Market Overview

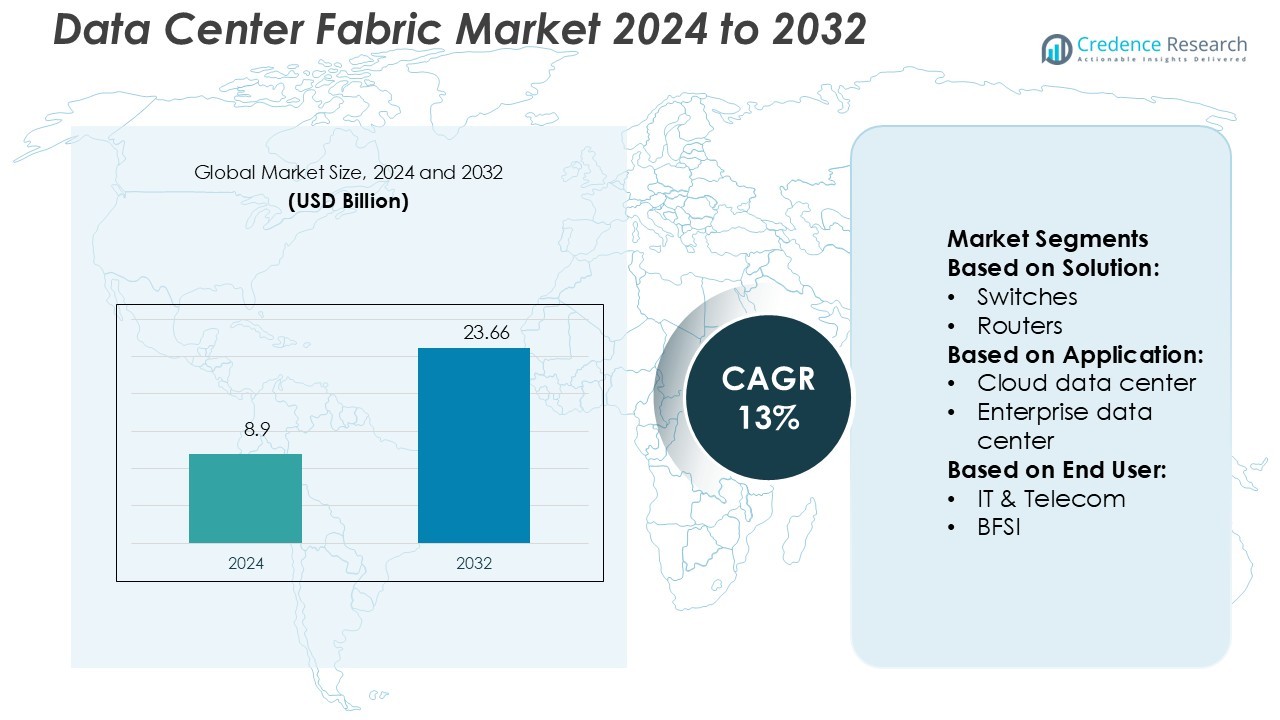

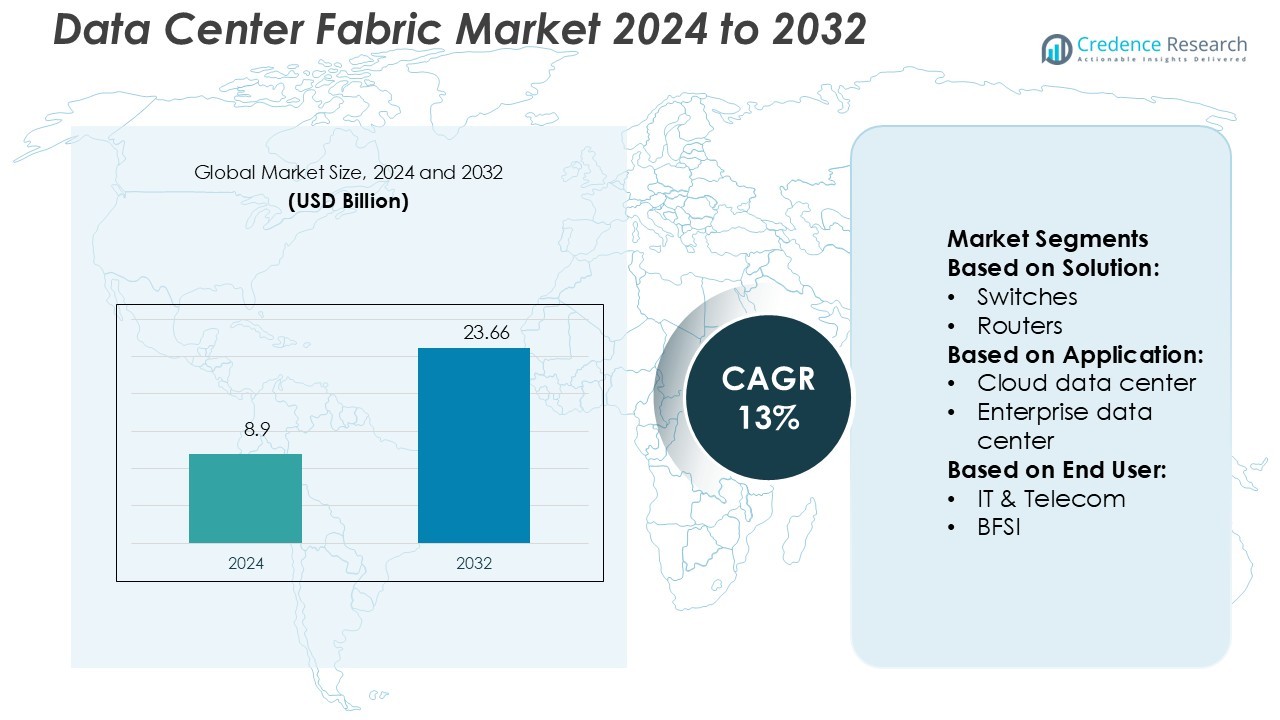

Data Center Fabric Market size was valued USD 8.9 billion in 2024 and is anticipated to reach USD 23.66 billion by 2032, at a CAGR of 13% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Data Center Fabric Market Size 2024 |

USD 8.9 Billion |

| Data Center Fabric Market, CAGR |

13% |

| Data Center Fabric Market Size 2032 |

USD 23.66 Billion |

The Data Center Fabric Market is shaped by major players including Juniper Networks, VMware, NEC, Cisco Systems, Dell Technologies, Nokia, Arista Networks, Extreme Networks, Huawei Technologies, and Hewlett Packard. These companies focus on advanced fabric solutions that enable high-speed connectivity, network automation, and seamless scalability. They invest in product innovation, AI-driven infrastructure, and open networking to support growing cloud, edge, and 5G deployments. North America leads the market with a 36% share, supported by strong hyperscale data center investments, rapid digital transformation, and early adoption of advanced networking technologies. Strategic partnerships and expansion into emerging markets further strengthen the competitive landscape.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Data Center Fabric Market was valued at USD 8.9 billion in 2024 and is expected to reach USD 23.66 billion by 2032, growing at a CAGR of 13%.

- Rising demand for high-speed and scalable networks, along with increased cloud and edge deployments, is driving strong market growth.

- Open and disaggregated networking, AI integration, and energy-efficient designs are emerging as major trends shaping product innovation.

- North America leads with a 36% market share, followed by Europe at 29% and Asia Pacific at 27%, while the hardware segment dominates among solutions.

- High capital investment and integration complexity remain key restraints, but strategic partnerships and global expansion continue to strengthen competition among leading players.

