Market Overview:

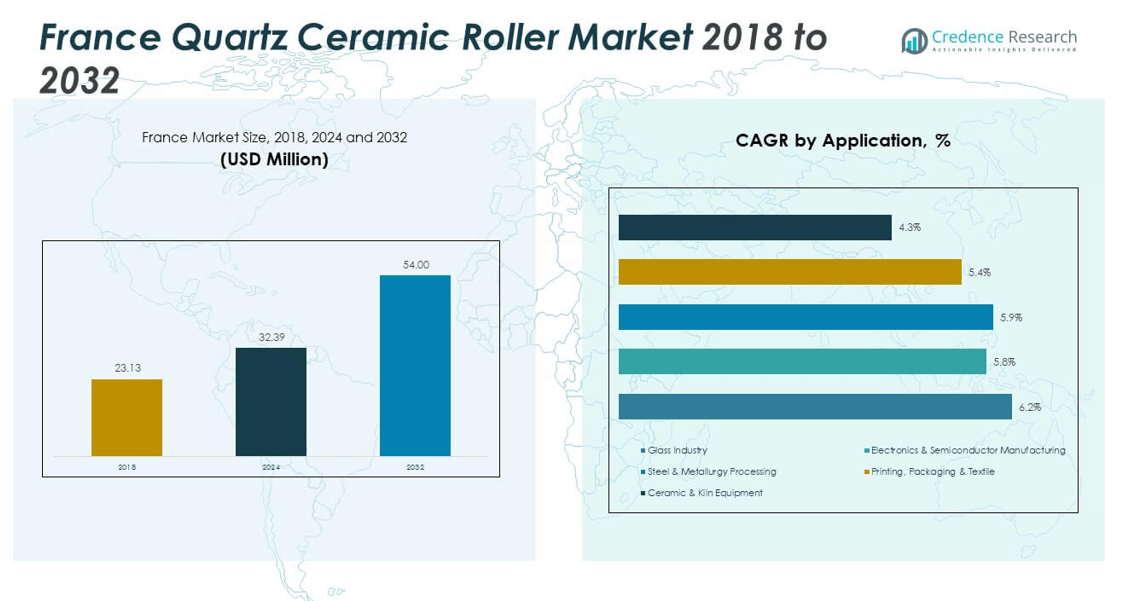

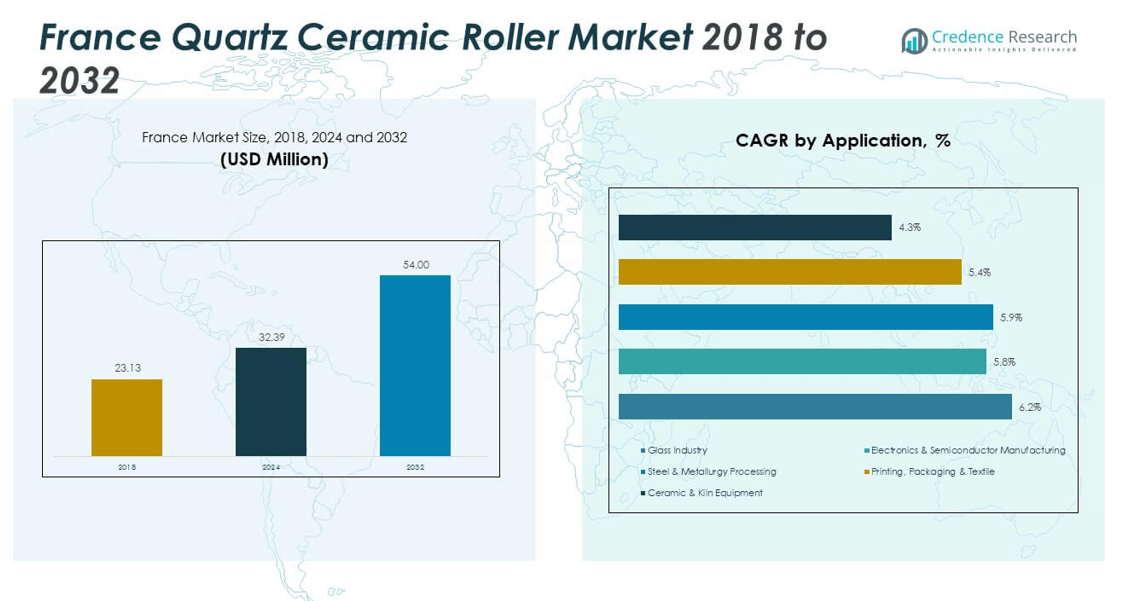

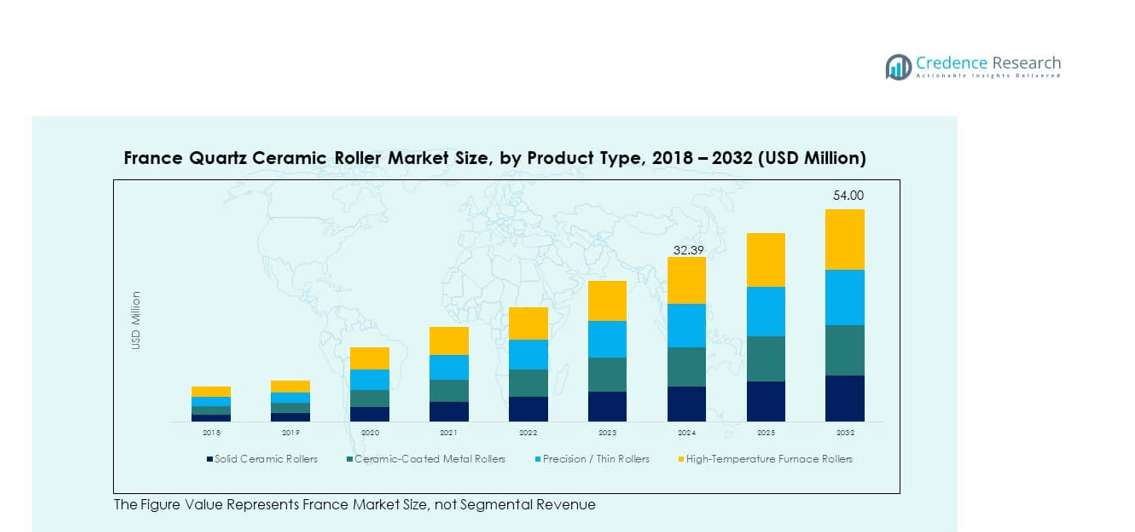

The France Quartz Ceramic Roller Market size was valued at USD 23.13 million in 2018, increased to USD 32.39 million in 2024, and is anticipated to reach USD 54.00 million by 2032, growing at a CAGR of 6.60% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| France Quartz Ceramic Roller Market Size 2024 |

USD 32.39 million |

| France Quartz Ceramic Roller Market, CAGR |

6.60% |

| France Quartz Ceramic Roller Market Size 2032 |

USD 54.00 million |

The France Quartz Ceramic Roller Market is driven by rising demand from the glass, semiconductor, and metallurgical industries. Manufacturers are focusing on improving heat resistance, dimensional stability, and surface smoothness to support precision glass processing. Growing investments in high-temperature furnace systems, alongside advancements in material purity and process automation, are accelerating market adoption. The shift toward energy-efficient industrial processes and the replacement of metal rollers with quartz-based alternatives further strengthen market expansion across industrial sectors.

Regionally, northern and central France lead the market due to the concentration of advanced manufacturing facilities and research institutions. Regions with strong glass and semiconductor production clusters are driving steady demand for high-performance rollers. Emerging areas in southern France are gaining attention for new production investments and industrial modernization initiatives. The market continues to grow due to expanding technological infrastructure and strong export capabilities within Europe.

