Market Overview

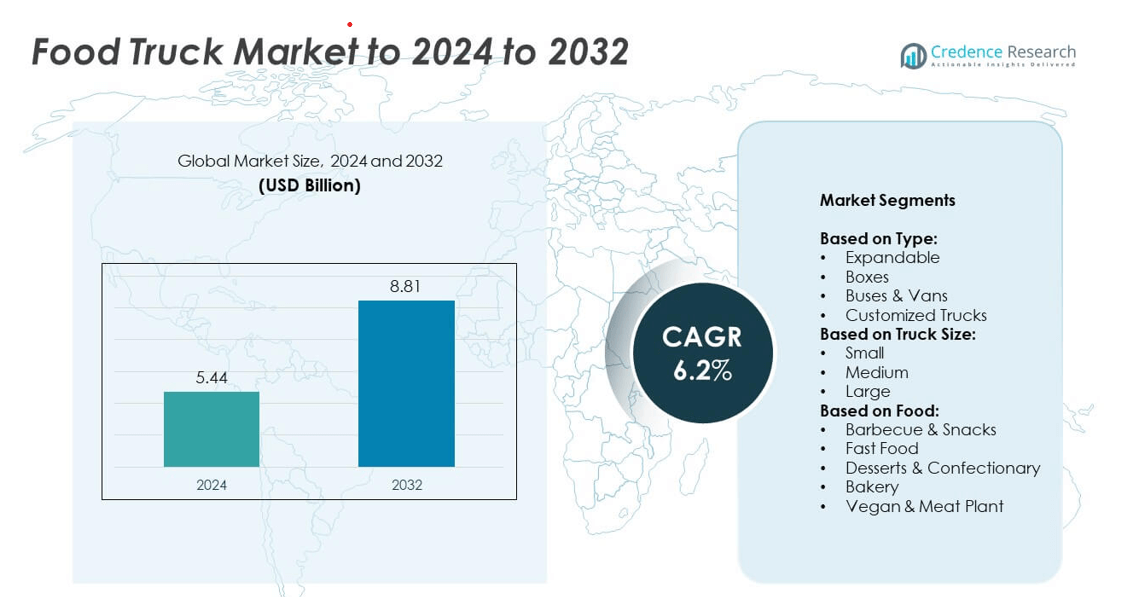

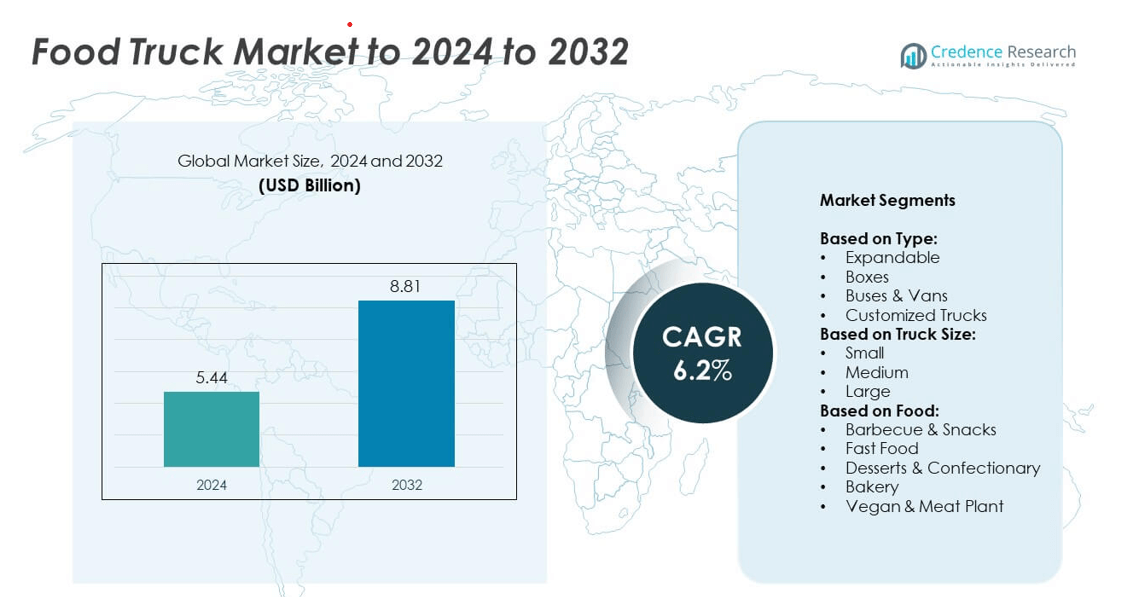

The global food truck market size was valued at USD 5.44 billion in 2024 and is anticipated to reach USD 8.81 billion by 2032, at a CAGR of 6.2% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Food Truck Market Size 2024 |

