Market Overview

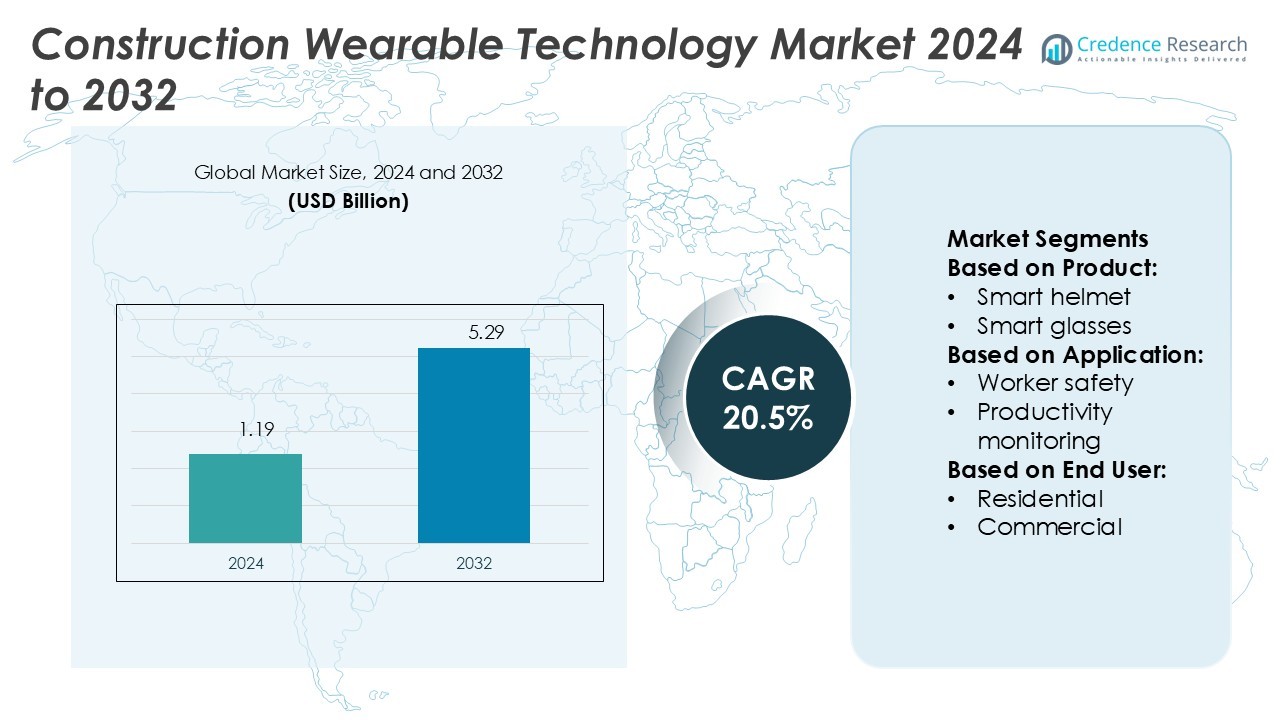

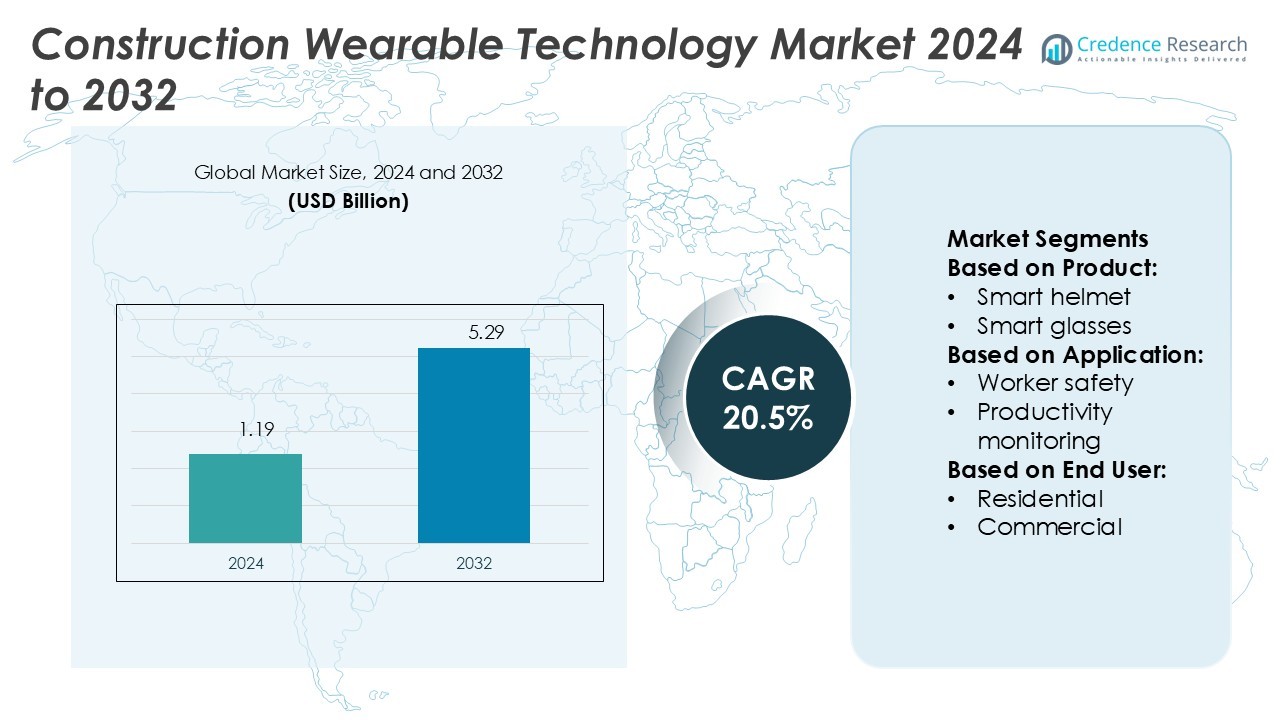

Construction Wearable Technology Market size was valued USD 1.19 billion in 2024 and is anticipated to reach USD 5.29 billion by 2032, at a CAGR of 20.5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Construction Wearable Technology Market Size 2024 |

USD 1.19 Billion |

| Construction Wearable Technology Market, CAGR |

20.5% |

| Construction Wearable Technology Market Size 2032 |

USD 5.29 Billion |

The Construction Wearable Technology Market is driven by major players including Garmin, Siemens, RealWear Inc., Honeywell International Inc., ARM Limited, German Bionic Systems GmbH, Trimble Inc., Panasonic, Kenzen, and Ekso Bionics. These companies focus on innovation, product expansion, and strategic collaborations to strengthen their market positions. Their technologies enhance worker safety, boost productivity, and support real-time data monitoring on construction sites. Advanced solutions such as biometric wearables, AR-enabled glasses, and exoskeletons are reshaping construction workflows. North America leads the global market with a 34.6% share, supported by strong regulatory frameworks, rapid digital adoption, and large-scale infrastructure investments. The presence of key technology providers in the region further accelerates innovation and market growth.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Construction Wearable Technology Market was valued at USD 1.19 billion in 2024 and is projected to reach USD 5.29 billion by 2032, growing at a CAGR of 20.5%.

- Rising demand for real-time monitoring, safety compliance, and productivity improvement is driving strong adoption across construction sites.

- Advanced technologies such as biometric sensors, AR-enabled glasses, and exoskeletons are reshaping workflows and increasing operational efficiency.

- The competitive landscape is defined by innovation from major players focusing on product expansion, strategic alliances, and integration with IoT and AI systems.

- North America holds the largest regional share at 34.6%, driven by regulatory support and digital transformation, while smart helmets and vests lead the segment with the highest adoption rate in safety applications.

