Market Overview

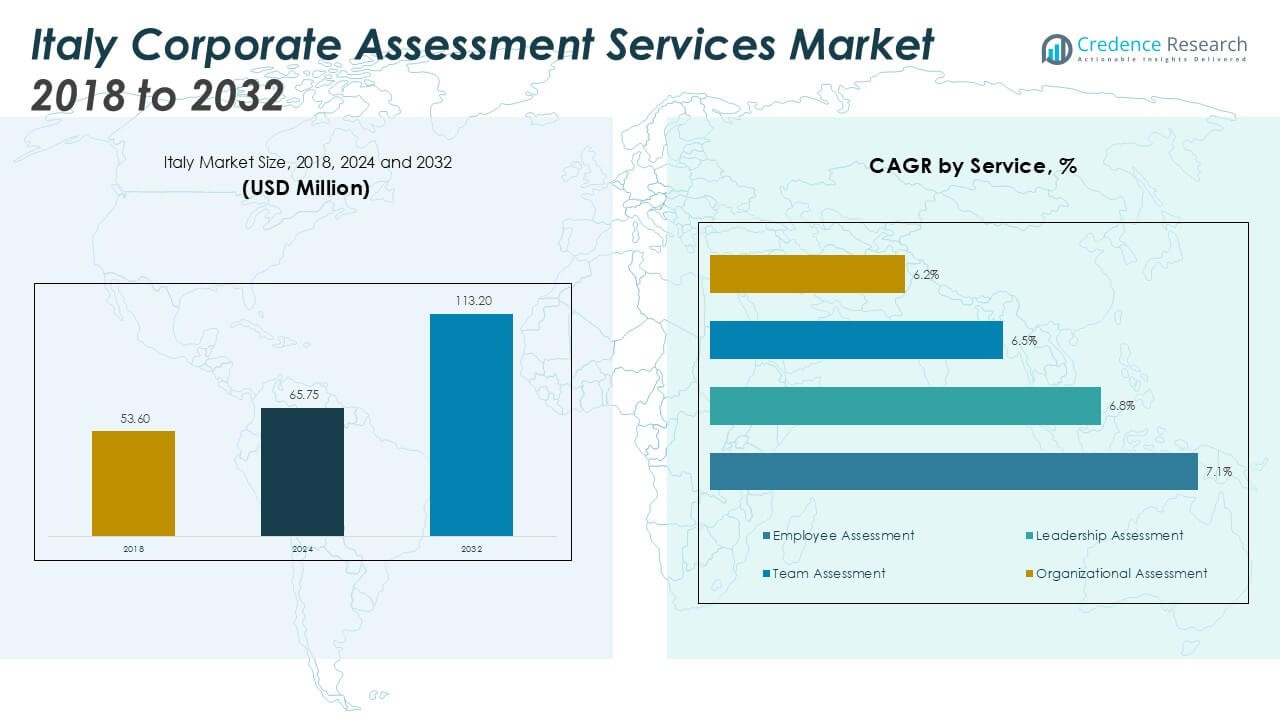

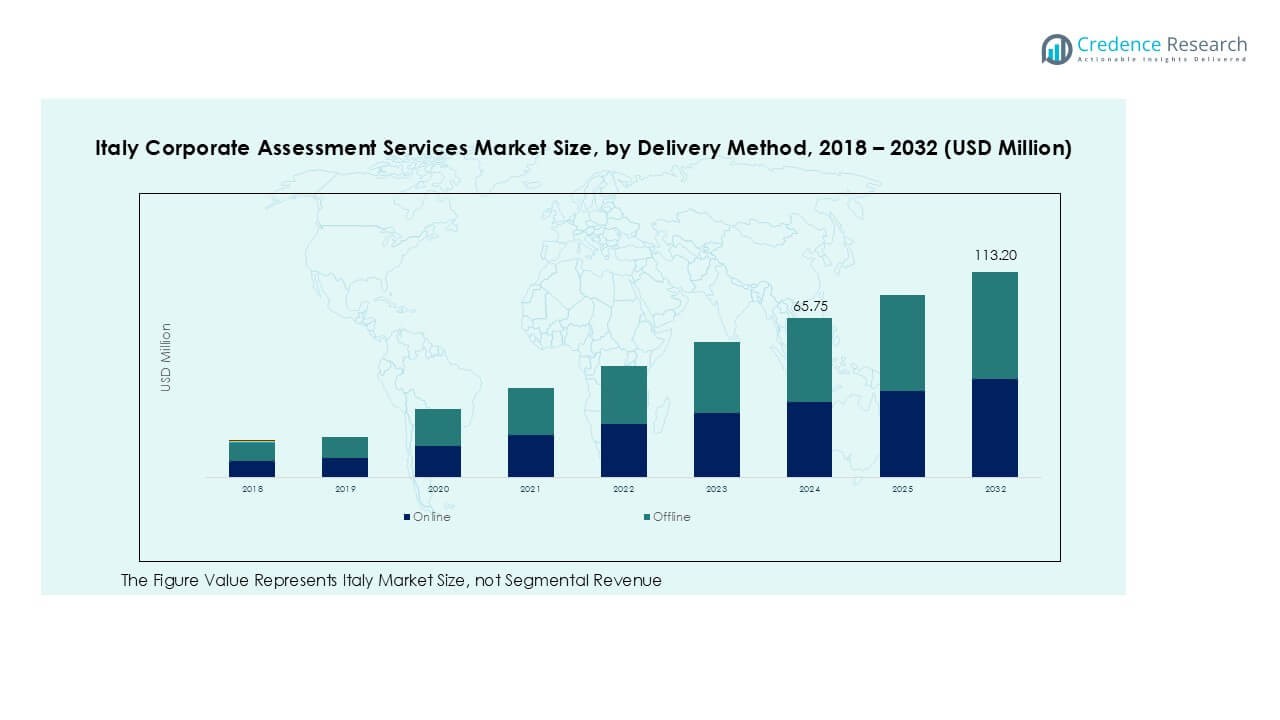

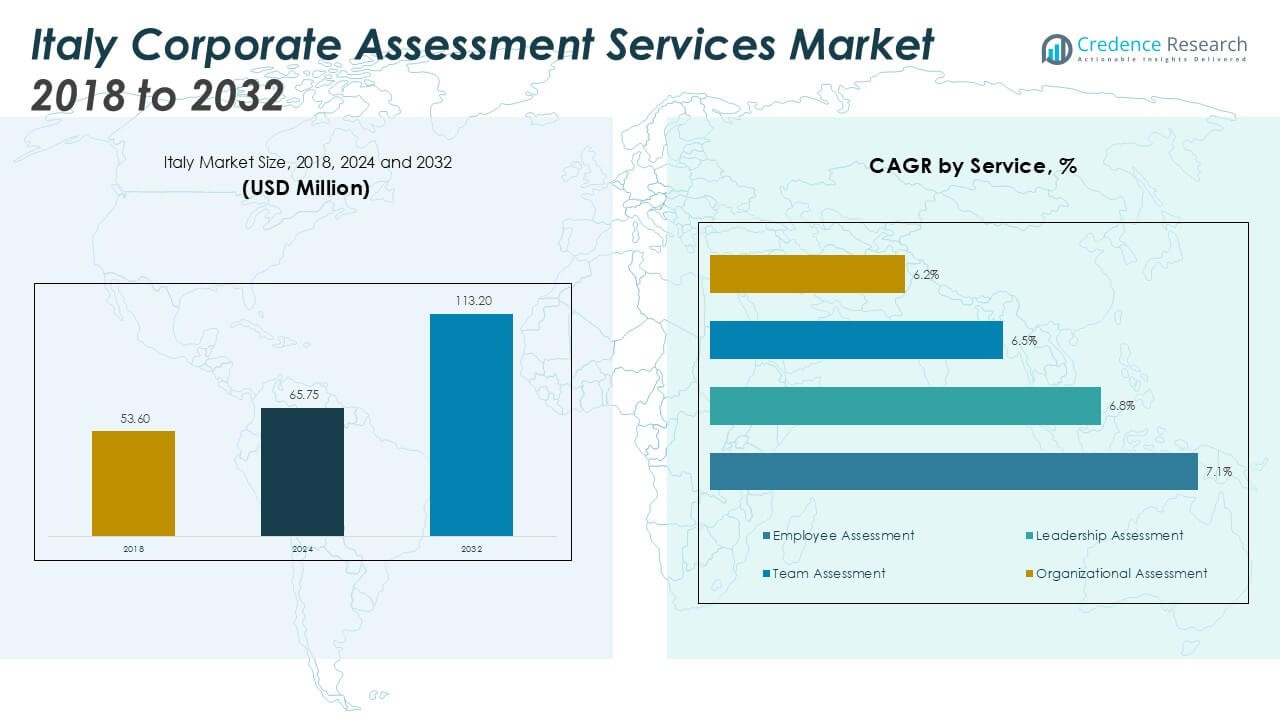

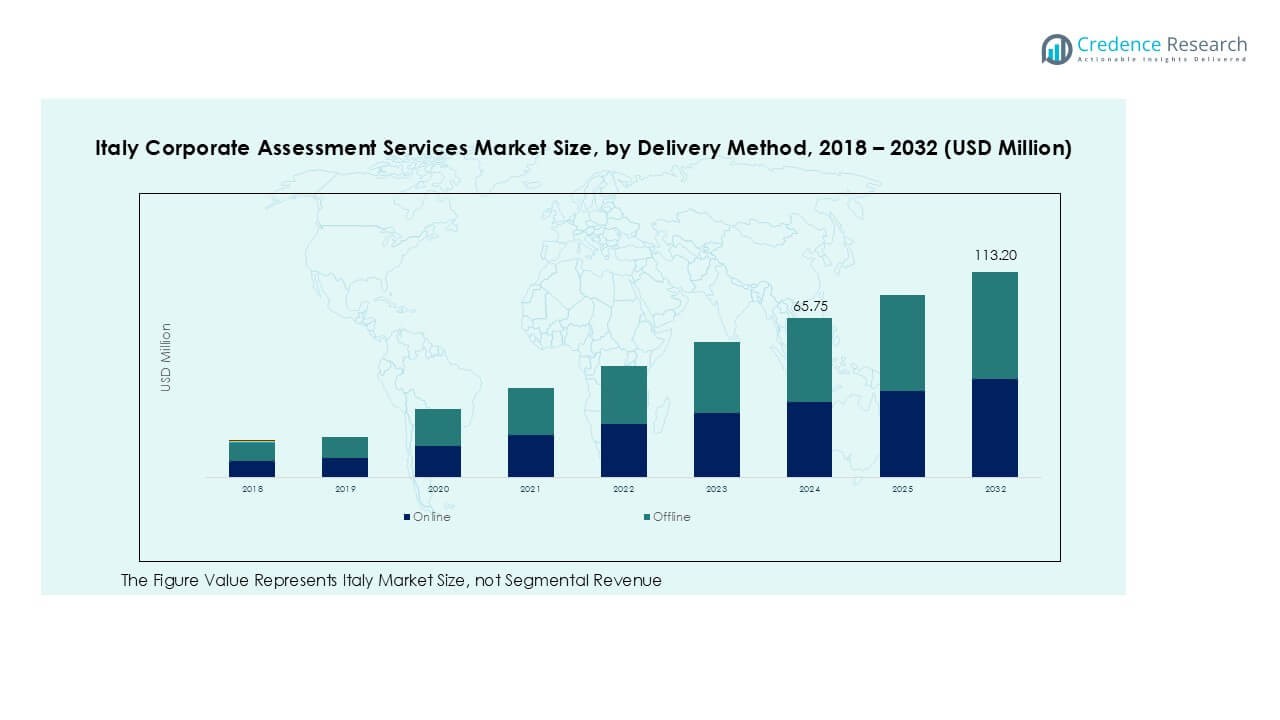

Italy Corporate Assessment Services Market size was valued at USD 53.60 million in 2018 and grew to USD 65.75 million in 2024. It is anticipated to reach USD 113.20 million by 2032, registering a CAGR of 7.03% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Italy Corporate Assessment Services Market Size 2024 |

USD 65.75 Million |

| Italy Corporate Assessment Services Market, CAGR |

7.03% |

| Italy Corporate Assessment Services Market Size 2032 |

USD 113.20 Million |

The Italy corporate assessment services market is dominated by key players such as Harrison Assessments, SHL Group Ltd., Aon plc, Korn Ferry, Hogan Assessments, and Thomas International. These companies lead through advanced psychometric testing, AI-based analytics, and cloud-enabled assessment platforms tailored to diverse industry needs. They focus on enhancing employee engagement, leadership evaluation, and organizational performance. Northern Italy holds the largest market share of 46%, driven by strong demand from major business hubs like Milan and Turin. Central and Southern Italy follow with growing adoption in public services, education, and manufacturing sectors, supporting steady regional expansion.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Italy Corporate Assessment Services market was valued at USD 65.75 million in 2024 and is projected to reach USD 113.20 million by 2032, growing at a CAGR of 7.03%.