Market Insights:

- The France Quartz Ceramic Roller Market was valued at USD 23.13 million in 2018, increased to USD 32.39 million in 2024, and is projected to reach USD 54.00 million by 2032, expanding at a CAGR of 6.60% during the forecast period.

- Northern France held the largest share at 36% in 2024, driven by its strong glass manufacturing and advanced industrial infrastructure. Central France followed with 31%, supported by semiconductor and electronics production, while Southern France accounted for 23%, backed by industrial modernization.

- Southern France is identified as the fastest-growing region, benefiting from infrastructure investments, expanding kiln equipment industries, and supportive regional policies enhancing local manufacturing capability.

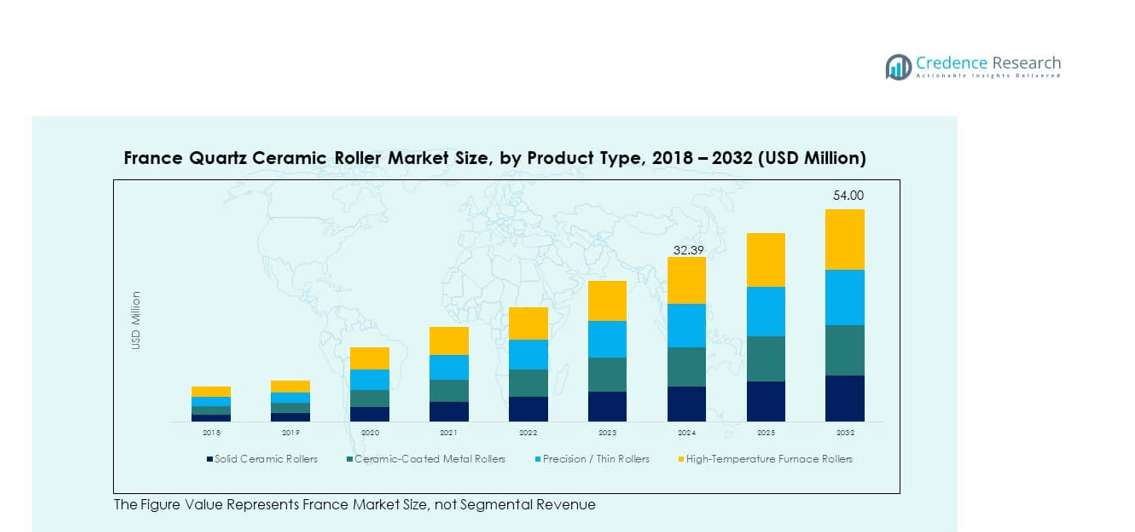

- The Solid Ceramic Rollers segment accounted for approximately 34% of the total market in 2024, maintaining dominance due to its high heat resistance and reliability in glass and metallurgy applications.

- The High-Temperature Furnace Rollers segment captured nearly 27% share, showing strong growth potential supported by rising use in continuous furnaces and high-efficiency processing systems.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Growing Demand for High-Performance Materials in Industrial Manufacturing

The France Quartz Ceramic Roller Market is expanding due to strong demand from the glass, semiconductor, and metallurgy industries. Industries rely on quartz rollers for their thermal stability and chemical resistance under extreme temperatures. Manufacturers are prioritizing durability and precision in production lines. Increased automation across glass and electronics manufacturing supports higher roller adoption. The material’s superior heat tolerance reduces downtime and improves energy efficiency. Companies focus on quality assurance to meet export standards. Rising industrial investments across France further stimulate product utilization.

- For instance, Saint-Gobain Advanced Ceramic Composites manufactures high-performance quartz fibers known as Quartzel®, which are engineered for high-temperature applications requiring thermal stability and chemical inertness. Some of Saint-Gobain’s advanced ceramic products, like oxide CMC materials, can also withstand temperatures over 1200°C.

