Market Overview:

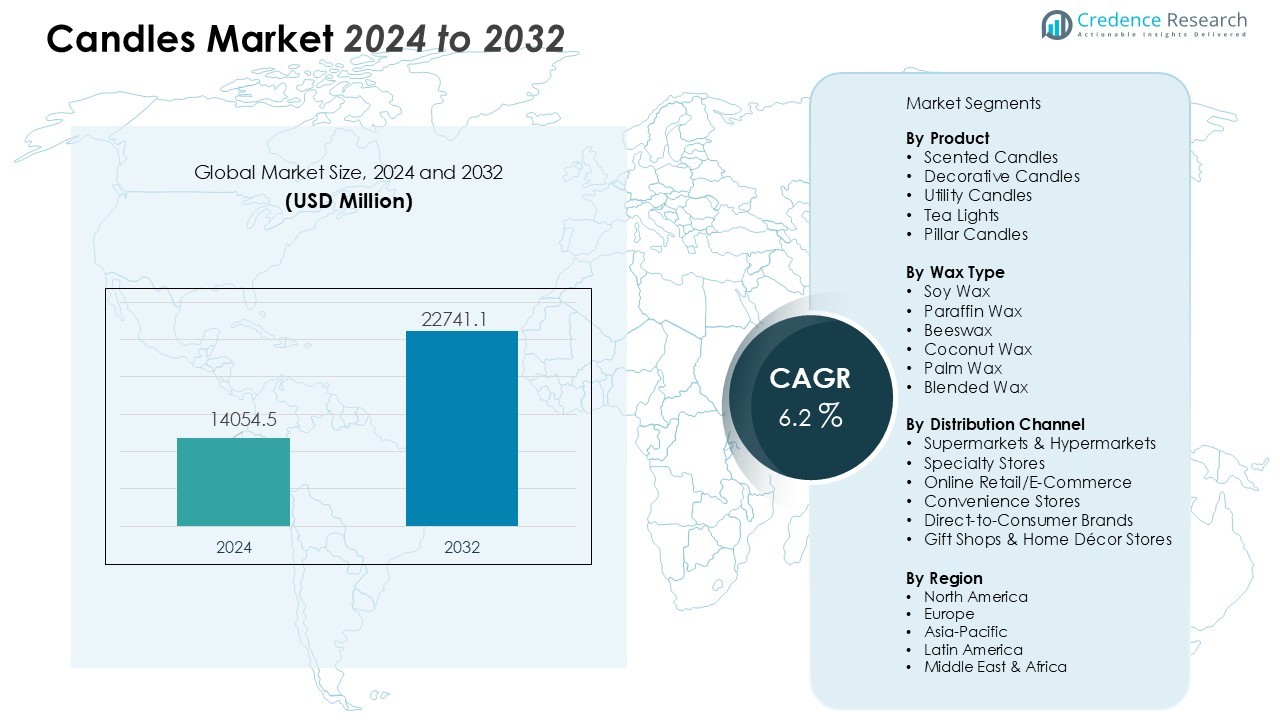

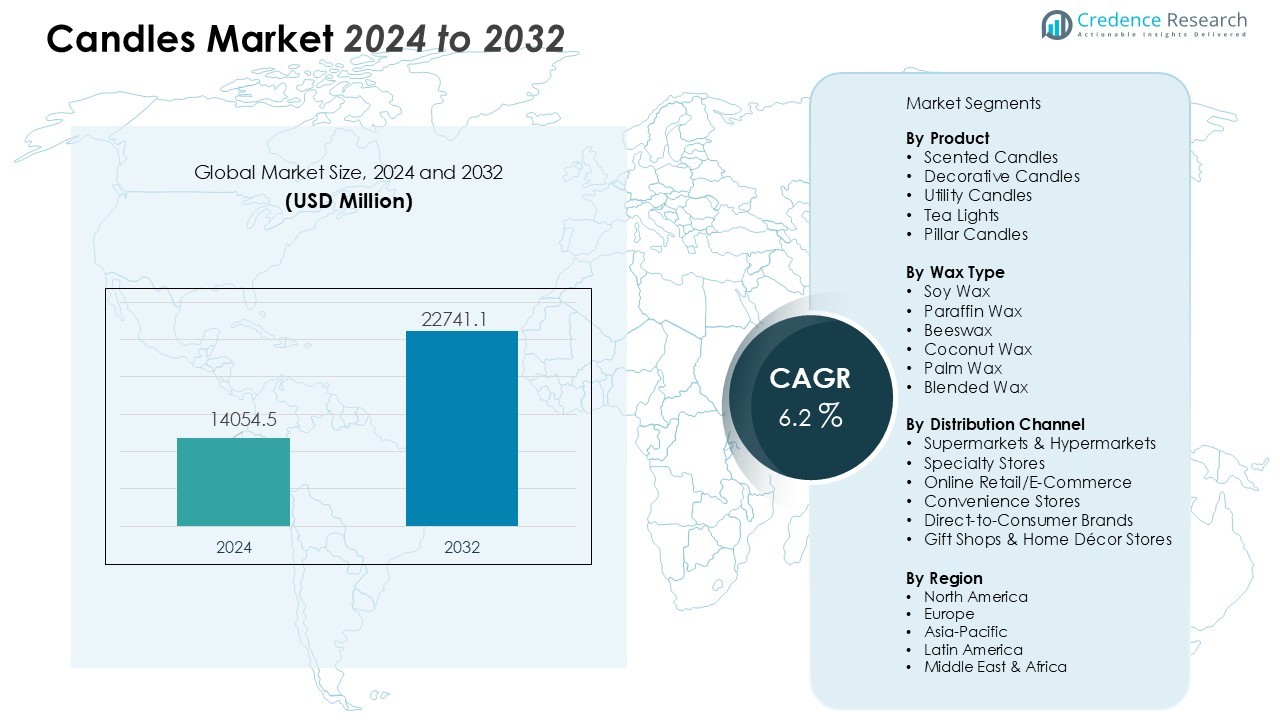

The candles market size was valued at USD 14054.5 million in 2024 and is anticipated to reach USD 22741.1 million by 2032, at a CAGR of 6.2 % during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Candles Market Size 2024 |

USD 14054.5 Million |

| Candles Market, CAGR |

6.2% |

| Candles Market Size 2032 |

USD 22741.1 Million |

Market growth is driven by rising consumer inclination toward home décor, wellness, and aromatherapy solutions. Brands introduce new fragrance blends, natural waxes, and clean-burn technologies to meet evolving sustainability expectations. The hospitality sector increases adoption of aesthetic and mood-enhancing candles, while gifting trends boost sales of decorative and personalized variants. Strong e-commerce penetration, subscription-based fragrance boxes, and influencer-led promotions also accelerate product visibility and purchase frequency.

Regionally, North America leads due to high consumption of scented and luxury candles, strong retail networks, and continuous innovation in fragrance technologies. Europe follows with strong demand for premium artisanal and eco-certified products. Asia-Pacific is the fastest-growing region, supported by rising disposable incomes, expanding home-fragrance trends, and increasing urban lifestyle adoption across China, India, and Southeast Asia. Emerging markets in Latin America and the Middle East steadily expand as retail modernization and lifestyle preferences evolve.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The candles market increases from USD 14054.5 million in 2024 to USD 22741.1 million by 2032, supported by a CAGR of 6.2% and strong demand for home décor, wellness, and aromatherapy-focused products.

