Market Overview

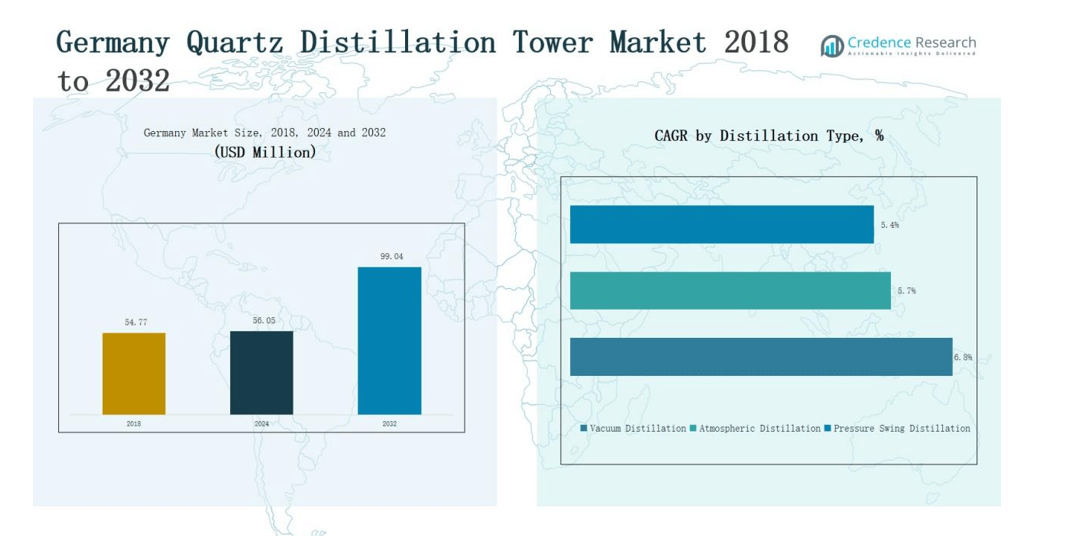

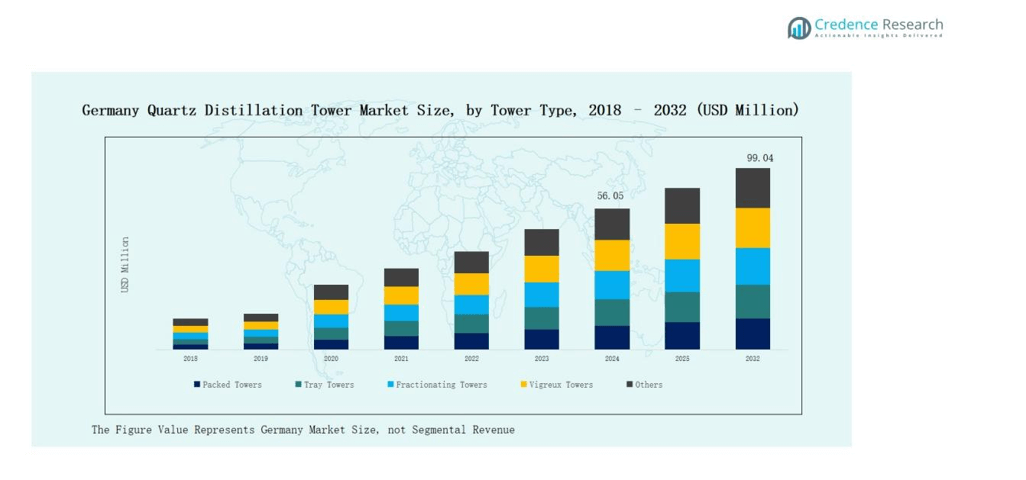

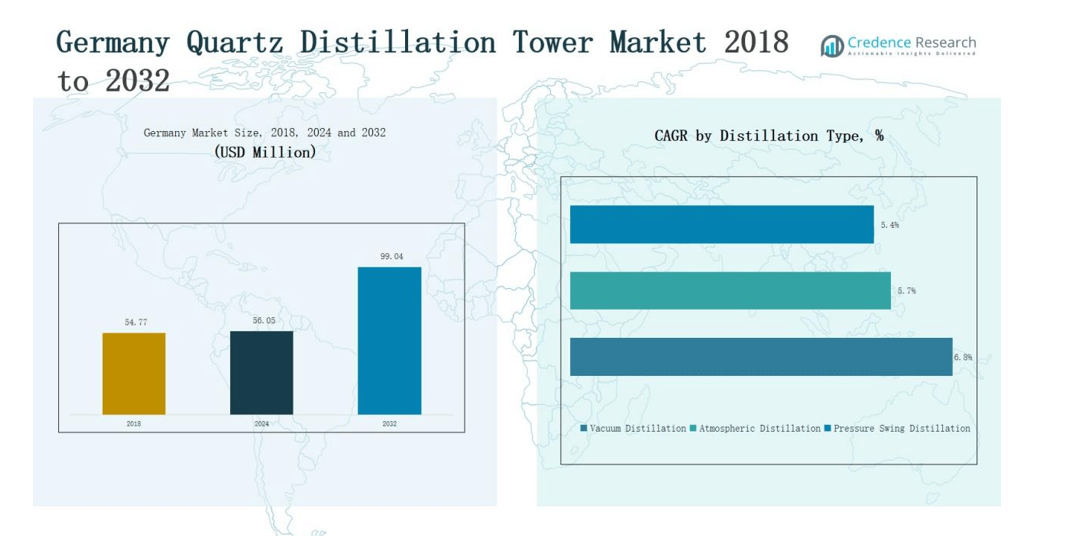

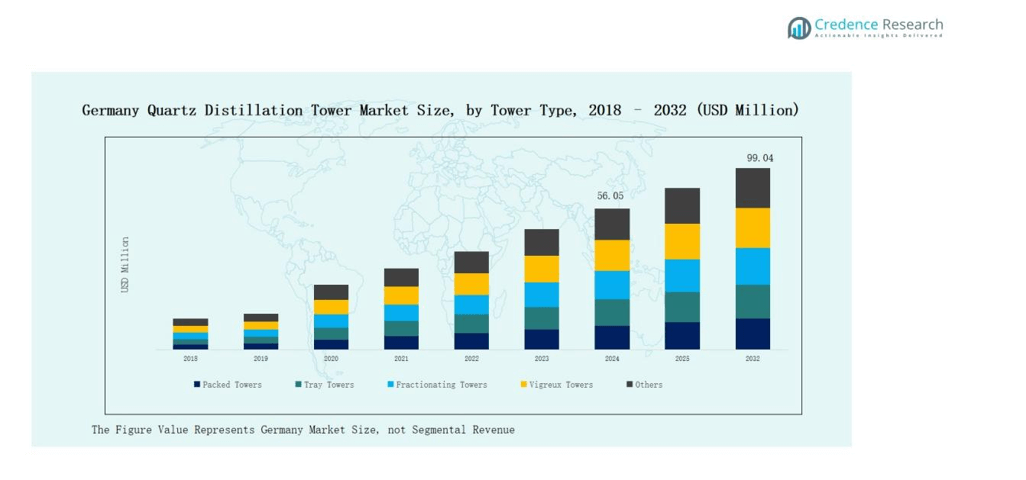

The Germany Quartz Distillation Tower Market was valued at USD 54.77 million in 2018, increasing to USD 56.05 million in 2024, and is projected to reach USD 99.04 million by 2032, growing at a CAGR of 7.38% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Germany Quartz Distillation Tower Market Size 2024 |

USD 56.05 million |

| Germany Quartz Distillation Tower Market, CAGR |

7.38% |

| Germany Quartz Distillation Tower Market Size 2032 |

USD 99.04 million |

The Germany Quartz Distillation Tower Market is driven by established players such as Raesch Quarz (Germany) GmbH, Heraeus Quarzglas GmbH & Co. KG, WONIK Quartz Europe, Quarzglas Komponenten und Service (QCS), semiQuarz GmbH, EUROQUARZ GmbH, and Nano Quarz Wafer GmbH. These companies focus on precision manufacturing, material innovation, and advanced automation to deliver high-purity, corrosion-resistant distillation systems for semiconductor, pharmaceutical, and chemical industries. Strategic collaborations and continuous R&D investments enhance their technological capabilities and product efficiency. Southern Germany emerged as the leading region, commanding 29% of the total market share in 2024, supported by its robust industrial base, high R&D intensity, and strong presence of semiconductor and process technology manufacturers.

Market Insights

- The Germany Quartz Distillation Tower Market was valued at USD 54.77 million in 2018, reached USD 56.05 million in 2024, and is expected to attain USD 99.04 million by 2032, growing at a CAGR of 7.38%.

- Packed Towers led the market with a 2% share in 2024, favored for high surface area and efficiency in semiconductor and chemical distillation processes.

- Vacuum Distillation dominated by 6% share in 2024, driven by demand for low-temperature purification in semiconductor and pharmaceutical manufacturing.

- Stainless Steel material held a 8% share, supported by strong resistance to corrosion, thermal stress, and suitability for high-purity industrial applications.

