Market Overview

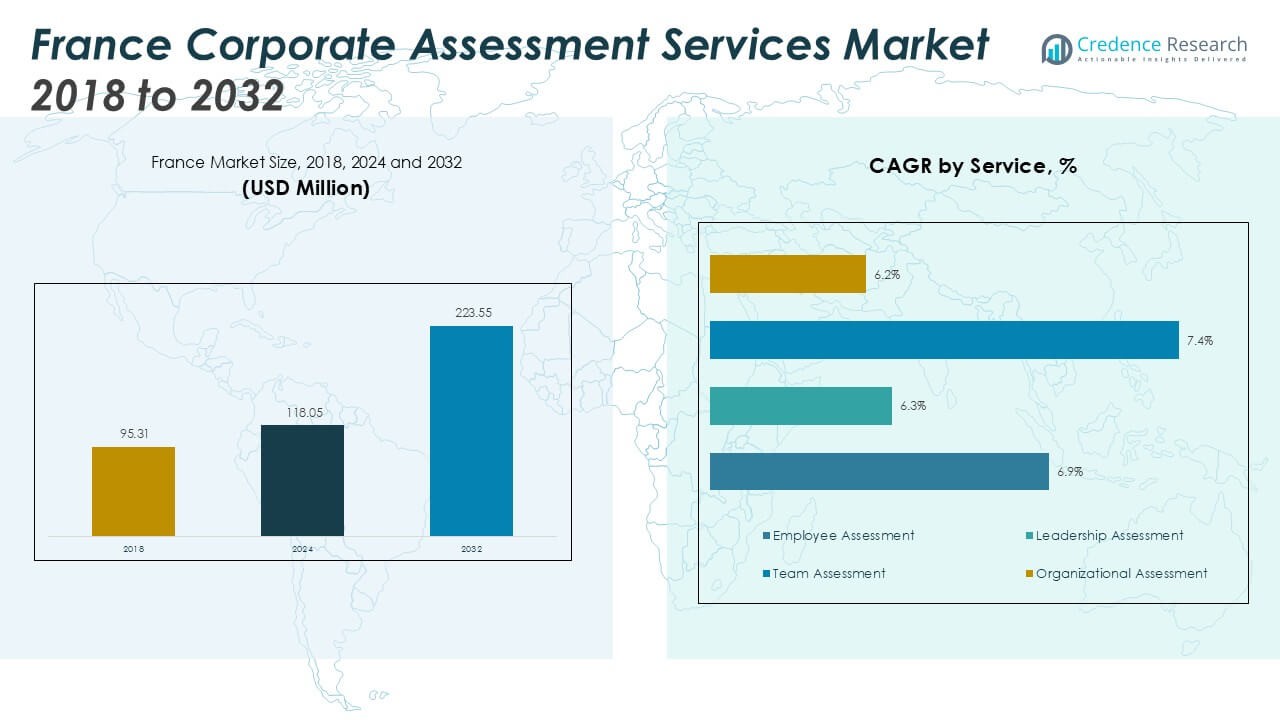

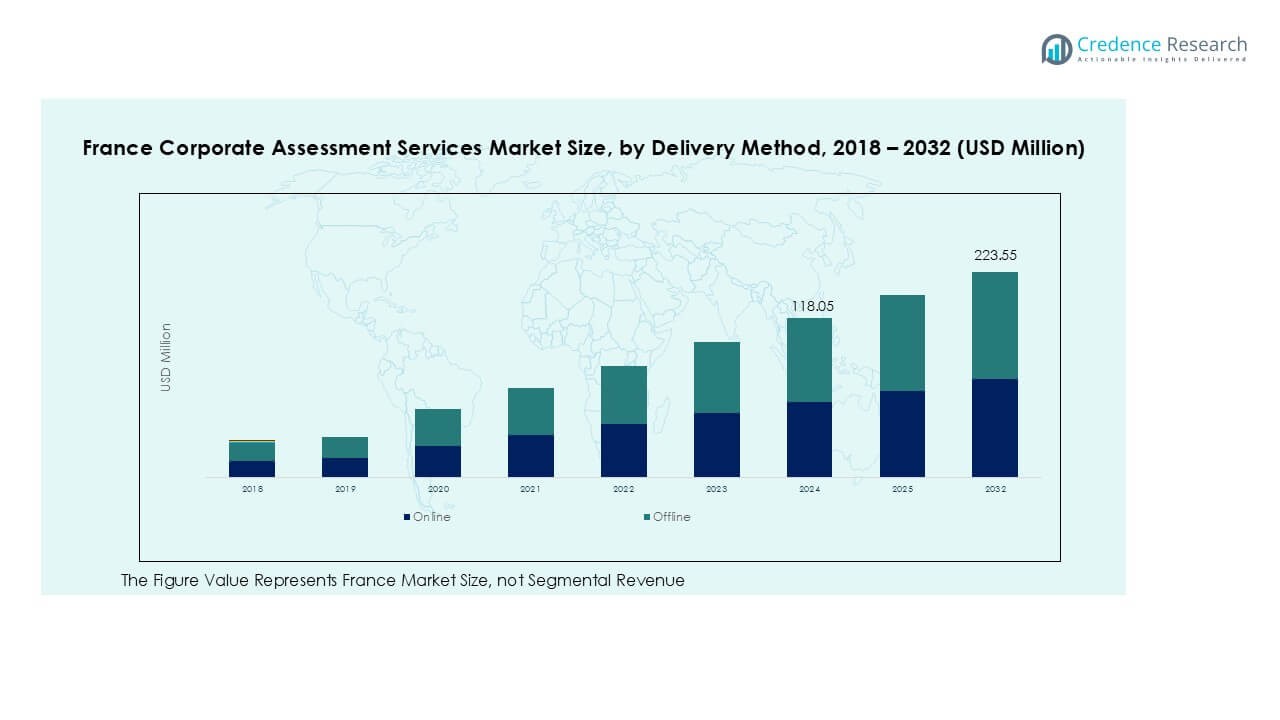

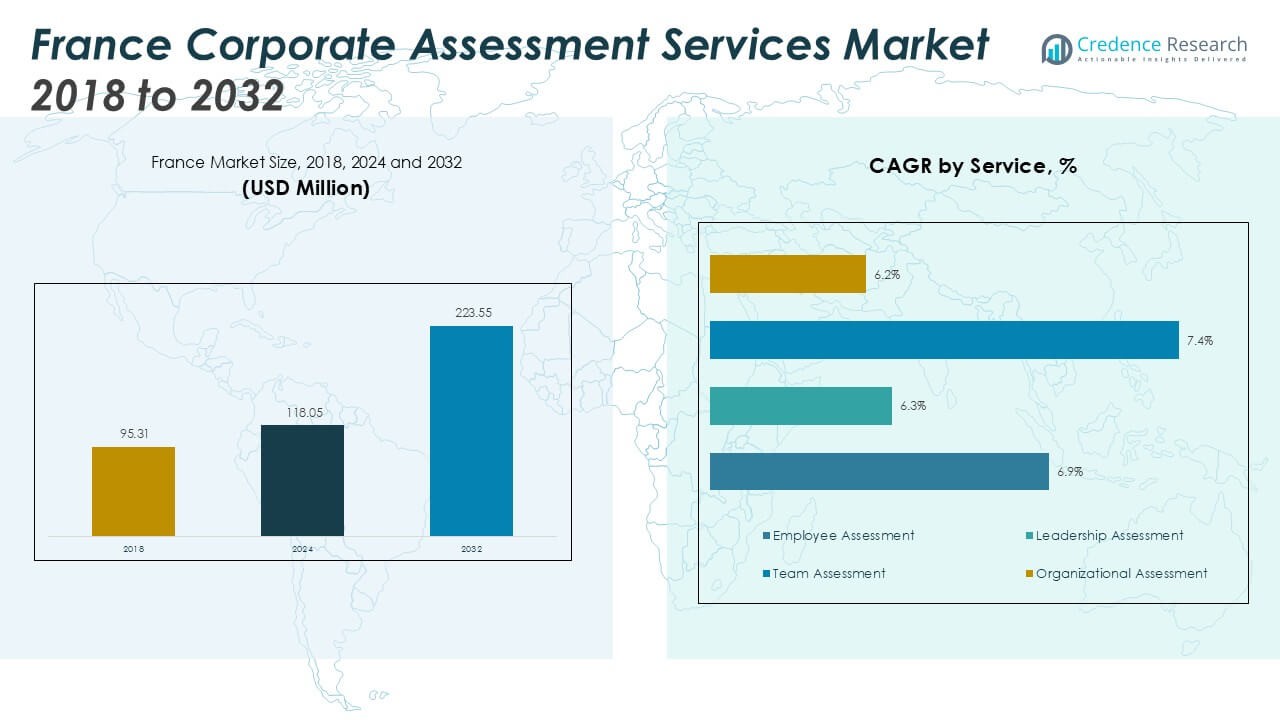

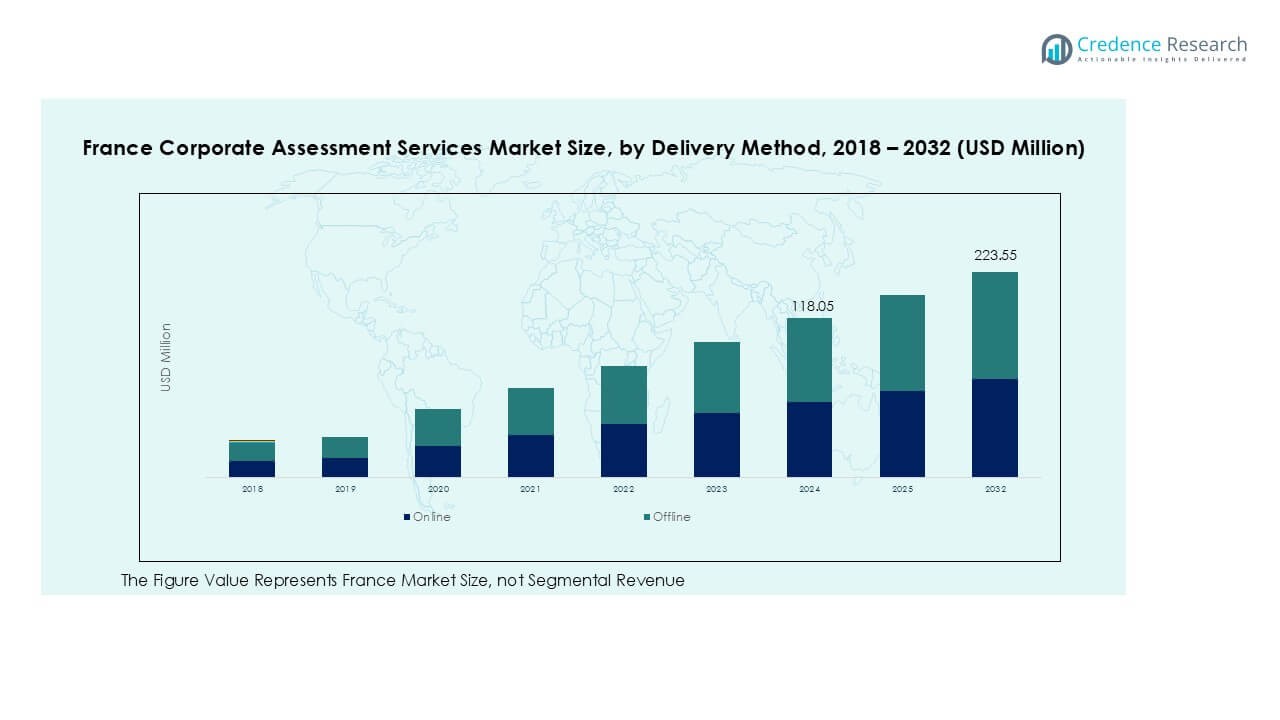

France Corporate Assessment Services market size was valued at USD 95.31 million in 2018 and grew to USD 118.05 million in 2024. It is anticipated to reach USD 223.55 million by 2032, expanding at a CAGR of 8.31% during the forecast period (2024–2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| France Corporate Assessment Services Market Size 2024 |

