Market Overview

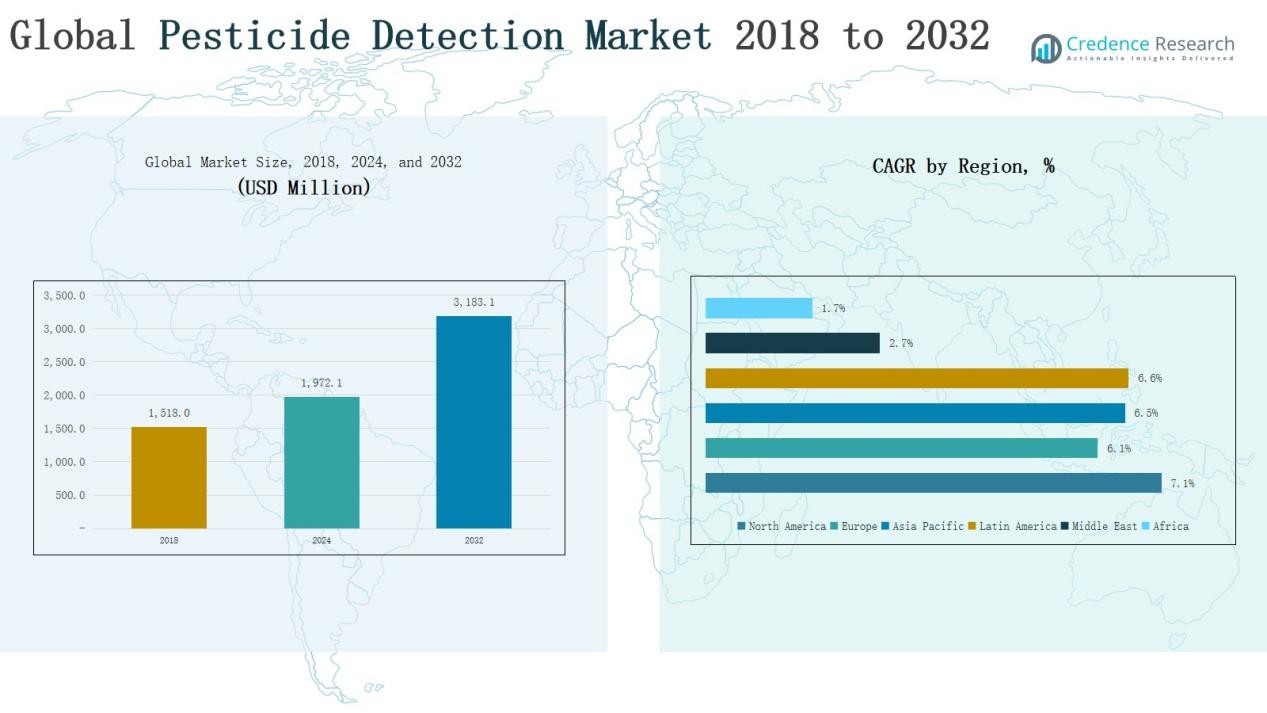

The Global Pesticide Detection Market was valued at USD 1,518.0 million in 2018, increased to USD 1,972.1 million in 2024, and is anticipated to reach USD 3,183.1 million by 2032, growing at a CAGR of 6.29% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Pesticide Detection Market Size 2024 |

USD 1,972.1 Million |

| Pesticide Detection Market, CAGR |

6.29% |

| Pesticide Detection Market Size 2032 |

USD 3,183.1 Million |

The Global Pesticide Detection Market is driven by major players such as Thermo Fisher Scientific Inc., Agilent Technologies, Shimadzu Corporation, Waters Corporation, PerkinElmer Inc., SGS SA, Sciex, Renka Bio, Equinox Lab, and Spensa Karlabs. These companies lead through innovations in chromatography, spectroscopy, and biosensor-based detection technologies, providing high-precision solutions for food safety and environmental monitoring. Strategic collaborations, product diversification, and technological advancements strengthen their global footprint. North America emerged as the leading region in 2024, capturing a 33% market share, supported by robust regulatory frameworks, advanced testing infrastructure, and strong demand from analytical laboratories.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Global Pesticide Detection Market was valued at USD 1,972.1 million in 2024 and is expected to reach USD 3,183.1 million by 2032, growing at a CAGR of 6.29%.

