Market Overview

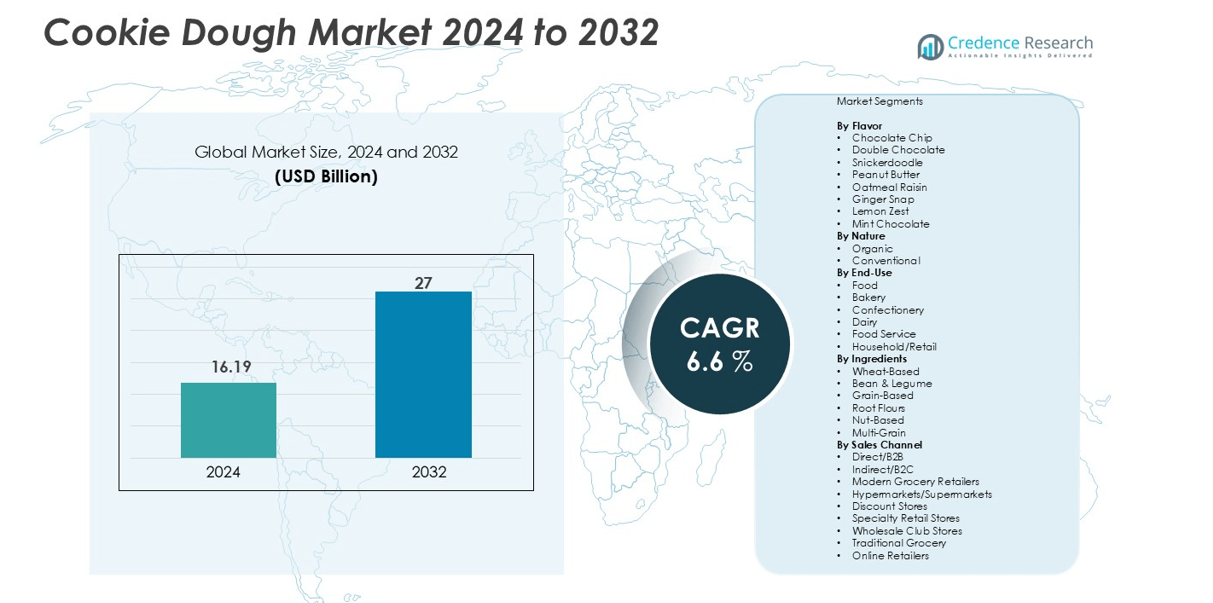

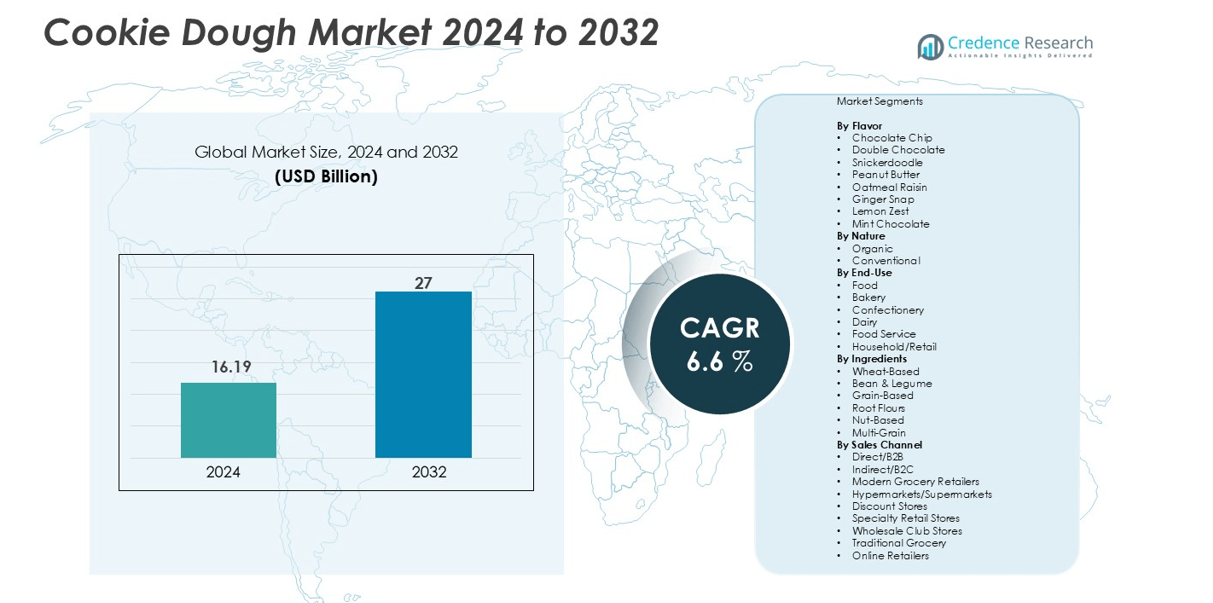

The cookie dough market size was valued at USD 16.19 billion in 2024 and is anticipated to reach USD 27 billion by 2032, at a CAGR of 6.6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Cookie Dough Market Size 2024 |

