Market Overview

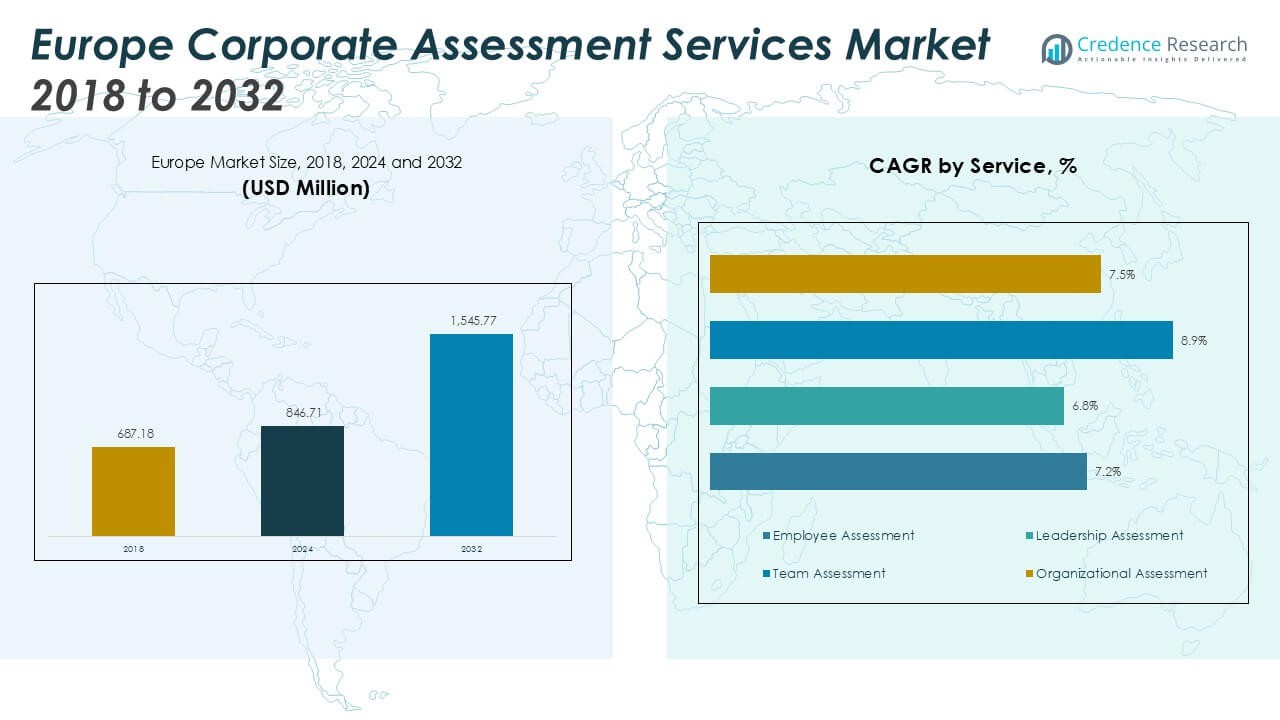

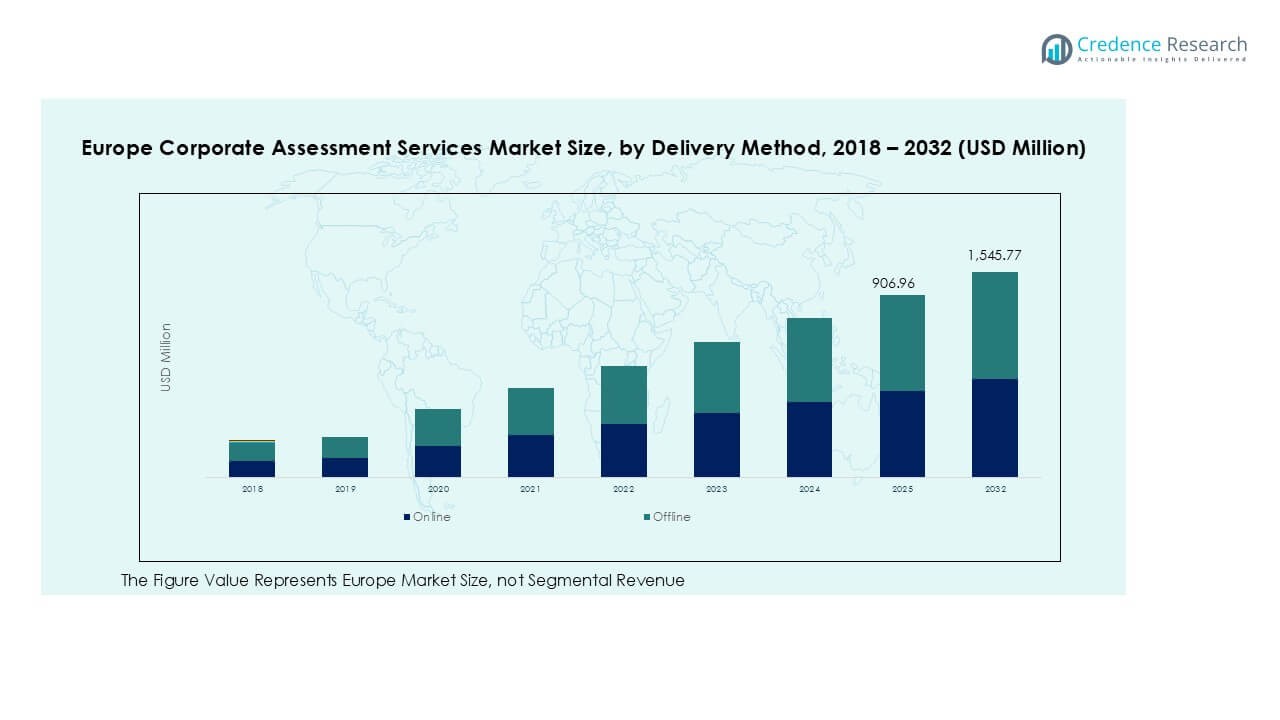

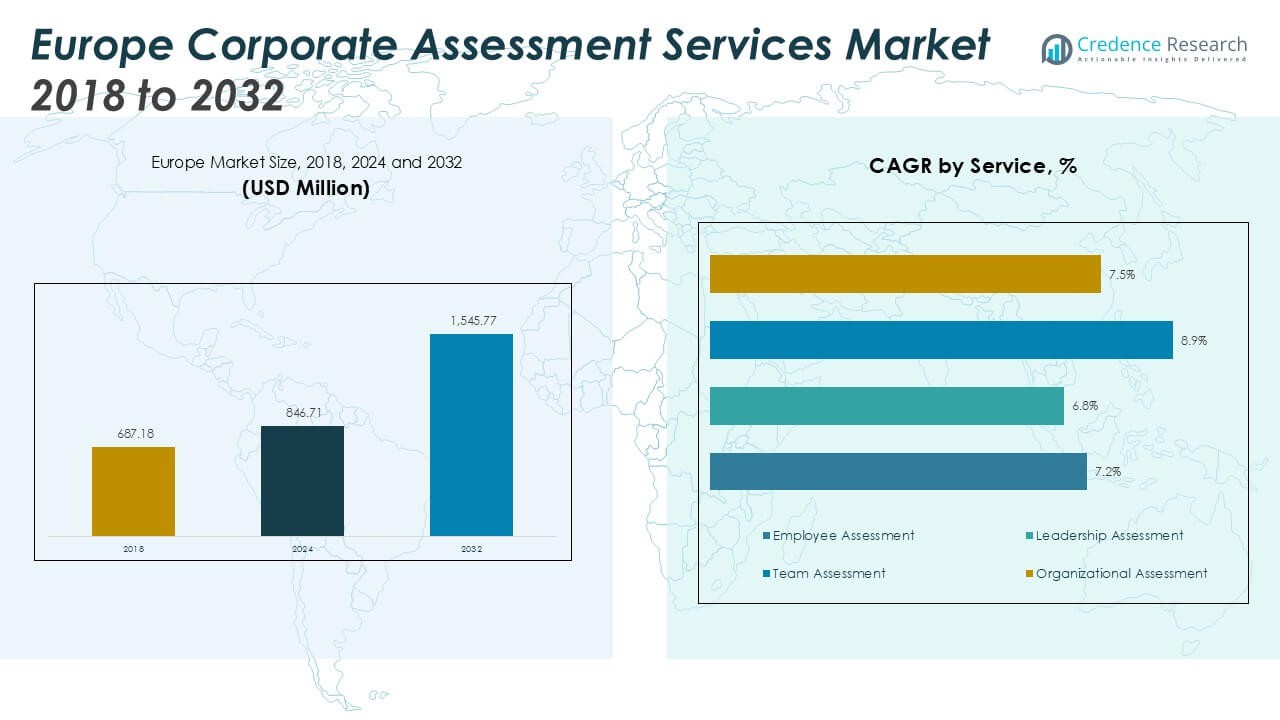

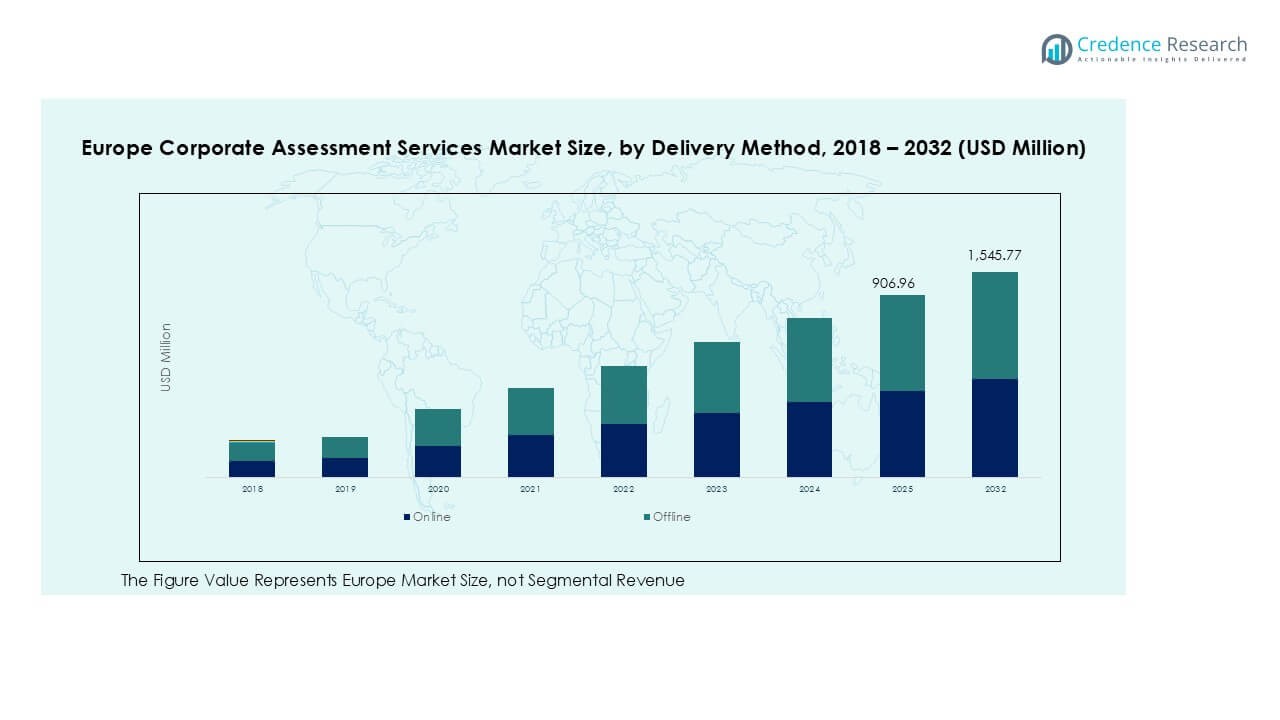

The Europe Corporate Assessment Services market was valued at USD 687.18 million in 2018, rising to USD 846.71 million in 2024, and is anticipated to reach USD 1,545.77 million by 2032, expanding at a CAGR of 7.9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Aerial Imaging Market Size 2024 |

USD 846.71 Million |

| Aerial Imaging Market, CAGR |

7.9% |

| Aerial Imaging Market Size 2032 |

USD 1,545.77 Million |

The Europe corporate assessment services market is led by prominent players such as SHL Group Ltd., Aon plc, Korn Ferry, Thomas International, Hogan Assessments, Saville Assessment, and PSI Services LLC. These companies dominate through advanced digital platforms, AI-enabled analytics, and competency-based evaluation frameworks. SHL and Aon remain key leaders due to their extensive global networks and integration of predictive talent analytics. Korn Ferry and Hogan Assessments strengthen their positions with leadership and behavioral assessment expertise. Regionally, the UK leads the market with a 28% share, followed by Germany with 19% and France with 17%. This dominance is supported by strong digital adoption, regulatory compliance, and large-scale corporate investments in workforce analytics across these countries.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Europe corporate assessment services market was valued at USD 846.71 million in 2024 and is projected to reach USD 1,545.77 million by 2032, growing at a CAGR of 7.9%.

