Market Overview

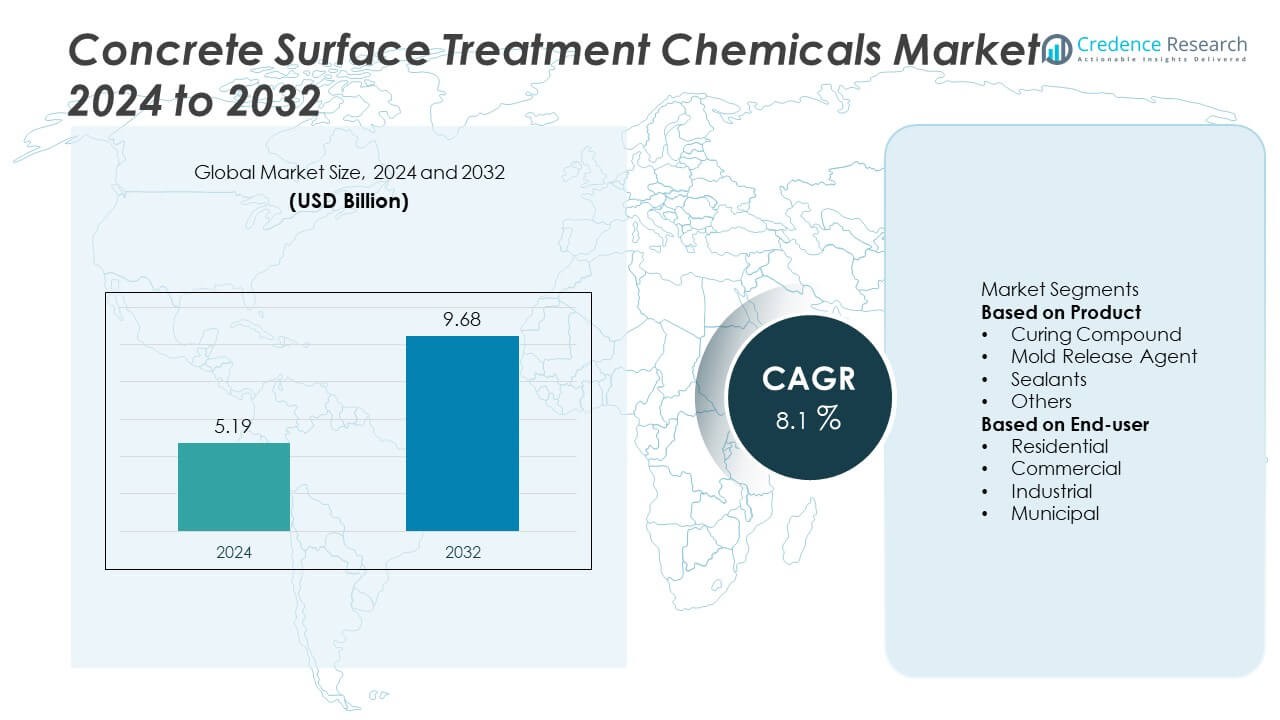

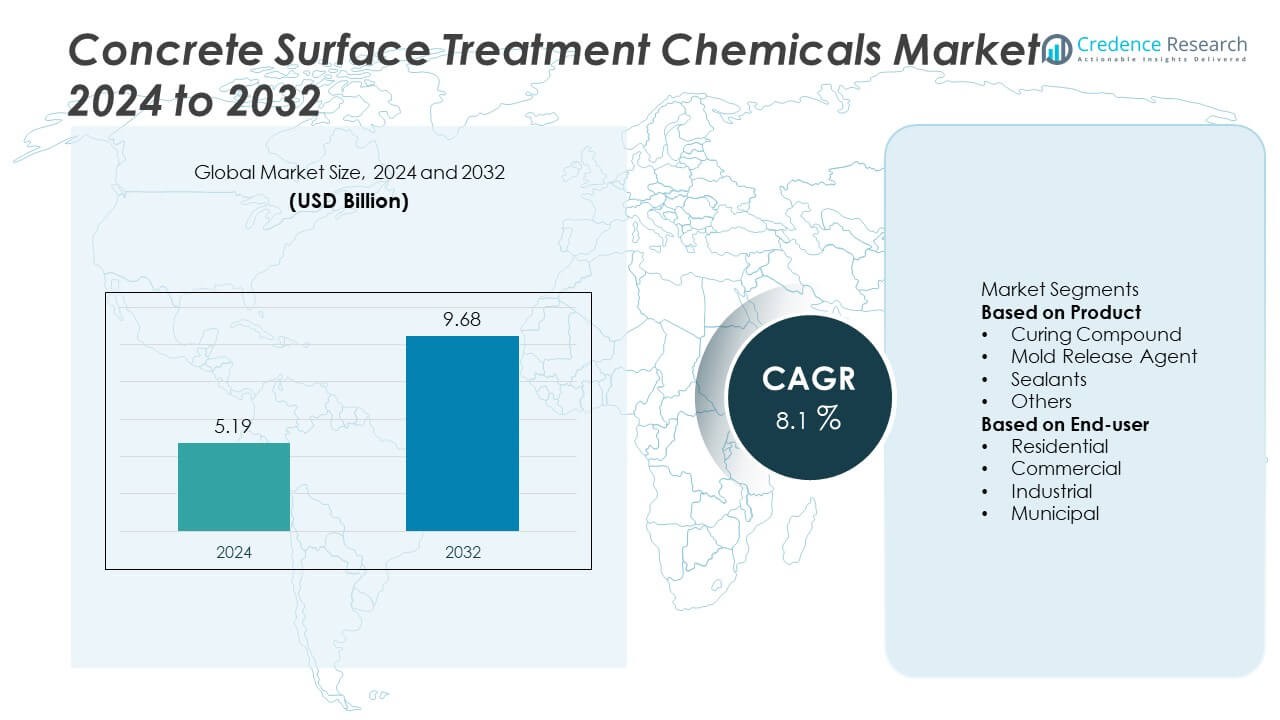

The Concrete Surface Treatment Chemicals Market was valued at USD 5.19 billion in 2024 and is projected to reach USD 9.68 billion by 2032, growing at a CAGR of 8.1% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Concrete Surface Treatment Chemicals Market Size 2024 |

USD 5.19 Billion |

| Concrete Surface Treatment Chemicals Market, CAGR |

8.1% |

| Concrete Surface Treatment Chemicals Market Size 2032 |

USD 9.68 Billion |

The concrete surface treatment chemicals market is led by key players such as Henkel Corporation, Laticrete International, BASF SE, Arkema, Sika AG, Croda International Plc, The Euclid Chemical Company, DowDuPont Inc, AkzoNobel Chemicals AG, and Mapei S.p.A. These companies focus on developing sustainable, high-performance solutions for curing, sealing, and protecting concrete surfaces across residential, commercial, and infrastructure projects. Asia-Pacific emerged as the leading region with a 37% market share in 2024, driven by rapid industrialization and large-scale construction investments. North America followed with 28%, supported by strong renovation activities and stringent environmental regulations promoting eco-friendly formulations.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The concrete surface treatment chemicals market was valued at USD 5.19 billion in 2024 and is projected to reach USD 9.68 billion by 2032, growing at a CAGR of 8.1%.

- Market growth is driven by increasing construction activities, rising demand for durable concrete protection, and strict building standards emphasizing long-term structural performance.

- Key trends include the growing adoption of eco-friendly, low-VOC, and water-based products along with innovations in nanotechnology and fast-curing sealants for modern infrastructure.

- The market is competitive with major players such as BASF SE, Sika AG, Henkel Corporation, and Arkema focusing on sustainable product portfolios and regional expansion.