- Chromatography-based technology dominated with a 42% share in 2024, driven by its precision, reproducibility, and compatibility across multiple pesticide detection applications.

- Food & beverage samples led the market with a 46% share, supported by strict safety regulations and advanced multi-residue analysis techniques.

- Environmental testing laboratories accounted for a 38% share, supported by strong demand for pollution control and regulatory compliance monitoring.

- North America led the global market with a 33% share in 2024, fueled by FDA and EPA regulations, advanced analytical infrastructure, and high adoption of testing technologies.

Market Segment Insights

By Technology:

Chromatography-based technology dominated the Global Pesticide Detection Market in 2024 with a 42% share. Its precision, reproducibility, and compatibility with multiple pesticide classes make it the preferred choice across testing laboratories. High-performance liquid chromatography (HPLC) and gas chromatography (GC) remain key tools for regulatory compliance and trace-level detection. Growing investments in advanced column materials and automated systems continue to strengthen adoption across environmental and food safety applications, supporting the market’s overall technological advancement.

- For instance, Shimadzu Corporation launched the Nexera UC hybrid SFC-HPLC system, enabling faster separation of pesticide residues in complex food matrices.

By Sample:

Food & beverage samples accounted for the largest market share of 46% in 2024, driven by stringent global food safety standards and increased consumer awareness of pesticide residues. Regulatory bodies such as the FDA and EFSA enforce strict limits, boosting demand for reliable residue monitoring in processed foods, fruits, and vegetables. Advancements in multi-residue analysis and portable testing kits are enhancing real-time detection capabilities across manufacturing and distribution points.

- For instance, Shimadzu launched its LC/MS-2050 system, allowing simultaneous detection of over 500 pesticide residues in fruit and vegetable batches for European exporters.

By End User:

Environmental testing laboratories led the market with a 38% share in 2024, owing to their critical role in regulatory compliance, contamination monitoring, and pollution control. The rise in environmental surveillance programs and water quality assessments has significantly boosted analytical service demand. Advanced laboratories are increasingly adopting integrated biosensor and spectroscopy tools to improve detection efficiency and reduce analysis time, supporting rapid and accurate pesticide identification in diverse ecosystems.

Key Growth Drivers

Rising Food Safety Regulations

Stringent global regulations on pesticide residue limits drive the need for advanced detection systems. Agencies such as the FDA, EFSA, and WHO enforce strict compliance to ensure food quality and consumer safety. This regulatory push compels food manufacturers and testing laboratories to adopt high-precision analytical tools like chromatography and spectroscopy. Growing export standards and international trade requirements further accelerate the use of pesticide detection technologies across the food, agriculture, and environmental sectors.

- For instance, Thermo Fisher Scientific unveiled the TSQ 9610 GC-MS/MS platform, engineered for food safety labs to comply with updated FDA residue limits in processed fruit and vegetable testing.

Technological Advancements in Detection Methods

Continuous innovation in analytical chemistry and biosensor technology fuels market expansion. Modern detection systems now deliver faster results, improved accuracy, and lower detection limits. The integration of automation, microfluidics, and AI-based data interpretation enhances efficiency in laboratory and on-site applications. These advancements reduce testing time and costs while enabling multi-residue screening, making them vital for regulatory compliance and real-time monitoring across industries such as food safety and environmental management.

- For instance, Agilent Technologies updated its 7800 ICP-MS System with advanced multi-residue screening capabilities, allowing environmental labs to simultaneously detect over 60 trace elements in water samples with detection limits below 0.1 ppb.

Growth in Agricultural and Environmental Monitoring

Expanding agricultural production and rising pesticide usage globally create strong demand for monitoring solutions. Environmental agencies and agricultural research institutions increasingly invest in advanced detection technologies to assess soil, water, and crop contamination. This growth is further supported by sustainability initiatives and eco-friendly farming practices, emphasizing pesticide traceability and pollution control. The trend strengthens partnerships between technology providers, governments, and laboratories to develop comprehensive monitoring frameworks.

