Market Overview

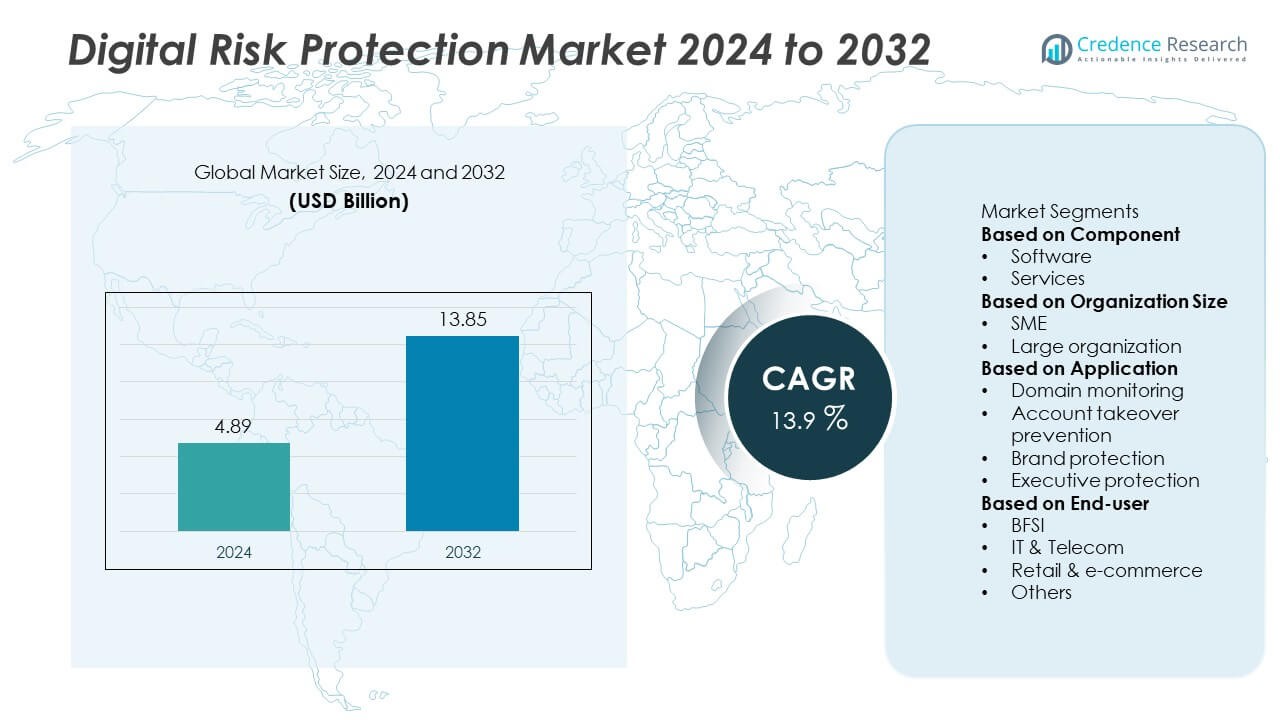

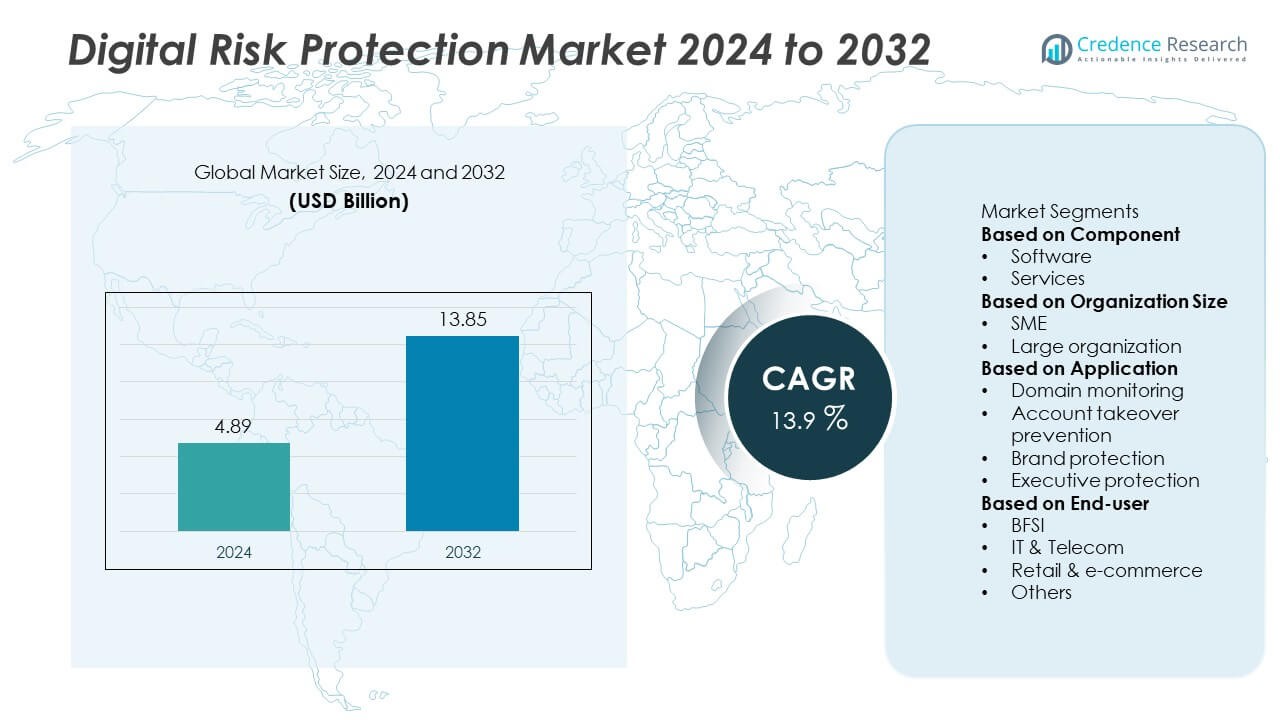

The Digital Risk Protection (DRP) Market was valued at USD 4.89 billion in 2024 and is projected to reach USD 13.85 billion by 2032, growing at a CAGR of 13.9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Digital Risk Protection Market Size 2024 |

USD 4.89 Billion |

| Digital Risk Protection Market, CAGR |

13.9% |

| Aerial Imaging Market Size 2032 |

USD 13.85 Billion |

The digital risk protection market is led by key players such as ZeroFOX, Broadcom (Symantec), ReliaQuest (Digital Shadows), Fortinet, BlueVoyant, Splunk Inc., Rapid7, Proofpoint, Palo Alto Networks, and Microsoft (RiskIQ). These companies dominate through AI-driven threat intelligence, brand protection, and real-time monitoring solutions that secure digital ecosystems across industries. North America led the market with a 38% share in 2024, supported by strong cybersecurity infrastructure and regulatory compliance standards. Europe followed with 27%, driven by GDPR enforcement and enterprise digitization, while Asia-Pacific, holding 30%, emerged as the fastest-growing region due to rapid cloud adoption and rising cyberattack incidents.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The digital risk protection market was valued at USD 4.89 billion in 2024 and is projected to reach USD 13.85 billion by 2032, growing at a CAGR of 13.9% during the forecast period.

- Market growth is driven by the rise in cyber threats, phishing attacks, and data breaches, pushing organizations to adopt advanced threat intelligence and digital monitoring solutions.

- Key trends include the integration of AI, automation, and cloud-based DRP platforms to enhance real-time threat detection and scalability across enterprises.

- The market is competitive with major players such as ZeroFOX, Fortinet, Proofpoint, and Microsoft (RiskIQ) focusing on expanding product portfolios, strategic collaborations, and regional partnerships.

- North America led with a 38% share in 2024, followed by Europe at 27% and Asia-Pacific at 30%, while the software segment dominated with a 63% share due to increasing demand for automated risk intelligence platforms.

