Market Overview:

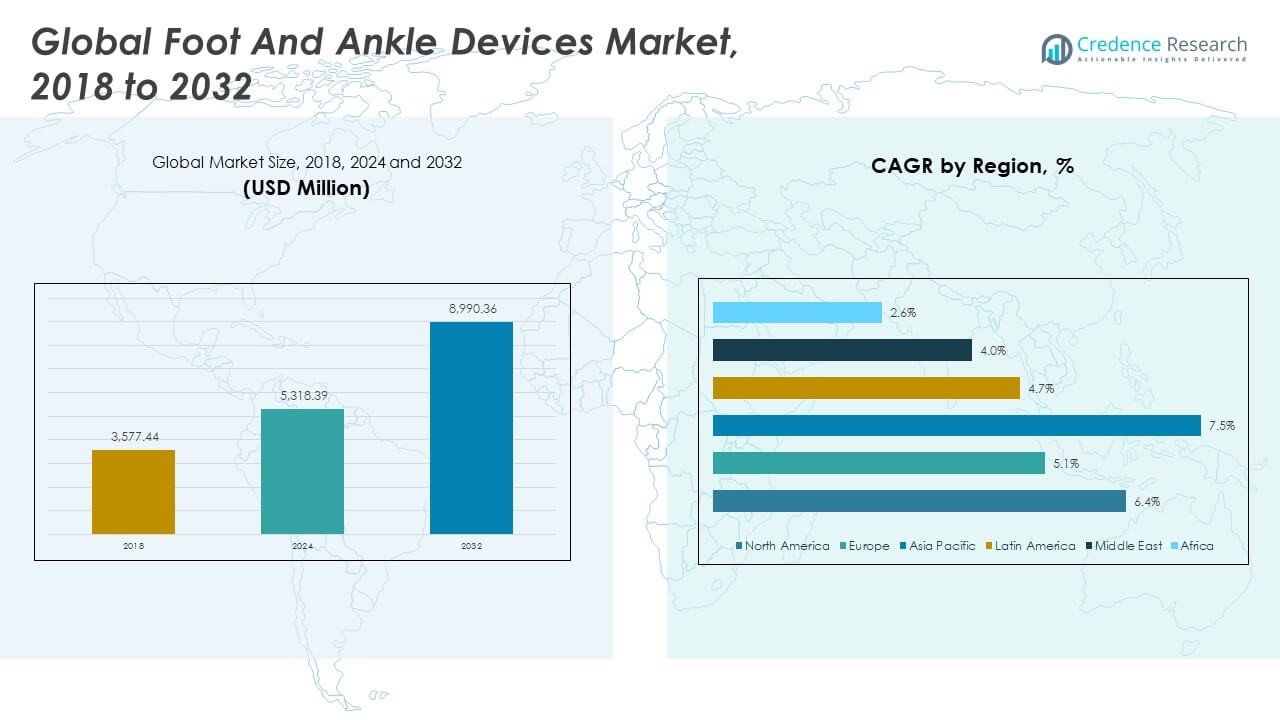

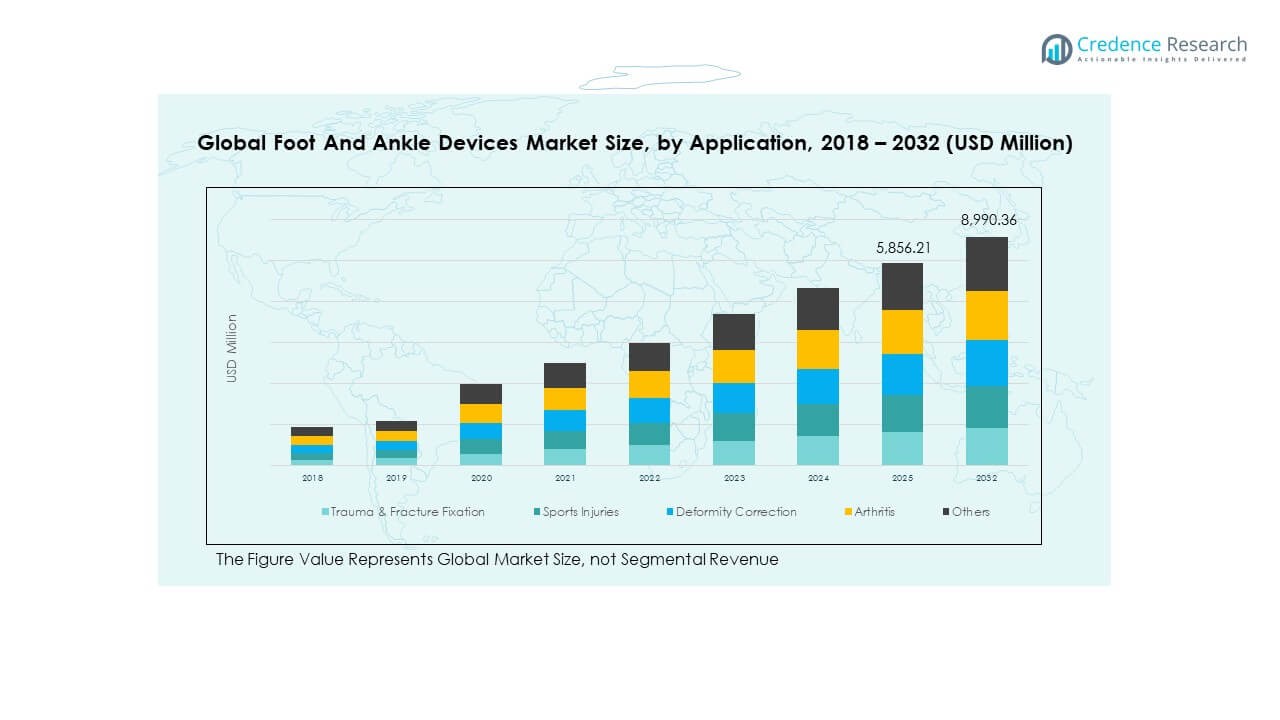

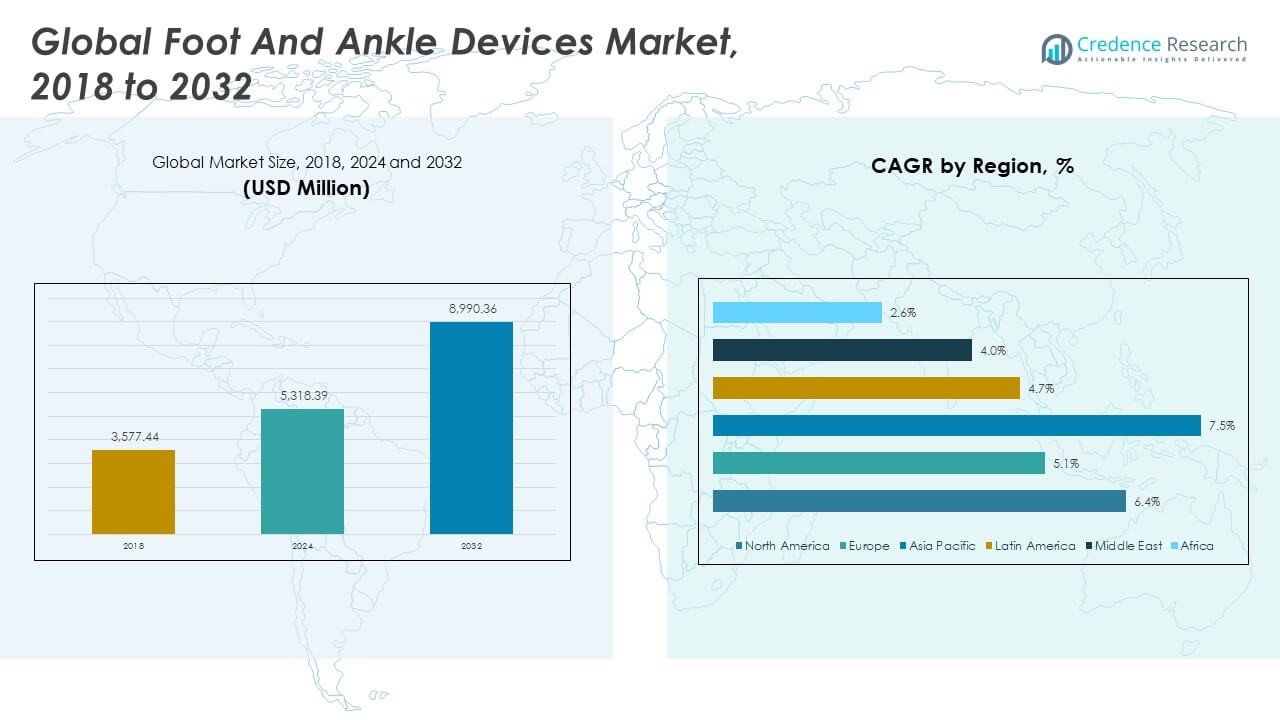

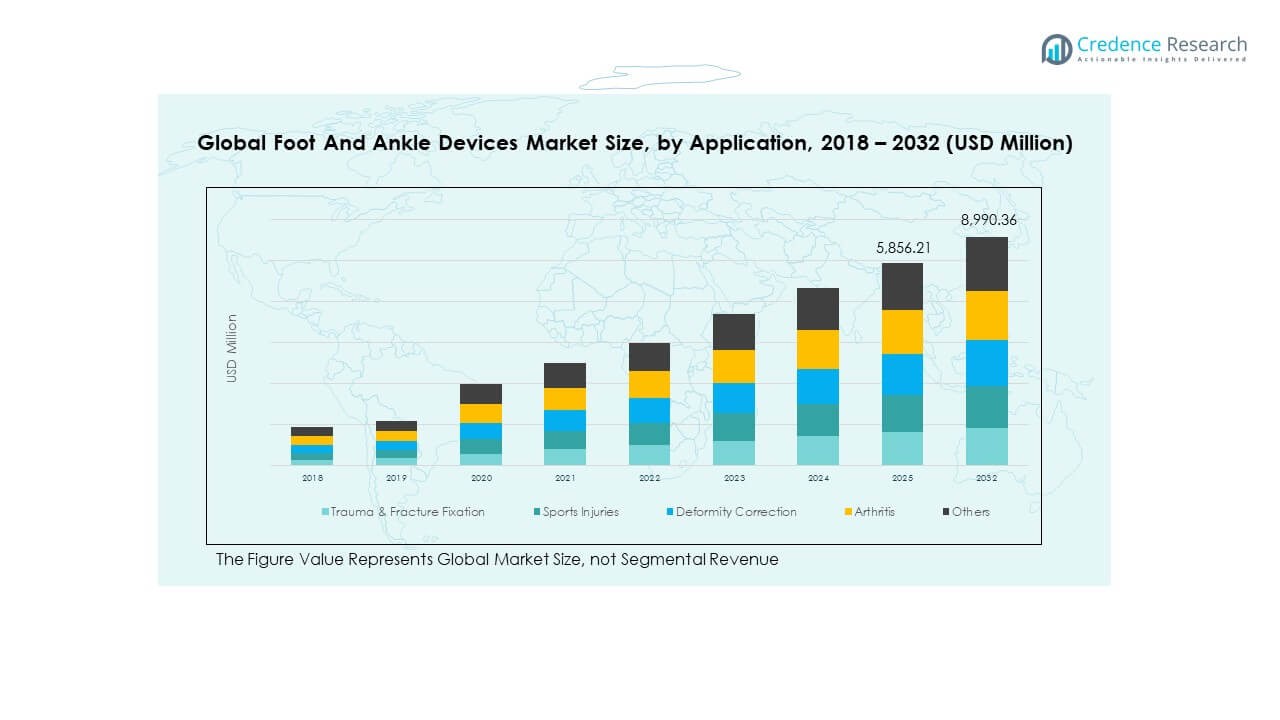

The Global Foot and Ankle Devices Market size was valued at USD 3,577.44 million in 2018, increased to USD 5,318.39 million in 2024, and is anticipated to reach USD 8,990.36 million by 2032, at a CAGR of 6.31% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Foot and Ankle Devices Market Size 2024 |

USD 5,318.39 Million |

| Foot and Ankle Devices Market, CAGR |

6.31% |

| Foot and Ankle Devices Market Size 2032 |

USD 8,990.36 Million |

The market is driven by the increasing prevalence of foot and ankle disorders, particularly among the aging population. Rising cases of arthritis, fractures, and sports injuries contribute significantly to the demand for orthopedic devices. Technological advancements, such as minimally invasive surgery techniques and the adoption of customized foot and ankle devices, are also boosting market growth. Additionally, healthcare infrastructure improvements in emerging regions are enhancing the availability of advanced treatment options.

Regionally, North America leads the market, primarily due to its advanced healthcare system and high demand for orthopedic treatments. The U.S. remains the key contributor, driven by its aging population and high adoption of advanced medical devices. Asia Pacific, with its rapidly improving healthcare infrastructure and growing patient base, is emerging as a high-growth region. Countries like China and India are seeing increased demand, further contributing to the region’s market expansion.

Market Insights:

- The Global Foot and Ankle Devices Market was valued at USD 3,577.44 million in 2018, USD 5,318.39 million in 2024, and is projected to reach USD 8,990.36 million by 2032, growing at a CAGR of 6.31% during the forecast period.

- North America holds the largest market share at approximately 43%, followed by Asia Pacific with 30%, and Europe with 19%. North America leads due to advanced healthcare infrastructure and high demand for orthopedic devices, while Asia Pacific is emerging with significant growth potential.