USD 16.19 billion |

| Cookie Dough Market, CAGR |

6.6% |

| Cookie Dough Market Size 2032 |

USD 27 billion |

The cookie dough market is dominated by leading players such as General Mills Inc., Nestlé S.A., Cérélia Group, Dawn Foods UK Ltd., Dough-to-Go Inc., Rhino Foods Inc., Neighbors LLC, Gregory’s Foods Inc., Mo’s Ltd., Foxtail Foods, Michael’s Bakery Products LLC, George Weston Limited, Wewalka, and Sara Lee Bakery Group. General Mills and Nestlé hold a commanding position, collectively accounting for approximately 55–60% of the global market, driven by extensive product portfolios, brand recognition, and wide distribution networks. Regionally, North America leads the market with a 32% share, supported by strong U.S. consumption of ready-to-bake and edible cookie dough products. Europe follows with about 18% market share, fueled by premiumization and bakery culture, while Asia-Pacific and emerging regions contribute roughly 35–40% combined, reflecting growing urbanization, disposable incomes, and modern retail expansion. The competitive landscape is shaped by product innovation, flavor diversification, and strategic regional penetration.

Market Insights

- The global cookie dough market was valued at USD 16.19 billion in 2024 and is projected to reach USD 27 billion by 2032, growing at a CAGR of 6.6% during the forecast period.

- Strong demand for convenient and ready-to-eat desserts, along with rising indulgence trends among millennials and working consumers, drives market growth across North America and Europe.

- Key trends include flavor diversification with chocolate chip, double chocolate, and peanut butter leading the segment, as well as the rising popularity of organic, plant-based, and clean-label cookie dough.

- The market is highly competitive, dominated by players like General Mills Inc., Nestlé S.A., Cérélia Group, Dawn Foods UK Ltd., and Dough-to-Go Inc., with North America holding 32% market share, Europe 18%, and Asia-Pacific and emerging regions 35–40% combined.

- Challenges include regulatory compliance, food safety concerns for raw consumption, and short shelf life, which restrict distribution and increase operational costs, particularly for organic and preservative-free products.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Flavor

Among flavors, the chocolate chip segment dominates the global cookie dough market, accounting for the largest market share. Its widespread consumer appeal, nostalgic value, and versatility in bakery and dessert applications drive its strong demand. Double chocolate and peanut butter follow closely, supported by growing indulgence trends and the popularity of protein-rich snack formulations. Emerging flavors such as lemon zest and mint chocolate are gaining traction due to premiumization and seasonal product launches, while innovations incorporating M&M’s and macadamia pieces attract younger demographics seeking texture-rich experiences.

- For instance, Nestlé provides Toll House Chocolate Chip Cookie Dough in varying formats for both retail and foodservice, such as a 30 oz retail tube for home baking and cases containing 240 pre-portioned cookies for commercial use.

By Nature

Within the nature segment, conventional cookie dough holds the dominant market share, driven by its affordability and wide availability across retail and foodservice channels. However, the organic sub-segment is expanding rapidly, fueled by increasing consumer preference for clean-label, preservative-free, and ethically sourced ingredients. Manufacturers are responding by reformulating products using organic wheat flour, natural sweeteners, and non-GMO ingredients. This shift is further supported by the rise of vegan and allergen-free options, appealing to health-focused and environmentally conscious consumers, thereby gradually reshaping purchasing patterns in both developed and emerging markets.

- For instance, Nestlé Toll House produces large quantities of refrigerated cookie dough for retail distribution across North America, supported by automated production lines to ensure consistency and scalability.

Key Growth Driver

Rising Demand for Ready-to-Eat and Convenience Foods

The growing preference for convenient and indulgent food options has become a major driver of the cookie dough market. Consumers increasingly seek ready-to-eat products that offer both taste and time efficiency, particularly among working professionals and millennials. The introduction of heat-treated, edible cookie dough that can be safely consumed raw has revolutionized product availability across retail and foodservice outlets. Brands like Nestlé and Ben & Jerry’s have expanded their portfolios with refrigerated and single-serve formats, appealing to on-the-go lifestyles. This convenience-driven consumption pattern continues to propel market growth, particularly in developed economies with fast-paced consumer habits.

- For instance, Nestlé launched its Toll House Edible Cookie Dough in 15-ounce tubs in July 2019. Initially available at retailers like Publix, the product became available in select Walmart stores and other regional grocery chains later that month.

