Market Overview

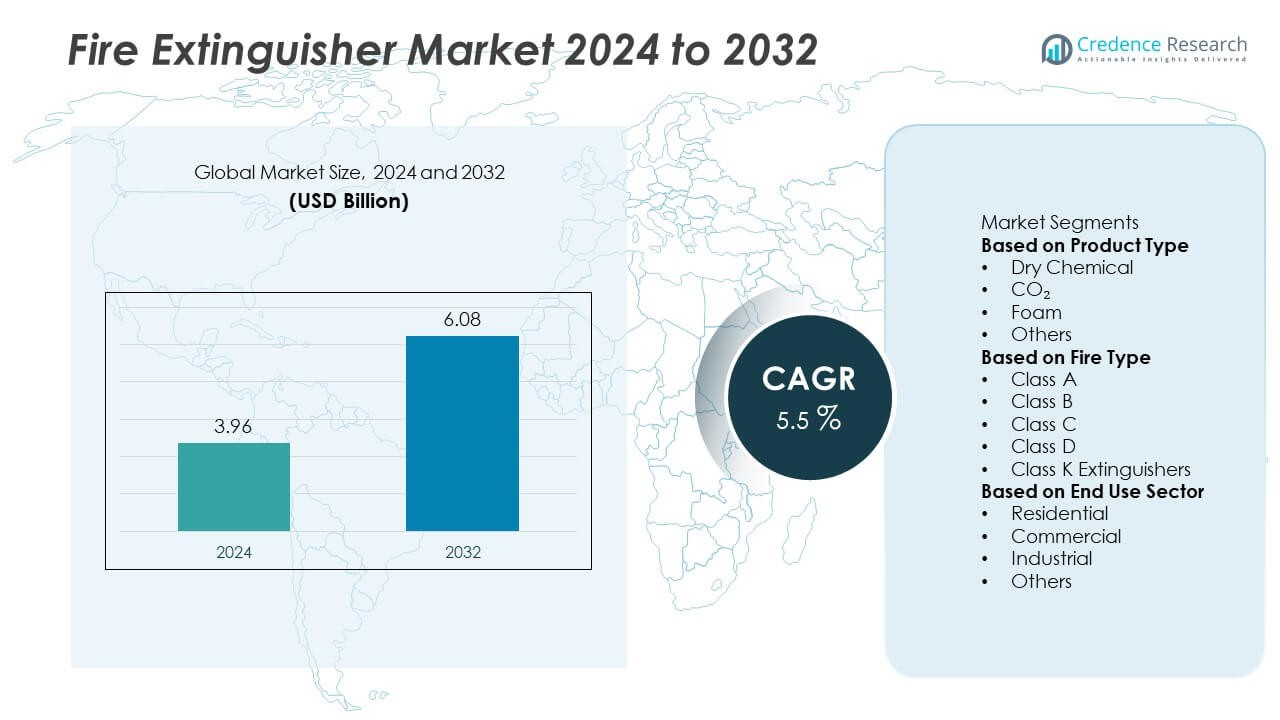

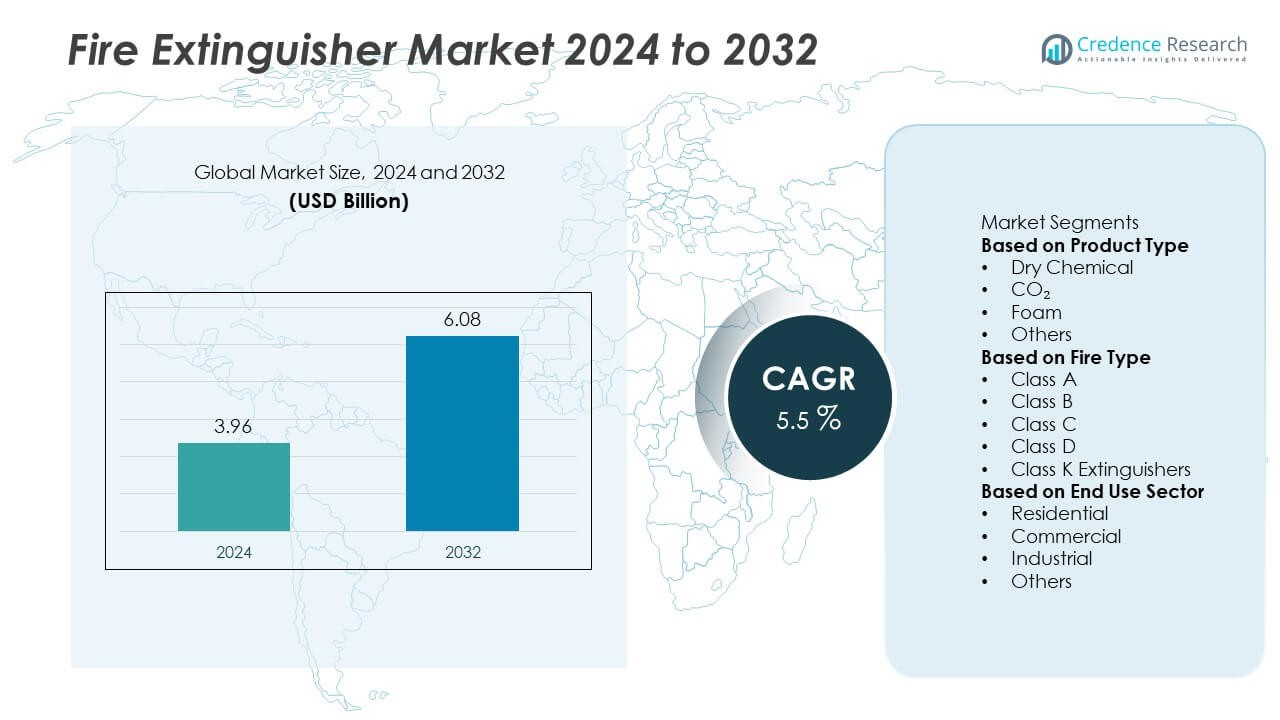

The Fire Extinguisher Market was valued at USD 3.96 billion in 2024 and is projected to reach USD 6.08 billion by 2032, expanding at a CAGR of 5.5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Fire Extinguisher Market Size 2024 |

USD 3.96 Billion |

| Fire Extinguisher Market, CAGR |

5.5% |

| Fire Extinguisher Market Size 2032 |

USD 6.08 Billion |

The top players in the fire extinguisher market include Safex Fire Services, Honeywell International Inc., Kidde Fire Systems, Minimax Viking Group, Johnson Controls International, FirePro Systems, BRK Brands, Inc., Amerex Corporation, National Fire Fighting Manufacturing FZCO (NAFFCO), and United Technologies Corporation. These companies drive the market through innovation in eco-friendly extinguishing agents, smart fire safety systems, and compliance with stringent regulatory standards. Regionally, North America led with 33% share in 2024, supported by strict safety codes and advanced infrastructure, while Asia-Pacific accounted for 29% share, fueled by rapid industrialization and urban development. Europe followed with 27% share, driven by regulatory enforcement and sustainability initiatives, whereas Latin America and the Middle East & Africa held 6% and 5% shares, respectively, reflecting growing but emerging adoption.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Fire Extinguisher market was valued at USD 3.96 billion in 2024 and is projected to reach USD 6.08 billion by 2032, growing at a CAGR of 5.5% during the forecast period.

- Growth is driven by strict fire safety regulations and rising adoption in residential, commercial, and industrial sectors, with the commercial segment leading at 39% share in 2024.

- Key trends include the shift toward eco-friendly extinguishing agents, smart fire suppression systems, and automatic solutions gaining traction in high-risk facilities and advanced infrastructure projects.

- The competitive landscape is defined by leading companies such as Safex Fire Services, Honeywell International Inc., Kidde Fire Systems, Minimax Viking Group, Johnson Controls International, FirePro Systems, BRK Brands, Inc., Amerex Corporation, NAFFCO, and United Technologies Corporation focusing on innovation and global expansion.

- Regionally, North America led with 33% share, followed by Asia-Pacific at 29% and Europe at 27%, while Latin America and Middle East & Africa accounted for 6% and 5% respectively.

