Market Overview

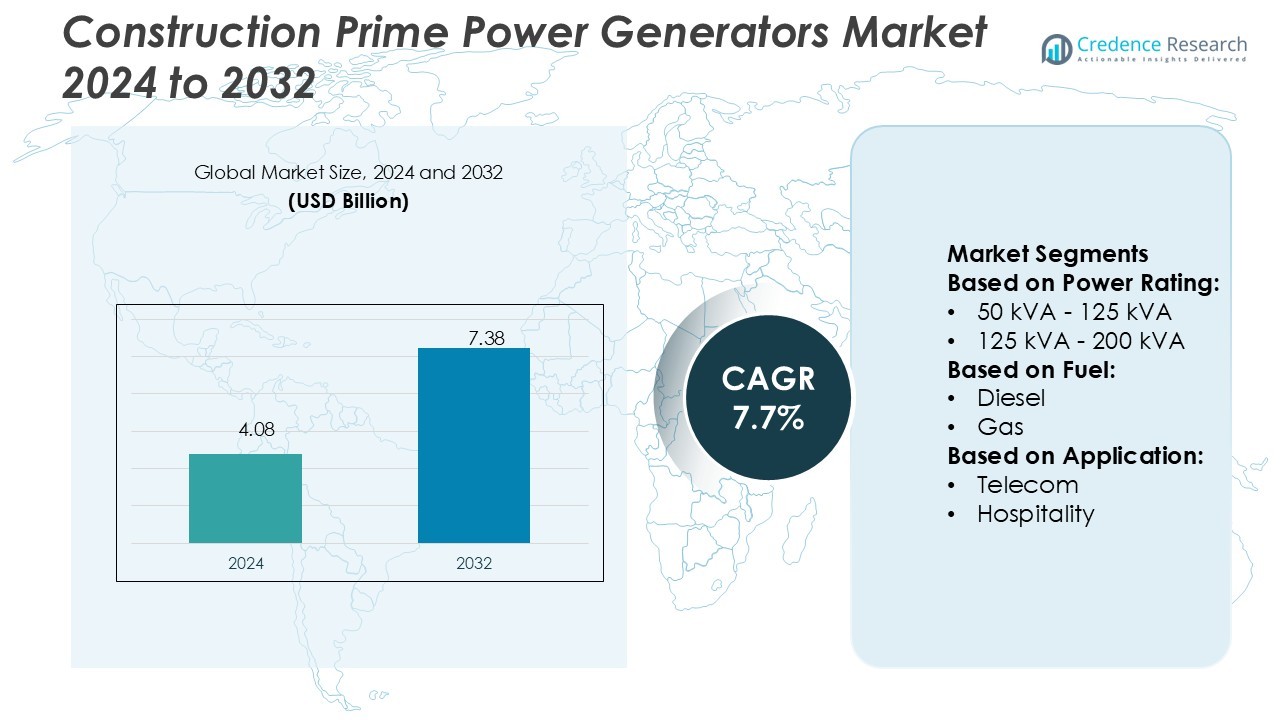

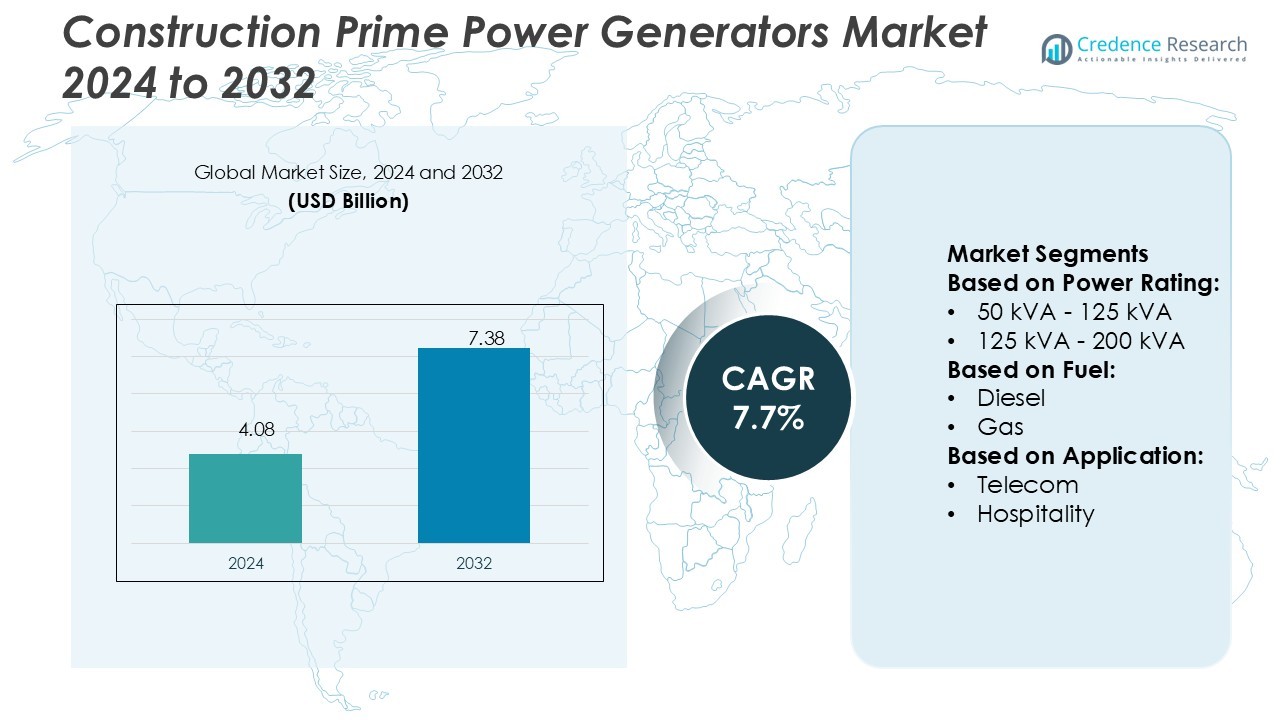

Construction Prime Power Generators Market size was valued USD 4.08 billion in 2024 and is anticipated to reach USD 7.38 billion by 2032, at a CAGR of 7.7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Construction Prime Power Generators Market Size 2024 |

USD 4.08 Billion |

| Construction Prime Power Generators Market, CAGR |

7.7% |

| Construction Prime Power Generators Market Size 2032 |

USD 7.38 Billion |

The Construction Prime Power Generators Market is characterized by strong competition among top players including Rapid Power Generation, Kirloskar, Siemens Energy, Mahindra POWEROL, Rolls-Royce, Rehlko, Scania, HIMOINSA, Mitsubishi Heavy Industries, and PR INDUSTRIAL. These companies focus on delivering efficient, durable, and low-emission generator solutions tailored for large-scale infrastructure and commercial projects. Their strategies emphasize advanced hybrid technologies, strong service networks, and expansion in high-growth construction markets. Asia Pacific leads the global market with a 33% share, driven by rapid urbanization, increasing construction activities, and rising demand for reliable power supply. Strong manufacturing capabilities, cost efficiency, and large infrastructure investments give the region a strategic advantage. This dominance, combined with competitive innovation, positions Asia Pacific as the most influential hub in the global construction generator landscape.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Construction Prime Power Generators Market was valued at USD 4.08 billion in 2024 and is projected to reach USD 7.38 billion by 2032, registering a CAGR of 7.7% during the forecast period.

- Rising infrastructure investments and growing power reliability concerns drive strong demand across commercial and industrial construction segments, with hybrid and diesel generator technologies holding the largest share.

- Market trends focus on low-emission engines, smart monitoring, modular power solutions, and hybrid systems that support large construction sites and comply with stricter environmental regulations.

- Competitive intensity increases as companies invest in digital platforms, localized manufacturing, and rental-based models to expand reach, while emission regulations and high operating costs act as key restraints.

- Asia Pacific leads with a 33% regional share, supported by rapid urbanization and large-scale projects, while North America holds 31%; hybrid generators dominate the segment share due to rising preference for sustainable power solutions.