Market Segmentation Analysis:

By Product

Smart helmets dominate the product segment with a 27.8% share in the Construction Wearable Technology Market. Their leadership stems from their ability to integrate real-time communication, environmental sensing, and impact detection in high-risk work zones. Smart helmets enhance on-site safety by alerting workers to falling objects, hazardous gases, and structural instability. Features like augmented reality (AR) overlays and noise cancellation improve operational awareness and task precision. Major construction firms are adopting these devices to meet stricter workplace safety regulations and improve productivity. Demand is also rising for smart glasses and exoskeletons in advanced construction sites.

- For instance, RealWear’s Navigator Z1 intrinsically safe smart glasses integrate a 48 MP high-resolution front camera, support Wi-Fi 6 and optional 5G IS connectivity, and include a modular FLIR Lepton 3.5 thermal camera capable of detecting temperature variations, typically with an accuracy greater than ±5 °C or 5% in high-gain mode.

By Application

Worker safety represents the dominant application segment, holding a 33.5% market share. Construction companies prioritize wearable technology to reduce accidents and meet compliance standards. Devices such as smart helmets and vests monitor location, posture, and vital signs in real time. These insights allow supervisors to act quickly in emergencies, minimizing injury risks. The growing integration of AI-driven safety analytics further enhances predictive capabilities. Productivity monitoring and communication applications are also gaining traction as firms focus on project efficiency and worker coordination.

- For instance, Honeywell’s Safety Watch real-time location solution can track worker location within 3 to 5 meter accuracy and trigger alerts when entering restricted zones, providing near-instantaneous alerts to supervisors.

By End User

The industrial segment leads the market with a 36.2% share. Large infrastructure and manufacturing projects demand advanced safety and monitoring solutions for their large workforce. Wearable technology supports continuous health tracking, location-based alerts, and fatigue detection, improving safety and operational efficiency. Industrial players are investing in connected PPE and sensor-based exoskeletons to lower accident rates and increase worker endurance. Commercial and infrastructure segments follow, driven by rapid digitalization of construction workflows and the push for smart construction site management. Residential usage remains smaller but is gradually growing.

Key Growth Drivers

Rising Focus on Worker Safety and Compliance

The demand for wearable devices in construction is increasing due to stricter safety regulations and rising accident rates. Governments and industry bodies are mandating real-time monitoring and safety compliance on worksites. Wearables such as smart helmets and vests help track location, posture, and vital signs. These tools improve response times during emergencies and reduce injury risks. Companies adopt these solutions to meet compliance standards and lower insurance costs. This focus on safety and regulatory alignment is driving strong market growth.

- For instance, German Bionic’s Exia exoskeleton delivers up to 38 kg of dynamic lift assistance per motion, helping reduce strain during lifting, walking, and bending.

Increased Productivity Through Real-Time Monitoring

Construction firms are deploying wearable technology to improve workforce productivity. Smart wearables provide data on worker performance, equipment use, and task completion. Real-time alerts help supervisors manage resources more effectively. Wearables reduce downtime, enhance coordination, and support predictive maintenance of equipment. By enabling better project planning and reduced delays, these technologies directly impact profitability. Companies adopting these solutions gain a competitive edge through improved operational efficiency and cost savings.

- For instance, Trimble’s TSC710 data collector (used in field-connected workflows) features a 7-inch touchscreen and supports 5G WWAN, while reducing device weight by 150 g compared to prior models, enabling longer continuous field use.

Growing Integration of IoT and AI Technologies

Advances in IoT and AI are accelerating the adoption of construction wearables. Devices can now collect, analyze, and transmit data seamlessly across connected platforms. AI-powered analytics identify safety risks, optimize workflows, and support decision-making. Integration with project management software creates a connected jobsite ecosystem. This technological convergence enhances accuracy and transparency in operations. As construction firms digitize their processes, wearable solutions become a key enabler of smart and efficient site management.

