Market Overview

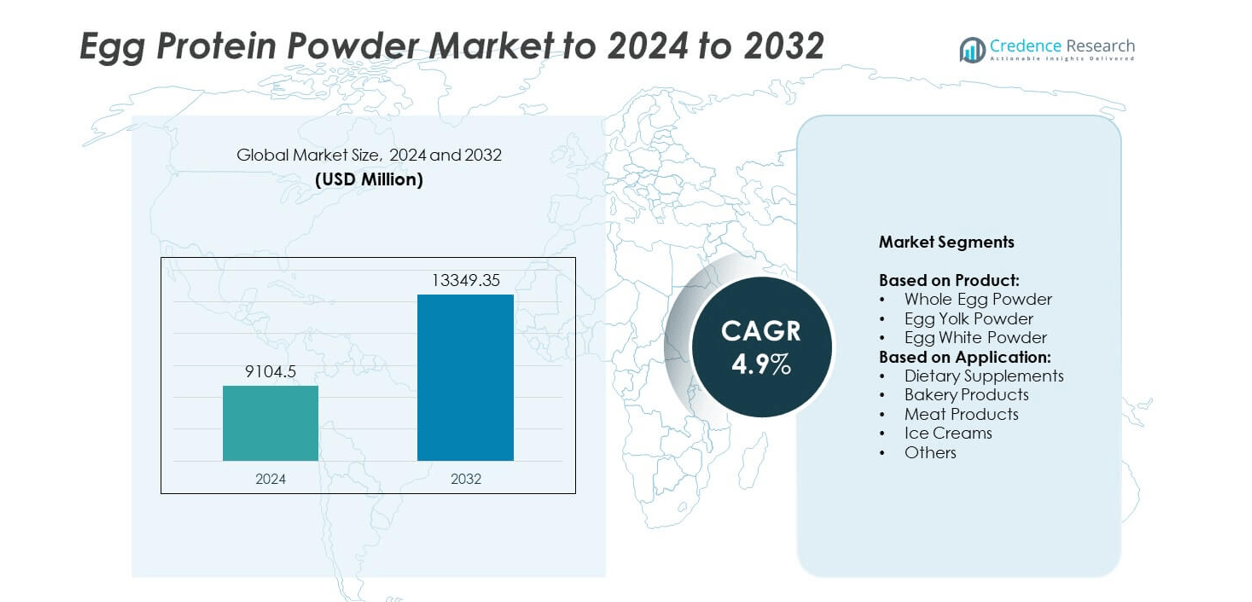

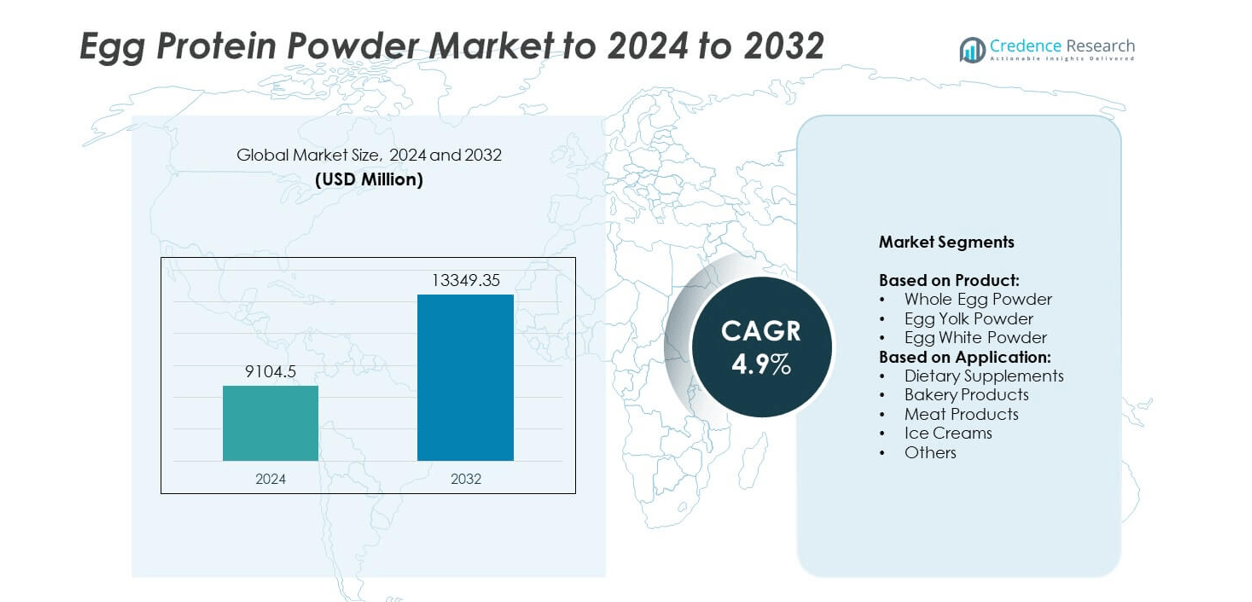

The global egg protein powder market size was valued at USD 9,104.5 million in 2024 and is anticipated to reach USD 13,349.35 million by 2032, growing at a CAGR of 4.9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Egg Protein Powder Market Size 2024 |

USD 9,104.5 million |

| Egg Protein Powder Market, CAGR |

4.9% |

| Egg Protein Powder Market Size 2032 |

USD 13,349.35 million |

The egg protein powder market is led by key players such as Rose Acre Farms, Bouwhuis Enthoven, NOW Foods, Sanovo Technology Group, Julian Bakery, EUROVO S.R.L, Rembrandt Foods, and GF Ovodry S.P.A. These companies dominate through advanced processing technologies, clean-label formulations, and wide product portfolios catering to dietary supplements, functional foods, and sports nutrition. Strategic partnerships and sustainable sourcing practices strengthen their global presence. North America emerged as the leading region in 2024, capturing about 36% of the global market share, driven by strong demand for high-protein nutrition, advanced food processing capabilities, and expanding fitness-oriented consumer segments.

Market Insights

- The egg protein powder market was valued at USD 9,104.5 million in 2024 and is projected to reach USD 13,349.35 million by 2032, growing at a CAGR of 4.9%.

- Rising consumer focus on high-protein diets and clean-label nutrition drives market expansion across dietary supplements and functional food sectors.

- Increasing demand for natural, allergen-free protein sources and product innovation in ready-to-mix formulations highlight key market trends.

- The market is highly competitive, with major players investing in sustainable sourcing, advanced drying technologies, and product diversification to strengthen global reach.

- North America led the market with a 36% share in 2024, followed by Europe at 28%, while the egg white powder segment held the largest 48% share due to its superior nutritional and functional benefits.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product

