Market Overview

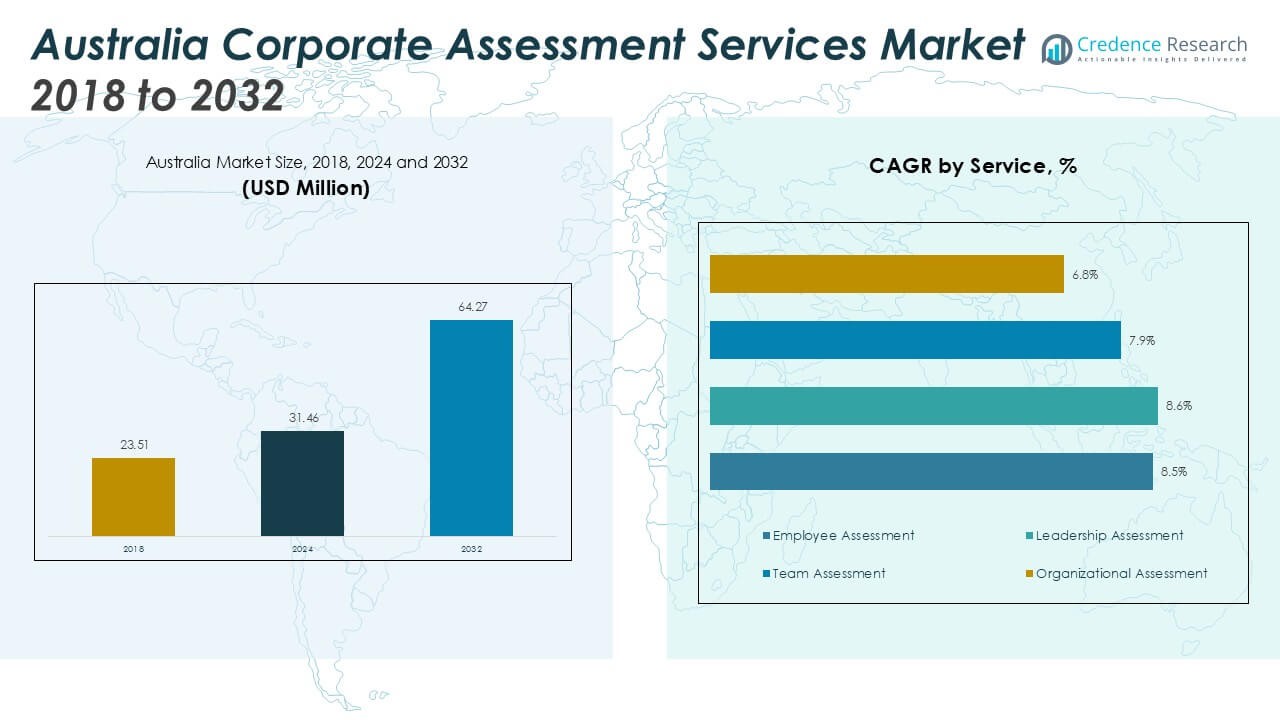

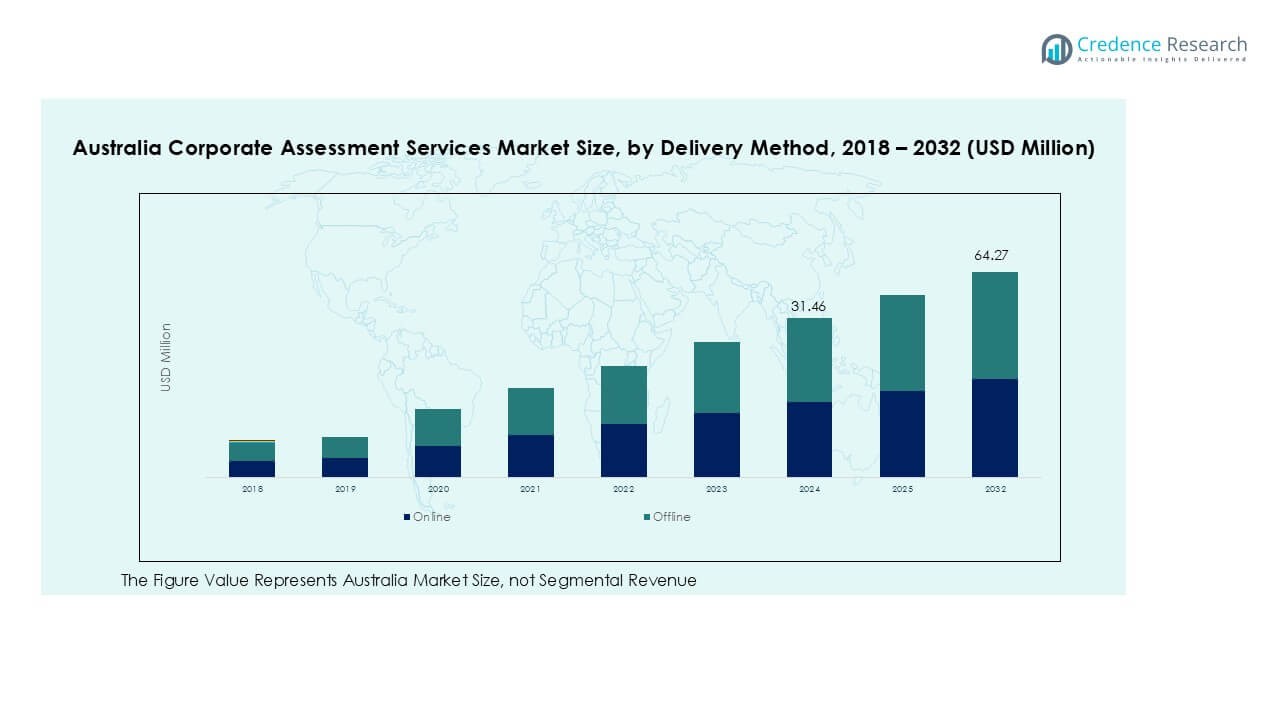

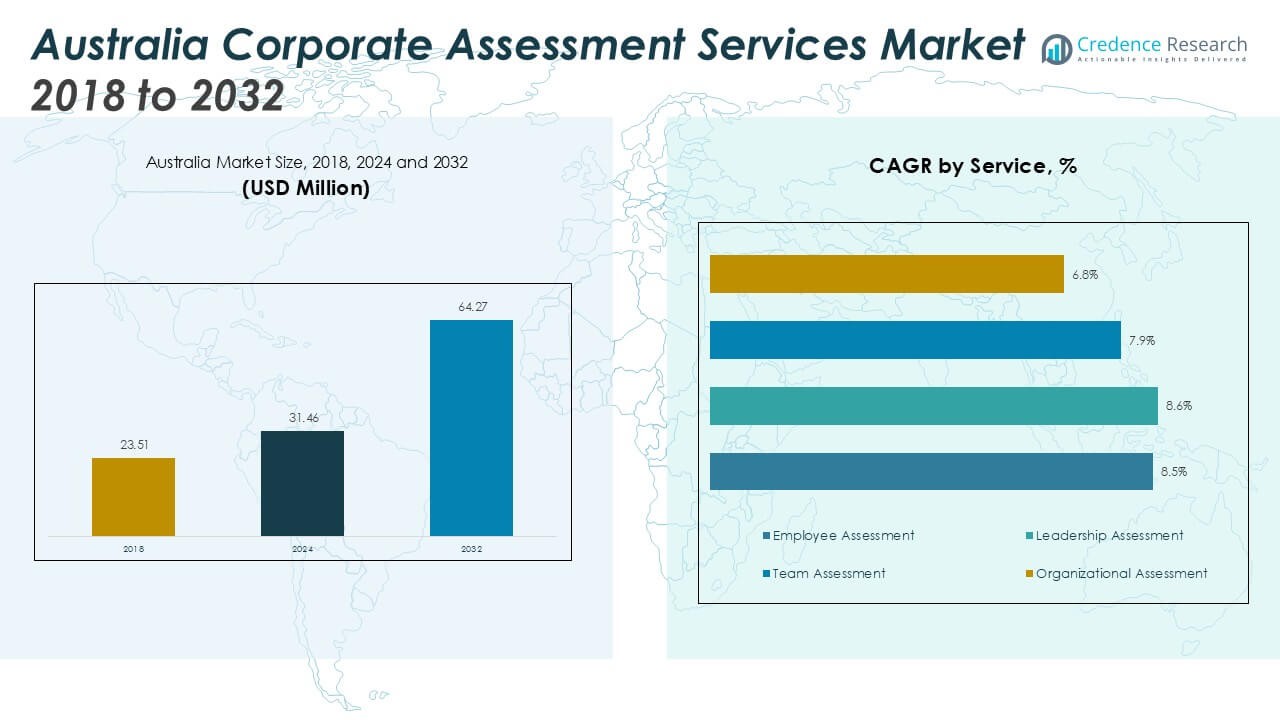

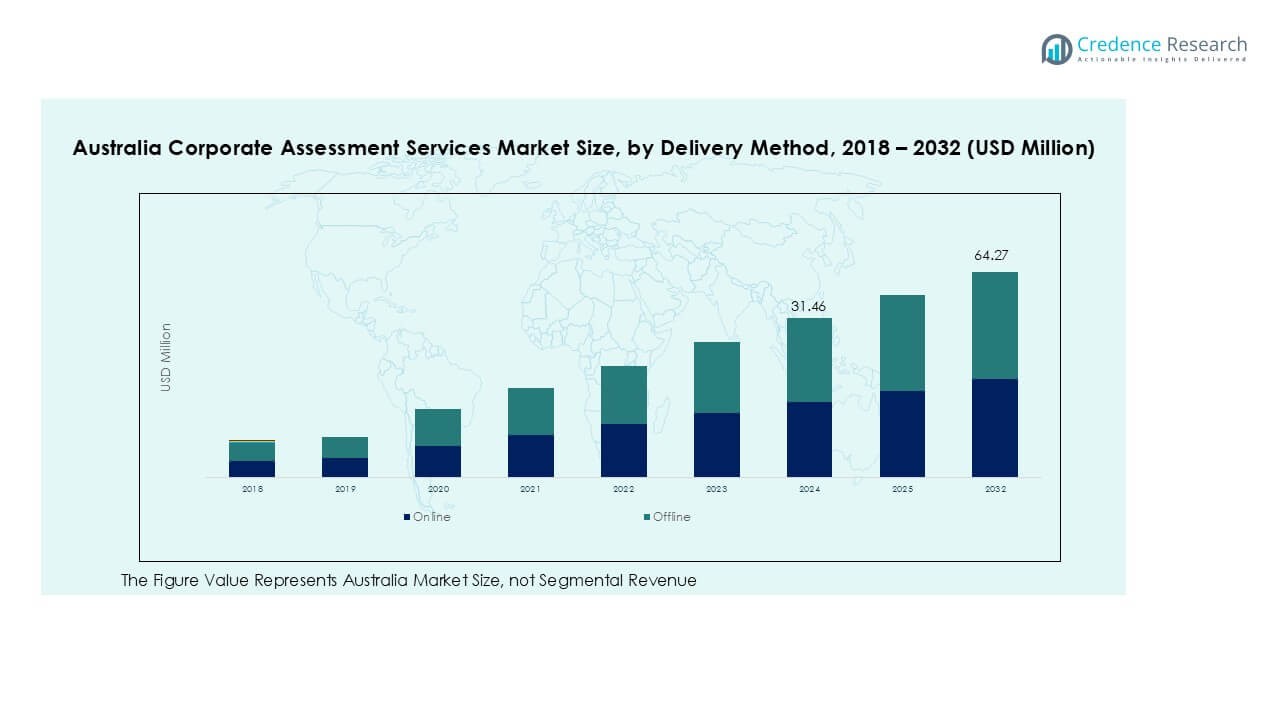

Australia Corporate Assessment Services market size was valued at 23.51 million in 2018, increasing to 31.46 million in 2024. The market is projected to reach 64.27 million by 2032, expanding at a CAGR of 9.34% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Australia Corporate Assessment Services Market Size 2024 |