Key Trends & Opportunities

Adoption of Smart PPE and Exoskeletons

Smart personal protective equipment (PPE) and powered exoskeletons are emerging as key trends. Wearables now combine protection with embedded sensors that monitor fatigue, temperature, and movement. Exoskeletons reduce worker strain during lifting and repetitive tasks, improving productivity and lowering injury risks. These innovations address both safety and labor shortage issues. Manufacturers investing in ergonomic and AI-enabled PPE solutions are well-positioned to capture growing demand.

- For instance, Panasonic (via its former in-house venture ATOUN) developed the ATOUN Model Y exoskeleton, which weighs around 4.5 kg and provides up to 10 kgf of back strain reduction when lifting heavy objects.

Expansion of Connected Construction Ecosystems

Construction firms are building connected ecosystems where wearables link directly with Building Information Modeling (BIM) and project management tools. This integration allows real-time updates, predictive risk analysis, and improved collaboration. Edge computing and 5G networks are enhancing wearable connectivity. These developments create opportunities for device makers, software developers, and service providers to offer comprehensive integrated solutions for smart jobsites.

- For instance, Ekso Bionics’ industrial exoskeleton “Ekso EVO” weighs about 4.1 kg (9 lbs) and provides adjustable assistive force in the range of 5.2–15.7 lbs (≈2.4–7.1 kg) per arm, helping reduce shoulder and arm fatigue during overhead work.

Rising Demand in Emerging Markets

Emerging economies in Asia Pacific, Latin America, and the Middle East are showing increased interest in construction wearables. Large infrastructure projects and urbanization initiatives are creating new market opportunities. Governments are investing in smart city projects and modern safety regulations. These regions offer strong growth potential for global and local wearable technology providers.

Key Challenges

High Implementation Costs and Budget Constraints

The cost of deploying wearable technology remains a major challenge for construction firms. High upfront investments in devices, software integration, and network infrastructure can limit adoption, especially among small contractors. Ongoing maintenance and data management costs also add to the burden. Many firms struggle to justify the return on investment, delaying large-scale adoption despite evident productivity and safety benefits.

Data Privacy and Security Concerns

Wearable devices collect sensitive worker and site data, raising privacy and security concerns. Unauthorized access, data breaches, and misuse of personal information can create legal and reputational risks. Construction companies must invest in strong cybersecurity measures and transparent data handling policies. Compliance with data protection regulations adds further complexity, making security a critical barrier to market expansion.

Regional Analysis

North America

North America holds the largest market share at 34.6%, driven by strong technology adoption and safety regulations. The U.S. leads the region with high investments in smart construction sites and connected workforce solutions. Demand for wearable devices such as smart helmets and vests is rising in large infrastructure projects to improve worker safety and productivity. Companies like Triax Technologies and Guardhat are actively deploying advanced IoT-enabled wearables across major projects. Strong regulatory support from OSHA and rapid digitalization in construction processes further strengthen the region’s dominance in the global construction wearable technology market.

Europe

Europe accounts for 27.3% of the global construction wearable technology market, supported by advanced safety standards and growing smart city initiatives. Countries such as Germany, the UK, and France lead adoption with strong investment in infrastructure modernization. Wearable technologies are increasingly used for health monitoring, real-time communication, and workforce tracking in construction projects. Government-driven digital transformation programs and high compliance with worker safety laws accelerate growth. Companies are focusing on smart helmets and AR glasses to enhance operational efficiency and reduce accident rates, driving steady market expansion across the region.

Asia Pacific

Asia Pacific captures 24.8% of the market, making it one of the fastest-growing regions. China, Japan, India, and South Korea are investing heavily in large-scale infrastructure and smart city projects. This rapid development boosts demand for wearable devices to enhance worker productivity and safety. Local manufacturers are expanding their product portfolios to offer cost-effective smart wearables for construction workers. Governments are also implementing stricter safety regulations, increasing adoption rates. The presence of global and regional tech companies accelerates the integration of wearable technologies into construction workflows, driving strong market growth.