- Rising demand for data-driven hiring and digital workforce evaluation tools is a major driver, supported by AI-enabled analytics and psychometric testing.

- Key trends include the integration of predictive analytics, remote assessment platforms, and leadership-focused evaluation models across large enterprises.

- The market is highly competitive, with SHL Group Ltd., Aon plc, Korn Ferry, and Thomas International leading through technological innovation and regional expansion.

- Regionally, the UK dominates with a 28% share, followed by Germany at 19% and France at 17%, while the employee assessment segment leads overall with a 42% share driven by increasing digital recruitment and performance measurement initiatives.

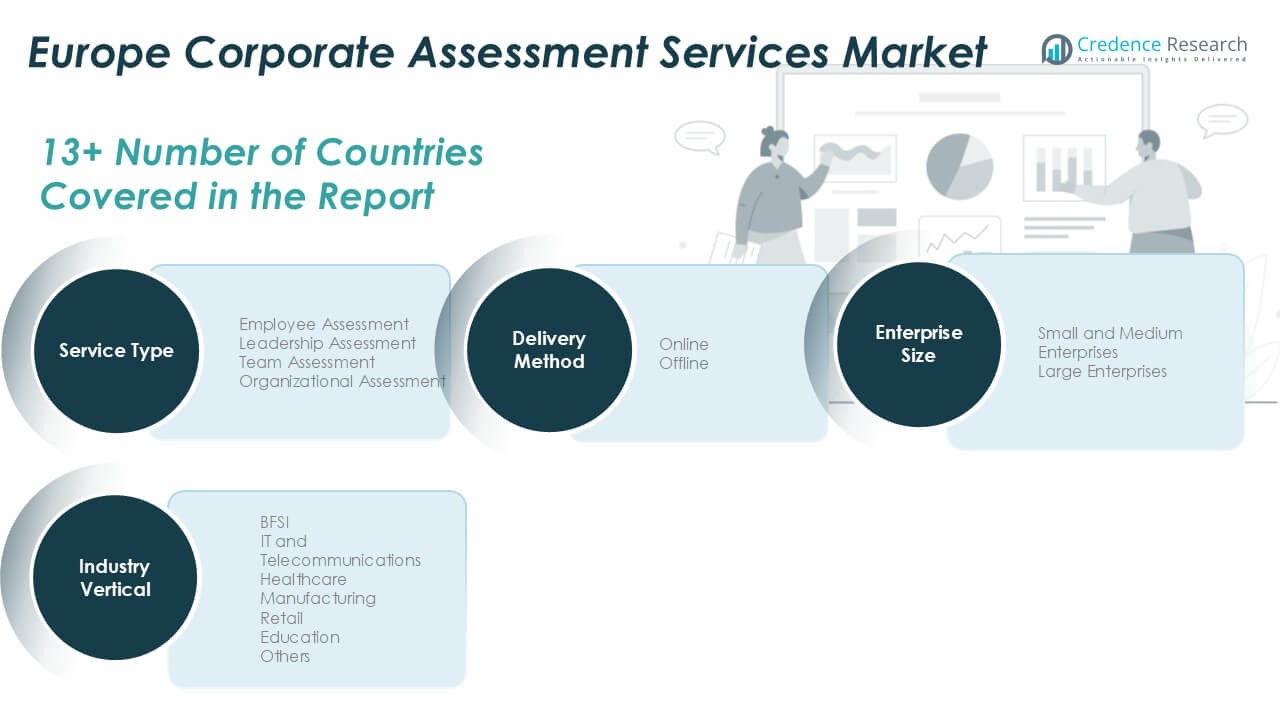

Market Segmentation Analysis:

By Service Type

Employee assessment held the dominant share of 42% in the Europe corporate assessment services market in 2024. The segment’s growth is driven by the rising need for data-backed hiring and competency evaluation across organizations. Digital tools for psychometric and cognitive testing are helping firms reduce bias and improve recruitment outcomes. Leadership and team assessments are also gaining traction as companies focus on upskilling senior executives and improving collaboration within hybrid work environments, especially in technology and consulting sectors.