Key Trends & Opportunities

Adoption of Portable and Real-Time Detection Devices

Portable pesticide analyzers and handheld biosensors are transforming field-based testing. These tools enable rapid, on-site detection with minimal sample preparation, improving decision-making in agricultural and environmental monitoring. Growing demand from developing countries, where laboratory infrastructure is limited, presents a major growth opportunity. The integration of wireless connectivity and data analytics further enhances traceability and reporting accuracy across supply chains.

- For instance, Agilent Technologies offers portable pesticide analyzers used worldwide for real-time field analysis, allowing farmers to assess contamination levels immediately.

Rising Use of Biosensor-Based Technologies

Biosensor-based pesticide detection is gaining momentum due to its speed, selectivity, and low cost. These systems utilize biological elements such as enzymes and antibodies for sensitive residue detection. Their miniaturized and user-friendly designs make them ideal for point-of-care and in-field testing. Increasing research investments and collaborations between academic institutions and biotech firms are expanding the application scope of biosensors in food safety, environmental health, and water quality assessment.

- For instance, Iowa State University researchers created a flexible, disposable graphene-ink biosensor that can detect pesticides in soil within minutes.

Key Challenges

High Cost of Advanced Analytical Instruments

Sophisticated technologies like LC-MS/MS and GC-MS require substantial capital investment and maintenance. These costs limit adoption among small laboratories and developing regions. The need for skilled operators further increases operational expenses. This economic barrier slows widespread technology penetration, particularly in cost-sensitive agricultural and food processing sectors that rely on low-budget testing solutions.

Complexity of Multi-Residue Detection

Detecting multiple pesticide residues simultaneously remains technically challenging. Variations in chemical structures, concentrations, and matrices demand complex sample preparation and calibration. Despite advances in analytical methods, ensuring consistent accuracy across diverse pesticide classes is difficult. This complexity often results in longer testing cycles and limits throughput in high-volume laboratories, affecting efficiency and scalability.

Limited Infrastructure in Developing Regions

Developing nations face significant gaps in testing infrastructure, trained personnel, and quality control frameworks. Many regions lack accredited laboratories and modern equipment necessary for reliable pesticide analysis. Weak regulatory enforcement and low awareness among farmers further hinder market growth. Addressing these barriers requires public-private partnerships and investments in laboratory modernization, capacity building, and affordable portable detection systems.

Regional Analysis

North America

The North America Pesticide Detection Market was valued at USD 489.6 million in 2018, increased to USD 653.8 million in 2024, and is projected to reach USD 1,052.3 million by 2032, expanding at a CAGR of 6.7%. The region held a 33% share in 2024, driven by strict regulatory enforcement by the FDA and EPA and the presence of major analytical technology providers. Strong demand from food and environmental testing laboratories, coupled with advanced research capabilities and government-supported monitoring initiatives, sustains market growth across the United States and Canada.

Europe

Europe accounted for a 28% market share in 2024, with the market growing from USD 425.0 million in 2018 to USD 552.2 million in 2024, and it is expected to reach USD 873.0 million by 2032, at a CAGR of 6.1%. Growth is primarily supported by stringent pesticide residue limits set by the European Food Safety Authority (EFSA) and growing investments in food quality control infrastructure. Widespread adoption of chromatography and biosensor-based methods across countries such as Germany, France, and the UK enhances traceability and regulatory compliance in the food and agriculture industries.

Asia Pacific

Asia Pacific emerged as the fastest-growing regional market, capturing a 25% share in 2024. It was valued at USD 379.5 million in 2018, rose to USD 493.0 million in 2024, and is projected to reach USD 889.3 million by 2032, expanding at a CAGR of 7.7%. Growth is driven by increasing pesticide usage in agriculture, rising awareness of food contamination, and expanding government-led monitoring programs. Rapid urbanization, along with advancements in portable detection technologies, fuels adoption in major markets such as China, Japan, India, and South Korea.