USD 31.46 Million |

| Australia Corporate Assessment Services Market , CAGR |

9.34% |

| Australia Corporate Assessment Services Market Size 2032 |

USD 64.27 Million |

The Australia corporate assessment services market is led by prominent players such as Korn Ferry, SHL Group Ltd., Aon plc, Thomas International, Mercer | Mettl, and Hogan Assessments. These companies maintain strong positions through advanced digital platforms, psychometric evaluation tools, and AI-driven analytics supporting workforce optimization. Korn Ferry and SHL lead in leadership and employee assessment solutions, while Aon and Mercer | Mettl strengthen their foothold in data-centric recruitment and talent analytics. Regionally, New South Wales accounted for the largest market share of 34% in 2024, driven by the high concentration of corporate headquarters and strong adoption of technology-enabled assessment tools across BFSI and IT industries.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Australia Corporate Assessment Services market was valued at USD 31.46 million in 2024 and is projected to reach USD 64.27 million by 2032, growing at a CAGR of 9.34%.

- Market growth is driven by rising demand for employee and leadership assessment tools to improve workforce productivity and hiring accuracy across large enterprises.

- Key trends include the adoption of AI-based, cloud-enabled, and data-driven assessment platforms that enhance scalability and predictive performance evaluation.

- Major players such as Korn Ferry, SHL Group Ltd., Aon plc, and Mercer | Mettl dominate through digital innovation and customized talent analytics solutions.

- Regionally, New South Wales led with a 34% share in 2024, followed by Victoria at 27% and Queensland at 18%, while the employee assessment segment held the largest 38% share across service types.

Market Segmentation Analysis:

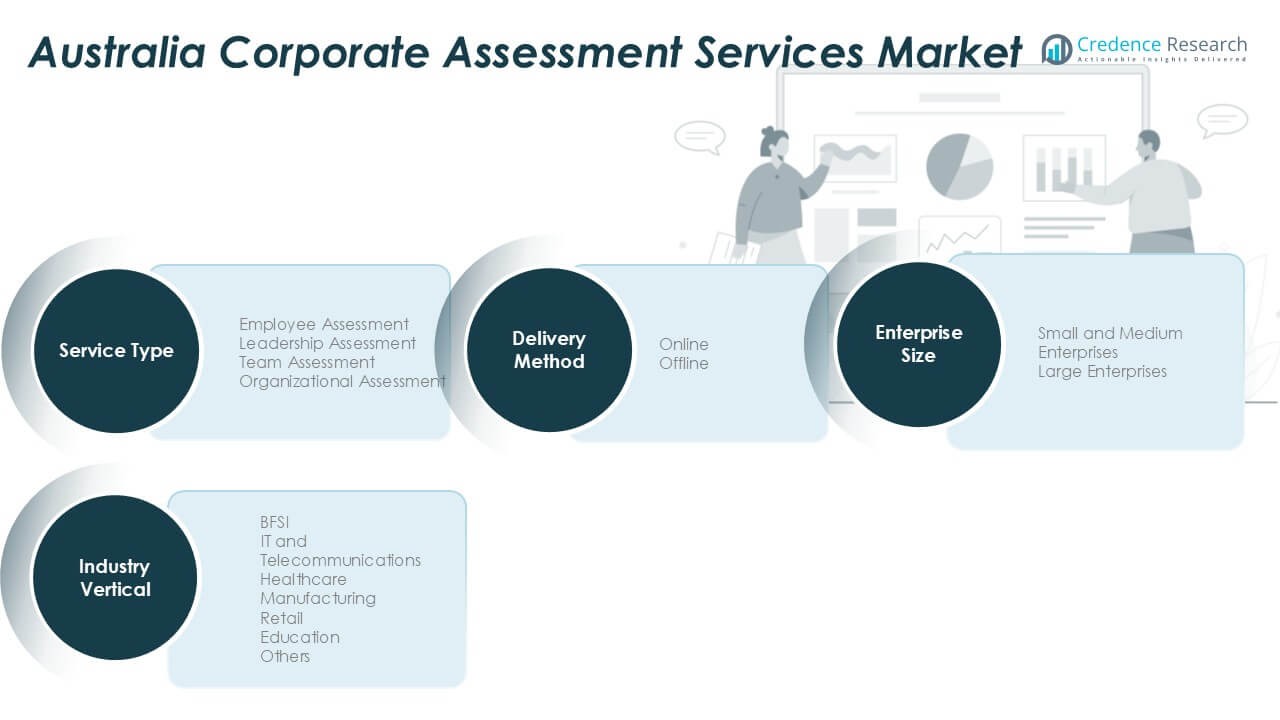

By Service Type

The employee assessment segment dominated the Australia corporate assessment services market in 2024 with a 38% share. Rising emphasis on talent acquisition, performance management, and workforce productivity drives its growth. Companies increasingly use psychometric and behavioral assessments to identify skill gaps and align employees with organizational goals. Leadership and team assessment services are also gaining traction as firms prioritize managerial development and collaboration efficiency. The shift toward data-driven human resource strategies further strengthens the adoption of digital assessment tools across enterprises.

- For instance, in 2024, Revelian (part of Criteria Corp) continued its practice of using game-based assessments like Cognify and Emotify to evaluate cognitive and emotional intelligence, a method commonly used in Australian recruitment.

By Industry Vertical

The BFSI segment held the largest share of 29% in 2024, leading the industry vertical category. Financial institutions rely heavily on structured employee evaluations to meet compliance and customer service standards. The sector’s growing investment in leadership development and ethical behavior training supports sustained demand. IT and telecommunications follow closely due to their focus on skill-based evaluations and fast-paced technological adoption. Expanding use of online assessment platforms across healthcare and manufacturing also contributes to the overall market’s steady diversification.

- For instance, SHL is a major provider of HR technology and talent assessment solutions, leveraging psychometric science. Australian banks actively engage in employee assessment practices, including compliance checks and service quality evaluations. The Australian Prudential Regulation Authority (APRA) has emphasized increasing minimum standards for operational resilience and cybersecurity and banks are required to conduct conduct background checks on new employees.

By Enterprise Size

Large enterprises accounted for a dominant 61% share of the Australia corporate assessment services market in 2024. Their extensive workforce, structured recruitment processes, and higher budgets drive large-scale adoption of advanced assessment solutions. These organizations increasingly integrate AI-driven analytics to improve hiring accuracy and leadership planning. Meanwhile, small and medium enterprises are rapidly adopting affordable cloud-based tools to enhance employee evaluation and engagement. The push toward performance optimization and digital transformation across all enterprise sizes continues to fuel steady market growth.

Key Growth Drivers

Rising Emphasis on Workforce Productivity and Talent Optimization

Australian organizations increasingly prioritize workforce productivity through structured assessment programs. Companies use psychometric, behavioral, and cognitive tests to match candidates with job requirements, improving retention and reducing turnover. The trend toward skill-based hiring aligns with national workforce strategies focused on performance-driven recruitment. Corporate assessment tools also help identify training needs, succession planning, and leadership readiness. As hybrid work models expand, businesses seek continuous evaluation methods to maintain engagement and productivity. This strategic use of data-backed assessments drives widespread adoption across corporate and institutional sectors.

- For instance, Criteria Corp, which acquired Australia-based psychometric assessment provider Revelian in 2020, offers digital psychometric assessments, including the game-based Cognify (cognitive aptitude) and Emotify (emotional intelligence) platforms.

Integration of Digital and AI-Based Assessment Platforms

Rapid digitization and automation are transforming Australia’s corporate assessment landscape. Enterprises are adopting AI-powered analytics, automated scoring systems, and virtual testing platforms to streamline recruitment and performance evaluation. These technologies enhance objectivity, speed, and scalability in employee assessments. Organizations use data analytics to predict future workforce needs and identify high-potential employees. The integration of cloud-based solutions further supports accessibility and cost efficiency, particularly for remote and hybrid teams. With digital transformation accelerating across industries, technology-driven assessments are becoming standard in modern HR operations.

- For instance, Criteria Corp expanded its Australian operations through the acquisition of Australia-based firms Revelian in 2020 and Alcami Interactive in 2021. While the company has launched new AI-powered tools, such as the talent development tool “Develop” in July 2024, and AI-powered interview scoring in May 2025.

