Market Overview:

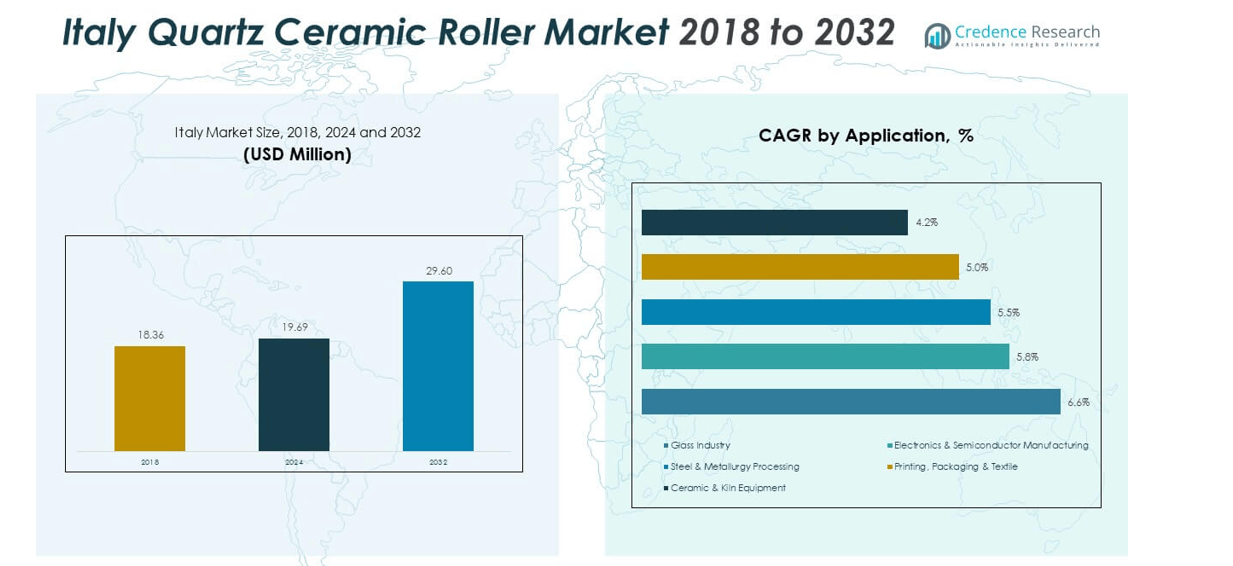

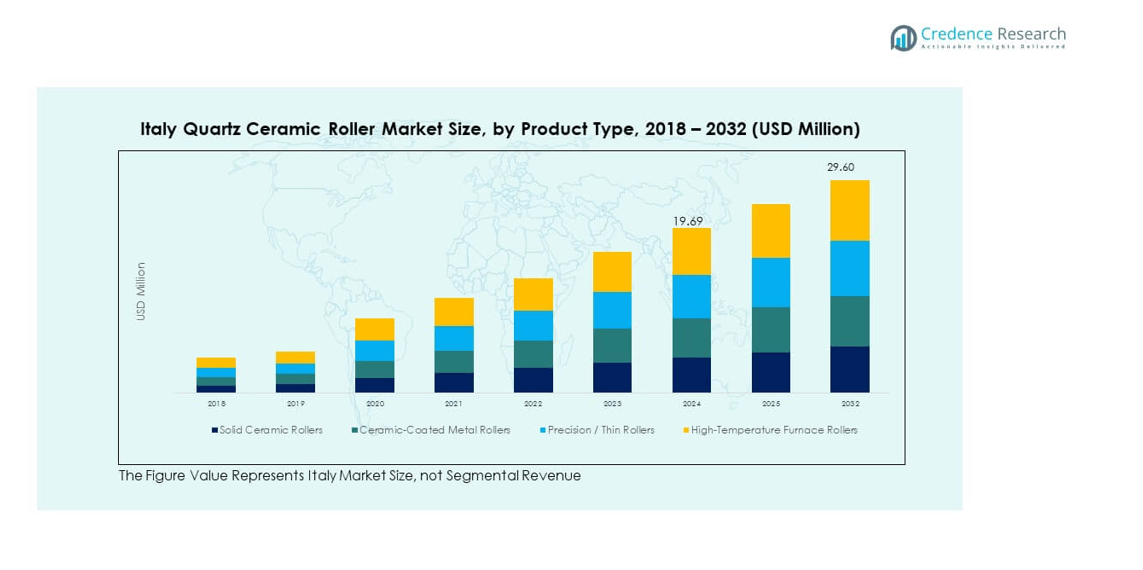

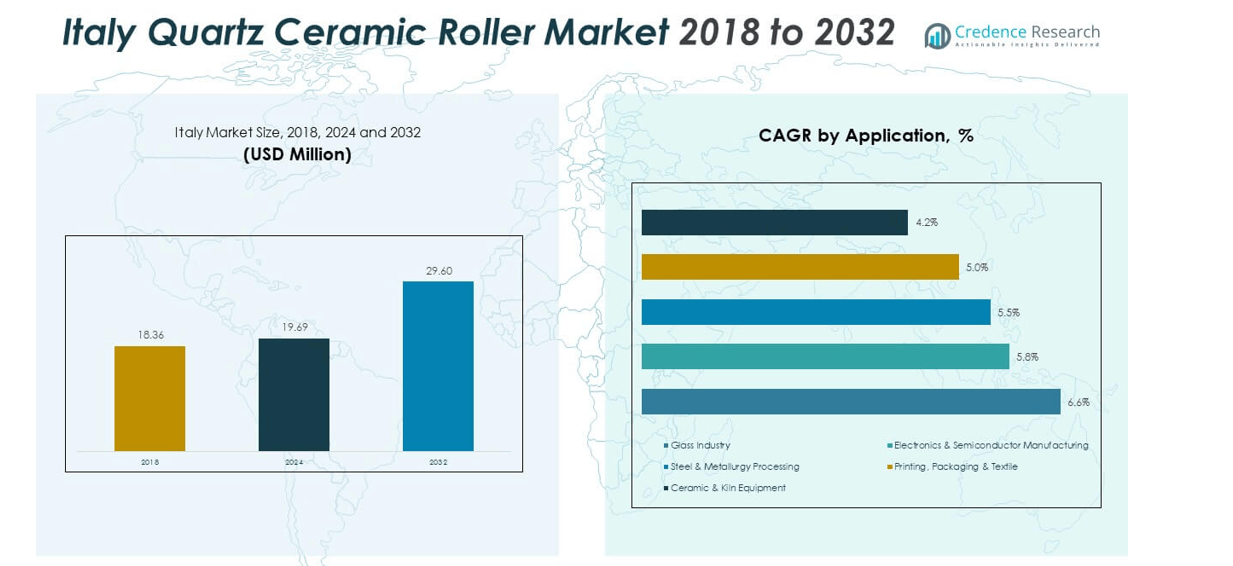

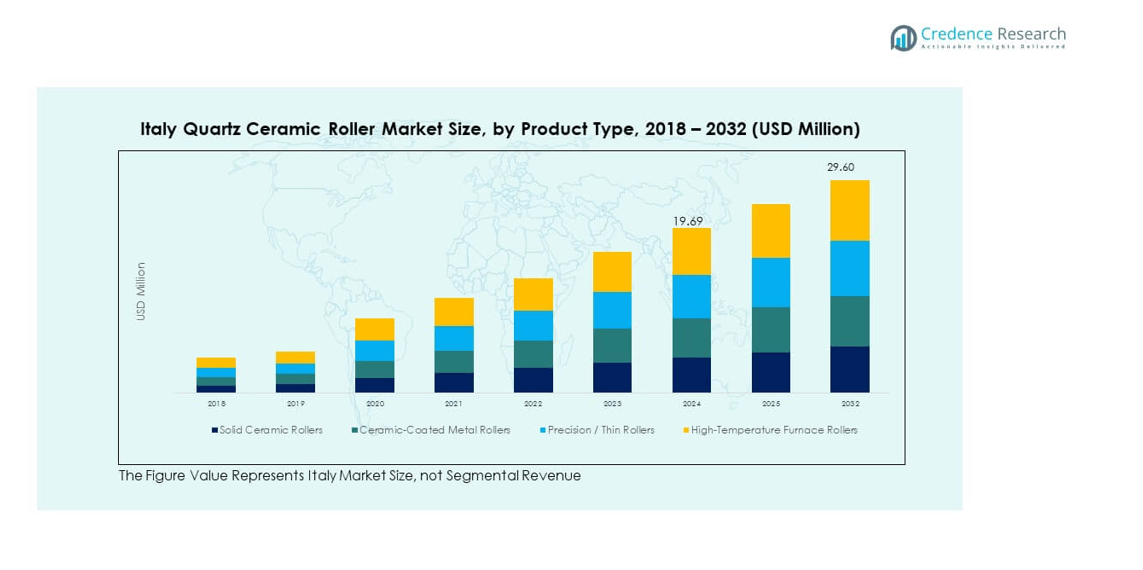

The Italy Quartz Ceramic Roller Market size was valued at USD 18.36 million in 2018, increased to USD 19.69 million in 2024, and is anticipated to reach USD 29.60 million by 2032, growing at a CAGR of 5.23% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Italy Quartz Ceramic Roller Market Size 2024 |

USD 19.69 million |

| Italy Quartz Ceramic Roller Market, CAGR |

5.23% |

| Italy Quartz Ceramic Roller Market Size 2032 |

USD 29.60 million |

The market growth is driven by increasing demand from glass, metallurgy, and semiconductor industries where precision and heat resistance are critical. Quartz ceramic rollers offer excellent thermal stability, low thermal expansion, and resistance to chemical corrosion. Italian manufacturers focus on developing high-purity rollers to enhance process reliability in continuous glass tempering and electronic component manufacturing. Rising adoption of energy-efficient industrial solutions and R&D investments in advanced ceramic processing further strengthen the market growth.