Latin America

Latin America represents 7.2% of the global market share, supported by infrastructure development and rising safety awareness. Brazil and Mexico lead the region with increased investments in commercial and industrial construction. Adoption of wearable technologies focuses on safety monitoring and communication solutions to manage on-site risks effectively. Although digitalization in construction remains at an early stage, the region shows strong potential for growth. International technology providers are partnering with local construction companies to introduce cost-efficient wearable solutions, improving safety compliance and operational efficiency across key projects in urban and industrial areas.

Middle East & Africa

The Middle East & Africa region accounts for 6.1% of the market, driven by rapid construction in the UAE, Saudi Arabia, and South Africa. Mega projects such as smart cities and large-scale infrastructure developments boost the demand for wearable safety devices. Construction companies increasingly use smart helmets, AR glasses, and body sensors to enhance worker safety and project coordination. Although adoption levels are lower compared to North America and Europe, strong government initiatives and investments in digital infrastructure are accelerating growth. The region is expected to emerge as a key market for wearable technology deployment.

Market Segmentations:

By Product:

- Smart helmet

- Smart glasses

By Application:

- Worker safety

- Productivity monitoring

By End User:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Construction Wearable Technology Market is shaped by leading players such as Garmin, Siemens, RealWear Inc., Honeywell International Inc., ARM Limited, German Bionic Systems GmbH, Trimble Inc., Panasonic, Kenzen, and Ekso Bionics. The Construction Wearable Technology Market is defined by rapid innovation and strong technological integration. Companies are investing in IoT-enabled wearables, AI-driven analytics, and real-time monitoring solutions to enhance construction site productivity and worker safety. Product differentiation focuses on smart helmets, connected vests, biometric sensors, and AR-based communication tools. Partnerships with construction firms and technology providers are expanding market reach and improving device interoperability. Exoskeleton technologies are gaining traction as they reduce physical strain and workplace injuries. The competitive environment is increasingly shaped by digital transformation strategies, regulatory compliance, and the push toward smart and connected construction ecosystems.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Garmin

- Siemens

- RealWear Inc.

- Honeywell International Inc.

- ARM Limited

- German Bionic Systems GmbH

- Trimble Inc.

- Panasonic

- Kenzen

- Ekso Bionics

Recent Developments

- In August 2025, JCB is about to transform the construction equipment scenario in India, when it will introduce a new generation of machines. It will be equipped with prototypes that are hydrogen-powered, fully electric, low-fuel consumption hybrid equipment, and enhanced diesel-powered machines that are approved to the CEV Stage-V norms.

- In July 2025, New Holland Construction introduces W100D Compact Wheel Loader with an all-new operator-centric cab and cab features. Constructed with landscapers, agricultural operators, snow removers and others in mind, the W100D is a dependable powerhouse with a deliberate design to provide productivity and performance in a small class size where there has been scarce choice.

- In January 2025, Volvo CE introduces New Generation Excavators in Southeast Asia to enhance efficiency, productivity and safety of the customers. The New Generation 5 models include: EC210, EC220, EC230, EC300 and EC360 and they will be sold throughout the region starting January 2025.

- In May 2024, Range Energy (Range) the organization empowering the powered trailers to the commercial trucking market announced the strategic collaboration with Dot Transportation Inc., which is the affiliate transportation of Dot Foods the largest redistributor of food industry in North America for introducing and installing the refrigerated version Range’s electric-powered trailer.

Report Coverage

The research report offers an in-depth analysis based on Product, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand as construction companies increase adoption of digital safety solutions.

- Wearable devices will become more compact, durable, and energy efficient.

- Integration with AI and IoT will enhance real-time monitoring and predictive safety measures.

- Exoskeleton adoption will grow to reduce worker fatigue and injury rates.

- AR and VR wearables will support on-site training and improve task accuracy.

- Data analytics from wearables will drive better decision-making and workforce planning.

- Regulatory compliance will accelerate investment in advanced safety technologies.

- Partnerships between tech firms and construction companies will strengthen innovation pipelines.

- Cloud-based wearable management platforms will improve data access and collaboration.

- Wearable technology will play a key role in shaping connected and automated construction sites.