Market Overview:

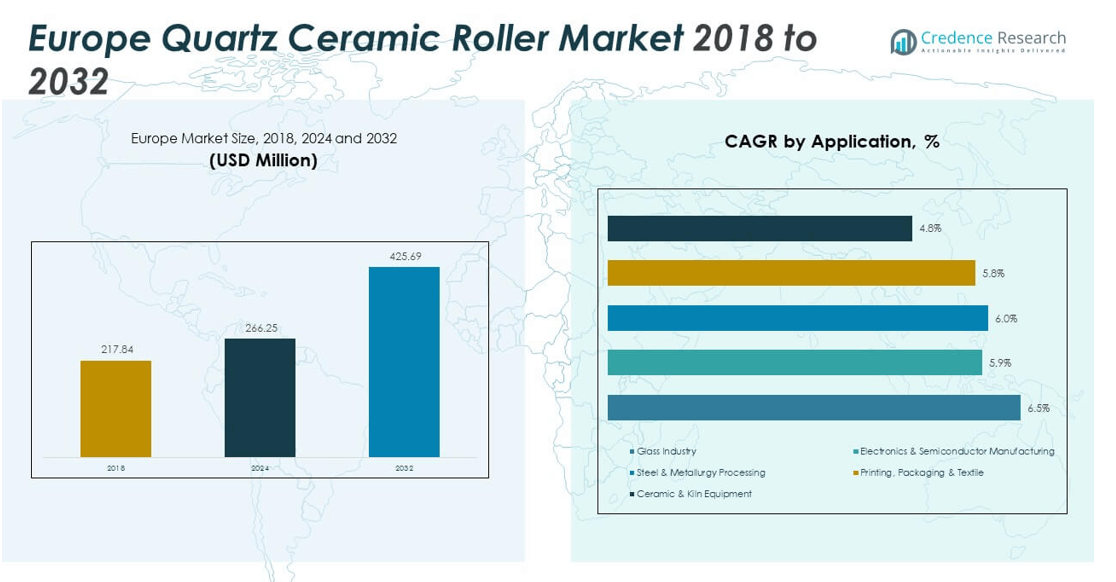

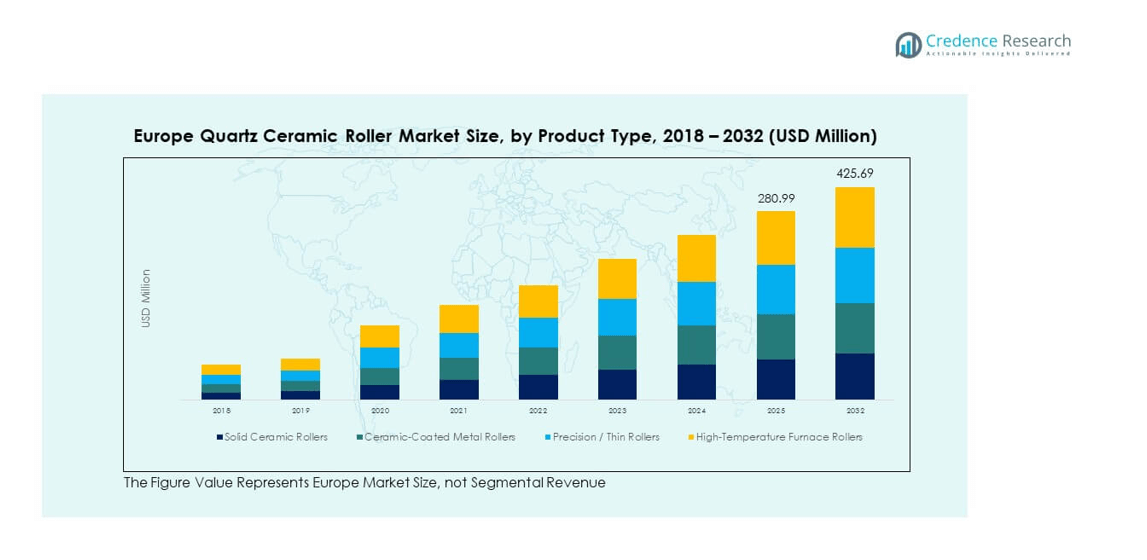

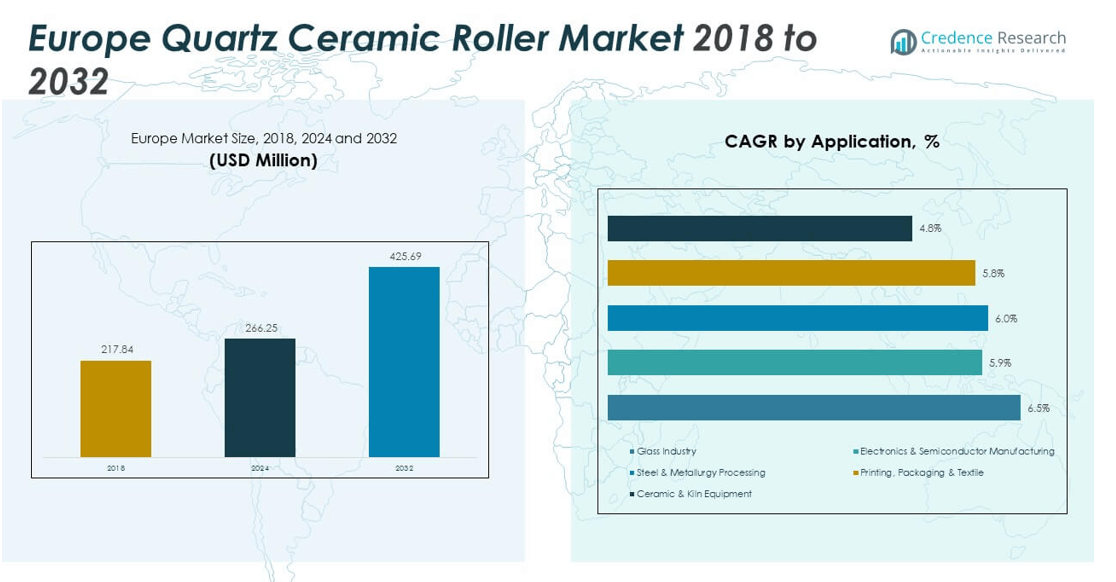

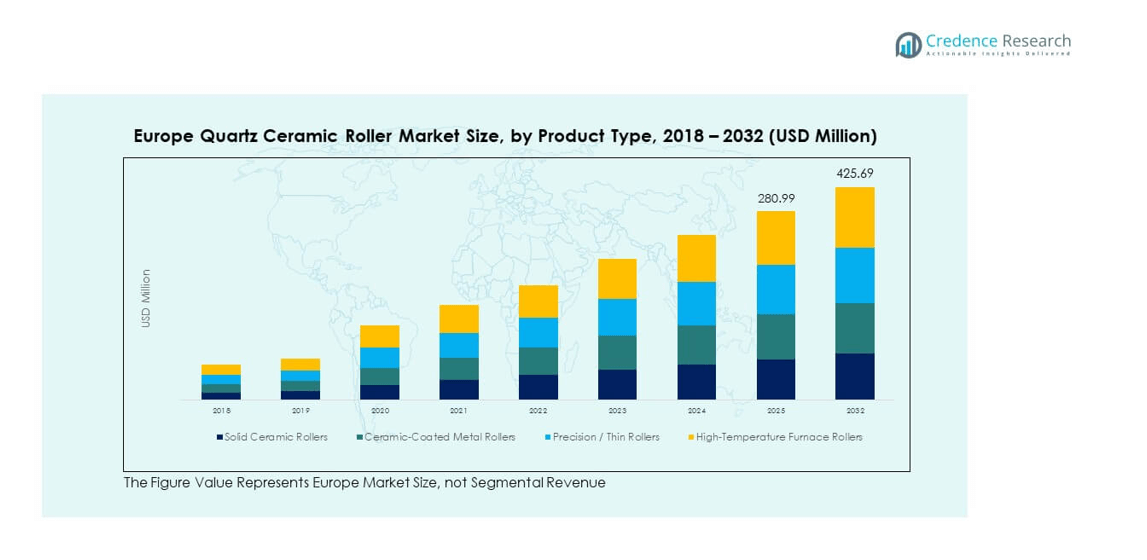

The Europe Quartz Ceramic Roller Market size was valued at USD 217.84 million in 2018, increased to USD 266.25 million in 2024, and is anticipated to reach USD 425.69 million by 2032, growing at a CAGR of 6.01% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Europe Quartz Ceramic Roller Market Size 2024 |

USD 266.25 million |

| Europe Quartz Ceramic Roller Market, CAGR |

6.01% |

| Europe Quartz Ceramic Roller Market Size 2032 |

USD 425.69 million |

The market is driven by rising demand for high-temperature and chemical-resistant materials in glass and metal processing industries. Quartz ceramic rollers are widely used for their superior thermal stability, low thermal expansion, and resistance to deformation. Growing investments in energy-efficient production technologies and an increasing shift toward precision manufacturing in the industrial sector are further supporting market growth across Europe.

