Market Overview:

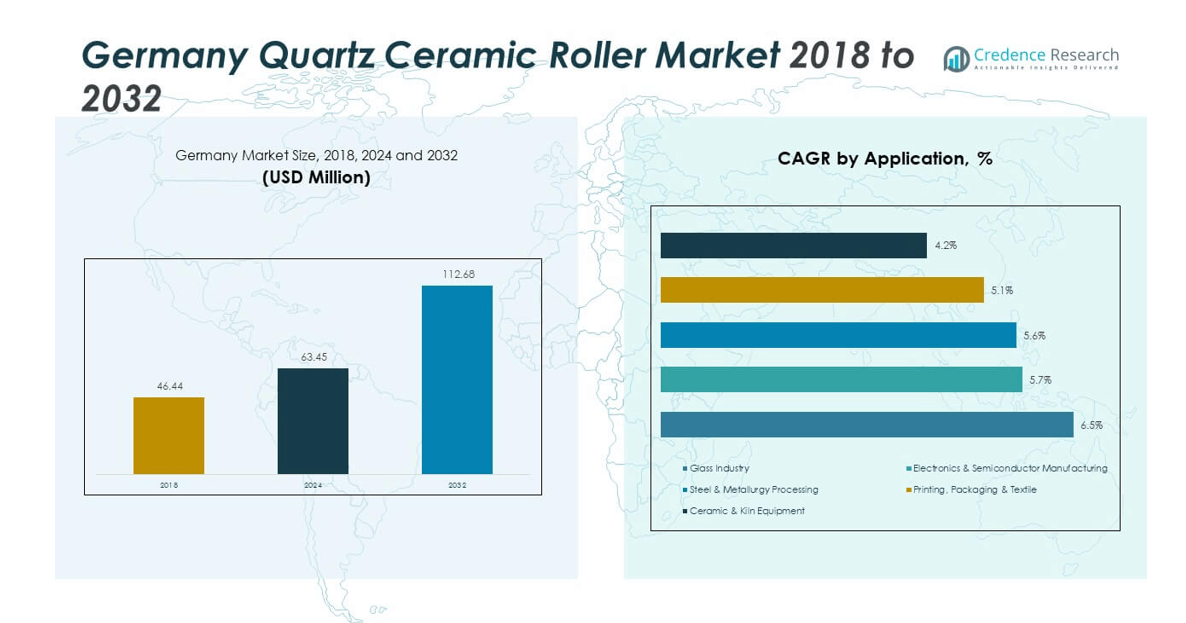

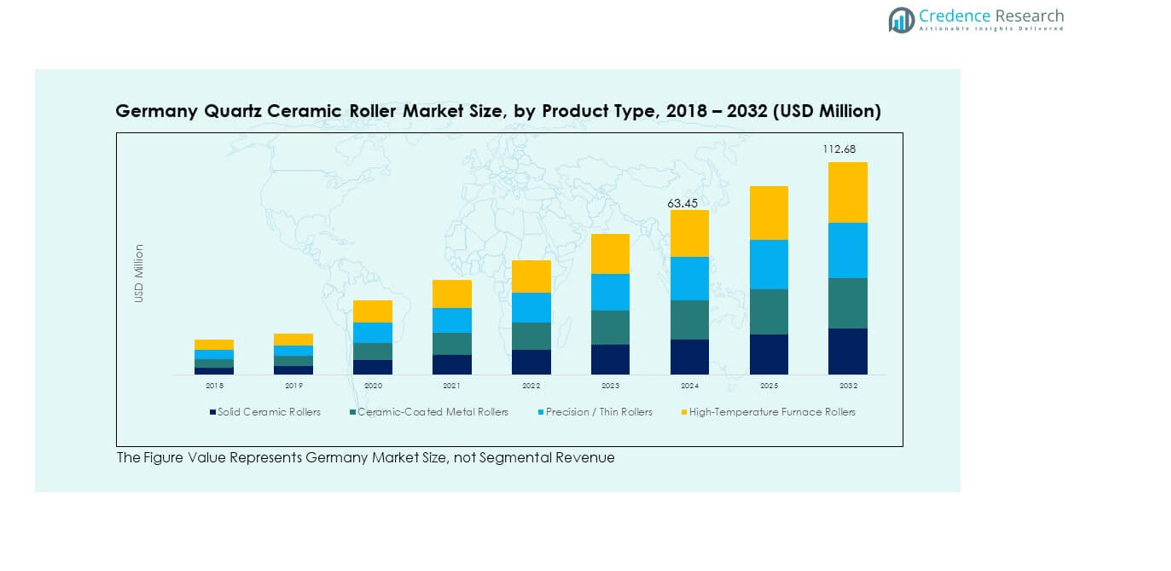

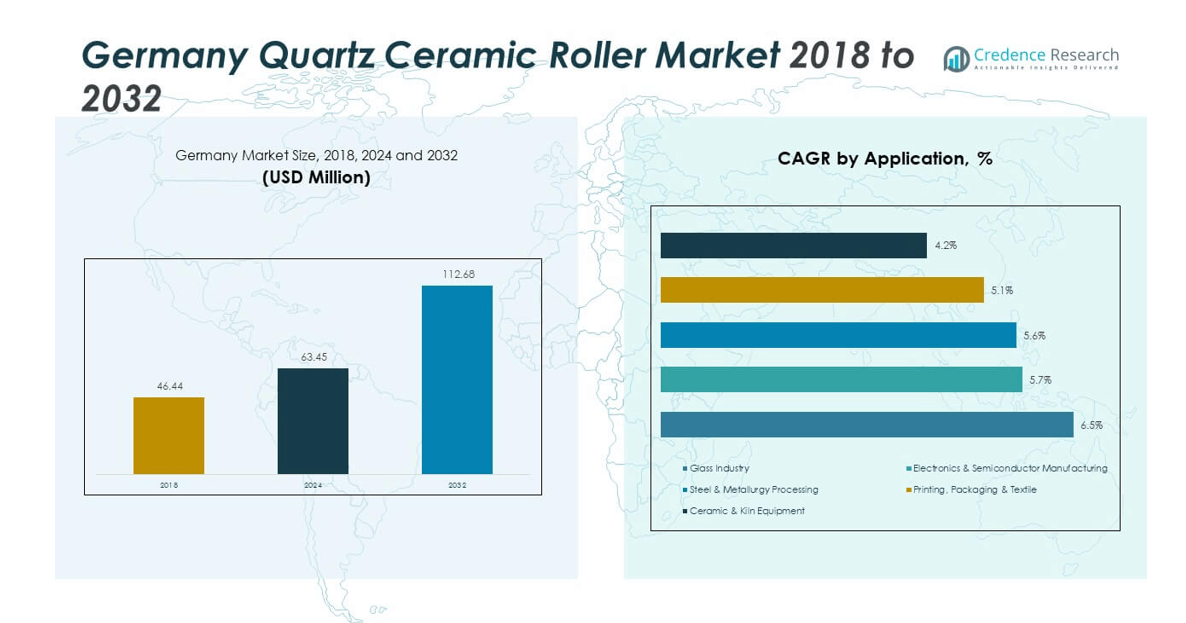

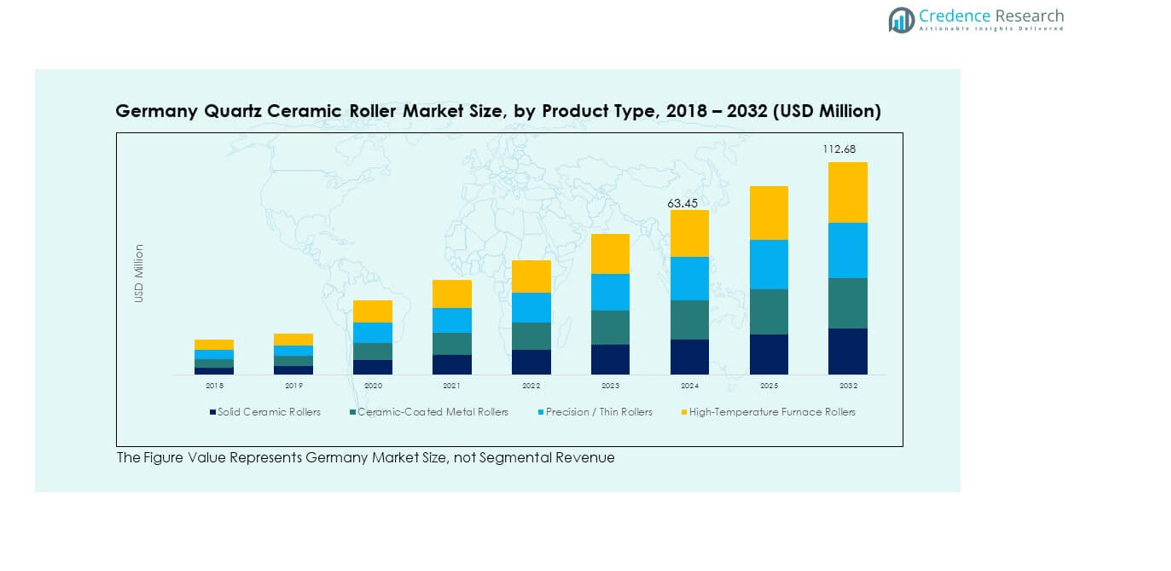

The Germany Quartz Ceramic Roller Market size was valued at USD 46.44 million in 2018, increased to USD 63.45 million in 2024, and is anticipated to reach USD 112.68 million by 2032, at a CAGR of 7.44% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Germany Quartz Ceramic Roller Market Size 2024 |

USD 63.45 million |

| Germany Quartz Ceramic Roller Market, CAGR |

7.44% |

| Germany Quartz Ceramic Roller Market Size 2032 |

USD 112.68 million |

Market growth is driven by rising demand across glass manufacturing, semiconductor, and metallurgical industries. The use of quartz ceramic rollers in high-temperature environments enhances durability, thermal resistance, and chemical stability. Manufacturers are focusing on improving roller precision, reducing defects, and extending lifespan to meet stringent industrial requirements. Increasing automation and the need for energy-efficient production processes further accelerate adoption across major end-use sectors.