Advancements in Material Engineering and Manufacturing Technologies

Continuous improvements in ceramic composition and fabrication techniques drive efficiency gains. French manufacturers invest in advanced sintering and surface finishing methods for better roller performance. The integration of automation ensures uniform quality and dimensional accuracy. These innovations reduce defects and increase production consistency in high-temperature processes. The France Quartz Ceramic Roller Market benefits from strong R&D capabilities supporting industrial modernization. Local companies collaborate with research institutions to develop low-porosity and high-durability rollers. The adoption of energy-efficient kilns enhances competitiveness in the regional market.

- For instance, Vesuvius France S.A. utilizes robotics in its manufacturing processes to improve safety and repeatability. The company has implemented automated solutions, such as the Tundish Dry-Vibratable Robot, which automates the layering of working lining in a high-temperature and dusty environment.

Expanding Glass and Semiconductor Production Base Across France

The rapid growth of flat glass and semiconductor sectors drives market demand. Quartz ceramic rollers are essential in float glass production and wafer processing. Manufacturers prefer quartz due to its purity and temperature resistance. The market benefits from France’s growing investments in electronic component fabrication. Expansions by domestic and European glass producers also strengthen the supply chain. The France Quartz Ceramic Roller Market gains momentum from advanced furnace upgrades. High precision and low contamination requirements make quartz the preferred choice for modern facilities.

Rising Focus on Energy Efficiency and Sustainable Industrial Operations

Industrial users emphasize sustainability through material efficiency and heat management. Quartz rollers support lower maintenance needs, cutting operational energy consumption. Their long service life reduces replacement frequency and material waste. Government initiatives promoting cleaner production enhance adoption in multiple sectors. The France Quartz Ceramic Roller Market aligns with national goals for carbon reduction and industrial innovation. Manufacturers focus on eco-friendly production lines to reduce emissions. This shift strengthens France’s role in sustainable material technology development.

Market Trends:

Integration of Smart Manufacturing and Process Automation Technologies

Automation trends transform roller production and usage in industrial plants. Smart monitoring systems track temperature, wear, and surface conditions in real time. The France Quartz Ceramic Roller Market benefits from predictive maintenance tools that enhance performance reliability. Digital process control allows uniform heating and cooling cycles. Integration with Industry 4.0 improves operational consistency and resource efficiency. Manufacturers deploy advanced control software to optimize production throughput. Automation also helps reduce manual errors in roller alignment and replacement.

Increased Adoption of Quartz Rollers in Specialty and High-Precision Applications

Growing demand for precision-based products supports wider roller applications. Semiconductor, solar, and optics industries require high-purity rollers with minimal contamination. The France Quartz Ceramic Roller Market witnesses greater use in cleanroom-grade processes. These applications need stable thermal properties and surface smoothness. Advanced quartz rollers ensure consistent temperature distribution in delicate production environments. Manufacturers develop customized solutions to meet strict industry tolerances. Rising demand for specialty glass and coatings expands market diversity.

- For instance, Saint-Gobain engineered rollers with surface smoothness below 0.01 μm Ra, certified for ISO Class 5 cleanroom use in solar and semiconductor manufacturing.

Emergence of Collaborative Research and Industrial Partnerships in France

Collaborations between academic research centers and manufacturing companies enhance innovation. R&D partnerships focus on creating high-performance composite materials. The France Quartz Ceramic Roller Market benefits from shared expertise in nanostructure development and surface optimization. Joint programs support testing of new thermal treatment methods. Cross-sector cooperation improves scalability of novel ceramic designs. Government-supported projects encourage commercialization of advanced roller materials. These alliances reinforce France’s leadership in industrial ceramic innovation.

Shift Toward Sustainable and Circular Production Practices

Manufacturers adopt eco-friendly practices to meet environmental regulations. Recyclable quartz materials and waste heat recovery systems gain popularity. The France Quartz Ceramic Roller Market aligns with sustainability-focused manufacturing models. Producers implement life-cycle assessment methods to minimize resource use. Adoption of renewable energy sources in factories supports greener production. Demand grows for products with lower carbon footprints and longer service life. Sustainability certifications become critical for brand differentiation in the market.