Product Innovation and Flavor Diversification

Continuous innovation in flavors and formulations significantly drives cookie dough market expansion. Manufacturers are experimenting with premium ingredients, novel inclusions such as protein and fiber fortification, and indulgent flavor profiles like double chocolate, peanut butter, and mint. Product differentiation through limited-edition and seasonal releases further enhances brand engagement. Companies such as General Mills and Doughp have launched creative flavor extensions targeting younger consumers and dessert enthusiasts. Additionally, advancements in cold-chain logistics and packaging technologies enable longer shelf life and freshness, allowing brands to diversify offerings without compromising quality.

- For instance, In May 2025, General Mills introduced Pillsbury BIG COOKIES cookie dough. The new product became available at Walmart that month before rolling out to other retailers later in the summer. The manufacturer’s suggested retail price (MSRP) was $5.99 for a six-count pack.

Expansion of Online and Retail Distribution Channels

E-commerce growth and digital marketing have redefined cookie dough accessibility and consumer outreach. Online platforms enable brands to directly connect with niche consumer groups, offering subscription-based models and personalized assortments. Meanwhile, expanding shelf presence in supermarkets, convenience stores, and specialty bakeries strengthens brand visibility. Partnerships between manufacturers and large retail chains, such as Walmart and Target, have enhanced market penetration. The surge in online grocery adoption, especially post-pandemic, has further boosted sales of refrigerated and edible cookie dough, underscoring the strategic importance of omnichannel distribution.

Key Trend & Opportunity

Rising Popularity of Plant-Based and Clean-Label Formulations

The market is witnessing a strong shift toward plant-based and clean-label cookie dough, driven by health-conscious consumers and vegan dietary preferences. Brands are introducing dairy-free, egg-free, and gluten-free variants using alternative proteins and natural sweeteners. The growing awareness of ethical sourcing and sustainable ingredients presents new opportunities for innovation. Companies focusing on transparency in labeling and minimal processing are gaining a competitive advantage. This trend aligns with the broader shift toward wellness-oriented indulgence, where consumers seek products that balance taste, nutrition, and sustainability without compromising texture or flavor.

- For instance, Deux Foods offers functional, plant-based cookie dough enhanced with ingredients such as immunity-boosting elderberry extract and zinc, and protein from sources like peas.

Integration of Functional Ingredients and Nutritional Benefits

Manufacturers are leveraging functional ingredients such as oats, nuts, and legumes to enhance the nutritional profile of cookie dough. The inclusion of protein, probiotics, and superfoods supports health-driven snacking trends. This opens opportunities for hybrid product positioning, merging indulgence with functionality. Brands introducing high-protein or low-sugar cookie dough variants cater to fitness-focused and diabetic-friendly markets. The blending of indulgent flavor experiences with better-for-you attributes allows companies to reach new consumer segments, particularly in premium retail and online wellness platforms.

- For instance, Whoa Dough cookie dough snack bars are made with a chickpea and oat flour blend. Depending on the flavor, each bar contains 3–4 grams of fiber and 3–5 grams of protein.

Key Challenges

Regulatory Compliance and Food Safety Concerns

Stringent food safety regulations pose a significant challenge for cookie dough manufacturers, especially in ensuring products are safe for raw consumption. Heat treatment of flour and pasteurization of eggs are essential to eliminate pathogens like E. coli and Salmonella. However, these processes increase production complexity and costs. Maintaining compliance across multiple regions with varying labeling and food safety standards also adds operational burden. Any lapse can lead to product recalls and brand damage, making quality assurance and traceability critical components of the supply chain.

Short Shelf Life and Distribution Limitations

Cookie dough, particularly in its fresh or refrigerated form, faces challenges related to shelf stability and transportation. Maintaining optimal temperature and preventing ingredient separation or spoilage require robust cold-chain logistics. Small-scale manufacturers often struggle to manage these costs, limiting product reach beyond local markets. Additionally, consumer demand for natural and preservative-free ingredients further reduces shelf life, necessitating frequent inventory turnover. Addressing these logistical constraints through advanced packaging and formulation innovation remains vital for sustained market competitiveness.

Regional Analysis

North America (United States & Canada)

North America leads the global cookie dough market, securing around 32 % of global revenue, driven chiefly. The U.S. dominates, supported by strong consumption of ready-to-eat and refrigerated dough segments, high retail penetration, and consumer preference for convenience. Canada, while smaller, exhibits stable growth fueled by health and specialty product demand (e.g. organic and gluten-free). Investments in cold-chain logistics, national distribution networks, and flavor innovation further reinforce North America’s commanding share and steady growth trajectory.

