Market Overview

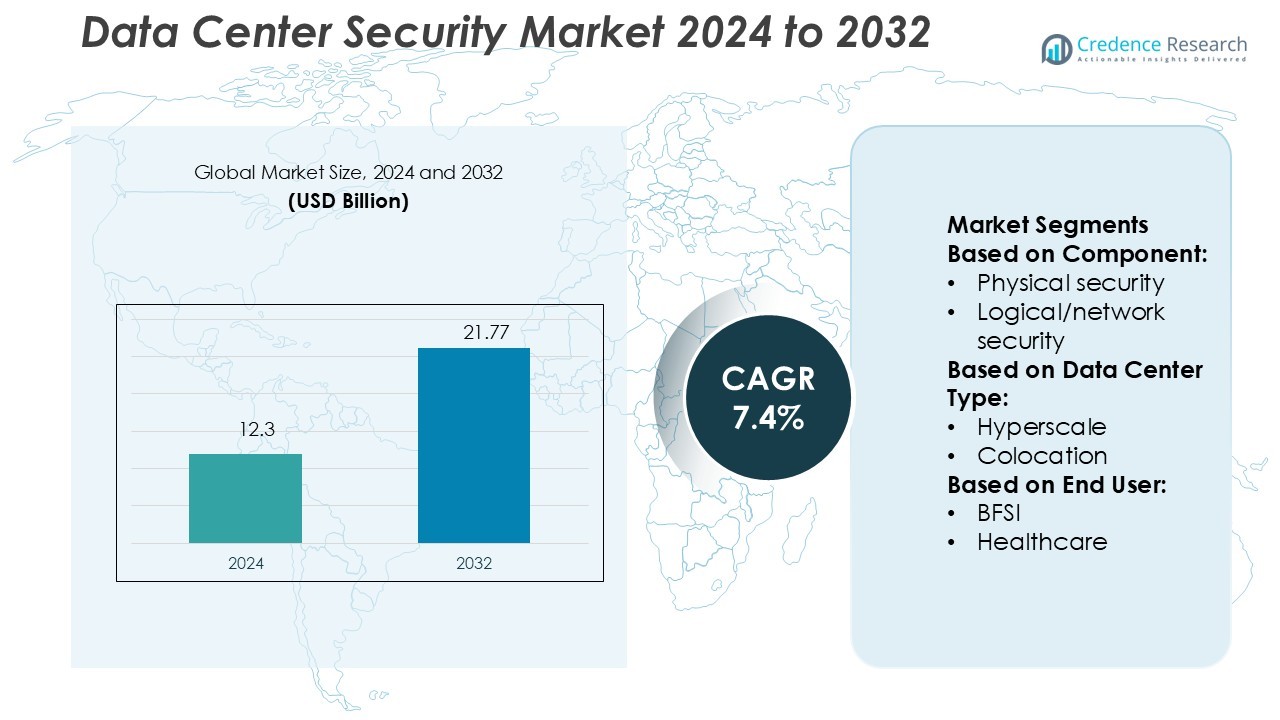

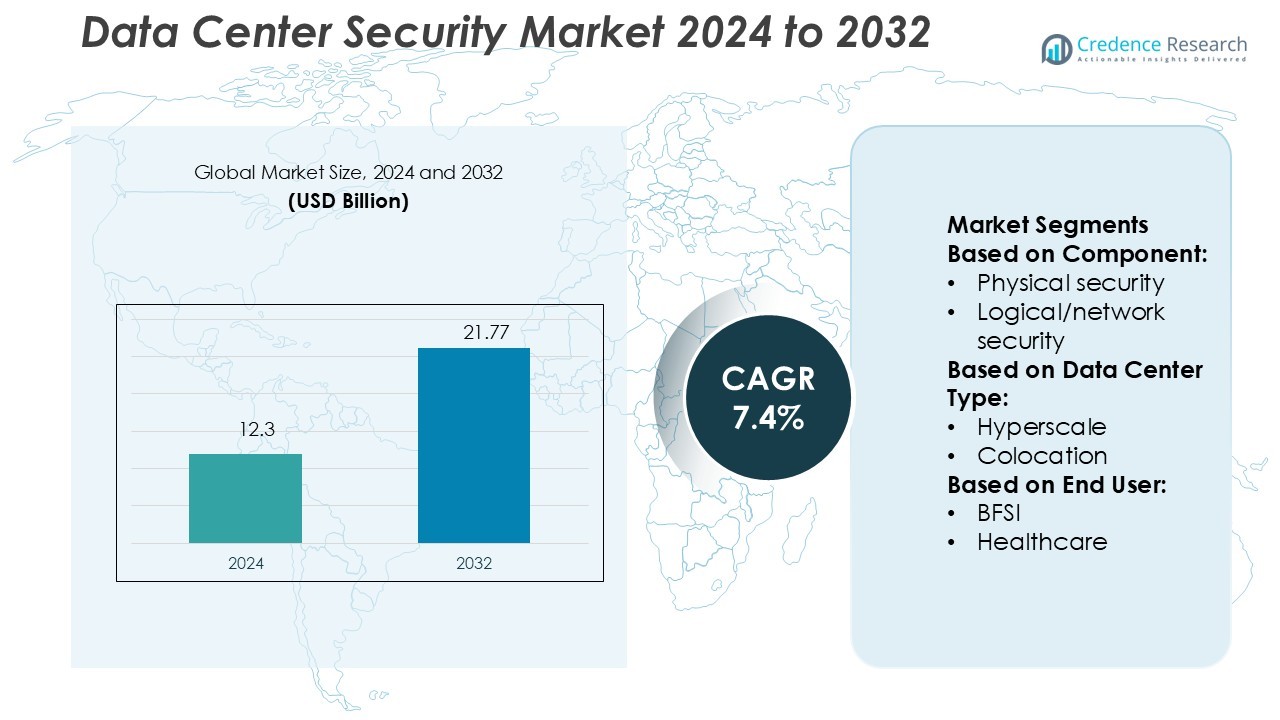

Data Center Security Market size was valued USD 12.3 billion in 2024 and is anticipated to reach USD 21.77 billion by 2032, at a CAGR of 7.4% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Data Center Security Market Size 2024 |

USD 12.3 Billion |

| Data Center Security Market, CAGR |

7.4% |

| Data Center Security Market Size 2032 |

USD 21.77 Billion |

The Data Center Security Market is led by major players including Fortinet, Axis Communications, Honeywell, Cisco, Securitas, ASSA ABLOY, Palo Alto Networks, Genetec, Allied Universal, and Johnson Controls. These companies drive innovation through AI-powered security platforms, biometric access systems, and zero-trust frameworks. They focus on integrating advanced physical and logical protection to meet rising cybersecurity demands. North America leads the market with a 36% share, supported by mature digital infrastructure, high hyperscale adoption, and strict regulatory standards. Strategic partnerships between security vendors and data center operators further strengthen the region’s leadership. This dominance is reinforced by significant investments in advanced surveillance, encryption, and network security technologies.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Data Center Security Market was valued at USD 12.3 billion in 2024 and is projected to reach USD 21.77 billion by 2032, growing at a CAGR of 7.4%.

- Increasing cyber threats and regulatory pressure are driving demand for AI-powered security, zero-trust models, and advanced biometric systems.

- North America holds a 36% share, supported by strong hyperscale adoption and mature infrastructure, while Europe and Asia Pacific show rapid expansion through colocation and edge deployments.

- Major players are enhancing competitiveness through innovation in network security, managed services, and strategic partnerships with data center operators.

- Rising complexity in hybrid environments and skill shortages remain key restraints, but growing investments in encryption, access control, and logical security solutions continue to strengthen market growth.

Market Segmentation Analysis:

By Component

Solutions lead the Data Center Security Market with a 61% share, driven by rising cyber threats. Logical/network security dominates within this segment due to its ability to detect and block real-time intrusions. Data centers are adopting advanced threat intelligence and automated security platforms to ensure resilience against ransomware and DDoS attacks. Physical security, including access control and surveillance, also supports compliance with regulatory standards. Services such as managed security, consulting, and support & maintenance enhance operational continuity and strengthen defense strategies. Managed security remains the fastest-growing sub-segment as enterprises outsource critical protection functions.