- Growth is driven by rising demand for data-driven hiring, leadership evaluation, and employee performance optimization across multiple sectors.

- Digital transformation and AI-based assessment platforms are reshaping the market, enabling predictive analytics and continuous performance monitoring.

- The market is competitive, with major players such as SHL Group Ltd., Aon plc, and Korn Ferry focusing on innovation, customization, and cloud integration.

- Northern Italy leads with a 46% share, followed by Central Italy with 32% and Southern Italy with 22%; by service type, employee assessment dominates with 42% market share.

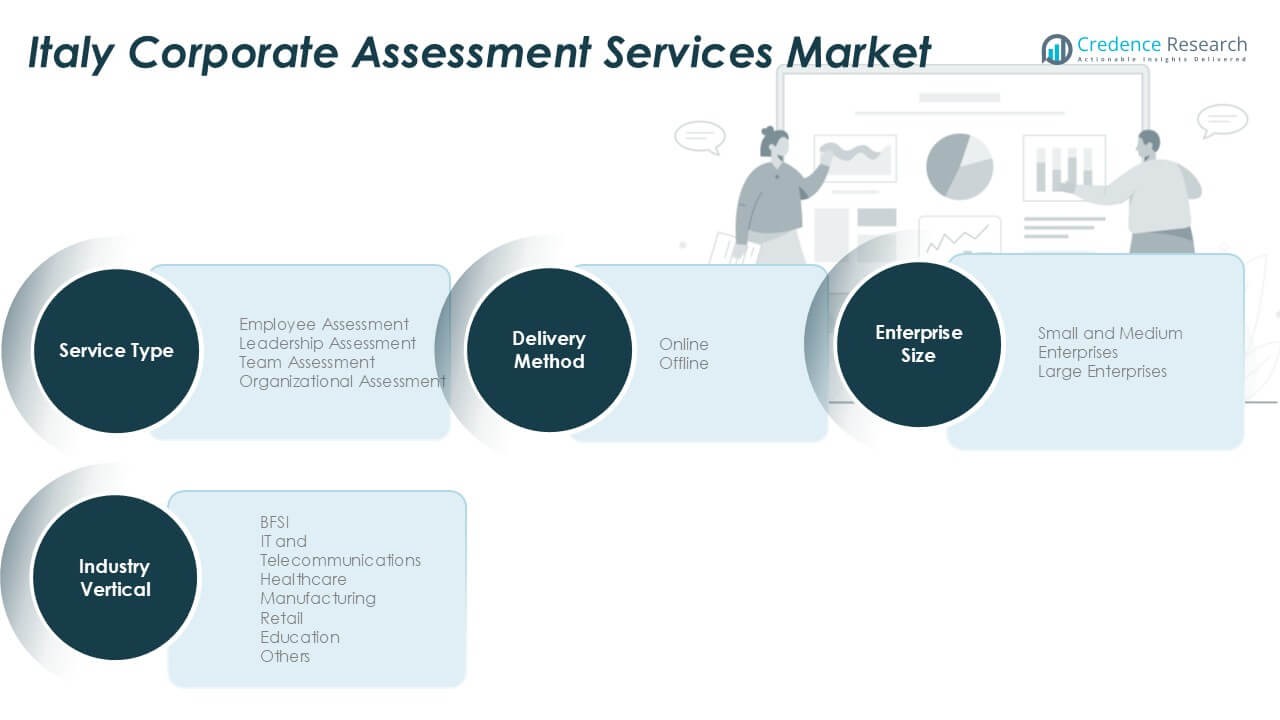

Market Segmentation Analysis:

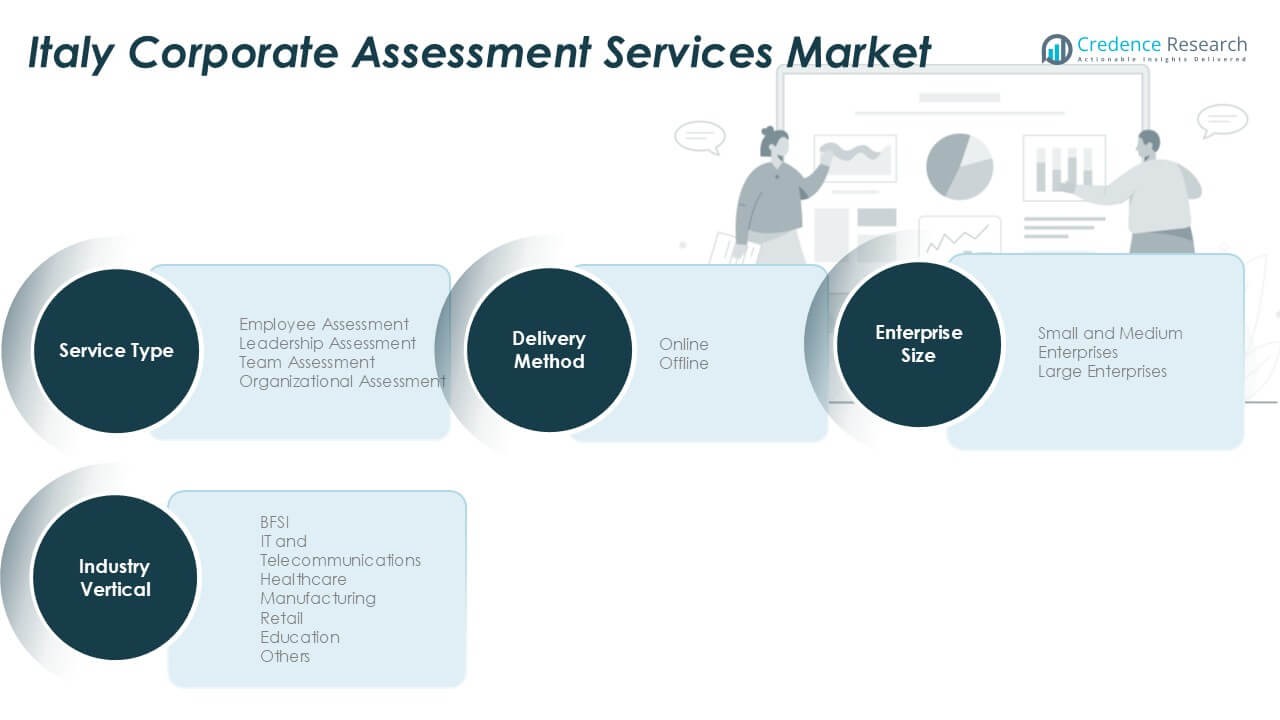

By Service Type

The employee assessment segment dominated the Italy corporate assessment services market in 2024 with a 42% share. This dominance stems from the growing use of psychometric and skill-based evaluations to optimize hiring and workforce productivity. Companies are integrating AI-enabled testing tools and data-driven performance analytics to enhance decision-making. Demand is rising as organizations focus on reducing hiring errors and improving retention. Leadership and organizational assessments are also expanding as firms invest in strategic talent alignment and succession planning initiatives.

- For instance, GSO Psychometrics (an Italian HR tools provider) offers over 100 distinct assessment tests via its platform to support selection and development.

By Industry Vertical

The BFSI sector led the market with a 31% share in 2024. Financial institutions rely heavily on corporate assessment tools for compliance-driven hiring, leadership development, and risk management training. Increasing digital transformation and regulatory scrutiny have accelerated demand for behavioral and competency-based evaluations. The IT and telecommunications sector follow closely, driven by technology-led performance analysis and remote workforce evaluations. Healthcare and manufacturing industries are also adopting these tools to enhance team efficiency and leadership pipeline development.

- For instance, Glasford Italy (a talent management firm) provides assessment architecture and people metrics services tailored to identify high-potential talent pools across sectors.

By Enterprise Size

Large enterprises accounted for a 63% share in 2024, making them the dominant segment. These companies implement corporate assessment services to support large-scale recruitment, leadership identification, and organizational restructuring. Growing reliance on analytics and customized testing modules helps streamline workforce management across departments. Small and medium enterprises are also increasing adoption due to cost-effective cloud-based solutions that offer flexible scalability and data insights. The rise of hybrid workplaces and remote assessments further strengthens demand across enterprise categories.

Key Growth Drivers

Rising Focus on Workforce Productivity and Skill Optimization

Italian enterprises are prioritizing data-driven talent assessment to improve workforce productivity. Corporate assessment tools help identify employee strengths, training needs, and role suitability, supporting more efficient human resource management. The growing shift toward performance analytics, soft skill measurement, and competency-based evaluations is fueling market expansion. Organizations are adopting AI-integrated testing platforms to deliver unbiased and scalable assessments. For instance, SHL and Aon plc have introduced AI-based behavioral testing solutions that enhance hiring accuracy and employee retention. Increasing competition across industries such as BFSI, IT, and manufacturing further drives adoption of structured employee evaluation programs.

