Market overview

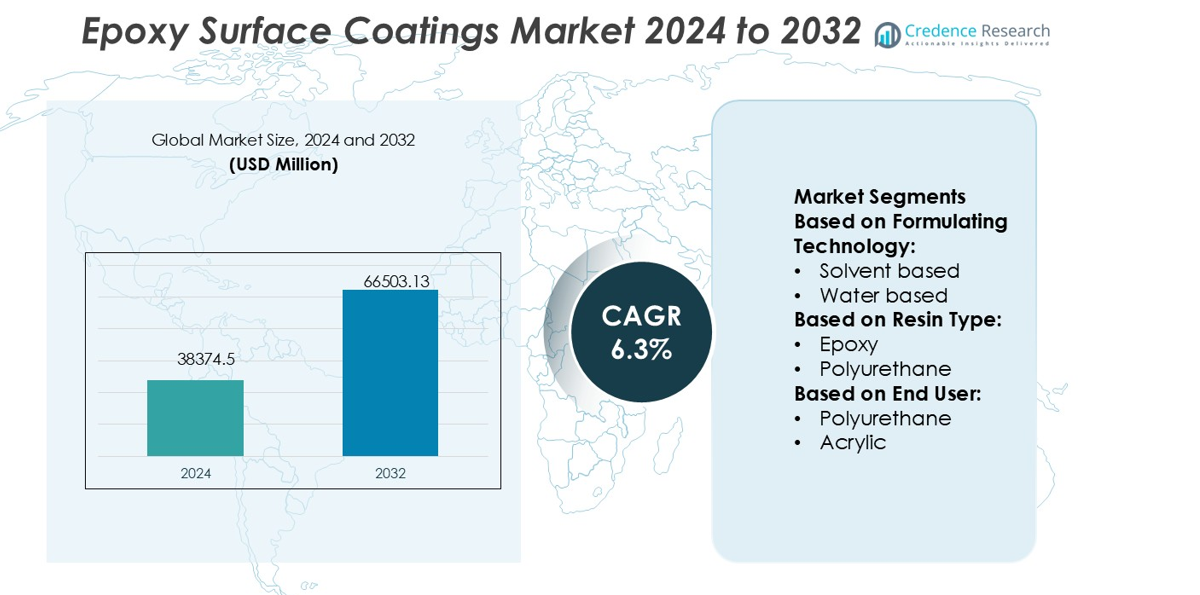

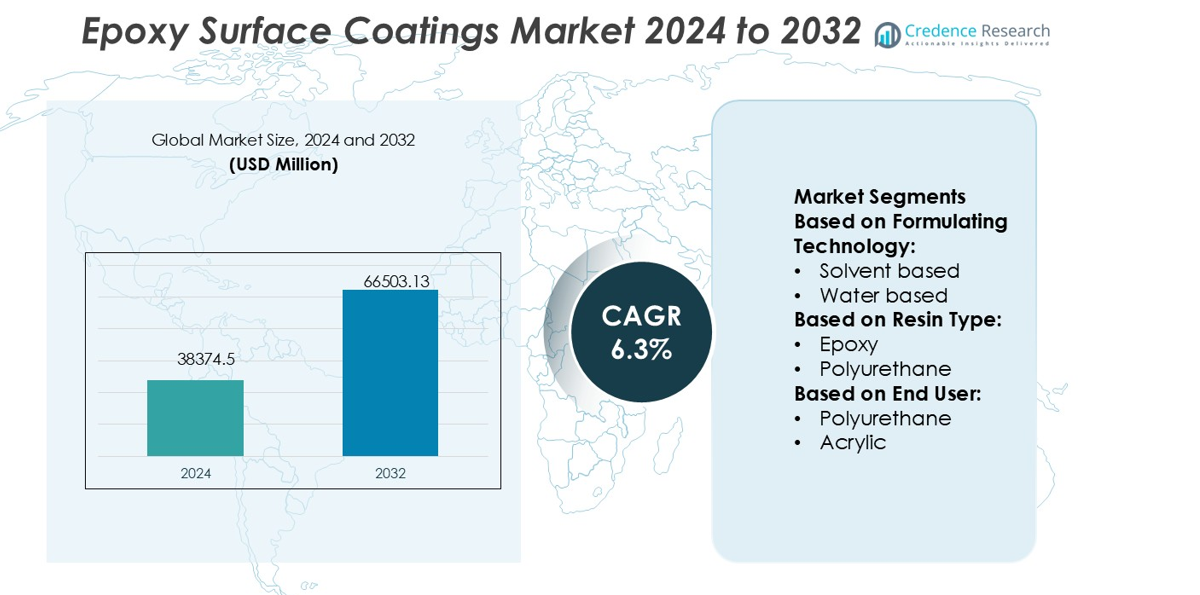

Epoxy Surface Coatings Market size was valued USD 38374.5 million in 2024 and is anticipated to reach USD 66503.13 million by 2032, at a CAGR of 6.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Epoxy Surface Coatings Market Size 2024 |

USD 38374.5 million |

| Epoxy Surface Coatings Market, CAGR |

6.3% |

| Epoxy Surface Coatings Market Size 2032 |

USD 66503.13 million |

The epoxy surface coatings market is driven by major players such as PPG Industries Inc., Akzo Nobel N.V., Sherwin-Williams Company, Axalta Coating Systems, RPM International Inc., Kansai Paint Co., Ltd., Asian Paints, Berger Paints India, BASF SE, and Nippon Paint Private Limited. These companies focus on advanced resin technologies, eco-friendly product development, and strategic expansions to strengthen their market positions. Asia-Pacific leads the global market with a 36% share, fueled by rapid urbanization, infrastructure investments, and strong industrial growth in China, India, and Southeast Asia. The region’s dominance is reinforced by large-scale construction projects and rising demand for high-performance protective coatings.

Market Insights

- The Epoxy Surface Coatings Market size was valued at USD 38374.5 million in 2024 and is projected to reach USD 66503.13 million by 2032, growing at a CAGR of 6.3%.

- Market growth is driven by rising infrastructure projects, industrial applications, and increasing demand for durable, corrosion-resistant coatings across automotive, marine, and construction sectors.

- Key trends include the shift toward water-based and low-VOC coatings, advancements in resin technologies, and sustainability-focused innovations catering to regulatory compliance and eco-friendly requirements.

- Competitive dynamics are shaped by leading players such as PPG Industries, Sherwin-Williams, BASF SE, Akzo Nobel, and Asian Paints, emphasizing R&D, product diversification, and global expansion while restraints include volatile raw material prices and stringent environmental regulations.

