Market Overview

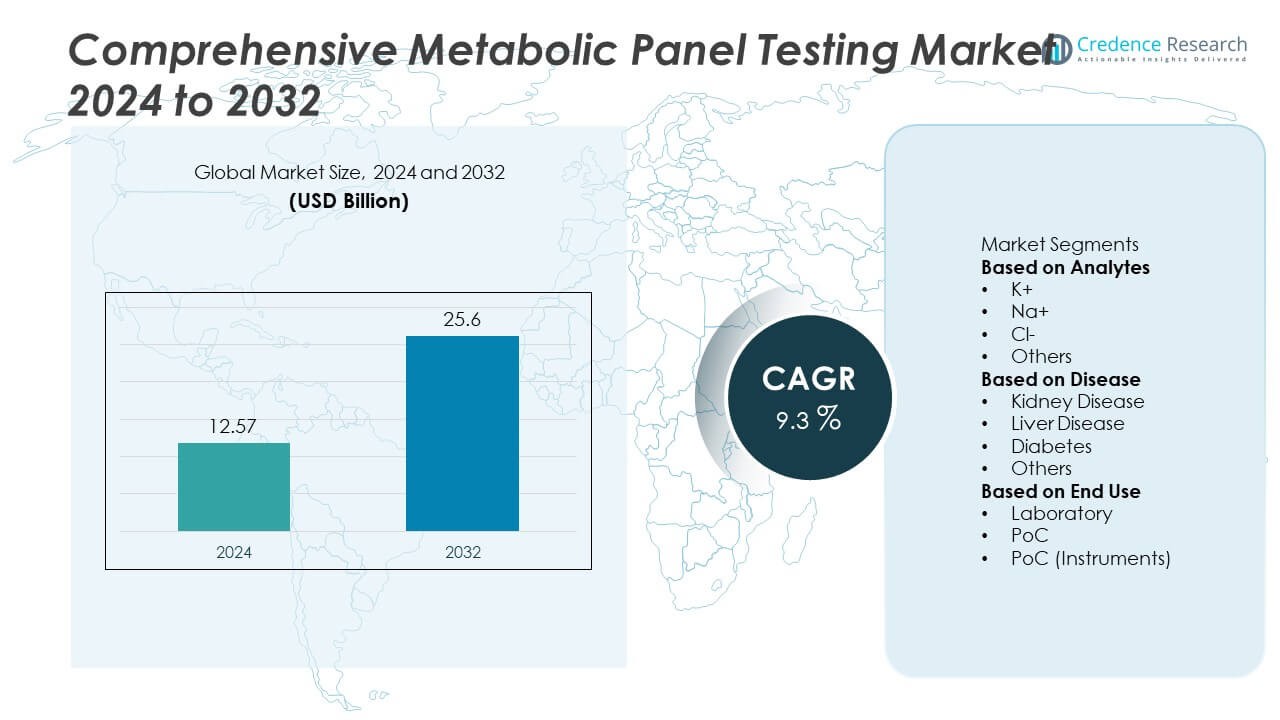

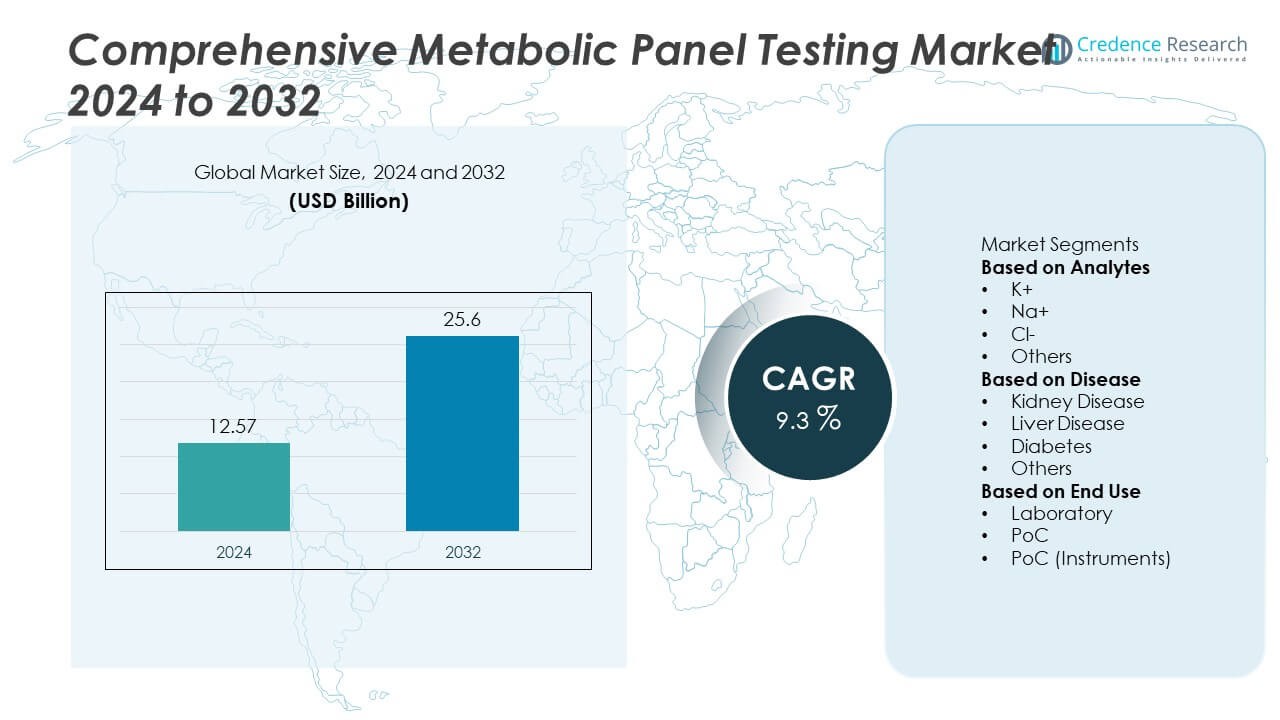

The Comprehensive Metabolic Panel (CMP) Testing Market was valued at USD 12.57 billion in 2024 and is projected to reach USD 25.6 billion by 2032, growing at a CAGR of 9.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Comprehensive Metabolic Panel Testing Market Size 2024 |

USD 12.57 Billion |

| Comprehensive Metabolic Panel Testing Market, CAGR |

9.3% |

| Comprehensive Metabolic Panel Testing Market Size 2032 |

USD 25.6 Billion |

The Comprehensive Metabolic Panel Testing Market is led by major players such as SYNLAB International GmbH, Quest Diagnostics, Genoptix Inc., Nova Medical, Sonic Healthcare, Abbott, ARUP Laboratories, Unipath, Laboratory Corporation of America Holdings Limited, and Eurofins Scientific. These companies dominate through extensive laboratory networks, automated testing platforms, and advanced biochemical analyzers that ensure high accuracy and efficiency. North America emerged as the leading region in 2024, holding a 38% market share, supported by strong healthcare infrastructure and high chronic disease prevalence. Asia-Pacific followed with a 31% share, driven by rapid healthcare expansion, growing awareness of preventive diagnostics, and technological advancements in laboratory automation.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Comprehensive Metabolic Panel Testing Market was valued at USD 12.57 billion in 2024 and is projected to reach USD 25.6 billion by 2032, growing at a CAGR of 9.3%.

- Rising prevalence of chronic diseases such as diabetes, kidney, and liver disorders is driving the demand for regular metabolic monitoring and preventive diagnostics.

- Technological advancements in automated chemistry analyzers and AI-based diagnostic platforms are enhancing test accuracy, efficiency, and reporting speed.

- Key players including Abbott, Quest Diagnostics, SYNLAB International GmbH, and Sonic Healthcare are focusing on laboratory automation, regional expansion, and digital diagnostic integration to maintain competitiveness.