- For instance, Aon’s Assessment Solutions administers more than 30 million psychometric evaluations annually, using AI to enhance objectivity and response accuracy in the assessment process.

By Industry Vertical

The BFSI sector accounted for the largest share of 31% in 2024 due to its heavy focus on compliance and workforce optimization. Financial institutions increasingly use behavioral and skills-based assessments to meet regulatory standards and enhance productivity. The IT and telecommunications industry follow closely, driven by rapid digital transformation and demand for leadership adaptability. Healthcare and manufacturing sectors are adopting assessment tools to ensure operational efficiency, while education and retail sectors are using them for training effectiveness and talent development programs.

- For instance, as a global organizational consulting firm, Korn Ferry provides leadership and compliance assessment services to major financial institutions, including European banks, to help them align their talent strategies with regulatory mandates.

By Enterprise Size

Large enterprises dominated the market with a 64% share in 2024, supported by their investment in talent analytics and AI-enabled evaluation platforms. These companies prioritize leadership benchmarking, succession planning, and employee engagement metrics to maintain competitive advantage. However, small and medium enterprises are growing rapidly as affordable cloud-based assessment platforms lower entry barriers. The shift toward remote hiring and digital workforce management is enabling SMEs to adopt scalable, automated assessment tools for skill verification and performance monitoring.

Key Growth Drivers

Rising Focus on Data-Driven Talent Decisions

Organizations across Europe are increasingly adopting data-based talent assessment solutions to enhance workforce efficiency and reduce turnover. Companies are integrating psychometric, cognitive, and behavioral tests to improve hiring accuracy and predict job performance. The growing emphasis on competency mapping and employee analytics has encouraged HR departments to rely on AI-driven assessment platforms. For instance, enterprises are using predictive analytics to identify leadership potential and assess cultural fit before recruitment. The ongoing digital transformation in HR processes, combined with a growing remote workforce, has reinforced the need for objective and scalable assessment systems.

- For instance, SHL uses AI-based analytics in its assessments to identify talent and predict outcomes. Globally, SHL processes approximately 35 million assessments annually. According to the company, employees who are a high fit for a recommended role demonstrate 82% higher work engagement.

Expansion of Digital Assessment Platforms

The rapid adoption of online evaluation tools has transformed how European companies assess talent. Cloud-based platforms enable remote testing, automated scoring, and faster recruitment, aligning with hybrid and flexible work models. Organizations prefer digital tools for their scalability, multilingual accessibility, and integration with learning management systems. For instance, HR tech companies are developing mobile-friendly assessment platforms to streamline hiring and performance reviews. The increasing demand for AI-enhanced solutions that evaluate emotional intelligence, leadership capability, and problem-solving skills is driving technological innovation. As businesses seek agility and inclusivity, digital assessments have become critical to optimizing recruitment and talent development across sectors.

- For instance, Talogy provides a suite of cloud-based digital assessment solutions globally, delivering more than 30 million assessments annually.

Growing Emphasis on Leadership Development

European corporations are prioritizing leadership assessments to build strong succession pipelines and maintain organizational resilience. Companies face rising leadership gaps due to demographic shifts and post-pandemic restructuring, increasing the demand for executive-level evaluation programs. Leadership assessments help identify high-potential individuals, map behavioral competencies, and align leadership styles with business strategies. For instance, major consulting firms now offer tailored programs that integrate 360-degree feedback, simulation exercises, and development planning. Industries such as BFSI, IT, and healthcare are investing heavily in leadership training to enhance decision-making and adaptability in uncertain economic environments. This emphasis supports long-term organizational stability and employee engagement.