- The Asia Pacific region is the fastest-growing market, with a CAGR of 7.5%. The rise in disposable income, increasing healthcare access, and a large population base, particularly in China and India, are key drivers for this growth.

- The Trauma & Fracture Fixation segment leads the market with a share of 35%, followed by Sports Injuries at 25% and Arthritis at 20%, as indicated in the image. These segments dominate due to the high prevalence of injuries and conditions requiring orthopedic treatment.

- The Deformity Correction segment has a growing share of 10%, with Arthritis holding 15% of the market. Increased awareness and demand for corrective surgeries and arthritis treatments are key factors driving the market in these segments.

Market Drivers:

Increasing Prevalence of Foot and Ankle Disorders

The Global Foot and Ankle Devices Market benefits from the rising incidence of foot and ankle disorders. These conditions, which include fractures, arthritis, and sports injuries, are becoming more prevalent, particularly with the aging population. As people age, their bones and joints become more susceptible to wear and tear, leading to a higher demand for medical devices. This trend is further amplified by the growing number of sports-related injuries among young adults. It is expected that the rising number of cases will drive the adoption of foot and ankle devices across various healthcare settings.

- For instance, Smith & Nephew’s PERI-LOC Small Frag System has received broad clinical adoption for ankle and foot fracture repair; the system is indicated for use in a wide range of fracture types and is listed in FDA device approvals and product manuals used in thousands of clinical cases globally as of 2024.

Advancements in Minimally Invasive Surgical Techniques

The Global Foot and Ankle Devices Market is experiencing growth due to advancements in minimally invasive surgery (MIS). These techniques offer patients reduced recovery times and less trauma to the body. MIS has gained significant traction in orthopedic procedures, particularly for foot and ankle conditions. The precision of these procedures, paired with the use of advanced devices, ensures better patient outcomes. As healthcare providers increasingly adopt these procedures, the demand for specialized foot and ankle devices continues to rise, pushing market growth.

- For instance, Stryker’s Infinity Total Ankle System incorporates advanced features from its Inbone and Infinity systems, designed to provide better surgical adaptability and support faster patient recovery. This system is a key part of Stryker’s portfolio of innovative orthopedic solutions.

Growing Awareness and Access to Orthopedic Solutions

Rising awareness of foot and ankle health is contributing to the growth of the Global Foot and Ankle Devices Market. Healthcare professionals and organizations are increasingly focusing on educating the public about the importance of foot care. This has led to a surge in the number of people seeking treatments for common foot disorders. In parallel, accessibility to orthopedic solutions is improving globally, with better insurance coverage and healthcare infrastructure. This widespread availability is driving more people to seek medical attention for foot and ankle problems.

Technological Innovations in Foot and Ankle Devices

The demand for foot and ankle devices is further fueled by technological innovations in the sector. Manufacturers are incorporating advanced materials and design features to improve the functionality and comfort of their products. Innovations such as 3D printing and robotics are enabling the production of highly customized devices, tailored to individual patient needs. These innovations also allow for better fitting and alignment, ensuring enhanced recovery and reduced complications. As technology continues to evolve, it will likely propel further growth in the Global Foot and Ankle Devices Market.

Market Trends:

Shift Toward Customizable and Patient-Specific Solutions

One of the key trends driving the Global Foot and Ankle Devices Market is the growing preference for customizable and patient-specific solutions. Patients today demand devices that cater to their unique anatomical needs and personal preferences. Custom-made orthotics, implants, and braces are becoming more popular, providing a better fit and improving overall patient comfort. Companies are leveraging advancements in 3D printing and digital modeling to design products that are tailored to individual specifications. This shift reflects the broader trend toward personalized healthcare in the orthopedic sector.

Rise in Geriatric Population and Aging Population Health Focus

The increasing geriatric population is a significant driver of the Global Foot and Ankle Devices Market. Older adults are more likely to suffer from joint pain, arthritis, and fractures, all of which require specialized medical devices. As this demographic continues to grow, so does the demand for devices that can improve mobility and alleviate discomfort. Healthcare providers are increasingly focusing on the needs of the aging population, investing in products designed specifically for older patients. This trend underscores the growing importance of foot and ankle care as a critical aspect of elderly healthcare.

- For instance, Zimmer Biomet’s acquisition of Paragon 28 strengthens its portfolio in orthopedic solutions, particularly focusing on age-related disorders. Paragon 28 is recognized for its specialized foot and ankle surgical products.