USD 118.05 Million |

| France Corporate Assessment Services Market, CAGR |

8.31% |

| France Corporate Assessment Services Market Size 2032 |

USD 223.55 Million |

The France corporate assessment services market is led by key players such as AssessFirst, SHL Group Ltd., Aon plc, Korn Ferry, Hogan Assessments, Thomas International, Saville Assessment, PSI Services LLC (Cubiks), CEB (now Gartner), and Mercer | Mettl. These companies dominate through AI-enabled assessment tools, cloud-based analytics, and psychometric evaluation platforms that enhance workforce efficiency and leadership development. Northern France emerged as the leading region, accounting for a 26% market share in 2024, driven by strong industrial activity and the presence of multinational corporations. Southern and Western France followed, supported by rapid digital adoption across healthcare, IT, and manufacturing sectors.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The France Corporate Assessment Services market was valued at USD 118.05 million in 2024 and is projected to reach USD 223.55 million by 2032, growing at a CAGR of 8.31%.

- Rising demand for employee and leadership assessment services drives market expansion, supported by digital transformation in HR processes and data-based recruitment.

- AI-enabled assessment platforms and analytics-driven insights are reshaping hiring and talent management practices, boosting adoption across large enterprises and SMEs.

- Leading players such as AssessFirst, SHL Group Ltd., Aon plc, and Korn Ferry compete through innovation, cloud-based delivery models, and strategic collaborations.

- Northern France led the market with a 26% share in 2024, followed by Southern France with 21% and Western France with 19%, while employee assessment remained the dominant segment with a 42% share due to strong corporate demand for performance optimization.

Market Segmentation Analysis:

By Service Type

Employee assessment dominated the France corporate assessment services market with a 42% share in 2024. The segment’s growth is driven by the increasing demand for data-backed recruitment and performance evaluation tools. Companies are focusing on skill-based testing and psychometric evaluations to improve hiring efficiency and reduce turnover. Leadership assessment is also gaining traction as firms emphasize leadership pipeline development. Team and organizational assessments are expanding, driven by the adoption of digital collaboration tools and the focus on workplace productivity optimization across mid- and large-scale enterprises.

- For instance, Aon Assessment Solutions integrates AI-based psychometric testing into its offerings to support talent selection. In 2024, the American Civil Liberties Union (ACLU) filed a complaint with the Federal Trade Commission (FTC), alleging that Aon’s AI tools discriminate against people with disabilities and specific racial groups.

By Industry Vertical

The BFSI sector led the market with a 28% share in 2024, supported by stringent regulatory compliance and the need for high-performing leadership in financial institutions. IT and telecommunications followed, fueled by the growing requirement for continuous upskilling and talent retention in a competitive labor market. Healthcare and manufacturing are emerging segments due to digital transformation and workforce modernization. Retail and education sectors are also increasing adoption, as organizations focus on behavioral analysis and employee engagement to improve customer service and institutional effectiveness.

- For instance, Accenture reported delivering 44 million training hours in fiscal 2024 via its digital learning platform.

By Enterprise Size

Large enterprises accounted for 63% of the market share in 2024, owing to their extensive investment in structured assessment programs and advanced analytics platforms. These organizations leverage AI-based tools for leadership evaluation, talent mapping, and competency benchmarking. Small and medium enterprises are rapidly adopting assessment solutions as part of digital HR transformation efforts to streamline hiring and performance tracking. Government support for SME digitalization and affordable SaaS-based platforms is further driving this segment’s expansion, improving accessibility to corporate assessment technologies across diverse business sizes.

Key Growth Drivers

Growing Emphasis on Workforce Productivity and Talent Optimization

The rising focus on improving workforce productivity and aligning employee capabilities with business goals is driving demand for corporate assessment services in France. Organizations are increasingly investing in assessment platforms to evaluate employee potential, identify skill gaps, and optimize team performance. The integration of psychometric testing, behavioral analytics, and performance benchmarking allows HR teams to make data-backed decisions. For instance, many French enterprises use AI-enabled assessment platforms to reduce bias in hiring and enhance internal mobility. The shift toward strategic talent management, combined with a competitive job market, has made workforce assessment essential for sustaining productivity and improving employee engagement across industries.

- For instance, in 2023, Capgemini significantly invested in artificial intelligence (AI), including upskilling its workforce on generative AI tools. Capgemini has invested billions of dollars in AI and data, and in 2023, it reported that 80% of organizations surveyed had increased their investment in generative AI.

