Market Overview:

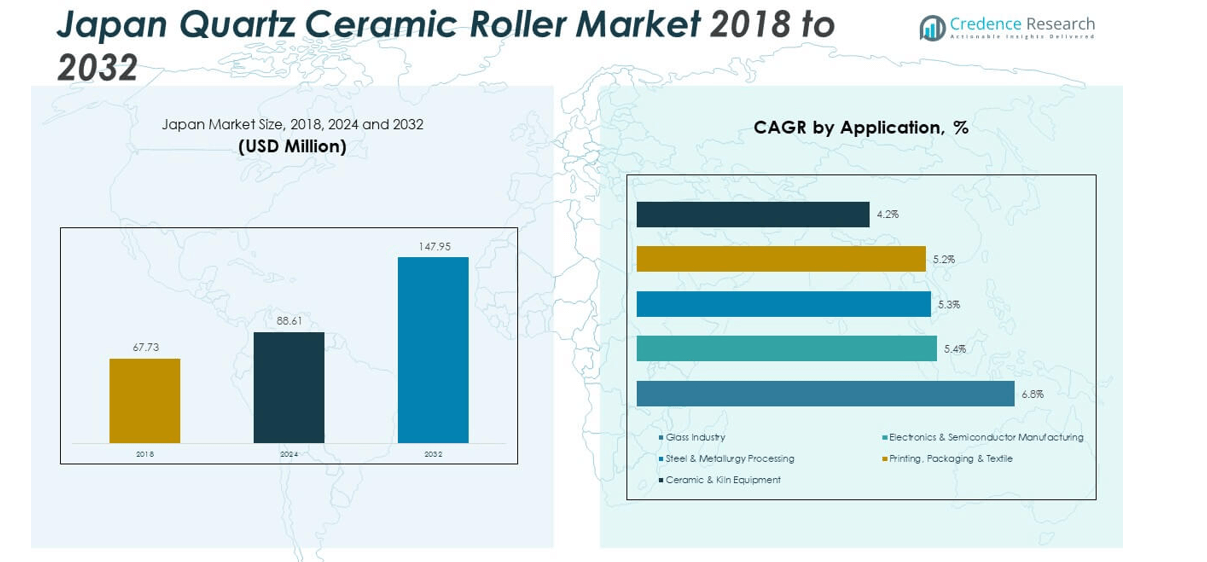

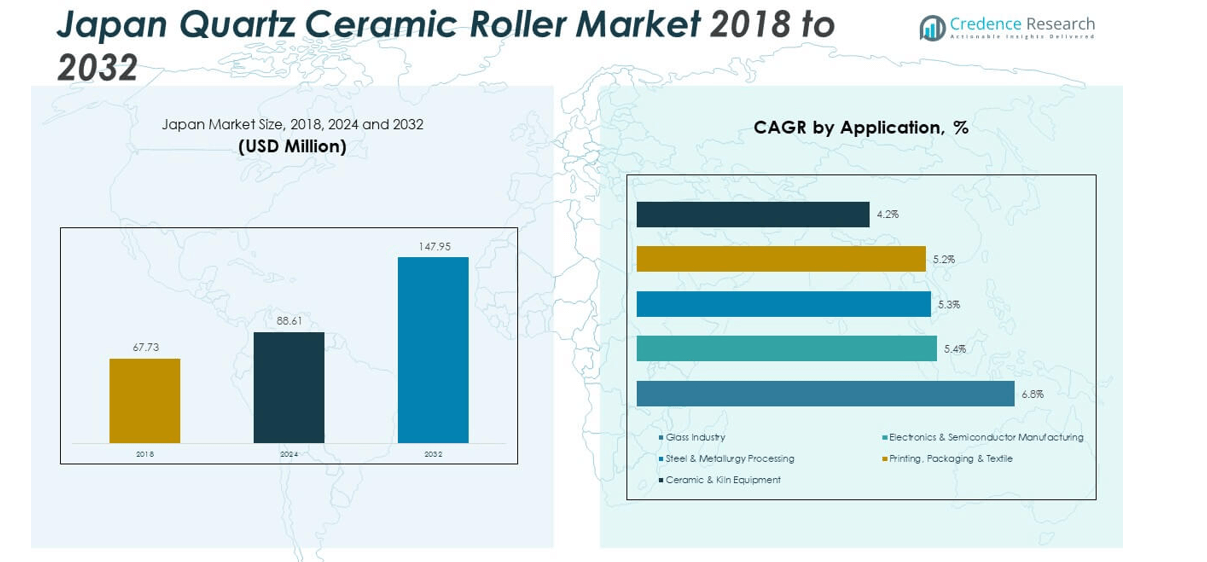

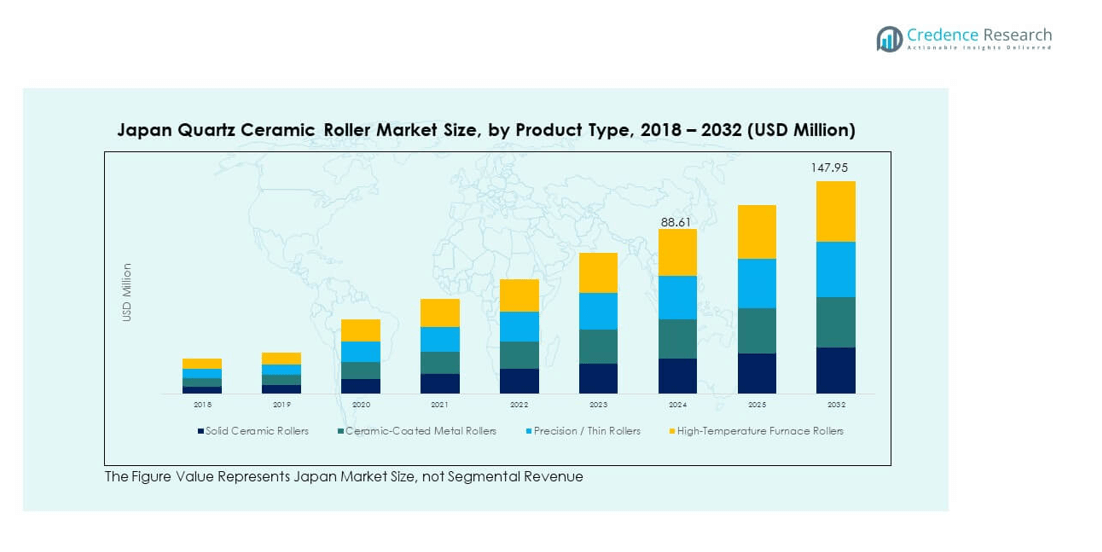

The Japan Quartz Ceramic Roller Market size was valued at USD 67.73 million in 2018, increased to USD 88.61 million in 2024, and is anticipated to reach USD 147.95 million by 2032, at a CAGR of 6.62% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Japan Quartz Ceramic Roller Market Size 2024 |

USD 88.61 million |

| Japan Quartz Ceramic Roller Market, CAGR |

6.62% |

| Japan Quartz Ceramic Roller Market Size 2032 |

USD 147.95 million |

The market growth is driven by expanding demand across glass manufacturing, semiconductor processing, and ceramic tile production. Rising investments in precision manufacturing and high-temperature industrial applications fuel adoption of quartz ceramic rollers due to their superior thermal resistance and dimensional stability. Manufacturers emphasize innovation in roller design and material purity to improve performance, minimize thermal deformation, and extend operational life in high-heat environments.

Regionally, major manufacturing hubs in Japan—such as Kanto, Kansai, and Chubu—dominate the market due to their strong industrial base. These areas host leading electronics, glass, and materials industries that rely on high-purity quartz components. Emerging growth potential is observed in southern and northern Japan, supported by technological modernization and increased semiconductor production capacity across regional clusters.

