Market Overview:

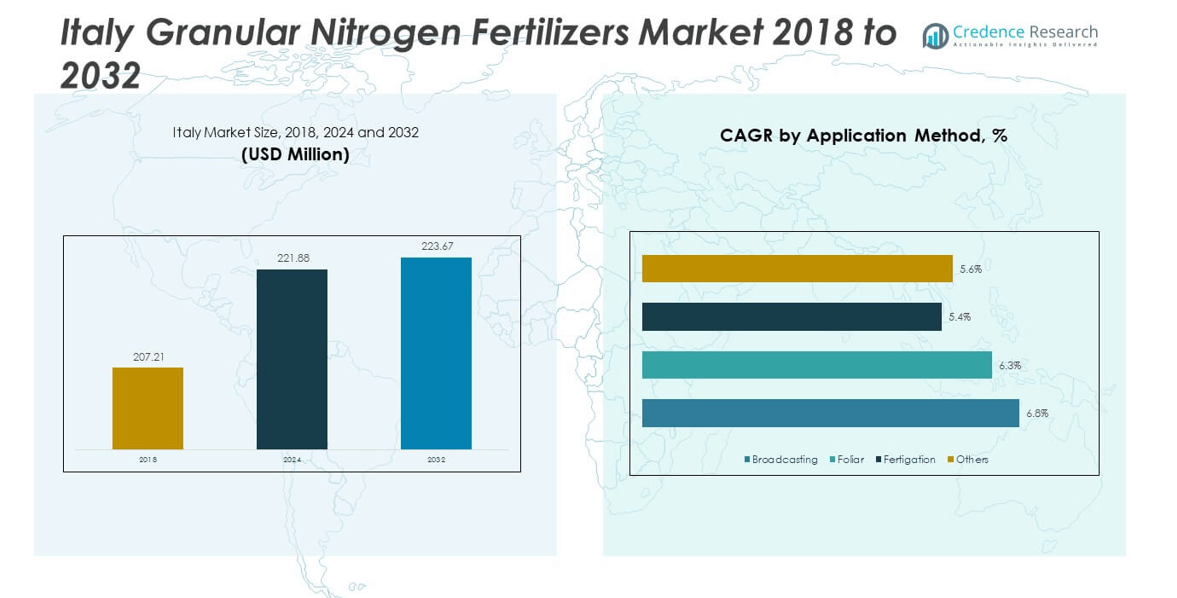

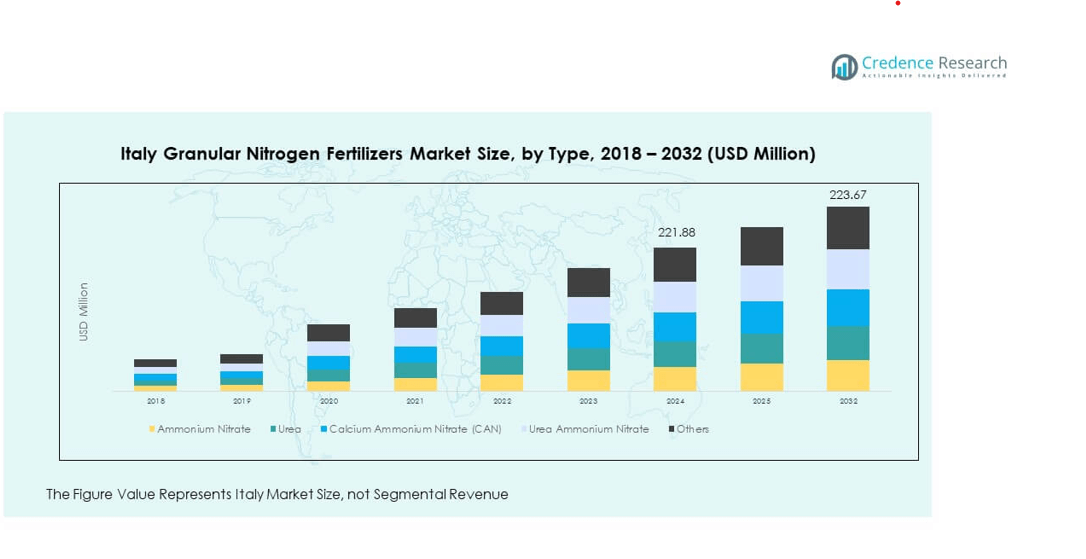

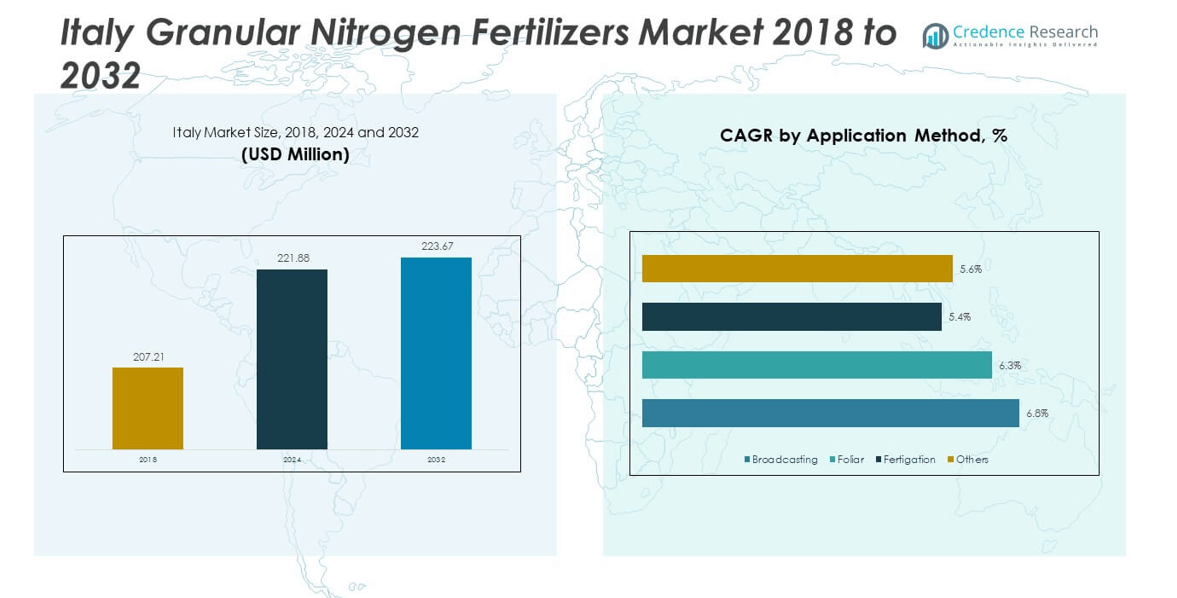

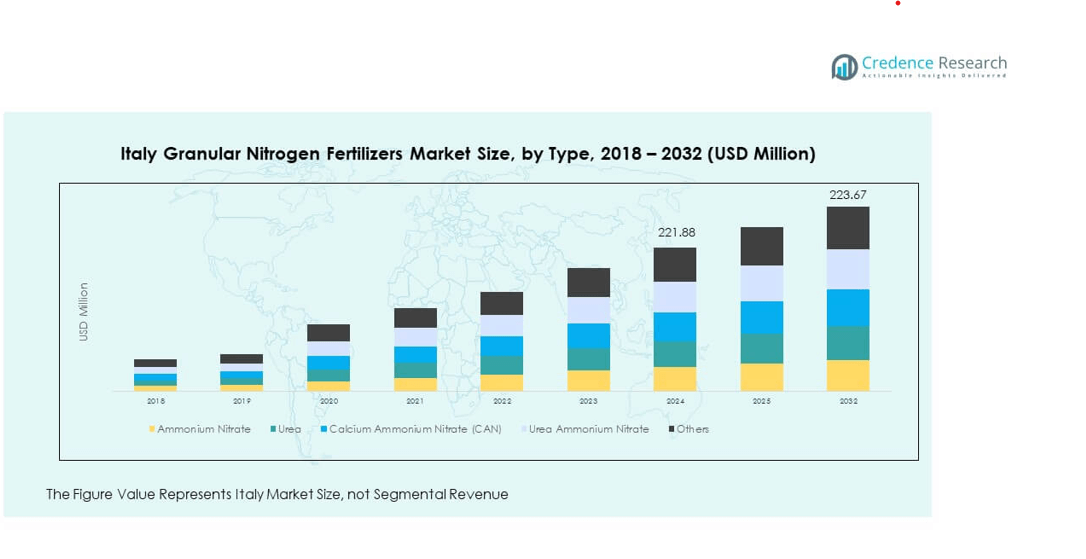

The Italy Granular Nitrogen Fertilizers Market size was valued at USD 207.21 million in 2018 to USD 221.88 million in 2024 and is anticipated to reach USD 223.67 million by 2032, at a CAGR of 0.10% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Italy Granular Nitrogen Fertilizers Market Size 2024 |

USD 221.88 million |

| Italy Granular Nitrogen Fertilizers Market, CAGR |

0.10% |

| Italy Granular Nitrogen Fertilizers Market Size 2032 |

USD 223.67 million |

The market growth is driven by the rising demand for high-yield crops, adoption of advanced farming practices, and government initiatives promoting sustainable agriculture. Italian farmers are increasingly using granular nitrogen fertilizers for better nutrient efficiency and soil health. Technological advances in fertilizer formulations, along with precision agriculture, are further enhancing the market demand across diverse crop categories.

Geographically, northern Italy leads the market due to its high concentration of agricultural activities and developed farming infrastructure. Regions such as Lombardy, Emilia-Romagna, and Veneto show strong fertilizer adoption supported by intensive crop cultivation. Southern regions, including Sicily and Puglia, are emerging with growing awareness and investment in modern agriculture. This regional expansion is strengthening the country’s overall fertilizer consumption landscape.