Key Trends & Opportunities

Integration of AI and Predictive Analytics

Artificial intelligence and predictive analytics are reshaping corporate assessment frameworks across Europe. AI algorithms analyze vast datasets to identify skill patterns, forecast job performance, and minimize human bias. For instance, assessment providers are embedding natural language processing and facial recognition tools into recruitment platforms to measure emotional and cognitive traits. Predictive insights derived from assessment data are guiding HR decisions related to promotions and training needs. The trend supports personalized learning paths, enhancing employee retention and development outcomes. This integration of advanced analytics presents significant opportunities for vendors offering AI-driven, transparent, and compliance-ready platforms.

- For instance, Aon’s Assessment Solutions use machine learning and AI to help forecast leadership potential and inform hiring decisions. The company states that its tools are designed to reduce bias and align with industry standards, including EU data protection laws like GDPR. However, the claim that the tools are bias-reducing is contested. In 2024, the American Civil Liberties Union (ACLU) filed complaints with the FTC and EEOC alleging that some of Aon’s assessments are discriminatory against people with disabilities and people of color.

Increased Adoption of Remote and Hybrid Assessment Models

The shift toward remote and hybrid work has accelerated the need for flexible digital assessments. European firms are increasingly deploying online tests and video-based evaluations to reach geographically dispersed candidates. For instance, leading HR technology providers now enable real-time monitoring, adaptive questioning, and automated feedback systems through secure platforms. This trend reduces recruitment costs, improves accessibility, and supports large-scale hiring drives. As organizations emphasize inclusivity and diversity, online assessments are ensuring equal opportunities by removing geographical and scheduling barriers. The opportunity lies in developing advanced, multilingual, and mobile-compatible solutions for cross-border talent assessment.

Key Challenges

Data Privacy and Compliance Concerns

One of the major challenges in the Europe corporate assessment services market is ensuring compliance with stringent data protection laws such as the General Data Protection Regulation (GDPR). Assessment platforms often handle sensitive personal data, including cognitive and behavioral test results. Breaches or non-compliance can result in severe financial penalties and reputational damage. For instance, several organizations have faced scrutiny for inadequate consent management and insecure data storage practices. Vendors must therefore implement advanced encryption, transparent consent mechanisms, and localized data servers to maintain user trust. The complexity of privacy regulations across multiple European nations further intensifies this challenge.

Resistance to Technological Adoption

Despite digital transformation, many organizations—particularly small and medium enterprises—remain hesitant to adopt automated assessment systems. Traditional HR teams often prefer in-person evaluations due to familiarity and perceived reliability. Limited budgets, lack of digital literacy, and skepticism toward AI-based decisions contribute to slower adoption rates. For instance, smaller firms in southern and eastern Europe face challenges in integrating cloud-based tools due to limited IT infrastructure. Overcoming this resistance requires awareness programs, user-friendly platforms, and cost-effective subscription models. Service providers need to focus on demonstrating measurable returns on investment and ensuring that digital assessments complement, rather than replace, human judgment.

Regional Analysis

UK

The UK accounted for a 28% share of the Europe corporate assessment services market in 2024. Growth is supported by strong adoption of digital HR technologies and remote recruitment platforms. Companies in financial services, IT, and professional consulting are using AI-enabled assessment tools for leadership evaluation and workforce analytics. The market also benefits from government-backed digital skills programs that encourage data-driven hiring. Major enterprises are investing in personalized employee assessments and psychometric testing to enhance retention and diversity. Continuous innovation and integration with learning management systems position the UK as the regional leader in advanced assessment solutions.

France

France held a 17% share of the regional market in 2024, driven by rising demand for organizational and leadership assessments. Large corporations emphasize employee engagement and succession planning, fueling adoption of competency-based evaluation models. The French labor market’s focus on transparency and fair hiring practices has accelerated use of standardized assessment tools. Companies are also integrating behavioral analytics into recruitment to improve cultural alignment. Key players offer AI-powered language and reasoning tests tailored to French-speaking applicants. The market’s growth is reinforced by strong corporate investments in talent development and digital HR transformation initiatives across industries.

Germany

Germany represented a 19% share of the Europe corporate assessment services market in 2024. The country’s strong industrial base and advanced corporate training culture drive steady demand for skill-based assessments. Manufacturing and IT sectors dominate usage, relying on digital evaluation tools for workforce optimization and leadership succession. Companies focus on compliance, performance benchmarking, and team collaboration metrics to maintain competitiveness. The widespread integration of HR analytics platforms supports real-time feedback and employee growth tracking. Germany’s focus on structured, data-centric evaluation frameworks positions it as a leading innovation hub for assessment software providers in Europe.