- Asia-Pacific leads with 36% market share, supported by rapid industrialization in China and India, while epoxy resin dominates with 46% share among resin types, highlighting its superior adhesion, durability, and protective properties across critical applications.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Formulating Technology

The solvent-based segment dominates the epoxy surface coatings market with a share of 42%. Its strength lies in superior adhesion, chemical resistance, and ability to deliver durable finishes across industrial and infrastructure applications. Despite regulatory pressure, the segment remains strong due to performance in heavy-duty environments. Water-based coatings are expanding, driven by environmental compliance and lower VOC emissions, while powder coatings gain traction for their efficiency and waste reduction. The shift toward sustainability is accelerating innovation, but solvent-based coatings maintain dominance due to high performance in demanding sectors.

- For instance, Berger Paints’ total installed capacity is significantly higher than the 33,000 KL/MT per month mentioned, which only refers to its Sandila plant. The total capacity of the company was approximately 745,000 KL/MT per annum as of FY23 and has since been expanded.

By Resin Type

Epoxy resin coatings hold the largest market share at 46%, driven by their superior corrosion resistance, adhesion, and versatility across industries. They are widely used in protective coatings for infrastructure, marine, and industrial floors. Polyurethane resins follow closely due to their weather resistance and flexibility, making them suitable for automotive and construction applications. Acrylic and alkyd resins contribute to decorative and cost-effective solutions, while zinc coatings provide strong anti-corrosion performance for steel structures. The epoxy segment leads, supported by strong demand for durability and long-term protection in industrial applications.