Integration of Digital Solutions for Monitoring and Recovery

Digital solutions are becoming integral to the Global Foot and Ankle Devices Market, particularly in post-operative recovery and monitoring. Smart devices that track the progress of recovery, such as sensors embedded in foot and ankle braces, are gaining popularity. These devices enable healthcare professionals to monitor healing remotely and make adjustments to treatment plans when necessary. The integration of digital health technologies with orthopedic devices is improving patient outcomes and driving the market’s growth. It represents a significant shift toward more data-driven, patient-centered care.

Expansion of Foot and Ankle Device Offerings

There is a noticeable trend toward the expansion of product offerings within the Global Foot and Ankle Devices Market. Companies are diversifying their product lines to address various types of foot and ankle conditions. This includes the development of devices for both surgical and non-surgical treatment options, such as ankle implants, foot braces, and corrective footwear. As the market grows, manufacturers are expanding their portfolios to include a wider range of products designed to treat conditions like flat feet, bunions, and diabetic foot ulcers. This expansion allows companies to reach more diverse patient groups and address a broader spectrum of healthcare needs.

- For instance, Exactech’s Vantage Ankle 3D and 3D+ tibial implants, featuring proprietary GPS Ankle navigation, provide surgeons with real-time guidance and enhanced surgical accuracy. These implants are designed to address a broader range of complex ankle replacement surgeries.

Market Challenges Analysis:

High Costs and Affordability Issues

One of the primary challenges facing the Global Foot and Ankle Devices Market is the high cost of medical devices. These devices, especially high-end implants and orthotics, can be prohibitively expensive for a significant portion of the population. The cost of treatment, including device acquisition, surgery, and post-operative care, often deters patients from seeking treatment. Healthcare systems, especially in emerging markets, may face challenges in providing affordable options to meet the growing demand for foot and ankle care. As a result, addressing affordability and cost-effectiveness will be crucial for market expansion.

Regulatory Barriers and Product Approval Delays

Regulatory barriers also pose a challenge to the Global Foot and Ankle Devices Market. The process for obtaining regulatory approval for new devices can be lengthy and complex. Manufacturers must navigate stringent regulations and clinical trials to ensure their products meet safety and efficacy standards. Delays in product approvals or regulatory hurdles can significantly slow down the market entry of innovative devices. This challenge is particularly relevant in regions with rigid regulatory frameworks, where the approval process may take years, delaying the introduction of new, potentially groundbreaking technologies.

Market Opportunities:

Growth in Emerging Markets

The Global Foot and Ankle Devices Market presents significant opportunities in emerging markets, particularly in Asia-Pacific and Latin America. The growing healthcare infrastructure and improved economic conditions in these regions are driving demand for orthopedic devices. As more individuals gain access to quality healthcare services, the need for foot and ankle treatments increases. Additionally, rising disposable incomes in these regions enable more patients to afford advanced medical devices. These developments provide substantial growth opportunities for manufacturers looking to expand their footprint in these high-potential markets.

Technological Advancements and Innovation

Technological advancements in the field of foot and ankle devices create new opportunities for growth in the market. Innovations such as 3D-printed implants and robotic-assisted surgery are expected to revolutionize the industry. These advancements improve the accuracy and success rates of treatments while reducing recovery times for patients. As new technologies continue to evolve, they will offer further opportunities for market expansion. Companies that can leverage these innovations to offer more efficient and personalized solutions are likely to capture a larger share of the growing market.

Market Segmentation Analysis:

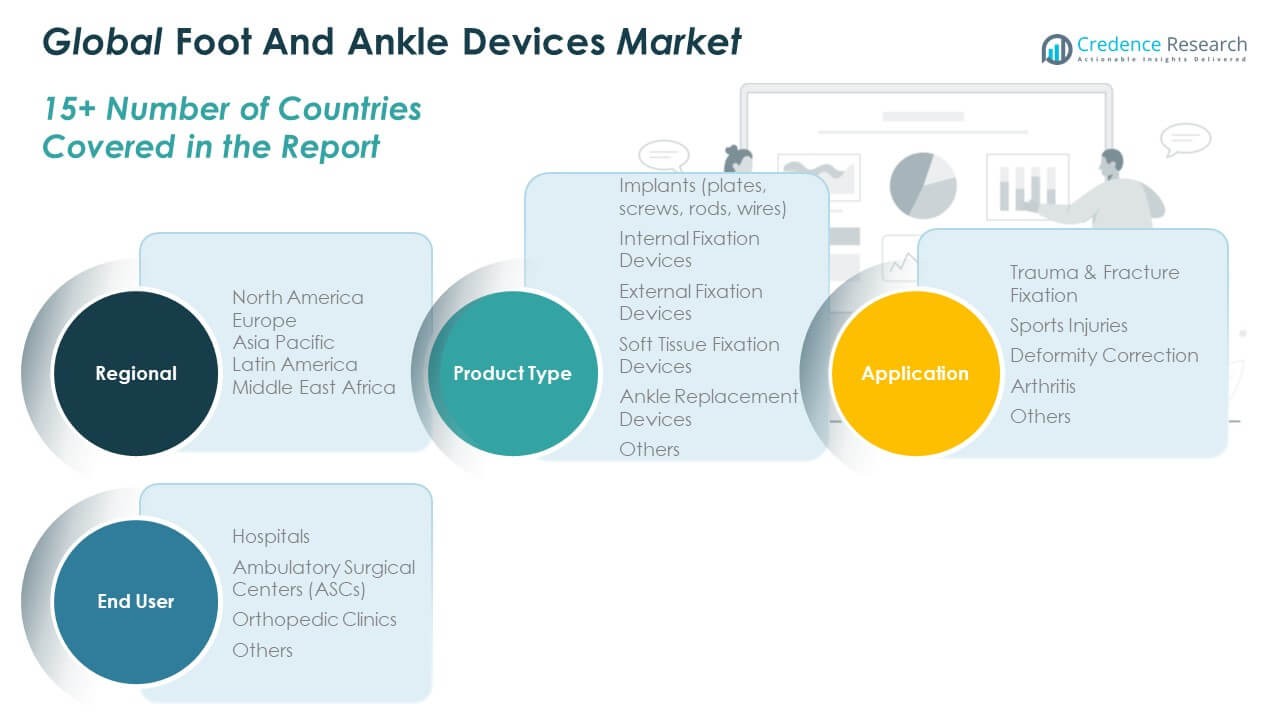

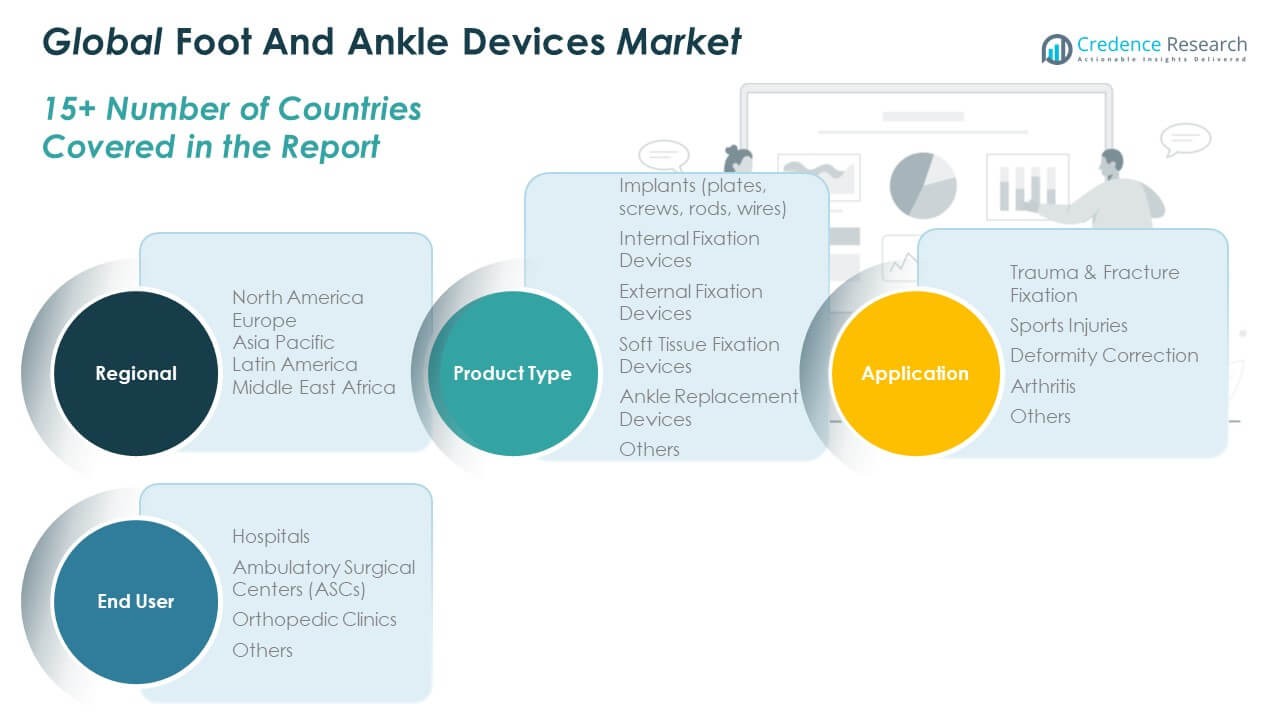

The Global Foot and Ankle Devices Market is segmented into product types, applications, and end users, each contributing significantly to its growth and dynamics.