Regionally, northern Italy dominates the market due to its strong presence of glass manufacturing and industrial ceramic companies. Regions such as Lombardy and Veneto lead adoption, supported by advanced production infrastructure and strong export activities. Central Italy is emerging rapidly, driven by new installations in industrial furnaces and increasing automation adoption. Southern regions are witnessing steady growth as local industries modernize their production lines and adopt high-performance quartz ceramics.

Market Insights:

- The Italy Quartz Ceramic Roller Market was valued at USD 18.36 million in 2018, reached USD 19.69 million in 2024, and is projected to attain USD 29.60 million by 2032, expanding at a CAGR of 5.23% during the forecast period.

- Northern Italy leads with 43% share due to its robust industrial base, advanced manufacturing infrastructure, and presence of major glass and semiconductor producers. Central Italy follows with 32%, supported by growing automation and material innovation, while Southern Italy holds 25%, driven by infrastructure expansion.

- Southern Italy is the fastest-growing region with its 25% share, driven by industrial modernization, foreign investments, and government-led sustainable development projects.

- By product type, solid ceramic rollers dominate with 35% share owing to superior thermal resistance and durability, supporting their extensive use in glass and metallurgy sectors.

- High-temperature furnace rollers capture 28% of the segment, showing rising adoption in continuous heating applications and advanced furnace technologies.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Growing Demand from Glass Manufacturing and Processing Industries

The Italy Quartz Ceramic Roller Market benefits from increasing demand within the glass manufacturing sector. Industries rely on these rollers for uniform heating, dimensional stability, and chemical resistance during glass tempering and annealing. Italian producers develop advanced roller compositions that withstand high temperatures and minimize product defects. The rising construction and automotive sectors fuel glass production, boosting roller consumption. Technological advancements enhance durability and reduce maintenance downtime. Manufacturers emphasize precision and energy efficiency to meet performance standards. It continues to grow through partnerships with glass producers expanding production capacity.