- For instance, Sherwin-Williams Company launched its FIRETEX® FX6010 intumescent epoxy coating, tested to protect structural steel for up to 180 minutes under cellulosic fire exposure. Its fast-drying properties allow for a certified film thickness reduction of up to 25%, enabling lower material consumption and faster application across industrial and commercial projects.

By End User

Infrastructure represents the leading end-user segment with a 38% share, fueled by rising urbanization, government projects, and investments in smart cities. Epoxy coatings dominate within this segment due to their durability and resistance to chemicals and moisture, making them ideal for bridges, highways, and water treatment facilities. Polyurethane and acrylic coatings also support architectural and commercial projects with flexible and aesthetic finishes. Industrial flooring, pipelines, and protective steel structures further strengthen infrastructure demand. The dominance of this segment is reinforced by ongoing construction growth, stringent safety standards, and the increasing need for long-lasting protective solutions.

Key Growth Drivers

Rising Demand from Infrastructure Development

The growth of infrastructure projects worldwide is a major driver for the epoxy surface coatings market. Rapid urbanization, government-led construction initiatives, and smart city programs have created strong demand for protective and durable coatings. Epoxy coatings are widely applied in bridges, highways, airports, and water treatment plants due to their chemical resistance and long service life. Increasing investments in developing economies, particularly in Asia-Pacific and the Middle East, continue to fuel the adoption of epoxy coatings, reinforcing their importance in meeting modern infrastructure requirements.

- For instance, Kansai Paint, through its Helios industrial coatings arm, recently launched a water-thinnable two-part epoxy primer whose anti-corrosion performance exceeds 1,500 hours in a salt-humidity chamber without defects.

Expanding Industrial Applications

Industrial sectors such as automotive, aerospace, and marine are contributing significantly to epoxy coating demand. Their superior adhesion, corrosion resistance, and durability make them essential in protecting equipment, vehicles, and structural components. Industries rely on epoxy surface coatings to enhance performance and extend service life, particularly in high-wear environments. The growing focus on operational efficiency and preventive maintenance is pushing manufacturers to use high-performance coatings. As industrial activity rises globally, epoxy coatings remain a preferred choice for ensuring safety, reliability, and cost efficiency in critical applications.

- For instance, PPG’s electrocoat (e-coat) systems deliver 98 % transfer efficiency in dip coating processes, yielding uniform films even on complex metal parts.Their Powercron® 160 anionic epoxy electrocoat achieved film builds beyond 6 mils (≈150 µm) across diverse substrate pretreatment chemistries, earning PPG an R&D 100 Award.

Shift Toward Sustainable and Low-VOC Solutions

Environmental regulations and consumer preference for eco-friendly products are accelerating the demand for water-based and low-VOC epoxy coatings. Governments across North America, Europe, and Asia-Pacific are enforcing stricter emission standards, compelling manufacturers to innovate sustainable formulations. The push for green building certifications and circular economy models further enhances the relevance of eco-friendly coatings. Companies investing in bio-based epoxy resins and recyclable coating systems are capturing new market opportunities. This trend positions sustainability not only as a compliance factor but also as a competitive advantage for long-term growth.

Key Trends & Opportunities

Technological Advancements in Coating Formulations

Innovation in resin chemistry and nanotechnology is transforming epoxy surface coatings. Advancements in self-healing coatings, antimicrobial finishes, and high-solids formulations are improving performance and broadening applications. These innovations address emerging needs in healthcare, electronics, and renewable energy sectors where durability and specialized properties are crucial. R&D investments are enabling manufacturers to deliver coatings that combine sustainability with enhanced functionality, creating opportunities for market expansion. Companies that leverage advanced materials and automation in production are positioned to meet evolving industry requirements and capture new growth avenues.