Rapid Digital Transformation in HR Processes

Digital transformation across corporate HR departments is significantly propelling market growth. French organizations are adopting digital assessment tools integrated with cloud computing, machine learning, and analytics for efficient recruitment and performance management. The shift from traditional pen-and-paper testing to digital, real-time evaluations improves speed and scalability. Cloud-based systems allow remote assessments, especially useful in hybrid and distributed work models. Enterprises are also deploying predictive analytics to forecast employee performance and retention. This transition toward digital-first HR ecosystems is supported by government-led digitalization initiatives and the rising use of SaaS-based HR solutions, enabling companies to streamline recruitment while ensuring compliance with data privacy regulations such as GDPR.

- For instance, Société Générale is actively digitizing its human resources processes and has been focusing on using technology, data, and automation to improve efficiency and employee experience.

Increasing Focus on Leadership Development and Succession Planning

Leadership assessment services are witnessing growing adoption as companies prioritize long-term talent development and succession planning. French corporations are investing in leadership evaluation frameworks to identify potential leaders, assess managerial competencies, and ensure smooth leadership transitions. Organizations across sectors, including finance, manufacturing, and technology, rely on leadership assessments to build resilient management pipelines. The growing complexity of organizational structures and the demand for adaptive leadership in dynamic markets are accelerating adoption. Additionally, multinational firms operating in France are using customized leadership models to align global strategies with local cultural and regulatory contexts, further strengthening this segment’s contribution to overall market growth.

Key Trends and Opportunities

Adoption of AI and Analytics-Driven Assessment Solutions

AI and analytics are transforming the French corporate assessment services market by enhancing accuracy and scalability. Advanced algorithms now evaluate cognitive abilities, behavioral tendencies, and leadership attributes with minimal human bias. Predictive analytics helps HR leaders forecast employee potential, engagement levels, and turnover risks. Companies are increasingly using natural language processing (NLP) and sentiment analysis to interpret responses in psychometric tests. The demand for data-driven decision-making and efficiency in talent evaluation is propelling AI-based platforms. This trend presents opportunities for service providers to offer integrated solutions that combine performance analytics, personalized learning, and development planning to improve workforce outcomes.

- For instance, 365Talents, an AI-powered talent intelligence firm, is used by large companies, including seven of France’s CAC 40 firms, to manage skills and internal talent mobility. As of mid-2024, the company had over one million users worldwide on its platform.

Growing Demand from SMEs and Hybrid Work Models

Small and medium enterprises in France are emerging as key adopters of affordable and scalable assessment tools. The shift toward hybrid and remote work models has intensified the need for digital assessment solutions that measure communication, adaptability, and teamwork. SMEs are leveraging cloud-based platforms to access advanced features like automated reporting and candidate benchmarking without major infrastructure investment. Moreover, the growing emphasis on mental well-being and work-life balance in hybrid settings is encouraging companies to adopt tools that assess emotional intelligence and resilience. This trend creates opportunities for vendors offering flexible, subscription-based assessment models.

Key Challenges

Data Privacy and Compliance Constraints

Stringent data protection regulations, including the General Data Protection Regulation (GDPR), pose a major challenge for assessment service providers in France. Handling sensitive employee data requires robust cybersecurity frameworks and transparent consent mechanisms. Any non-compliance can result in heavy penalties and reputational risks for organizations. Additionally, ensuring that AI-driven assessments remain free from algorithmic bias while complying with fairness and transparency standards adds to operational complexity. Service providers must continuously upgrade their data governance systems and maintain transparency in scoring models to build client trust and adhere to evolving privacy laws.

Resistance to Change and Implementation Costs

Despite clear benefits, several organizations, particularly traditional firms, remain hesitant to adopt digital assessment platforms. The transition from manual or interview-based evaluation to structured, technology-driven assessments requires investment in tools, training, and change management. SMEs often struggle with upfront costs, integration issues, and limited technical expertise. Moreover, resistance from employees and HR professionals accustomed to legacy methods can slow down adoption. Addressing these challenges requires service providers to demonstrate clear ROI, provide localized support, and develop user-friendly, customizable solutions that align with varying corporate cultures and business structures across France.

