| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Digital Oilfield Solutions Market Size 2024 |

USD 27,828.4 million |

| Digital Oilfield Solutions Market, CAGR |

6.46% |

| Digital Oilfield Solutions Market Size 2032 |

USD 45,783.1 million |

Market Overview

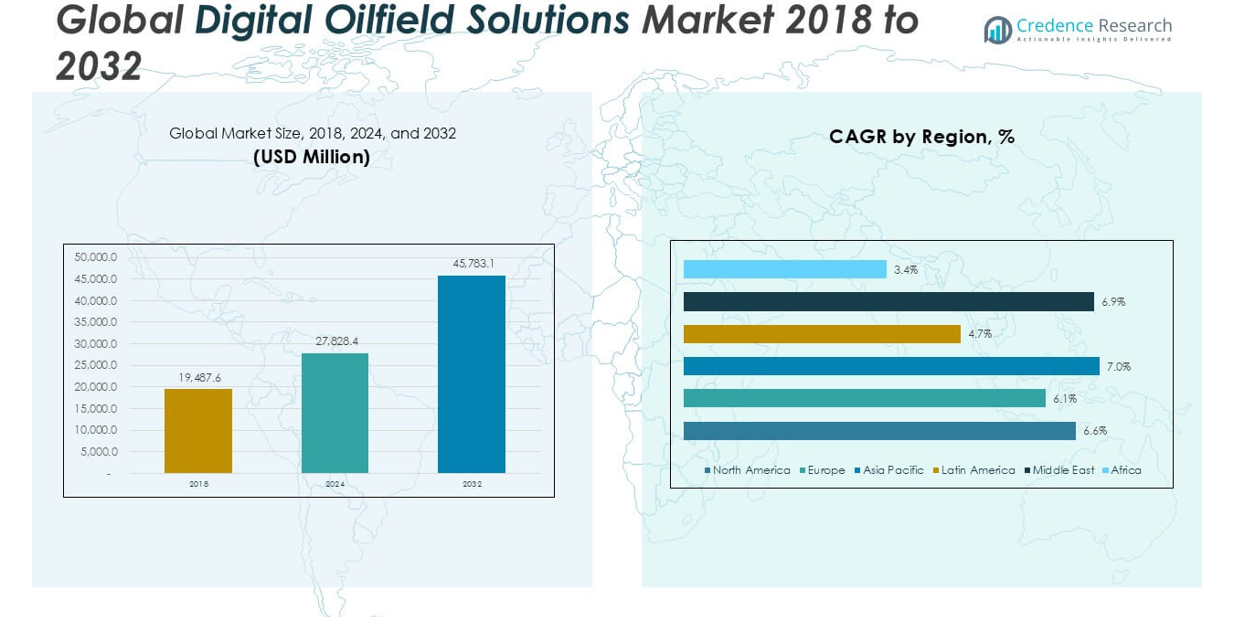

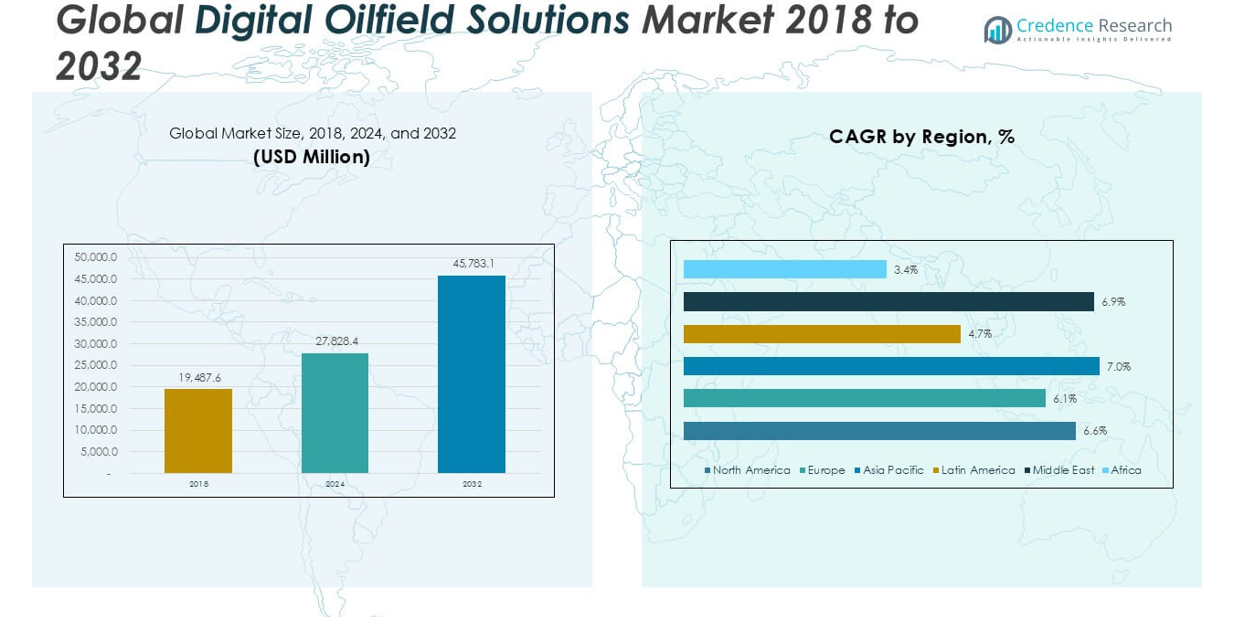

The Digital Oilfield Solutions market size was valued at USD 19,487.6 million in 2018, reached USD 27,828.4 million in 2024, and is anticipated to reach USD 45,783.1 million by 2032, at a CAGR of 6.46% during the forecast period.

Top players in the Digital Oilfield Solutions market include Weatherford, Rockwell Automation, Accenture, Honeywell Process Solutions, National Oilwell Varco, ABB, Osprey Informatics, Baker Hughes Company, Pason Systems Corp., and Emerson. These companies drive market innovation through comprehensive digital platforms, advanced analytics, and integrated hardware-software offerings. North America leads the market with a 37.1% share, fueled by early adoption of digital technologies, robust investment in upstream activities, and a strong presence of key industry players. The region’s focus on operational efficiency and technological advancement cements its position as the dominant force in the global Digital Oilfield Solutions market.

Market Insights

- The Digital Oilfield Solutions market was valued at USD 27,828.4 million in 2024 and is expected to reach USD 45,783.1 million by 2032, growing at a CAGR of 6.46%.

- Rising demand for operational efficiency, automation, and real-time data analytics drives widespread adoption of digital solutions across the oil and gas sector.

- Key market trends include rapid deployment of cloud-based platforms, increasing integration of AI and IoT technologies, and a shift toward remote monitoring and predictive maintenance.

- The market is highly competitive, with leading players such as Weatherford, Rockwell Automation, Accenture, Honeywell Process Solutions, National Oilwell Varco, ABB, Osprey Informatics, Baker Hughes Company, Pason Systems Corp., and Emerson focusing on technology innovation and global expansion.

- North America dominates with a 37.1% regional share, followed by Asia Pacific at 22.8%, while the software & service solutions segment leads in market share among solution types.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