Regionally, southern and western Germany dominate the market due to their strong industrial and manufacturing infrastructure. These regions host several glass and semiconductor fabrication facilities, driving consistent demand for high-performance rollers. Northern and eastern Germany are emerging as growth zones, supported by ongoing industrial expansion, infrastructure modernization, and investment in advanced materials research. This geographic distribution reflects Germany’s balanced approach to technological and industrial growth across the country.

Market Insights:

- The Germany Quartz Ceramic Roller Market was valued at USD 46.44 million in 2018, grew to USD 63.45 million in 2024, and is expected to reach USD 112.68 million by 2032, registering a CAGR of 7.44% during the forecast period.

- Southern Germany (36%), Western Germany (28%), and Northern Germany (20%) hold the largest shares due to their strong industrial infrastructure, established glass and semiconductor manufacturing bases, and advanced process automation facilities.

- Eastern Germany (16%) is the fastest-growing region, driven by expanding industrial diversification, new manufacturing investments, and government-backed innovation in advanced materials.

- Among product segments, Solid Ceramic Rollers account for 35% of the market share, supported by their high durability and low thermal expansion properties that suit continuous high-temperature applications.

- High-Temperature Furnace Rollers contribute 28% of total revenue, with rising use in glass tempering and metallurgical processing driving their consistent demand in industrial operations.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Adoption in High-Temperature Industrial Applications

The Germany Quartz Ceramic Roller Market is driven by growing demand from high-temperature industrial operations such as glass, metallurgy, and semiconductor production. These industries require materials that offer thermal stability and low thermal expansion. Quartz ceramic rollers provide superior durability under extreme conditions, reducing production downtime. Manufacturers prefer these rollers for their ability to maintain precision at elevated temperatures. Their chemical inertness enhances product purity during processing. The adoption of automation across production lines further supports demand. Strong investment in process optimization continues to push technological advancements in roller design.

