Market Overview:

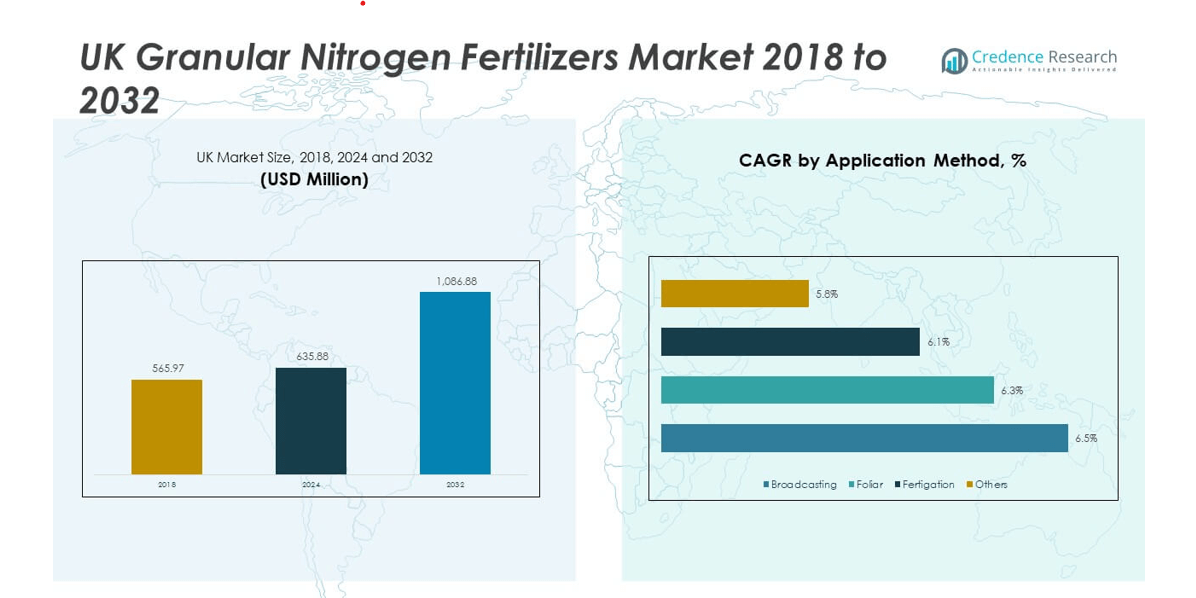

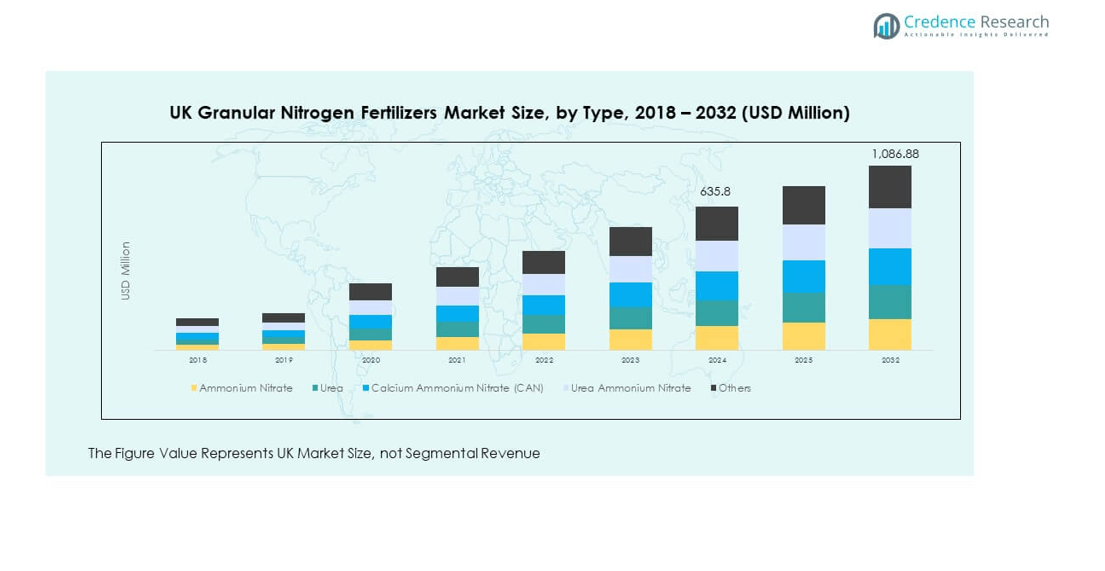

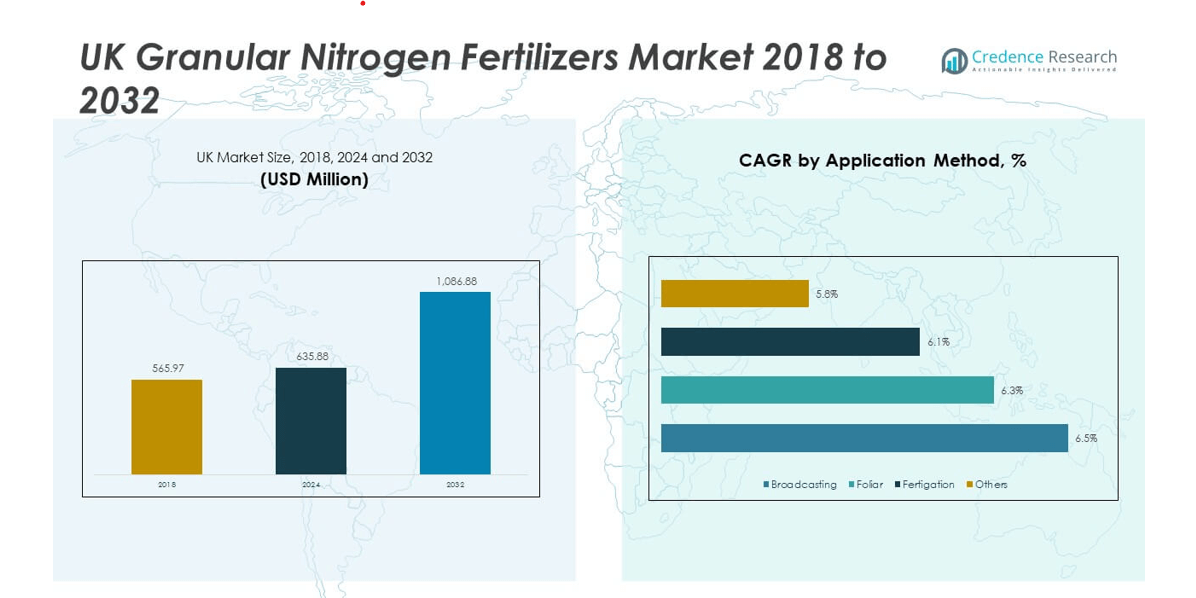

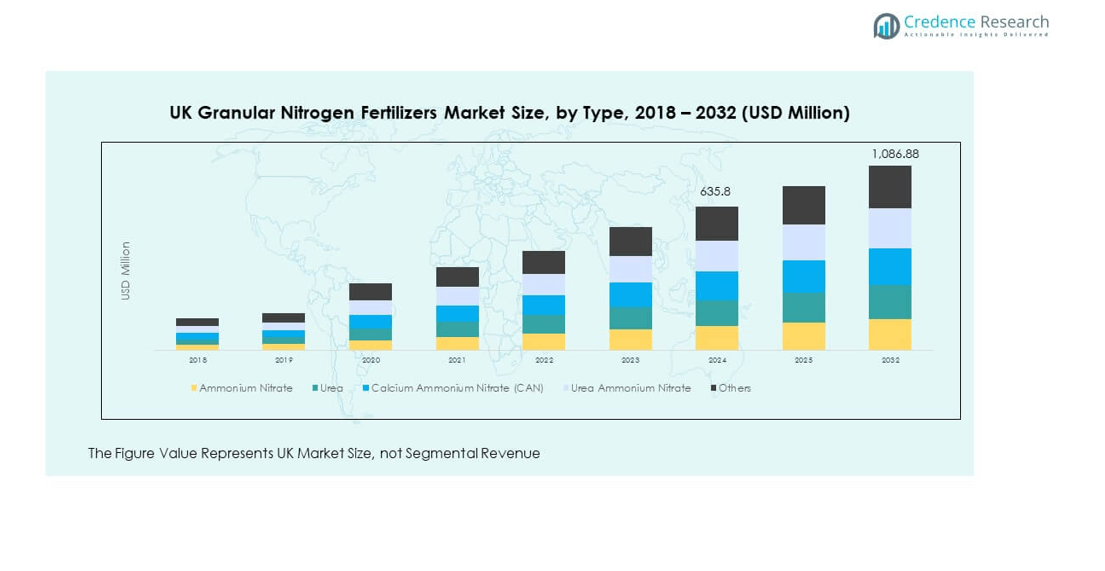

The UK Granular Nitrogen Fertilizers Market size was valued at USD 565.97 million in 2018, increased to USD 635.88 million in 2024, and is anticipated to reach USD 1,086.88 million by 2032, expanding at a CAGR of 6.93% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| UK Granular Nitrogen Fertilizers Market Size 2024 |

USD 635.88 million |

| UK Granular Nitrogen Fertilizers Market, CAGR |

6.93% |

| UK Granular Nitrogen Fertilizers Market Size 2032 |

USD 1,086.88 million |

The market is driven by rising demand for efficient crop nutrition solutions across the UK’s agriculture sector. Increasing adoption of precision farming, nutrient management practices, and sustainable soil enhancement techniques boosts the use of granular nitrogen fertilizers. Supportive government programs promoting balanced fertilizer usage, along with advances in controlled-release formulations, further enhance market penetration. Growing awareness among farmers regarding yield improvement and soil health maintenance also supports steady market growth.