Regional Analysis

Northern France

Northern France accounted for a 26% share of the corporate assessment services market in 2024. The region’s strong industrial base and presence of multinational corporations drive high adoption of talent evaluation tools. Lille and Amiens have emerged as hubs for HR technology integration, with organizations using digital assessments to improve hiring accuracy and leadership development. Demand is growing across logistics and automotive sectors, supported by regional digitalization programs. The focus on employee performance optimization and compliance with evolving labor standards continues to strengthen market penetration across both large enterprises and mid-sized firms in Northern France.

Western France

Western France held a 19% market share in 2024, led by expanding IT, retail, and service-based industries in cities like Nantes and Rennes. Companies are increasingly adopting assessment platforms to enhance recruitment quality and team alignment. The growth of technology parks and startup ecosystems has encouraged HR departments to implement psychometric and skill-based testing tools. Public-sector institutions are also integrating performance assessments for organizational efficiency. The region’s balanced industrial mix, coupled with growing digital adoption and investment in human capital development, continues to drive sustained demand for corporate assessment solutions across diverse business segments.

Southern France

Southern France captured 21% of the market share in 2024, supported by its thriving tourism, healthcare, and manufacturing industries. Cities such as Marseille, Montpellier, and Nice are key adopters of digital assessment tools aimed at workforce skill development. Enterprises in this region are focusing on performance-based evaluations to strengthen competitiveness and innovation capacity. The integration of AI-driven assessment software and behavioral analytics is rising, particularly among service-oriented companies. Additionally, regional initiatives promoting digital transformation and education partnerships with universities are accelerating adoption of talent evaluation platforms among medium and large organizations in Southern France.

Central France

Central France represented 17% of the France corporate assessment services market in 2024. The region benefits from a growing base of industrial firms and administrative organizations emphasizing workforce productivity and management efficiency. Orléans and Tours are witnessing steady deployment of digital testing platforms for leadership and organizational assessments. The region’s HR departments are using assessment tools to reduce recruitment cycles and enhance decision-making. Increased collaboration between HR solution providers and regional enterprises, along with government-led training programs, supports the ongoing expansion of structured assessment frameworks across multiple industries in Central France.

Eastern France

Eastern France accounted for a 17% share of the market in 2024, driven by strong manufacturing, healthcare, and education sectors. Cities like Strasbourg and Nancy have become early adopters of corporate assessment tools to ensure compliance, enhance training outcomes, and retain skilled talent. The integration of behavioral and cognitive testing technologies is rising among industrial employers to improve workforce efficiency. Regional collaboration with HR analytics firms and the emphasis on data-driven employee evaluations are reinforcing market growth. The availability of multilingual assessment platforms also supports adoption across cross-border enterprises operating near Germany and Switzerland.