- For instance, Heraeus Conamic implemented AI-driven automated quality control for quartz glass cylinders in early 2024, using a camera system to reliably detect production defects such as bubbles and cracks over a distance of up to 3.5 meters, enabling greater manufacturing precision and fewer manual interventions.

Expansion of Semiconductor and Electronics Manufacturing in Germany

Germany’s expanding semiconductor and electronics manufacturing base boosts market growth. The increasing integration of cleanroom technologies demands materials with minimal contamination risk. Quartz ceramic rollers meet these standards with high chemical resistance and purity. Leading producers focus on supplying rollers for wafer processing and display panel production. The country’s strong R&D infrastructure supports innovation in quartz materials. Government support for semiconductor self-reliance strengthens the supply chain. This growth in high-tech industries creates steady demand for precision-engineered rollers.

- For instance, SCHOTT’s strategic acquisition of QSIL GmbH in January 2025 integrated advanced quartz glass production and 275 skilled employees, expanding high-performance manufacturing capabilities in Germany and ensuring precision-engineered components for microchip fabrication.

Focus on Energy Efficiency and Sustainable Production Processes

Energy-efficient manufacturing is a major growth driver across Germany. Quartz ceramic rollers help industries achieve lower energy consumption through better heat transfer control. Their long operational life reduces material waste and maintenance frequency. Manufacturers prioritize sustainability by using recyclable and durable materials. The shift toward eco-friendly industrial practices promotes adoption of these rollers. Continuous advancements in material composition improve performance and efficiency. Companies align their product development strategies with EU sustainability goals to remain competitive.

Continuous Technological Advancements in Material Engineering

Material innovation remains central to the market’s development. Research on nanostructured coatings and reinforced quartz composites enhances roller strength and surface integrity. German manufacturers integrate smart process monitoring to ensure dimensional accuracy. Improved fabrication techniques enable higher production consistency and performance reliability. The incorporation of advanced sintering technologies reduces defects. These developments enhance competitiveness across industrial applications. The market benefits from collaborations between academic institutions and industry players focused on material improvement.

Market Trends:

Integration of Automation and Industry 4.0 Technologies

Automation and digital control systems are transforming roller manufacturing and end-use applications. Smart sensors embedded in production equipment allow real-time performance tracking. The Germany Quartz Ceramic Roller Market benefits from precision-driven monitoring solutions. Manufacturers use data analytics to optimize roller performance and predict wear. This trend supports consistent product quality and process efficiency. Companies invest in intelligent machinery for faster, defect-free production. The integration of Industry 4.0 principles enhances operational transparency across production lines.

- For instance, Heraeus’ introduction of AI-driven imaging and cloud-based analysis in 2024 for quartz glass production has enabled manufacturers to process up to 15,000 images per production batch in minutes, optimizing defect identification and improving quality control efficiency.

Rising Demand for Custom-Engineered Quartz Components

Industries increasingly demand rollers tailored for specific temperature, size, and load requirements. German firms respond by offering customized quartz roller solutions. The focus on application-specific design enhances overall system efficiency. Custom fabrication techniques allow greater precision and flexibility in production. This trend aligns with the shift toward specialized equipment in advanced industries. Manufacturers invest in design software and simulation tools to improve accuracy. The move toward customization strengthens long-term supplier–client partnerships.

- For instance, SCHOTT expanded its custom quartz glass component offerings for semiconductor and optical applications following its acquisition of QSIL GmbH, allowing flexible production to meet precise microchip manufacturing standards in 2025.

Growing Adoption of Hybrid Quartz Composites and Coated Rollers

Hybrid quartz materials combining multiple refractory compounds are gaining traction. These advanced rollers deliver improved wear resistance and reduced thermal shock. The trend reflects a shift toward high-performance industrial components. Coatings such as silicon carbide or alumina enhance lifespan and performance stability. German producers explore innovative surface treatments for greater mechanical strength. The Germany Quartz Ceramic Roller Market adapts rapidly to these innovations. This evolution supports long-term operational reliability and sustainability.