- Asia-Pacific led with a 37% share in 2024, followed by North America with 28% and Europe with 25%, while the curing compound segment dominated the market with a 42% share due to its wide use in infrastructure and commercial construction.

Market Segmentation Analysis:

By Product

The curing compound segment dominated the concrete surface treatment chemicals market in 2024, capturing 42% of the total share. Its leadership stems from its essential role in maintaining moisture during the concrete curing process, enhancing surface strength and durability. Growing use in roadways, bridges, and large-scale infrastructure projects drives demand for curing compounds. Their ability to prevent cracking and improve abrasion resistance makes them a preferred choice across climates. Increasing adoption of water-based and eco-friendly formulations further supports growth, especially in developed markets emphasizing sustainable construction practices.

- For instance, Mapei S.p.A. launched its Mapecure E30 curing compound designed for large concrete surfaces, achieving a water retention mass loss of \(\le \) 0.55 kg/m² after 72 hours under ASTM C156 testing.

By End-User

The commercial segment held the largest market share of 38% in 2024, driven by rising construction of shopping complexes, office buildings, and parking structures. Commercial projects rely heavily on high-performance sealants and curing agents to ensure longevity and surface finish. The segment benefits from expanding investments in urban real estate and renovation activities. Rapid urbanization across Asia-Pacific and North America is further boosting product consumption. Additionally, government-funded infrastructure upgrades and smart city programs are enhancing the use of advanced surface treatment chemicals in commercial and municipal applications.

- For instance, Sika AG supplied Sikafloor-161 epoxy primer for commercial parking facilities, delivering a compressive strength of up to 70 megapascals (MPa) as part of a mortar screed and a bond strength of greater than 1.5 MPa on concrete substrates.

