Market Overview

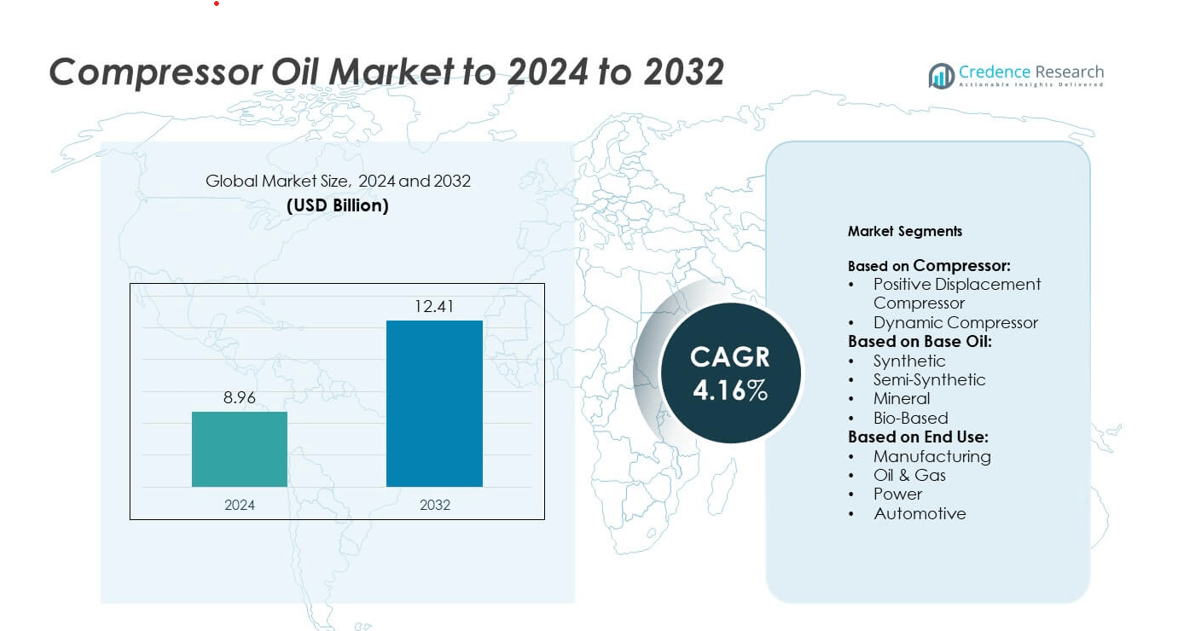

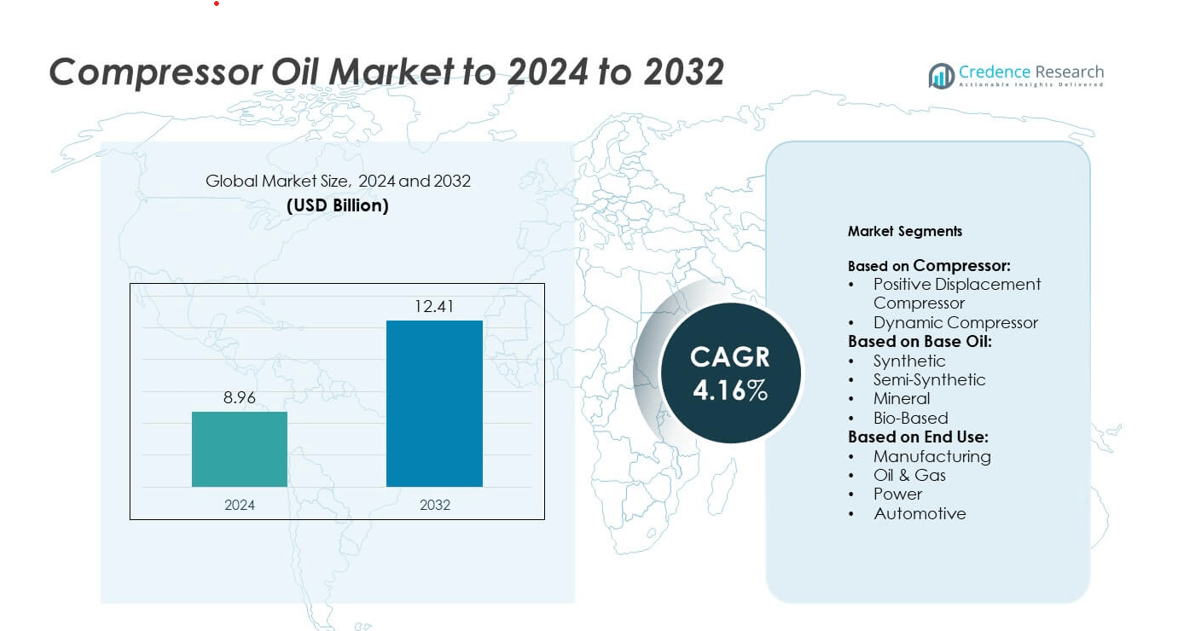

Compressor Oil Market size was valued at USD 8.96 Billion in 2024 and is anticipated to reach USD 12.41 Billion by 2032, at a CAGR of 4.16% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Compressor Oil Market Size 2024 |

USD 8.96 Billion |

| Compressor Oil Market, CAGR |

4.16% |

| Compressor Oil Market Size 2032 |

USD 12.41 Billion |

The compressor oil market is driven by major players such as Atlas Copco Group, MITSUBISHI HEAVY INDUSTRIES, LTD., FUCHS, Repsol, Shell plc, Siemens AG, Chevron Corporation, and Exxon Mobil Corporation. These companies focus on developing advanced synthetic and bio-based compressor oils that enhance equipment efficiency and meet global sustainability standards. Their strong R&D investments and partnerships with compressor manufacturers help improve oil performance and compatibility. Asia-Pacific led the global market in 2024 with a 34% share, supported by rapid industrialization, infrastructure growth, and expanding manufacturing activities across China, India, and Japan.

Market Insights

- The compressor oil market was valued at USD 8.96 Billion in 2024 and is projected to reach USD 12.41 Billion by 2032, growing at a CAGR of 4.16%.

- Market growth is driven by rising industrial automation, increased power generation, and expanding manufacturing activities worldwide.

- Synthetic and bio-based compressor oils are gaining traction due to superior performance, longer service life, and compliance with sustainability regulations.

- Competition remains strong, with major players focusing on innovation, product diversification, and regional expansion to strengthen their global presence.

- Asia-Pacific led the market with a 34% share in 2024, followed by North America at 28% and Europe at 25%, while the positive displacement compressor segment dominated with 62% market share.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Compressor

The positive displacement compressor segment dominated the compressor oil market in 2024, accounting for nearly 62% share. These compressors, including rotary screw and reciprocating types, require continuous lubrication to reduce friction and heat during compression cycles. High operational reliability and suitability for varied industrial applications make them the preferred choice. Their widespread use in manufacturing and energy sectors drives consistent oil demand. Growth in industrial automation and increased maintenance schedules in heavy-duty operations further strengthen the dominance of positive displacement compressors in the market.

