Market Overview

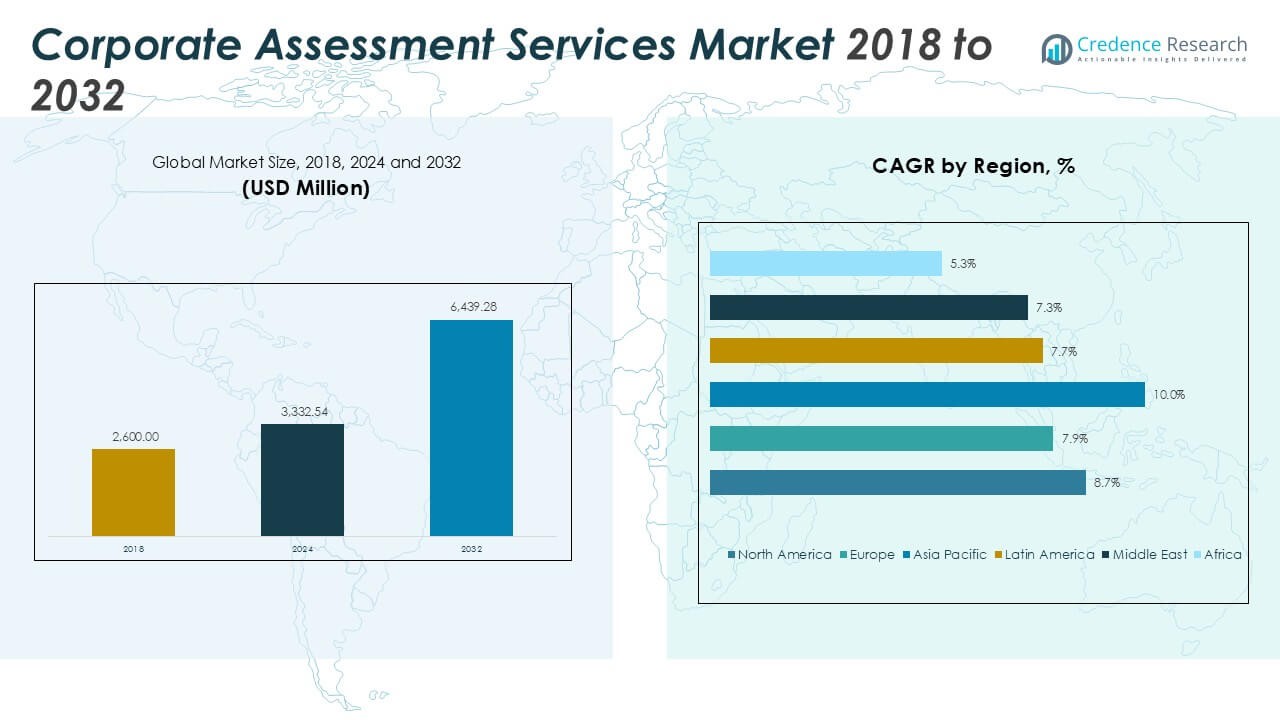

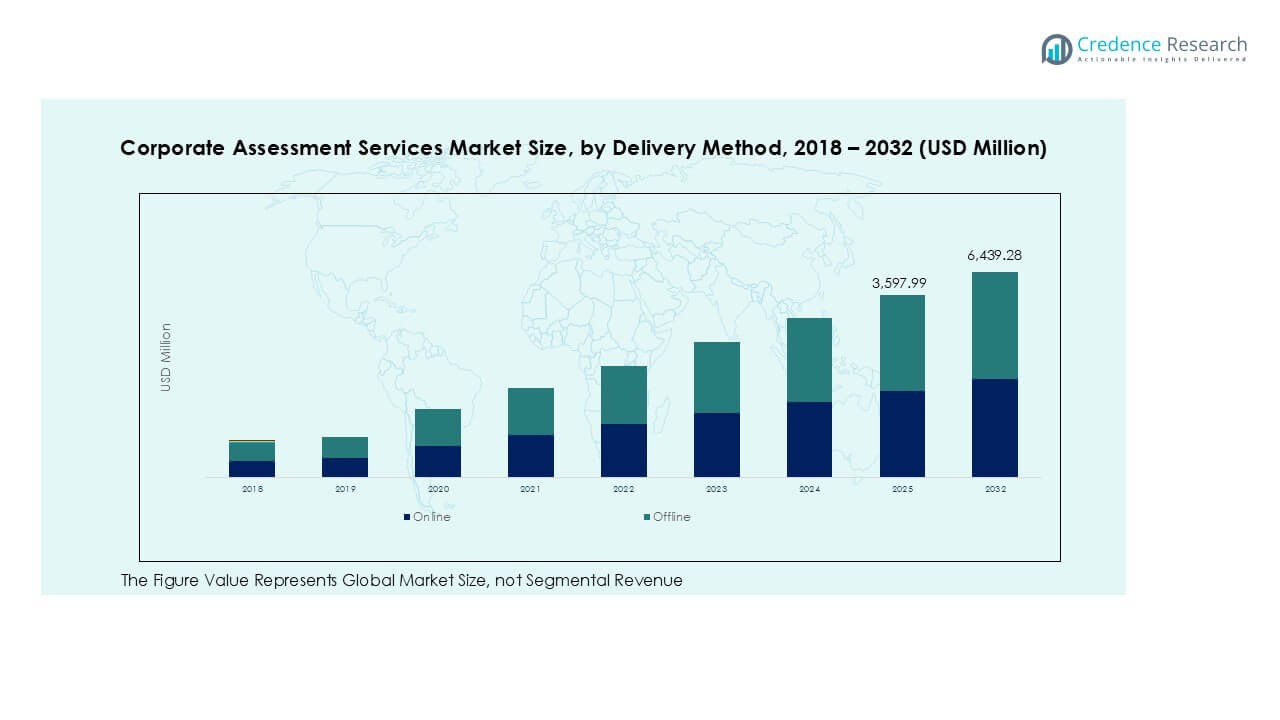

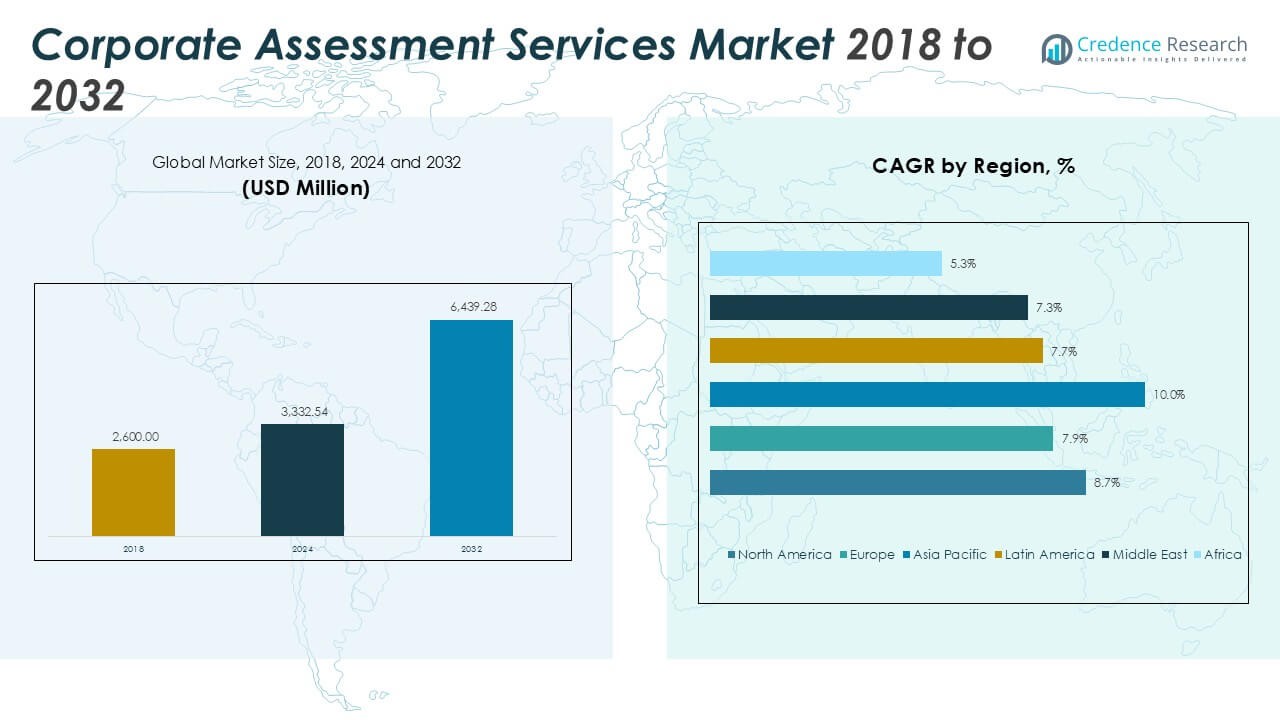

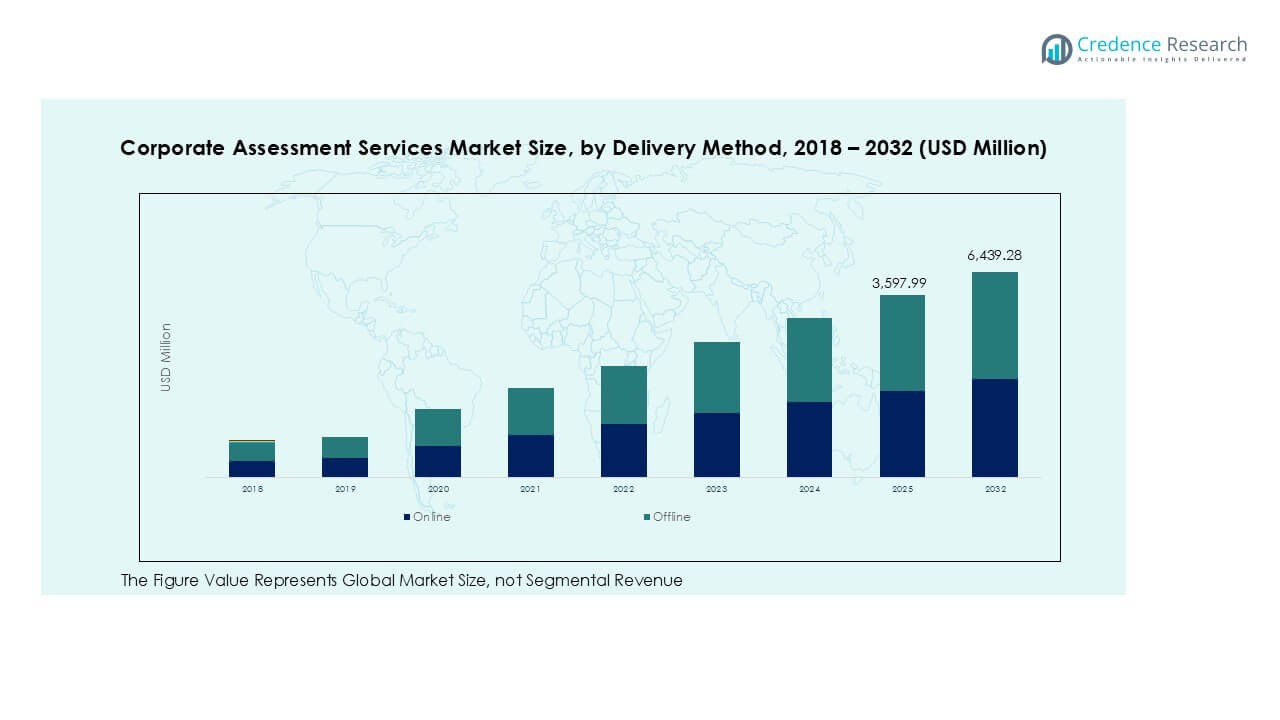

The Corporate Assessment Services market size was valued at USD 2,600.00 million in 2018, increasing to USD 3,332.54 million in 2024, and is anticipated to reach USD 6,439.28 million by 2032, growing at a CAGR of 8.67% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Corporate Assessment Services Market Size 2024 |