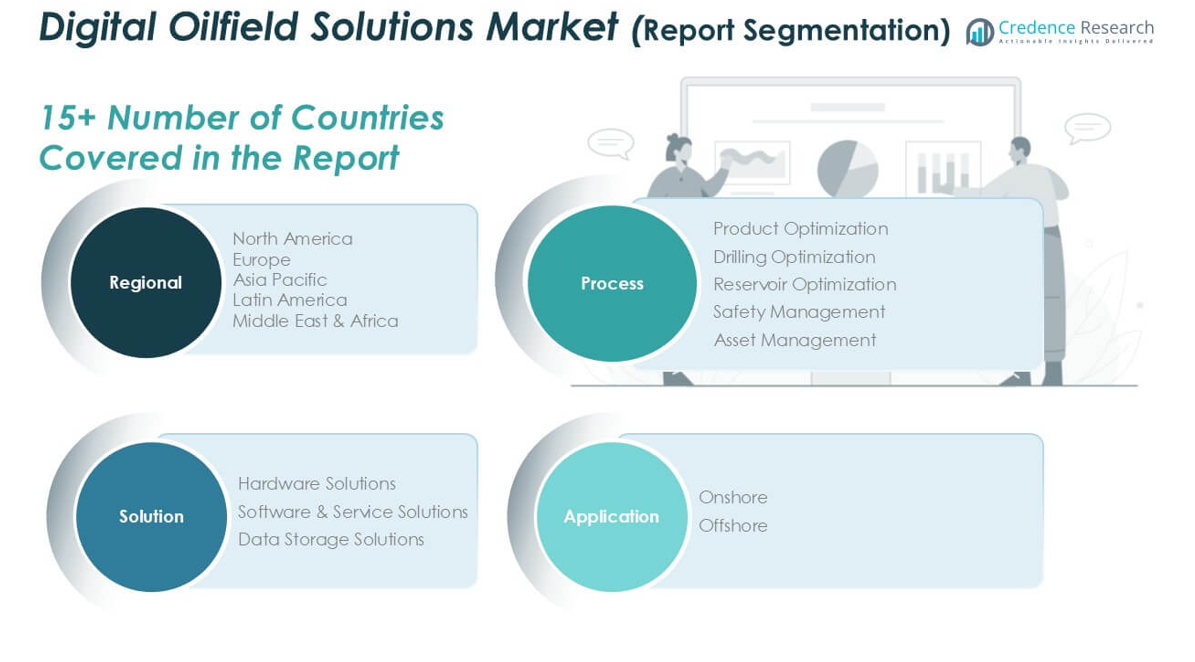

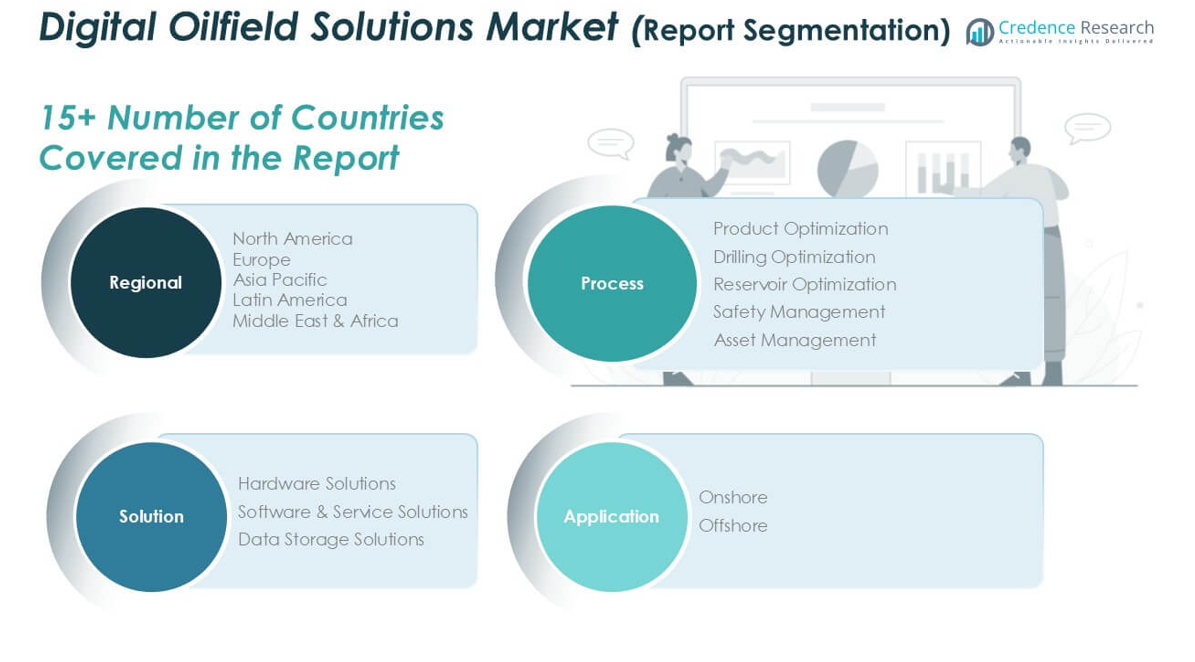

By Process

Product Optimization leads the process segment of the Digital Oilfield Solutions market, accounting for the largest market share. Companies prioritize product optimization to maximize production efficiency, minimize downtime, and enhance hydrocarbon recovery. This dominance reflects ongoing investments in automation, real-time monitoring, and advanced analytics to boost output and profitability. Growing adoption of digital twins and predictive maintenance further strengthens product optimization’s position as oil and gas operators seek cost-effective solutions to improve field performance.