Italy

Italy captured a 10% market share in 2024, supported by growing digitalization among mid-sized enterprises and multinational subsidiaries. Organizations increasingly implement online cognitive and behavioral tests to enhance recruitment accuracy and productivity. Demand from manufacturing, retail, and healthcare sectors is rising as firms prioritize workforce agility and skill alignment. Italian companies are adopting modular assessment systems integrated with HR software for continuous performance monitoring. The government’s support for digital upskilling programs is fostering a stronger corporate training ecosystem. Increasing awareness of competency-based hiring practices continues to strengthen Italy’s position in the evolving assessment landscape.

Spain

Spain accounted for a 9% share of the Europe corporate assessment services market in 2024. The expansion of hybrid work models and emphasis on employee well-being have encouraged adoption of cloud-based evaluation tools. The BFSI and education sectors lead the market, leveraging psychometric and aptitude tests for recruitment and training. Spanish firms are using AI-enabled assessments to support large-scale hiring and performance tracking. Continuous innovation by HR tech providers is driving platform adoption among SMEs. Government-led digital transformation programs and regional investments in workforce analytics are further boosting the market’s growth momentum.

Russia

Russia held a 7% share of the European market in 2024, driven by growing adoption of online recruitment and talent management platforms. Enterprises in the IT and industrial sectors increasingly use digital assessments to streamline hiring and training. Despite regulatory constraints and slower adoption among smaller firms, large corporations are prioritizing leadership evaluation and skills mapping. HR service providers are localizing assessment platforms to meet language and cultural preferences. The focus on efficiency and workforce optimization supports gradual market expansion, though geopolitical and data governance challenges may limit broader penetration.

Rest of Europe

The Rest of Europe region, encompassing Nordic and Eastern European countries, accounted for a 10% share in 2024. Growth is driven by increasing investment in HR analytics, leadership development, and online assessment tools. Nordic nations lead in digital adoption, while Eastern Europe shows rising interest from emerging technology and service industries. Cross-border companies use standardized assessment frameworks to ensure consistent hiring practices. Cloud-based, multilingual tools are gaining traction across smaller economies. Enhanced awareness of data-driven workforce evaluation and a growing focus on talent retention continue to strengthen regional adoption and market expansion.