Market Segmentation Analysis:

By Product Type

Dry chemical extinguishers dominated the market in 2024, holding a 42% share due to their effectiveness against Class A, B, and C fires. Their widespread use in residential, commercial, and industrial facilities stems from affordability, easy maintenance, and high fire suppression efficiency. CO₂ extinguishers accounted for a significant portion, particularly in electronics and data centers, while foam extinguishers gained traction in oil and fuel-based fire risks. Other products, including wet chemical and dry powder types, continue to serve niche needs. Dry chemical remains the leading category, supported by broad adoption across multiple fire risk scenarios.

- For instance, Amerex Corporation manufactures approximately 2.5 million fire extinguishers annually, for commercial and industrial applications. Amerex has manufactured a wide range of firefighting products since its founding in 1971, ensuring they meet the necessary safety and performance standards.

By Fire Type

Class A fire extinguishers represented the largest category in 2024 with a 35% share, driven by widespread use in residential and commercial environments where wood, paper, and fabric fires are common. Class B extinguishers followed closely, addressing flammable liquid and gas-related hazards, particularly in industrial and transportation settings. Class C extinguishers are crucial in electrical fires, ensuring workplace safety in offices and data centers. Class D and Class K extinguishers, though smaller in share, serve critical functions in metalworking industries and commercial kitchens, respectively. Class A maintains dominance due to its relevance in everyday fire incidents.

- For instance, schools and universities across the U.S. acquire fire extinguishers to comply with NFPA 10 standards, sourcing them from various manufacturers including Kidde.

By End Use Sector

The commercial sector led the market in 2024, accounting for 39% share, driven by mandatory safety regulations across offices, retail outlets, hospitality, and educational facilities. Rising construction of commercial infrastructure and strict compliance with fire safety codes fuel steady demand. The industrial sector followed, supported by manufacturing plants, oil & gas facilities, and warehouses requiring specialized extinguishers for varied fire hazards. Residential usage also contributed significantly, with growing adoption of portable extinguishers for home safety. Other end uses, including public areas and transportation hubs, continue to expand adoption. Commercial remains the leading segment due to regulatory enforcement and safety mandates.

Key Growth Drivers

Stringent Fire Safety Regulations

Government-mandated safety regulations across commercial, residential, and industrial facilities strongly drive the fire extinguisher market. Authorities in regions like North America, Europe, and Asia-Pacific enforce strict fire safety codes, requiring businesses and public buildings to install certified extinguishers. Compliance ensures reduced fire risks, minimized property damage, and protection of human life. Regular inspections and mandatory replacements further sustain recurring demand. With stricter enforcement of occupational safety standards, the global market continues to grow steadily, making regulation-driven adoption a key growth pillar across multiple sectors.

- For instance, Honeywell International provides integrated fire and life safety systems, including cloud-based platforms like Connected Life Safety Services (CLSS), used in buildings across Asia and worldwide. These systems can streamline safety procedures, enable remote diagnostics, and facilitate compliance reporting for regulatory audits.

Expansion of Industrial and Commercial Infrastructure

Rapid growth in industrial facilities, high-rise buildings, and commercial complexes is boosting demand for fire extinguishers. Industries such as manufacturing, oil and gas, and logistics require specialized extinguishers to address diverse fire hazards including chemical and electrical risks. Urbanization trends and increasing construction of offices, malls, and hotels have heightened fire safety awareness, driving large-scale installations. This expansion supports long-term demand, as both developed and emerging economies prioritize infrastructure safety. The rising focus on protecting assets and workers in modern industrial and commercial settings ensures consistent market growth.

- For instance, FirePro Systems supplied condensed aerosol units for marine vessels, reflecting rising demand from the shipping industry. FirePro’s technology is compliant with marine codes and can be installed on new or retrofit applications in a short time. The systems come in various sizes, with products available for a wide range of marine enclosures.

Rising Awareness of Residential Fire Safety

Growing consumer awareness of fire risks in residential spaces is a major growth driver. Homeowners are increasingly adopting portable fire extinguishers to enhance household safety against cooking-related and electrical fires. Rising awareness campaigns, insurance benefits, and increased affordability of compact extinguishers contribute to this trend. Countries facing higher fire-related incidents, particularly in Asia-Pacific and Latin America, are seeing stronger adoption in households. As residential safety concerns expand globally, this segment is expected to contribute significantly to the overall growth of the fire extinguisher market.