- For instance, Ingersoll Rand’s Ultra Coolant is rated for up to 8,000 hours in rotary screw compressors.

By Base Oil

The synthetic oil segment led the compressor oil market with around 48% share in 2024. Synthetic oils offer superior thermal stability, oxidation resistance, and extended drain intervals compared to mineral oils, which lower maintenance costs and downtime. Their performance in extreme temperature conditions makes them suitable for high-load industrial compressors. Industries focusing on energy efficiency and reduced environmental impact are increasingly adopting synthetic lubricants. Expanding manufacturing and power generation sectors, particularly in Asia-Pacific, continue to boost demand for synthetic-based compressor oils.

- For instance, Shell Corena S4 R supports up to 12,000 operating hours in rotary vane and screw compressors.

By End Use

The manufacturing segment held the largest share of approximately 41% in the compressor oil market in 2024. Continuous compressor operation in machinery, assembly lines, and production units creates strong lubrication requirements. The rise of smart factories, automation, and process optimization enhances oil consumption for equipment protection and efficiency. Demand is further supported by growth in sectors like food processing, chemicals, and electronics manufacturing. With expanding industrial infrastructure in developing economies, the manufacturing sector remains the key growth driver for compressor oil applications.

Key Growth Drivers

Expanding Industrial and Manufacturing Activities

Rising industrialization and expansion of manufacturing facilities worldwide are major drivers of compressor oil demand. Continuous operation of compressors in assembly lines, production plants, and processing units requires reliable lubrication to maintain efficiency and reduce wear. Emerging economies such as India and China are investing heavily in manufacturing infrastructure, increasing the need for high-performance compressor oils. The shift toward energy-efficient production systems further boosts the adoption of premium synthetic lubricants that extend equipment life and minimize maintenance downtime.