Expansion of Cross-Sector Applications Beyond Glass and Semiconductors

The market sees growing adoption in chemical, automotive, and renewable sectors. Manufacturers develop rollers suited for composite material handling and precision furnaces. Demand from hydrogen energy and battery manufacturing sectors expands opportunities. The versatility of quartz ceramic rollers drives interest in new process environments. German companies capitalize on this by diversifying product portfolios. The market’s adaptability reflects the country’s innovation-driven industrial landscape. Broader end-use integration enhances the overall growth potential of the market.]

Market Challenges Analysis:

High Production Costs and Complex Fabrication Processes

The production of quartz ceramic rollers involves costly raw materials and precision processing steps. High-purity quartz and controlled sintering environments increase manufacturing expenses. Small defects during fabrication can compromise performance and raise rejection rates. This complexity limits scalability and raises end-user prices. The Germany Quartz Ceramic Roller Market faces strong cost pressures from alternative materials. Limited availability of specialized raw materials adds further strain on supply chains. Companies must invest heavily in quality assurance systems to maintain standards.

Limited Skilled Workforce and Dependence on Specialized Equipment

Manufacturing high-quality quartz rollers requires technical expertise and advanced machinery. Germany’s industrial base faces a shortage of skilled professionals in precision ceramics. This skill gap slows production expansion and technology transfer. Specialized machinery demands regular calibration and high maintenance costs. The dependency on imported fabrication equipment adds logistical challenges. The market must balance automation with human expertise for optimal results. Strengthening workforce training and local equipment production could reduce long-term dependency.

Market Opportunities:

Growing Potential in Renewable Energy and Advanced Manufacturing Sectors

Rising investment in renewable energy technologies creates new opportunities for quartz ceramics. Solar panel and hydrogen fuel cell production rely on heat-resistant components. The Germany Quartz Ceramic Roller Market benefits from this expanding demand base. Advancements in green manufacturing drive innovation in high-purity materials. Companies exploring partnerships with clean energy producers gain a competitive edge. This diversification enhances revenue stability and promotes sustainable industrial growth.

Emerging Demand from Developing European Economies

Eastern and Central European nations present untapped potential for market expansion. Rapid industrialization and modernization initiatives create strong demand for thermal processing equipment. German manufacturers can leverage their technological expertise to serve these emerging regions. Strategic collaborations and export initiatives strengthen regional presence. The increasing adoption of automation and advanced materials supports long-term growth prospects.