USD 3,332.54 Million |

| Corporate Assessment Services Market, CAGR |

8.67% |

| Corporate Assessment Services Market Size 2032 |

USD 6,439.28 Million |

The Corporate Assessment Services market is led by prominent players such as Mercer, Aon plc, Korn Ferry, SHL Group Ltd., and Hogan Assessments, which collectively account for over 45% of the global market share. These firms dominate through advanced analytics-driven platforms, diversified assessment solutions, and strong enterprise partnerships. North America remains the leading region with a 37% market share in 2024, driven by widespread adoption of AI-based assessment technologies and a mature corporate talent ecosystem. Europe follows with 28%, supported by growing digital transformation in HR practices, while Asia-Pacific, holding 24%, emerges as the fastest-growing region fueled by expanding enterprise digitalization and workforce development initiatives.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Corporate Assessment Services market was valued at USD 3,332.54 million in 2024 and is projected to reach USD 6,439.28 million by 2032, growing at a CAGR of 8.67%.

- Growing demand for data-driven hiring, leadership development, and employee performance analytics is driving market expansion across industries.

- AI-enabled assessments, predictive analytics, and remote evaluation tools are key trends enhancing efficiency and scalability in recruitment and talent management.

- The market is moderately consolidated, with major players such as Mercer, Aon plc, Korn Ferry, SHL Group Ltd., and Hogan Assessments collectively holding over 45% of the global share.

- Regionally, North America leads with 37% market share, followed by Europe at 28% and Asia-Pacific at 24%, while the employee assessment segment dominates with 41% share, reflecting the strong demand for skill-based evaluations and workforce optimization solutions.

Market Segmentation Analysis:

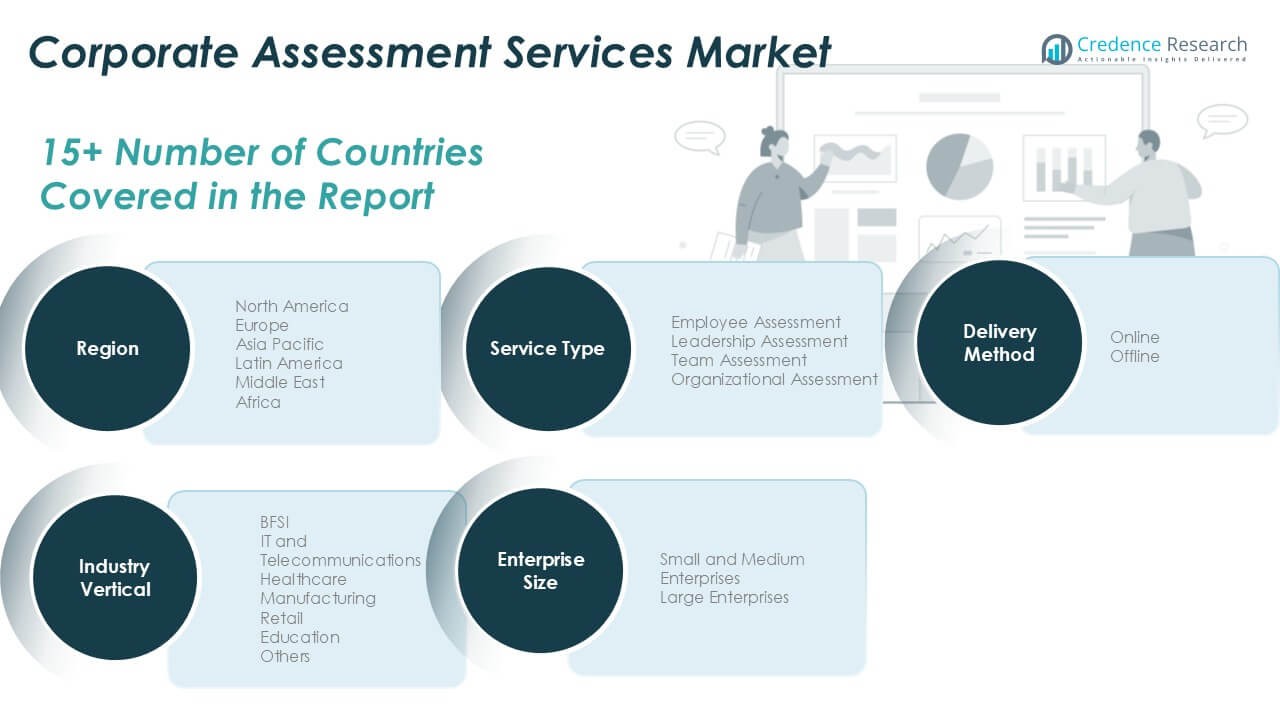

By Service Type

The employee assessment segment dominated the Corporate Assessment Services market in 2024 with a 41% share. This dominance is driven by the growing need for data-based hiring and performance evaluation across enterprises. Organizations increasingly adopt psychometric and skill-based tests to enhance recruitment quality and reduce attrition. Leadership and organizational assessments are gaining traction as firms focus on succession planning and culture alignment. The integration of AI-driven analytics and behavioral profiling further strengthens the use of digital employee assessment tools for workforce optimization and talent retention.

- For instance, in 2020, SHL integrated its existing Smart Interview platform with popular video conferencing tools, such as Zoom and Microsoft Teams. The platform uses AI and natural language processing (NLP) to evaluate video responses, helping recruiters to more quickly screen and shortlist candidates.

By Industry Vertical

The BFSI segment led the market in 2024, accounting for nearly 28% of the total share. The demand is fueled by strict regulatory compliance, high-volume hiring, and the need for continuous competency evaluation in banking and financial institutions. IT and telecommunications follow closely due to digital transformation and agile workforce requirements. Healthcare and manufacturing sectors are adopting assessment platforms for skill certification and risk management. The retail and education sectors also show steady growth as organizations enhance customer service training and academic performance evaluations.

- For instance, IBM Kenexa’s talent analytics platform has been utilized by various financial institutions to assess employee capabilities, including digital readiness and compliance, for their regional operations.

By Enterprise Size

Large enterprises dominated the Corporate Assessment Services market in 2024 with a 62% share. These organizations rely on structured assessment programs to manage large-scale recruitment, leadership development, and employee engagement initiatives. The integration of analytics, cloud-based tools, and AI-driven dashboards supports scalable and cost-efficient evaluation processes. Small and medium enterprises are growing steadily, driven by affordable SaaS-based platforms and remote assessment solutions. The increasing emphasis on talent benchmarking and hybrid work models further drives adoption among SMEs seeking to strengthen workforce efficiency and retention.

Key Growth Drivers

Increasing Demand for Data-Driven Talent Decisions

Organizations are increasingly adopting corporate assessment services to make evidence-based talent decisions. The shift toward data analytics in HR has improved hiring accuracy, reduced employee turnover, and strengthened performance evaluations. Companies use psychometric, cognitive, and behavioral tools to evaluate candidates beyond resumes, aligning recruitment with organizational goals. Advanced assessment platforms integrate AI and predictive analytics, enabling continuous monitoring of employee potential. This growing reliance on data-driven evaluation ensures consistency, fairness, and efficiency in workforce management, fueling steady market growth across industries and enterprise sizes.

- For instance, IBM used its Watson AI to create a “predictive attrition program” for its own workforce and has promoted predictive analytics solutions for clients, such as Watson Talent Insights.

Rising Emphasis on Leadership Development and Succession Planning

Leadership assessment services are witnessing strong demand as organizations prioritize leadership continuity and strategic planning. Businesses are investing in tools that identify high-potential employees and evaluate leadership readiness. With an increasing number of retirements and leadership transitions, structured assessment programs have become essential. Companies use simulation-based evaluations and 360-degree feedback to benchmark leadership competencies. Global corporations are embedding leadership development into long-term talent strategies, integrating assessments with learning management systems. This focus on sustainable leadership pipelines drives sustained demand for assessment services.