Growing Demand from BFSI and IT Sectors

The BFSI and IT sectors lead demand for corporate assessment services due to their stringent skill and compliance requirements. Financial institutions emphasize behavioral, risk, and ethics assessments to meet regulatory standards and improve service quality. Meanwhile, the IT industry increasingly relies on technical and cognitive assessments to identify digital talent in cybersecurity, analytics, and cloud computing. These sectors’ continued investment in leadership development and competency evaluation drives market expansion. The focus on digital skill verification and risk mitigation positions BFSI and IT as long-term growth engines in the assessment market.

Key Trends & Opportunities

Adoption of Data-Driven and Predictive Analytics Tools

Predictive analytics is emerging as a transformative trend in corporate assessment. Australian firms are using advanced data models to forecast employee performance, cultural fit, and long-term potential. These analytics-driven insights help refine hiring strategies and improve retention rates. HR departments leverage real-time dashboards to track behavioral trends and engagement levels. The integration of AI with predictive analytics also enables continuous learning assessments and adaptive testing. This trend enhances strategic workforce planning, offering a major opportunity for assessment providers to deliver high-value, outcome-oriented solutions.

- For instance, SHL is a global talent insights company that uses predictive analytics and AI, drawing on a talent database with billions of data points, to help enterprises forecast leadership potential and job performance around the world.

Expansion of Remote and Hybrid Assessment Solutions

The shift toward hybrid work environments has fueled strong demand for remote-friendly assessment platforms. Companies across Australia are deploying online proctoring systems, video-based interviews, and gamified assessments to evaluate candidates effectively. This flexibility allows organizations to assess a geographically dispersed workforce without logistical barriers. Cloud-based delivery ensures scalability for both large enterprises and SMEs. The opportunity for vendors lies in developing secure, user-friendly platforms with strong data protection. As remote work becomes institutionalized, virtual assessments are expected to remain a core component of corporate evaluation strategies.

Key Challenges

Data Privacy and Regulatory Compliance Concerns

Rising concerns over employee data security pose a major challenge for assessment service providers. The use of AI-based analytics and cloud storage introduces vulnerabilities in handling sensitive personal information. Compliance with Australia’s Privacy Act and GDPR-equivalent frameworks requires continuous monitoring and data governance. Breaches or mishandling of assessment data can lead to reputational and financial damage. Companies must invest in secure encryption, multi-level authentication, and transparent consent mechanisms. Maintaining trust through ethical data practices is essential for sustaining long-term adoption across regulated sectors such as BFSI and healthcare.

High Implementation Costs for Advanced Assessment Solutions

The high cost of implementing digital assessment systems remains a significant barrier, particularly for small and medium enterprises. Advanced platforms using AI, analytics, and virtual testing require substantial initial investment and technical integration. Many SMEs still rely on traditional evaluation methods due to limited budgets and expertise. Ongoing subscription fees and maintenance costs further increase financial pressure. Service providers must develop scalable, modular pricing models to expand accessibility. Balancing technological sophistication with affordability will be key to market penetration, especially among resource-constrained organizations seeking performance improvement.

Regional Analysis

New South Wales

New South Wales dominated the Australia corporate assessment services market in 2024 with a 34% share. The region’s strong concentration of corporate headquarters, financial institutions, and technology firms drives high demand for employee and leadership assessment tools. Sydney’s role as a business hub encourages widespread adoption of AI-based and data-driven HR solutions. Companies in BFSI and IT sectors invest heavily in continuous evaluation programs to enhance workforce efficiency. The government’s focus on digital transformation and workforce upskilling further supports growth in assessment adoption across public and private enterprises.

Victoria

Victoria accounted for 27% of the market share in 2024, positioning it as a key contributor to national growth. The region’s expanding manufacturing, healthcare, and education sectors drive the demand for structured performance evaluation systems. Melbourne-based corporations are adopting cloud-based and hybrid assessment platforms to improve recruitment accuracy and succession planning. Strong government support for workforce innovation and professional development initiatives also fuels adoption. Increasing investments by multinational companies and local enterprises in skill-based assessments strengthen Victoria’s position in Australia’s growing corporate evaluation ecosystem.

