Market Overview

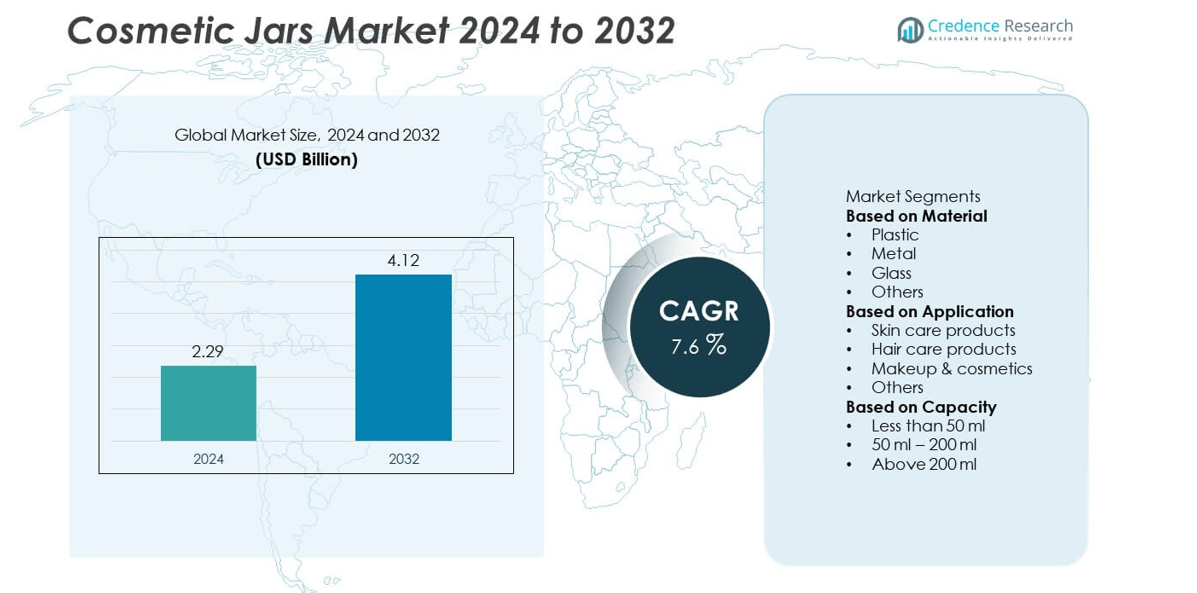

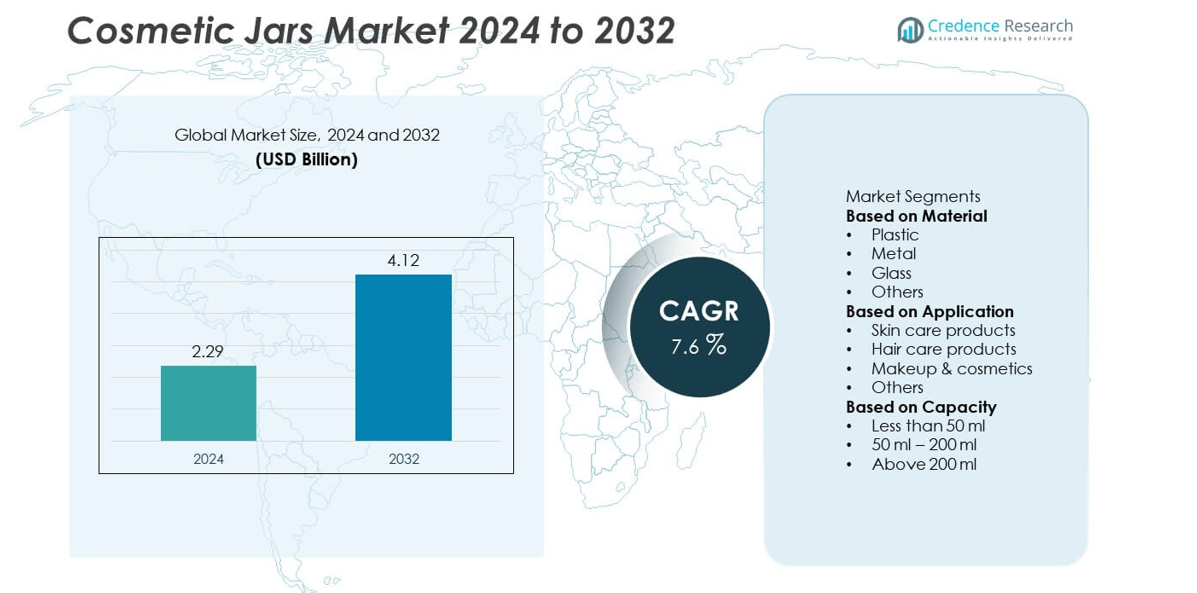

The Cosmetic Jars market was valued at USD 2.29 billion in 2024 and is projected to reach USD 4.12 billion by 2032, growing at a CAGR of 7.6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Cosmetic Jars Market Size 2024 |