- North America led the market with a 38% share, followed by Asia-Pacific at 31% and Europe at 29%; by disease, the diabetes segment dominated with a 39% share, supported by growing adoption of preventive health testing worldwide.

Market Segmentation Analysis:

By Analytes

The K+ (potassium) segment dominated the Comprehensive Metabolic Panel Testing Market in 2024, holding a 34% market share. This dominance is attributed to the critical role of potassium measurement in assessing kidney function, electrolyte balance, and cardiovascular health. Elevated demand stems from increasing cases of chronic kidney disease and hypertension, where potassium levels are key diagnostic indicators. Advancements in automated analyzers have enhanced accuracy and testing speed, improving diagnostic efficiency. The growing emphasis on routine health checkups and metabolic disorder management continues to support this segment’s strong growth trajectory.

- For instance, Abbott Laboratories introduced the Alinity c clinical chemistry analyzer with a throughput capacity of 1,200 tests per hour, enabling precise electrolyte and potassium analysis. The system integrates ion-selective electrode (ISE) technology to ensure potassium detection accuracy within ±0.1 mmol/L, enhancing clinical decision-making in high-volume laboratories.

By Disease

The diabetes segment accounted for the largest share of 39% in the Comprehensive Metabolic Panel Testing Market in 2024. Rising global diabetes prevalence has increased the need for regular glucose, kidney, and liver function testing. CMP tests help monitor organ performance and detect metabolic complications associated with long-term diabetes management. Widespread adoption of diagnostic screening programs and government-led awareness campaigns are fueling demand. Increasing integration of CMP testing in diabetic care protocols supports consistent growth, particularly across primary healthcare and outpatient diagnostic centers.

- For instance, Quest Diagnostics provides comprehensive diagnostic testing services, including the Comprehensive Metabolic Panel and HbA1c tests, and utilizes an extensive, automated lab network to support diabetic monitoring.

By End Use

The laboratory segment led the Comprehensive Metabolic Panel Testing Market in 2024 with a 61% share. Clinical laboratories dominate due to their advanced testing infrastructure, automation capabilities, and higher accuracy compared to point-of-care settings. The rising volume of diagnostic tests driven by chronic disease monitoring and preventive health screenings has strengthened laboratory demand. Centralized labs benefit from economies of scale, handling large test volumes efficiently. Growing collaboration between hospitals and diagnostic chains for metabolic screening and chronic disease management continues to drive growth in the laboratory-based CMP testing segment.

Key Growth Drivers

Rising Prevalence of Chronic Diseases

The growing incidence of diabetes, liver disorders, and kidney diseases is a major driver of the Comprehensive Metabolic Panel (CMP) Testing Market. These conditions require frequent monitoring of metabolic and biochemical parameters to guide treatment decisions. Increasing patient awareness and early disease detection initiatives are boosting the adoption of CMP tests in both developed and developing regions. The expansion of diagnostic infrastructure and integration of metabolic testing in preventive healthcare programs further support consistent market growth globally.

- For instance, Sonic Healthcare operates over 130 laboratories across eight countries and processes more than 120 million pathology tests annually, including metabolic and liver function panels. The company’s advanced diagnostic facilities in Australia and Europe provide automated analysis for chronic disease monitoring, supporting early detection and long-term disease management.

Technological Advancements in Diagnostic Testing

Advancements in automated analyzers, digital pathology, and clinical chemistry instruments have improved test precision and speed. Modern CMP testing systems enable high-throughput processing, reducing human error and ensuring faster reporting. Integration with digital health platforms and electronic health records supports better clinical data sharing and patient management. These technological improvements enhance workflow efficiency, making CMP testing more accessible and reliable across hospitals, laboratories, and diagnostic centers.

- For instance, the Beckman Coulter AU5800 series is capable of processing thousands of tests per hour for large laboratories. This system, which can be used for comprehensive metabolic panel (CMP) testing, integrates with clinical information systems for efficient data management.