Market Insights:

- The Italy Granular Nitrogen Fertilizers Market was valued at USD 207.21 million in 2018, grew to USD 221.88 million in 2024, and is expected to reach USD 223.67 million by 2032, expanding at a CAGR of 0.10% during the forecast period.

- Northern Italy led the market with a 56% share in 2024, supported by large-scale farming, advanced irrigation systems, and precision agriculture practices. Central Italy accounted for 25%, driven by strong horticultural and vineyard activity, while Southern Italy held 19% due to increasing fertilizer adoption in arid regions.

- Southern Italy and its islands represent the fastest-growing region with a 19% share, supported by government-backed modernization programs and expanding greenhouse cultivation.

- The urea segment accounted for around 35% of total revenue, driven by its high nitrogen content and cost-effectiveness.

- Calcium ammonium nitrate (CAN) held approximately 25% share due to its balanced nutrient composition and growing preference for sustainable fertilizer options.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Focus on Crop Productivity and Nutrient Efficiency

The Italy Granular Nitrogen Fertilizers Market is driven by growing demand for high-yield crops supported by advanced agricultural inputs. Farmers aim to enhance soil fertility and ensure consistent nutrient delivery across key crops. Granular nitrogen fertilizers offer controlled release, improving plant uptake and reducing nutrient loss. It supports