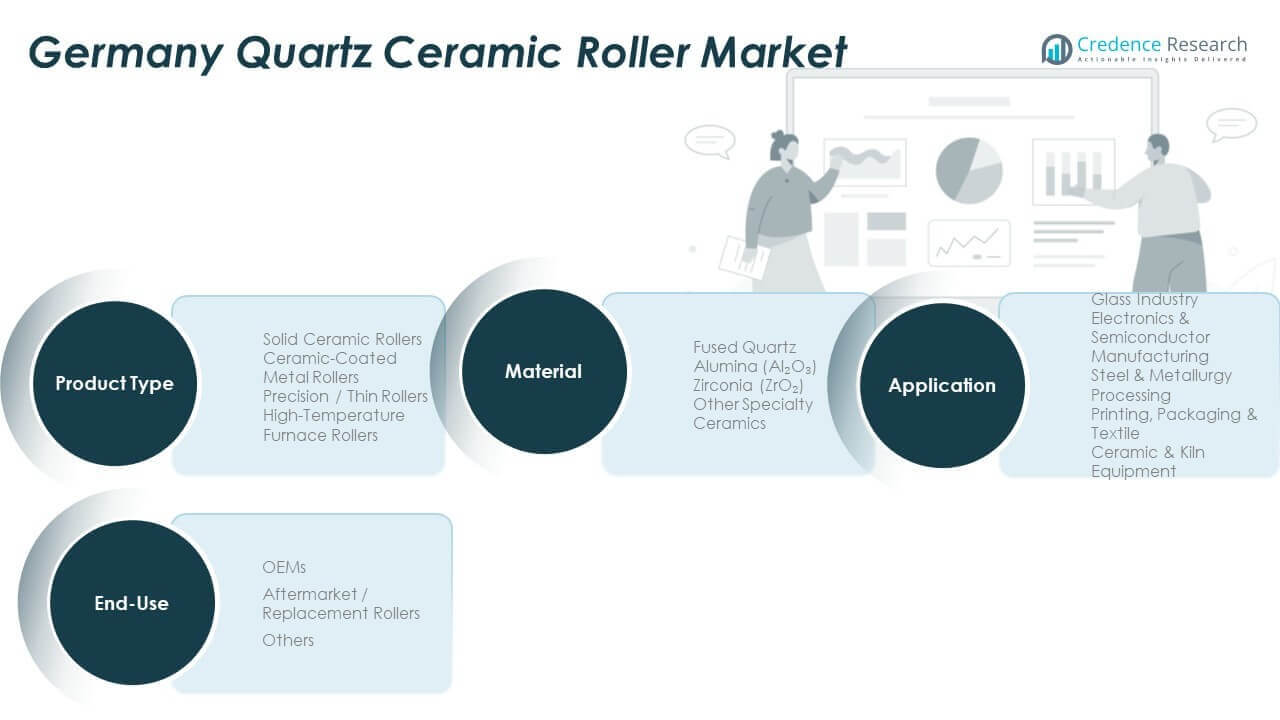

Market Segmentation Analysis:

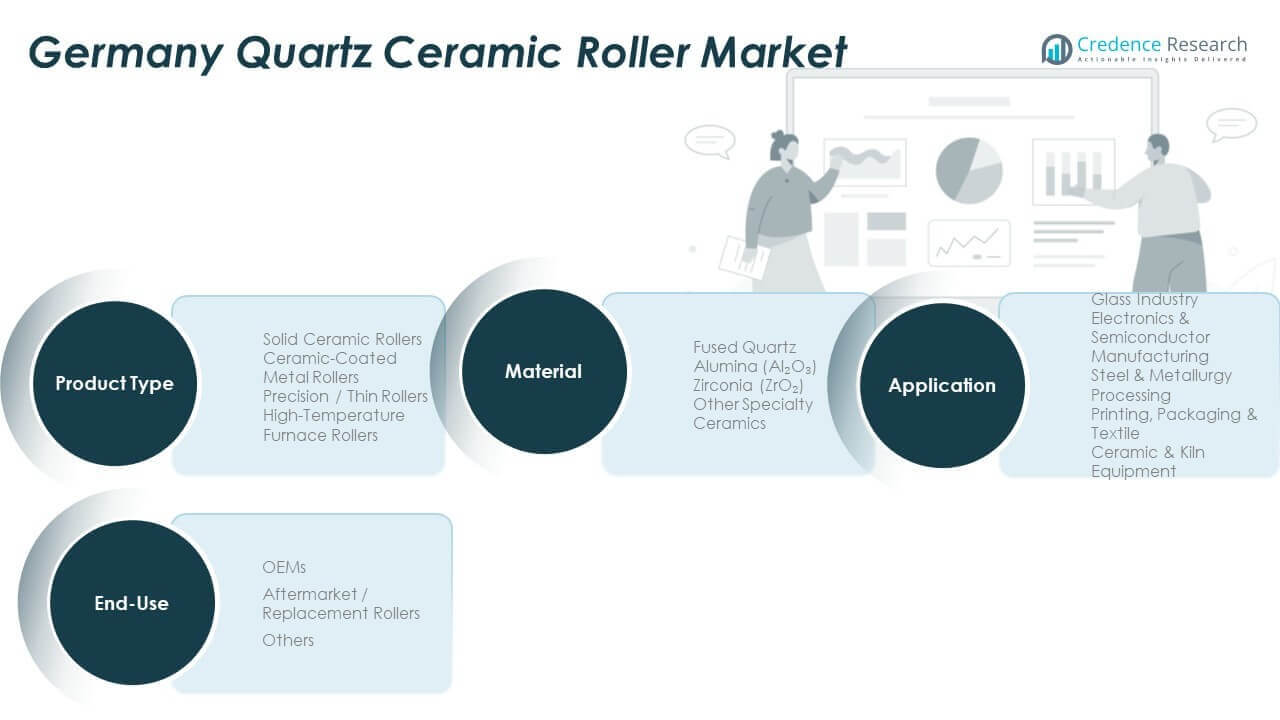

By Product Type

The Germany Quartz Ceramic Roller Market is segmented into Solid Ceramic Rollers, Ceramic-Coated Metal Rollers, Precision/Thin Rollers, and High-Temperature Furnace Rollers. Solid Ceramic Rollers dominate due to their high durability, low thermal expansion, and suitability for continuous high-temperature operations. Ceramic-Coated Metal Rollers are gaining traction in heavy-duty industrial environments that demand improved mechanical strength. Precision/Thin Rollers serve niche applications in electronics and precision glass production. High-Temperature Furnace Rollers remain essential for glass tempering and metallurgical processing, driven by their superior heat resistance.

- For instance, Heraeus and SCHOTT continue to deliver solid and custom-engineered quartz rollers suitable for specialized applications such as wafer carrier parts and process tubes for etching in semiconductor manufacturing, supported by advanced material purity standards as of 2025.

By Application

Key applications include Glass Industry, Electronics & Semiconductor Manufacturing, Steel & Metallurgy Processing, Printing, Packaging & Textile, and Ceramic & Kiln Equipment. The glass sector holds a leading share due to continuous production processes requiring stable thermal control. Electronics and semiconductor manufacturing demand high-purity, defect-free rollers for wafer and display fabrication. Steel and metallurgy industries prefer quartz rollers for consistent surface finish and reduced contamination risk. Demand in printing and ceramics continues to grow with automation in production lines.

- For instance, quartz glass cylinders and advanced process components produced by Heraeus and SCHOTT are used in high-volume semiconductor wafer processing and glass manufacturing lines, supporting defect reduction and higher purity outcomes in Germany by 2025.

By End-Use

End-use segments include OEMs, Aftermarket/Replacement Rollers, and Others. OEMs lead due to large-scale integration into new equipment lines. The aftermarket segment grows steadily due to periodic replacement needs driven by wear and temperature stress. The Others segment includes specialized industrial applications requiring custom roller configurations.

By Material

Material segmentation covers Fused Quartz, Alumina (Al₂O₃), Zirconia (ZrO₂), and Other Specialty Ceramics. Fused Quartz remains the preferred choice for its purity and temperature tolerance. Alumina offers mechanical strength and cost efficiency, while Zirconia provides excellent wear resistance. Specialty ceramics gain attention for tailored performance in emerging industrial environments.

Segmentation:

By Product Type

- Solid Ceramic Rollers

- Ceramic-Coated Metal Rollers

- Precision / Thin Rollers

- High-Temperature Furnace Rollers

By Application

- Glass Industry

- Electronics & Semiconductor Manufacturing

- Steel & Metallurgy Processing

- Printing, Packaging & Textile

- Ceramic & Kiln Equipment

By End-Use

- OEMs

- Aftermarket / Replacement Rollers

- Others

By Material

- Fused Quartz

- Alumina (Al₂O₃)

- Zirconia (ZrO₂)

- Other Specialty Ceramics

Regional Analysis:

Southern Germany – Industrial and Manufacturing Hub

Southern Germany dominates the Germany Quartz Ceramic Roller Market, accounting for 36% of the total share in 2024. The region’s strength lies in its dense concentration of glass, steel, and semiconductor manufacturing facilities. Strong industrial clusters in Bavaria and Baden-Württemberg drive steady adoption of high-temperature and precision rollers. The presence of advanced machinery and automation-based production lines supports continuous demand. Local manufacturers emphasize process innovation and energy-efficient operations to maintain competitiveness. R&D partnerships between industrial and academic institutions foster advancements in ceramic materials and production technology. Southern Germany remains the core contributor to both technological and revenue growth within the market.