Market Insights:

- The Japan Quartz Ceramic Roller Market was valued at USD 67.73 million in 2018, reached USD 88.61 million in 2024, and is projected to hit USD 147.95 million by 2032, growing at a CAGR of 6.62% during the forecast period.

- The Kanto region led with 38% share in 2024 due to its strong semiconductor and electronics base, followed by Kansai (31%) driven by glass and metallurgy industries, and Chubu (19%) supported by advanced materials engineering.

- Tohoku and Kyushu, together holding 12%, represent the fastest-growing regions, propelled by expanding semiconductor manufacturing, renewable energy component production, and ongoing automation initiatives.

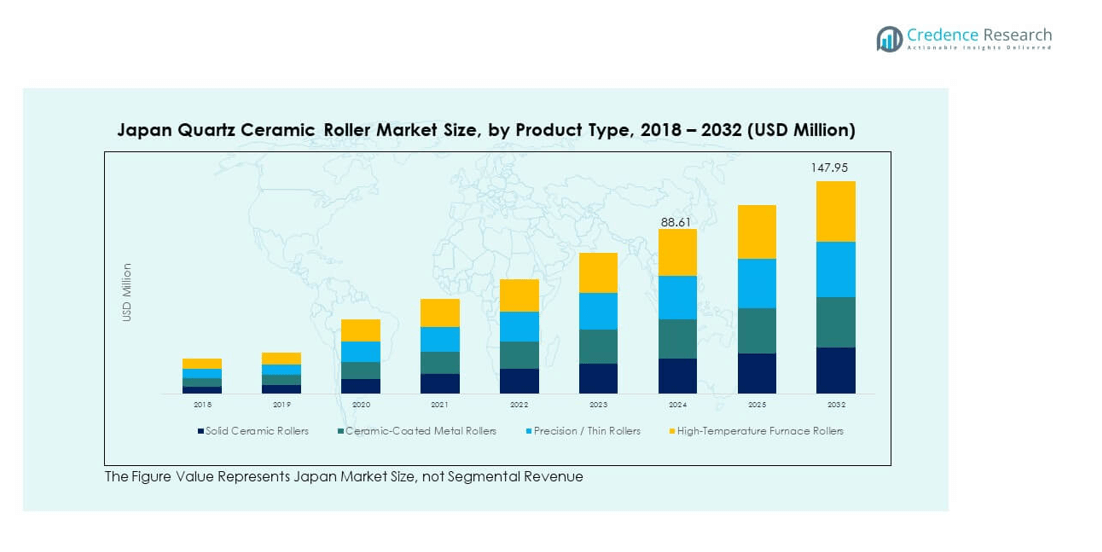

- By product type, Solid Ceramic Rollers accounted for the largest segment share due to their durability and superior thermal resistance, ensuring efficient performance in high-temperature applications.

- Ceramic-Coated Metal Rollers and High-Temperature Furnace Rollers followed with rising adoption across glass and steel manufacturing sectors, supported by strong domestic innovation and industrial modernization.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Growing Adoption of Quartz Ceramic Rollers in Semiconductor and Electronics Manufacturing

Rising demand for high-purity, heat-resistant materials in semiconductor and electronics manufacturing is driving market expansion. The Japan Quartz Ceramic Roller Market benefits from its use in wafer processing and display panel fabrication. These rollers provide stability at elevated temperatures, ensuring defect-free production. Manufacturers focus on achieving dimensional accuracy and thermal uniformity to enhance output efficiency. Growing investments in semiconductor fabs and advanced electronics contribute to steady demand. It supports reliable production under demanding thermal cycles. The ongoing growth of Japan’s semiconductor ecosystem sustains product penetration across key facilities.