Market Segmentation Analysis:

By Solution

The hardware segment dominates the Data Center Fabric Market with the largest market share. Switches hold a significant portion due to their critical role in high-speed connectivity and data traffic management. Advanced switching solutions enable low latency and improved scalability, supporting modern workload demands. Routers and network controllers are also gaining traction with increased adoption of spine-leaf architectures. Rising data traffic and cloud workloads drive strong investment in robust physical infrastructure. Software and services segments are expanding steadily as automation, network orchestration, and managed services gain more importance in data center modernization initiatives.

- For instance, Juniper Networks launched its QFX5700 Series switch, which delivers up to 25.6 Tbps throughput and supports 400 GbE interfaces for hyperscale data centers. The platform integrates Junos OS Evolved with intent-based automation, enabling rapid deployment and reduced network downtime.

By Application

The cloud data center segment leads the market with a substantial share. This dominance is driven by rapid cloud adoption among enterprises and hyperscalers. Cloud facilities demand flexible and scalable fabric architectures to support dynamic workloads and hybrid cloud integration. Enterprise data centers follow, supported by digital transformation and edge deployments. Telecommunication providers are investing in advanced fabrics to manage high-bandwidth 5G traffic and network slicing. Increased need for agility, energy efficiency, and network reliability fuels demand across these application segments, ensuring strong growth momentum.

- For instance, VMware’s latest Cloud Foundation 9.0, they introduced Advanced Memory Tiering using NVMe as a second memory layer, which claims up to 40 % lower TCO and improved VM consolidation ratios.

By End User

The IT & telecom segment accounts for the highest market share in the Data Center Fabric Market. The surge in data consumption, 5G rollout, and AI-driven workloads accelerates infrastructure upgrades. BFSI follows closely, with rising adoption of secure, low-latency networks for real-time transaction processing. Healthcare and retail are witnessing strong adoption due to increased digitalization and IoT integration. Government initiatives toward digital infrastructure further boost demand. These industries prioritize fabric technologies to improve network efficiency, enhance performance, and support mission-critical applications.

Key Growth Drivers

Rising Demand for High-Speed and Scalable Network Infrastructure

The growing need for high-speed data transfer and scalable connectivity is driving the Data Center Fabric Market. Enterprises are deploying advanced switching and routing technologies to support real-time analytics, AI workloads, and cloud-native applications. High bandwidth, low latency, and simplified network management are key requirements in modern data centers. Fabric architecture enables horizontal scaling and better traffic distribution, supporting massive workloads efficiently. Hyperscale data center expansion and 5G deployments further accelerate investments in scalable and flexible network fabric solutions.

- For instance, NEC–NTT IOWN collaboration introduced a 400 Gbps inter-data center solution using disaggregated hardware/software and open 400G ZR/ZR+ optics. This cut deployment cost by ~50 % and lowered power use by ~40 %.

Increased Adoption of Cloud and Hybrid Architectures

The rapid migration to cloud and hybrid IT environments fuels strong market growth. Businesses are adopting fabric-based architectures to ensure seamless connectivity between on-premises infrastructure and public cloud platforms. Cloud providers prefer fabric solutions for their flexibility, security, and simplified network control. This adoption helps reduce network complexity, improve agility, and enhance operational efficiency. Enterprises in IT, BFSI, and retail sectors are accelerating hybrid deployments to support digital transformation, increasing the demand for advanced fabric technologies.

- For instance, Nokia’s Data Center Fabric portfolio supports system capacities up to 460.8 Tb/s, and handles port speeds from 1 GE up to 800 GE across leaf, spine, and super-spine roles.

Growing Investments in Automation and AI-Driven Networks

Rising investments in automation, SDN, and AI-based network management tools act as a major growth driver. Automated fabric solutions help data centers reduce manual intervention, optimize traffic flows, and enhance reliability. AI-powered analytics improves visibility and predictive maintenance, enabling efficient network scaling. Organizations are adopting intent-based networking and automated provisioning to support evolving workloads. This trend supports reduced operational costs and faster service delivery, making fabric technologies essential for next-generation data center infrastructure.