- For instance, BASF has made strides in epoxy curing technology through its Baxxodur® EC 151 curing agent. In a joint development with Sika, this hardener enables formulations that emit up to 90 % less VOCs compared to conventional hardeners.

Growth in Emerging Economies

The epoxy surface coatings market is witnessing strong potential in Asia-Pacific, Latin America, and Africa. Rapid construction growth, expanding industrial bases, and rising disposable incomes are fueling demand for premium coatings. Emerging economies are investing heavily in infrastructure modernization, industrial corridors, and housing projects, which directly support coating consumption. Local manufacturing expansion and international collaborations are enabling wider availability of cost-effective epoxy solutions. This trend highlights a clear opportunity for players to establish early presence, build distribution networks, and capitalize on the fast-growing demand in developing regions.

- For instance, Nippon Paint Marine has released FASTAR®, a nanodomain antifouling epoxy product, which has been applied to over 1,000 vessels since its 2021 launch. The coating yields fuel savings of up to 8 % and lower friction via hydrogel water-trapping technology.

Key Challenges

Volatility in Raw Material Prices

Fluctuations in crude oil prices directly affect the cost of key raw materials such as epichlorohydrin and bisphenol-A, used in epoxy resin production. These price instabilities create supply chain uncertainties and margin pressures for manufacturers. The dependence on petrochemical-derived inputs makes the market vulnerable to global energy dynamics. Producers are challenged to balance competitive pricing with profitability, pushing them to explore alternative raw materials and long-term supplier agreements. Managing cost volatility remains a significant hurdle to ensuring stable growth and competitiveness in the epoxy coatings market.

Stringent Environmental Regulations

Compliance with evolving environmental and safety regulations presents a major challenge for epoxy coating manufacturers. Strict limits on VOC emissions and hazardous substances demand costly reformulations and investments in sustainable technologies. Smaller companies, in particular, face difficulties in aligning with these requirements due to limited R&D budgets. Failure to comply risks market restrictions and reputational damage. While regulations encourage sustainability, they also increase production costs and complexity. Navigating this regulatory environment requires strategic investment and innovation to maintain market presence and long-term resilience.

Regional Analysis

North America

North America holds a 28% share of the epoxy surface coatings market, driven by strong demand from construction, automotive, and aerospace industries. The U.S. dominates regional consumption, supported by infrastructure renovation projects and strict safety standards. Water-based and low-VOC epoxy coatings are witnessing rising adoption due to environmental regulations from agencies like the EPA. Canada contributes significantly through industrial flooring and marine applications, while Mexico’s growing automotive and manufacturing sectors add to regional demand. Investments in smart infrastructure and industrial modernization continue to reinforce North America’s leading position in the global market.

Europe

Europe accounts for 24% of the global epoxy surface coatings market, led by Germany, France, and the UK. The region’s focus on sustainability and compliance with REACH and VOC regulations has accelerated the shift toward water-based epoxy solutions. Demand is driven by applications in automotive manufacturing, aerospace, and marine industries. Germany leads with a strong automotive sector, while France and the UK contribute through construction and infrastructure projects. Eastern Europe is witnessing growing adoption in industrial and commercial sectors, creating expansion opportunities. Europe’s commitment to green building and eco-friendly technologies strengthens long-term market growth.

Asia-Pacific

Asia-Pacific dominates the epoxy surface coatings market with a 36% share, fueled by rapid urbanization, industrialization, and infrastructure investments. China leads demand through construction and large-scale industrial activities, while India records strong growth in residential and commercial projects. Japan, South Korea, and Southeast Asian nations contribute significantly through automotive, marine, and electronics applications. The region’s cost-effective manufacturing base and government-driven infrastructure programs enhance market growth. Asia-Pacific also shows rising adoption of water-based epoxy coatings due to environmental initiatives. Strong population growth and expansion of industrial hubs ensure Asia-Pacific remains the largest and fastest-growing market globally.