USD 2.29 billion |

| Cosmetic Jars Market, CAGR |

7.6% |

| Cosmetic Jars Market Size 2032 |

USD 4.12 billion |

The cosmetic jars market is led by key players such as HCP Packaging, Berlin Packaging, Berry Global, Inc., Stoelzle Glass Group, Gerresheimer AG, Quadpack Industries, Eurovetrocap, Albea Group, AptarGroup, Inc., and RPC Group Plc. These companies dominate through innovation in sustainable materials, premium design, and customizable packaging solutions. Asia-Pacific emerged as the leading region with a 34% market share in 2024, driven by high cosmetic production in China, Japan, and South Korea. Europe followed with 28%, supported by luxury skincare brands and eco-friendly packaging trends, while North America, holding 26%, benefitted from strong consumer preference for premium and refillable cosmetic containers.

Market Insights

- The Cosmetic Jars market was valued at USD 2.29 billion in 2024 and is projected to reach USD 4.12 billion by 2032, growing at a CAGR of 7.6% during the forecast period.

- Market growth is driven by rising demand for premium skincare and personal care packaging, supported by the expansion of sustainable, reusable, and luxury cosmetic products across global brands.

- Key trends include the adoption of eco-friendly materials, refillable jar systems, and minimalist designs that enhance product appeal and align with green packaging initiatives.

- The market is moderately fragmented, with leading players such as HCP Packaging, Berry Global, and Berlin Packaging focusing on innovation, customization, and recyclable material development to strengthen competitiveness.

- Asia-Pacific leads with a 34% share, followed by Europe at 28% and North America at 26%, while the plastic material segment dominates with a 52% share due to its affordability, flexibility, and lightweight design advantages.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Material

The plastic segment dominated the cosmetic jars market in 2024, accounting for around 52% of the total share. Plastic jars remain the preferred choice due to their lightweight design, affordability, and high durability. They are widely used for skincare and haircare packaging across mass and mid-range cosmetic brands. The flexibility of plastic allows for varied shapes, sizes, and finishes, making it ideal for both functional and aesthetic packaging. Increasing innovations in recyclable and bio-based plastics further support segment growth as brands shift toward sustainable packaging materials.

- For instance, Berry Global, Inc. collaborated with Mars to transition its pantry jars to 100% post-consumer recycled plastic, eliminating over 1,300 metric tons of virgin plastic annually.

By Application

The skincare products segment led the market with a 49% share in 2024, supported by growing consumer focus on self-care and premium beauty formulations. Cosmetic jars are extensively used for creams, lotions, serums, and masks that require secure and air-tight storage. The rise in demand for anti-aging and organic skincare products has driven the need for visually appealing and eco-friendly packaging. Luxury brands are increasingly adopting glass and acrylic jars for high-end skincare lines, enhancing both product safety and brand appeal.

- For instance, Gerresheimer AG manufactures precision-molded cosmetic glass jars, along with packaging for the pharmaceutical, biotech, and food industries. Its moulded glass unit provides expertise and global production capabilities from eight plants across Europe, the Americas, and Asia, though the company began a process to divest this business in 2025.

By Capacity

The 50 ml – 200 ml segment held the largest market share of 45% in 2024, driven by its suitability for daily-use skincare and makeup products. This capacity range balances convenience and portability, making it popular among both retail and travel-size packaging. Manufacturers prefer this size for facial creams, moisturizers, and foundation jars. The segment benefits from strong adoption in both mass-market and premium cosmetic lines. Smaller jars under 50 ml cater to luxury samples and travel kits, while larger sizes above 200 ml are mainly used for professional salon and spa products.

Market Overview

Rising Demand for Premium and Sustainable Packaging

The growing preference for premium and eco-friendly beauty packaging is a major driver of the cosmetic jars market. Consumers increasingly favor sustainable materials such as glass, recycled plastic, and bamboo to align with environmental values. Luxury and organic beauty brands are investing in aesthetically appealing jar designs that enhance shelf presence and product experience. The trend toward reusable and refillable containers further strengthens market expansion, as brands focus on circular economy models to reduce plastic waste and improve brand sustainability perception.

- For instance, Albéa Group developed the 50ml refillable jar named Twirl, which is made of recyclable materials like PP and PET and features an inner cup for an easy and intuitive refill process. The company has also developed other sustainable solutions, such as recyclable tubes that incorporate recycled plastic and monomaterial designs.