- Premium, natural, and eco-conscious candle formulations gain traction as consumers shift toward soy, beeswax, and coconut-wax options paired with clean-burn and toxin-free technologies.

- Commercial adoption rises across hospitality, spas, restaurants, and gifting channels as businesses use decorative and fragrance-rich candles to enhance ambience and guest experiences.

- Digital retail, influencer-led campaigns, and customizable candle formats fuel rapid e-commerce growth, boosting visibility and repeat purchases across global markets.

- Raw material price fluctuations, fragrance-allergen regulations, and supply chain gaps create obstacles for manufacturers striving to maintain consistent quality and cost stability.

- Competition intensifies with the rise of private-label and low-cost imports, pushing brands to innovate through premium packaging, authentication features, and transparent sustainability claims.

- Regional dynamics remain strong, with North America leading consumption, Europe advancing on eco-certified artisanal trends, and Asia-Pacific emerging as the fastest-growing market driven by lifestyle upgrades.

Market Drivers:

Rising Consumer Shift Toward Home Ambience and Wellness Enhancement

The candles market benefits from a strong shift toward wellness-focused lifestyles and home ambience improvement. Consumers prefer scented and aromatherapy candles to create relaxing indoor environments. It supports growth across premium fragrance categories and natural wax blends. It attracts buyers who seek stress-relief solutions and sensory experiences through curated scents. Demand rises further as households increase focus on interior aesthetics.