- For instance, Baker Hughes deployed its JewelSuite software for Equinor, which helped reduce well planning time from 13 weeks to 5 weeks on the Johan Sverdrup field.

By Solution

Software & Service Solutions represent the dominant sub-segment in the solution category, capturing the highest market share in the Digital Oilfield Solutions market. Operators value advanced analytics, integrated platforms, and cloud-based services that deliver actionable insights and streamline workflows. The increasing demand for real-time data management and remote operations drives the adoption of software and service offerings. This segment’s growth is supported by ongoing digital transformation initiatives and the push for operational agility across upstream activities.

- For instance, Emerson’s Paradigm software allowed Ecopetrol to accelerate seismic data processing by 400%, reducing turnaround time from 15 days to 3 days for specific projects.

By Application

Onshore applications hold the leading share in the Digital Oilfield Solutions market, driven by the vast number of mature fields and relatively lower deployment complexities compared to offshore sites. Operators focus on digital technologies to optimize production, reduce operational costs, and extend asset life in onshore environments. The scalability of digital tools and ease of implementation contribute to the segment’s dominance. Increased investment in sensor technologies and automation also accelerates onshore digitalization, reinforcing its market leadership.

Market Overview

Rising Demand for Operational Efficiency

The Digital Oilfield Solutions market is propelled by the growing need for operational efficiency across upstream oil and gas operations. Companies seek advanced digital technologies that automate workflows, improve production monitoring, and optimize resource allocation. Integration of real-time data analytics enables faster decision-making and reduced non-productive time, resulting in significant cost savings. The focus on maximizing output and minimizing downtime encourages widespread adoption of digital oilfield solutions, making operational efficiency a core growth driver.

- For instance, Honeywell Process Solutions automated over 1,200 wells for Occidental Petroleum in the Permian Basin, leading to an annual reduction in unplanned downtime of 220 hours

Increasing Focus on Remote and Automated Operations

Rising emphasis on remote and automated field operations drives growth in the Digital Oilfield Solutions market. Oil and gas companies invest in remote monitoring, predictive maintenance, and automated control systems to ensure safety and reduce reliance on onsite personnel. These solutions enable continuous asset surveillance, facilitate timely intervention, and improve risk management, especially in hazardous or hard-to-reach environments. Demand for remote operations surged following recent global disruptions, further strengthening this trend.

- For instance, ABB’s Ability™ System 800xA supports over 350 remotely operated oil and gas installations for Shell in the North Sea.

Adoption of Advanced Data Analytics and IoT

The growing adoption of advanced data analytics and Internet of Things (IoT) technologies acts as a major catalyst for market expansion. Oilfield operators leverage big data platforms, cloud computing, and IoT-enabled sensors to capture, analyze, and interpret vast datasets in real time. These capabilities support proactive maintenance, optimized reservoir management, and informed decision-making. Increasing investments in digital infrastructure and smart devices solidify the role of analytics and IoT as essential market drivers.

Key Trends & Opportunities

Digital Transformation and Cloud Adoption

Digital transformation remains a prominent trend as companies accelerate the deployment of cloud-based oilfield solutions. Migrating to cloud platforms enhances scalability, supports collaboration across locations, and reduces IT infrastructure costs. This trend creates opportunities for providers offering secure, scalable, and customizable digital oilfield platforms, meeting the evolving needs of global oil and gas operators.

- For instance, Accenture partnered with a major Middle Eastern NOC to migrate and integrate data from more than 1,500 wells into a centralized cloud platform, streamlining reservoir management and real-time decision-making.