Key Trends & Opportunities

Integration of Edge Computing and Distributed Architectures

The increasing deployment of edge data centers creates strong opportunities for fabric solutions. Edge architectures require low-latency, high-speed, and adaptive network designs to process data closer to end-users. Fabric solutions enable seamless connectivity between core and edge facilities, supporting real-time applications and IoT workloads. Telecom operators and hyperscalers are investing heavily in distributed networks. This shift creates opportunities for vendors to offer lightweight, energy-efficient fabric solutions optimized for edge environments.

- For instance, Arista supports up to 576 ports of 400 G and 2,304 ports of 100/50/25/10 G/1 G in a single non-blocking monitoring/TAP aggregation mesh.

Sustainability and Energy-Efficient Network Designs

Sustainability is emerging as a major trend in data center infrastructure. Operators are prioritizing energy-efficient network fabric solutions to reduce power consumption and meet environmental goals. Innovations like intelligent cooling integration, energy-aware routing, and modular designs are gaining traction. These developments align with corporate ESG commitments and global decarbonization targets. Vendors focusing on green data center fabrics can gain a competitive edge as enterprises increasingly prioritize low PUE and sustainable operations.

- For instance, Huawei’s CloudFabric 3.0 data center network switches use over 50 patented heat-dissipation methods. They achieve 54% lower per-bit power consumption for 400 GE ports versus industry average.

Growing Adoption of Open and Disaggregated Networking

Open networking and disaggregated fabric solutions are gaining traction, offering flexibility and vendor neutrality. Enterprises are adopting open standards to avoid vendor lock-in and optimize costs. Disaggregated systems allow independent upgrades of hardware and software components, enhancing scalability. This trend encourages innovation, fosters interoperability, and drives faster deployment cycles. It creates new opportunities for both established vendors and emerging players in the fabric ecosystem.

Key Challenges

High Capital Expenditure and Integration Complexity

Implementing advanced data center fabric solutions requires significant capital investment. Enterprises face high costs for switching equipment, automation tools, and skilled labor. Integration with legacy infrastructure can be complex and time-consuming. Many organizations struggle to balance modernization with budget constraints. This cost and complexity barrier limits adoption among small and medium-sized enterprises, slowing overall market penetration.

Cybersecurity and Network Vulnerability Risks

As data center networks become more interconnected and automated, security risks intensify. Fabric architectures, if not properly secured, can expose organizations to threats such as data breaches and DDoS attacks. The rapid integration of AI, IoT, and edge increases the attack surface. Ensuring secure network fabrics requires continuous monitoring, advanced encryption, and zero-trust architectures. High security demands add operational complexity and may slow down deployment in sensitive sectors like BFSI and healthcare.

Regional Analysis

North America

North America holds the largest share of the Data Center Fabric Market at 36%. The region’s dominance is supported by the presence of hyperscale data centers, strong cloud adoption, and advanced digital infrastructure. Major technology firms and cloud providers drive large-scale deployments of fabric solutions to support AI, IoT, and 5G applications. The U.S. leads the region with continuous investments in high-capacity network infrastructure. Canada follows with growing demand for sustainable and energy-efficient designs. Strong regulatory frameworks and rapid edge network expansion further strengthen North America’s leadership in data center fabric deployments.

Europe

Europe accounts for 29% of the Data Center Fabric Market, driven by strong digitalization initiatives and data sovereignty regulations. Countries like Germany, France, and the UK lead fabric adoption through modernized cloud facilities and colocation expansions. The region focuses on green and energy-efficient data centers to meet stringent EU sustainability goals. Telecom operators and enterprises are integrating fabric solutions to support low-latency applications and hybrid architectures. Investments in 5G and edge networks further accelerate growth, while regulatory compliance under GDPR drives the need for secure and reliable fabric infrastructure.

Asia Pacific

Asia Pacific captures 27% of the Data Center Fabric Market and is the fastest-growing region. China, India, Japan, and South Korea are major contributors, driven by rapid cloud adoption, 5G rollout, and strong digital transformation programs. Hyperscale and edge data center construction is increasing, boosting demand for high-speed, scalable fabric networks. Government incentives and strong investments from global technology companies strengthen market momentum. The region’s growing e-commerce and fintech sectors also fuel demand for reliable, low-latency network infrastructure, making Asia Pacific a key growth hub for fabric solutions.