Key Growth Drivers

Rising Infrastructure and Urban Development Projects

The rapid pace of urbanization and infrastructure expansion worldwide is fueling demand for concrete surface treatment chemicals. Governments are investing heavily in highways, bridges, and metro networks that require long-lasting and durable concrete protection. These chemicals improve surface strength, reduce permeability, and enhance structural life, making them critical for large-scale projects. The growing emphasis on sustainable urban infrastructure, particularly in Asia-Pacific and the Middle East, continues to create consistent market opportunities for high-performance concrete treatment solutions.

- For instance, Master Builders Solutions (formerly BASF) supplied its white-pigmented, wax-based MasterKure 107WB curing compound for bridge deck applications, which achieves a water loss of less than 0.55 kg/m² over 72 hours, ensuring minimal surface cracking in hot climates.

Increasing Adoption of Green and Low-VOC Products

Environmental awareness and stricter regulations are driving the use of eco-friendly, low-VOC concrete treatment chemicals. Manufacturers are developing water-based and bio-based formulations to meet green building standards such as LEED and BREEAM. These products minimize environmental impact while maintaining strong sealing, curing, and protection capabilities. Construction companies are shifting toward sustainable alternatives to comply with emission norms, supporting the expansion of environmentally responsible chemical solutions in both developed and emerging markets.

- For instance, Arkema has developed a range of sustainable solutions, including bio-based additives and resins, designed to meet the growing demand for low-VOC and lower-carbon footprint coatings.

Growth in Commercial and Industrial Construction

Rising investments in commercial complexes, industrial plants, and logistics facilities are boosting the market for surface treatment chemicals. These structures require enhanced protection from chemical spills, abrasion, and heavy mechanical loads. Sealants and curing compounds are increasingly used to ensure surface durability and reduce maintenance costs. Industrial growth in manufacturing and warehousing, particularly across North America and Asia-Pacific, continues to drive product consumption as end-users prioritize performance longevity and improved floor aesthetics.

Key Trends & Opportunities

Technological Advancements in Formulations

Manufacturers are focusing on advanced formulations that enhance curing efficiency and surface performance. The integration of nanotechnology and reactive silane-based sealers improves resistance to water, chloride, and abrasion. Smart coatings with self-healing and anti-dust properties are gaining attention for long-term protection. Companies investing in R&D to develop faster-curing and energy-efficient solutions are likely to gain a competitive edge. These innovations cater to the growing demand for high-durability materials in high-traffic and industrial flooring applications.

- For instance, Evercrete DPS is a silicate-based surface treatment capable of penetrating 20 to 30 mm into concrete, creating a crystalline structure that significantly reduces water permeability after curing.

Rising Demand from Sustainable Construction Initiatives

Sustainability-focused construction trends are opening new opportunities for concrete surface treatment chemical suppliers. Green building certifications encourage the use of materials that reduce maintenance frequency and environmental footprint. Waterborne sealants and low-emission curing compounds are increasingly preferred in urban housing and commercial projects. Governments promoting sustainable infrastructure are also supporting adoption through tax incentives and green procurement policies. This shift is reshaping the market toward eco-conscious, performance-driven chemical solutions.

- For instance, Henkel Corporation developed its LOCTITE PC 9416 concrete repair and surface coating system with VOC levels under 10 grams per liter, which is a 100% solids epoxy-based system.

Key Challenges

Fluctuating Raw Material Prices

Volatility in raw material costs, especially petrochemical derivatives used in solvent-based products, poses a major challenge. Price fluctuations impact overall production costs and profit margins for manufacturers. The dependence on imported materials in developing regions further exacerbates pricing instability. Companies are exploring local sourcing and bio-based alternatives to mitigate these risks, but maintaining cost competitiveness while meeting quality standards remains difficult in highly regulated construction markets.

Limited Awareness in Emerging Economies

In many developing countries, low awareness about the long-term benefits of concrete surface treatment chemicals limits adoption. Contractors often prioritize short-term cost savings over performance-based materials. The lack of skilled applicators and inadequate product training also hinder effective use. Market growth in these regions depends on education campaigns, technical guidance, and demonstration projects that showcase durability improvements. Bridging this knowledge gap is essential for broader market penetration and sustainable growth.

Regional Analysis

North America

North America held a 28% market share in 2024, driven by robust construction activity across residential, commercial, and industrial sectors. The U.S. and Canada continue to adopt high-performance concrete treatment chemicals to enhance durability and reduce maintenance costs. Strict environmental regulations by the EPA are encouraging the use of low-VOC and water-based formulations. Infrastructure renovation projects, especially in transportation and public facilities, further support market growth. Continuous investment in smart city development and sustainable building practices strengthens regional demand for advanced sealants and curing compounds.