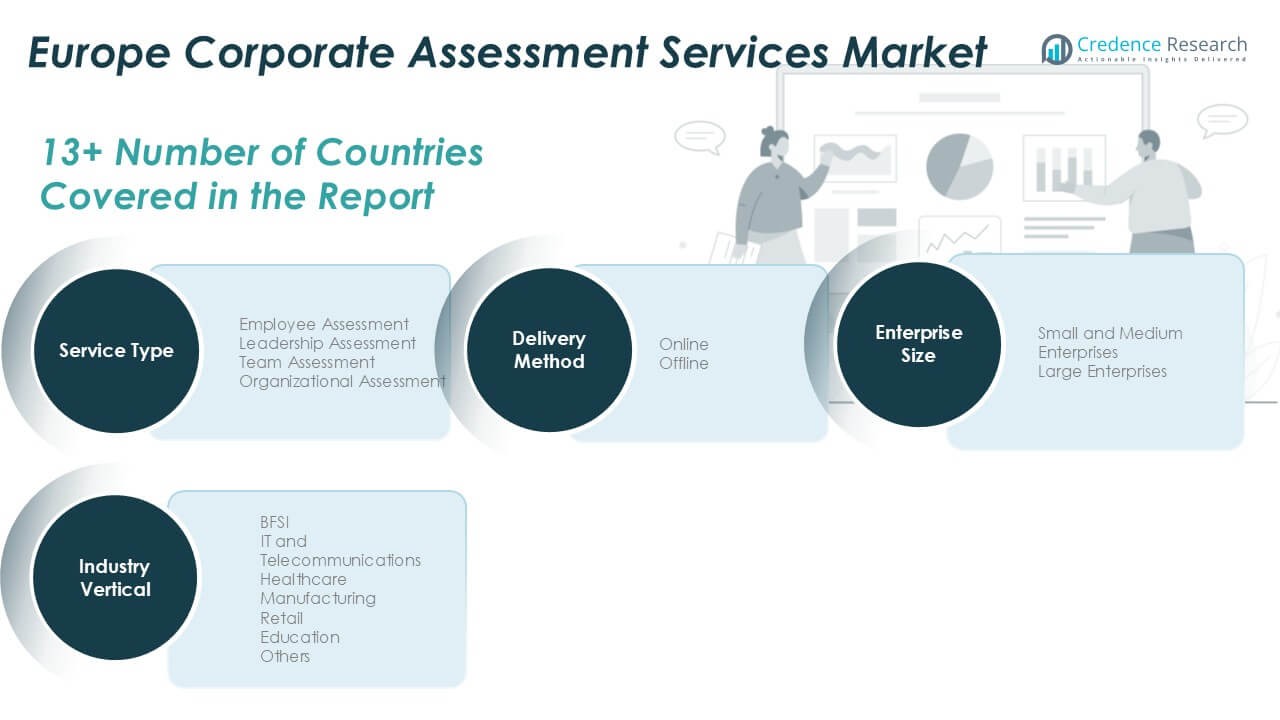

Market Segmentations:

By Service Type

- Employee Assessment

- Leadership Assessment

- Team Assessment

- Organizational Assessment

By Industry Vertical

- BFSI

- IT and Telecommunications

- Healthcare

- Manufacturing

- Retail

- Education

- Others

By Enterprise Size

- Small and Medium Enterprises

- Large Enterprises

By Delivery Mode

By Geography

- Northern France

- Western France

- Southern France

- Central France

- Eastern France

Competitive Landscape

The France corporate assessment services market is moderately consolidated, with global and domestic players competing through innovation, technological integration, and industry partnerships. Leading providers such as AssessFirst, SHL Group Ltd., Aon plc, Korn Ferry, and Mercer | Mettl dominate the market through comprehensive talent evaluation platforms and AI-driven analytics tools. These companies focus on expanding digital capabilities, offering customized assessments, and integrating behavioral analytics to enhance workforce insights. Local firms like AssessFirst emphasize agility and data-driven personalization, while global leaders leverage cloud-based solutions for scalability. Continuous product innovation, mergers, and collaborations with HR technology companies are key strategies to strengthen market presence. Additionally, the rising demand for leadership and organizational assessments across diverse industries encourages players to develop specialized solutions aligned with France’s regulatory and cultural framework, fostering a competitive yet technology-oriented market environment.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In 2023, IBM Corporation introduced AI-driven recruitment tools that assess behavioral patterns and predict job success. These tools leverage machine learning to minimize biases in recruitment processes, enhancing efficiency and fairness in candidate evaluation

- In 2023, Mercer Mettl Launched the “Mercer|Mettl Online Assessments,” an AI-powered platform to evaluate soft skills, technical competencies, and cognitive abilities. It includes advanced proctoring features for remote hiring and corporate training, emphasizing test security and scalability.

Report Coverage

The research report offers an in-depth analysis based on Service Type, Industry Vertical, Enterprise Size, Delivery Mode and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand as digital HR transformation accelerates across French enterprises.

- AI-driven and predictive analytics tools will enhance employee and leadership assessments.

- Demand for cloud-based and mobile-friendly assessment platforms will rise among SMEs.

- Data privacy and GDPR-compliant solutions will remain a core business priority.

- Integration of behavioral and emotional intelligence testing will gain wider adoption.

- Leadership and succession planning assessments will see increased corporate investment.

- Partnerships between assessment providers and HR software firms will strengthen service portfolios.

- Customization of assessments for industry-specific roles will become a key differentiator.

- Remote and hybrid work models will drive need for virtual assessment solutions.

- Regional demand will grow steadily, with Northern and Southern France maintaining dominant positions.