USD 5.44 billion |

| Food Truck Market, CAGR |

6.2% |

| Food Truck Market Size 2032 |

USD 8.81 billion |

The food truck market features prominent players such as Futuristo Trailers, Cousins Maine Lobster, Food Truck Company, Veicoli Speciali, MSM Catering Trucks MFG. Inc., Prestige Food Trucks, The Fud Trailer, Bostonian Body, Inc., United Food Truck, and M&R Specialty Trailers and Trucks. These companies strengthen the industry by offering customized, durable, and technologically advanced mobile kitchens tailored to diverse operator needs. North America led the global market in 2024 with a 38% share, supported by strong street food culture, high consumer spending, and widespread participation in food festivals. Europe followed with 27%, while Asia Pacific accounted for 22%, driven by rising urbanization and demand for affordable, on-the-go dining solutions

Market Insights

- The food truck market was valued at USD 5.44 billion in 2024 and is projected to reach USD 8.81 billion by 2032, growing at a CAGR of 6.2%.

- Growth is fueled by the rising popularity of street food culture, low startup costs, and increasing demand for mobile and convenient food services across urban areas.

- Key trends include the adoption of digital ordering systems, social media marketing, and menu diversification with health-conscious options such as vegan, gluten-free, and organic offerings.

- The market is highly competitive with global and regional players focusing on customizable trucks, energy-efficient designs, and strategic partnerships with entrepreneurs to strengthen their presence.

- North America led the market with 38% share in 2024, followed by Europe at 27% and Asia Pacific at 22%. By type, buses & vans dominated with over 40% share, while medium-sized trucks held the lead in truck size due to their balance of mobility and capacity.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

The buses & vans segment held the dominant share of the food truck market in 2024, accounting for over 40% of total revenue. Their popularity stems from flexibility, ease of mobility, and cost-efficient operations compared to expandable or customized trucks. Buses and vans offer suitable space for fast food and beverages, making them the preferred choice among new entrepreneurs and small businesses. Growing urban street food demand and low initial investment requirements continue to drive the adoption of vans and buses, particularly in North America and Asia-Pacific urban centers.

- For instance, SNS Insider reports that “Buses & Vans” held roughly 60–65 % share in the global food truck market by type.

By Truck Size

Medium-sized trucks accounted for the largest share, holding nearly 45% of the global food truck market in 2024. These vehicles strike a balance between mobility and kitchen space, allowing operators to serve diverse menus while accessing both high-traffic urban zones and event venues. Small trucks remain popular in densely populated cities but face space limitations, while large trucks offer higher capacity but are costlier. Rising food festivals and catering events are fueling demand for medium-sized food trucks, making them the most commercially viable option.

- For instance, In 2024, trucks of 14 to 22 ft length held a leading position in many markets.

By Food

Fast food dominated the market by food category in 2024, securing around 38% of total revenue share. The segment benefits from rising consumer demand for quick-service meals, including burgers, sandwiches, and fried snacks. Food trucks specializing in fast food are highly scalable and draw consistent demand across urban areas, college campuses, and event gatherings. While barbecue & snacks and bakery categories also show steady growth, fast food trucks continue to lead due to convenience, affordability, and the influence of international quick-service trends on local street food culture.

Key Growth Drivers

Rising Popularity of Street Food Culture

Street food culture is expanding rapidly worldwide, and food trucks play a vital role in this shift. Consumers, especially younger demographics, are drawn to affordable, diverse, and convenient dining experiences. The trend is reinforced by social media exposure, where food trucks gain visibility through digital marketing and influencer promotions. Events, festivals, and pop-up dining also contribute to increased demand. This cultural acceptance has turned food trucks into mainstream dining options, positioning the segment as a critical driver of growth in both developed and emerging markets.

- For instance, in a recent assessment of food truck marketing, 75% of operators were found to actively use Facebook to promote their business.