efficient nitrogen utilization, minimizing environmental impact from leaching. Government initiatives promoting precision agriculture encourage the adoption of these fertilizers. Increased awareness of sustainable farming practices boosts their use in cereals, fruits, and vegetables. Rising population and food demand continue to strengthen fertilizer consumption.

- For instance, Yara’s N-Sensor technology has delivered up to a 12% increase in crop yields and up to a 14% reduction in nitrogen fertilizer usage across multiple crop types, according to verified company reports and field results.

Government Initiatives and Sustainable Agricultural Programs

Italian authorities are supporting eco-friendly farming policies that promote balanced nutrient management. Subsidies and awareness programs focus on responsible fertilizer use to protect soil health. The Italy Granular Nitrogen Fertilizers Market benefits from the Common Agricultural Policy (CAP) and EU environmental guidelines. Farmers receive training to optimize fertilizer efficiency and limit overuse. Sustainable nitrogen management aligns with carbon neutrality goals in the agricultural sector. It encourages innovative fertilizer blends that balance crop nutrition and soil sustainability. Continuous public investment in sustainable inputs strengthens long-term growth.

- For instance, Yara’s N-Sensor has reduced nitrogen residues in soil post-harvest and cut the risk of nitrogen losses to the environment, supporting national and EU sustainability targets in farming practices.