Expanding Skincare and Personal Care Industry

Rapid growth in skincare and personal care product consumption globally drives significant demand for cosmetic jars. Increasing awareness of self-care routines and premium skincare formulations boosts packaging requirements. Jars remain a preferred choice for creams, masks, and moisturizers that require air-tight and temperature-stable storage. The rise of gender-neutral and unisex skincare products further widens market potential. Additionally, expanding e-commerce beauty channels and social media-driven cosmetic marketing strengthen product visibility and packaging innovation.

- For instance, Stoelzle Glass Group has a total annual production capacity of billions of glass containers across multiple facilities and offers premium cosmetic and perfumery packaging with a UV-filter coating, LumiCoat.

Growth in Customization and Brand Differentiation

Brands are increasingly using customized cosmetic jars to enhance identity and attract consumer attention. Packaging now acts as a key marketing tool, reflecting product value and brand sustainability. Advanced printing, embossing, and decorative techniques allow companies to differentiate through texture, color, and finish. Small and mid-size brands are adopting personalized jars to compete with established players in the premium beauty space. This shift toward tailored packaging experiences drives continuous innovation in design flexibility, material variety, and consumer engagement strategies.

Key Trends & Opportunities

Shift Toward Eco-Friendly and Refillable Packaging

The market is witnessing a strong transition to sustainable and refillable cosmetic jars as consumers demand environmentally responsible products. Brands are introducing biodegradable plastics, glass, and metal jars that reduce waste and enhance recyclability. The refillable packaging concept is gaining traction, particularly in skincare and luxury cosmetics. This shift not only aligns with global sustainability goals but also creates repeat-purchase opportunities. Manufacturers focusing on lightweight, durable, and visually appealing eco-packaging materials stand to gain a competitive advantage in this evolving market landscape.

- For instance, Quadpack developed its Regula Refill Jar, made with recyclable PET and PP, that is designed for easy and repeatable use by consumers. The thick outer jar is made of PET, while the inner jar and cap are made of PP. The refilling system allows for easy removal of the inner jar. PCR content is also available for solid colored versions of the jar.

Integration of Smart and Digital Packaging Features

Innovations such as smart labeling, QR codes, and sensor-based packaging are emerging in the cosmetic jars market. These features enhance consumer interaction by providing real-time product information, authenticity verification, and usage guidance. Premium brands are using digital packaging to improve transparency and traceability, appealing to tech-savvy consumers. The combination of aesthetics and functionality offers new avenues for differentiation. This trend supports higher engagement and loyalty while enabling companies to collect valuable customer insights through connected packaging systems.

- For instance, Aptar partnered with Legit.Health to create an advanced digital solution for immuno-dermatology, which uses AI technology to help healthcare professionals diagnose skin conditions and improve patient experience.

Key Challenges

High Production and Material Costs

The growing use of sustainable materials such as glass, aluminum, and biodegradable plastics increases production expenses. These materials require specialized processing, molding, and finishing techniques, adding to overall costs. Smaller cosmetic brands often struggle to balance design quality and cost-effectiveness. Fluctuating raw material prices further pressure profit margins. Although demand for premium and eco-conscious packaging remains strong, affordability concerns continue to limit widespread adoption, particularly in cost-sensitive markets where price competition is intense.

Environmental and Recycling Limitations

While sustainability drives growth, recycling remains a major challenge for mixed-material cosmetic jars. Jars combining plastic, metal, and decorative coatings are difficult to recycle through conventional waste streams. Inadequate recycling infrastructure in developing economies worsens the problem, leading to increased landfill waste. Manufacturers are focusing on simplifying designs and using mono-material solutions to address recyclability issues. However, achieving a balance between visual appeal, performance, and sustainability remains complex, requiring continuous innovation and collaboration across the packaging supply chain.

Regional Analysis

North America

North America held a 26% market share in 2024, driven by high demand for premium skincare and beauty products. The United States leads the region, supported by strong spending on luxury cosmetics and the popularity of sustainable packaging. Brands are focusing on recyclable and refillable jars to meet eco-conscious consumer preferences. The growing influence of clean beauty trends and the rise of indie brands further stimulate packaging innovation. Continuous investment in design aesthetics and functional packaging solutions strengthens the region’s role as a key market for advanced cosmetic jar manufacturing.

Europe

Europe accounted for 28% of the global market share in 2024, supported by a mature beauty industry and strict environmental regulations. Countries such as France, Germany, and Italy drive strong demand through premium skincare and fragrance packaging. The region’s focus on sustainability encourages the use of glass, metal, and biodegradable jar materials. European brands emphasize minimalistic and refillable packaging to align with circular economy goals. High consumer preference for natural and organic products continues to push manufacturers toward sustainable, high-quality, and visually appealing cosmetic jar designs.