- For instance, DDI’s Leadership Mirror is a platform for 360-degree leadership assessments. It helps organizations gather holistic feedback on their leaders and identify potential successors for key roles.

Expansion of Remote Work and Digital Learning Ecosystems

The global adoption of hybrid and remote work models has accelerated the use of online assessment tools. Organizations now depend on digital platforms to evaluate distributed teams and virtual candidates efficiently. Cloud-based assessment systems enable scalability, real-time analytics, and accessibility across geographies. These tools help measure employee engagement, adaptability, and collaboration in virtual environments. Additionally, integration with learning and development platforms allows continuous upskilling. The growing digital transformation across HR ecosystems supports long-term adoption of online corporate assessments, positioning remote evaluation as a core market growth driver.

Key Trends & Opportunities

Integration of AI and Predictive Analytics in Assessments

Artificial intelligence is reshaping the corporate assessment landscape by improving efficiency, personalization, and insight accuracy. AI-enabled systems analyze large datasets to predict employee success, identify skill gaps, and enhance recruitment precision. Predictive analytics allow HR teams to anticipate workforce trends and align hiring with business objectives. The growing use of natural language processing, sentiment analysis, and adaptive testing enables dynamic, bias-free evaluations. Vendors integrating AI-based analytics with learning and development tools are creating new growth opportunities for intelligent, end-to-end assessment ecosystems.

- For instance, Pymetrics (part of Harver) uses AI-driven neuroscience games to analyze candidate data and match cognitive and emotional traits with job success probabilities.

Focus on Soft Skills and Behavioral Competency Evaluation

Organizations increasingly value emotional intelligence, communication, adaptability, and teamwork alongside technical expertise. As automation expands, soft skills have become crucial for organizational agility and innovation. Assessment providers are developing behavioral testing tools and situational judgment simulations to measure interpersonal competencies. The trend aligns with employers’ need to build collaborative and resilient teams in evolving business environments. This focus on holistic workforce evaluation opens new avenues for specialized assessment platforms that blend behavioral analytics with digital learning solutions.

Key Challenges

Concerns over Data Privacy and Regulatory Compliance

The increasing use of digital assessment platforms raises concerns about data protection and compliance. Handling sensitive employee information across global jurisdictions requires adherence to GDPR, HIPAA, and regional data security laws. Breaches or misuse of personal data can damage reputation and result in legal liabilities. Many organizations hesitate to adopt cloud-based systems due to data residency and privacy risks. Vendors must invest in encryption, secure hosting, and transparent consent mechanisms to maintain client trust and ensure compliance, posing a persistent challenge for market participants.

High Implementation Costs and Integration Complexity

While digital assessment tools deliver measurable benefits, high initial costs and integration challenges hinder widespread adoption. Implementing enterprise-scale platforms requires investment in software, analytics, and training infrastructure. Smaller firms face difficulty aligning new systems with existing HR or ERP tools. Integration issues between assessment platforms and legacy systems can lead to inefficiencies and data silos. Providers are addressing these barriers through subscription-based and modular solutions, yet customization and interoperability remain significant challenges affecting scalability and long-term adoption.

Regional Analysis

North America

North America dominated the Corporate Assessment Services market in 2024 with a 37% share. The region’s leadership is driven by early adoption of AI-enabled assessment tools and a mature HR technology ecosystem. U.S.-based corporations emphasize data-driven hiring and leadership development programs, boosting market growth. Major providers continuously innovate with predictive analytics and virtual assessment centers. High demand from BFSI, IT, and healthcare sectors strengthens regional dominance. Widespread use of cloud-based platforms, strong data governance frameworks, and integration with learning management systems further consolidate North America’s position in the global market.