Technological Advancements in Fertilizer Formulation and Application

Manufacturers are investing in advanced coating technologies for controlled and slow-release fertilizers. The Italy Granular Nitrogen Fertilizers Market gains from enhanced efficiency and reduced nitrogen volatilization. Automation in fertilizer blending and precision spreading improves accuracy and uniformity. It allows farmers to optimize dosage based on real-time soil data. Integration with GPS-guided machinery supports resource conservation and productivity gains. New product developments focus on customized nutrient compositions tailored for local crops. Technological innovation continues to improve application methods and reduce operational costs.

Growing Adoption of Precision Agriculture and Smart Farming Solutions

Modern farming practices across Italy are increasingly data-driven, encouraging efficient fertilizer use. The Italy Granular Nitrogen Fertilizers Market sees rising integration with IoT-based monitoring systems. Farmers use data analytics to adjust nitrogen application by soil type and crop stage. Precision agriculture reduces waste, enhances yield, and supports environmental sustainability. It helps maintain soil balance and improves cost-effectiveness in crop management. Agritech companies are partnering with cooperatives to deliver smart fertilizer solutions. These innovations expand adoption among small and medium-scale farms nationwide.

Market Trends:

Shift Toward Environmentally Friendly and Low-Emission Fertilizers

Growing concerns over nitrogen runoff and greenhouse emissions are reshaping fertilizer production. The Italy Granular Nitrogen Fertilizers Market is moving toward low-emission and bio-based products. Manufacturers are introducing sustainable formulations to meet EU climate goals. Eco-labeled fertilizers help farmers align with green certification programs. Demand for biodegradable coatings and organic nitrogen sources is increasing steadily. It supports reduced environmental impact and aligns with circular economy principles. These trends highlight Italy’s transition to climate-smart agriculture.

- For instance, Yara’s N-Sensor technology has led to a 10-30% decrease in the carbon footprint of fertilizer application by improving nitrogen use efficiency through site-specific application and monitoring.

Integration of Digital Agriculture Tools and Farm Automation

Digitalization is transforming how farmers plan and monitor fertilizer application. The Italy Granular Nitrogen Fertilizers Market benefits from AI-driven soil analysis and remote sensing systems. Digital tools improve nutrient mapping and enhance crop response tracking. Automation in fertilizer application reduces wastage and increases precision. It enables integration with drones and variable-rate technologies for real-time adjustments. Agritech startups are developing cloud-based platforms for nutrient management. The growing use of these systems is redefining efficiency in agricultural production.

- For instance, Yara’s N-Sensor provides real-time, variable-rate nitrogen application to ensure optimal fertilizer for every part of the field, with documented increases in combine output by up to 18.5% and a reduction in lodging rates by 80% for cereal crops.

Emergence of Customized and Crop-Specific Fertilizer Formulations

Farmers increasingly prefer fertilizers suited to regional soils and specific crop needs. The Italy Granular Nitrogen Fertilizers Market is witnessing demand for tailor-made formulations. Companies focus on optimizing nitrogen balance for high-value crops like grapes and olives. It ensures balanced nutrition while supporting export-quality yields. Research centers collaborate with fertilizer firms to develop locally adapted solutions. Customized nutrient blends help minimize waste and enhance profitability. The trend supports long-term sustainability and competitiveness in agricultural production.

Increasing Collaboration Between Fertilizer Producers and Research Institutions

Collaboration between universities and fertilizer manufacturers is strengthening innovation in the market. The Italy Granular Nitrogen Fertilizers Market benefits from scientific input on nutrient efficiency and soil interaction. Joint projects focus on improving fertilizer composition and minimizing nitrogen loss. It promotes sustainable soil enrichment practices supported by data validation. Such partnerships enhance product quality and build farmer confidence. They also drive pilot projects for advanced formulations in diverse climatic zones. Continuous research ensures alignment with global agricultural standards.