- For instance, a Kaeser project cut 361,099 kWh per year after optimizing a plant’s compressor setup.

Increasing Use in Power and Energy Infrastructure

The growing demand for electricity and the development of renewable energy facilities are fueling the need for compressor oils in turbines, air systems, and gas handling equipment. Power plants rely on compressors for operations such as air separation and cooling systems. With global power generation capacity expanding, the requirement for long-lasting and thermally stable oils continues to rise. Energy companies are also focusing on low-viscosity oils that improve compressor performance and reduce energy losses, driving consistent product consumption.

- For instance, ExxonMobil’s Mobil Rarus 800 Series extends typical reciprocating drains to 2,000 hours versus 500 hours for mineral oils.

Shift Toward Environmentally Sustainable Lubricants

Environmental regulations and sustainability goals are accelerating the adoption of eco-friendly compressor oils. Manufacturers are introducing bio-based and low-toxicity lubricants that comply with REACH and EPA standards. These oils reduce emissions and improve biodegradability without compromising lubrication performance. Industries are investing in sustainable maintenance practices to meet corporate ESG targets. The shift aligns with broader decarbonization goals across sectors, positioning green lubricants as a strategic growth driver within the compressor oil market.

Key Trends & Opportunities

Rising Adoption of Synthetic Compressor Oils

Synthetic compressor oils are gaining traction due to their superior performance and longer service life compared to mineral-based alternatives. Their ability to operate under extreme temperatures and resist oxidation makes them ideal for demanding industrial conditions. Companies are adopting synthetic oils to minimize downtime and maintenance costs while improving operational efficiency. This trend presents an opportunity for lubricant manufacturers to expand product lines targeting high-performance industrial and energy applications worldwide.

- For instance, Chevron Cetus PAO 68 carries ABB turbocharger approval with a 5,000-hour drain requirement.

Advancements in Smart Maintenance and Monitoring Systems

Integration of IoT-based monitoring in industrial equipment is reshaping compressor oil maintenance strategies. Smart systems track lubricant quality, temperature, and viscosity in real time, allowing predictive maintenance and timely oil replacement. These advancements help reduce equipment failure and extend service intervals. The growing preference for automated maintenance solutions across industries creates new opportunities for manufacturers offering sensor-compatible and performance-tracking compressor oils.

- For instance, Castrol’s SmartOil and SmartMonitor won a 2025 IoT Emerging Technology Award for industrial applications.

Key Challenges

Fluctuating Crude Oil Prices and Supply Instability

Volatile crude oil prices directly impact the cost of raw materials used in compressor oil production. Sudden price shifts affect profit margins and create uncertainty in supply chains. Manufacturers face challenges in maintaining stable pricing while ensuring consistent product quality. Supply disruptions, particularly during geopolitical tensions, can delay production schedules and increase operational costs for both producers and end users.

Rising Competition from Alternative Lubrication Technologies

The development of oil-free and dry-type compressors poses a growing challenge to traditional compressor oil demand. These technologies eliminate the need for lubricants, reducing operational maintenance and environmental risks. As industries adopt oil-free compressors in sectors like food processing and healthcare, market growth for conventional oils faces constraints. Manufacturers must innovate through advanced formulations or hybrid solutions to retain competitiveness in applications increasingly shifting toward low-maintenance technologies.

Regional Analysis

North America

North America held a 28% share of the compressor oil market in 2024, driven by strong industrial and energy sector demand. The United States remains a key contributor due to widespread use of compressors in manufacturing, automotive, and power generation. Technological advancements in synthetic lubricants and increased adoption of energy-efficient systems support market expansion. The presence of major oil producers and lubricant manufacturers further strengthens regional supply capabilities. Regulatory emphasis on reducing emissions and improving operational efficiency continues to encourage the shift toward premium synthetic and bio-based compressor oils.

Europe

Europe accounted for a 25% market share in 2024, supported by its well-established industrial base and environmental regulations promoting sustainable lubricants. Countries such as Germany, France, and the United Kingdom are leading consumers, driven by advanced manufacturing and power generation industries. The European Union’s policies on emissions reduction and waste management are encouraging adoption of biodegradable and low-toxicity compressor oils. Increased investment in renewable energy facilities and compressed air systems across industrial sectors contributes to steady market growth, with synthetic and bio-based oils gaining rapid traction among end users.