- For instance, SHL uses an AI-powered platform to process a large volume of candidate assessments, including behavioral assessments, for clients worldwide. This technology helps organizations make more objective and precise hiring decisions by matching candidates to roles, which can improve retention.

Adoption of Digital Platforms and Cloud-Based Assessment Tools

Digital transformation is reshaping the Italian corporate assessment landscape through cloud-based and mobile-enabled tools. Companies are replacing traditional testing with automated, online assessment systems that offer real-time analytics and scalability. These solutions enable remote testing, continuous feedback, and easy integration with HR software. Growing demand from SMEs for affordable subscription-based models is accelerating adoption. Global players such as Korn Ferry and Mercer are expanding cloud-based offerings tailored for hybrid and remote workforces. The ability to collect and analyze large-scale candidate data enhances predictive hiring and workforce development, positioning digital platforms as a key growth driver.

- For instance, Mercer’s cloud-based “Mercer | Mettl” platform hosts more than one million questions and supports multi-rater processes across global clients.

Increasing Emphasis on Leadership and Organizational Development

Italian corporations are investing in leadership assessment to strengthen management pipelines and succession planning. Leadership evaluation programs use psychometric tests, behavioral profiling, and 360-degree feedback mechanisms to identify high-potential employees. This approach helps improve team cohesion, innovation, and long-term business continuity. Companies like Hogan Assessments and Thomas International are partnering with local firms to deliver advanced leadership evaluation frameworks. The rising focus on executive coaching and emotional intelligence assessment supports this trend. The demand for organizational assessment tools also grows as businesses align workforce strategies with digital transformation and sustainability goals.

Key Trends and Opportunities

Integration of Artificial Intelligence and Predictive Analytics

AI integration is transforming the corporate assessment services market in Italy by enabling predictive hiring and advanced performance analytics. AI algorithms analyze candidate behavior, language patterns, and decision-making to provide deeper insights into role fit and leadership potential. Predictive analytics allows companies to forecast employee success and turnover probability with high accuracy. Leading firms like SHL and IBM Kenexa are integrating machine learning models into assessment solutions to improve decision-making. The trend supports bias reduction, data transparency, and faster talent acquisition cycles, creating opportunities for AI-driven assessment innovation.

- For instance, SHL released a new AI module in April 2025 that processes audio recordings with its refined scoring engine, improving evaluation consistency across thousands of applicants.

Rising Demand for Personalized and Continuous Employee Development

Organizations in Italy are moving beyond one-time evaluations toward continuous performance monitoring and personalized development plans. Cloud-based assessment platforms now deliver adaptive testing and instant feedback, supporting career growth and engagement. Companies are investing in reskilling and upskilling tools to prepare employees for evolving digital roles. For example, Aon’s adaptive assessment platform allows employers to tailor testing modules based on real-time performance data. This shift toward continuous learning and skill development presents a strong opportunity for service providers offering integrated talent lifecycle management solutions.

Key Challenges

Data Privacy and Compliance Concerns

Data protection regulations such as the EU’s General Data Protection Regulation (GDPR) create major compliance challenges for corporate assessment providers in Italy. These assessments involve large volumes of sensitive employee data, including psychometric and behavioral insights. Companies must ensure secure storage, anonymization, and ethical data handling. Non-compliance can result in legal penalties and reputational damage. Service providers are now investing in encrypted platforms and local data hosting to comply with privacy laws. However, balancing innovation in AI-driven analytics with data security remains a complex issue for the market’s sustainable growth.

Limited Awareness and Budget Constraints Among SMEs

While large enterprises rapidly adopt corporate assessment tools, small and medium-sized enterprises (SMEs) often face financial and awareness barriers. Many SMEs perceive assessment services as costly or complex, limiting their adoption despite clear productivity benefits. The lack of internal HR analytics expertise further restricts implementation. Vendors are responding by offering subscription-based models and simplified testing platforms tailored for smaller firms. However, cost sensitivity and limited digital transformation readiness among SMEs continue to challenge broader market penetration, particularly in traditional sectors such as manufacturing and retail.