Integration of Artificial Intelligence and Machine Learning

The integration of artificial intelligence (AI) and machine learning (ML) into digital oilfield operations presents significant growth opportunities. AI-powered solutions deliver predictive analytics, automate complex processes, and enhance asset reliability. Companies harness AI and ML to unlock new value from operational data, leading to better performance, reduced risk, and greater flexibility in dynamic market conditions.

- For instance, Weatherford’s ForeSite platform applied machine learning to optimize production from over 5,000 wells globally, delivering an average production increase of 8% per well.

Key Challenges

High Implementation and Integration Costs

High initial costs associated with implementing and integrating digital oilfield solutions pose a significant challenge for operators. Investments in advanced hardware, software, and skilled personnel can strain budgets, particularly for small and mid-sized companies. Complex integration with legacy systems adds to the financial and technical barriers, potentially slowing the pace of digital adoption.

Cybersecurity and Data Privacy Risks

The increased reliance on digital technologies elevates cybersecurity and data privacy risks in the Digital Oilfield Solutions market. Oil and gas assets become targets for cyberattacks, which can disrupt operations and compromise sensitive information. Companies must invest in robust security frameworks and regular risk assessments to mitigate vulnerabilities, but evolving threats remain a persistent challenge.

Resistance to Organizational Change

Resistance to change within traditional oil and gas organizations can hinder digital transformation efforts. Employees may be reluctant to adopt new technologies or alter established workflows, resulting in delayed project timelines or underutilized solutions. Successful digital oilfield deployment requires strong leadership, effective training, and a culture of innovation to overcome internal resistance.

Regional Analysis

North America

North America leads the Digital Oilfield Solutions market, holding the largest market share at 37.1% in 2024, with a market size of USD 10,327.52 million, up from USD 7,175.32 million in 2018. The region’s dominance is attributed to early technology adoption, significant investments in digital infrastructure, and robust shale activities. The market is projected to reach USD 17,168.67 million by 2032, growing at a CAGR of 6.6%. Strong regulatory support and a focus on operational efficiency drive continuous advancements and digital transformation across upstream operations.

Europe

Europe secures a 17.5% market share in 2024, with the Digital Oilfield Solutions market valued at USD 4,877.13 million, rising from USD 3,486.32 million in 2018. The region benefits from stringent environmental regulations and the presence of major oilfield service providers. Europe’s market is anticipated to reach USD 7,801.44 million by 2032, expanding at a CAGR of 6.1%. Emphasis on sustainability, energy transition initiatives, and adoption of advanced analytics and automation solutions position Europe as a key market for digital oilfield innovation.

Asia Pacific

Asia Pacific represents 22.8% of the global Digital Oilfield Solutions market in 2024, with a value of USD 6,353.62 million, up from USD 4,310.65 million in 2018. This region is forecast to reach USD 10,887.22 million by 2032 at a CAGR of 7.0%, the highest among major regions. Growth is driven by increasing exploration and production activities, digital investments, and a growing focus on resource optimization. Expanding energy demand and rapid adoption of IoT and data analytics propel Asia Pacific’s digital oilfield market growth.

Latin America

Latin America holds a 8.0% market share in 2024, valued at USD 2,231.04 million, compared to USD 1,711.01 million in 2018. The market is projected to achieve USD 3,204.82 million by 2032, with a CAGR of 4.7%. Regional growth is supported by national oil companies modernizing operations, the adoption of automation solutions, and renewed offshore exploration efforts. Budget constraints and slower digital transformation pace limit overall expansion, but targeted investments in production optimization continue to stimulate market activity.

Middle East

The Middle East accounts for a 13.1% share of the Digital Oilfield Solutions market in 2024, with a market value of USD 3,650.69 million, rising from USD 2,490.51 million in 2018. The region is expected to reach USD 6,212.77 million by 2032, registering a CAGR of 6.9%. Extensive upstream activity, a focus on maximizing reservoir performance, and large-scale adoption of advanced digital technologies drive market growth. The push for operational excellence and asset reliability positions the Middle East as a vital digital oilfield market.