The egg white powder segment dominated the market in 2024, accounting for around 48% of the global share. Its leadership is driven by high protein concentration, low fat content, and wide use in sports nutrition and dietary formulations. Egg white powder offers superior foaming and gelling properties, making it a preferred ingredient in bakery and confectionery applications. Whole egg powder followed as a versatile substitute for fresh eggs in industrial baking, while egg yolk powder gained traction in emulsified products and cosmetics due to its rich lipid and nutrient content.

- For instance, Bouwhuis Enthoven’s Egg Protein Isolate 90 guarantees 93% protein content.

By Application

The dietary supplements segment held the largest share of about 40% in 2024, driven by increasing health awareness and demand for clean-label, animal-based proteins. Athletes and fitness enthusiasts prefer egg protein for its high digestibility and amino acid profile, boosting its inclusion in protein powders and meal replacements. Bakery products also represent a major application, supported by rising use in cakes, pastries, and ready-to-eat snacks. Meanwhile, meat products and ice creams are increasingly adopting egg powders for improved texture, flavor, and shelf-life stability.

- For instance, NOW Foods’ Creamy Vanillaegg white protein provides 20 g of protein per serving (one level scoop or 28 g)

Key Growth Drivers

Rising Demand for High-Protein Nutrition

The growing awareness of protein-rich diets is a major growth driver in the egg protein powder market. Consumers are increasingly adopting protein supplements to support muscle development, weight management, and overall wellness. Egg protein powder’s complete amino acid profile and high bioavailability make it a preferred source among athletes and health-conscious individuals. The trend toward clean-label and natural products further supports this shift, as egg protein offers a non-synthetic alternative to whey and plant proteins, strengthening its market presence globally.