Western Germany – Strong Base of Electronics and Engineering Industries

Western Germany holds 28% of the total market share, supported by its robust electronics, metallurgical, and materials engineering sectors. The region benefits from proximity to major export hubs, enabling efficient distribution of quartz ceramic rollers across Europe. Companies in North Rhine-Westphalia and Hesse invest in product customization for high-performance industrial applications. The demand for rollers in semiconductor and glass coating industries continues to expand due to technological modernization. Local manufacturers focus on product reliability, dimensional accuracy, and consistent thermal performance. It demonstrates strong collaboration between equipment manufacturers and process technology developers to meet evolving industrial requirements.

Northern and Eastern Germany – Emerging Growth Corridors

Northern and Eastern Germany collectively account for 36% of the market share, with growth led by new infrastructure investments and industrial diversification. The expansion of renewable energy, automotive, and specialty glass production facilities stimulates product adoption. The Berlin-Brandenburg and Saxony regions are emerging as centers for advanced materials research and pilot-scale production. Increased funding for innovation and sustainability projects enhances competitiveness in these regions. Manufacturers target these areas for strategic expansion to balance national production capacity. It reflects a shift toward geographically diversified manufacturing supported by regional innovation ecosystems.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Morgan Advanced Materials – Haldenwanger GmbH

- CeramTec GmbH

- Heraeus Group

- Schunk Group

- Raesch Quarz (Germany) GmbH

Competitive Analysis:

The Germany Quartz Ceramic Roller Market features a moderately consolidated landscape, led by established companies focusing on innovation, product quality, and long-term client partnerships. Major players such as Morgan Advanced Materials – Haldenwanger GmbH, CeramTec GmbH, Heraeus Group, Schunk Group, and Raesch Quarz (Germany) GmbH dominate through advanced manufacturing capabilities and material engineering expertise. It emphasizes high-purity production, durability, and precision control in roller design. Competitive differentiation is built around customization, thermal performance, and sustainability. Strategic R&D investment and technological collaboration with industrial sectors strengthen overall competitiveness.

Recent Developments:

- In September 2025, the Heraeus Group expanded its portfolio in the medical materials sector by acquiring Synthecure®, a synthetic calcium sulfate bone void filler developed by Austin Medical Ventures, thereby reinforcing Heraeus Medical’s presence in orthopedic trauma and infection management.

- In August 2025, Morgan Advanced Materials – Haldenwanger GmbH announced the sale of its global Molten Metals Systems business, which includes operations in Germany, India, and China, to Vesuvius PLC, a move aimed at simplifying Morgan’s portfolio and focusing on higher-growth segments; the transaction is set to be completed by early October 2025.

- In January 2025, Schunk Group completed the full acquisition of ESK-SIC GmbH, a leading manufacturer of silicon carbide powder; this move strengthens Schunk’s product offering for high-performance ceramics and enables industrial-scale recycling of silicon carbide for advanced material applications.q

Report Coverage:

The research report offers an in-depth analysis based on product type, application, end-use, and material segments. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Demand will rise across semiconductor, glass, and metallurgy sectors due to process optimization.

- Innovation in coating technologies will enhance durability and extend roller lifespan.

- Automation and Industry 4.0 integration will improve production precision and consistency.

- Local manufacturing expansion will reduce import dependency and enhance supply resilience.

- Sustainability-driven designs will dominate future material engineering approaches.

- Advanced ceramics and hybrid materials will open new industrial application areas.

- Strategic collaborations between research institutes and manufacturers will intensify.

- The aftermarket segment will grow due to increasing maintenance and replacement cycles.

- Government support for green and efficient manufacturing will sustain market growth.

- Technological differentiation and R&D investment will remain the key competitive advantage.