Market Overview

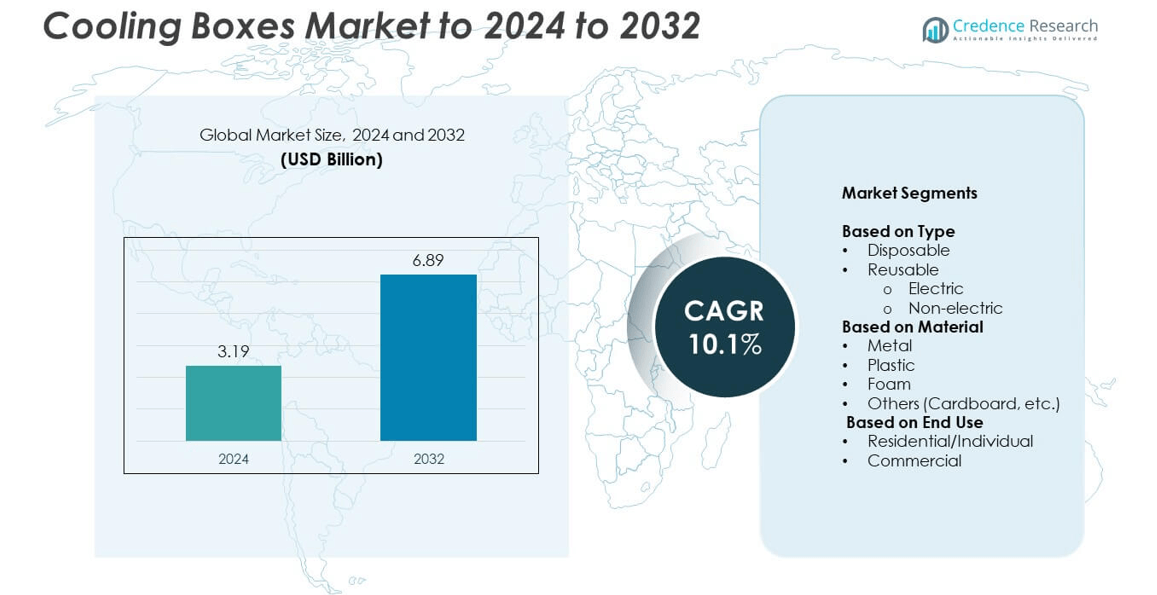

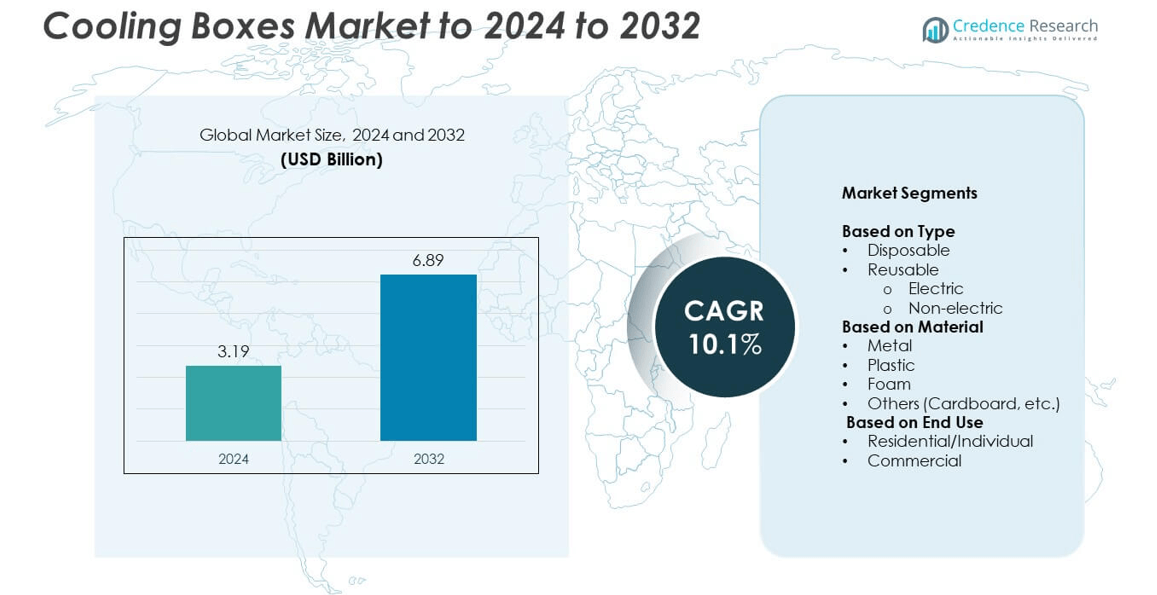

Cooling Boxes Market size was valued at USD 3.19 Billion in 2024 and is anticipated to reach USD 6.89 Billion by 2032, at a CAGR of 10.1% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Cooling Boxes Market Size 2024 |