Market Challenges Analysis:

Environmental Regulations and Compliance Constraints in Fertilizer Use

Strict EU environmental directives are posing operational challenges for fertilizer manufacturers. The Italy Granular Nitrogen Fertilizers Market faces tighter limits on nitrogen application rates to curb emissions. Compliance with nitrate directives requires advanced monitoring and recordkeeping. It increases production costs for companies adapting to green chemistry standards. Smaller producers struggle to meet the certification requirements for sustainable fertilizers. Farmers also face pressure to reduce dependency on synthetic nitrogen inputs. This regulatory tightening impacts market flexibility and pricing competitiveness.

Rising Production Costs and Supply Chain Disruptions Impacting Profit Margins

The fertilizer industry is affected by volatile raw material and energy prices. The Italy Granular Nitrogen Fertilizers Market experiences cost fluctuations due to natural gas dependency. High transportation and logistics expenses further affect distribution efficiency. It challenges producers to balance affordability and profitability. Imported fertilizers face longer lead times and variable import tariffs. These conditions force companies to revise pricing strategies and production planning. The market’s long-term stability depends on improving domestic manufacturing resilience and raw material diversification.

Market Opportunities:

Expansion of Organic and Bio-Based Fertilizer Production in Italy

Growing demand for organic produce offers strong opportunities for fertilizer innovation. The Italy Granular Nitrogen Fertilizers Market can benefit from bio-based nitrogen alternatives. Manufacturers are investing in natural nutrient sources like composted manure and green ammonia. It aligns with Italy’s focus on reducing chemical dependence in farming. Expanding organic farming zones create new prospects for sustainable fertilizer use. Public incentives for eco-friendly inputs further support product diversification. This trend enhances Italy’s position in the European sustainable agriculture movement.

Adoption of Smart Fertilizer Management Systems for Yield Optimization

Digital transformation across agriculture is creating new growth avenues for fertilizer producers. The Italy Granular Nitrogen Fertilizers Market is witnessing adoption of AI-based nutrient monitoring systems. Smart sensors enable precise nitrogen management and reduce environmental loss. It allows real-time crop data analysis for adaptive fertilizer application. Government-backed precision farming initiatives encourage this technological shift. Collaboration between agritech firms and cooperatives is driving awareness among small farmers. These developments ensure efficient fertilizer use and sustainable productivity growth.

Market Segmentation Analysis:

By Type

The Italy Granular Nitrogen Fertilizers Market is segmented into ammonium nitrate, urea, calcium ammonium nitrate (CAN), urea ammonium nitrate, and others. Urea dominates the market due to its high nitrogen concentration and widespread use in major crops. Ammonium nitrate follows, valued for its rapid nutrient release and compatibility with Italian soil types. CAN is gaining preference for its stable performance and reduced risk of soil acidification. Urea ammonium nitrate supports precision agriculture with uniform distribution and higher efficiency. The others category includes specialized nitrogen blends used in niche agricultural applications. Each fertilizer type addresses specific nutrient and soil requirements across different farming systems.

- For instance, Yara’s N-Sensor technology demonstrated 3.5% greater cereal yields and up to 3.9% higher canola yields when used with standard and advanced fertilizer types in Italy.

By Application Method

The market is divided into broadcasting, foliar, fertigation, and others. Broadcasting holds the largest share due to its practicality and adoption in large-scale crop cultivation. Foliar application is expanding due to faster nutrient absorption and reduced wastage. Fertigation is growing steadily with advancements in irrigation systems and precision agriculture. It improves nutrient delivery, enhances soil balance, and supports water-efficient farming. The others category includes innovative methods applied in greenhouse and controlled environments. This segmentation highlights a clear trend toward efficiency-driven application practices across Italian farms.

- For instance, the implementation of Yara’s N-Sensor allowed precision application via broadcasting, resulting in more uniform crop nutrition, improved protein consistency (0.2–0.5% above target), and lower harvesting costs for Italian farmers.

By End-User

End users include agriculture, horticulture, and landscaping and turf. Agriculture represents the dominant segment due to extensive nitrogen use in grain and cereal cultivation. Horticulture is expanding with higher fertilizer consumption for fruits, vegetables, and floriculture. Landscaping and turf are emerging segments supported by urban development projects and recreational spaces. It reflects Italy’s growing attention to sustainable soil management and productivity enhancement across all farming sectors.