Geographically, Western Europe leads the market due to the strong presence of glass manufacturing and metallurgical industries in Germany, France, and the UK. Central and Eastern Europe are emerging markets, driven by industrial modernization and expansion in automotive and electronics production. Favorable government policies promoting advanced material research and growing adoption of automation in industrial processes strengthen the regional market outlook.

Market Insights:

- The Europe Quartz Ceramic Roller Market was valued at USD 217.84 million in 2018, increased to USD 266.25 million in 2024, and is projected to reach USD 425.69 million by 2032, growing at a CAGR of 6.01% during the forecast period.

- Western Europe led the market with a 42% share in 2024, driven by strong industrial infrastructure in Germany, France, and the UK. Southern Europe followed with 27%, supported by manufacturing expansion in Italy and Spain, while Central & Eastern Europe held 21%, benefiting from cost-efficient production and foreign investments.

- Central & Eastern Europe is the fastest-growing region, accounting for 21% of total revenue, driven by rapid industrial modernization, growing glass and steel production, and supportive government investment policies.

- By product type, Solid Ceramic Rollers dominated the market in 2024 with a 38% share, supported by their superior thermal resistance and durability in continuous furnace operations.

- High-Temperature Furnace Rollers accounted for 26% of the total share, gaining traction due to rising demand in glass, metallurgy, and solar glass production lines across Europe.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Demand for High-Temperature Industrial Applications

The Europe Quartz Ceramic Roller Market is expanding due to its increasing use in high-temperature operations across glass, steel, and metallurgy industries. These rollers offer exceptional resistance to heat deformation and corrosion, improving product quality and reducing operational downtime. Their superior thermal shock resistance supports efficiency in continuous manufacturing lines. The market benefits from industrial modernization projects and automation across production facilities. Manufacturers prefer quartz ceramic rollers for their durability and stability under extreme heat conditions. Growing energy efficiency mandates across Europe further strengthen adoption. Technological improvements in material design enhance their performance across industrial applications.

- For instance, CeramTec GmbH’s Cyrol silicon nitride bearing rollers are engineered to withstand maximum usable temperatures up to 1200°C and display thermal shock resistance values of 650 K, with density reduced by approximately 40% compared to conventional steel bearings.

Increasing Shift Toward Sustainable and Energy-Efficient Manufacturing

Industries in Europe are emphasizing sustainable production systems that reduce emissions and energy waste. Quartz ceramic rollers align well with this shift due to their long life cycle and minimal maintenance needs. The product reduces waste and energy consumption during heating processes. Glass and metal manufacturers are investing in advanced furnace technologies that rely on these rollers for stable performance. Rising government focus on green manufacturing strengthens adoption across sectors. It benefits from strict EU environmental standards encouraging energy-efficient materials. The growing importance of sustainability drives manufacturers to integrate advanced materials for responsible production.

- For instance, Saint-Gobain’s Advanced Ceramic Composites division produces high-purity Quartzel quartz fibers with greater than 99.95% silica content, offering long-term stability and excellent dielectric properties up to 1200°C in both industrial and solar glass applications.

Strong Expansion in the European Glass Manufacturing Sector

Rapid growth in flat glass and solar glass manufacturing supports market expansion. The demand for precision-engineered rollers has grown with technological upgrades in float and tempered glass production. The material’s ability to maintain dimensional stability at high temperatures ensures consistent quality output. Leading manufacturers invest in automation and robotics, increasing reliance on durable rollers. The Europe Quartz Ceramic Roller Market gains momentum from the architectural and automotive glass sectors. Government-backed solar initiatives increase production of low-iron solar glass, further boosting demand. Continuous plant expansions across Germany, France, and Italy reinforce the market’s growth outlook.

Adoption of Advanced Industrial Automation and Process Control Technologies

The increasing integration of digital manufacturing systems enhances the use of quartz ceramic rollers. Automated furnaces require materials that perform reliably under continuous operation cycles. Quartz ceramic rollers deliver superior stability and precise movement, supporting advanced process control. Manufacturers adopt smart monitoring systems that extend roller lifespan and improve quality consistency. Rising adoption of Industry 4.0 technologies accelerates modernization of glass and metal plants. It enables higher throughput and reduced maintenance downtime. Europe’s strong industrial base continues to favor investment in advanced material handling systems.