USD 3.19 Billion |

| Cooling Boxes Market, CAGR |

10.1% |

| Cooling Boxes Market Size 2032 |

USD 6.89 Billion |

The Cooling Boxes market is led by major players such as YETI, Coleman, RTIC, Igloo, Engel, Arctic Zone, Grizzly, Orca, Pelican, Campingaz, Magma, K2, Cabela’s, Bison, and B Medical Systems. These companies dominate through innovative designs, advanced insulation technologies, and diversified product portfolios catering to both residential and commercial needs. Continuous investment in electric and smart cooling systems has strengthened their competitive position. North America emerged as the leading region, accounting for 34% of the global market share in 2024, driven by strong demand from outdoor recreation, cold chain logistics, and healthcare transport applications.

Market Insights

- The Cooling Boxes Market was valued at USD 3.19 Billion in 2024 and is projected to reach USD 6.89 Billion by 2032, growing at a CAGR of 10.1%.

- Rising demand for temperature-controlled food, beverages, and medical transport drives market growth, supported by expanding cold chain networks and outdoor recreation activities.

- The market trends show increasing adoption of electric and smart cooling systems along with a shift toward eco-friendly, recyclable materials.

- Competition remains strong among global brands focusing on product innovation, energy efficiency, and sustainability to enhance performance and market reach.

- North America led with 34% share in 2024, followed by Asia Pacific at 28% and Europe at 27%, while reusable cooling boxes dominated by type with 68% share due to durability and multi-use benefits.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

Reusable cooling boxes dominated the market in 2024, accounting for nearly 68% of the global share. Their durability, long lifespan, and suitability for frequent use in outdoor activities, logistics, and food transport drive this dominance. Electric reusable variants are increasingly adopted due to their efficient temperature control and integration with thermoelectric or compressor-based systems. Disposable boxes, though convenient, hold a smaller share owing to single-use limitations and rising environmental restrictions on non-recyclable materials. Growth in cold chain operations and outdoor leisure trends continues to support reusable type expansion.

- For instance, Dometic’s CFX3 55IM holds 53 L, deep-freezes to −7 °F, and makes ice onboard.

By Material

Plastic-based cooling boxes held the largest share of around 54% in 2024. Their lightweight structure, cost-effectiveness, and excellent insulation make them popular in both household and commercial applications. Advanced polyethylene and polypropylene variants further enhance durability and temperature retention. Foam materials, mainly polyurethane, are also growing due to their superior insulation properties for perishable storage. Metal boxes remain limited to heavy-duty industrial use, while cardboard and other materials cater to short-term, eco-friendly applications. The wide adaptability of plastic materials across end uses sustains their leading position.

- For instance, YETI’s Tundra 45 weighs 24.6 lb and measures 25.6 × 15.9 × 15.5 in.

By End Use

The commercial segment accounted for nearly 61% of the market share in 2024, driven by demand from food delivery, hospitality, and healthcare industries. Businesses rely on cooling boxes to ensure temperature stability during storage and transport of perishable goods, vaccines, and beverages. The growing e-commerce and catering sectors further expand usage across regional logistics networks. Residential or individual users also contribute significantly, supported by rising recreational activities, camping, and portable cooling needs. However, the commercial sector remains dominant due to consistent large-scale applications and stringent temperature management requirements.

Key Growth Drivers

Rising Demand for Temperature-Controlled Food and Beverage Storage

The expanding food delivery, catering, and beverage distribution industries are driving strong demand for cooling boxes. These containers help maintain product freshness during transit and outdoor use. With growing urban populations and lifestyle shifts toward on-the-go consumption, businesses increasingly rely on efficient cold storage solutions. Rapid expansion of quick commerce and grocery delivery networks across North America and Asia-Pacific further strengthens this demand, positioning temperature-controlled storage as a key driver in overall market growth.