- Southern Germany emerged as the leading region with 29% share, driven by its robust semiconductor base, industrial automation investments, and strong R&D ecosystem.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segment Insights

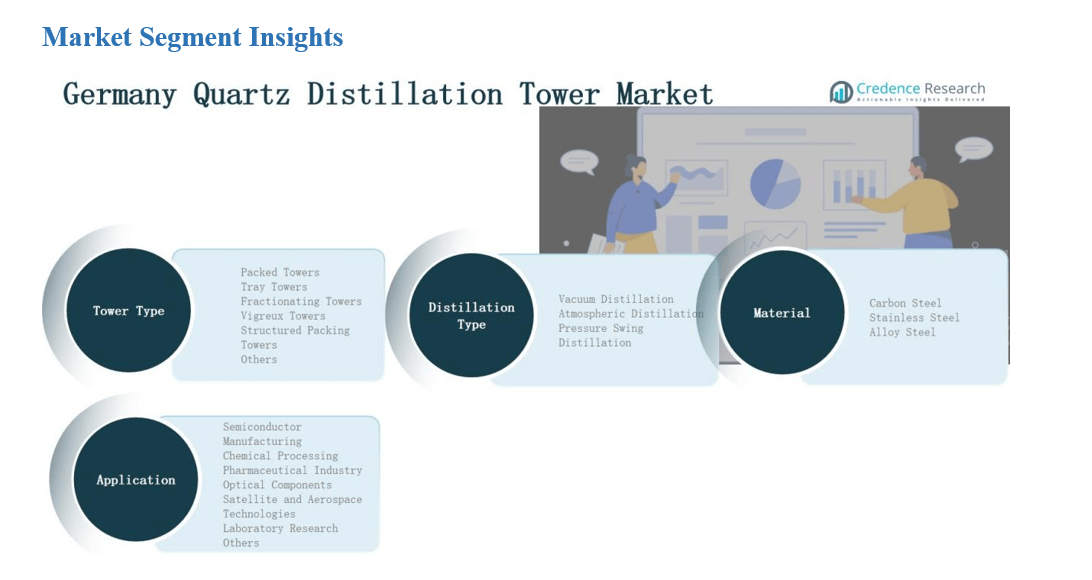

By Tower Type:

The Packed Towers segment dominated the Germany Quartz Distillation Tower Market in 2024, accounting for 37.2% of total revenue. Their high surface area, efficient mass transfer, and low pressure drop make them ideal for high-purity applications in semiconductor and chemical industries. Growing demand for compact and corrosion-resistant tower designs drives their adoption. Structured packing variants further enhance performance by optimizing vapor–liquid contact efficiency, supporting energy savings and improved operational reliability in advanced process environments.

- For instance, Heraeus Quartzglass expanded its production of high-purity quartz components used in packed distillation systems for semiconductor-grade chemical distillation in Bitterfeld, Germany.

By Distillation Type:

The Vacuum Distillation segment held the largest share of 44.6% in 2024, driven by its ability to separate heat-sensitive compounds at lower temperatures. This method minimizes thermal degradation, making it essential for semiconductor-grade quartz purification and pharmaceutical synthesis. Increasing industrial focus on high-purity output and energy efficiency supports segment expansion. Adoption of automated control systems and integration with digital monitoring platforms enhance process accuracy and reduce operational downtime across manufacturing facilities.

- For instance, high-purity magnesium (99.999%) was refined using vacuum distillation techniques for applications like blue-light laser diodes in the semiconductor industry, with apparatus designed to condense purified metal onto specially placed baffle plates, significantly enhancing purity levels.

By Material:

The Stainless Steel segment led the market with a 51.8% share in 2024, favored for its superior corrosion resistance, strength, and thermal stability. It is widely used in distillation systems processing aggressive chemicals or high-purity compounds. The material’s durability and compatibility with quartz components improve system lifespan and reliability. Advancements in alloy formulations and surface treatment technologies continue to enhance mechanical integrity, driving preference across chemical, semiconductor, and optical manufacturing industries in Germany.

Key Growth Drivers

Rising Semiconductor Production Demand

Germany’s expanding semiconductor industry is a major growth driver for the Quartz Distillation Tower Market. High-purity quartz towers are essential for producing ultrapure chemicals used in wafer cleaning and etching. Increasing government and private investments in chip fabrication facilities boost the adoption of advanced distillation systems. The focus on energy-efficient and contamination-free operations encourages manufacturers to upgrade to automated quartz-based units, supporting steady market expansion across the semiconductor value chain.

- For instance, Heraeus Conamic introduced an energy-efficient quartz tower system for semiconductor-grade hydrofluoric acid production, reducing contamination risks during microchip fabrication.