- For instance, Fenzi Group became a main partner of Italy’s Glass Group before 2023, establishing a specialized supply chain network to promote glass innovation and share advanced processing know-how among Italy’s leading glass manufacturers.

Expansion of Semiconductor and Electronics Manufacturing Activities

Growth in the semiconductor and electronics industries is strengthening the demand for quartz ceramic rollers. These rollers ensure precision and stability in processes requiring high thermal and mechanical strength. Italy’s industrial clusters in Lombardy and Piedmont are witnessing investments in electronic material production. It supports the demand for components that maintain integrity at elevated temperatures. The surge in domestic electronics manufacturing drives innovation in roller coating technologies. High-purity quartz rollers provide superior chemical resistance for wafer processing. Continuous automation and cleanroom-compatible solutions further accelerate product adoption.

Rising Focus on Energy-Efficient Industrial Equipment

Energy efficiency remains a core driver for market expansion in Italy. Industries aim to minimize thermal losses during high-temperature operations, making quartz rollers ideal. The product’s low thermal conductivity supports stable furnace operation and improves energy balance. Government policies promoting energy conservation encourage adoption in multiple industrial setups. Manufacturers invest in eco-friendly production methods to reduce carbon emissions. The use of renewable energy in industrial furnaces also enhances sustainability. It demonstrates strong alignment with Italy’s decarbonization targets. Product development in this area emphasizes long service life and minimal energy waste.

Advancement in Material Engineering and Production Technologies

Continuous progress in ceramic material engineering supports innovation in roller manufacturing. Advanced formulations and nanostructured coatings increase product lifespan and performance. Research institutions in Italy collaborate with industrial manufacturers to optimize microstructure design. It enables the development of rollers with enhanced corrosion and thermal resistance. Automation in machining and precision grinding ensures consistent quality output. Adoption of computer-aided simulation improves design accuracy and operational predictability. Domestic firms invest in new sintering methods for uniform density and structural strength. The market benefits from the country’s focus on precision manufacturing excellence.

Market Trends:

Integration of Digital Monitoring and Predictive Maintenance Systems

Smart manufacturing adoption is shaping the Italy Quartz Ceramic Roller Market through advanced digital systems. Predictive maintenance solutions using sensors monitor roller wear and operational temperature. It helps manufacturers prevent production downtime and reduce maintenance costs. Real-time data analytics support process optimization and quality assurance. Integration with industrial IoT platforms provides visibility across production cycles. Automation in inspection and fault detection increases efficiency. These innovations enable consistent performance, especially in continuous furnace lines. The shift toward digitalized manufacturing enhances long-term equipment reliability.

- For instance, leading Italian glass and ceramics companies are implementing real-time condition assessment and predictive maintenance strategies to decrease maintenance intervals and energy consumption, following sector-wide adoption of advanced digital platforms as documented in multiple industry updates.

Development of High-Purity and Specialty Quartz Materials

Manufacturers are investing in high-purity quartz materials to improve product resilience. Increasing quality requirements from semiconductor and optical industries fuel this trend. It ensures rollers maintain stability under corrosive and ultra-high temperature conditions. Advances in chemical refining techniques reduce impurity levels, enhancing transparency and heat resistance. Italian producers emphasize local sourcing and vertical integration for better material control. The demand for customized compositions tailored for specific industrial needs continues to grow. Research in hybrid quartz-ceramic blends offers improved thermal shock resistance. This development supports diversification across high-precision industries.

- For instance, the European high-purity quartz market, including Italian suppliers, invests in improved refining processes to address the growing demand for electronics and precision optics, as disclosed by recent industry studies.