Asia-Pacific

Asia-Pacific dominated the compressor oil market with a 34% share in 2024, led by rapid industrialization in China, India, Japan, and South Korea. Strong growth in manufacturing, construction, and energy sectors fuels demand for high-performance lubricants. Expanding infrastructure development and government investments in industrial automation create new opportunities for compressor oil manufacturers. Rising adoption of synthetic oils to reduce maintenance costs and improve efficiency supports market expansion. Local producers are also focusing on cost-effective formulations to meet the growing needs of small and medium-scale industries in the region.

Latin America

Latin America captured an 8% market share in 2024, primarily driven by industrial activities in Brazil, Mexico, and Argentina. The region’s oil and gas sector remains a major end-user of compressor oils, with expanding refinery and energy infrastructure projects sustaining demand. Growth in food processing, packaging, and automotive industries also contributes to consumption. Increasing preference for synthetic and semi-synthetic oils, supported by efforts to enhance operational reliability, is shaping regional trends. However, economic fluctuations and dependency on imports for raw materials pose moderate challenges to consistent market growth.

Middle East & Africa

The Middle East & Africa accounted for a 5% share of the compressor oil market in 2024, supported by the strong presence of the oil and gas industry. Demand is high in nations such as Saudi Arabia, the UAE, and South Africa, where compressors are widely used in extraction and power operations. Ongoing infrastructure projects and industrial diversification initiatives are boosting lubricant consumption. Increasing awareness of maintenance efficiency and energy savings encourages the shift toward high-performance synthetic oils. However, limited local production capacity restricts broader regional penetration.

Market Segmentations:

By Compressor:

- Positive Displacement Compressor

- Dynamic Compressor

By Base Oil:

- Synthetic

- Semi-Synthetic

- Mineral

- Bio-Based

By End Use:

- Manufacturing

- Oil & Gas

- Power

- Automotive

By Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The compressor oil market features prominent players such as Atlas Copco Group, MITSUBISHI HEAVY INDUSTRIES, LTD., FUCHS, Repsol, Hitachi, Ltd., KAESER KOMPRESSOREN, Shell plc, Siemens AG, Chevron Corporation, and Exxon Mobil Corporation. These companies focus on expanding their product portfolios with high-performance synthetic and bio-based lubricants designed for enhanced efficiency and sustainability. Strategic investments in R&D enable innovations in oxidation-resistant, low-viscosity oils tailored to meet industrial energy-saving goals. Many producers are forming partnerships with compressor manufacturers to ensure compatibility with advanced systems and optimize performance. Expansion across Asia-Pacific and the Middle East remains a key priority to capture growing industrial demand. Companies are also adopting digital platforms for predictive maintenance and performance monitoring, reinforcing customer retention and operational reliability. Competitive differentiation increasingly relies on offering eco-friendly formulations and meeting regulatory standards, positioning technologically advanced lubricant solutions as the core of future market competition.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In 2025, Chevron confirmed plans to reduce its workforce by 15% to 20%, affecting approximately 6,830 to 9,100 jobs, as part of an organizational restructuring.

- In 2024, Shell was once again named the leading global lubricants supplier for the 18th consecutive year by Kline & Company.

- In 2023, MITSUBISHI HEAVY INDUSTRIES, LTD. Provided advanced compressor technology for industries like oil and gas, LNG, and refineries.

Report Coverage

The research report offers an in-depth analysis based on Compressor, Base Oil, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The compressor oil market will continue expanding with rising global industrial automation.

- Demand for synthetic and bio-based compressor oils will strengthen due to sustainability goals.

- Power generation and renewable energy sectors will boost lubricant consumption.

- Manufacturers will invest in advanced formulations offering higher oxidation and thermal stability.

- Digital monitoring of compressor performance will increase the need for smart-compatible oils.

- The Asia-Pacific region will remain the leading market with strong industrial growth.

- Oil-free compressor technology will pressure traditional lubricant producers to innovate.

- Partnerships between OEMs and lubricant suppliers will enhance product performance standards.

- Environmental regulations will drive the adoption of low-emission and recyclable oil solutions.

- Continuous R&D investment will shape next-generation lubricants focused on efficiency and durability.