- For instance, a version of the Coleman 120-Quart Hard Cooler, which falls under the 316 Series (sometimes branded as “Classic Series” or “Chest Cooler”), holds 102 cans and 60 pounds of ice.

Expansion of Cold Chain Logistics

The global rise in cold chain logistics for pharmaceuticals, dairy, and processed foods significantly boosts the cooling boxes market. As temperature-sensitive goods require reliable short-term storage, insulated and reusable boxes are becoming essential tools. Healthcare and vaccine distribution networks, in particular, have accelerated investments in portable cooling systems. Advanced cooling box designs with integrated thermal insulation and reusable materials are increasingly replacing traditional ice containers, ensuring consistent performance during long-distance or last-mile deliveries.

- For instance, Envirotainer OnePal maintains −20 °C to +20 °C for over 95 hours under ISTA 7D.

Technological Advancements in Electric Cooling Systems

Electric and thermoelectric cooling boxes are gaining traction due to their energy-efficient and maintenance-free performance. Manufacturers are incorporating digital temperature control, battery integration, and eco-friendly refrigerants to improve reliability and reduce environmental impact. These systems cater to both commercial logistics and personal recreation needs, offering extended cooling durations without the need for ice packs. Growing adoption of lithium-ion battery technology further supports mobility, making electric models one of the most transformative drivers for long-term market expansion.

Key Trends & Opportunities

Sustainability and Recyclable Materials Adoption

A major trend shaping the market is the move toward eco-friendly materials such as recyclable plastics, biodegradable foams, and cardboard composites. Consumers and businesses are increasingly conscious of reducing carbon footprints and plastic waste. This shift creates opportunities for manufacturers to introduce sustainable product lines with similar thermal efficiency. Government regulations promoting green packaging solutions also encourage innovation in material composition and disposal management, supporting broader adoption of sustainable cooling boxes in food and pharmaceutical logistics.

- For instance, Igloo RECOOL is 16 qt, 1.6 lb, holds 20 cans, and uses 100% biodegradable molded fiber.

Integration of Smart and IoT-Enabled Cooling Boxes

Emerging smart technologies are redefining product functionality with IoT-based monitoring, temperature tracking, and digital control systems. These connected cooling boxes allow users to manage temperature settings remotely and record data for quality assurance. Logistics and healthcare operators are integrating these devices into supply chains for real-time monitoring and compliance. As digital logistics platforms expand globally, IoT-enabled cooling systems present a key opportunity for manufacturers to add value and strengthen partnerships with cold chain operators.

- For instance, ARB ZERO provides Bluetooth app control for temperature and status across 36–60 L single-zone and dual-zone models.

Key Challenges

High Initial Costs of Electric and Smart Models

One of the main challenges in the market is the high upfront cost associated with electric and IoT-enabled cooling boxes. The inclusion of sensors, batteries, and control modules raises production expenses, limiting adoption among small businesses and individual users. Despite long-term efficiency benefits, cost-sensitive customers often prefer traditional insulated models. Addressing affordability through modular design and mass-scale production will be essential for accelerating penetration of advanced cooling technologies in emerging markets.

Environmental and Disposal Concerns of Plastic-Based Units

While plastic remains the dominant material, its environmental footprint poses ongoing challenges for the industry. Non-recyclable plastics contribute to landfill accumulation, drawing criticism from sustainability advocates and regulatory bodies. Governments are imposing stricter recycling and waste management requirements, forcing producers to redesign materials. Developing biodegradable or recyclable alternatives without compromising insulation performance is critical. Manufacturers that effectively balance sustainability with durability will be better positioned to meet future environmental standards and consumer expectations.

Regional Analysis

North America

North America held the largest share of 34% in the cooling boxes market in 2024. The region’s dominance stems from strong demand in food delivery, camping, and outdoor leisure activities. The United States leads with widespread use of electric and reusable cooling boxes across households and commercial logistics. Rapid growth in the cold chain and healthcare sectors further supports adoption. Manufacturers focus on premium and energy-efficient models to meet rising sustainability preferences. The mature retail distribution network and innovation-driven market dynamics continue to reinforce regional leadership in portable cooling solutions.

Europe

Europe accounted for 27% of the global market share in 2024. The demand is fueled by increasing outdoor recreation, food transportation, and eco-friendly storage needs. Germany, France, and the United Kingdom are key markets adopting recyclable materials and thermoelectric cooling boxes. Stringent EU regulations on packaging waste are driving a shift toward sustainable designs. The strong presence of established outdoor and camping brands also supports continuous innovation. Commercial users, especially in food catering and pharmaceuticals, further contribute to steady regional growth driven by high product quality and energy efficiency standards.