Europe

Europe accounted for 25% of the global market share in 2024, supported by strong construction standards and sustainability-focused regulations. Countries such as Germany, France, and the United Kingdom lead in adopting eco-friendly surface treatment products that comply with REACH and BREEAM standards. The rising demand for renovation and energy-efficient structures drives consistent product usage. Rapid adoption of green concrete technologies and durable sealing solutions across industrial and municipal projects enhances regional growth. Ongoing urban renewal initiatives and public infrastructure investments continue to stimulate demand across the region.

Asia-Pacific

Asia-Pacific dominated the market with a 37% share in 2024, led by large-scale urban infrastructure and industrial expansion in China, India, and Southeast Asia. The region’s rapid construction growth is fueled by government-backed projects in housing, transportation, and industrial development. Demand for curing compounds and sealants is increasing due to the need for cost-effective and long-lasting concrete protection. Rising adoption of sustainable and water-based products aligns with national green building targets. Expanding manufacturing capacities and a growing commercial construction pipeline continue to strengthen the regional market outlook.

Middle East & Africa

The Middle East & Africa region captured a 6% share of the global market in 2024, driven by infrastructure diversification and mega construction projects in Saudi Arabia, the UAE, and South Africa. The growing focus on durable materials suited for extreme climates fuels adoption of concrete protection products. Investment in smart cities and industrial facilities under national transformation plans supports market expansion. Additionally, regional governments are encouraging environmentally friendly materials in construction, creating new opportunities for advanced curing and sealing solutions tailored to high-temperature and arid conditions.

South America

South America held a 4% market share in 2024, supported by steady growth in commercial and public infrastructure projects in Brazil, Argentina, and Chile. Increasing investments in urban redevelopment, highways, and water management facilities drive product adoption. Government efforts to modernize construction standards and improve material durability are boosting demand for curing compounds and surface sealants. Economic recovery and growing awareness of maintenance-free concrete structures also contribute to expansion. Partnerships between local producers and global suppliers are helping address regional needs for cost-effective, sustainable treatment solutions.

Market Segmentations:

By Product

- Curing Compound

- Mold Release Agent

- Sealants

- Others

By End-user

- Residential

- Commercial

- Industrial

- Municipal

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the concrete surface treatment chemicals market features major players such as Henkel Corporation, Laticrete International, BASF SE, Arkema, Sika AG, Croda International Plc, The Euclid Chemical Company, DowDuPont Inc, AkzoNobel Chemicals AG, and Mapei S.p.A. These companies focus on developing high-performance, eco-friendly formulations to enhance durability, adhesion, and resistance of concrete surfaces. Strategic initiatives such as product innovation, mergers, and regional expansion are central to maintaining market leadership. Key players are emphasizing water-based, low-VOC, and sustainable solutions to meet green building standards. Collaboration with construction firms and distributors supports stronger market penetration across infrastructure and commercial segments. With the rise in global construction activities, competition is intensifying, leading companies to invest in advanced chemical technologies, digital monitoring solutions, and technical support services to strengthen brand presence and capture growth opportunities in emerging economies.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In September 2024, Sika broke ground on a 29,000 sq ft admixture plant in Florida to scale production of concrete additives and surface chemistry lines.

- In July 2024, Henkel Corporation introduced Bonderite M CR 1405, an RoHS-compliant compound that combines passivation and pretreatment in one step; it demonstrated salt spray resistance of 800 hours using a chromium primer.

- In 2024, Henkel / Polybit markets POLYBIT Polycrete MC, a free-flowing micro concrete repair material suited for thicknesses from 10 mm to 250 mm, used in structural restoration and surface treatment works.

- In 2024, Henkel / Polybit offers POLYBIT Polycure AC, an acrylic curing and sealing compound for fresh concrete surfaces, applied at coverage rates of 5 m² per liter.

Report Coverage

The research report offers an in-depth analysis based on Product, End-user and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will grow steadily as global construction and infrastructure projects expand.

- Demand for eco-friendly and low-VOC concrete treatment chemicals will increase.

- Asia-Pacific will remain the leading regional market due to rapid urbanization.

- North America and Europe will see strong adoption of sustainable and high-performance products.

- Curing compounds and sealants will continue to dominate product demand across applications.

- Manufacturers will focus on nanotechnology and advanced polymer formulations for improved durability.

- Strategic partnerships between chemical producers and construction firms will strengthen distribution.

- Government initiatives promoting green building standards will boost product innovation.

- Industrial and commercial construction segments will generate consistent growth opportunities.

- Long-term focus will shift toward sustainable, cost-efficient, and high-strength concrete protection solutions.