Europe

Europe accounted for nearly 28% of the global market in 2024, supported by the region’s focus on workforce digitalization and regulatory compliance. Countries such as the U.K., Germany, and France are leading adopters of structured assessment tools for recruitment and employee development. The increasing emphasis on soft-skill evaluation and leadership succession planning fuels adoption across industries. Enterprises in Europe are integrating multilingual assessment platforms to align with diverse workforces. Moreover, growing investment in HR analytics and standardized testing methods reinforces Europe’s strong position in the corporate assessment services landscape.

Asia-Pacific

Asia-Pacific held a 24% share of the Corporate Assessment Services market in 2024, emerging as the fastest-growing regional segment. Rapid digital transformation, expanding enterprise sectors, and a young workforce drive adoption across China, India, Japan, and Southeast Asia. Organizations increasingly use AI-based platforms for large-scale talent evaluation and campus recruitment. The rise of hybrid work environments and continuous learning culture accelerates online assessment use. Growing investment from multinational firms and domestic providers in scalable, mobile-based assessment tools enhances regional market expansion. Increasing HR technology integration further boosts Asia-Pacific’s long-term growth trajectory.

Latin America

Latin America captured around 6% of the Corporate Assessment Services market in 2024. Countries such as Brazil, Mexico, and Chile are experiencing growing demand for employee evaluation and training solutions. Expanding service-sector employment and increased focus on productivity improvement are major drivers. Organizations are gradually shifting toward cloud-based and digital assessment models to support remote hiring. Partnerships between regional HR tech firms and global vendors enhance accessibility and affordability. However, budget limitations and infrastructure gaps in smaller economies moderate growth, keeping Latin America a developing but promising market segment.

Middle East & Africa

The Middle East & Africa region accounted for a 5% market share in 2024, reflecting steady but emerging adoption trends. Increasing corporate diversification, particularly in the UAE, Saudi Arabia, and South Africa, fuels the demand for professional assessment tools. Organizations emphasize leadership and competency evaluations to support national workforce development goals. Government-backed digital transformation initiatives and growing investments in education and training support gradual market expansion. However, limited digital infrastructure and lower awareness among SMEs constrain rapid adoption, though ongoing technological modernization is expected to improve regional performance.