Market Challenges Analysis:

High Production Costs and Complex Manufacturing Processes

The production of quartz ceramic rollers requires specialized raw materials and advanced equipment. High purity standards increase overall production expenses. The France Quartz Ceramic Roller Market faces cost pressure from imported alternatives with lower pricing. Complex sintering processes and stringent quality control add operational overhead. Limited domestic suppliers of high-grade quartz impact scalability. Small and medium manufacturers struggle with high capital requirements. Maintaining consistent quality while reducing costs remains a persistent challenge. Industry players focus on technological upgrades to improve cost efficiency and production throughput.

Supply Chain Constraints and Dependence on Limited Raw Material Sources

Limited global suppliers of premium quartz materials affect supply stability. The France Quartz Ceramic Roller Market experiences fluctuations in lead times and pricing due to raw material shortages. Trade restrictions and transportation costs further disrupt procurement cycles. Dependence on imports from Asia and North America increases vulnerability to geopolitical risks. Local manufacturers face difficulties maintaining continuous production during supply disruptions. Variations in material quality impact product performance consistency. Companies seek to diversify sourcing strategies and strengthen domestic supply chains through strategic partnerships.

Market Opportunities:

Growing Investments in Advanced Industrial Infrastructure and Automation Systems

France’s expanding industrial base creates new opportunities for quartz roller adoption. Automation upgrades in glass and electronics plants raise demand for precision rollers. The France Quartz Ceramic Roller Market benefits from government incentives supporting technological modernization. Advanced furnace installations increase the requirement for high-temperature rollers. Companies supplying to automated production lines can secure long-term contracts. Enhanced domestic production reduces import reliance and strengthens market resilience. The shift toward industrial efficiency opens lucrative opportunities for local manufacturers.

Expansion into Emerging High-Tech and Export-Oriented Industries

Emerging applications in semiconductors, photovoltaics, and specialty coatings expand revenue potential. The France Quartz Ceramic Roller Market benefits from increasing international collaborations and export opportunities. French manufacturers can leverage expertise in high-purity ceramics to serve global clients. Investment in innovation and sustainability enhances competitiveness abroad. The growing focus on advanced materials research strengthens France’s export capacity. These developments position the country as a key supplier in the European and global industrial ceramics market.

Market Segmentation Analysis:

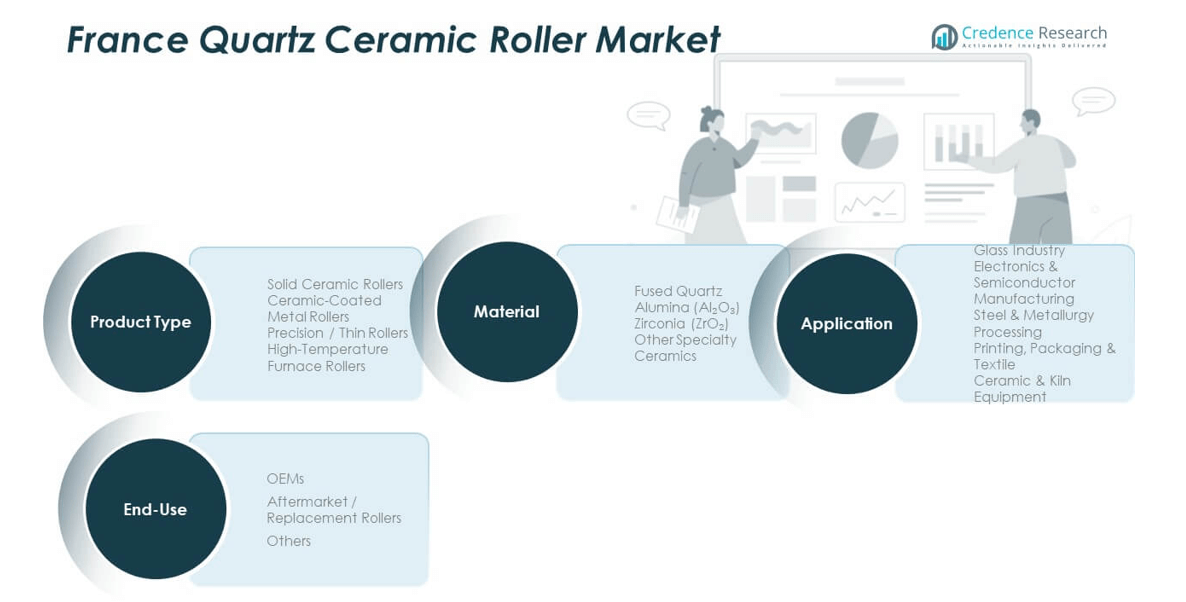

By Product Type

The France Quartz Ceramic Roller Market is segmented into Solid Ceramic Rollers, Ceramic-Coated Metal Rollers, Precision/Thin Rollers, and High-Temperature Furnace Rollers. Solid Ceramic Rollers dominate due to their durability and high thermal resistance in glass and steel applications. Ceramic-Coated Metal Rollers provide enhanced surface protection and longer service life in medium-temperature operations. Precision Rollers gain traction in semiconductor and optical production, where dimensional accuracy is critical. High-Temperature Furnace Rollers are used in continuous furnaces for their exceptional heat tolerance and structural stability.

- For instance, Vesuvius Zyarock® fused silica furnace rollers demonstrated heat tolerance of up to 1100°C in applications such as steel annealing, though they are typically used at temperatures up to 900°C in the glass industry. No publicly available data from Vesuvius mentions a specific test involving 750 cycles at 1350°C.

By Application

Key application areas include the Glass Industry, Electronics & Semiconductor Manufacturing, Steel & Metallurgy Processing, Printing, Packaging & Textile, and Ceramic & Kiln Equipment. The glass sector leads due to consistent demand from float glass and specialty glass production. Electronics manufacturing increasingly adopts quartz rollers for contamination-free thermal processes. Steel and metallurgical operations rely on them for high-temperature stability and wear resistance.

- For instance, Imerys offers high-purity quartz products, including quartz rollers used in continuous glass operations, which are known for their chemical inertness and high-temperature stability. These properties are essential for meeting the stringent requirements of the electronics and specialty glass sectors.

By End-Use

OEMs hold a major share owing to continuous industrial integration and advanced manufacturing lines. The Aftermarket segment grows steadily, driven by roller replacements and equipment refurbishments. Other users include research institutions and small-scale processing units adopting specialized ceramic rollers for testing and niche applications.

By Material

Fused Quartz dominates due to its purity and exceptional heat endurance. Alumina (Al₂O₃) and Zirconia (ZrO₂) offer mechanical strength and wear resistance for heavy-duty processes. Other Specialty Ceramics cater to customized industrial needs focused on energy efficiency and performance optimization.

Segmentation:

By Product Type:

- Solid Ceramic Rollers

- Ceramic-Coated Metal Rollers

- Precision / Thin Rollers

- High-Temperature Furnace Rollers

By Application:

- Glass Industry

- Electronics & Semiconductor Manufacturing

- Steel & Metallurgy Processing

- Printing, Packaging & Textile

- Ceramic & Kiln Equipment

By End-Use:

- OEMs

- Aftermarket / Replacement Rollers

- Others

By Material:

- Fused Quartz

- Alumina (Al₂O₃)

- Zirconia (ZrO₂)

- Other Specialty Ceramics

Regional Analysis:

Northern France

Northern France leads the France Quartz Ceramic Roller Market, accounting for 36% of the total share in 2024. The region benefits from its strong concentration of glass manufacturing and industrial furnace facilities. It hosts several advanced production units that utilize high-temperature rollers for precision glass and metallurgical processing. The presence of key manufacturing clusters and well-developed logistics infrastructure strengthens industrial integration. Government-backed energy-efficiency programs encourage companies to adopt durable quartz-based rollers. Continuous technological upgrades and export-oriented production make the region a vital hub for industrial ceramics.