- For instance, Ovostar Union produced 571 tons of dry egg products in Q1 2024

Expanding Application in Functional Foods and Beverages

The inclusion of egg protein powder in functional foods and beverages is rapidly increasing. Manufacturers use it to enhance nutritional value and texture in bakery items, meal replacements, and dairy alternatives. Its emulsifying and foaming properties improve product stability and sensory appeal. The growing functional food market, especially in North America and Europe, supports strong demand. Food processors are leveraging egg protein as a natural ingredient that meets consumer expectations for health, convenience, and high nutritional content.

- For instance, Sanovo’s integrated factory processes up to 226,800 eggs per hour.

Rising Use in Sports Nutrition and Dietary Supplements

The expanding fitness and sports nutrition sector acts as another key growth driver. Egg protein powder is widely used in protein bars, shakes, and recovery formulas. Its superior digestibility and balanced amino acid content make it ideal for post-workout recovery and muscle synthesis. Increasing participation in gym and endurance activities, coupled with growing disposable incomes in emerging economies, boosts supplement demand. Manufacturers are innovating product formats and flavors to cater to active consumers seeking efficient, clean protein sources.

Key Trends & Opportunities

Shift Toward Clean-Label and Natural Protein Sources

A major trend shaping the market is the global move toward clean-label nutrition. Consumers now prefer products with minimal processing, transparent sourcing, and no artificial additives. Egg protein powder aligns with this demand as a natural, high-quality ingredient. Producers are emphasizing sustainable poultry farming and traceable sourcing to meet these expectations. This trend creates opportunities for brands to differentiate through purity certifications and eco-friendly packaging, enhancing their appeal in both mature and emerging health-conscious markets.

- For instance, Kewpie’s PL-30S lists 12-month shelf life, storage below 10 °C, and packs of 1 kg × 10 or 15 kg.

Rising Popularity of Ready-to-Mix and Functional Products

Convenience-driven consumption is creating new opportunities in the egg protein powder market. Ready-to-mix powders, on-the-go shakes, and fortified snacks are gaining traction, especially among urban consumers. Food and beverage manufacturers are integrating egg protein into innovative products like protein-rich bakery mixes and smoothies. These applications cater to time-sensitive lifestyles while providing essential nutrition. The trend supports higher product diversification and the development of premium, functional product lines targeting millennials and working professionals.

- For instance, Rembrandt Foods, which acquired Artisan Kitchens in early 2024, processes a wide range of dry, liquid, and frozen egg products. Artisan Kitchens, now a part of Rembrandt Foods, was reported to process over 80 million eggs yearly into pre-cooked items such as egg bites and omelets.

Key Challenges

Price Volatility and Supply Chain Dependency

One major challenge for the market is the fluctuation in raw material prices due to poultry industry dynamics. Factors such as feed costs, avian disease outbreaks, and regional supply constraints directly impact egg availability and production costs. This volatility affects profit margins and pricing stability for manufacturers. Dependence on consistent egg supply chains also poses risks, particularly in regions facing biosecurity issues or trade restrictions, making cost management a critical concern for industry participants.

Allergen Concerns and Plant-Based Alternatives

Rising consumer awareness about allergens and the growth of vegan lifestyles pose challenges to market expansion. Egg protein is a known allergen, limiting its use in certain food formulations and among sensitive populations. Meanwhile, plant-based proteins like pea and soy are gaining favor for being allergen-free and sustainable. This shift pressures manufacturers to innovate with allergen labeling, hybrid protein blends, and improved safety standards to retain competitiveness amid the growing popularity of alternative protein sources.

Regional Analysis

North America

North America held the largest share of around 36% in the global egg protein powder market in 2024. The region’s growth is driven by high consumption of protein supplements, functional foods, and sports nutrition products. Strong presence of major manufacturers and increasing health awareness among consumers further strengthen demand. The U.S. dominates regional production due to advanced food processing infrastructure and rising demand for clean-label ingredients. Growth in the fitness and nutraceutical sectors continues to boost market expansion across both the U.S. and Canada.

Europe

Europe accounted for nearly 28% of the global market share in 2024, driven by growing adoption of egg protein in dietary and functional food applications. The region emphasizes sustainable and high-quality animal protein sources, aligning with the clean-label trend. Strong bakery and confectionery industries in Germany, France, and the U.K. contribute significantly to market demand. Manufacturers are focusing on organic and traceable sourcing to meet strict European regulations. Expanding vegan and flexitarian populations also drive innovation in hybrid protein blends.