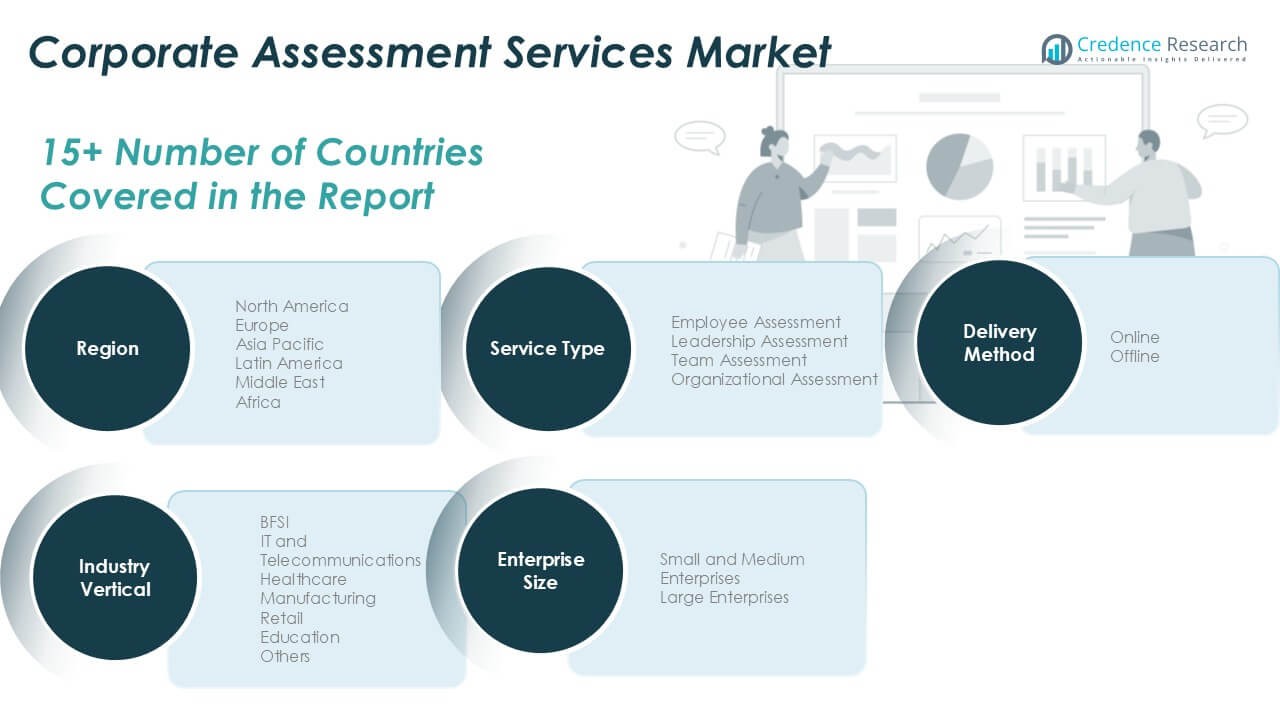

Market Segmentations:

By Service Type

- Employee Assessment

- Leadership Assessment

- Team Assessment

- Organizational Assessment

By Industry Vertical

- BFSI

- IT and Telecommunications

- Healthcare

- Manufacturing

- Retail

- Education

- Others

By Enterprise Size

- Small and Medium Enterprises

- Large Enterprises

By Delivery Mode

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Corporate Assessment Services market is highly competitive, characterized by the presence of global consulting firms, specialized assessment providers, and technology-driven platforms. Leading players such as Mercer, Aon plc, Korn Ferry, SHL Group Ltd., and Hogan Assessments dominate through extensive product portfolios, global reach, and advanced analytics capabilities. These companies focus on integrating AI, machine learning, and psychometric analytics to deliver more accurate and scalable workforce evaluations. Partnerships, mergers, and acquisitions are common strategies to expand service offerings and geographic presence, as seen with Mettl’s integration into Mercer and Cut-e’s acquisition by Aon. Emerging firms like AssessFirst and HireVue are gaining traction with AI-based video and behavioral assessment solutions. Competitive differentiation increasingly depends on data security, customization, and seamless integration with HR management systems. Continuous innovation, digital transformation, and emphasis on predictive workforce analytics remain key factors shaping competition across global and regional markets.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Mercer

- Aon plc

- Korn Ferry

- SHL Group Ltd.

- Hogan Assessments

- CEB (now Gartner)

- Talent Plus

- IBM Corporation

- DDI (Development Dimensions International)

- Psytech International

- Cubiks (now part of PSI Services)

- Harrison Assessments

- Thomas International

- Chandler Macleod Group

- AssessFirst

- Saville Assessment

- Mettl (now part of Mercer)

- Cut-e (now part of Aon plc)

- HireVue

- Criteria Corp

Recent Developments

- In 2023, IBM Corporation introduced AI-driven recruitment tools that assess behavioral patterns and predict job success. These tools leverage machine learning to minimize biases in recruitment processes, enhancing efficiency and fairness in candidate evaluation

- In 2023, Mercer Mettl Launched the “Mercer|Mettl Online Assessments,” an AI-powered platform to evaluate soft skills, technical competencies, and cognitive abilities. It includes advanced proctoring features for remote hiring and corporate training, emphasizing test security and scalability.

Report Coverage

The research report offers an in-depth analysis based on Service Type, Industry Vertical, Enterprise Size, Delivery Mode and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- AI-driven assessments will become standard for hiring and performance evaluation.

- Predictive analytics will enhance talent retention and workforce planning accuracy.

- Cloud-based platforms will expand due to remote and hybrid work adoption.

- Soft-skill and behavioral evaluations will gain higher importance across industries.

- Integration with HR and learning management systems will increase efficiency.

- Personalized and adaptive testing will improve employee engagement and outcomes.

- Data privacy and compliance standards will shape vendor selection and market trust.

- Emerging economies will drive new demand through enterprise digitalization initiatives.

- Partnerships between HR tech firms and assessment providers will accelerate innovation.

- Continuous learning and upskilling assessments will become core to long-term workforce strategy.