficiency. It remains widely used in titanium dioxide and welding electrode production. Synthetic ilmenite, though less prevalent, is growing as industries adopt high-purity feedstock for advanced applications such as aerospace-grade titanium metal production. Demand for synthetic grades is rising with technological progress, especially in regions with strong aerospace and defense manufacturing. The balance between natural supply and synthetic advancements shapes overall market dynamics, ensuring both segments remain integral to end-user industries.

- For instance, Peekay Agencies offers an ‘Ilmenite Sand’ product with a specific gravity of 4.7, which aligns with its use in industrial applications such as welding rods and TiO₂ feedstock.

By Application

Titanium dioxide production leads the application segment, holding the highest share as it accounts for most ilmenite consumption. Demand stems from its role in paints, coatings, plastics, and paper industries, where brightness and opacity are crucial. Titanium metal production follows, driven by aerospace, defense, and medical implants requiring lightweight yet strong materials. Welding electrodes also account for a stable portion, supporting construction and fabrication industries. Other applications, including chemical intermediates, expand the market’s scope. The dominance of titanium dioxide reflects ilmenite’s critical role in everyday products and industrial advancements.

Key Growth Drivers

Rising Demand for Titanium Dioxide

The ilmenite market is primarily driven by the surging demand for titanium dioxide, which is widely used as a pigment in paints, coatings, plastics, and paper. Titanium dioxide’s role in enhancing brightness, opacity, and durability makes it indispensable across construction, automotive, and consumer goods industries. Rapid urbanization and infrastructure development, coupled with growing consumer preference for high-quality finishes, fuel this demand. Expanding construction and automotive sectors in Asia Pacific further amplify consumption, positioning titanium dioxide production as the strongest driver for sustained market growth.

- For instance, Iluka’s synthetic rutile product typically reaches TiO₂ concentrations between 88 % and 95 % after kiln upgrading from ilmenite feedstock.

Expansion in Aerospace and Defense Applications

Growing aerospace and defense industries drive significant demand for titanium metal derived from ilmenite. Titanium’s high strength-to-weight ratio and corrosion resistance make it vital for aircraft structures, military equipment, and space applications. Rising global investments in defense modernization and increasing space exploration projects create steady demand for titanium metal. This trend strengthens the value chain of ilmenite, encouraging mining companies to supply high-grade materials. As advanced nations expand their aerospace fleets, the market benefits from consistent titanium consumption, ensuring long-term growth prospects.

- For instance, Base Resources’ Toliara Project in Madagascar hosts a Ranobe deposit with an Ore Reserve of 904 million tonnes at 6.1 % heavy mineral, which includes high-grade ilmenite suitable for downstream processing into titanium intermediates.

Shift Toward Sustainable Mining Practices

Sustainability has emerged as a critical growth driver, with companies investing in eco-friendly mining and processing technologies. Stricter regulations on carbon emissions and environmental impact push ilmenite producers to adopt energy-efficient methods and responsible waste management practices. Implementation of renewable energy in mining operations and advanced refining technologies enhances production efficiency while reducing ecological footprints. These efforts not only meet compliance standards but also attract environmentally conscious customers and investors. The integration of sustainable practices strengthens market credibility and ensures long-term competitiveness in a resource-driven industry.

Key Trends & Opportunities

Technological Advancements in Processing

Advances in beneficiation and refining technologies create opportunities for producing high-purity ilmenite to meet specialized needs. Emerging techniques in mineral separation and processing improve recovery rates and reduce costs, ensuring better profitability for producers. These innovations enable ilmenite to serve high-end applications, particularly in aerospace and medical industries. Companies adopting cutting-edge processing systems can cater to the growing demand for premium-grade titanium dioxide and titanium metal. The trend toward advanced technology not only boosts efficiency but also aligns with industry needs for quality and precision.

- For instance, Eramet’s website and subsidiary site for Grande Côte Opérations (GCO) confirm the production of ilmenite with \(TiO_{2}\) contents of 54% and 58%.

Growth in Emerging Markets

Developing economies in Asia Pacific, Africa, and the Middle East present significant opportunities for the ilmenite market. Rising construction activity, rapid urbanization, and growing automotive industries in these regions drive titanium dioxide consumption. Governments are also encouraging local mineral resource development, leading to increased mining projects. With abundant natural reserves and expanding infrastructure needs, these regions are set to become critical growth hubs. Producers targeting these emerging markets can benefit from expanding demand while securing long-term supply contracts with regional industries.

- For instance, Mineral Commodities’ Tormin operation produces a medium-grade magnetic concentrate containing over 70% ilmenite and at least 15% garnet. This product is used as a feedstock for titanium intermediates.

Key Challenges

Environmental and Regulatory Pressures

The ilmenite market faces increasing challenges from stringent environmental regulations governing mining operations and waste disposal. Compliance with carbon emission standards, land rehabilitation requirements, and water use restrictions adds significant operational costs. Producers that fail to meet regulatory expectations risk penalties, reputational damage, and restricted market access. Balancing economic efficiency with environmental responsibility remains a pressing challenge. Companies must invest heavily in sustainable technologies and monitoring systems, which can strain profitability in an already competitive landscape.

Price Volatility and Supply Chain Risks

Ilmenite prices are highly sensitive to fluctuations in global titanium dioxide demand and supply dynamics. Economic downturns, trade restrictions, and geopolitical tensions can disrupt supply chains, leading to sharp price swings. Dependence on a few mining regions for supply further amplifies vulnerability to market instability. Producers and end-users alike face difficulties in long-term planning and contract negotiations due to unpredictable pricing trends. Managing price volatility while ensuring stable supply remains a significant challenge for the industry.