Key Trends & Opportunities

Adoption of Smart and Automatic Fire Extinguishers

A strong trend in the market is the integration of smart technologies in fire safety solutions. Automatic extinguishers, IoT-enabled monitoring systems, and advanced suppression technologies are being adopted in industries, data centers, and high-value facilities. These solutions reduce human intervention and offer real-time alerts, enhancing fire management efficiency. Manufacturers are investing in R&D to develop eco-friendly extinguishing agents that minimize environmental impact. This trend creates opportunities for innovation-driven growth and strengthens adoption across advanced safety applications.

- For instance, FirePro Systems installs condensed aerosol-based automatic units on a wide variety of vessels, including navy flotillas, cruise ships, cargo ships, and luxury yachts, to protect engine rooms, electrical and control rooms, and other enclosed spaces without requiring manual intervention.

Growth of Eco-Friendly and Sustainable Solutions

The shift toward eco-friendly extinguishing agents presents major opportunities. Traditional chemical agents often raise environmental and health concerns, prompting demand for water-mist, inert gas, and biodegradable agents. Green building certifications and corporate sustainability initiatives are further encouraging the adoption of environmentally safe fire extinguishers. Manufacturers focusing on developing low-toxicity and ozone-friendly agents are gaining competitive advantage. This trend aligns with global sustainability goals, offering opportunities for long-term differentiation and growth in both developed and emerging markets.

- For instance, Minimax Viking, a provider of fire protection systems, offers water-mist extinguishing systems for hospitals across various countries. These systems, like the Minifog EconAqua, are certified by fire safety organizations such as VdS and use significantly less water than conventional sprinklers, thereby reducing potential water damage.

Key Challenges

High Maintenance and Replacement Costs

One of the key challenges in the fire extinguisher market is the recurring cost of inspection, maintenance, and replacement. Extinguishers require periodic checks, refills, or replacements to remain compliant with safety regulations, which can burden small businesses and households. Industrial facilities with large inventories face even higher costs. While necessary for safety assurance, these expenses may limit wider adoption in cost-sensitive regions. Manufacturers and service providers need to innovate cost-efficient solutions to overcome this restraint.

Counterfeit and Low-Quality Products

The presence of counterfeit and uncertified fire extinguishers poses a significant challenge to market growth. Low-cost, substandard products compromise safety, fail to meet regulatory standards, and increase fire risks instead of preventing them. These products are more prevalent in emerging markets with limited regulatory enforcement, affecting consumer trust. To address this challenge, stronger certification systems, awareness campaigns, and stricter government monitoring are required. Ensuring product authenticity and quality assurance remains a priority for manufacturers and regulators in the fire extinguisher market.

Regional Analysis

North America

North America held a 33% share of the fire extinguisher market in 2024, supported by strict fire safety regulations and high awareness levels across residential, commercial, and industrial sectors. The United States leads adoption due to OSHA and NFPA guidelines mandating fire safety compliance in workplaces and public facilities. Growth is further driven by modernization of infrastructure, rising demand in data centers, and adoption of advanced extinguishing systems. Canada contributes steadily with increasing residential installations. Regulatory enforcement, coupled with technological upgrades, sustains North America’s position as one of the largest markets for fire extinguishers.

Europe

Europe accounted for a 27% share of the fire extinguisher market in 2024, driven by strong regulatory frameworks such as EN standards and EU fire safety directives. Countries including Germany, the UK, and France are major adopters, particularly in commercial buildings, public infrastructure, and industrial facilities. Increasing adoption of eco-friendly extinguishing agents supports sustainability goals, making the region a leader in green fire safety solutions. High demand for Class A and Class B extinguishers in urban areas and expanding construction projects further reinforce growth. Europe remains a highly regulated and mature market focused on innovation and compliance.