- For instance, Fortinet’s FortiGate 4800F platform is a high-performance firewall for large-scale data centers, with an official firewall throughput of 2.4 Tbps, enabling it to secure both east-west and north-south traffic.

By Data Center Type

Hyperscale data centers dominate the market with a 47% share, supported by massive cloud and AI workloads. These facilities require multilayered security architectures to safeguard large volumes of sensitive data. Colocation centers follow, driven by growing enterprise demand for shared yet secure infrastructure. Enterprise data centers invest heavily in perimeter and endpoint security to protect legacy systems. Edge data centers, though emerging, show strong adoption of lightweight, automated security tools to protect distributed networks. The surge in AI-driven data processing and cloud expansion accelerates investments in advanced security measures across all data center types.

- For instance, Axis Communications deployed its network cameras and access control solutions in hyperscale environments with support for 20,000+ connected devices under a single system, enabling centralized monitoring across multiple campuses.

By End User

The IT & telecommunication segment holds a 33% share, making it the leading end user of data center security solutions. These companies depend on uninterrupted network availability and secure infrastructure for global service delivery. BFSI follows closely, adopting zero-trust architectures and multi-factor authentication to protect financial data. Healthcare providers invest in encrypted access controls to secure electronic health records and comply with HIPAA standards. Retail and media segments focus on securing customer data and digital content distribution. Government and defense prioritize advanced surveillance and secure access frameworks to protect sensitive national assets.

Key Growth Drivers

Rising Threat Landscape and Regulatory Compliance

The growing frequency of cyberattacks is pushing data centers to adopt advanced security frameworks. Organizations are implementing zero-trust models, multi-factor authentication, and AI-based threat detection systems to protect critical assets. Strict regulatory standards such as GDPR, CCPA, and ISO 27001 further drive investments in security infrastructure. Cloud operators and colocation providers are integrating automated monitoring and encryption solutions to ensure compliance. This increasing regulatory pressure and threat complexity are expanding the demand for comprehensive physical and logical security systems in modern data center environments.

- For instance, Palo Alto Networks’ Cortex XSIAM® delivered ~ $500 million in bookings in a single fiscal year, doubling prior bookings, reflecting enterprise demand for AI-driven security operations.

Rapid Expansion of Hyperscale and Edge Infrastructure

The rise of hyperscale and edge data centers is a major driver for advanced security adoption. These facilities handle massive data volumes and require multi-layered protection against evolving threats. Edge locations, often in remote or distributed areas, need automated monitoring and intrusion detection systems to maintain resilience. Hyperscale operators are deploying AI-powered solutions to secure traffic flow, access points, and APIs. The rapid rollout of 5G networks and cloud services further accelerates the demand for scalable and adaptive security frameworks across diverse deployment models.

- For instance, Genetec offers its CloudLink 310 appliance, which can bridge 8 to 32 local cameras into its Security Center SaaS environment, depending on storage capacity. This allows remote sites to integrate their surveillance into a centralized control system.

Increased AI and Automation in Threat Detection

Artificial intelligence and automation are transforming data center security strategies. AI-powered platforms offer predictive threat detection, behavioral analytics, and real-time response capabilities, reducing incident resolution time. Automation enhances patch management, identity control, and log monitoring, minimizing manual intervention. This technology adoption helps enterprises address complex threats more efficiently. Security orchestration and automated response systems are now integrated into both hyperscale and colocation environments. These advancements enable faster, more precise defense against targeted attacks, making AI adoption a critical growth catalyst in the market.

Key Trends & Opportunities

Zero-Trust Architecture and Software-Defined Security

Zero-trust security models are gaining traction as data centers move away from perimeter-based defenses. This approach focuses on continuous identity verification and least-privilege access control. Software-defined security solutions provide flexibility, real-time visibility, and rapid response capabilities. With increasing remote workloads and hybrid cloud environments, zero-trust frameworks offer scalable and consistent protection. Enterprises view this as a strategic opportunity to enhance network resilience, streamline compliance, and reduce the impact of breaches through centralized security orchestration.

