Market Overview

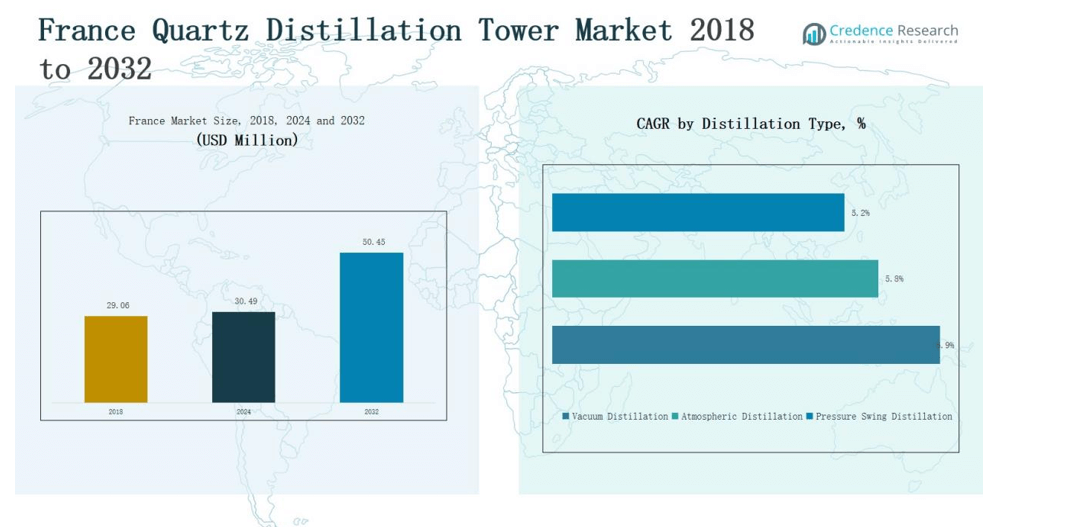

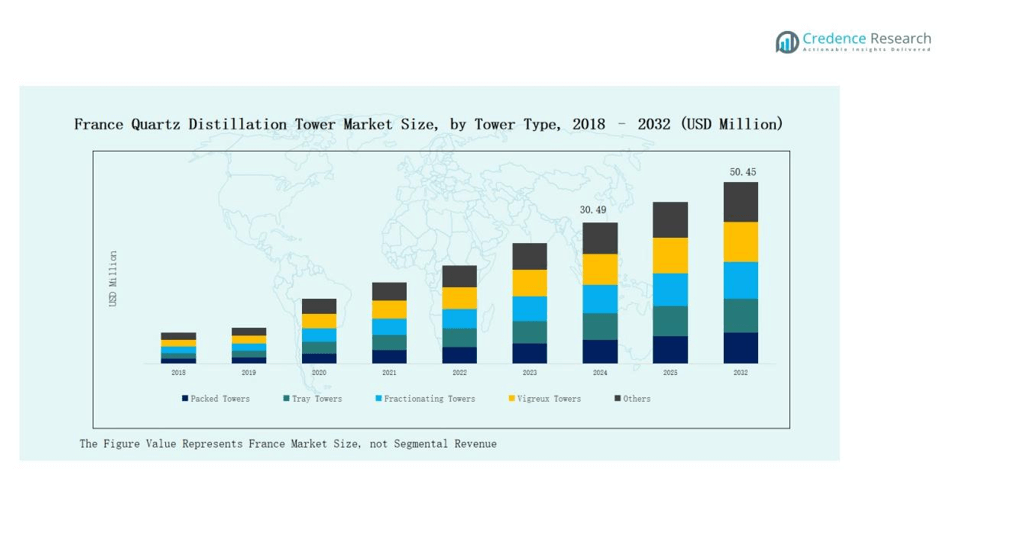

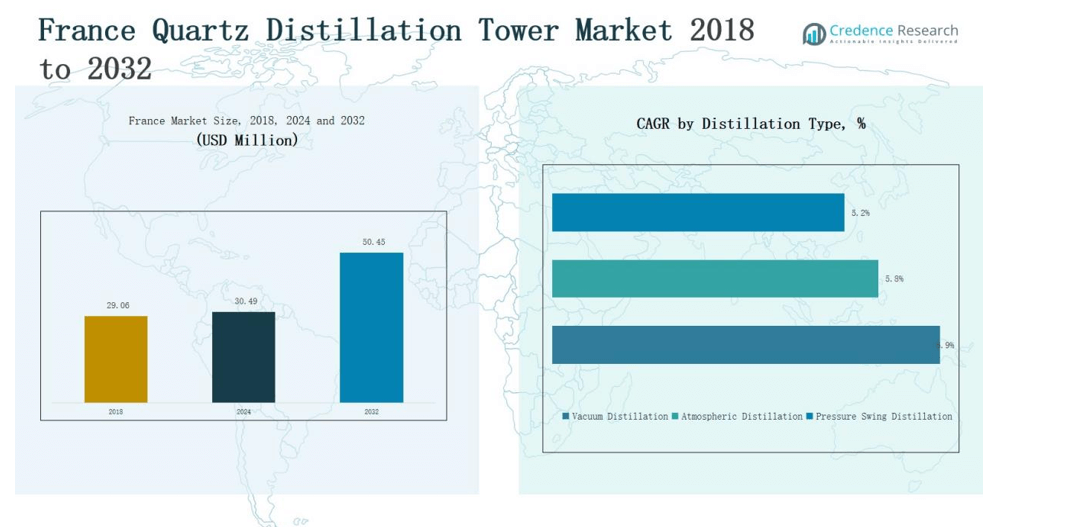

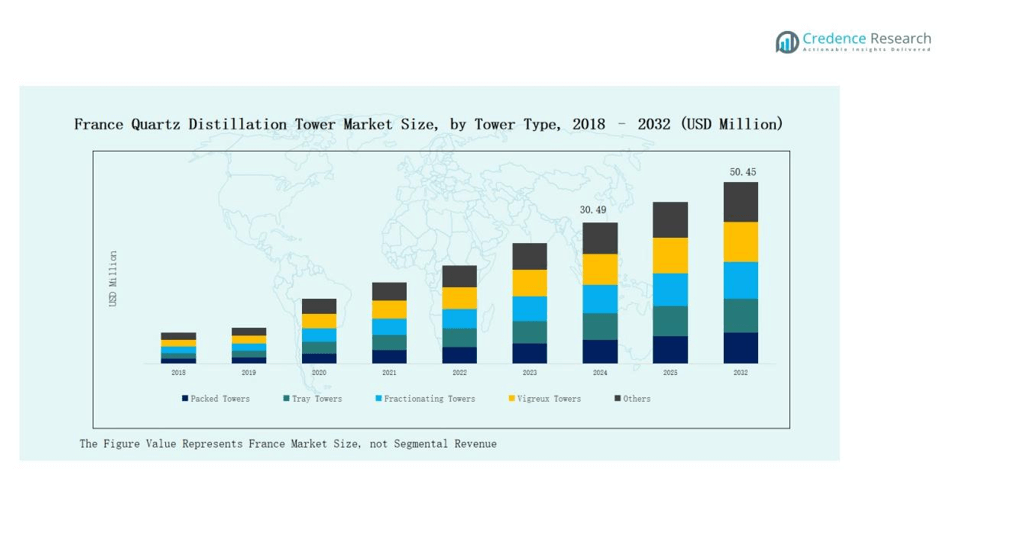

The France Quartz Distillation Tower Market size was valued at USD 29.06 million in 2018, rising to USD 30.49 million in 2024, and is projected to reach USD 50.45 million by 2032, growing at a CAGR of 6.50% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| France Quartz Distillation Tower Market Size 2024 |

USD 30.49 million |

| France Quartz Distillation Tower Market, CAGR |

6.50% |

| France Quartz Distillation Tower Market Size 2032 |

USD 50.45 million |

The France Quartz Distillation Tower Market is led by prominent companies such as Saint-Gobain, Labbe Process Equipment, Chalvignac Group, Heraeus, Shin-Etsu Quartz Products, Wacom Quartz Corporation, Koch-Glitsch, and Sulzer Ltd. These firms focus on developing high-purity, corrosion-resistant, and energy-efficient distillation systems to serve semiconductor, pharmaceutical, and chemical sectors. They emphasize automation, material innovation, and digital process control to enhance operational performance and sustainability. Île-de-France emerged as the leading region in 2024, commanding 31% of the total market share, supported by strong industrial infrastructure, advanced R&D capabilities, and concentration of high-tech manufacturing facilities.

Market Insights

- The France Quartz Distillation Tower Market grew from USD 29.06 million in 2018 to USD 30.49 million in 2024 and is projected to reach USD 50.45 million by 2032, registering a 6.50% CAGR.

- Île-de-France led the market with a 31% share in 2024, supported by advanced semiconductor facilities, strong R&D infrastructure, and high-tech manufacturing concentration.

- The Packed Towers segment dominated by tower type, holding 34.6% share, driven by high efficiency, scalability, and growing use in chemical and semiconductor processes.