Low Startup and Operating Costs

Compared to traditional restaurants, food trucks offer significantly lower entry barriers for entrepreneurs. Investment in a food truck business requires less capital for infrastructure, staffing, and permits, making it attractive to small businesses. This affordability encourages startups and established restaurateurs alike to explore mobile food ventures. Lower operating expenses also allow for greater flexibility in menu innovation and pricing strategies. As governments in several regions promote small business development, favorable licensing and financial support further fuel this cost-driven expansion.

- For instance, in the 2024 food truck market, operations focused on events and festivals comprised 60.9% of the revenue in roaming and event-based services.

Growing Demand for Mobile and On-the-Go Food Services

Urban lifestyles are increasingly fast-paced, creating a strong appetite for convenient food options. Food trucks fulfill this demand by providing mobility and easy access in offices, colleges, public spaces, and events. Their ability to relocate and serve high-footfall areas boosts revenue potential compared to static restaurants. Rising participation in outdoor events, food fairs, and festivals adds to the expansion. With changing consumer preferences toward quick-service and portable food, mobile food solutions stand out as one of the key growth drivers in this industry.

Key Trends & Opportunities

Menu Innovation and Health-Conscious Offerings

Food trucks are capitalizing on the rising demand for healthier, sustainable, and plant-based meals. Vendors are expanding menus with vegan, gluten-free, and organic options to cater to evolving consumer preferences. This shift not only broadens customer reach but also aligns with global wellness and sustainability trends. Innovative fusion cuisines and seasonal menus further differentiate operators in a competitive market. Offering unique dining experiences through diverse and health-focused menus presents a strong opportunity for food truck operators to attract a wider, health-aware consumer base.

- For instance, in 2025, reports on food truck technology adoption found that 61% of food trucks were using digital menus to enhance clarity and ordering, while 66% had adopted mobile ordering systems to improve customer experience and reduce wait times.

Technology Integration and Digital Ordering

Adoption of digital solutions is transforming the food truck market. Mobile apps, QR-based ordering, and digital payment systems streamline customer service and improve convenience. Integration with food delivery platforms expands reach beyond physical locations, enabling trucks to serve remote customers. Social media engagement also boosts brand visibility and customer loyalty. Technology-driven operations allow for better inventory management, customer feedback analysis, and targeted marketing. This technological shift offers food truck businesses an opportunity to enhance efficiency and align with the growing demand for digital-first consumer experiences.

- For instance, the Guinness World Record for the largest parade of food trucks was 121 trucks, which was achieved in Tampa in 2014. However, the current record for the largest rally of food trucks is 158 trucks, achieved in Malaysia in 2018.

Key Challenges

Regulatory and Licensing Barriers

Food trucks face strict regulations related to health, safety, and location permits, which vary widely across regions. Obtaining licenses, parking permissions, and health clearances often requires time and resources, limiting operational flexibility. Inconsistent or restrictive local policies can hinder expansion, especially for smaller entrepreneurs. Compliance costs may also offset the affordability advantage of food trucks. These regulatory complexities create significant barriers to market entry and sustained operations, making legal compliance a major challenge for growth in the food truck market.

High Competition and Market Saturation

The food truck industry is highly competitive, with new entrants frequently emerging due to low startup costs. Intense rivalry often results in price wars, reduced margins, and difficulty in maintaining customer loyalty. Established restaurant chains entering the mobile dining space add further pressure. Additionally, consumer preferences for novelty create challenges for sustaining consistent demand. Operators must continuously innovate menus and marketing strategies to stay competitive. Market saturation in key urban centers intensifies the struggle for prime operating locations, posing a long-term growth challenge.

Regional Analysis

North America

North America held the largest share of the food truck market in 2024, accounting for 38% of global revenue. The region’s strong dominance is supported by a well-established street food culture, a large base of urban consumers, and extensive participation in food festivals and public events. Rising demand for fast food and gourmet offerings through mobile outlets also strengthens market expansion. Supportive regulations in several states and the presence of established operators enhance competitiveness. The United States leads the region, while Canada is experiencing steady growth with growing adoption of food trucks in metropolitan cities.

Europe

Europe accounted for 27% of the global food truck market in 2024, supported by urban demand for diverse street food experiences. Countries such as the United Kingdom, Germany, and France are key contributors, driven by consumer interest in fusion cuisine and mobile dining concepts. Food truck businesses benefit from tourism and cultural events, providing steady growth opportunities. However, the region faces stricter regulations compared to North America, which can limit expansion in certain cities. Despite this, Europe’s evolving consumer food habits and increasing popularity of health-conscious offerings continue to create significant growth potential for the market.