Asia-Pacific

Asia-Pacific captured a 29% share of the fire extinguisher market in 2024, making it one of the fastest-growing regions. Rising urbanization, expanding industrial base, and large-scale infrastructure projects drive demand across China, India, and Japan. Governments are tightening fire safety regulations, encouraging higher adoption in residential, commercial, and industrial facilities. Growing awareness of fire risks in manufacturing hubs and high-rise residential developments further supports growth. The region also shows increasing interest in automatic and smart fire safety systems. Asia-Pacific’s large population, rapid urban growth, and regulatory reforms position it as a critical growth engine for the market.

Latin America

Latin America accounted for a 6% share of the fire extinguisher market in 2024, with Brazil and Mexico leading adoption. The market is expanding due to growing construction of commercial spaces, stricter enforcement of safety codes, and rising fire risk awareness in industrial facilities. Economic growth and urban development projects contribute to demand across public infrastructure and residential sectors. However, limited enforcement in rural areas and price sensitivity pose restraints. Despite challenges, increasing foreign investment in industrial facilities and greater focus on workplace safety position Latin America for gradual but steady market growth.

Middle East & Africa

The Middle East & Africa region held a 5% share of the fire extinguisher market in 2024, supported by expanding construction and industrial projects. Countries such as Saudi Arabia, the UAE, and South Africa drive demand through rapid urbanization and infrastructure investments. Rising fire incidents in commercial buildings and industrial zones highlight the need for compliance with global safety standards. Public awareness campaigns and government initiatives to strengthen fire safety infrastructure are boosting adoption. Although growth is moderate compared to other regions, infrastructure expansion and regulatory tightening will create long-term opportunities in this region.

Market Segmentations:

By Product Type

- Dry Chemical

- CO₂

- Foam

- Others

By Fire Type

- Class A

- Class B

- Class C

- Class D

- Class K Extinguishers

By End Use Sector

- Residential

- Commercial

- Industrial

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the fire extinguisher market is shaped by leading players such as Safex Fire Services, Honeywell International Inc., Kidde Fire Systems, Minimax Viking Group, Johnson Controls International, FirePro Systems, BRK Brands, Inc., Amerex Corporation, National Fire Fighting Manufacturing FZCO (NAFFCO), and United Technologies Corporation. These companies focus on expanding their product portfolios with advanced extinguishing technologies, including eco-friendly agents, smart systems, and automatic solutions, to address evolving fire safety needs. Strategic investments in R&D, mergers, and collaborations allow them to strengthen global presence and enhance technological capabilities. Regional expansion in fast-growing markets like Asia-Pacific and the Middle East further boosts competitiveness. Companies also prioritize regulatory compliance, certifications, and sustainability initiatives to gain customer trust and meet international safety standards. Strong distribution networks, after-sales services, and innovation-driven offerings enable these players to maintain leadership while competing in a highly regulated and safety-critical industry.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Safex Fire Services

- Honeywell International Inc.

- Kidde Fire Systems

- Minimax Viking Group

- Johnson Controls International

- FirePro Systems

- BRK Brands, Inc.

- Amerex Corporation

- National Fire Fighting Manufacturing FZCO (NAFFCO)

- United Technologies Corporation

Recent Developments

- In September 2025, KiddeFenwal recommitted to sustainable fire suppression and pushed its NATURA™ inert gas system.

- In August 2025, Johnson Controls expressed plans to expand in its Fire & Security division.

- In June 2025, Johnson Controls relaunched its Connected Sprinkler service with predictive, data-driven maintenance.

- In February 2025, NAFFCO signed an MoU with Hytera Communications to improve emergency communications.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Fire Type, End Use Sector and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will grow steadily with rising enforcement of fire safety regulations worldwide.

- Adoption of eco-friendly extinguishing agents will increase due to sustainability concerns.

- Smart and automatic fire extinguishers will gain wider use in commercial and industrial sectors.

- Residential adoption will rise as awareness of household fire safety improves.

- Industrial growth in oil, gas, and manufacturing sectors will drive higher demand.

- Asia-Pacific will remain the fastest-growing region with rapid urbanization and infrastructure projects.

- North America and Europe will sustain dominance through strict compliance and advanced safety standards.

- Partnerships and mergers will strengthen distribution networks and expand global reach.

- Demand for portable and compact extinguishers will rise in residential and small business applications.

- Technological innovations will focus on improving efficiency, reliability, and environmental safety of fire extinguishers.