- The Vacuum Distillation segment led by distillation type with 41.2% share, preferred for temperature-sensitive compound purification and enhanced process stability.

- The Stainless Steel segment accounted for 46.5% share by material, favored for corrosion resistance, durability, and expanding use in pharmaceutical and industrial manufacturing.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segment Insights

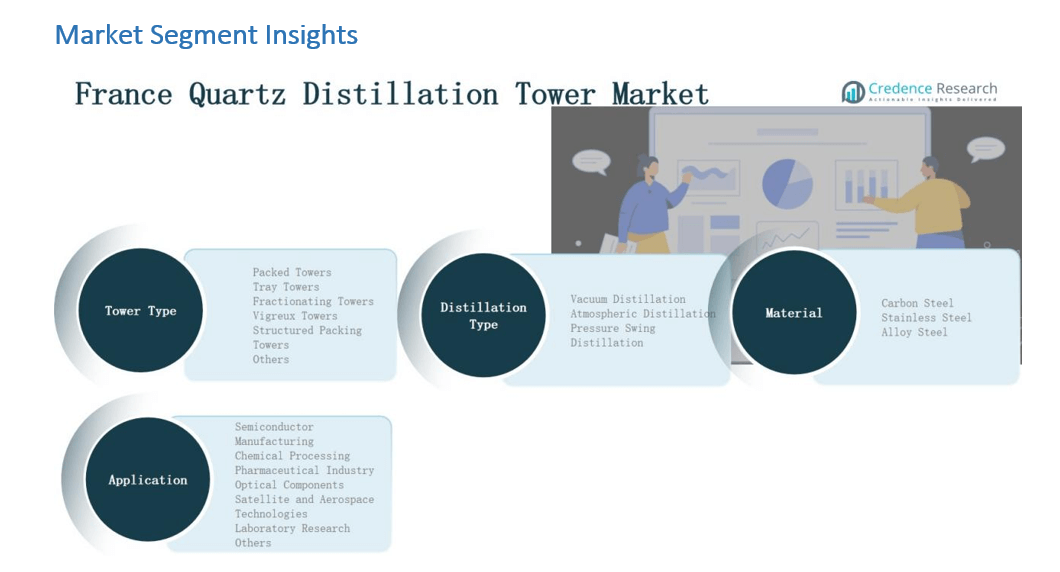

By Tower Type

The Packed Towers segment dominated the France Quartz Distillation Tower Market in 2024, holding a 34.6% share. These towers are preferred for their high mass-transfer efficiency, low pressure drop, and cost-effective operation in chemical and semiconductor applications. Their modular design enables efficient purification and easy scalability for research and industrial setups. The demand continues to rise due to advancements in packing materials and increasing adoption in pharmaceutical and optical component distillation processes.

- For instance, Nikon Corporation in December 2023 announced the release of its NSR-S636E ArF immersion lithography scanner, which employs specialized high-precision quartz components designed for semiconductor fabrication, highlighting its extensive use of quartz in high-tech manufacturing environments.

By Distillation Type

The Vacuum Distillation segment led the market with a 41.2% share in 2024. It is widely used for purifying temperature-sensitive and high-purity quartz-based compounds in semiconductor and specialty chemical sectors. This method reduces thermal decomposition risks, ensuring higher product yield and purity. The segment’s growth is driven by rising demand for precision distillation under controlled pressure and the adoption of automated vacuum systems enhancing energy efficiency and process stability.

- For instance, Momentive Technologies adopted precision vacuum purification systems at its Ohio plant to improve the purity levels of fused quartz materials used in photolithography processes.

By Material

The Stainless Steel segment accounted for a 46.5% share of the France Quartz Distillation Tower Market in 2024. Stainless steel offers superior corrosion resistance, mechanical strength, and thermal durability, making it ideal for long-term operation in chemical and pharmaceutical applications. Its compatibility with high-purity quartz structures enhances reliability and reduces contamination risk. The segment benefits from rising investments in advanced fabrication technologies and the expansion of France’s high-performance industrial manufacturing facilities.

Key Growth Drivers

Rising Demand from Semiconductor and Chemical Industries

The growing use of quartz distillation towers in semiconductor and chemical manufacturing is a key growth driver. These industries rely on high-purity distillation systems to ensure material integrity and process precision. France’s expanding semiconductor ecosystem and the push toward localized chip production are fueling equipment demand. The chemical sector’s focus on refining specialty compounds and achieving higher yield efficiency further strengthens market growth across production facilities and R&D centers.