Latin America

Latin America represents 5% of the Data Center Fabric Market and is witnessing steady growth. Brazil and Mexico are leading markets, supported by increasing cloud adoption and investments from global data center operators. The region’s digital infrastructure modernization is driving demand for efficient network fabrics that support scalable and secure connectivity. Telecom network upgrades and rising enterprise cloud workloads are boosting deployments. While infrastructure gaps and budget constraints remain challenges, expanding colocation facilities and edge deployments are creating opportunities for vendors in this region.

Middle East & Africa

The Middle East & Africa holds a 3% share of the Data Center Fabric Market. Growth is supported by strong investments in digital infrastructure and hyperscale projects, particularly in the UAE, Saudi Arabia, and South Africa. Regional governments are promoting digital transformation, cloud adoption, and smart city initiatives, driving demand for modern fabric solutions. Telecom operators are expanding high-speed networks to support 5G and edge computing. Although adoption remains at an early stage compared to other regions, increasing foreign investments and strategic partnerships are expected to boost market penetration.

Market Segmentations:

By Solution:

By Application:

- Cloud data center

- Enterprise data center

By End User:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Data Center Fabric Market features strong competition among key players such as Juniper Networks, VMware, NEC, Cisco Systems, Dell Technologies, Nokia, Arista Networks, Extreme Networks, Huawei Technologies, and Hewlett Packard. The Data Center Fabric Market is characterized by intense competition, rapid innovation, and strong focus on scalability. Companies are investing heavily in advanced networking technologies to support growing cloud adoption, AI-driven workloads, and 5G deployments. The competitive landscape is shaped by strategic mergers, acquisitions, and partnerships aimed at expanding product portfolios and enhancing market presence. Vendors are prioritizing automation, software-defined networking, and energy-efficient solutions to address increasing enterprise and hyperscale demand. Open networking and edge integration are key areas of differentiation. This competitive environment drives continuous technological advancement, improving network agility, operational efficiency, and overall data center performance.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In March 2025, Arista Networks introduced an AI-optimized network fabric designed to enhance the performance of AI and machine learning workloads. The solution integrates advanced features like low latency, high bandwidth, and scalability to meet the demands of AI-driven data centers.

- In September 2024, SoftBank Corporation and NewPhotonics announced a significant collaboration focused on advancing photonics technology, specifically in Linear-drive Pluggable Optics (LPO), Co-packaged Optics (CPO), and all-optics switch fabric.

- In June 2024, Cisco unveiled the Nexus HyperFabric, a simplified data center infrastructure solution developed in collaboration with NVIDIA, tailored for generative AI applications. This cutting-edge fabric optimizes performance with high bandwidth, low-latency connectivity, and seamless integration with NVIDIA AI clusters.

- In July 2023, Huawei’s announced three innovative data center facility solutions as unveiled the next-generation indirect evaporative cooling solution EHU and the mobile intelligent management solution iManager-M. These scenario-based data center solutions promise optimal reliability throughout the lifecycle and aim to drive the high-quality development of the data center industry.

Report Coverage

The research report offers an in-depth analysis based on Solution, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand steadily with increasing cloud and edge deployments.

- AI and automation will drive greater efficiency in network operations.

- Open and disaggregated networking will gain stronger adoption across enterprises.

- Energy-efficient designs will become a priority for new data center builds.

- Hybrid and multi-cloud strategies will accelerate fabric deployments globally.

- 5G and IoT growth will create strong demand for low-latency infrastructure.

- Vendors will focus more on software-defined and intent-based networking solutions.

- Edge data centers will emerge as key growth drivers in multiple regions.

- Strategic partnerships will strengthen market penetration and innovation.

- Regulatory focus on security and sustainability will shape future product strategies.