Growing Focus on Preventive and Personalized Healthcare

The shift toward preventive diagnostics and personalized medicine is accelerating CMP testing adoption. Regular metabolic screening helps detect early abnormalities and prevents chronic disease progression. Personalized healthcare relies on biochemical profiling, with CMP serving as a key diagnostic tool for ongoing health evaluation. Growing participation in wellness programs, corporate health initiatives, and insurance-driven screening campaigns continues to strengthen demand for CMP testing worldwide.

Key Trends & Opportunities

Integration of AI and Data Analytics in Diagnostics

Artificial intelligence and data analytics are transforming the CMP testing landscape. AI tools enhance interpretation accuracy, while predictive analytics allow early identification of disease risks and treatment outcomes. Integration with laboratory information systems ensures efficient workflow and data tracking. The rise of data-driven diagnostics is helping clinicians make faster, more informed decisions, offering new opportunities for innovation and precision in metabolic testing.

- For instance, Eurofins Scientific, a global leader in bioanalytical testing, uses AI and machine learning tools, including its DiscoveryAI platform, to accelerate drug discovery, analyze large proprietary datasets, and perform predictive analytics.

Expansion of Point-of-Care Testing Solutions

The adoption of point-of-care (PoC) devices is rapidly increasing in the CMP testing market. Portable analyzers provide quick, reliable results, making them ideal for emergency departments, remote clinics, and home healthcare. These systems improve accessibility in resource-limited regions and reduce the dependence on centralized laboratories. The growing emphasis on decentralized healthcare delivery and real-time diagnostics continues to create new market opportunities for PoC testing manufacturers.

- For instance, Nova Biomedical developed the Stat Profile Prime Plus analyzer, capable of performing 22 critical tests, including electrolytes, glucose, and renal markers, with results available in about 90 seconds.

Key Challenges

High Cost of Advanced Testing Equipment

The high setup and maintenance costs of advanced CMP analyzers remain a challenge for small and mid-sized laboratories. Upfront investments, calibration expenses, and reagent costs increase operational burdens, limiting adoption in developing regions. Budget constraints among healthcare facilities and reimbursement limitations further hinder access to advanced diagnostic infrastructure, especially in cost-sensitive markets.

Shortage of Skilled Laboratory Professionals

The expanding demand for CMP testing highlights the shortage of skilled laboratory technicians capable of operating advanced diagnostic systems. Accurate interpretation and quality assurance require technical expertise that is limited in many healthcare settings. This workforce gap impacts testing accuracy and efficiency. Addressing this challenge requires training programs, workforce development initiatives, and increased automation to maintain testing standards globally.

Regional Analysis

North America

North America held a 38% market share in the Comprehensive Metabolic Panel Testing Market in 2024. The region’s leadership is driven by high prevalence of chronic diseases such as diabetes, cardiovascular disorders, and liver ailments. Strong healthcare infrastructure, widespread diagnostic awareness, and early adoption of automated chemistry analyzers support growth. The United States dominates regional demand due to advanced laboratory networks and strong insurance coverage for diagnostic testing. Continuous technological innovation and integration of AI-based diagnostic tools are further strengthening the region’s market position in preventive and personalized healthcare diagnostics.

Europe

Europe accounted for a 29% market share in the Comprehensive Metabolic Panel Testing Market in 2024. The region’s growth is supported by expanding diagnostic capabilities and increasing focus on preventive care. Countries such as Germany, the United Kingdom, and France are leading adopters of automated laboratory systems and digital testing solutions. Rising aging population and government-funded healthcare initiatives continue to boost test volumes. Strong regulatory frameworks promoting early disease screening and standardized laboratory practices are fostering market expansion across Europe, particularly in public health institutions and large diagnostic chains.