Growth in Pharmaceutical and Chemical Sectors

Strong performance of Germany’s pharmaceutical and specialty chemical industries fuels demand for high-purity distillation systems. Quartz distillation towers ensure superior resistance to corrosion and thermal shock, vital for synthesizing sensitive compounds. With stricter regulatory standards and growing production of active pharmaceutical ingredients (APIs), companies prioritize precision distillation equipment. Continuous process upgrades and research-focused infrastructure in Germany strengthen the market for advanced quartz towers with enhanced purity, durability, and operational consistency.

- For instance, GESLabs uses thin-film distillation plants from VTA Verfahrenstechnische Anlagen GmbH to produce high-purity cannabinoid APIs, ensuring minimal thermal decomposition and high potency.

Technological Advancements and Automation

Advancements in tower design, including structured packing and automated temperature control, significantly enhance process efficiency. German manufacturers increasingly adopt smart monitoring systems for real-time operational control and predictive maintenance. Integration of digital sensors and AI-based process analytics minimizes energy use and product loss, ensuring consistent quality. These innovations align with Germany’s Industry 4.0 goals, driving the modernization of distillation infrastructure in semiconductor, chemical, and optical material production facilities.

Key Trends & Opportunities

Shift Toward Sustainable and Energy-Efficient Systems

Sustainability trends are transforming the Germany Quartz Distillation Tower Market. Manufacturers focus on developing energy-efficient designs that reduce emissions and thermal losses. Integration of eco-friendly materials and recyclable quartz components supports circular manufacturing goals. Government initiatives promoting carbon-neutral industrial operations encourage adoption of green distillation technologies. Companies investing in sustainable tower designs gain a competitive edge through operational cost reduction and compliance with evolving European environmental standards.

- For instance, in 2025, companies like SAES Getters developed advanced quartz towers utilizing recyclable materials aimed at reducing thermal losses and emissions.

Rising Adoption of High-Purity Quartz Materials

Increasing reliance on ultra-high-purity quartz in chemical and semiconductor processing presents major growth opportunities. High-purity quartz improves distillation precision, prevents contamination, and ensures long-term operational stability. German R&D initiatives in advanced materials technology foster the development of superior quartz compositions for complex applications. Collaborations between material suppliers and equipment manufacturers enhance innovation, paving the way for next-generation distillation towers that meet stricter performance and safety standards.

- For instance, Sibelco launched its IOTA series high-purity quartz products in September 2024, specifically engineered for semiconductor crucibles with 99.998% silica content.

Key Challenges

High Manufacturing and Installation Costs

Quartz distillation towers involve complex manufacturing processes and high material costs, limiting adoption among small and medium-sized enterprises. The need for specialized fabrication, machining, and thermal treatment increases production expenses. Installation and maintenance require skilled technicians, adding to total system costs. These financial barriers restrict market entry for new players and slow adoption rates across less capital-intensive industries, especially when competing with conventional metal-based alternatives.

Limited Availability of High-Purity Quartz Material

Access to high-purity quartz remains a critical challenge for manufacturers in Germany. Dependence on limited global suppliers and fluctuating raw material prices affect production stability. Supply chain disruptions can delay project timelines and inflate procurement costs. Manufacturers are exploring local sourcing and recycling initiatives to mitigate risks, but ensuring consistent purity and quality remains difficult. These material constraints pose long-term risks to scalability and cost competitiveness within the market.

Stringent Regulatory and Safety Standards

Germany’s rigorous environmental and industrial safety regulations increase compliance costs for manufacturers. Standards covering emissions, energy efficiency, and chemical handling require continuous process upgrades and certifications. Non-compliance can lead to operational delays or product recalls. Companies must invest in advanced monitoring systems and documentation to meet evolving European norms. Although necessary for quality assurance, these regulations add financial and operational pressure, especially for smaller market participants.

Regional Analysis

Southern Germany

Southern Germany accounted for 29% of the Germany Quartz Distillation Tower Market in 2024. Strong industrial infrastructure across Bavaria and Baden-Württemberg supports high adoption of advanced distillation systems. The region hosts leading semiconductor and chemical manufacturing facilities that rely on precision quartz towers for ultra-pure production. It benefits from significant investments in automation and cleanroom technologies. The presence of research institutions and equipment suppliers strengthens innovation and testing capabilities. Expanding renewable energy integration in process industries further supports long-term market growth.

Northern Germany

Northern Germany held 21% of the market share in 2024, driven by its well-developed chemical and pharmaceutical base. Hamburg and Bremen remain strategic hubs for quartz component manufacturing and export. It benefits from proximity to North Sea ports, enabling efficient material imports for tower production. Industrial clusters across Lower Saxony and Schleswig-Holstein are upgrading to sustainable distillation systems to meet environmental norms. Government support for green process technology adoption enhances the region’s competitiveness in high-purity chemical applications.