Market Trends:

Technological Advancements in Material Composition and Production Techniques

Manufacturers are developing new quartz ceramic formulations with improved heat and wear resistance. These innovations increase performance consistency across longer production cycles. The introduction of precision-controlled sintering processes enhances material density and surface finish. The Europe Quartz Ceramic Roller Market benefits from innovations improving operational reliability. Companies are also exploring hybrid roller composites combining quartz with alumina for better thermal balance. New coating technologies extend the service life of rollers in harsh furnace environments. Continuous material improvements help industries achieve better energy efficiency and reduced maintenance frequency.

- For instance, CeramTec GmbH’s precision manufacturing and sintering processes ensure roller elements have consistent wall thickness uniformity and high material density, with technical data confirming reliability at operating temperatures up to 1200°C and verified dimensional control via laser measurement systems.

Growing Adoption in the Renewable Energy and Solar Glass Sector

Europe’s renewable energy expansion has increased the demand for solar glass manufacturing. Quartz ceramic rollers are critical in producing thin, low-defect solar glass sheets. Their stability and surface precision ensure defect-free results under high thermal loads. The solar manufacturing boom in countries like Germany and Spain drives product utilization. The Europe Quartz Ceramic Roller Market benefits from investments in photovoltaic infrastructure. Manufacturers develop specialized roller grades suited for high-clarity solar glass production. Growing solar deployment in the region enhances the market’s long-term growth potential.

- For instance, Saint-Gobain’s Quartzel quartz fiber technology delivers ultra-high purity (above 99.95% silica) and is used in industrial equipment for high-tech manufacturing, such as the crucibles and insulation necessary for creating defect-free silicon wafers used in solar cells. This allows for reliable performance under the extreme thermal loads required for producing precision sheets and other components.

Rising Focus on Automation, Predictive Maintenance, and Process Efficiency

Automation and smart maintenance systems are transforming industrial manufacturing processes. Integration of predictive monitoring enables real-time assessment of roller wear. The data-driven approach minimizes production interruptions and increases operational life. It supports industries aiming for zero-defect manufacturing environments. The Europe Quartz Ceramic Roller Market aligns with this trend through digitalized production support. Companies are investing in AI-enabled condition monitoring for process optimization. Automated inspection systems also ensure quality consistency in high-volume production plants.

Strategic Partnerships and Vertical Integration Among Manufacturers

Manufacturers are entering partnerships to secure stable raw material supplies and improve R&D capacity. Vertical integration allows better control over production cost and quality standards. The Europe Quartz Ceramic Roller Market sees collaboration between roller producers and equipment suppliers. Such partnerships enable customized solutions that meet specific temperature and load requirements. Companies also focus on localization of production to reduce lead times. The trend supports regional supply chain stability and resilience. Growing alliances with energy-efficient equipment firms further enhance technological development.

Market Challenges Analysis:

High Manufacturing Costs and Complex Production Processes

Producing quartz ceramic rollers requires advanced equipment and precise temperature control. The high cost of raw materials such as fused silica and alumina adds financial pressure. Manufacturers face challenges maintaining cost efficiency while ensuring material quality. The Europe Quartz Ceramic Roller Market is affected by limited global suppliers and energy-intensive fabrication. Complex machining and finishing processes extend production timelines. The high initial investment for production infrastructure limits entry for smaller firms. It creates dependency on a few established manufacturers. Rising electricity costs across Europe further increase operational expenses for producers.

Supply Chain Disruptions and Limited Availability of Technical Expertise

The market faces issues related to raw material availability and skilled workforce shortages. Global supply chain instability disrupts sourcing of key raw materials. The precision required in roller production demands specialized technical knowledge. A shortage of skilled engineers and technicians restricts production scalability. The Europe Quartz Ceramic Roller Market experiences delays in product delivery during logistic constraints. Import dependencies for high-purity quartz increase vulnerability to global trade fluctuations. Companies must invest in workforce training and supply diversification to sustain growth. Government initiatives supporting industrial skills development can help mitigate these challenges.