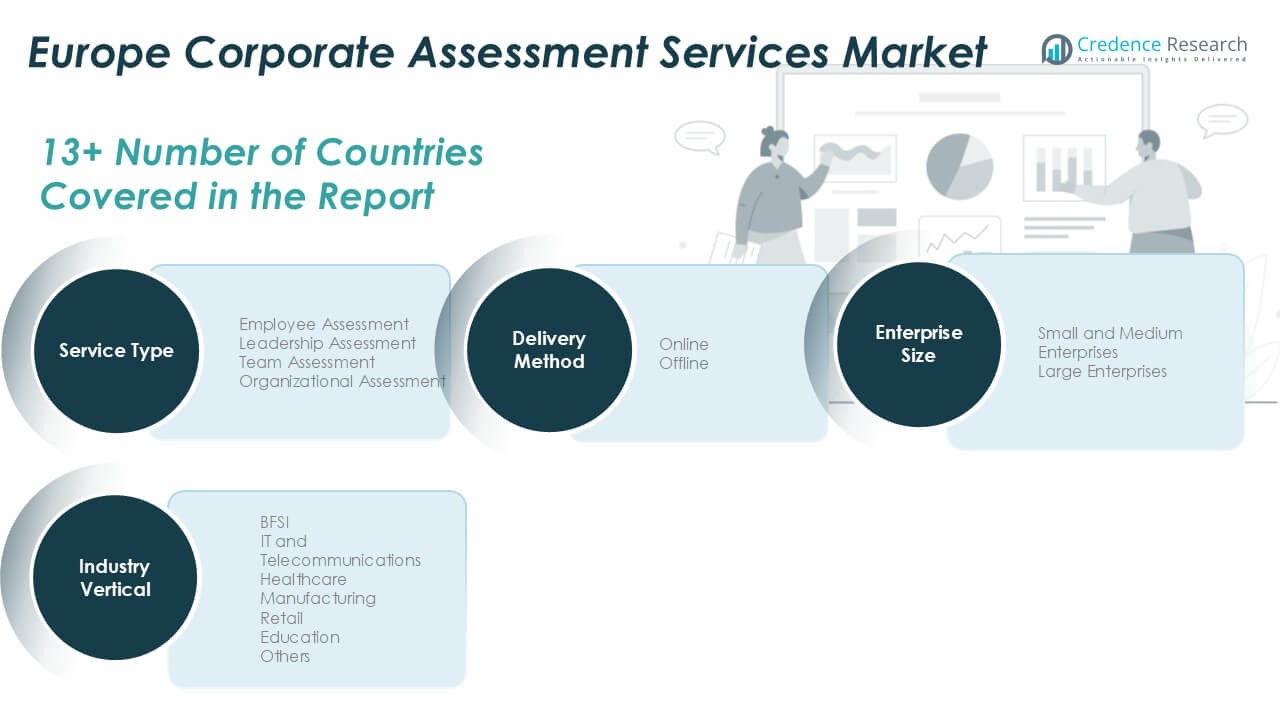

Market Segmentations:

By Service Type

- Employee Assessment

- Leadership Assessment

- Team Assessment

- Organizational Assessment

By Industry Vertical

- BFSI

- IT and Telecommunications

- Healthcare

- Manufacturing

- Retail

- Education

- Others

By Enterprise Size

- Small and Medium Enterprises

- Large Enterprises

By Delivery Mode

By Geography

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Rest of Europe

Competitive Landscape

The Europe corporate assessment services market features a competitive landscape dominated by global and regional players offering digital evaluation and talent management solutions. Key participants such as SHL Group Ltd., Aon plc, Korn Ferry, Thomas International, and Hogan Assessments maintain strong brand presence through advanced psychometric tools, AI-driven analytics, and integrated leadership assessment platforms. These companies focus on innovation, mergers, and digital expansion to strengthen their market reach. Emerging firms like AssessFirst and Psytech International are gaining traction with cloud-based and behavior-driven assessment solutions tailored for SMEs. Strategic collaborations with corporate clients and continuous platform upgrades drive customer retention and differentiation. Vendors increasingly emphasize compliance with European data privacy laws, multilingual accessibility, and predictive analytics capabilities to address diverse workforce needs. Competitive intensity remains high, pushing players to focus on customization, scalability, and technology integration to capture long-term growth opportunities across Europe.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- SHL Group Ltd.

- Aon plc (Aon Assessment Solutions / Cut-e)

- Saville Assessment

- Cubiks (now part of PSI Services LLC)

- Harrison Assessments

- Thomas International

- Korn Ferry

- Hogan Assessments (Europe Division)

- AssessFirst

- Psytech International

- Talent Q (now part of Korn Ferry)

- CEB (now Gartner)

- Chandler Macleod Group

Recent Developments

- In 2023, IBM Corporation introduced AI-driven recruitment tools that assess behavioral patterns and predict job success. These tools leverage machine learning to minimize biases in recruitment processes, enhancing efficiency and fairness in candidate evaluation

- In 2023, Mercer Mettl Launched the “Mercer|Mettl Online Assessments,” an AI-powered platform to evaluate soft skills, technical competencies, and cognitive abilities. It includes advanced proctoring features for remote hiring and corporate training, emphasizing test security and scalability.

Report Coverage

The research report offers an in-depth analysis based on Service Type, Industry Vertical, Enterprise Size, Delivery Mode and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Europe corporate assessment services market will expand steadily due to rising demand for AI-based evaluation tools.

- Organizations will increasingly adopt digital assessment systems to support hybrid and remote workforce management.

- Predictive analytics and behavioral insights will become key differentiators for assessment providers.

- Companies like SHL, Aon, and Korn Ferry will continue investing in cloud-based and scalable platforms.

- Data privacy compliance under GDPR will shape product design and client engagement strategies.

- The UK will remain the leading regional market, followed by Germany and France.

- Employee assessment will continue to dominate, supported by widespread adoption across corporate sectors.

- Leadership and team assessment tools will gain traction for succession planning and collaboration analysis.

- Partnerships between HR tech firms and corporate clients will drive innovation in assessment delivery.

- SMEs will adopt affordable, automated testing solutions, expanding market penetration across emerging European economies.