Expansion of Glass Manufacturing and Ceramic Tile Industries Across Japan

The expanding glass and ceramic tile industries strengthen demand for durable rollers with consistent thermal performance. It supports applications in glass tempering, coating, and continuous production lines. These rollers reduce surface defects and improve throughput under high thermal stress. The sector’s modernization drives replacement of traditional rollers with advanced quartz ceramics. Japanese glass producers increasingly rely on quartz rollers for uniform heating and cooling processes. Continuous infrastructure development and consumer demand for architectural glass fuel production capacity. Rising exports of high-quality glass materials further boost industry consumption.

- For instance, NSG Group highlights its advancements in glass coating technology on its official site, referencing improvements in architectural and automotive glass through features like low-emissivity and anti-fog coatings.

Technological Advancements in Production and Design Optimization

Innovations in material science and roller fabrication improve efficiency, lifespan, and reliability. It includes advancements in sintering methods, surface finishing, and defect-free molding. Manufacturers adopt precision machining to ensure superior thermal shock resistance. Improved roller coatings minimize friction and maintain performance during high-speed operations. These developments reduce maintenance costs and improve energy efficiency in production. The growing use of digital monitoring enhances predictive maintenance. Continuous R&D investments by Japanese firms create value-driven differentiation across end-use sectors.

- For instance, Morgan Advanced Materials uses its advanced materials expertise and IoT-enabled solutions to optimize performance and reliability across various manufacturing sectors, including electronics.

Sustainability and Shift Toward Energy-Efficient Industrial Equipment

The increasing focus on sustainable industrial processes strengthens market adoption. Industries prioritize rollers that reduce heat loss and enhance energy recovery. It enables manufacturers to meet strict emission and energy regulations. Japanese industries promote green manufacturing practices supported by government initiatives. Energy-efficient quartz ceramic rollers align with national sustainability goals. Manufacturers develop recyclable and long-lasting materials to reduce waste generation. The transition toward eco-efficient production environments reinforces market growth across industrial facilities.

Market Trends:

Integration of Smart Manufacturing and Digital Monitoring Systems

Integration of smart manufacturing and monitoring systems reshapes operational efficiency. It allows predictive maintenance and process optimization in real time. The Japan Quartz Ceramic Roller Market witnesses the use of IoT sensors for temperature tracking and stress evaluation. This trend reduces downtime and enhances roller longevity. Manufacturers implement AI-driven diagnostics to forecast performance deviations. The digitalization of production facilities improves quality control. Growing automation adoption ensures better process stability and cost efficiency across industries.

- For instance, Hitachi’s IoT-based ‘high-efficiency production model’ at Omika Works, which leverages data analytics and automation, successfully halved the production lead time for its core products.

Increased Demand for Ultra-Pure and High-Performance Ceramic Materials

The shift toward high-purity materials drives precision manufacturing in Japan. It enables better control over contamination in semiconductor and glass processes. Industries demand quartz rollers with minimal impurities for enhanced product consistency. Japanese producers invest in refining purification and processing technologies. It ensures the development of ultra-durable and thermally stable components. The trend supports innovation in display glass, photovoltaic panels, and optical applications. Continuous improvement in material integrity sustains Japan’s reputation for high-performance industrial ceramics.

- For instance, The Quartz Corp is a major supplier of ultra-high-purity quartz sand for the semiconductor industry, which uses it to manufacture critical components like crucibles. This material must meet extremely high purity standards to prevent contamination, with competitors and industry reports indicating the increasing production of materials at or near the 50 parts per billion level to meet rising demand from semiconductor fabrication plants.

Collaborative Research and Technological Partnerships with Global Firms

Collaborative R&D projects between Japanese and international manufacturers strengthen product innovation. Partnerships focus on advanced materials, production techniques, and sustainability. It promotes cross-border technology transfer and knowledge sharing. Global alliances accelerate product testing and market expansion. These initiatives foster competitiveness and ensure long-term product excellence. Domestic firms benefit from access to advanced sintering and automation technologies. Such cooperation drives consistent improvement in performance, quality, and global market reach.