Asia-Pacific

Asia-Pacific dominated the cosmetic jars market with a 34% market share in 2024. The region’s leadership is fueled by expanding beauty industries in China, Japan, South Korea, and India. Rapid urbanization, rising disposable incomes, and growing interest in skincare routines boost product packaging demand. K-beauty and J-beauty trends significantly influence global packaging aesthetics and innovation. Local manufacturers are increasingly investing in lightweight and recyclable jar materials to attract both domestic and international brands. The booming e-commerce and social media-driven beauty market further strengthen Asia-Pacific’s dominance in the cosmetic jar industry.

Latin America

Latin America captured 7% of the market share in 2024, led by Brazil and Mexico. Rising awareness of personal grooming and increased female workforce participation drive cosmetic consumption. Growing demand for affordable yet stylish packaging encourages the use of plastic jars in mass-market beauty products. The regional market is expanding with strong e-commerce growth and local production of skincare and haircare products. Sustainable packaging initiatives are gradually gaining traction as brands adopt recyclable plastics and eco-friendly alternatives to meet evolving consumer expectations.

Middle East & Africa

The Middle East and Africa region accounted for 5% of the market share in 2024. The market benefits from growing demand for luxury skincare and fragrance products in countries such as the United Arab Emirates, Saudi Arabia, and South Africa. Increasing consumer preference for premium packaging and imported cosmetic brands supports regional expansion. Tourism growth and retail developments further boost beauty product sales. However, reliance on imported packaging materials limits local production capacity. Manufacturers are exploring partnerships to establish regional facilities and meet rising demand for customized and sustainable cosmetic jar solutions.

Market Segmentations:

By Material

- Plastic

- Metal

- Glass

- Others

By Application

- Skin care products

- Hair care products

- Makeup & cosmetics

- Others

By Capacity

- Less than 50 ml

- 50 ml – 200 ml

- Above 200 ml

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of Middle East and Africa

Competitive Landscape

The competitive landscape of the cosmetic jars market includes major players such as HCP Packaging, Berlin Packaging, Berry Global, Inc., Stoelzle Glass Group, Gerresheimer AG, Quadpack Industries, Eurovetrocap, Albea Group, AptarGroup, Inc., and RPC Group Plc. These companies compete through innovation, material sustainability, and design customization to meet the growing demand for premium and eco-friendly cosmetic packaging. Leading manufacturers emphasize recyclable, refillable, and lightweight jar solutions made from glass, bio-based plastics, and metal. Strategic partnerships with cosmetic brands and investments in automated manufacturing strengthen their market reach. European and North American players dominate luxury packaging, while Asian companies focus on cost-effective, high-volume production. Continuous R&D efforts in aesthetic finishes, smart labeling, and minimalistic designs enhance brand differentiation. The market remains moderately fragmented, with sustainability, functionality, and brand collaboration serving as key competitive factors shaping long-term positioning and growth.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- HCP Packaging

- Berlin Packaging

- Berry Global, Inc.

- Stoelzle Glass Group

- Gerresheimer AG

- Quadpack Industries

- Eurovetrocap

- Albea Group

- AptarGroup, Inc.

- RPC Group Plc

Recent Developments

- In April 2025, HCP Packaging expanded its packaging portfolio by launching a new collection of skincare pumps and stock jars, and introduced its patented Affinity pump system (both atmospheric and airless) into its jar/pump assemblies.

- In January 2025, Gerresheimer AG launched a “Connected Packaging” initiative in beauty, integrating digital features (e.g. NFC tags) into its jars and containers to enhance product traceability.

- In October 2023, Albéa Beauty (Albea group’s beauty arm) introduced a line of fully recyclable, refillable jars made from post-consumer recycled (PCR) materials.

- In April 2023, Quadpack/Sulapac launched a wood-based refillable jar for solid and cream formulas under its Nordic sustainable packaging collection.

Report Coverage

The research report offers an in-depth analysis based on Material, Application, Capacity and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will continue to grow due to rising global demand for skincare and beauty products.

- Sustainable and refillable cosmetic jars will gain strong consumer and brand preference.

- Manufacturers will focus on lightweight, recyclable, and bio-based materials for eco-friendly packaging.

- Premium and luxury brands will drive innovation in glass and metal jar designs.

- Digital printing and smart labeling technologies will enhance product personalization.

- Asia-Pacific will remain the leading region, supported by expanding cosmetic production and e-commerce growth.

- Collaborations between packaging suppliers and beauty brands will increase customization options.

- Minimalist and aesthetically refined designs will dominate premium product lines.

- Advancements in automated manufacturing will improve production efficiency and consistency.

- Continuous R&D in sustainable materials and circular packaging systems will shape long-term market competitiveness.