Africa

Africa comprises 1.4% of the global Digital Oilfield Solutions market in 2024, with a market size of USD 388.41 million, up from USD 313.75 million in 2018. The market is anticipated to reach USD 508.19 million by 2032, growing at a CAGR of 3.4%. Digital oilfield adoption remains in early stages, with investments focused on select mature fields. Infrastructure constraints and limited digital expertise restrain rapid growth, yet ongoing modernization efforts and international collaborations present long-term market opportunities for Africa.

Market Segmentations:

By Process

- Product Optimization

- Drilling Optimization

- Reservoir Optimization

- Safety Management

- Asset Management

By Solution

- Hardware Solutions

- Software & Service Solutions

- Data Storage Solutions

By Application

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Digital Oilfield Solutions market features a dynamic mix of global technology providers, oilfield service companies, and specialized software vendors. Leading firms such as Weatherford, Rockwell Automation, Accenture, Honeywell Process Solutions, National Oilwell Varco, ABB, Osprey Informatics, Baker Hughes Company, Pason Systems Corp., and Emerson shape the industry by offering integrated solutions that span hardware, software, and advanced analytics. These players compete on technological innovation, scalability, and their ability to provide end-to-end digital transformation services. Strategic partnerships, mergers, and acquisitions are common as companies aim to expand their digital portfolios and geographic presence. Continuous investment in artificial intelligence, IoT, and cloud-based platforms strengthens market positions and enables firms to address evolving operational challenges. With a focus on operational efficiency, data-driven decision-making, and enhanced field productivity, market leaders remain committed to delivering robust digital oilfield solutions that support the evolving needs of oil and gas operators worldwide.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Weatherford

- Rockwell Automation

- Accenture

- Honeywell Process Solutions

- National Oilwell Varco

- ABB

- Osprey Informatics

- Baker Hughes Company

- Pason Systems Corp.

- Emerson

Recent Developments

- In April 2025, ABB India delivered integrated automation and digital solutions for IndianOil’s cross-country pipeline network. This project involves the ABB Ability™ SCADAvantage digital platform for real-time monitoring and cybersecurity, demonstrating ABB’s continued focus on digital solutions for midstream operations.

- In January 2025, Baker Hughes introduced SureCONNECT FE, a field-proven downhole fiber-optic wet-mate system. This technology enables real-time, efficient reservoir performance in high-pressure environments, reducing rig time, maintenance costs, and safety risks.

- In September 2024: ABB signed an agreement to support a major LNG export project in the US.

Market Concentration & Characteristics

The Digital Oilfield Solutions Market displays a moderate to high level of market concentration, characterized by the presence of several global technology leaders and specialized solution providers. It is shaped by a few dominant players, such as Weatherford, Rockwell Automation, Accenture, Honeywell Process Solutions, National Oilwell Varco, ABB, Osprey Informatics, Baker Hughes Company, Pason Systems Corp., and Emerson, who collectively hold significant market share and influence industry standards. The market features strong technological differentiation, with companies competing on the basis of innovation, integration capabilities, and digital transformation expertise. It sees frequent strategic partnerships and acquisitions as key players seek to expand their solution portfolios and regional footprints. Rapid advancements in artificial intelligence, IoT, and cloud platforms drive continuous product evolution, while customers increasingly value end-to-end service offerings and seamless data integration. The market’s characteristics include high entry barriers due to technical complexity, a focus on operational efficiency, and a strong demand for customized, scalable digital oilfield solutions.

Report Coverage

The research report offers an in-depth analysis based on Process, Solution, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Adoption of AI-driven analytics will increase across all operational stages.

- Operators will prioritize cybersecurity frameworks to protect digital assets.

- Cloud-native solutions will dominate deployment strategies due to scalability.

- Integration of edge computing will support real-time decision-making onsite.

- Partnerships between technology providers and oilfield operators will accelerate.

- Demand for predictive maintenance tools will grow in both onshore and offshore fields.

- Digital twin implementations will expand for reservoir and asset optimization.

- IoT sensor networks will become standard in remote and mature fields.

- Customized, modular solutions will gain traction for diverse field requirements.

- Operators will pursue unified platforms that combine hardware, software, and services across disciplines.