Market Segmentation Analysis:

By Component

The software segment dominated the digital risk protection market in 2024, holding a 63% share. Its leadership is driven by growing demand for automated threat intelligence and digital footprint monitoring tools. Software platforms enable real-time detection of data leaks, phishing domains, and impersonation attempts across web and social channels. Enterprises are increasingly deploying integrated DRP software for faster response and advanced analytics. The expansion of cloud-based platforms and AI-powered monitoring systems continues to enhance adoption, as organizations seek scalable, continuous protection against evolving external cyber risks.

- For instance, ZeroFOX enhanced its External Cyber Intelligence Platform with automated takedown capabilities, performing millions of disruption actions annually through automated systems. This includes successfully taking down hundreds of thousands of malicious URLs and domains every year, often faster than manual detection allows.

By Organization Size

Large organizations accounted for a 68% share of the digital risk protection market in 2024, driven by their extensive digital ecosystems and high exposure to cyber threats. Enterprises across BFSI, IT, and telecom sectors invest heavily in advanced DRP solutions to safeguard sensitive data and brand integrity. These organizations prioritize real-time monitoring, incident response, and compliance management. The rising complexity of attacks targeting global corporations has accelerated the adoption of multi-layered protection platforms. Meanwhile, SMEs are rapidly increasing investments in affordable, cloud-based DRP tools to strengthen online security.

- For instance, ReliaQuest’s GreyMatter DRP Platform, incorporating the capabilities of its acquisition Digital Shadows, offers continuous dark web surveillance for financial institutions, monitoring for exposed credentials and corporate domains.

By Application

The brand protection segment led the market with a 41% share in 2024, fueled by increasing brand impersonation, counterfeiting, and phishing activities. Companies across retail, finance, and e-commerce sectors are using DRP solutions to detect fake domains, fraudulent accounts, and trademark misuse. Protecting brand reputation and customer trust has become a strategic priority in digital ecosystems. The integration of AI and machine learning for early threat detection enhances response efficiency. Additionally, the rising use of domain monitoring and account takeover prevention tools complements the growing adoption of comprehensive digital brand protection strategies.

Key Growth Drivers

Rising Cyber Threats and Data Breaches

The increasing frequency of cyberattacks, phishing campaigns, and data breaches is a primary driver of the digital risk protection market. Enterprises face escalating risks across cloud, social media, and dark web channels. DRP solutions help organizations monitor, detect, and mitigate external threats in real time, reducing data exposure and financial losses. As threat actors become more sophisticated, businesses are prioritizing proactive digital risk intelligence and automated threat monitoring tools to safeguard sensitive information and maintain operational continuity.

- For instance, Proofpoint’s 2024 State of the Phish report found that 68% of employees willingly engaged in risky actions that could expose their organization to threats, with convenience cited as the most common reason.

Growing Adoption of Cloud-Based and AI-Driven Solutions

The integration of artificial intelligence, machine learning, and cloud computing is revolutionizing digital risk protection. AI-driven platforms enable predictive threat detection and faster remediation by analyzing massive data streams from multiple sources. Cloud-based delivery enhances scalability and accessibility, making DRP solutions more cost-effective for global enterprises. This technological advancement allows businesses to strengthen digital security posture while ensuring flexibility across hybrid and remote working environments.

- For instance, Rapid7, Inc. enhanced its Command Platform and Incident Command solutions using AI-based correlation that processes trillions of security events weekly, providing automated remediation capabilities to streamline security workflows.

Regulatory Compliance and Data Protection Requirements

Strict data privacy regulations, including GDPR, CCPA, and other cybersecurity frameworks, are fueling DRP solution adoption. Organizations are mandated to protect sensitive information and demonstrate compliance through continuous monitoring. Digital risk protection platforms offer automated compliance reporting, data exposure alerts, and forensic analytics that help businesses meet evolving regulatory demands. The growing emphasis on data governance and third-party risk management further strengthens the need for comprehensive external threat visibility and risk mitigation tools.