Latin America

Latin America represents 6% of the epoxy surface coatings market, with Brazil and Mexico driving regional demand. Infrastructure modernization, industrial expansion, and growth in automotive manufacturing are key drivers. Brazil’s construction sector supports adoption of epoxy coatings for commercial buildings and public infrastructure. Mexico benefits from increasing demand in automotive and industrial applications, supported by trade integration with North America. Chile, Argentina, and Colombia show emerging opportunities with infrastructure projects and industrial development. Although growth is slower compared to Asia-Pacific, Latin America’s market is expanding steadily, supported by rising urbanization and government-led infrastructure investments.

Middle East & Africa (MEA)

The Middle East & Africa hold a 6% share of the epoxy surface coatings market, supported by infrastructure investments and oil and gas projects. GCC countries such as Saudi Arabia and the UAE lead demand, driven by construction of smart cities, airports, and industrial complexes. Epoxy coatings are widely used for corrosion protection in pipelines and offshore structures. In Africa, South Africa and Nigeria contribute through building projects and industrial applications. Increasing investments in energy, infrastructure, and commercial real estate create opportunities, while sustainability initiatives encourage adoption of low-VOC coatings across the region.

Market Segmentations:

By Formulating Technology:

- Solvent based

- Water based

By Resin Type:

By End User:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The epoxy surface coatings market is characterized by intense competition among leading players including Berger Paints India, Sherwin-Williams Company, Kansai Paint Co., Ltd., PPG Industries Inc., BASF SE, Nippon Paint Private Limited, RPM International Inc., Asian Paints, Akzo Nobel N.V., and Axalta Coating Systems. The epoxy surface coatings market features a highly competitive environment shaped by innovation, sustainability, and regional expansion strategies. Companies are investing heavily in research and development to introduce advanced formulations, including water-based and low-VOC solutions, to comply with stringent environmental regulations. The market also sees growing emphasis on high-performance coatings that provide superior durability, corrosion resistance, and long-term protection across infrastructure, automotive, marine, and industrial applications. Expansion into emerging economies, supported by infrastructure growth and rising industrialization, is a key strategy for strengthening market presence. Strategic collaborations, acquisitions, and eco-friendly product launches continue to define competitive differentiation and long-term growth.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In May 2024, Sherwin-Williams packaging coatings expanded its non-BPA (non-bisphenol A) epoxy coatings production in Europe after a multi-year investment with the production of its value V70 coatings for beverage drink cans. Further, this plant will produce commercial batches of the valPure V70 series to market and distribute across Europe, the Middle East, Africa, and the Indian region.

- In March 2024, Grasim Industries Limited, a subsidiary of Aditya Birla Group, in its chemical business inaugurated the capacity expansion project of Epoxy resins and formulation capacity at Vilayat, Gujarat. With this capacity expansion, the company’s overall capacity of its advanced materials will increase to 246,000 tons per annum.

- In February 2024, BASF Coatings partnered with INEOS Automotive for their program known as “Global Body and Paint Program” that involves meeting industry standards and using sustainable refinish solutions. This collaboration also supplements sustainable refinish solutions, proficiency, digital color-matching solutions, and training.

- In September 2023, PPG announced that it completed the capacity expansion of its powder coating plant located in Sumaré, Brazil. With an investment of the company expanded the production capacity of the plant by 40%

Report Coverage

The research report offers an in-depth analysis based on Formulating Technology, Resin Type, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will witness strong demand from infrastructure development and urbanization projects worldwide.

- Water-based and low-VOC epoxy coatings will gain wider adoption due to stricter regulations.

- Industrial applications such as automotive, aerospace, and marine will continue driving growth.

- Emerging economies will remain key hotspots with rising construction and industrial investments.

- Sustainability initiatives will push manufacturers to develop bio-based and recyclable formulations.

- Technological innovations will enhance performance with self-healing and antimicrobial coating solutions.

- Expansion of smart cities will increase the use of durable epoxy coatings in public projects.

- Strategic mergers and acquisitions will shape competitive dynamics across global markets.

- Digital tools and automation in coating production will improve efficiency and consistency.

- Long-term growth will rely on balancing cost, compliance, and high-performance demands in diverse sectors.