Asia Pacific

Asia Pacific captured about 22% of the global market share in 2024 and is projected to witness the fastest growth during the forecast period. Rising disposable income, rapid urbanization, and increasing health awareness are fueling demand for protein-based products. Countries such as China, Japan, and India are key contributors, supported by expanding fitness trends and dietary supplement usage. Local producers are enhancing processing capabilities to meet rising domestic consumption. The growing bakery and confectionery industry also adds momentum to the regional market growth.

Latin America

Latin America held around 8% of the global egg protein powder market in 2024, driven by expanding food processing and sports nutrition sectors. Brazil and Mexico lead the regional demand, supported by a growing population and increasing adoption of high-protein diets. The region benefits from abundant poultry production, which provides steady raw material availability. However, economic fluctuations and limited technological infrastructure constrain large-scale production. Rising awareness of functional foods and clean-label nutrition is expected to support steady market expansion across the region.

Middle East & Africa

The Middle East & Africa accounted for nearly 6% of the global market share in 2024. Growth in this region is primarily supported by the rising demand for protein-enriched dietary products and bakery goods. The UAE, Saudi Arabia, and South Africa represent key markets with expanding health-conscious consumer bases. Limited local egg production encourages imports from European and Asian suppliers. Investment in food processing facilities and the growing popularity of fitness nutrition products are expected to gradually enhance market penetration across the region.

Market Segmentations:

By Product:

- Whole Egg Powder

- Egg Yolk Powder

- Egg White Powder

By Application:

- Dietary Supplements

- Bakery Products

- Meat Products

- Ice Creams

- Others

By Geography

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East

- GCC Countries

- Israel

- Turkey

- Rest of Middle East

- Africa

- South Africa

- Egypt

- Rest of Africa

Competitive Landscape

The egg protein powder market is characterized by strong competition among leading players such as Rose Acre Farms, Bouwhuis Enthoven, NOW Foods, Sanovo Technology Group, Julian Bakery, EUROVO S.R.L, Rembrandt Foods, GF Ovodry S.P.A, AVANGARDCO IPL, Sharrets Nutritions LLP, BNL Food Group AVANGARDCO, DEPS, Taj Agro Products, Alver, Taiyo Kagku, and Apollon Nutrition. These companies compete through innovation, quality enhancement, and expansion into functional nutrition and sports supplement segments. The market is witnessing rising investments in advanced drying and pasteurization technologies to ensure product purity, solubility, and extended shelf life. Companies are emphasizing sustainable sourcing, traceability, and non-GMO certifications to meet global consumer preferences. Strategic collaborations, product diversification, and regional expansions are strengthening global supply networks. Moreover, increasing focus on customized formulations, including organic and flavored variants, is helping manufacturers capture evolving consumer segments

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Rose Acre Farms

- Bouwhuis Enthoven

- NOW Foods

- Sanovo Technology Group

- Julian Bakery

- EUROVO S.R.L

- Rembrandt Foods

- GF Ovodry S.P.A

- AVANGARDCO IPL

- Sharrets Nutritions LLP

- BNL Food Group AVANGARDCO

- DEPS

- Taj Agro Products

- Alver

- Taiyo Kagku

- Apollon Nutrition

Recent Developments

- In 2025, Rose Acre Farms confirmed an avian influenza outbreak at its facility in Seymour, Indiana.

- In 2024, Sanovo Technology Group Introduced the GraderPro 800, which it called the world’s largest egg grader.

- In 2024, Bouwhuis Enthoven announced its attendance at Food ingredients Europe 2024 in Frankfurt to showcase its egg solutions.

Report Coverage

The research report offers an in-depth analysis based on Product, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will continue to expand steadily driven by rising health and fitness awareness.

- Demand for clean-label and natural protein sources will strengthen product adoption.

- Asia Pacific will emerge as the fastest-growing regional market due to rising urbanization.

- Manufacturers will focus on developing flavored and ready-to-mix protein formulations.

- Functional food and beverage applications will create significant growth opportunities.

- Technological advancements in spray drying will enhance product quality and shelf life.

- Strategic partnerships will increase to secure egg supply and expand distribution networks.

- Plant-based competition will encourage innovation in hybrid protein formulations.

- E-commerce growth will improve accessibility and global brand visibility.

- Sustainability and animal welfare practices will play a key role in brand differentiation.