Western Germany

Western Germany captured 25% of total market share in 2024, supported by a dense concentration of chemical and optical manufacturing companies. North Rhine-Westphalia remains a major production zone with strong infrastructure and advanced processing facilities. It demonstrates consistent demand for corrosion-resistant and energy-efficient quartz towers across multiple industries. Industrial modernization programs continue to improve equipment performance and reduce emissions. Continuous R&D collaborations with engineering institutes enhance technological progress and material development in this region.

Eastern Germany

Eastern Germany represented 14% of the market share in 2024. It is witnessing increasing industrial investments in precision manufacturing and semiconductor fabrication. Saxony’s “Silicon Saxony” cluster drives demand for high-purity quartz distillation systems in electronic and optical applications. It benefits from improved manufacturing infrastructure and federal funding programs promoting advanced process technologies. Growing partnerships between public research bodies and equipment producers support product innovation. The region’s emerging industrial base strengthens its contribution to national production capacity.

Central Germany

Central Germany accounted for 11% of the market share in 2024. It is gaining momentum through growing investments in specialty chemical production and laboratory research. The region leverages its central location for efficient logistics and equipment distribution across Europe. Universities and technical centers support local innovation and skill development in high-purity quartz applications. Manufacturers are expanding regional facilities to serve niche industrial clients requiring customized distillation systems. It continues to play a supporting role in national production and R&D networks.

Market Segmentations:

By Tower Type

- Packed Towers

- Tray Towers

- Fractionating Towers

- Vigreux Towers

- Structured Packing Towers

- Others

By Distillation Type

- Vacuum Distillation

- Atmospheric Distillation

- Pressure Swing Distillation

By Material

- Carbon Steel

- Stainless Steel

- Alloy Steel

By Application

- Semiconductor Manufacturing

- Chemical Processing

- Pharmaceutical Industry

- Optical Components

- Satellite and Aerospace Technologies

- Laboratory Research

- Others

By Region

- Southern Germany

- Northern Germany

- Western Germany

- Eastern Germany

Competitive Landscape

The Germany Quartz Distillation Tower Market features a moderately consolidated structure, with leading players focusing on product innovation, material enhancement, and process automation. Key companies such as Raesch Quarz (Germany) GmbH, Heraeus Quarzglas GmbH & Co. KG, WONIK Quartz Europe, and Quarzglas Komponenten und Service (QCS) dominate through advanced manufacturing capabilities and extensive product portfolios. These firms emphasize the production of high-purity, thermally stable, and corrosion-resistant towers tailored for semiconductor, pharmaceutical, and chemical applications. Continuous R&D investments aim to improve tower efficiency and durability under extreme conditions. Strategic collaborations with research institutions and process equipment manufacturers strengthen technological leadership. Mid-sized companies such as semiQuarz GmbH, EUROQUARZ GmbH, and Nano Quarz Wafer GmbH compete through customized product solutions and regional client networks. The market remains innovation-driven, with growing emphasis on sustainable production, precision engineering, and automation to enhance competitiveness across domestic and international markets.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Players

Recent Developments

- In April 2024, Raesch Quarz (Germany) GmbH emphasized their continuous quality improvements and innovative quartz glass refinement for process cylinders and distillation vessels, supporting future-oriented quartz glass applications.

- On January 1, 2025, Heraeus merged its Conamic and Comvance units into a new operating company, Heraeus Covantics.

- In January 2025, SCHOTT AG completed the acquisition of QSIL GmbH Quarzschmelze Ilmenau in Germany, strengthening its portfolio in high-performance quartz materials for semiconductor and optical applications.

Report Coverage

The research report offers an in-depth analysis based on Tower Type, Distillation Type, Application, Material and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for high-purity quartz towers will rise with semiconductor manufacturing expansion.

- Automation and digital monitoring will improve operational efficiency and process control.

- Adoption of energy-efficient and sustainable distillation designs will gain momentum.

- Integration of AI-based predictive maintenance systems will reduce downtime and maintenance cost.

- Local sourcing of high-purity quartz will strengthen supply chain stability.

- Pharmaceutical and specialty chemical industries will continue driving product demand.

- Collaborations between research institutions and manufacturers will accelerate product innovation.

- Customized tower configurations will grow to meet diverse industrial needs.

- Government initiatsives supporting advanced manufacturing will enhance domestic production capacity.

- Export opportunities for German-made quartz towers will expand across Europe and Asia.