- For Instance, candle market is experiencing a significant shift towards natural, wellness-oriented products, with demand for soy wax growing substantially as consumers seek sustainable and eco-friendly alternatives to traditional paraffin wax candles.

Growing Preference for Premium, Natural, and Eco-Conscious Candle Formulations

The candles market accelerates as brands adopt soy, beeswax, and coconut-based alternatives to replace paraffin. It strengthens appeal among environmentally aware customers who value clean-burn and toxin-free options. Manufacturers diversify product lines with biodegradable packaging and sustainable wicks. It attracts consumers who prioritize responsible consumption and transparent ingredient sourcing. Demand for handcrafted and artisanal candles increases across specialty retail channels.

- For instance, Mala the Brand utilizes natural coconut soy wax in its handcrafted scented candles, paired with lead-free cotton and wood wicks for clean burning. This formulation has enabled them to plant 76,210+ trees through purchases.

Expanding Commercial Adoption Across Hospitality, Spa, and Gifting Ecosystems

The candles market gains support from high usage across hotels, restaurants, wellness centers, and gifting outlets. It enhances ambience, brand identity, and sensory engagement in commercial settings. Businesses incorporate decorative and scented variants to elevate guest experiences. It supports consistent demand through event décor, festive gifting, and corporate gifting programs. Strong participation from lifestyle and luxury brands expands product placement opportunities.

Rapid Growth of E-Commerce, Digital Branding, and Customization Trends

The candles market grows rapidly due to strong online retail penetration and influencer-driven visibility. It benefits from customizable fragrances, shapes, colors, and personalization features that attract younger demographics. Brands use digital platforms to launch limited-edition collections and subscription-based fragrance boxes. It strengthens customer engagement and boosts repeat purchases across global markets. Improved logistics and doorstep delivery expand access to diverse candle formats.

Market Trends:

Growing Shift Toward Sustainable, Clean-Burn, and Plant-Based Candle Innovations

The candles market moves toward sustainable and clean-burn solutions driven by rising consumer expectations for healthier indoor environments. It pushes manufacturers to introduce soy, coconut, and beeswax formulations with minimal soot output. Brands adopt natural fragrances, cotton or wooden wicks, and recyclable packaging to reinforce environmental credibility. It encourages premiumization as consumers show willingness to pay more for safe and ethically produced products. Demand for cruelty-free and vegan-certified candles expands across retail and e-commerce channels. Brands highlight ingredient transparency to build strong loyalty and trust among health-conscious buyers. Seasonal and nature-inspired fragrance collections gain stronger traction across global markets.

- For Instance, ReCandle Co. uses 100% soy wax with cotton wicks and phthalate-free oils in refillable ceramic vessels, enabling a zero-waste system

Strong Advancement in Personalization, Aesthetic Appeal, and Technology-Enabled Candle Formats

The candles market evolves with rising demand for personalized and aesthetically distinctive candle designs. It supports growth in curated gift sets, customized labels, unique shapes, and event-themed variants. Brands integrate technology through LED-infused candles, crackling wooden wicks, and smart-controlled aroma diffusers to elevate sensory appeal. It drives engagement among younger consumers who prefer experiential and visually appealing products. Artistic collaborations with designers and fragrance experts promote limited-edition offerings that attract premium buyers. Influencer partnerships and social media storytelling expand visibility for niche and boutique candle makers. Home décor trends influence color palettes, vessel designs, and multifunctional candle accessories across global markets.

- For instance, the WoodWick brand, which is part of the Newell Brands portfolio, features crackling wooden wicks that simulate a fireplace sound, enhancing the sensory experience and differentiating their products in the home fragrance market.

Market Challenges Analysis:

Rising Pressure From Raw Material Volatility and Quality Compliance Constraints

The candles market faces persistent challenges due to fluctuations in raw material prices, including soy wax, beeswax, paraffin, and fragrance oils. It affects production planning and narrows margins for both large and small manufacturers. Strict regulations related to indoor air quality, fragrance allergens, and soot emissions increase compliance costs. It creates hurdles for brands that rely on synthetic additives or low-cost wax blends. Supply chain disruptions in natural waxes and essential oils further complicate consistent sourcing. Smaller producers struggle to maintain stable product quality across batches.