Regional Analysis

Northern Italy

Northern Italy dominated the Italy corporate assessment services market in 2024 with a 46% share. Major business hubs such as Milan, Turin, and Venice drive demand due to high corporate density and advanced HR digitalization. Large enterprises in finance, manufacturing, and technology sectors are adopting AI-based assessment platforms for recruitment and leadership evaluation. Milan’s strong concentration of multinational headquarters supports continuous talent development programs. Turin’s industrial base and Venice’s service-driven economy further contribute to the region’s growth, making Northern Italy the leading center for corporate assessment adoption and technological innovation.

Central Italy

Central Italy held a 32% share of the Italy corporate assessment services market in 2024. The region, led by Rome, Florence, and Bologna, benefits from a growing concentration of professional services, education institutions, and public administration organizations. Companies in Rome are investing in employee engagement and leadership assessment programs to improve workforce efficiency. Florence’s strong creative and educational sector drives the use of skill-based assessments. Bologna’s manufacturing and research-driven economy further boosts adoption of advanced digital tools for workforce evaluation, solidifying Central Italy’s position as a key contributor to market growth.

Southern Italy

Southern Italy accounted for a 22% share of the corporate assessment services market in 2024. Cities such as Naples, Palermo, and Bari are witnessing gradual digital adoption and investment in workforce assessment tools. Regional enterprises, particularly in retail, healthcare, and tourism, are increasingly using cloud-based assessment solutions to manage human capital. Naples is emerging as a growing business hub focused on improving workforce productivity. Palermo and Bari show rising adoption among SMEs through cost-effective digital platforms. While growth is slower than in the north, digital transformation initiatives are steadily expanding the region’s market presence.

Market Segmentations:

By Service Type

- Employee Assessment

- Leadership Assessment

- Team Assessment

- Organizational Assessment

By Industry Vertical

- BFSI

- IT and Telecommunications

- Healthcare

- Manufacturing

- Retail

- Education

- Others

By Enterprise Size

- Small and Medium Enterprises

- Large Enterprises

By Delivery Mode

By Geography

Competitive Landscape

The Italy corporate assessment services market features a competitive landscape led by global and regional players offering advanced testing and analytics platforms. Companies such as Harrison Assessments, SHL Group Ltd., Aon plc, Korn Ferry, and Hogan Assessments dominate through strong technology integration and wide client networks. These firms leverage AI-driven evaluation tools, behavioral analytics, and cloud-based solutions to deliver personalized and scalable assessment services. Thomas International, Saville Assessment, PSI Services, and AssessFirst strengthen market competition with tailored programs for SMEs and large enterprises. Strategic partnerships, product innovation, and regional expansion remain key competitive strategies, while emphasis on leadership evaluation and psychometric precision enhances differentiation. Overall, competition centers on technology adoption, service customization, and compliance with EU data protection standards, shaping a dynamic and innovation-driven market ecosystem.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Harrison Assessments

- SHL Group Ltd.

- Aon plc (Aon Assessment Solutions / Cut-e)

- Korn Ferry

- Hogan Assessments

- Thomas International

- Saville Assessment

- PSI Services LLC (Cubiks)

- AssessFirst

Recent Developments

- In 2023, IBM Corporation introduced AI-driven recruitment tools that assess behavioral patterns and predict job success. These tools leverage machine learning to minimize biases in recruitment processes, enhancing efficiency and fairness in candidate evaluation

- In 2023, Mercer Mettl Launched the “Mercer|Mettl Online Assessments,” an AI-powered platform to evaluate soft skills, technical competencies, and cognitive abilities. It includes advanced proctoring features for remote hiring and corporate training, emphasizing test security and scalability.

Report Coverage

The research report offers an in-depth analysis based on Service Type, Industry Vertical, Enterprise Size, Delivery Mode and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for AI-driven assessment tools will increase to improve hiring accuracy and employee engagement.

- Cloud-based and mobile assessment platforms will gain popularity among enterprises of all sizes.

- Integration of predictive analytics will support better workforce planning and leadership succession.

- Personalized and adaptive testing solutions will enhance candidate experience and retention rates.

- Collaboration between assessment providers and HR tech firms will expand digital service offerings.

- Data privacy and cybersecurity will remain a primary focus for service providers under EU regulations.

- SMEs will increasingly adopt cost-effective subscription-based assessment solutions.

- Leadership and behavioral assessments will play a larger role in executive development programs.

- Remote and hybrid work models will drive growth in virtual assessment platforms.

- Continuous skill evaluation and reskilling assessments will become essential for long-term workforce readiness.