Asia Pacific

Asia Pacific captured 28% of the cooling boxes market share in 2024, supported by rapid urbanization and expanding logistics infrastructure. China, Japan, and India are witnessing strong demand from the e-commerce and food delivery industries. Affordable non-electric and plastic-based cooling boxes dominate due to cost sensitivity and high product turnover. Local manufacturers are expanding production capacity to meet rising domestic consumption. Increasing recreational tourism and awareness of temperature-controlled storage solutions also promote household adoption. The region is poised for the fastest growth due to large population bases and ongoing cold chain expansion.

Latin America

Latin America held an 8% share of the global cooling boxes market in 2024. The region’s growth is driven by increasing demand for temperature-controlled storage in the food and beverage sector. Brazil and Mexico lead with expanding retail, catering, and tourism industries. The adoption of plastic and foam-based boxes is high due to affordability and availability. Import dependency for electric cooling systems limits technological adoption, but local brands are investing in regional manufacturing. Rising awareness of portable cooling solutions among small businesses and outdoor enthusiasts continues to drive market penetration.

Middle East & Africa

The Middle East and Africa region accounted for 3% of the global cooling boxes market in 2024. The demand is primarily supported by tourism, hospitality, and medical cold storage applications. Gulf countries such as the UAE and Saudi Arabia rely on cooling boxes for outdoor leisure and food distribution in high-temperature environments. Limited cold chain infrastructure in parts of Africa restricts large-scale adoption. However, rising investments in healthcare logistics and retail sectors are gradually improving uptake. The region offers growth potential with increasing demand for durable and reusable temperature-control products.

Market Segmentations:

By Type

By Material

- Metal

- Plastic

- Foam

- Others (Cardboard, etc.)

By End Use

- Residential/Individual

- Commercial

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Cooling Boxes market is characterized by the presence of established brands such as YETI, Coleman, RTIC, Igloo, Engel, Arctic Zone, Grizzly, Orca, Pelican, Campingaz, Magma, K2, Cabela’s, Bison, and B Medical Systems. These companies compete through product innovation, advanced insulation technologies, and expansion into specialized end-use sectors. Manufacturers focus on improving portability, temperature retention, and eco-friendly material use to enhance user convenience and meet regulatory standards. Strategic alliances with retailers and e-commerce channels strengthen brand visibility across key regions. The market also sees growing investment in smart and electric cooling solutions with longer battery life and digital monitoring features. Leading players emphasize sustainability through recyclable materials and energy-efficient systems, catering to increasing consumer preference for green products. Competition remains intense, with global and regional manufacturers continuously diversifying their product portfolios to serve commercial, healthcare, and outdoor recreation markets effectively.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- YETI

- Coleman

- RTIC

- Igloo

- Engel

- Arctic Zone

- Grizzly

- Orca

- Pelican

- Campingaz

- Magma

- K2

- Cabela’s

- Bison

- B Medical Systems

Recent Developments

- In 2025, Coleman launched its Pro Cooler line, which featured significant advancements in insulation, antimicrobial liners, and a 10-year warranty.

- In 2024, Igloo released its Slayer Cooler Collection in Blood Sling, a pop-culture collaboration featuring limited-edition coolers and drinkware with iconic album artwork.

- In 2023, B Medical Systems’ RCW25 transport box has been certified by CERTICOLD Pharma to comply with EU Good Distribution Practices (GDP)

Report Coverage

The research report offers an in-depth analysis based on Type, Material, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will continue to expand with increasing demand for portable temperature-controlled storage.

- Electric and thermoelectric cooling boxes will gain higher adoption across logistics and leisure sectors.

- Sustainable and recyclable materials will replace traditional plastic-based units to meet green regulations.

- Integration of IoT and smart monitoring systems will enhance product functionality and control.

- Manufacturers will focus on lightweight, energy-efficient, and long-lasting product designs.

- Asia Pacific will remain the fastest-growing region due to expanding cold chain infrastructure.

- Commercial applications in food delivery, catering, and healthcare will drive consistent revenue growth.

- Technological collaborations will improve performance and battery efficiency in electric models.

- Government incentives for eco-friendly packaging and logistics solutions will support market development.

- Growing consumer awareness toward food safety and product freshness will sustain long-term demand.