Sustainability-Driven Production and Green Manufacturing Practices

Sustainability remains a strong trend influencing product innovation and process design. Companies aim to minimize emissions during quartz processing and roller fabrication. It aligns with Italy’s industrial sustainability and circular economy goals. The adoption of eco-friendly binders and low-emission kilns reduces environmental impact. Manufacturers explore recycling options for defective components to cut material waste. Renewable energy integration within production lines strengthens green credentials. Collaborative projects between government and industry encourage eco-compliance certification. The market’s alignment with environmental policies enhances its competitiveness across Europe.

Emergence of Custom-Engineered Rollers for Diverse Industrial Applications

Customization is becoming increasingly important across industries requiring specialized roller performance. Tailor-made quartz ceramic rollers address unique temperature, load, and surface requirements. It caters to advanced applications in metallurgy, photovoltaics, and ceramics processing. Italian firms are introducing modular roller designs for flexible use in different furnace systems. Demand for small-batch, high-precision rollers supports niche manufacturing growth. 3D modeling and simulation tools aid in faster prototyping. Product differentiation through surface texturing and optimized coatings adds competitive advantage. The focus on application-specific engineering fosters innovation-driven expansion.

Market Challenges Analysis:

High Manufacturing Costs and Complex Production Processes

Production of quartz ceramic rollers requires high-purity materials and precise fabrication methods. The Italy Quartz Ceramic Roller Market faces cost challenges due to expensive raw materials and energy-intensive processes. Maintaining consistent quality during sintering and shaping increases production time. It leads to limited scalability for smaller manufacturers. Equipment maintenance and process calibration add operational expenses. Price sensitivity among industrial users often restrains large-scale adoption. Global competition from low-cost producers intensifies pricing pressure. Balancing cost control with performance remains a critical challenge for Italian manufacturers.

Technical Limitations and Replacement Constraints in Existing Infrastructure

Adoption of advanced rollers is limited by the compatibility of existing furnace systems. Retrofitting older industrial equipment to accommodate modern rollers increases capital costs. It slows down modernization efforts within traditional glass and metal industries. Thermal expansion mismatches between legacy setups and new rollers cause operational inefficiencies. Limited technical expertise in some regional plants restricts smooth implementation. Downtime during replacement cycles reduces production continuity. The lack of standardized roller specifications across industries complicates integration. Overcoming these technical barriers is essential for broader market penetration.

Market Opportunities:

Growing Industrial Modernization and Automation Investments

The Italian manufacturing sector’s push toward modernization creates strong growth opportunities. Automation across glass and semiconductor industries increases reliance on precision rollers. The Italy Quartz Ceramic Roller Market benefits from demand for efficient, low-maintenance products. It supports automated production environments with consistent temperature control and minimal wear. Collaborations between manufacturers and technology providers accelerate innovation. Government incentives for digital transformation enhance capital flow into advanced materials. Emerging smart factories in industrial clusters are adopting next-generation ceramic rollers rapidly.

Expansion into Export Markets and Collaborative European R&D Initiatives

Italian producers are exploring export opportunities across Europe and Asia. Strong product quality and customization capabilities enhance their international appeal. It fosters new trade relationships and strategic partnerships with foreign manufacturers. Joint research initiatives under European innovation programs support material science advancements. Cross-border collaborations accelerate product testing and certification. This cooperative approach expands market access while sharing R&D costs. Growing global demand for high-performance ceramics positions Italian suppliers as competitive exporters. The market’s alignment with EU innovation frameworks strengthens long-term international growth.