Growing Replacement Demand and Product Lifecycle Upgrades

Industries replace aging ceramic rollers with new-generation quartz-based designs. It results from increased expectations for longevity and precision. Companies focus on lifecycle cost reduction through durable materials and design upgrades. End-users demand components that withstand repeated high-temperature cycles. Manufacturers respond by offering rollers with improved stress tolerance and thermal endurance. Growing modernization in Japan’s industrial infrastructure accelerates replacement demand. This trend enhances product innovation and ensures continuous operational reliability.

Market Challenges Analysis:

High Production Costs and Limited Raw Material Availability Affecting Market Expansion

The high cost of quartz raw materials and energy-intensive production processes limit profitability. Manufacturers in the Japan Quartz Ceramic Roller Market face challenges balancing quality and cost efficiency. Precision fabrication requires advanced equipment and strict purity standards, raising capital expenses. Energy costs further strain margins due to prolonged high-temperature firing cycles. Supply constraints of high-purity quartz also affect production schedules. Domestic producers often rely on imported materials, increasing dependency risks. The need for advanced quality control systems adds to operational expenses, restraining smaller market entrants.

Complex Manufacturing Processes and Intense Global Competition

Complex fabrication procedures demand specialized expertise and controlled environments. It increases production lead times and slows scalability. Maintaining consistent quality across batches is challenging for local manufacturers. Global competition from low-cost producers intensifies market pressure. Foreign entrants benefit from economies of scale and lower labor costs. Japanese producers focus on innovation and performance differentiation to maintain competitiveness. Sustaining export competitiveness requires continuous improvement in process automation and cost optimization.

Market Opportunities:

Rising Demand from Semiconductor and Renewable Energy Industries

Expanding semiconductor and renewable energy sectors create strong growth potential. It encourages the use of quartz ceramic rollers in wafer, solar, and coating applications. Japan’s government initiatives to enhance domestic chip manufacturing support local demand. Increasing solar panel production strengthens adoption across fabrication facilities. The integration of automation technologies enhances roller precision and reliability. Domestic firms invest in upgrading production lines to meet growing quality requirements.

Export Potential and Advancement in High-End Ceramic Technologies

Japan’s expertise in advanced ceramics opens export opportunities in Europe and Asia-Pacific. It positions the industry as a global supplier of high-performance quartz rollers. Emerging demand from advanced manufacturing markets accelerates overseas expansion. Continuous innovation in surface treatment, material purity, and thermal resistance strengthens export competitiveness. It supports Japan’s role in supplying components for precision industries worldwide. Collaborations with foreign manufacturers enhance technological reach and product diversification.

Market Segmentation Analysis:

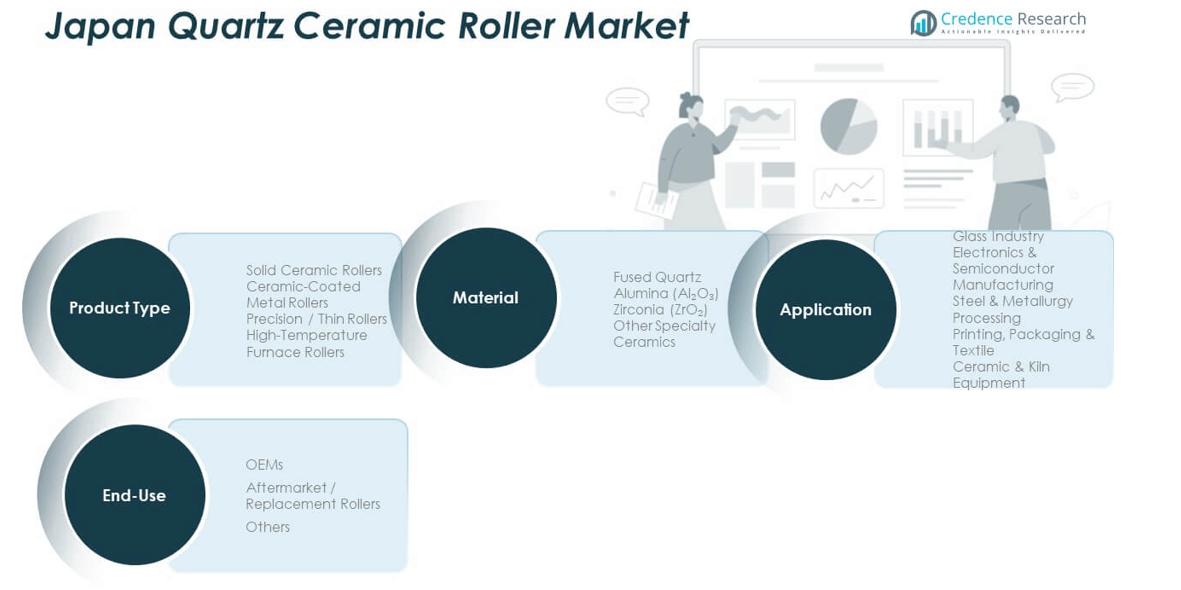

By Product Type

The Japan Quartz Ceramic Roller Market features four major product categories: solid ceramic rollers, ceramic-coated metal rollers, precision/thin rollers, and high-temperature furnace rollers. Solid ceramic rollers lead the segment due to their durability and uniform thermal resistance. Ceramic-coated metal rollers gain traction for their balance of strength and cost efficiency. Precision and thin rollers support semiconductor and glass processing where tolerance accuracy is critical. High-temperature furnace rollers remain vital in heavy-duty applications demanding superior heat endurance and mechanical stability.

- For instance, CeramTec GmbH’s ceramic rollers and tools offer enhanced performance and increased longevity in steel processing environments due to their superior properties like hardness and wear resistance, which can lead to increased efficiency and reduced downtime compared to traditional steel components.

By Application

Key application areas include the glass industry, electronics and semiconductor manufacturing, steel and metallurgy processing, printing, packaging, textile, and ceramic kiln equipment. The glass sector dominates due to the need for consistent heating and defect-free finishing. Electronics and semiconductor manufacturing follow closely, relying on precision rollers for thermal control. Steel and ceramic industries adopt advanced rollers for energy efficiency and reduced maintenance cycles.

- For instance, NGK Insulators, Ltd. rollers used in continuous firing kilns for Multilayer Ceramic Capacitor (MLCC) manufacturing contribute to improved quality and yields by enabling precise control of kiln atmosphere and temperature.

By End-Use

The end-use segment includes OEMs, aftermarket or replacement rollers, and others. OEMs hold the largest share due to steady integration in new production setups. Aftermarket demand is growing with equipment modernization and lifecycle replacement.

By Material

Fused quartz dominates material selection due to high purity and excellent thermal shock resistance. Alumina (Al₂O₃) and zirconia (ZrO₂) materials gain preference for improved hardness and stability under extreme conditions. Other specialty ceramics provide tailored performance for niche applications, supporting product diversification and technological advancement across industries.

Segmentation:

By Product Type:

- Solid Ceramic Rollers

- Ceramic-Coated Metal Rollers

- Precision / Thin Rollers

- High-Temperature Furnace Rollers

By Application:

- Glass Industry

- Electronics & Semiconductor Manufacturing

- Steel & Metallurgy Processing

- Printing, Packaging & Textile

- Ceramic & Kiln Equipment

By End-Use:

- OEMs

- Aftermarket / Replacement Rollers

- Others

By Material:

- Fused Quartz

- Alumina (Al₂O₃)

- Zirconia (ZrO₂)

- Other Specialty Ceramics

Regional Analysis:

Kanto Region – Leading Manufacturing and Semiconductor Hub

The Kanto region dominates the Japan Quartz Ceramic Roller Market, holding 38% of the total share in 2024. Tokyo and its surrounding industrial clusters drive production through advanced semiconductor, electronics, and glass manufacturing facilities. The region’s established technological infrastructure and strong R&D ecosystem support continuous innovation in quartz ceramic materials. Major companies operate precision fabrication plants to meet strict industrial standards. Demand from cleanroom environments and automated fabrication lines strengthens product utilization. It benefits from high investment in advanced materials, fueling steady revenue growth within key industrial segments.

Kansai Region – Expanding Industrial and Export Base

The Kansai region ranks second, accounting for 31% of the market share in 2024. Osaka, Kyoto, and Hyogo contribute significantly to glass, steel, and industrial furnace production. The region supports growing adoption of high-temperature rollers for heavy manufacturing and furnace applications. Local companies focus on energy-efficient technologies and export-oriented production strategies. Expanding demand from metallurgy and precision glass industries reinforces Kansai’s industrial presence. It continues to benefit from the modernization of thermal processing lines and government-led manufacturing support programs that promote material efficiency.

Chubu and Other Regions – Emerging Growth Centers

The Chubu region holds 19% of the total share, driven by its strong automotive and materials engineering base. It supports increasing adoption of quartz ceramic rollers in precision coating and surface finishing lines. Tohoku and Kyushu collectively account for 12% of the market, showing rising potential with expanding semiconductor and renewable energy component production. Regional investments in industrial automation and green manufacturing accelerate the shift toward sustainable processes. It continues to attract attention from both domestic and foreign manufacturers seeking cost-effective production locations with skilled labor and infrastructure support.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

Competitive Analysis:

The Japan Quartz Ceramic Roller Market is characterized by strong competition among domestic and international manufacturers focusing on precision engineering and advanced material innovation. Major players include Saint-Gobain SEFPRO, Kamroller, Ohara Corporation, Murata Machinery, and SUMCO Corporation. Each company emphasizes high-temperature stability, purity, and product customization for semiconductor, glass, and metallurgical applications. It demonstrates competitive differentiation through R&D investments, automation integration, and strategic partnerships. Continuous improvements in production efficiency, energy savings, and product performance sustain their leadership in Japan’s industrial materials sector.

Recent Developments:

- Saint-Gobain SEFPRO finalized the acquisition of Glass Service in January 2024, expanding SEFPRO’s portfolio and technological capabilities in glass industry solutions relevant to the Japanese market.

- In the first half of 2025, Ohara Corporation renewed its thermal expansion measurement equipment and updated its product catalog to reflect changes in the coefficient of linear expansion for its glass materials. These updates allow Ohara’s quartz ceramics and optical glass offerings to better meet the evolving precision requirements of Japanese manufacturers.

- Murata Machinery announced in June 2025 a strategic partnership with Selway Machine Tool Company, expanding its CNC capabilities and automation solutions across western U.S. markets. This partnership helps reinforce Murata’s position as a high-precision manufacturer for ceramic roller and automation systems, also benefitting their Japanese production footprint.

Report Coverage:

The research report offers an in-depth analysis based on Product Type, Application, End-Use, and Material. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Rising integration of automation will enhance roller precision and productivity.

- Growing semiconductor investments will strengthen domestic product demand.

- Sustainable manufacturing practices will shape product development standards.

- High-purity quartz materials will gain wider application in advanced industries.

- Replacement demand from glass and steel plants will sustain aftermarket growth.

- Regional expansions in Kyushu and Tohoku will drive new production capacity.

- Collaboration between Japanese and global firms will accelerate innovation cycles.

- Development of energy-efficient furnace rollers will remain a top priority.

- Digital monitoring and predictive maintenance technologies will improve reliability.

- Continuous R&D investment will position Japan as a leader in high-performance ceramic rollers.