Segmentation:

By Type

- Ammonium Nitrate

- Urea

- Calcium Ammonium Nitrate (CAN)

- Urea Ammonium Nitrate

- Others

By Application Method

- Broadcasting

- Foliar

- Fertigation

- Others

By End-User

- Agriculture

- Horticulture

- Landscaping and Turf

Regional Analysis:

Northern Italy – Dominant Agricultural and Industrial Hub (56% Market Share)

Northern Italy leads the Italy Granular Nitrogen Fertilizers Market with a 56% share, driven by intensive agricultural activities and advanced farming infrastructure. Regions such as Lombardy, Emilia-Romagna, and Veneto have high fertilizer usage due to the cultivation of cereals, maize, and industrial crops. It benefits from well-developed irrigation systems and precision agriculture adoption. Strong agrochemical distribution networks and access to research institutions support product innovation and farmer awareness. Local cooperatives encourage sustainable fertilizer practices and efficient nutrient management. High-income farms in this region focus on maximizing yield and maintaining soil fertility through balanced nitrogen applications.

Central Italy – Expanding Horticultural and Vineyard Production (25% Market Share)

Central Italy holds around 25% of the total market share, supported by diversified crop cultivation and expanding horticultural output. Tuscany, Umbria, and Marche regions have growing demand for granular nitrogen fertilizers used in vineyards, olive groves, and vegetable farming. It shows a strong shift toward organic and eco-friendly fertilizers, aligning with regional sustainability goals. Farmers are investing in advanced fertilization techniques to meet export-grade production standards. Government support for agri-innovation and local cooperatives enhances access to improved fertilizer blends. This region is expected to maintain steady growth through modernization and targeted nutrient application.

Southern Italy and Islands – Emerging Growth Region (19% Market Share)

Southern Italy, including Sicily and Puglia, accounts for 19% of the Italy Granular Nitrogen Fertilizers Market. It is an emerging growth area driven by increasing awareness of soil nutrition and modernization of farming practices. The region benefits from rising investments in irrigation infrastructure and greenhouse farming. Growing horticultural and citrus crop cultivation is creating demand for high-efficiency nitrogen fertilizers. Local producers are focusing on fertigation and precision application to optimize usage in arid conditions. Government-led rural development projects and subsidies for fertilizer adoption continue to support growth, making the southern region a potential hotspot for future expansion.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

Competitive Analysis:

The Italy Granular Nitrogen Fertilizers Market is moderately competitive, featuring both international and domestic producers focused on improving fertilizer efficiency and environmental performance. It is led by companies such as Yara International ASA, EuroChem Group AG, BASF SE, FCP Cerea, and Lea Agricola, which emphasize innovation and sustainable fertilizer formulations. Firms compete on product differentiation, nutrient efficiency, and regional distribution strength. The market shows rising collaboration between manufacturers and research institutions to develop advanced nitrogen solutions. Local players are strengthening their presence through tailored products for regional crop requirements and expanding precision agriculture partnerships.

Recent Developments:

- In July 2025, Yara International ASA reported record-high production results in the granular nitrogen fertilizers segment, driven by commercial performance and supportive market fundamentals.

- In January 2025, FCP Cerea announced a strategic merger agreement with Demeter Investment Managers, positioning the joint entity as Demea Invest—a leading player in private equity and debt investments for startups, SMEs, and mid-sized companies in the agri-food value chain and energy sectors.

Report Coverage:

The research report offers an in-depth analysis based on by type, application method, and end-user. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Rising adoption of precision agriculture is expected to improve nitrogen efficiency across Italian farms.

- Government initiatives supporting eco-friendly fertilizers will drive innovation in product formulations.

- Demand for slow-release and coated nitrogen fertilizers will expand with sustainability awareness.

- Northern Italy will retain market leadership due to advanced infrastructure and high crop productivity.

- Fertigation-based applications will grow rapidly, supported by irrigation modernization.

- Local manufacturers will gain share through region-specific fertilizer blends.

- Investments in bio-based and low-emission fertilizers will create new growth opportunities.

- Partnerships between agritech companies and cooperatives will enhance distribution networks.

- Technological advancements in monitoring systems will optimize nitrogen application precision.

- The market will maintain steady long-term growth with increasing focus on soil health and regulatory compliance.