Intensifying Competition, Counterfeit Products, and Shifting Consumer Expectations

The candles market encounters rising competition from private-label brands, artisanal makers, and low-cost imports. It raises concerns about product differentiation and long-term brand loyalty. Counterfeit scented candles and unsafe replicas enter informal markets, which undermines consumer trust in established brands. It pressures companies to invest more in authentication measures and premium packaging. Rapid shifts in fragrance preferences and décor trends require continuous innovation cycles. Rising expectations for sustainability and transparency challenge manufacturers that lack clear environmental strategies.

Market Opportunities:

Expansion of Premium, Wellness-Focused, and Sustainable Candle Categories

The candles market gains strong opportunities through rising demand for wellness-driven and eco-friendly products. It supports the introduction of aromatherapy blends, essential oil–infused variants, and mood-enhancing fragrance collections. Brands can expand portfolios with clean-burn, plant-based waxes that appeal to health-conscious consumers. It creates space for luxury packaging, refillable jars, and reusable vessels that elevate perceived value. Growth in home décor and self-care routines increases demand for premium candles across retail and online channels. Seasonal launches and nature-inspired themes strengthen year-round sales potential.

Growing Potential in Customization, Digital Commerce, and Niche Consumer Segments

The candles market benefits from opportunities linked to digital expansion, personalization, and emerging gifting trends. It enables brands to offer customized fragrances, engraved labels, and tailored gift sets that attract younger buyers. E-commerce platforms support wider distribution for artisanal and boutique candle makers. It opens doors for subscription models that deliver curated scent experiences. Demand rises for themed candles tailored to events, festivals, and lifestyle preferences. Collaborations with designers, influencers, and wellness experts enhance brand differentiation in competitive markets.

Market Segmentation Analysis:

By Product

The candles market shows strong demand across scented candles, decorative candles, and utility candles. It gains momentum in scented categories due to rising preference for home ambience and wellness-oriented fragrances. Decorative pillars, jars, and novelty shapes attract consumers seeking aesthetic value and personalized décor themes. Utility candles hold steady demand in regions with frequent power disruptions and during emergency preparedness cycles. Premium variants supported by unique vessel designs and curated fragrance blends expand presence across specialty retail formats.

- For Instance, Bath & Body Works produces various jar candles known for a strong scent due to an optimized combination of ingredients and design features, including a proprietary blend of paraffin, vegetable, and soy waxes. The company customizes fragrance load, wax blend, and wick size for each candle and conducts extensive quality and safety testing under rigorous burn conditions, advising users to trim wicks and not burn for longer than 4-hour intervals for a typical 25-45 hour burn time on 3-wick candles.

By Wax Type

The candles market evolves with rapid adoption of soy wax, beeswax, and coconut wax due to rising interest in clean-burn and plant-based alternatives. It strengthens demand for natural formulations that reduce soot and improve indoor air quality. Paraffin wax retains a significant share due to cost advantages and consistent performance across mass-produced lines. Beeswax appeals to buyers who value artisanal craftsmanship and natural aroma profiles. Blended waxes gain traction as brands balance performance, burn stability, and environmental considerations.

- For Instance, Golden Brands, a prominent producer of natural soy waxes for candle makers, offers widely used products like Golden Wax 464 that are known for providing a clean burn and extended performance compared to traditional paraffin wax.

By Distribution Channel

The candles market benefits from strong distribution across supermarkets, specialty stores, and e-commerce platforms. It observes rapid growth in online sales driven by access to niche brands, subscription boxes, and personalized fragrance collections. Specialty home décor stores maintain demand for premium and designer candles. Supermarkets and hypermarkets support high-volume sales through affordable, fast-moving product lines. Direct-to-consumer websites enable brands to highlight ingredient transparency, customization features, and limited-edition launches.

Segmentations:

By Product

- Scented Candles

- Decorative Candles

- Utility Candles

- Tea Lights

- Pillar Candles

By Wax Type

- Soy Wax

- Paraffin Wax

- Beeswax

- Coconut Wax

- Palm Wax

- Blended Wax

By Distribution Channel

- Supermarkets & Hypermarkets

- Specialty Stores

- Online Retail/E-Commerce

- Convenience Stores

- Direct-to-Consumer Brands

- Gift Shops & Home Décor Stores

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

Regional Analysis:

Strong Market Presence in North America Driven by Premiumization and Lifestyle Trends

The candles market holds a dominant position in North America due to strong consumer interest in home ambience, wellness, and luxury fragrance experiences. It benefits from high spending on premium scented candles supported by established brands and boutique artisans. Retailers expand assortments with clean-burn, plant-based, and seasonally themed collections that attract diverse consumer groups. It gains support from widespread gifting traditions and high adoption of decorative candles across households. Influencer-driven trends strengthen visibility for niche fragrance launches. E-commerce penetration remains strong, which increases access to customized and limited-edition formats across the U.S. and Canada.