- For instance, Fujitsu developed a multi-AI agent security system capable of simulating cyberattacks and defenses in real time, scanning over 3,500 known generative AI vulnerabilities through its LLM vulnerability scanner module.

Integration of Biometrics and Physical Access Controls

Data centers are upgrading physical security infrastructure with biometric access systems, smart locks, and AI-enabled surveillance. This trend is driven by the need to protect mission-critical assets from insider threats and unauthorized entry. Multi-layer access authentication, including fingerprint and facial recognition, strengthens perimeter defense. Real-time monitoring platforms offer centralized visibility across distributed facilities. This shift toward intelligent physical security systems creates strong growth opportunities for vendors offering integrated solutions that combine physical and digital protection layers.

- For instance, Midas Immersion Cooling configures each 50U MIDAS XCI tank to dissipate up to 150 kW of heat per tank using dielectric immersion cooling, with hot-swappable cooling modules that replace in under 10 minutes without tools.

Rising Adoption of Managed Security Services

Outsourcing security functions is becoming a strategic move for enterprises aiming to reduce complexity and operational costs. Managed security services provide continuous monitoring, compliance management, and incident response. Providers offer specialized expertise and 24/7 protection against evolving threats. This model is particularly attractive to colocation and edge operators with limited in-house security resources. The rising demand for managed services represents a significant opportunity for providers to expand service portfolios and deliver tailored security solutions.

Key Challenges

Growing Complexity of Multi-Cloud Environments

The adoption of hybrid and multi-cloud architectures creates fragmented security landscapes. Securing workloads across distributed platforms demands consistent policies and visibility, which many enterprises struggle to maintain. Legacy systems often lack integration with modern security frameworks, creating gaps. These complexities increase the risk of misconfigurations, data leaks, and unauthorized access. Managing security across multiple environments requires advanced orchestration tools and skilled personnel, making this a persistent challenge for operators.

Shortage of Skilled Cybersecurity Professionals

The global cybersecurity skills gap remains a critical barrier to effective data center security. Organizations face difficulties in recruiting and retaining qualified experts to manage advanced threat detection systems. Many facilities rely heavily on automation due to workforce shortages. This lack of expertise slows incident response and increases the risk of breaches. The shortage also affects the deployment of complex security architectures, delaying digital transformation initiatives and creating operational vulnerabilities.

Regional Analysis

North America

North America holds a 36% share of the Data Center Security Market, supported by strong cloud adoption and mature IT infrastructure. The U.S. leads regional demand with large hyperscale data centers and strict regulatory standards such as HIPAA and CCPA. Enterprises invest heavily in AI-powered security tools and zero-trust frameworks to protect sensitive workloads. Colocation providers are expanding managed security services to address rising cyber threats. Continuous investments in advanced surveillance, encryption, and access control systems strengthen physical and logical defenses. The strong presence of leading technology firms and cybersecurity vendors further accelerates market expansion in the region.

Europe

Europe accounts for 28% of the Data Center Security Market, driven by GDPR compliance and rapid digital transformation. Countries such as Germany, the UK, and the Netherlands dominate data center investments, requiring robust security measures. Enterprises prioritize encryption, identity management, and real-time threat intelligence to meet regulatory demands. Colocation and edge facilities integrate biometric access and AI-based monitoring for improved protection. Growing energy-efficient data center development also increases investment in advanced security infrastructure. The rising deployment of cloud services across industries like BFSI and government further strengthens the region’s leadership in data protection strategies.

Asia Pacific

Asia Pacific holds a 24% share of the market, fueled by rapid hyperscale and edge infrastructure expansion in China, India, Japan, and Singapore. Regional operators adopt AI-driven intrusion detection, firewalls, and biometric systems to counter rising cyberattacks. Governments promote data localization policies, pushing enterprises to strengthen security frameworks. Telecom and cloud service providers drive most investments, focusing on real-time monitoring and zero-trust deployments. The growing digital economy and 5G rollout further accelerate security demand. Increasing partnerships between security vendors and data center operators enhance regional resilience and support steady market growth.