Latin America

The Latin America Pesticide Detection Market held an 8% share in 2024, with values increasing from USD 121.4 million in 2018 to USD 157.8 million in 2024, and projected to reach USD 245.6 million by 2032, at a CAGR of 5.6%. Market growth is supported by increasing agricultural exports, stricter residue regulations, and growing use of analytical technologies in Brazil and Argentina. Adoption of cost-effective and rapid testing solutions is expanding, supported by collaborations between government agencies and private laboratories focused on improving food safety compliance.

Middle East & Africa

The Middle East & Africa region collectively accounted for a 6% share in 2024. The market grew from USD 102.5 million in 2018 to USD 115.3 million in 2024, and is projected to reach USD 123.0 million by 2032, expanding at a CAGR of 5.1%. Growth is driven by increasing government focus on water and soil testing, rising awareness of pesticide contamination, and expanding laboratory networks. However, limited infrastructure and high equipment costs continue to challenge widespread adoption, especially across African nations, where portable and biosensor-based solutions show rising potential.

Market Segmentations:

By Technology:

- Chromatography-Based

- Spectroscopy-Based

- Immunoassay-Based

- Biosensor-Based

- Others

By Sample:

- Environmental Samples

- Agricultural Samples

- Food & Beverage Samples

- Biological Samples

By End User:

- Marine Source

- Environmental Testing Laboratories

- Agricultural Research Institutes

- Food & Beverage Manufacturers

- Regulatory & Government Agencies

- Universities & Academic Labs

- Others

By Region:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Global Pesticide Detection Market is moderately fragmented, featuring a mix of multinational corporations and regional analytical service providers. Leading players such as Thermo Fisher Scientific Inc., Agilent Technologies, Shimadzu Corporation, Waters Corporation, PerkinElmer Inc., SGS SA, Sciex, and Renka Bio dominate through advanced detection instruments, chromatography systems, and biosensor technologies. These companies focus on enhancing precision, automation, and multi-residue capabilities to meet evolving food safety regulations. Strategic partnerships, mergers, and R&D investments strengthen their technological portfolios and global distribution networks. Regional laboratories and niche firms like Equinox Lab and Spensa Karlabs contribute by offering specialized testing services and portable analytical solutions. Sustainability initiatives, cost-effective biosensors, and AI-based analysis tools are reshaping competition, driving innovation toward faster and more reliable detection methods. Overall, competition is intensifying as companies expand in emerging markets, develop user-friendly devices, and pursue integrated digital solutions for real-time pesticide residue monitoring.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Players

- SGS SA

- Renka Bio

- Sciex

- Equinox Lab

- Agilent Technologies

- PerkinElmer Inc.

- Shimadzu Corporation

- Waters Corporation

- Thermo Fisher Scientific Inc.

- Spensa Karlabs

Recent Developments

- In October 2024, Harbin Medical University unveiled a SERS imaging technique that enables ultra-sensitive, noninvasive detection of pesticide residues in crops.

- In October 2025, Syngenta partnered with Taranis to enhance AI-powered crop intelligence platforms supporting pesticide application and residue monitoring.

- In October 2025, Corteva announced the separation of its seed and pesticide divisions into two listed entities to improve operational focus and efficiency.

- In July 2025, Mérieux NutriSciences completed the acquisition of Bureau Veritas’ food testing operations in Ecuador, expanding its global food safety and residue testing network.

Report Coverage

The research report offers an in-depth analysis based on Technology, Sample, End User and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for rapid and portable pesticide detection devices will continue to rise globally.

- Integration of AI and machine learning will enhance data accuracy and residue prediction.

- Biosensor-based systems will gain strong adoption for on-site and low-cost testing.

- Growing regulatory enforcement will increase testing frequency across food supply chains.

- Expansion of certified laboratories in developing countries will strengthen regional monitoring capacity.

- Automation and robotics will improve throughput in large-scale testing facilities.

- Partnerships between governments and private firms will boost technology development and awareness.

- Cloud-based reporting systems will streamline result sharing and regulatory documentation.

- Demand from environmental agencies for soil and water testing will expand significantly.

- Continuous R&D investments will drive innovation toward faster, sensitive, and eco-friendly detection technologies.