Key Trends & Opportunities

Expansion of DRP in Small and Medium Enterprises

The growing digital presence of small and medium enterprises (SMEs) presents a major opportunity for DRP providers. SMEs are increasingly targeted by cybercriminals due to weaker security infrastructure. Affordable, cloud-based DRP solutions allow smaller organizations to access enterprise-grade threat monitoring capabilities. Vendors are offering modular and subscription-based pricing models to improve accessibility. As SMEs adopt digital transformation strategies, demand for scalable and automated external threat protection continues to rise.

- For instance, Broadcom (Symantec) leverages its Global Intelligence Network, one of the world’s largest civilian threat collection networks, which applies AI to analyze its data lake containing 11 trillion elements of telemetry to help discover and block advanced targeted attacks.

Integration of Threat Intelligence and Automation

A key trend in the market is the integration of DRP with broader threat intelligence and security orchestration systems. Automation enables faster response to incidents and reduces dependence on manual analysis. Advanced DRP platforms now combine dark web monitoring, domain protection, and account takeover prevention under unified dashboards. This integration enhances visibility across digital ecosystems and improves response efficiency. The shift toward real-time, automated digital threat intelligence strengthens resilience against sophisticated cyberattacks.

- For instance, Palo Alto Networks integrated its Cortex XSIAM and XSOAR platforms with modules that use AI and automation to analyze and correlate threat data, enabling enterprises to significantly reduce manual tasks and accelerate incident remediation.

Key Challenges

High Implementation and Maintenance Costs

The cost of deploying and maintaining digital risk protection solutions remains a major challenge, particularly for small enterprises. Advanced tools that offer AI-driven analytics and global threat monitoring require significant investment in technology and skilled personnel. Many organizations struggle to justify these expenses despite the evident security benefits. Vendors are addressing this by introducing subscription-based cloud models and modular solutions, but cost sensitivity continues to hinder adoption in developing markets.

Complexity in Managing Distributed Digital Assets

The growing digital footprint of enterprises across multiple platforms and regions creates management complexity. Tracking and securing diverse assets—including domains, social media, and third-party integrations—requires advanced coordination. Inconsistent visibility across distributed networks often leaves gaps that attackers exploit. Organizations must adopt integrated DRP systems capable of centralized monitoring and automated alerting. However, limited interoperability between existing cybersecurity tools remains a barrier, slowing comprehensive digital risk coverage.

Regional Analysis

North America

North America held a 38% share of the digital risk protection market in 2024, driven by the strong presence of cybersecurity solution providers and increasing cyberattacks targeting enterprises. The U.S. leads the region with high adoption across BFSI, IT, and government sectors. Growing regulatory compliance mandates, such as CCPA and HIPAA, are fueling investment in advanced DRP solutions. Companies are integrating AI-driven analytics for faster threat detection and automated response. Expanding cloud infrastructure and heightened focus on protecting digital brand assets continue to reinforce North America’s dominant position in the global market.

Europe

Europe accounted for a 27% share of the digital risk protection market in 2024, supported by stringent data protection regulations like GDPR and NIS2 Directive. Countries such as Germany, the U.K., and France are leading adopters of DRP solutions to mitigate phishing, identity theft, and domain spoofing. The region’s emphasis on privacy compliance and digital trust has accelerated the demand for threat intelligence platforms. Growing digital transformation among enterprises and government initiatives to strengthen cybersecurity resilience are enhancing market expansion. Continuous investments in cloud-based monitoring tools also support Europe’s steady market growth.

Asia-Pacific

Asia-Pacific dominated the market with a 30% share in 2024, driven by rapid digitization, growing e-commerce, and increasing cyber threats in China, India, and Japan. Enterprises across the region are adopting DRP solutions to safeguard brand integrity and protect sensitive data against online exploitation. The surge in social media usage and expansion of digital banking have increased vulnerability to account takeovers and phishing attacks. Government programs promoting cybersecurity awareness and investment in AI-based protection tools further strengthen regional growth. The rising focus on securing hybrid and cloud infrastructures continues to fuel demand for DRP solutions.