Latin America

Latin America represents 7% of the Data Center Security Market, supported by growing cloud adoption and data center development in Brazil, Mexico, and Chile. Operators focus on integrating managed security services and physical access control to address infrastructure vulnerabilities. Rising cyberattacks on financial and government institutions increase demand for encryption and network defense solutions. Regional investments are shifting toward zero-trust frameworks and compliance-focused architectures. Strategic partnerships with global vendors are improving cybersecurity capabilities. Though smaller in market size, the region shows strong potential for growth with increasing enterprise digital transformation initiatives.

Middle East & Africa

The Middle East & Africa holds a 5% share, driven by rising investments in colocation and hyperscale facilities in the UAE, Saudi Arabia, and South Africa. Data sovereignty initiatives and government cybersecurity programs are key growth enablers. Enterprises adopt advanced perimeter security, biometric access, and AI-driven monitoring tools to protect sensitive data. Cloud adoption is expanding rapidly, particularly in BFSI and government sectors. Regional data center operators focus on building security capabilities that align with international compliance standards. While the market remains emerging, accelerating digital infrastructure development positions the region for strong future growth.

Market Segmentations:

By Component:

- Physical security

- Logical/network security

By Data Center Type:

By End User:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Data Center Security Market is shaped by key players such as Fortinet, Axis Communications, Honeywell, Cisco, Securitas, ASSA ABLOY, Palo Alto Networks, Genetec, Allied Universal, and Johnson Controls. The Data Center Security Market is defined by continuous innovation and strategic expansion. Vendors are focusing on integrating advanced cybersecurity measures with strong physical security infrastructure to address rising threats. AI-powered analytics, automated threat detection, and zero-trust frameworks are becoming central to their offerings. Many companies are strengthening their service portfolios through managed security solutions to support hybrid and multi-cloud environments. Strategic alliances with hyperscale and colocation operators are helping expand market presence. Regulatory compliance, biometric access systems, and encrypted network protection remain core priorities. This focus on holistic, scalable security solutions is intensifying competition and driving technological advancement.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Fortinet

- Axis Communications

- Honeywell

- Cisco

- Securitas

- ASSA ABLOY

- Palo Alto Networks

- Genetec

- Allied Universal

- Johnson Controls

Recent Developments

- In September 2025, Johnson Controls launched the Silent-Aire Coolant Distribution Unit platform, expanding its thermal management product line to address operational efficiencies and environmental impact in high-density AI-powered data centers.

- In August 2025, Securitas announced strategic expansion of leadership in North America, reinforcing its commitment to growth in intelligent protective services and further integration of technology-driven solutions.

- In June 2025, Honeywell completed the acquisition of Sundyne for expanding its Energy and Sustainability Solutions business with advanced pump and compressor technologies for petrochemicals, LNG, and clean fuels, reinforcing its solutions portfolio for process industries.

- In June 2025, Cisco announced the launch of its next-generation Secure Firewall, integrating advanced AI-driven threat detection and zero-trust architecture to enhance network security for enterprise clients. This move aligns with the company’s strategy to lead in the cybersecurity market, addressing the increasing complexity of digital threats.

Report Coverage

The research report offers an in-depth analysis based on Component, Data Center Type, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Adoption of AI and automation will strengthen real-time threat detection capabilities.

- Zero-trust security models will become standard across data center infrastructures.

- Demand for managed security services will grow rapidly among colocation operators.

- Biometric access control will replace traditional physical security systems.

- Hybrid and multi-cloud environments will drive investment in integrated security platforms.

- Regulatory compliance will continue to shape security strategies and technology adoption.

- Edge data centers will increasingly deploy lightweight and automated security solutions.

- Strategic alliances between security vendors and cloud providers will accelerate market expansion.

- Advanced encryption and identity management will become critical for securing workloads.

- Continuous innovation will push vendors to deliver more scalable and adaptive security solutions.