Central France

Central France holds 31% of the market share and plays a key role in supporting the semiconductor and electronics industries. The region is home to several innovation-driven companies focused on high-performance ceramics and advanced material processing. Its industrial ecosystem benefits from research partnerships and automation in production lines. Demand for quartz rollers continues to grow due to high adoption in cleanroom environments and temperature-controlled facilities. Central France also emphasizes domestic sourcing to reduce dependency on imported rollers. It remains a strong contributor to national output through innovation and skilled manufacturing capabilities.

Southern France

Southern France captures 23% of the market share and shows steady growth driven by rising investments in industrial modernization. The region is expanding its role in specialty ceramics and kiln equipment production. Emerging glass and metal processing industries drive consistent demand for heat-resistant rollers. It attracts both domestic and foreign investments due to supportive regional industrial policies. The France Quartz Ceramic Roller Market benefits from infrastructure development and new production sites in the south. Strategic partnerships with European manufacturers are helping southern France position itself as a growing hub for high-performance industrial ceramics.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Imerys

- Saint-Gobain Advanced Ceramic Composites

- Vesuvius France S.A.

- ABRASIENNE

- AGP Abrasifs Grains et Poudres

- Asahi Diamond Industrial SAS

Competitive Analysis:

The France Quartz Ceramic Roller Market features a moderately consolidated competitive landscape with a mix of global and domestic manufacturers. Key players include Imerys, Saint-Gobain Advanced Ceramic Composites, Vesuvius France S.A., ABRASIENNE, AGP Abrasifs Grains et Poudres, and Asahi Diamond Industrial SAS. These companies emphasize innovation, thermal stability, and material efficiency to maintain their competitive edge. It focuses on expanding production capacity, enhancing product quality, and developing eco-friendly materials. Strong R&D capabilities and partnerships with industrial clients help sustain leadership positions. The market’s competition is driven by precision engineering, cost optimization, and long-term supply agreements.

Recent Developments:

- In October 2025, Saint-Gobain Advanced Ceramic Composites initiated a new phase in its business, focusing on advancing the market for quartz and oxide ceramic fibers by expanding production capacity and engaging in multi-year R&D programs, including partnerships funded by France and the EU to supply advanced ceramics for aerospace and industrial sectors. The company has also formalized its transformation with a country-focused organization, aiming to accelerate growth through localized solutions as of July 2025, according to recent press releases from the board meeting held in June 2025.

- In April 2025, Vesuvius France S.A. completed the acquisition of PiroMET, a Turkish specialist in refractory solutions, strengthening its position and expanding its expertise with enhanced robotics and gunning technology, furthering the innovation portfolio and service capabilities for customers across Europe and the Middle East.

Report Coverage:

The research report offers an in-depth analysis based on Product Type, Application, End-Use, and Material. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Rising automation in glass and semiconductor plants will increase demand for high-precision rollers.

- Sustainable manufacturing practices will shape product innovation and material selection.

- Companies will focus on low-maintenance, energy-efficient roller systems to reduce operational costs.

- Strategic partnerships will expand domestic production and reduce reliance on imports.

- Technological advances in ceramic coating will enhance wear resistance and lifespan.

- The semiconductor and optics sectors will emerge as key growth contributors.

- Export potential will rise with France’s growing reputation in advanced ceramics.

- Market players will strengthen aftersales support and customization for niche industries.

- R&D initiatives will target hybrid materials to improve mechanical and thermal performance.

- Government support for industrial modernization will create favorable conditions for sustained expansion.