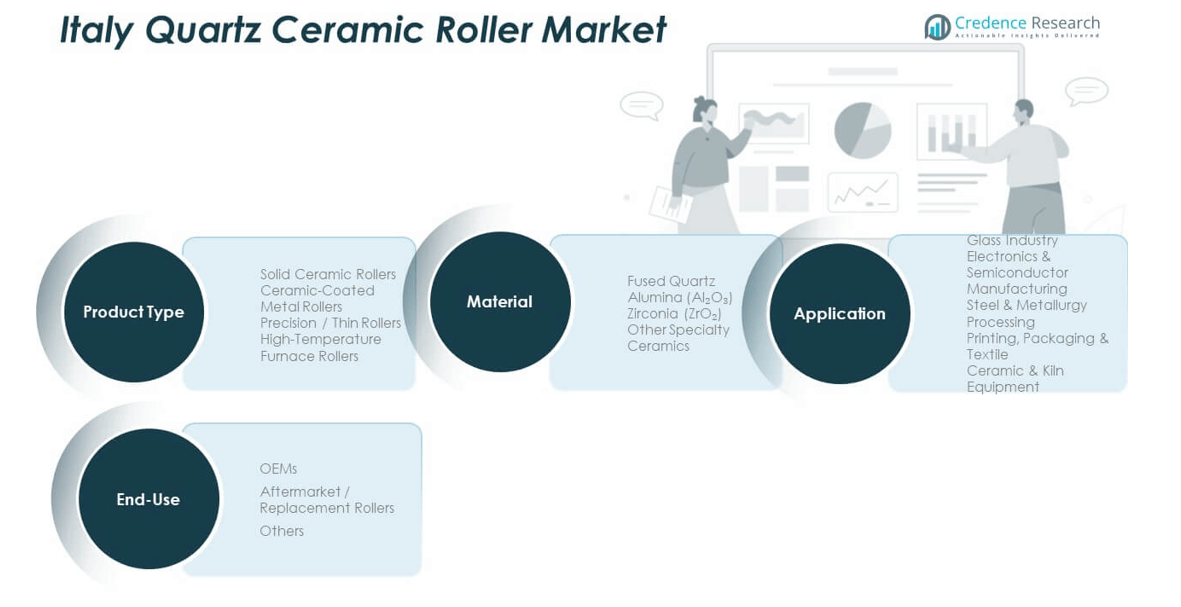

Market Segmentation Analysis:

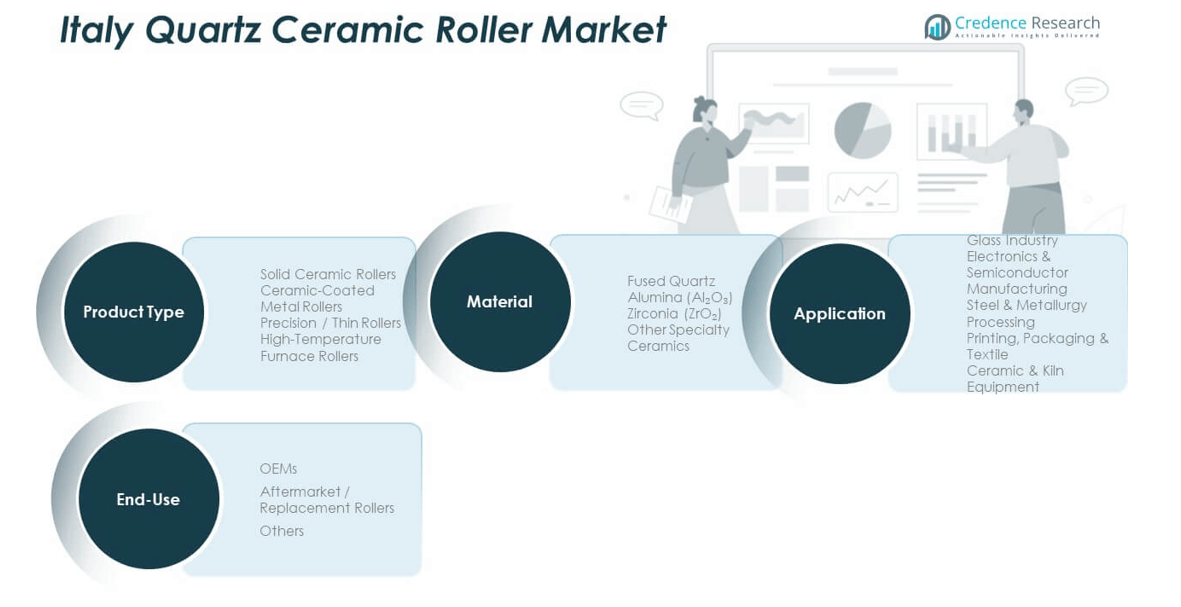

By Product Type

The Italy Quartz Ceramic Roller Market features diverse product categories catering to specialized industrial requirements. Solid ceramic rollers dominate due to their high durability, thermal stability, and resistance to deformation under extreme heat. Ceramic-coated metal rollers gain traction in applications demanding enhanced mechanical strength and surface smoothness. Precision or thin rollers are preferred in high-accuracy operations within electronics and optical production. High-temperature furnace rollers exhibit rising demand in continuous glass processing and metallurgical furnaces for maintaining consistent heat performance.

- For instance, major suppliers of high-purity quartz and advanced ceramics—which include firms based in Italy and other countries—are expanding their product lines, like solid quartz and ceramic-coated rollers. This strategic move is a direct response to the rising demand from glass and semiconductor manufacturers, who are adopting stricter performance standards, as reported in recent industry analyses.

By Application

Glass manufacturing remains the leading application segment, driven by growth in construction and automotive sectors. Electronics and semiconductor manufacturing follow closely, supported by Italy’s expanding microfabrication industry. The steel and metallurgy sector adopts these rollers to achieve precise temperature control during heat treatment. Printing, packaging, and textile industries utilize them for smooth material handling. Ceramic and kiln equipment manufacturers rely on their thermal endurance and chemical resistance.

- For instance, the glass and processed glass manufacturers in Italy include major international players such as Verallia SA and O-I Glass Inc., as well as prominent Italian firms like Zignago Vetro. These companies utilize advanced technologies, including roller technology, to support high-volume output.

By End-Use

OEMs account for a major share due to demand for high-performance components in new industrial setups. The aftermarket segment shows steady growth as industries replace worn rollers to maintain operational efficiency. Others include small-scale users focusing on niche heating and processing systems.

By Material

Fused quartz remains the preferred material due to its superior thermal and chemical properties. Alumina-based rollers offer strong mechanical performance and cost efficiency. Zirconia variants provide high toughness and wear resistance. Other specialty ceramics are gaining adoption in customized and high-precision manufacturing environments.

Segmentation:

By Product Type

- Solid Ceramic Rollers

- Ceramic-Coated Metal Rollers

- Precision / Thin Rollers

- High-Temperature Furnace Rollers

By Application

- Glass Industry

- Electronics & Semiconductor Manufacturing

- Steel & Metallurgy Processing

- Printing, Packaging & Textile

- Ceramic & Kiln Equipment

By End-Use

- OEMs

- Aftermarket / Replacement Rollers

- Others

By Material

- Fused Quartz

- Alumina (Al₂O₃)

- Zirconia (ZrO₂)

- Other Specialty Ceramics

Regional Analysis:

Northern Italy – Industrial Core and Market Leader

Northern Italy dominates the Italy Quartz Ceramic Roller Market, accounting for 43% of the total share in 2024. The region’s strong industrial ecosystem in Lombardy, Veneto, and Emilia-Romagna supports extensive glass, ceramics, and metallurgy production. Leading manufacturing clusters and high investment in automation drive adoption of precision-engineered quartz ceramic rollers. It benefits from advanced research facilities and partnerships between material science institutes and industrial producers. The presence of key companies such as Raesch Quarz (Italy) GmbH and Heraeus strengthens technological innovation and export capabilities. Continuous demand from automotive glass processing and semiconductor manufacturing sustains market momentum across this region.