By Product Type, the market includes a variety of devices catering to different orthopedic needs. Implants, such as plates, screws, rods, and wires, remain a dominant category due to their role in stabilizing bone fractures. Internal Fixation Devices are widely used for providing internal support, while External Fixation Devices are preferred in cases requiring stabilization from outside the body. Soft Tissue Fixation Devices support soft tissue repair, and Ankle Replacement Devices offer solutions for severe joint degeneration. Other niche products also cater to specific needs, enhancing treatment options.

- For example, Stryker’s Incompass™ Total Ankle System treats end-stage ankle arthritis and was launched at the AOFAS Annual Meeting in September 2025. This system integrates designs from the legacy Infinity and Inbone systems, which have demonstrated five-year survivorship rates of 98% or higher in clinical studies.

By Application, the market addresses several conditions, including Trauma & Fracture Fixation, which remains the largest segment, given the frequency of foot and ankle injuries. Sports Injuries drive demand for specialized devices aimed at high-impact recovery. Deformity Correction and Arthritis treatment segments are growing, reflecting the aging population’s need for surgical solutions to chronic conditions.

- For instance, Zimmer Biomet has expanded its portfolio to address foot and ankle deformities and fractures with advanced devices, strengthening its position in the orthopedic market.

By End User, Hospitals lead the demand for foot and ankle devices, followed by Ambulatory Surgical Centers (ASCs), which are expanding with a focus on outpatient procedures. Orthopedic Clinics also represent a key end-user segment, offering specialized care for foot and ankle conditions. The growing need for efficient surgical treatments is boosting demand across all segments, fostering significant market opportunities.

Segmentation:

By Product Type:

- Implants (plates, screws, rods, wires)

- Internal Fixation Devices

- External Fixation Devices

- Soft Tissue Fixation Devices

- Ankle Replacement Devices

- Others

By Application:

- Trauma & Fracture Fixation

- Sports Injuries

- Deformity Correction

- Arthritis

- Others

By End User:

- Hospitals

- Ambulatory Surgical Centers (ASCs)

- Orthopedic Clinics

- Others

By Region:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America:

The North America Global Foot and Ankle Devices Market size was valued at USD 1,564.18 million in 2018, increased to USD 2,301.26 million in 2024, and is anticipated to reach USD 3,900.91 million by 2032, at a CAGR of 6.4% during the forecast period. North America holds a dominant share of the market, driven by the high prevalence of foot and ankle disorders, particularly in the aging population. The U.S. leads the market due to its advanced healthcare infrastructure and well-established orthopedic treatment systems. The demand for foot and ankle devices is bolstered by the widespread adoption of minimally invasive surgeries and technological advancements in devices. Hospitals and outpatient surgical centers in this region play a significant role in driving demand for these products. Moreover, the strong presence of leading manufacturers and the increasing focus on personalized treatment solutions contribute to North America’s market growth.

Europe:

The Europe Global Foot and Ankle Devices Market size was valued at USD 692.08 million in 2018, increased to USD 974.48 million in 2024, and is anticipated to reach USD 1,503.45 million by 2032, at a CAGR of 5.1% during the forecast period. Europe accounts for a substantial share of the market, with countries like Germany, the UK, and France leading the demand for foot and ankle devices. The region is witnessing a rise in the geriatric population, which is contributing to the demand for orthopedic treatments. Healthcare advancements, particularly in surgical procedures and recovery technologies, are also driving growth. The market benefits from well-established healthcare policies and increasing investment in medical technologies. Europe’s growing focus on advanced medical solutions for foot and ankle conditions positions it for steady market expansion.

Asia Pacific:

The Asia Pacific Global Foot and Ankle Devices Market size was valued at USD 1,006.50 million in 2018, increased to USD 1,582.11 million in 2024, and is anticipated to reach USD 2,922.94 million by 2032, at a CAGR of 7.5% during the forecast period. Asia Pacific is the fastest-growing region in the market, driven by rapid economic development and increasing healthcare access in countries like China and India. The region’s large population, combined with rising disposable incomes, is pushing the demand for healthcare services, including foot and ankle treatments. The growing number of sports injuries, coupled with a significant rise in traffic-related accidents, further stimulates market growth. Hospitals and orthopedic clinics are major contributors to the adoption of foot and ankle devices. With technological advancements and innovations in device manufacturing, the market in this region is poised for robust growth.

