Market overview

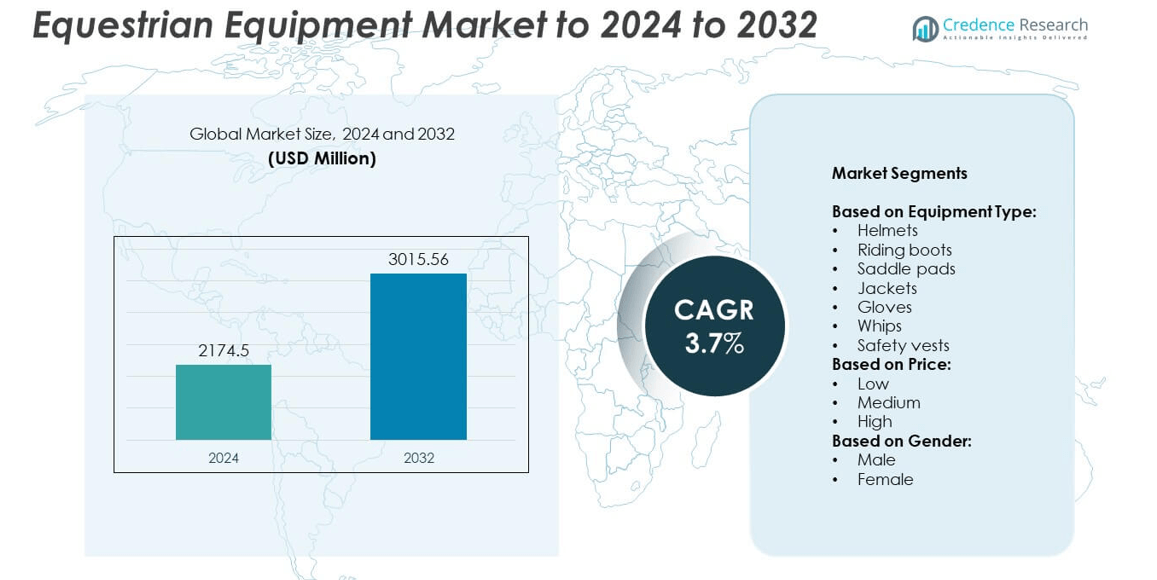

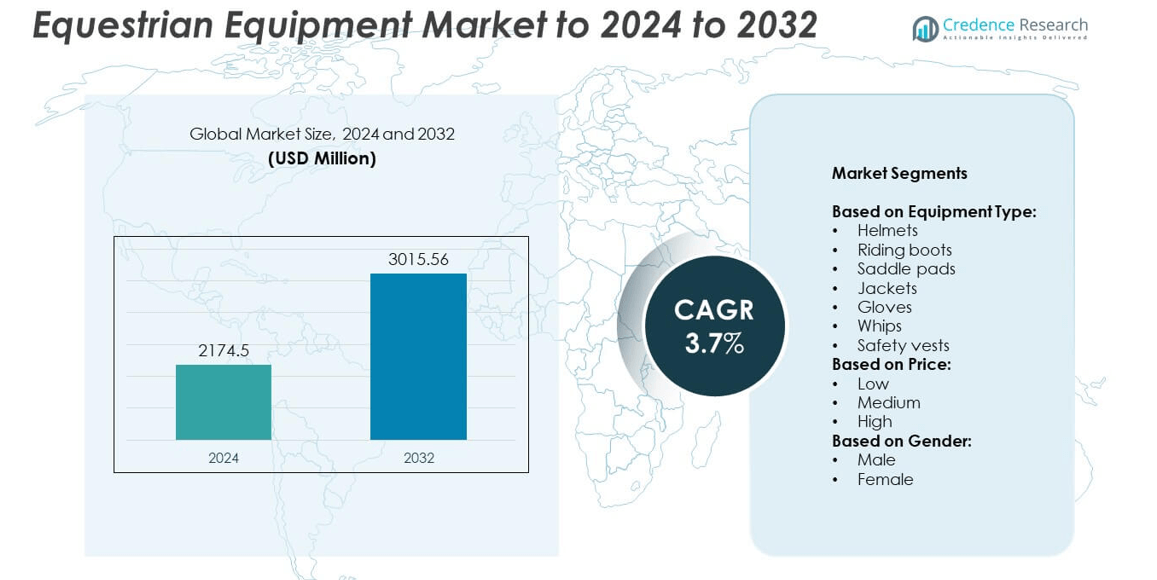

The Equestrian Equipment Market size was valued at USD 2174.5 million in 2024 and is anticipated to reach USD 3015.56 million by 2032, at a CAGR of 3.7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Equestrian Equipment Market Size 2024 |