Asia-Pacific

Asia-Pacific dominated the Comprehensive Metabolic Panel Testing Market in 2024 with a 31% market share. Rapid urbanization, growing healthcare spending, and increasing awareness of chronic disease management are driving demand across China, India, and Japan. Expanding diagnostic infrastructure and the adoption of advanced chemistry analyzers in hospitals and laboratories contribute significantly to growth. Governments in developing economies are promoting early screening programs and rural healthcare access. The rising burden of lifestyle-related diseases and increasing investments by global diagnostic companies continue to strengthen Asia-Pacific’s position as a key growth hub for metabolic testing.

Latin America

Latin America captured a 4% market share in the Comprehensive Metabolic Panel Testing Market in 2024. The region is witnessing steady growth due to rising healthcare modernization and expanding private diagnostic laboratories. Brazil and Mexico lead demand, supported by growing incidences of diabetes and kidney disorders. Increasing healthcare access and government investments in public diagnostic infrastructure are improving testing capacity. Strategic collaborations between global manufacturers and local providers are helping to bridge diagnostic gaps. Growing focus on preventive health screening and affordable metabolic testing is further supporting the region’s market growth.

Middle East & Africa

The Middle East & Africa region held a 3% market share in the Comprehensive Metabolic Panel Testing Market in 2024. Market growth is driven by expanding healthcare infrastructure, urbanization, and rising cases of metabolic and chronic diseases. The Gulf Cooperation Council (GCC) countries, particularly Saudi Arabia and the United Arab Emirates, are investing in advanced laboratory facilities and digital health initiatives. In Africa, increasing awareness of preventive diagnostics and growing private healthcare investments are improving test accessibility. Regional governments’ focus on enhancing diagnostic capabilities continues to support gradual market development across the region.

Market Segmentations:

By Analytes

By Disease

- Kidney Disease

- Liver Disease

- Diabetes

- Others

By End Use

- Laboratory

- PoC

- PoC (Instruments)

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Comprehensive Metabolic Panel Testing Market includes key players such as SYNLAB International GmbH, Quest Diagnostics, Genoptix Inc., Nova Medical, Sonic Healthcare, Abbott, ARUP Laboratories, Unipath, Laboratory Corporation of America Holdings Limited, and Eurofins Scientific. These companies lead the market through advanced diagnostic infrastructure, extensive laboratory networks, and a strong focus on automation and accuracy. Global players are expanding their testing portfolios by integrating digital platforms and AI-based analysis to enhance efficiency and result interpretation. Strategic collaborations with hospitals, clinics, and healthcare providers are improving accessibility to metabolic testing services. Companies are also investing in regional expansion and laboratory automation to meet the growing demand for preventive diagnostics. Rising emphasis on precision medicine and large-scale disease screening programs is further intensifying competition, driving continuous innovation in high-throughput chemistry analyzers and automated metabolic testing solutions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In July 2025, Laboratory Corporation of America (Labcorp) raised its 2025 profit guidance on stronger diagnostic testing demand.

- In March 2025, SYNLAB completed the sale of its Spanish clinical diagnostics operations to Eurofins.

- In February 2025, ARUP Laboratories partnered with Tasso to offer decentralized biomarker testing for clinical research.

- In October 2024, SYNLAB International GmbH agreed to sell its Spanish clinical diagnostics business to Eurofins Scientific.

Report Coverage

The research report offers an in-depth analysis based on Analytes, Disease, End Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will grow steadily with rising demand for preventive and routine health testing.

- Automation and AI integration will enhance accuracy and reduce diagnostic turnaround times.

- Point-of-care metabolic testing will gain traction in decentralized and remote healthcare settings.

- Laboratories will expand digital connectivity for faster data sharing and result interpretation.

- Chronic disease management programs will continue to drive frequent metabolic monitoring.

- Asia-Pacific will witness the fastest growth due to expanding healthcare access and infrastructure.

- Companies will focus on developing cost-efficient and high-throughput analyzers for large-scale testing.

- Personalized healthcare and wellness screening will increase the use of metabolic panels.

- Strategic collaborations between hospitals and diagnostic laboratories will strengthen testing availability.

- Regulatory emphasis on quality assurance and early disease detection will further support market expansion.