Regional Analysis

North America

North America holds a 21% share of the ilmenite market, driven by strong demand from aerospace, automotive, and construction sectors. The region benefits from advanced processing technologies and established supply chains for titanium dioxide and titanium metal production. The United States leads the market with significant investments in aerospace manufacturing and defense modernization, while Canada contributes with mining activities and exports. Growing infrastructure projects and sustainability-driven initiatives further support regional growth. The presence of global titanium suppliers ensures steady availability, making North America a mature yet consistently growing market.

Europe

Europe accounts for 18% of the ilmenite market, supported by robust demand from paints, coatings, and plastics industries. Countries such as Germany, France, and the UK drive consumption, particularly in automotive and construction applications. The region emphasizes sustainable mining practices and advanced processing methods, aligning with strict environmental regulations. European aerospace and defense industries also generate stable demand for titanium metal. With its focus on renewable technologies and recycling initiatives, Europe maintains a balanced supply-demand structure, ensuring consistent market performance while promoting innovation in processing and utilization.

Asia Pacific

Asia Pacific dominates the ilmenite market with a 43% share, led by China, India, and Australia. The region’s rapid urbanization, booming construction activity, and growing automotive sector fuel strong titanium dioxide demand. Australia stands out as a major supplier, with extensive reserves and large-scale mining operations. China drives consumption through its expanding paints, plastics, and aerospace industries. India contributes with both mining capacity and increasing end-user applications. With ongoing industrialization and high demand from multiple industries, Asia Pacific remains the central growth hub for ilmenite, offering long-term opportunities for producers and investors.

Latin America

Latin America captures an 8% share of the ilmenite market, supported by expanding construction, automotive, and consumer goods sectors. Brazil leads regional demand with its strong paints and coatings industry, while Chile and Mexico contribute with infrastructure development and manufacturing growth. Rising interest in sustainable building materials and urbanization trends further enhance demand for titanium dioxide-based products. Though mining activities are comparatively smaller than in Asia or Africa, Latin America benefits from growing imports and partnerships with global producers, positioning it as a steadily emerging consumer base in the global ilmenite landscape.

Middle East & Africa

The Middle East & Africa region holds a 10% share of the ilmenite market, anchored by rich mineral sands reserves and rising industrial activity. South Africa and Mozambique are leading sources of ilmenite, supplying both regional and global markets. Demand is primarily driven by construction, oil and gas, and infrastructure projects, with titanium dioxide consumption steadily increasing. Government-led initiatives to encourage local mineral development add further growth potential. Limited processing facilities remain a challenge, but ongoing investments in mining infrastructure position the region as a strategic supplier to international markets.

Market Segmentations:

By Product:

By Type:

- Natural ilmenite

- Synthetic ilmenite

By Application:

- Titanium dioxide production

- Titanium metal production

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Ilmenite Market features key players such as Salgo Minerals, Rio Tinto, Peekay Agencies, Iluka Resources, Base Resources, GMA Garnet, Devidayal Chemical Industries, Eramet, Mineral Commodities, and Kenmare Resources. The Ilmenite Market is defined by large-scale mining operations, advanced processing technologies, and expanding global supply chains. Companies are focusing on improving extraction efficiency and adopting sustainable practices to meet increasing demand from the paints, coatings, plastics, and aerospace industries. Strategic moves such as capacity expansions, mergers, and partnerships with downstream industries are common, enabling producers to strengthen their market presence. Rising demand for high-purity ilmenite for titanium dioxide and titanium metal production is pushing firms to invest in innovation and advanced refining methods. Sustainability initiatives, including reduced energy consumption and responsible mining, are also shaping competition as environmental compliance becomes a critical factor.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Salgo Minerals

- Rio Tinto

- Peekay Agencies

- Iluka Resources

- Base Resources

- GMA Garnet

- Devidayal Chemical Industries

- Eramet

- Mineral Commodities

- Kenmare Resources

Recent Developments

- In November 2024, IREL (India) Limited and Kazakhstan’s Ust-Kamenogorsk Titanium and Magnesium Plant (UKTMP JSC) entered into a joint venture to form IREUK Titanium Limited. This collaboration aims to produce titanium slag in India, enhancing the country’s titanium value chain by upgrading low-grade ilmenite into high-grade titanium feedstock.

- In May 2023, Ukraine’s UMCC (United Mining and Chemical Company) announced plans to restart mining and processing operations of ilmenite concentrate at Irshansk Mining and Processing Plant.

- In July 2023, ATI, Inc., a U.S.-based manufacturing firm, declared the investment in increasing the melting capacity at its facility situated at Richland in Washington with a view of optimizing the production of titanium metal, which is experiencing an increase in its market-grown boosted by the aerospace & defense industries.

- In April 2023, Rio Tinto Iron and Titanium (RTIT) started its BlueSmelting demonstration plant at its metallurgical complex in Sorel-Tracy as part of the process to validate the BlueSmelting technology, which aims to decarbonize RTIT’s Quebec Operations.

Report Coverage

The research report offers an in-depth analysis based on Product, Type, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The ilmenite market will continue to expand with rising demand for titanium dioxide.

- Aerospace and defense industries will drive steady growth in titanium metal consumption.

- Emerging economies will strengthen market opportunities through rapid urbanization and construction.

- Technological advancements in processing will improve efficiency and product quality.

- Sustainability initiatives will push producers toward eco-friendly mining and refining methods.

- Strategic mergers and acquisitions will enhance global supply chain integration.

- Price volatility will remain a key factor influencing long-term planning and contracts.

- Governments will enforce stricter regulations on environmental compliance in mining operations.

- Growing investment in renewable energy projects will support ilmenite-based applications.

- Asia Pacific will maintain dominance, while Africa and Latin America will emerge as strong suppliers.