- For instance, France’s semiconductor sector is expanding significantly with firms like STMicroelectronics and Soitec investing in new fabrication plants in industrial hubs such as Grenoble and Crolles, boosting demand for precision equipment in localized chip production.

Technological Advancements in Tower Design

Continuous innovation in tower design enhances energy efficiency, purity levels, and operational control. Advanced configurations such as structured packing and automated vacuum control improve separation performance and reduce process time. French manufacturers are investing in digital monitoring and predictive maintenance technologies to extend equipment life. These developments not only improve operational precision but also reduce downtime and operational costs, making quartz distillation towers more attractive for high-tech and industrial applications.

- For instance, Gerhardt Process Systems implemented automated vacuum control modules in its latest tower units, cutting average process cycles by 15%.

Expanding Pharmaceutical and Biotechnology Applications

The pharmaceutical sector in France increasingly adopts quartz distillation systems for high-purity solvent recovery and compound separation. These systems ensure contamination-free processing, which is critical for drug formulation and vaccine production. The rise in biotechnology and life sciences research further supports demand. Growing investment in R&D laboratories and the country’s strong regulatory standards for cleanroom equipment continue to drive the adoption of advanced quartz-based distillation systems in pharmaceutical applications.

Key Trends & Opportunities

Integration of Smart Monitoring and Automation

Automation and IoT-based control systems are transforming distillation tower operations. Real-time process monitoring, predictive analytics, and AI-enabled temperature regulation improve efficiency and safety. This digital shift helps minimize human error and operational downtime. France’s industrial automation strategy and the adoption of Industry 4.0 principles create new opportunities for suppliers offering intelligent quartz distillation systems with enhanced connectivity and sustainability features.

- For instance, Schneider Electric introduced its EcoStruxure Plant architecture to enable real-time energy and process optimization in chemical distillation units.

Focus on Sustainable Manufacturing Practices

Sustainability is a growing focus among manufacturers developing quartz distillation towers. Companies are adopting recyclable materials, reducing energy consumption, and optimizing system design for low-emission operations. The French government’s push for green industrial technologies supports this trend. Growing awareness among end-users regarding eco-efficient production aligns with the country’s environmental goals, opening opportunities for suppliers that integrate energy-efficient materials and advanced thermal recovery technologies.

- For instance, Caesarstone integrates recycled glass and quartz offcuts into its quartz surfaces, minimizing waste and conserving natural resources.

Key Challenges

High Initial Investment and Installation Costs

The high capital requirement for quartz distillation towers remains a major barrier for small and mid-scale industries. Advanced systems involve costly materials, precision engineering, and complex assembly, which increase initial expenses. Installation and maintenance further add to operational costs. This limits adoption across smaller chemical and laboratory facilities, slowing overall market penetration despite long-term operational benefits.

Technical Complexity and Skilled Workforce Shortage

Operating and maintaining high-precision quartz distillation systems demand skilled personnel and technical expertise. France faces a shortage of technicians proficient in advanced process automation and vacuum control. Insufficient training and limited technical education programs in this niche field can lead to operational inefficiencies and equipment downtime, affecting productivity across critical sectors such as semiconductor manufacturing and pharmaceuticals.

Supply Chain Constraints and Raw Material Availability

Dependence on imported high-purity quartz and precision components poses supply chain challenges. Disruptions in global logistics, trade restrictions, and rising material costs can delay production and increase pricing pressures. France’s limited domestic quartz mining capacity adds further strain. These factors compel manufacturers to establish strategic partnerships and diversify sourcing channels to maintain steady production and cost efficiency.

Regional Analysis

Île-de-France

Île-de-France led the France Quartz Distillation Tower Market in 2024, commanding 31% share. The region’s dominance stems from its concentration of advanced semiconductor manufacturing facilities and research institutions. Strong government support for industrial innovation and clean technology adoption drives equipment demand. Leading manufacturers in this region invest in automation and high-purity production systems to improve output quality. It benefits from a strong logistics network, skilled workforce, and presence of multinational chemical and pharmaceutical firms, reinforcing its leadership position across France.

Auvergne-Rhône-Alpes

Auvergne-Rhône-Alpes accounted for 22% share in 2024, supported by its strong chemical and materials engineering sector. The region’s industrial hubs in Lyon and Grenoble serve as key centers for process equipment manufacturing. It exhibits steady growth due to the increasing adoption of precision distillation systems in specialty chemicals and life sciences. Local manufacturers emphasize durable materials and process optimization to meet environmental and safety standards. Continuous R&D investments and regional technology clusters sustain its competitive position in the national market.