Sustained Growth in Europe Through Sustainability Focus and Artisanal Craftsmanship

The candles market expands in Europe due to rising preference for eco-certifications, natural waxes, and clean indoor air solutions. It receives support from consumers who value artisanal craftsmanship, minimalist aesthetics, and responsibly sourced ingredients. Premium jar candles, hand-poured variants, and refined fragrance blends gain strong acceptance across major markets such as Germany, France, and the U.K. It benefits from stable demand during seasonal events, cultural festivities, and tourism-driven retail. Strict regulations around chemical safety and emissions guide manufacturers toward high-quality, compliant formulations. Specialty stores, concept boutiques, and home décor chains strengthen product visibility across the region.

Rapid Expansion Across Asia-Pacific Backed by Urbanization and Lifestyle Upgrades

The candles market records the fastest growth in Asia-Pacific due to rising disposable incomes and expanding urban lifestyles. It gains traction in wellness, aromatherapy, and home décor categories across China, India, Japan, and Southeast Asia. Growing interest in plant-based living and natural fragrances supports demand for soy, coconut, and blended wax options. It benefits from increasing penetration of modern retail formats and strong e-commerce growth. Gifting culture, festival-driven consumption, and hospitality sector expansion elevate opportunities for premium and decorative candles. Local manufacturers and global brands invest in new fragrance lines and region-specific designs to capture emerging consumer segments.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Bath & Body Works Direct, Inc.

- Better Homes & Gardens

- Bridgewater Candle Company

- Colonial Candle

- Circle E Candles

- Diptyque S.A.S.

- Jo Malone London

- MALIN+GOETZ

- NEST Fragrances, LLC

- The Yankee Candle Company, Inc.

- Conscious Candle Company

- Contract Candles & Diffusers Ltd.

- Ellis Brooklyn

- TRUDON

- Le Labo

Competitive Analysis:

The candles market features a competitive landscape shaped by global fragrance leaders, premium artisanal brands, and mass-market manufacturers. Key companies include Bath & Body Works Direct, Inc., Better Homes & Gardens, Bridgewater Candle Company, Colonial Candle, Circle E Candles, Diptyque S.A.S., and Jo Malone London. It reflects strong brand differentiation driven by fragrance innovation, vessel design, sustainability commitments, and premium positioning. Established players focus on sophisticated scent profiles, clean-burn wax blends, and limited-edition seasonal launches to retain loyal customers. It benefits brands that invest in storytelling, experiential retail formats, and curated collections tailored to diverse lifestyle segments. E-commerce growth creates space for boutique makers that offer customized candles and small-batch craftsmanship. Leading companies strengthen competitiveness through strategic collaborations, expanded distribution networks, and continuous enhancement of fragrance quality and burn performance.

Recent Developments:

- In June 2024, Grace Management Group, the parent company of Bridgewater Candle Company, acquired Audrey’s, a designer and distributor of home accent products with over 40 years in the industry.

- In October 2025, TRUDON launched a new collection of highly concentrated perfumes named Nuit Rouge and opened a second boutique in New York City.

Report Coverage:

The research report offers an in-depth analysis based on Product, Wax Type, Distribution Channel and Region. It details leading Market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current Market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven Market expansion in recent years. The report also explores Market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on Market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the Market.

Future Outlook:

- Growth in wellness-focused fragrances strengthens demand for aromatherapy and mood-enhancing candle collections.

- Rising preference for clean-burn and plant-based waxes expands opportunities for soy, coconut, and beeswax formulations.

- Brands introduce refillable vessels and sustainable packaging to meet stronger expectations for environmental responsibility.

- E-commerce expansion supports wider access to niche candle makers and personalized fragrance offerings.

- Premium and designer collaborations gain traction as consumers seek unique scents and visually distinctive vessels.

- Innovation in crackle wicks, dual-scent formats, and LED-integrated designs enhances sensory appeal.

- Gifting culture drives steady demand for curated sets, festive collections, and personalized labels.

- Regional fragrance adaptations expand product relevance across emerging markets with diverse cultural preferences.

- Investment in ingredient transparency and safety compliance improves trust among health-conscious buyers.

- Technology-driven marketing, influencer partnerships, and virtual fragrance discovery tools strengthen customer engagement.