Queensland

Queensland held an 18% share of the corporate assessment services market in 2024, supported by its fast-growing industrial and service sectors. The state’s expanding focus on regional business hubs and tourism-related enterprises creates demand for tailored workforce evaluation tools. Organizations in healthcare, retail, and education are increasingly adopting digital assessments to improve employee engagement and skill alignment. Brisbane’s emerging technology sector also drives interest in analytics-based HR platforms. Continuous investment in employee development programs and remote-friendly solutions contributes to Queensland’s steady market expansion across small and medium enterprises.

Western Australia

Western Australia captured a 13% share of the corporate assessment services market in 2024, driven by strong adoption within mining, energy, and infrastructure industries. Companies in these sectors use assessment tools for safety compliance, technical skill evaluation, and leadership training. Perth’s growing professional services and IT ecosystem further enhances demand for digital HR solutions. As resource-based companies diversify into sustainability and innovation-driven operations, employee competency assessment becomes crucial. The region’s focus on operational efficiency and workforce retention continues to fuel growth in assessment adoption across industrial enterprises.

South Australia and Others

South Australia, along with Tasmania and the Northern Territory, collectively accounted for an 8% market share in 2024. The growing number of SMEs and government-led digital workforce initiatives drive gradual adoption of assessment platforms. Adelaide’s education and defense industries increasingly implement structured performance reviews and leadership assessments. Meanwhile, Tasmania and the Northern Territory are witnessing early adoption of online and hybrid testing tools among public-sector organizations. Ongoing digital transformation programs and efforts to improve regional employment quality support steady market expansion across these emerging regions.

Market Segmentations:

By Service Type

- Employee Assessment

- Leadership Assessment

- Team Assessment

- Organizational Assessment

By Industry Vertical

- BFSI

- IT and Telecommunications

- Healthcare

- Manufacturing

- Retail

- Education

- Others

By Enterprise Size

- Small and Medium Enterprises

- Large Enterprises

By Delivery Mode

By Geography

- New South Wales

- Victoria

- Queensland

- Western Australia

- South Australia and Others

Competitive Landscape

The Australia corporate assessment services market is moderately consolidated, with leading global and regional players competing through technology integration, service customization, and strategic partnerships. Key participants such as Korn Ferry, SHL Group Ltd., Aon plc, Thomas International, and Mercer | Mettl dominate through comprehensive assessment platforms and data-driven analytics. These firms focus on expanding digital and AI-based solutions to improve recruitment accuracy and leadership evaluation. Local providers are also gaining traction by offering cost-effective, industry-specific assessments tailored to SMEs. Mergers and collaborations among technology firms and HR consultancies are increasing to enhance service delivery and market presence. Continuous investment in cloud-based tools, psychometric testing, and predictive analytics supports competitive differentiation. As enterprises prioritize performance management and employee development, competition is shifting toward integrated talent analytics and continuous assessment ecosystems. Vendors emphasizing innovation, data security, and user experience are expected to strengthen their foothold in Australia’s evolving corporate evaluation landscape.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In 2023, IBM Corporation introduced AI-driven recruitment tools that assess behavioral patterns and predict job success. These tools leverage machine learning to minimize biases in recruitment processes, enhancing efficiency and fairness in candidate evaluation

- In 2023, Mercer Mettl Launched the “Mercer|Mettl Online Assessments,” an AI-powered platform to evaluate soft skills, technical competencies, and cognitive abilities. It includes advanced proctoring features for remote hiring and corporate training, emphasizing test security and scalability.

Report Coverage

The research report offers an in-depth analysis based on Service Type, Industry Vertical, Enterprise Size, Delivery Mode and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for AI-driven and predictive assessment tools will continue to rise across enterprises.

- Cloud-based and remote-friendly assessment platforms will gain wider adoption among SMEs.

- Data analytics will play a major role in evaluating employee performance and leadership potential.

- Integration of gamified and interactive assessment formats will enhance candidate engagement.

- BFSI and IT sectors will remain leading adopters due to compliance and skill demands.

- Vendors will focus on scalable, subscription-based models to expand accessibility.

- Investments in data security and privacy compliance will increase to build trust.

- Regional expansion will strengthen, with New South Wales and Victoria driving growth.

- Partnerships between HR technology firms and consulting providers will intensify.

- Continuous learning and development assessments will become core to talent management strategies.