Asia Pacific

Asia Pacific captured 22% of the global food truck market in 2024, driven by rising urbanization and expanding middle-class consumer spending. Street food has a long cultural presence in countries such as India, China, and Thailand, and modern food trucks are adapting to changing preferences by offering innovative and hygienic solutions. Rapid growth in urban centers and increasing youth demand for convenient, affordable dining options fuel the market. Government initiatives supporting small businesses also encourage new entrants. With its large population base and expanding food service sector, Asia Pacific represents one of the fastest-growing regions in this industry.

Latin America

Latin America represented 8% of the food truck market in 2024, with growth led by Brazil, Mexico, and Argentina. The region benefits from a strong street food tradition combined with growing urban demand for mobile food services. Food trucks in Latin America are increasingly offering diverse menus ranging from traditional snacks to international cuisines. The affordability of starting food truck businesses makes them appealing for entrepreneurs, particularly in major cities. However, regulatory inconsistencies and infrastructure limitations pose challenges. Despite this, the region’s rising tourism sector and increasing adoption of food festivals continue to create opportunities for steady expansion.

Middle East & Africa

The Middle East & Africa held a 5% share of the global food truck market in 2024, emerging as a niche but growing segment. Rising urbanization, tourism expansion, and increasing demand for international cuisines support adoption in countries such as the United Arab Emirates and South Africa. The region benefits from strong investments in hospitality and food service sectors, particularly in urban hubs and tourist destinations. However, limited consumer awareness and high regulatory barriers in some areas slow market penetration. Despite these challenges, the growing trend of outdoor dining and cultural festivals is fostering gradual regional market growth.

Market Segmentations:

By Type:

- Expandable

- Boxes

- Buses & Vans

- Customized Trucks

By Truck Size:

By Food:

- Barbecue & Snacks

- Fast Food

- Desserts & Confectionary

- Bakery

- Vegan & Meat Plant

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The food truck market is characterized by the presence of leading manufacturers and franchise operators such as Futuristo Trailers, Cousins Maine Lobster, Food Truck Company, Veicoli Speciali, MSM Catering Trucks MFG. Inc., Prestige Food Trucks, The Fud Trailer, Bostonian Body, Inc., United Food Truck, and M&R Specialty Trailers and Trucks. These players compete by offering a wide variety of truck designs, customizable features, and innovative kitchen layouts to meet the needs of different food service operators. Strong emphasis is placed on durability, mobility, and compliance with regional safety and hygiene standards. Many companies are also investing in advanced technologies, including energy-efficient power systems and integrated digital solutions, to enhance operational efficiency. Competitive strategies often focus on partnerships with small businesses and entrepreneurs, enabling affordable entry into the market. Additionally, increasing demand for specialized trucks, such as those catering to health-conscious or gourmet offerings, is driving innovation across the competitive landscape.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Futuristo trailers

- Cousins Maine Lobster (Franchise Operator)

- Food Truck Company

- Veicoli Speciali

- MSM CATERING TRUCKS MFG. INC.

- Prestige Food Trucks

- The Fud Trailer

- Bostonian Body, Inc.

- United Food Truck

- M&R SPECIALTY TRAILERS AND TRUCKS

Recent Developments

- In 2025, Cousins Maine Lobster (Franchise Operator) Launched a second franchise food truck in the Upstate New York area, following the successful debut of its first truck there nine months prior.

- In 2024, Prestige Food Trucks Grew its operations by completing nearly 50 custom food truck builds, delivering to over 20 U.S. states and overseas.

- In 2024, United Food Trucks unveiled a custom-designed food truck for UTEC, a non-profit organization

Report Coverage

The research report offers an in-depth analysis based on Type, Truck Size, Food and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The food truck market will continue to expand with rising urban street food demand.

- Medium-sized trucks will remain the preferred choice due to balance of space and mobility.

- Fast food trucks will dominate, supported by growing quick-service culture across cities.

- Health-focused menus such as vegan and organic options will gain more popularity.

- Digital payments and app-based ordering will drive operational efficiency and customer engagement.

- Food festivals and outdoor events will provide consistent revenue opportunities for operators.

- North America will maintain leadership, while Asia Pacific will see the fastest growth.

- Competition will intensify, pushing operators to innovate menus and marketing approaches.

- Regulatory simplification in emerging markets will encourage new entrants and small businesses.

- Partnerships with delivery platforms will expand reach beyond traditional food truck locations.