Market Segmentation Analysis:

By Power Rating

The > 125 kVA – 200 kVA segment dominates the Construction Prime Power Generators Market. This power range offers the optimal balance between capacity and mobility, making it the preferred choice for medium to large construction sites. Contractors rely on these generators to run heavy equipment and site lighting continuously. Their stable power output ensures reliable performance in harsh environments, reducing downtime and increasing project efficiency. Rising urban infrastructure development and expanding commercial construction projects further drive the demand for this segment globally.

- For instance, Saudi Arabia also announced 13.3 billion worth of healthcare investment deals during the Global Health Exhibition in Riyadh in 2024. These deals included a pharmaceuticals manufacturing partnership as well as an expansion by Fakeeh Care Group and new healthcare facilities to be funded by Almoosa Health Group.

By Fuel

The diesel segment holds the largest market share in the Construction Prime Power Generators Market. Diesel generators are favored for their high fuel efficiency, durability, and easy maintenance in remote construction sites. They provide steady power output, even in demanding conditions, and offer longer run times compared to gas alternatives. Construction firms choose diesel units for their cost-effectiveness over project lifecycles and compatibility with existing fuel logistics. Their strong performance and lower operating costs continue to make diesel the dominant choice in prime power applications.

- For instance, Siemens Energy’s generator lines push boundaries in efficiency, cooling methods, and operational cycles. Their SGen-1000A air-cooled generator achieves efficiency up to 98.9 % and is engineered for 10,000 start/stop cycles, offering high load stability and modular customization.

By Application

The construction segment leads the Construction Prime Power Generators Market. Generators play a vital role in powering heavy machinery, lighting systems, temporary offices, and safety infrastructure at construction sites. The need for continuous and reliable power supply drives high adoption rates. Rapid expansion of residential, commercial, and infrastructure projects fuels strong demand from contractors. This segment benefits from urbanization trends, smart city projects, and increased investment in public works, making construction the key application for prime power generator deployment.

Key Growth Drivers

Expanding Infrastructure and Urban Development

Rapid infrastructure growth drives strong demand for prime power generators in construction. Large-scale projects such as roads, bridges, airports, and commercial buildings require continuous and reliable power. Generators support essential operations, including heavy machinery, lighting, and safety systems. Government investment in housing and smart city development also accelerates equipment deployment. The surge in urban expansion across Asia Pacific, the Middle East, and Africa strengthens market demand. These generators offer stable output in off-grid or unstable grid environments, ensuring uninterrupted construction activity.

- For instance, Mahindra Powerol does offer generator sets up to at least 500 kVA in India. Official specifications for the 200 kVA generator confirm a fuel tank capacity of 388 liters for the 50 Hz model.

Increasing Preference for On-Site Power Reliability

Construction firms rely on prime power generators to reduce operational risks from grid instability and power cuts. On-site power generation ensures seamless functioning of cranes, compressors, and concrete mixers. Many contractors adopt generators as primary power sources to maintain project timelines and productivity. This reliability lowers downtime and supports remote or rural construction work. The growing need for time-efficient operations and cost control encourages the widespread use of generator sets in large and small infrastructure projects globally.

- For instance, Rolls-Royce’s mtu Series 1600 gensets, launched in 2025 for 50 Hz markets, deliver 590 to 996 kVA output, with up to 40 % more power over previous versions.

Rising Demand for High-Capacity and Fuel-Efficient Units

Modern construction projects require generators with high output and fuel efficiency. Manufacturers are introducing advanced engine technologies to reduce fuel use and extend runtime. High-capacity units support multiple equipment simultaneously, improving site productivity. Fuel-efficient designs help reduce operating costs, making them attractive to contractors managing tight budgets. Growing emphasis on sustainable and cost-effective operations further accelerates the adoption of these generators. This trend is especially strong in regions with large, continuous construction activity and limited grid reliability.