Provence-Alpes-Côte d’Azur

Provence-Alpes-Côte d’Azur held 17% share of the national market in 2024. The region’s proximity to Mediterranean trade routes enhances export opportunities for high-performance distillation equipment. Growth is driven by expanding pharmaceutical and biotechnology activities in Marseille and Nice. Manufacturers focus on sustainable process design to align with environmental regulations. It shows rising adoption in laboratory and academic research facilities due to growing investments in advanced purification technologies across regional innovation ecosystems.

Occitanie

Occitanie represented 15% share in 2024, driven by expanding aerospace, optical, and scientific research sectors. The Toulouse region supports steady demand for quartz distillation systems used in high-purity material production. It benefits from government-backed industrial modernization programs promoting local manufacturing. Key players emphasize cost-effective production and integration of advanced automation. Strong collaboration between research centers and private industries enhances product innovation, ensuring long-term market relevance.

Other Regions (Hauts-de-France, Nouvelle-Aquitaine, Grand Est)

Other regions collectively accounted for 15% share in 2024. These areas display moderate growth supported by small and medium manufacturers catering to local chemical and academic markets. Gradual infrastructure development and incentives for sustainable manufacturing support new investments. Increasing R&D partnerships with national laboratories improve adoption of high-efficiency quartz distillation towers. These regions contribute steadily to overall market expansion, strengthening France’s position in the European high-purity process equipment landscape.

Market Segmentations:

By Tower Type

- Packed Towers

- Tray Towers

- Fractionating Towers

- Vigreux Towers

- Structured Packing Towers

- Others

By Distillation Type

- Vacuum Distillation

- Atmospheric Distillation

- Pressure Swing Distillation

By Material

- Carbon Steel

- Stainless Steel

- Alloy Steel

By Application

- Semiconductor Manufacturing

- Chemical Processing

- Pharmaceutical Industry

- Optical Components

- Satellite and Aerospace Technologies

- Laboratory Research

- Others

By Region

- Île-de-France

- Auvergne-Rhône-Alpes

- Provence-Alpes-Côte d’Azur

- Occitanie

- Others

Competitive Landscape

The France Quartz Distillation Tower Market features a competitive environment led by multinational and domestic manufacturers focusing on precision engineering and material innovation. Key players such as Saint-Gobain, Labbe Process Equipment, Chalvignac Group, Heraeus, and Shin-Etsu Quartz Products dominate through advanced fabrication capabilities and customized solutions. These companies emphasize high-purity quartz production, corrosion-resistant designs, and automation integration to meet semiconductor and chemical processing standards. Strategic collaborations with research institutions and universities strengthen innovation pipelines and product testing. Local firms increasingly invest in energy-efficient systems and modular tower configurations to attract small and medium-scale clients. Continuous R&D in structured packing, heat recovery, and process optimization enhances operational performance. The market exhibits moderate consolidation, with leading players expanding their production capacities and establishing long-term supply agreements with chemical and pharmaceutical manufacturers to sustain growth and competitive advantage.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Players

Recent Developments

- In 2023, Saint-Gobain Quartz announced its transition to Saint-Gobain Advanced Ceramic Composites (ACC) to expand in quartz, ceramic fibers and composites.

- In 2023, ACC expanded its manufacturing capabilities in Courtenay, France, focusing on ceramic continuous filament production to enhance quartz composite integration in industrial applications.

- Heraeus Covantics launched a new quartz manufacturing plant in Shenyang, China in March 2025, showing expansion by major quartz players, but this pertains to China rather than France.

- In December 2024, SCHOTT struck a deal to acquire QSIL GmbH Quarzschmelze Ilmenau (its quartz division) to expand its semiconductor materials offerings.

Report Coverage

The research report offers an in-depth analysis based on Tower Type, Distillation Type, Material, Application and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for high-purity distillation systems will rise across semiconductor and chemical sectors.

- Manufacturers will focus on automation and smart process control for higher efficiency.

- Energy-efficient and sustainable tower designs will gain stronger adoption.

- Expansion in pharmaceutical and biotechnology industries will support consistent equipment demand.

- Local R&D investments will strengthen innovation in material composition and tower configuration.

- Digital monitoring and predictive maintenance will become standard operational features.

- Partnerships between equipment suppliers and research institutions will enhance product performance.

- Government support for clean manufacturing technologies will drive modernization initiatives.

- Import dependence for high-purity quartz materials will encourage domestic sourcing strategies.

- Competitive differentiation will rely on precision engineering, modular design, and process optimization.