Middle East & Africa

The Middle East & Africa region captured a 3% share of the digital risk protection market in 2024, driven by growing digital transformation initiatives in the UAE, Saudi Arabia, and South Africa. Increasing cyber espionage and ransomware incidents across financial and government sectors are accelerating adoption. National cybersecurity frameworks and Vision 2030 initiatives are promoting the use of advanced monitoring and threat mitigation platforms. Enterprises in the region are focusing on brand protection and identity security as part of broader risk management strategies, driving gradual but consistent market expansion.

South America

South America held a 2% share of the digital risk protection market in 2024, with Brazil and Mexico leading adoption. Rising digitalization in banking, retail, and telecom sectors is increasing exposure to online threats, prompting enterprises to deploy DRP solutions. Governments are strengthening cybersecurity laws and encouraging businesses to adopt proactive threat monitoring systems. Growing awareness of digital asset protection and the emergence of local cybersecurity startups are contributing to steady growth. However, limited budgets and lack of skilled professionals continue to pose challenges for large-scale implementation across the region.

Market Segmentations:

By Component

By Organization Size

By Application

- Domain monitoring

- Account takeover prevention

- Brand protection

- Executive protection

By End-user

- BFSI

- IT & Telecom

- Retail & e-commerce

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the digital risk protection market includes major players such as ZeroFOX, Broadcom (Symantec), ReliaQuest (Digital Shadows), Fortinet, BlueVoyant, Splunk Inc., Rapid7, Proofpoint, Palo Alto Networks, and Microsoft (RiskIQ). These companies are focusing on developing advanced threat intelligence, brand protection, and domain monitoring platforms to safeguard organizations from evolving cyber threats. Strategic initiatives such as mergers, acquisitions, and partnerships are expanding their global presence and service capabilities. Leading vendors are investing heavily in AI, automation, and machine learning to enhance real-time threat detection and response efficiency. Cloud-based DRP platforms are gaining traction due to scalability and cost-effectiveness, attracting both large enterprises and SMEs. Continuous innovation in external threat intelligence, account takeover prevention, and data leak detection remains central to maintaining a competitive edge in the rapidly growing cybersecurity landscape.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- ZeroFOX

- Broadcom (Symantec)

- ReliaQuest (Digital Shadows)

- Fortinet, Inc.

- BlueVoyant

- Splunk Inc.

- Rapid7, Inc.

- Proofpoint

- Palo Alto Networks

- Microsoft (RiskIQ)

Recent Developments

- In June 2025, ZeroFOX earned multiple 2025 Comparably Awards, ranking among the top 35 leadership teams and top 25 engineering teams.

- In 2025, ZeroFOX enhanced its digital risk platform to monitor takedowns and protection across social media, domains, dark web, and executive avenues.

- In December 2024, ZeroFOX released its 2025 Threat Forecast Report, highlighting growing risks from social engineering, ransomware, and initial access brokers.

- In February 2024, Rapid7 Inc. expanded its MDR portfolio with the introduction of the Managed Digital Risk Protection (DRP) service, actively monitoring the clear, deep, and dark web for early threat signals like data leaks and phishing kits.

Report Coverage

The research report offers an in-depth analysis based on Component, Organization Size, Application, End-user and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand rapidly as cyber threats and digital fraud continue to rise globally.

- AI and machine learning will play a key role in predictive threat detection and automation.

- Cloud-based DRP solutions will dominate due to scalability and cost efficiency.

- Integration with threat intelligence and SOC platforms will enhance real-time visibility and response.

- North America will remain the largest market, supported by strong cybersecurity infrastructure.

- Asia-Pacific will record the fastest growth driven by rapid digital transformation.

- Demand from SMEs will increase as affordable subscription-based DRP models gain popularity.

- Vendors will focus on low-latency, multi-channel monitoring to improve data protection.

- Partnerships between cybersecurity firms and cloud providers will strengthen service offerings.

- Long-term growth will rely on regulatory compliance, digital trust, and automation in cyber risk management.