USD 2174.5 million |

| Equestrian Equipment Market, CAGR |

3.7% |

| Equestrian Equipment Market Size 2032 |

USD 3015.56 million |

The equestrian equipment market is driven by prominent players including WeatherBeeta, Hermes, Ariat International, Samshield, Charles Owen, Kerrits Equestrian Apparel, and Horseware Ireland, each focusing on innovation, safety, and comfort to strengthen their global presence. These companies compete through premium product offerings, eco-friendly designs, and digital sales expansion to meet rising consumer expectations. Regionally, North America led the market in 2024 with a 38% share, supported by strong equestrian traditions, high participation rates, and established infrastructure. Europe followed with 30% share, benefiting from its heritage in equestrian sports and strict safety regulations, while Asia-Pacific accounted for 18%, emerging as the fastest-growing region due to rising recreational participation and increasing investments in equestrian facilities.

Market Insights

- The equestrian equipment market was valued at USD 2174.5 million in 2024 and is projected to reach USD 3015.56 million by 2032, growing at a CAGR of 3.7%.

- Rising focus on rider safety and growing recreational participation are driving strong demand for helmets, safety vests, and boots across professional and leisure riders.

- Sustainability, eco-friendly materials, and digital customization are shaping market trends, with consumers increasingly preferring durable and responsibly manufactured equipment.

- The market is highly competitive, with global and regional players investing in innovation, premium-quality offerings, and collaborations with equestrian clubs to expand customer reach.

- North America led the market with 38% share in 2024, followed by Europe at 30% and Asia-Pacific at 18%, while helmets dominated the equipment segment with over 30% share, highlighting strong adoption due to safety awareness.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Equipment Type

Helmets represented the dominant sub-segment in 2024, accounting for over 30% of the market share. Their leadership comes from rising safety regulations in equestrian sports and increased rider awareness about head protection. Riding boots and saddle pads followed closely due to comfort, performance, and durability demands in both professional and recreational activities. Jackets, gloves, whips, and safety vests contributed smaller shares but are witnessing steady adoption as riders seek protective and performance-enhancing gear. Advancements in lightweight, impact-resistant materials further support helmet demand, positioning them as a primary growth driver in this category.

- For instance, Back on Track’s EQ3 Pardus+ Screw Smooth helmet was rated 29% better than the average helmet in Folksam’s 2021 independent safety test, receiving a “Recommended” label.

By Price

The medium-price segment held the largest market share, exceeding 45% in 2024, as it offers an effective balance of affordability and quality. Riders across both professional and leisure categories are increasingly selecting mid-range equipment that delivers reliable safety and durability without premium pricing. High-priced equipment caters to elite riders, while low-priced products serve entry-level or casual users. The growth in the medium segment is supported by expanding equestrian clubs and events that encourage participants to adopt well-performing gear, while manufacturers focus on value-added designs within this pricing range.

- For instance, Decathlon operated 1,817 stores across 79 territories in 2024, widening access to mid-range equestrian gear.

By Gender

The female segment accounted for the dominant share of the market in 2024, representing nearly 55% of overall sales. This dominance is linked to the high participation of women in equestrian sports, recreational riding, and related events worldwide. Women-specific designs in helmets, boots, and apparel have seen increasing adoption, as brands target this expanding consumer base with stylish yet protective options. The male segment continues to contribute steadily, particularly in competitive disciplines. However, the strong presence of female riders and the rising number of female-focused equestrian clubs remain the key drivers for segment leadership.

Key Growth Drivers

Rising Focus on Rider Safety

The increasing emphasis on rider safety remains the primary growth driver in the equestrian equipment market. Regulatory standards in sports events and heightened consumer awareness are driving demand for helmets, safety vests, and protective gear. Brands are investing in advanced materials like carbon fiber and shock-absorbing foams to enhance rider protection. This focus not only safeguards riders but also expands market opportunities for premium safety equipment. Growing participation in equestrian events worldwide further accelerates adoption of high-standard safety products, reinforcing this as the most influential growth factor.

- For instance, Helite air vests inflate in under 100 milliseconds using a mechanical trigger system.