Central Italy – Expanding Technological and Industrial Capabilities

Central Italy holds a 32% market share, supported by growing investments in advanced materials and industrial modernization. Regions like Tuscany and Lazio exhibit rising adoption of quartz ceramic rollers in electronics, packaging, and kiln operations. Local manufacturers are shifting toward energy-efficient furnace systems to improve productivity and lower operating costs. It is becoming a hub for small and medium enterprises producing customized rollers for niche applications. Government support for sustainable industrial development enhances research and production capacity. The growing presence of material engineering startups contributes to product diversification and market competitiveness in this area.

Southern Italy – Emerging Opportunities through Infrastructure Growth

Southern Italy represents 25% of the total market share and is steadily progressing toward industrial maturity. The demand is driven by infrastructure expansion, new glass production lines, and modernization of existing metallurgical facilities. It benefits from increasing foreign investments aimed at regional development and production diversification. Local industries in Campania, Puglia, and Sicily are embracing automation to enhance efficiency and output quality. Collaborations with northern manufacturers ensure technology transfer and process optimization. Rising focus on sustainable manufacturing practices and renewable energy integration supports long-term regional growth and strengthens its position in the national market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Morgan Advanced Materials – Haldenwanger GmbH

- CeramTec GmbH

- Heraeus Group

- Schunk Group

- Raesch Quarz (Italy) GmbH

- WONIK Quartz Europe GmbH

- EUROQUARZ GmbH

- semiQuarz GmbH

- Quarzglas Komponenten und Service (QCS)

- Nano Quarz Wafer GmbH

Competitive Analysis:

The Italy Quartz Ceramic Roller Market is characterized by strong competition among established manufacturers focused on high-purity materials and advanced engineering. Leading companies such as Morgan Advanced Materials, CeramTec GmbH, Heraeus Group, Schunk Group, and Raesch Quarz (Italy) GmbH emphasize precision manufacturing and product innovation. It benefits from the presence of specialized firms offering custom solutions for glass, metallurgy, and semiconductor industries. Continuous R&D investment in high-temperature ceramics and automation strengthens market differentiation. Strategic collaborations and European export partnerships enhance brand visibility and technological depth. Competitive dynamics are shaped by innovation speed, quality assurance, and after-sales support.

Recent Developments:

- In 2025, Morgan Advanced Materials’ Haldenwanger GmbH continued its commitment to innovation in advanced ceramics, manufacturing custom tubes and rollers for thermal processing, and collaborating with Penn State University through a new five-year Memorandum of Understanding to advance silicon carbide crystal research, supporting semiconductor market growth.

- CeramTec GmbH launched its new CeramSense® ultrasonic sensors for flow metering at Sensor+Test 2025 in May, targeting smart ultrasonic water meters with high precision and reliability under varying pressure and temperature conditions, a significant step in advanced ceramic sensor solutions.

- The Schunk Group acquired a majority stake in MS Ultrasonic Technology Group in July 2024, expanding its ultrasonic welding technologies to encompass both metal and plastic welding, thus enhancing its market presence in automotive, medical, and packaging industries.

- Raesch Quarz (Italy) GmbH announced in September 2025 its integration under the Hoenle Group corporate brand, continuing to supply high-quality quartz products for UV curing and semiconductor industries with enhanced synergy and corporate identity.

Report Coverage:

The research report offers an in-depth analysis based on product type, application, end-use, and material segments. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Increasing demand for high-performance rollers in glass and semiconductor manufacturing will sustain long-term growth.

- Rising industrial automation will create consistent demand for precision-engineered and energy-efficient rollers.

- Companies will prioritize R&D in advanced coatings and thermal stability to enhance durability.

- Sustainable manufacturing initiatives will drive adoption of eco-friendly production processes and materials.

- The aftermarket segment will expand through maintenance and replacement activities across industrial facilities.

- Regional manufacturers will explore export opportunities to strengthen their European footprint.

- Integration of digital monitoring systems will optimize performance and predictive maintenance.

- Technological collaboration between Italian and European firms will accelerate product innovation.

- Increased infrastructure modernization in southern Italy will open new market opportunities.

- Strategic alliances and localized production hubs will reinforce the market’s competitive position.