Key Trends & Opportunities

Integration of Smart Monitoring Technologies

Manufacturers are integrating digital monitoring systems, IoT sensors, and remote control features in generator sets. These solutions enable real-time performance tracking, predictive maintenance, and efficient fuel use. Remote management improves site productivity and reduces unplanned downtime. Smart generators also offer better safety compliance and energy optimization. This technology adoption creates opportunities for advanced service models, including performance-based leasing and predictive support. Construction firms prefer smart solutions to lower operating costs and ensure uninterrupted workflow on large infrastructure projects.

- For instance, EHR 90/130 is a product from HIMOINSA, a global power technology company. The EHR 90/130 does offer a storage capacity of 130 kWh, using 36 LFP (LiFePO4) batteries.

Shift Toward Hybrid and Sustainable Solutions

There is a rising focus on reducing emissions and improving fuel efficiency in construction power systems. Hybrid generators that combine diesel with solar or battery storage are gaining traction. These solutions help contractors meet sustainability targets while lowering operational costs. Governments are implementing stricter emission standards, pushing firms to adopt cleaner technologies. This shift creates opportunities for manufacturers to develop low-emission and fuel-flexible generator systems tailored for construction applications.

Expansion of Rental and Leasing Models

Contractors increasingly prefer renting or leasing generators to reduce capital expenditure. This model allows flexible capacity planning and access to modern, high-efficiency units without high upfront costs. Rental firms offer maintenance support, ensuring minimal downtime and reliable performance. Growing infrastructure projects in emerging markets further fuel this demand. The rising popularity of short- to medium-term rentals presents a significant growth opportunity for generator suppliers and rental service providers.

- For instance, Mitsubishi launched the MGS-R Series standby gensets in 2022, covering ratings from 500 kVA to 2,750 kVA in 50 Hz applications, with a 10-second start time and overhaul intervals extended to more than double prior models.

Key Challenges

Volatility in Fuel Prices and Operating Costs

Fluctuating fuel prices increase operational costs for contractors relying on diesel generators. Higher fuel expenses can affect project profitability and budgeting. Unpredictable price trends force construction firms to adjust their power strategies frequently. Many firms seek alternative or hybrid systems to manage costs, but initial investment remains a barrier. This volatility directly impacts demand and can slow equipment procurement in cost-sensitive markets.

Stringent Emission Regulations and Compliance Pressure

Global emission standards are becoming more stringent, especially in developed economies. Construction firms must upgrade or replace older generator sets to comply with environmental rules. Meeting these standards increases costs for equipment acquisition and maintenance. Non-compliance risks penalties, operational delays, or project suspension. These regulations push the market toward cleaner solutions but also create financial and operational challenges for smaller contractors.

Regional Analysis

North America

North America holds 27% share of the Construction Prime Power Generators Market. Strong investment in infrastructure modernization, transportation, and commercial projects drives demand. The U.S. leads with ongoing upgrades in highways, bridges, and energy infrastructure. Reliable backup and prime power solutions are essential due to weather-related power disruptions and off-grid construction sites. Adoption of high-capacity diesel generators remains dominant, supported by stringent quality standards and advanced fuel-efficient technologies. The presence of key market players and well-established rental networks further strengthen market growth across both the U.S. and Canada.

Europe

Europe accounts for 22% share of the Construction Prime Power Generators Market. Major demand comes from the U.K., Germany, and France, where urban renewal and green infrastructure projects are expanding. Strict emission norms push the adoption of hybrid and low-emission generators. EU-funded construction initiatives and sustainable building programs also boost equipment usage. Advanced monitoring systems and energy-efficient units are widely deployed on project sites. Strong focus on environmental compliance influences purchasing decisions, favoring fuel-efficient and low-noise generator sets across both public and private construction segments.

Asia Pacific

Asia Pacific commands the largest market share at 31%, driven by rapid urbanization, infrastructure expansion, and industrial development. China, India, Japan, and Southeast Asian nations lead construction spending. Massive investment in transportation corridors, housing projects, and smart city programs fuels continuous power needs. Contractors rely on medium- and high-capacity diesel generators to support 24/7 operations on large sites. The region also sees rising adoption of hybrid systems to balance cost and emission goals. Fast-paced growth in construction activity positions Asia Pacific as the most dynamic regional market globally.