Market Opportunities:

Rising Adoption in Emerging Industrial Sectors and Energy Applications

Expanding use of quartz ceramic rollers in energy, electronics, and chemical industries presents new avenues. Their precision and heat endurance make them suitable for advanced production systems. The Europe Quartz Ceramic Roller Market is positioned to benefit from the growing semiconductor and battery sectors. Increased focus on electric vehicle components manufacturing enhances material demand. Advancements in clean energy and energy storage technology create broader utilization scope. It offers suppliers a chance to diversify beyond glass and metal applications. The growing push toward regional industrial integration strengthens these opportunities.

Investment in Technological Upgradation and Local Manufacturing Capacity

European manufacturers are investing in localized production facilities to reduce dependence on imports. Government-backed programs promoting industrial innovation support domestic production capacity. The use of automation and AI in roller manufacturing boosts product consistency. The Europe Quartz Ceramic Roller Market benefits from public-private collaboration on advanced ceramics research. Companies focusing on cost optimization through process innovation gain competitive advantage. Expansion into Eastern Europe provides access to lower-cost production zones. These developments create favorable conditions for market expansion and technological leadership.

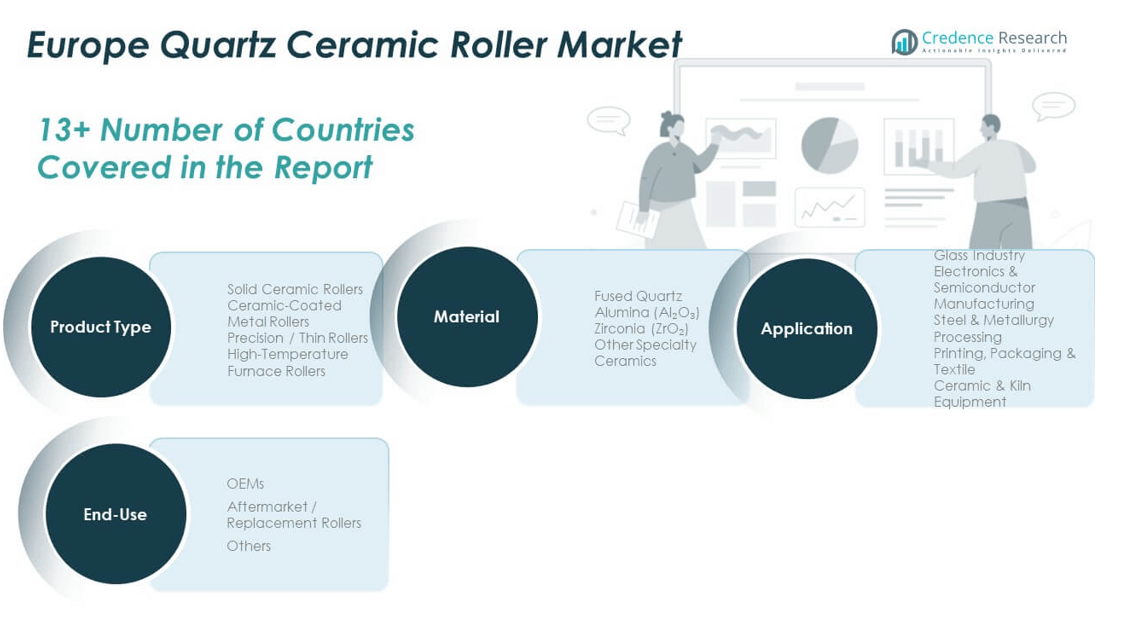

Market Segmentation Analysis:

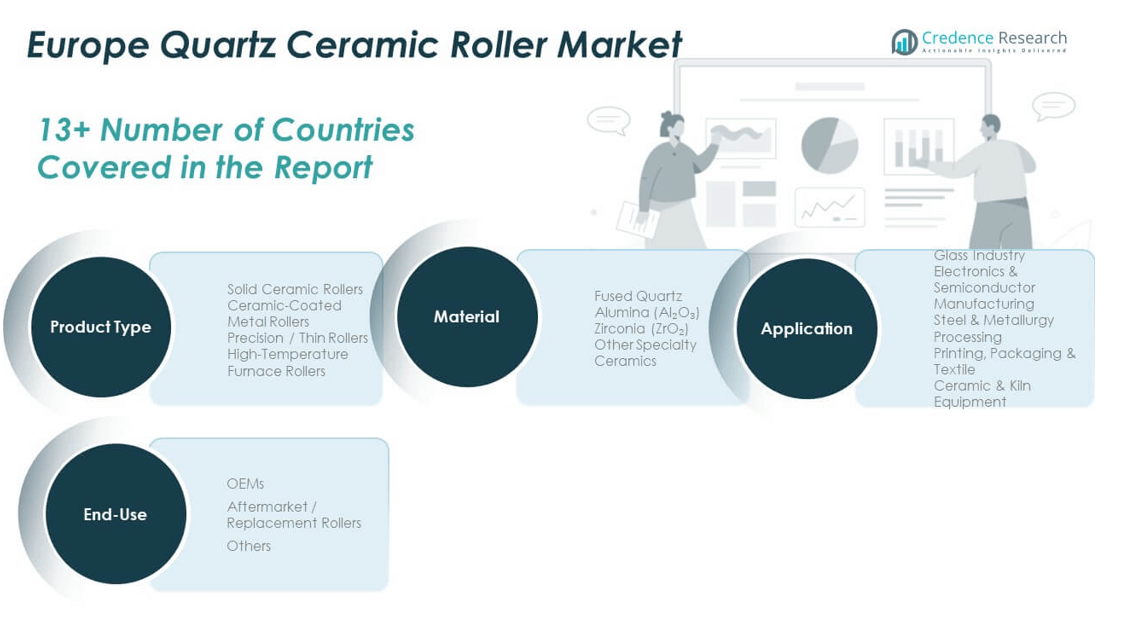

By Product Type

The Europe Quartz Ceramic Roller Market is segmented into Solid Ceramic Rollers, Ceramic-Coated Metal Rollers, Precision/Thin Rollers, and High-Temperature Furnace Rollers. Solid ceramic rollers hold a dominant share due to their superior thermal resistance and long operational life in high-temperature furnaces. Ceramic-coated metal rollers provide strength and stability for medium-load industrial applications. Precision or thin rollers are gaining traction in semiconductor and electronic production lines for their fine tolerance and smooth surface. High-temperature furnace rollers serve glass and steel industries requiring consistent thermal performance.

- For instance, CeramTec’s Cyrol solid ceramic rollers are manufactured according to ASTM F2730/F2730M standards for rolling bearings, achieving high wear resistance and service life in demanding heat-intensive operations such as steel, chemicals, and glass manufacturing.

By Application

Key applications include Glass Industry, Electronics & Semiconductor Manufacturing, Steel & Metallurgy Processing, Printing, Packaging & Textile, and Ceramic & Kiln Equipment. The glass industry leads usage owing to large-scale deployment in float and solar glass manufacturing. Electronics and semiconductor segments are expanding due to rising demand for heat-resistant and dimensionally stable rollers. Steel and metallurgy applications rely on quartz ceramics for efficient high-temperature handling.

- For instance, CeramTec GmbH’s advanced technical ceramics demonstrate mechanical strength and thermal resistance, supporting continual operation up to 1200°C in glass, electronics, and steel manufacturing environments, as validated in continuous industrial use.

By End-Use

The market is divided into OEMs, Aftermarket/Replacement Rollers, and Others. OEMs dominate demand due to ongoing industrial automation and process integration. The aftermarket segment shows steady growth supported by frequent replacement needs in continuous furnace operations.

By Material

Material types include Fused Quartz, Alumina (Al₂O₃), Zirconia (ZrO₂), and Other Specialty Ceramics. Fused quartz remains preferred for high-purity and heat-stable applications. Alumina provides strength and wear resistance, while zirconia offers superior durability under thermal shock. Specialty ceramics cater to customized, high-performance industrial environments.

Segmentation:

By Product Type

- Solid Ceramic Rollers

- Ceramic-Coated Metal Rollers

- Precision / Thin Rollers

- High-Temperature Furnace Rollers

By Application

- Glass Industry

- Electronics & Semiconductor Manufacturing

- Steel & Metallurgy Processing

- Printing, Packaging & Textile

- Ceramic & Kiln Equipment

By End-Use

- OEMs

- Aftermarket / Replacement Rollers

- Others

By Material

- Fused Quartz

- Alumina (Al₂O₃)

- Zirconia (ZrO₂)

- Other Specialty Ceramics

By Country

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Rest of Europe

Regional Analysis:

Western Europe – Established Industrial Powerhouse

Western Europe dominates the Europe Quartz Ceramic Roller Market with a 42% market share in 2024. Germany, France, and the UK are leading contributors due to their advanced manufacturing and glass production sectors. Germany’s strong base in float glass and metallurgical industries drives consistent demand for high-performance ceramic rollers. France emphasizes sustainable material innovation, aligning with EU environmental standards that promote energy-efficient components. The UK supports growth through investments in modern glass processing and high-tech manufacturing facilities. It benefits from developed infrastructure, technological expertise, and strong partnerships between manufacturers and research institutions. This region remains the primary innovation hub, influencing market trends across the continent.