Latin America:

The Latin America Global Foot and Ankle Devices Market size was valued at USD 172.16 million in 2018, increased to USD 252.82 million in 2024, and is anticipated to reach USD 379.18 million by 2032, at a CAGR of 4.7% during the forecast period. Latin America is experiencing steady growth in the foot and ankle devices market due to improved healthcare infrastructure and increasing awareness about orthopedic conditions. Brazil and Mexico are the leading markets, benefiting from rising healthcare investments and growing patient demand for advanced treatment options. The prevalence of diabetes and obesity, which are linked to foot-related complications, is also driving market growth. The region’s demand for orthopedic devices is expected to continue expanding, fueled by rising healthcare standards and a focus on reducing healthcare disparities.

Middle East:

The Middle East Global Foot and Ankle Devices Market size was valued at USD 97.43 million in 2018, increased to USD 132.04 million in 2024, and is anticipated to reach USD 187.25 million by 2032, at a CAGR of 4.0% during the forecast period. The market in the Middle East is growing at a moderate pace, supported by increasing healthcare investments in countries such as Saudi Arabia and the UAE. The region’s healthcare sector is undergoing significant reforms, which are improving the availability and quality of foot and ankle treatments. Additionally, the rise in sports-related injuries and an aging population are factors contributing to market expansion. Hospitals and clinics in the region are increasingly adopting advanced surgical procedures, leading to greater demand for specialized devices. The region’s focus on improving health outcomes and providing cutting-edge orthopedic solutions is expected to fuel market growth.

Africa:

The Africa Global Foot and Ankle Devices Market size was valued at USD 45.10 million in 2018, increased to USD 75.67 million in 2024, and is anticipated to reach USD 96.63 million by 2032, at a CAGR of 2.6% during the forecast period. The African market is growing at a slower pace compared to other regions, primarily due to limited healthcare infrastructure and economic challenges. However, there is increasing awareness about the importance of foot and ankle health, particularly in South Africa and Nigeria. The market is witnessing growth in orthopedic clinics and hospitals, driven by the rising incidence of diabetes, arthritis, and trauma. Although adoption rates remain lower than in more developed regions, initiatives to improve healthcare access and infrastructure are expected to gradually increase demand for foot and ankle devices in the coming years.

Key Player Analysis:

- Stryker Corporation

- Johnson & Johnson (DePuy Synthes)

- Zimmer Biomet

- Smith+Nephew

- Bioventus LLC

- Enovis Corp.

- Acumed LLC

- Arthrex, Inc.

- Anika Therapeutics, Inc.

- Orthofix, Inc.

Competitive Analysis:

The Global Foot and Ankle Devices Market is characterized by intense competition among several key players striving to capture significant market share. Companies are focusing on developing innovative and technologically advanced devices to cater to the growing demand for foot and ankle care. Major players are engaged in strategic partnerships, mergers and acquisitions, and product launches to expand their product portfolios and strengthen their market position. The competition is fierce, with companies emphasizing product quality, reliability, and affordability. Additionally, players are investing in research and development activities to introduce novel solutions and address the evolving needs of patients and healthcare professionals in the foot and ankle care sector. This dynamic competitive landscape is expected to drive continuous innovation and improvements in the global foot and ankle devices market.

Recent Developments:

- In October 2025, Zimmer Biomet has launched two orthopedic devices in partnership with Paragon 28, following its $1.1 billion acquisition of the foot and ankle specialist earlier this year. This collaboration combines Zimmer Biomet’s global distribution capabilities and Paragon 28’s leading expertise in foot and ankle product innovation, resulting in advanced clinical solutions for orthopedic surgeons.

Report Coverage:

The research report offers an in-depth analysis based on Product Type, Application and End User. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Technological innovations, such as 3D printing and robotic surgery, will continue to enhance the precision of treatments.

- The demand for minimally invasive surgeries will drive further market adoption, offering reduced recovery times.

- Increasing awareness of foot and ankle disorders will lead to higher adoption of orthopedic devices globally.

- Personalized and custom-made foot and ankle devices will see growth, catering to specific patient needs.

- Expansion in emerging markets like Asia Pacific and Latin America will contribute significantly to market growth.

- The aging global population will continue to drive demand, especially for arthritis and deformity correction devices.

- Enhanced healthcare infrastructure in developing regions will lead to greater access to foot and ankle treatments.

- Growing sports injuries among the younger population will increase the demand for specialized treatment devices.

- Companies will focus on strategic acquisitions and partnerships to expand their product offerings and geographic presence.

- Continuous research and development will result in advanced, more effective solutions that address unmet patient needs.