Increasing Participation in Recreational Riding

Recreational riding activities are expanding globally, driving consistent demand for equestrian equipment. Rising disposable incomes and lifestyle changes encourage more individuals to invest in riding gear for leisure and hobby purposes. Growth of equestrian clubs, schools, and leisure centers supports broader access to structured training and facilities. Equipment like riding boots, gloves, and saddle pads benefit significantly from this surge in participation. This trend strengthens recurring demand, as recreational riders frequently replace or upgrade gear for improved comfort and style, ensuring steady growth across product categories.

- For instance, The Dover Saddlery Store Locator lists a total of 39 stores in the U.S., A new flagship store at the World Equestrian Center in Ocala, FL, was also announced to open in 2026, further expanding their retail footprint.

Product Innovation and Material Advancements

Ongoing innovation in design and material science is significantly boosting the appeal of equestrian equipment. Manufacturers are introducing lightweight, durable, and eco-friendly materials to enhance rider comfort and safety. Examples include breathable fabrics for jackets and gloves, along with impact-resistant composites in helmets. Smart technologies, such as sensors integrated into safety vests, are gaining visibility. These innovations not only attract professional athletes but also appeal to recreational users seeking better performance. The focus on product differentiation ensures brand competitiveness and strengthens consumer loyalty in a highly fragmented market.

Key Trends & Opportunities

Sustainability and Eco-Friendly Products

Sustainability is emerging as a major trend, with eco-friendly materials and ethical sourcing shaping purchasing decisions. Brands are developing biodegradable saddle pads, recycled fabrics for jackets, and low-impact tanning for boots. Growing consumer preference for responsible products is opening new opportunities, particularly among younger demographics focused on environmental responsibility. Companies that embrace sustainable production methods are better positioned to capture long-term customer loyalty and meet evolving regulatory standards. This trend is expected to redefine product development strategies across the equestrian equipment market.

- For instance, LeMieux reported saving over 90,000 litres of water in 2024 versus 2023 through site efficiency upgrades.

Digitalization and Customization Opportunities

The integration of digital solutions and customization options presents strong opportunities for market growth. E-commerce platforms are expanding access to a broader range of equestrian gear, while offering customization for helmets, boots, and jackets to match rider preferences. Advanced sizing technologies and digital fitting tools enhance customer experience, improving product adoption rates. This personalization trend appeals to both professional and leisure riders who value performance and aesthetics. The shift toward online channels also allows manufacturers to expand global reach and strengthen direct consumer engagement.

- For instance, One K’s Defender CCS MIPS helmet supports user-swappable color panels and features 5 vent zones for fit and airflow.

Key Challenges

High Equipment Costs

The relatively high cost of quality equestrian equipment remains a significant challenge for broader adoption. Premium helmets, boots, and safety vests often fall beyond the budgets of casual riders or beginners. This cost barrier limits accessibility, particularly in emerging markets where equestrian sports are still developing. While mid-priced options support market growth, maintaining affordability without compromising safety and durability is a challenge for manufacturers. Companies must balance innovation with cost efficiency to avoid alienating potential customer segments.

Limited Awareness in Emerging Regions

Another key challenge is limited awareness and exposure to equestrian sports in emerging regions. While North America and Europe dominate participation and sales, markets in Asia-Pacific, Latin America, and Africa remain underpenetrated. Lack of equestrian infrastructure, training facilities, and organized events restricts the adoption of essential equipment. Without targeted awareness programs or regional investments, growth opportunities in these areas remain untapped. Addressing this challenge requires collaborations between manufacturers, local associations, and governments to foster interest and participation in equestrian activities.

Regional Analysis

North America

North America held the largest share of the equestrian equipment market in 2024, accounting for 38%. The region’s dominance stems from strong equestrian traditions, widespread participation in sports, and well-developed infrastructure. High disposable incomes and strict safety regulations further support demand for premium helmets, boots, and safety vests. The presence of established brands and active equestrian clubs strengthens growth, while rising recreational riding activities continue to expand market opportunities. The U.S. remains the largest contributor, supported by frequent competitions and training facilities, ensuring steady sales of both performance-driven and leisure-focused equestrian products across the region.

Europe

Europe accounted for 30% of the equestrian equipment market in 2024, positioning it as the second-largest region. The region benefits from a rich equestrian heritage, with countries like Germany, the UK, and France leading in professional and recreational participation. Strong regulatory frameworks for safety standards drive consistent adoption of helmets and protective vests. The demand for premium, customized gear is also notable, reflecting a strong culture of professionalism in equestrian sports. Sustainability and eco-friendly product development are gaining traction among European manufacturers, further shaping the competitive landscape and reinforcing long-term market growth across the region.