Latin America

Latin America represents 7% share of the Construction Prime Power Generators Market. Brazil and Mexico lead due to large-scale industrial and infrastructure development programs. Generators support projects in energy, roadways, and commercial construction, especially in remote areas with unreliable grid access. Diesel generator use dominates, but rental and leasing services are expanding due to budget constraints. Regulatory efforts encouraging cleaner technologies are still in early stages, offering growth opportunities for hybrid and fuel-efficient systems. The region’s steady infrastructure pipeline supports stable long-term equipment demand.

Middle East & Africa

The Middle East & Africa region holds 13% share of the Construction Prime Power Generators Market. Mega infrastructure projects in Saudi Arabia, the UAE, and South Africa drive equipment demand. Unstable grid connections and remote site locations make prime power generators critical. Diesel remains the preferred fuel, though hybrid systems are gradually gaining interest. Government investment in transportation, energy, and tourism infrastructure strengthens demand. High-temperature conditions create strong requirements for durable, high-output generator units designed for continuous operation in harsh environments.

Market Segmentations:

By Power Rating:

- 50 kVA – 125 kVA

- 125 kVA – 200 kVA

By Fuel:

By Application:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Construction Prime Power Generators Market is shaped by Rapid Power Generation, Kirloskar, Siemens Energy, Mahindra POWEROL, Rolls-Royce, Rehlko, Scania, HIMOINSA, Mitsubishi Heavy Industries, and PR INDUSTRIAL. The Construction Prime Power Generators Market is defined by continuous technological advancement, strategic partnerships, and strong regional expansion strategies. Manufacturers are focusing on developing fuel-efficient, low-emission, and hybrid generator systems to meet rising demand from large infrastructure and commercial construction projects. Companies are strengthening their positions through localized production facilities, rental service models, and comprehensive after-sales support. Regulatory compliance and integration with smart grid solutions are key competitive factors shaping product portfolios. Innovation in power management technologies, modular design, and digital monitoring platforms further enhances operational efficiency and reliability. This strategic focus enables companies to target both mature and emerging construction markets, ensuring long-term competitiveness and sustained market share growth.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In February 2025, Rolls- Royce offered the previously mentioned innovations in the mtu Series 1600 generator sets for the 50 hertz market. Both open and enclosed power units are available. The new series features modular construction with plug and play assembly, along with seamless usage of HVO fuel which boasts a reduction of up to 90% CO2 emission, high-power density, and flexible application.

- In September 2024, Caterpillar entered an MoU with the Tamil Nadu government for an expansion investment of nearly on its plants in Krishnagiri and Tiruvallur districts. This expansion is intended to enhance the nearby manufacturing capacity. This is consistent with an overall investment thrust in the region.

- In May 2024, John Deere declared an investment of around for enlarging its manufacturing plant located at Catalão, Goiás, Brazil. The expansion will augment the existing factory floor space 42,000 square meters by sprayer and harvester production utilizing more sophisticated digital technologies.

- In March 2024, Recon Technologies, Mahindra Powerol launched a new series of diesel generators which are CPCBIV+ compliant. The gensets up to 625 KVA are equipped with sophisticated after-treatment systems and engineering innovations that augment fuel efficiency and load-handling ability.

Report Coverage

The research report offers an in-depth analysis based on Power Rating, Fuel, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand with rising infrastructure investments across developed and emerging economies.

- Hybrid and low-emission generator technologies will gain strong traction.

- Smart monitoring systems will enhance operational efficiency and uptime.

- Modular and scalable generator solutions will support large construction projects.

- Integration with renewable energy sources will strengthen sustainable power strategies.

- Rental and service-based business models will grow rapidly in urban construction zones.

- Digital platforms will improve predictive maintenance and reduce operational costs.

- Regulatory standards will drive innovation in cleaner and quieter generator systems.

- Strategic partnerships will accelerate market penetration in new regions.

- Advancements in fuel efficiency and durability will boost product competitiveness.