Southern Europe – Expanding Manufacturing and Energy Infrastructure

Southern Europe holds a 27% market share, driven by Italy and Spain’s expanding industrial infrastructure. Italy leads regional production with a focus on precision ceramics used in automotive and architectural glass manufacturing. Spain’s growing solar energy sector fuels demand for rollers used in solar glass production lines. It experiences rising adoption across ceramics, textile, and steel applications due to local manufacturing recovery and automation investments. Southern Europe benefits from favorable policies supporting industrial modernization and renewable energy initiatives. The presence of small and mid-sized manufacturers strengthens domestic supply capabilities and export potential. Continued investment in R&D supports competitive pricing and product advancement in this region.

Central & Eastern Europe – Emerging Growth Frontier

Central and Eastern Europe account for a 21% market share, representing the fastest-growing region with expanding industrial capacity. Poland, Czech Republic, and Hungary are witnessing increasing demand for high-temperature rollers used in steel, glass, and semiconductor processing. It benefits from low production costs, rising foreign investments, and proximity to Western European manufacturing hubs. Governments in these countries support advanced material industries through innovation grants and export-oriented policies. The region’s modernization of industrial plants and integration into EU supply chains drive growth momentum. Strong partnerships between regional producers and multinational companies enhance technological capability and market accessibility. This growth trajectory positions Central and Eastern Europe as a key contributor to the market’s long-term expansion.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- CeramTec GmbH

- Saint-Gobain S.A.

- Morgan Advanced Materials plc

- Imerys

- CoorsTek, Inc.

- Corning Incorporated

- 3M Company

- Kyocera Corporation

- Momentive Performance Materials

- Schunk Group

- Treibacher Industrie AG

- IBIDEN Co., Ltd.

- Heraeus Holding GmbH

- Schott AG

- Tosoh Corporation

Competitive Analysis:

The Europe Quartz Ceramic Roller Market is highly competitive, with major players focusing on innovation, material performance, and process optimization. Companies such as Saint-Gobain S.A., CeramTec GmbH, Morgan Advanced Materials plc, and CoorsTek dominate through strong R&D capabilities and diversified product portfolios. It is characterized by continuous product upgrades, energy-efficient designs, and customized solutions for industrial clients. Global and regional manufacturers compete on quality, durability, and temperature tolerance to meet the evolving needs of glass and steel industries. Strategic partnerships, acquisitions, and automation investments strengthen competitive positioning and operational efficiency across the region.

Recent Developments:

- In August 2025, Morgan Advanced Materials plc welcomed a new CEO and engaged in ongoing research on methane storage technology, but no Google-verified news for a quartz ceramic roller partnership, product launch, or acquisition in Europe has recently surfaced.

- In July 2025, Saint-Gobain S.A. reinforced its construction chemicals platform through three bolt-on acquisitions in North America, Italy, and Peru, expanding its presence in these regions and strengthening its portfolio for industrial and commercial markets.

- In 2025, CeramTec GmbH continued to participate in several high-profile European trade fairs and events, showcasing its ceramic solutions for industrial and medical applications; however, no verified partnership or product launch specific to quartz ceramic rollers has been confirmed via Google-indexed sources as of October 2025.

Report Coverage:

The research report offers an in-depth analysis based on product type, application, end-use, and material. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Increasing automation in glass and metallurgy manufacturing will boost demand for high-performance rollers.

- Development of advanced heat-resistant ceramics will enhance production efficiency and lifespan.

- Sustainable manufacturing practices will gain importance due to EU environmental mandates.

- Expansion in solar and electronic glass production will create new growth opportunities.

- Rising replacement demand from continuous industrial operations will sustain aftermarket revenues.

- Integration of smart monitoring and predictive maintenance will drive process optimization.

- Growing localization of production will reduce dependence on imported materials.

- Strategic mergers and partnerships among European manufacturers will strengthen market stability.

- Continued R&D investment will support the creation of lighter and more durable roller designs.

- Emerging Eastern European economies will act as new manufacturing and export hubs.