Asia-Pacific

Asia-Pacific captured 18% of the equestrian equipment market in 2024, reflecting growing interest in equestrian sports. Rising disposable incomes and increasing exposure to international competitions in China, Japan, and Australia are fueling demand for modern equipment. Governments and private organizations are investing in equestrian training centers, which support broader participation. The expanding youth population engaged in riding activities also strengthens growth. However, awareness remains lower compared to developed regions, limiting market penetration. With increasing recreational and competitive events, the region is expected to emerge as one of the fastest-growing markets, supported by growing lifestyle-driven demand.

Latin America

Latin America represented 8% of the equestrian equipment market in 2024, supported mainly by Brazil, Argentina, and Mexico. Traditional equestrian culture, combined with rising sports events, drives steady growth. The demand for affordable helmets, boots, and gloves is higher in this region, as consumer purchasing power remains limited compared to developed markets. Growing equestrian clubs and increasing involvement of youth participants are encouraging market expansion. However, limited infrastructure and inconsistent regulatory standards for safety remain constraints. Manufacturers focusing on cost-effective solutions and expanding distribution networks are likely to strengthen their presence across this region over the forecast period.

Middle East & Africa

The Middle East & Africa accounted for 6% of the equestrian equipment market in 2024, with the Middle East showing stronger adoption due to cultural significance of horse riding. Countries such as the UAE and Saudi Arabia invest heavily in equestrian facilities and international competitions, boosting demand for premium equipment. In Africa, the market remains underdeveloped due to limited awareness and infrastructure, though South Africa leads in participation. While overall share remains small, the region holds potential for growth as interest in equestrian sports rises, particularly with government-backed initiatives and increased investments in training and riding schools.

Market Segmentations:

By Equipment Type:

- Helmets

- Riding boots

- Saddle pads

- Jackets

- Gloves

- Whips

- Safety vests

By Price:

By Gender:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the equestrian equipment market is shaped by leading players such as WeatherBeeta, Kerrits Equestrian Apparel, Hermes, Troxel Helmets, Equine Couture, Horseware Ireland, Ariat International, Samshield, Weaver Leather, Dublin Clothing, Horse Health, HKM Sports Equipment GmbH, Charles Owen, Premier Equestrian, Devoucoux, and Cavallo GmbH. These companies compete through product innovation, premium quality, and strong distribution networks. The market is highly fragmented, with brands focusing on safety, comfort, and sustainability to attract both professional and recreational riders. Manufacturers are investing in advanced materials, eco-friendly production, and digital sales platforms to strengthen their presence. Strategic collaborations with equestrian clubs and events enhance brand visibility, while expanding product lines tailored to specific demographics, such as women and youth riders, further support competitiveness. Growing demand for mid-priced and customizable equipment also drives companies to adopt value-based approaches, ensuring broader consumer reach in established as well as emerging regions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- WeatherBeeta

- Kerrits Equestrian Apparel

- Hermes

- Troxel Helmets

- Equine Couture

- Horseware Ireland

- Ariat International

- Samshield

- Weaver Leather

- Dublin Clothing

- Horse Health

- HKM Sports Equipment GmbH

- Charles Owen

- Premier Equestrian

- Devoucoux

- Cavallo GmbH

Recent Developments

- In 2024, Samshield Introduced a new line of Helmets 2.0, the culmination of four years of research, offering exceptional comfort and top-tier safety in horse riding helmets.

- In 2024, Horse Pilot (E-Twist’Air) Developed and launched the E-Twist’Air Airbag, the first cable-free, self-contained airbag in the equestrian world, designed to inflate in 30 milliseconds to cover different types of falls, while prioritizing comfort and freedom of movement, and allowing for quick inflator changes.

- In 2024, Ariat International, Inc. collaborated with World Champion cowboy Trevor Brazile to launch the limited-edition Relentless Futurity collection.

Report Coverage

The research report offers an in-depth analysis based on Equipment Type, Price, Gender and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will see steady growth driven by rising participation in equestrian sports.

- Safety-focused equipment like helmets and vests will remain the primary demand driver.

- Medium-priced products will continue to dominate due to balanced affordability and quality.

- Female riders will lead demand, supported by growing women-centric equestrian clubs.

- Sustainability and eco-friendly materials will gain stronger adoption in product design.

- Digital sales channels and customization will reshape consumer purchasing preferences.

- Emerging regions will witness gradual adoption with rising awareness and investments.

- Premium equipment demand will grow in professional and competitive equestrian activities.

- Technological innovations will enhance comfort, durability, and rider safety.

- Global brands will expand reach through collaborations with local distributors and clubs.