Europe, Middle East & Africa (EMEA)

In the EMEA region, Europe takes the lead in cookie dough consumption, supported by established bakery traditions and growing adoption of convenient dessert formats. The region’s market share is estimated in the mid-teens percent range of the global total (i.e. roughly 15–20 %). Manufacturers in Western Europe emphasize premiumization, clean labels, and gourmet variants, while Eastern Europe shows rising interest in Western-style indulgent snacks. Meanwhile, Middle Eastern and African markets are nascent yet promising, aided by rising urbanization, retail modernisation, and increasing exposure to Western dessert trends.

Asia-Pacific & Rest of World

Asia-Pacific and Rest of World (Latin America, MEA beyond core, etc.) currently hold a combined share of about 35–40 % of the global cookie dough market. In Asia-Pacific, fast urbanization, rising disposable incomes, and expanding modern retail chains in China, India, Japan, and Australia are driving demand for refrigerated and ready-to-bake dough. Markets in Latin America, the Middle East, and Africa are emerging, propelled by growing middle classes, tourism, and increasing exposure to Western dessert formats. Although base volumes remain lower, these regions present high growth potential, especially in e-commerce and niche premium offerings.

Market Segmentations:

By Flavor

- Chocolate Chip

- Double Chocolate

- Snickerdoodle

- Peanut Butter

- Oatmeal Raisin

- Ginger Snap

- Lemon Zest

- Mint Chocolate

By Nature

By End-Use

- Food

- Bakery

- Confectionery

- Dairy

- Food Service

- Household/Retail

By Ingredients

- Wheat-Based

- Bean & Legume

- Grain-Based

- Root Flours

- Nut-Based

- Multi-Grain

By Sales Channel

- Direct/B2B

- Indirect/B2C

- Modern Grocery Retailers

- Hypermarkets/Supermarkets

- Discount Stores

- Specialty Retail Stores

- Wholesale Club Stores

- Traditional Grocery

- Online Retailers

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The global cookie dough market is highly competitive, with a mix of multinational corporations and regional players driving innovation and growth. General Mills Inc. and Nestlé S.A. are key leaders, commanding a significant market share of approximately 55–60%, supported by extensive brand portfolios and strong distribution networks. Cérélia Group has expanded its presence in Europe and North America through strategic acquisitions and product diversification. Other notable players include Dawn Foods UK Ltd., Dough-to-Go Inc., Rhino Foods Inc., Mo’s Ltd., Neighbors LLC, and Sara Lee Bakery Group, which compete by offering niche flavors, premium ingredients, and customized formulations. Companies are increasingly focusing on clean-label, organic, and ready-to-eat variants to meet evolving consumer preferences. The market’s competitive dynamics are further shaped by regional consumption patterns, retail expansion, and e-commerce penetration, requiring continuous innovation and strategic positioning to maintain and grow market share.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Cérélia Group

- Foxtail Foods

- Neighbors LLC

- Wewalka

- General Mills Inc.

- Michael’s Bakery Products LLC

- Mo’s Ltd.

- Dough-to-Go Inc.

- Sara Lee Bakery Group

- Gregory’s Foods Inc.

- Nestlé S.A.

- Rhino Foods Inc.

- Dawn Foods UK Ltd.

Recent Developments

- In 2024, Tiff’s Treats expanded their product line with a new range of edible cookie dough flavors, including classic Chocolate Chip, Brownie Batter, and Cake Batter. The dough is heat-treated to ensure safety for raw consumption and comes in convenient, resealable tubs.

- In 2024, Nestlé Toll House introduced a new line of edible cookie dough featuring their signature chocolate morsels. Available in flavors like Chocolate Chip and Peanut Butter Cup, this dough is designed for safe raw consumption and also works well for baking.

Report Coverage

The research report offers an in-depth analysis based on Flavor Outlook, Nature Outlook, Ingredients Outlook, Sales Channel Outlook, and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The cookie dough market is expected to witness steady growth driven by rising consumer preference for convenient and ready-to-bake products.

- Innovation in flavors and premium ingredients will continue to attract new consumer segments.

- Plant-based and organic cookie dough variants will see increased adoption due to health-conscious trends.

- Expansion of online retail and e-commerce channels will enhance market reach and accessibility.

- Functional and fortified cookie dough products with added protein or fiber will gain popularity.

- Emerging markets in Asia-Pacific and Latin America will offer high growth opportunities.

- Companies will focus on sustainable sourcing and clean-label ingredients to meet evolving consumer expectations.

- Strategic collaborations and acquisitions will help players strengthen regional presence.

- Short shelf-life challenges will drive innovation in packaging and preservation technologies.

- Overall, the market will continue to evolve with premiumization, convenience, and health-oriented offerings shaping future growth.