Regionally, England dominates the UK Granular Nitrogen Fertilizers Market due to its extensive arable land and large-scale cereal production. Scotland and Northern Ireland are emerging regions driven by increasing adoption of improved crop management practices and modern agricultural inputs. Wales shows gradual growth supported by small-scale farming modernization and government efforts to improve soil productivity. Regional variations in soil type, crop mix, and climate influence fertilizer preferences and application intensity across the UK.

Market Insights:

- The UK Granular Nitrogen Fertilizers Market was valued at USD 565.97 million in 2018, reached USD 635.88 million in 2024, and is expected to hit USD 1,086.88 million by 2032, expanding at a CAGR of 6.93% during the forecast period.

- England led the market with 57% share in 2024 due to large-scale cereal farming and advanced fertilizer management. Scotland followed with 21%, supported by sustainable agricultural initiatives, while Wales and Northern Ireland jointly captured 22% from modernization and pasture development.

- Wales and Northern Ireland are the fastest-growing regions, driven by rising adoption of nutrient-efficient formulations and digital farming technologies that improve nitrogen utilization.

- By type, Urea accounted for around 34% of total revenue in 2024 due to its affordability and high nitrogen concentration, while Ammonium Nitrate held nearly 26% supported by rapid nutrient release and crop response.

- The remaining share was distributed among Calcium Ammonium Nitrate (CAN), Urea Ammonium Nitrate (UAN), and Others, reflecting steady diversification toward balanced and environmentally sustainable fertilizer solutions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Emphasis on Crop Productivity and Nutrient Efficiency

The growing focus on improving crop productivity and nutrient efficiency drives the UK Granular Nitrogen Fertilizers Market. Farmers aim to increase output from limited arable land while preserving soil health. The market gains momentum from the use of controlled-release and stabilized nitrogen formulations that reduce volatilization losses. Government programs promoting balanced fertilizer application strengthen adoption rates. Awareness of nutrient management practices enhances demand for granular nitrogen fertilizers. Technological innovation in fertilizer granulation supports even nutrient distribution and absorption. Rising food demand continues to reinforce fertilizer usage across all major crops.

- For instance, according to Yara UK, the use of urea fertilizers combined with urease inhibitor technology achieves an average of 70% reduction in ammonia volatilization when compared with untreated urea across field tests in the UK, significantly improving nitrogen use efficiency for local cereal crops.

Adoption of Precision Agriculture and Smart Farming Techniques

The increasing use of precision agriculture and digital farming platforms supports market expansion. Farmers are integrating GPS mapping, soil sensors, and variable rate technologies to optimize nitrogen application. It enables efficient use of resources and minimizes environmental impact. The UK Granular Nitrogen Fertilizers Market benefits from this trend, as granular forms allow accurate placement and reduced nutrient loss. Collaboration between technology providers and fertilizer companies enhances field-level implementation. Government initiatives promoting data-driven agriculture further boost adoption. Rising awareness about sustainable farming methods fuels steady demand growth.

- For instance, UK farms are currently running field trials with advanced, real-time smart soil sensor systems—such as the “Electronic Smart System (ESS)” developed by the Tyndall National Institute in Ireland or the “chemPEGS” technology from Imperial College London. These systems aim to help growers optimize fertilizer applications with sensor-guided recommendations, with research suggesting a potential for significant nutrient loss reductions (the EU “Farm-to-Fork” strategy aims for a 50% reduction).

Government Incentives and Sustainable Agriculture Policies

Strong policy backing for sustainable agriculture supports fertilizer demand across the UK. Authorities emphasize reducing greenhouse gas emissions while maintaining food security. Subsidy programs and incentive schemes for efficient fertilizer use encourage responsible application. It enables small and medium farmers to invest in better-quality granular nitrogen fertilizers. The UK Granular Nitrogen Fertilizers Market benefits from alignment with national sustainability goals. Support for research into eco-friendly fertilizers enhances market prospects. Public-private partnerships further accelerate innovation and distribution in rural areas.

Rising Awareness of Soil Health and Crop Nutrition Balance

Farmers are becoming more aware of the importance of maintaining soil health through proper nutrient management. Balanced nitrogen application is now central to sustainable farming strategies. The UK Granular Nitrogen Fertilizers Market benefits from education programs that promote long-term soil fertility. Companies are introducing granules with micronutrient enrichment to support plant growth. Awareness campaigns from agricultural agencies improve fertilizer literacy among small farmers. This trend reduces the overuse of nitrogen and supports eco-friendly practices. Market players continue investing in soil testing and advisory services to guide efficient usage.

Market Trends:

Shift Toward Controlled-Release and Enhanced Efficiency Formulations

The fertilizer industry is witnessing a shift toward controlled-release nitrogen products designed for prolonged nutrient availability. Farmers prefer such formulations for consistent crop nutrition and reduced application frequency. The UK Granular Nitrogen Fertilizers Market is seeing innovation in polymer-coated and sulfur-coated urea products. These solutions ensure uniform nutrient release and minimize leaching losses. Environmental regulations push manufacturers to develop eco-efficient granules. Demand for these advanced fertilizers grows across high-value crops such as fruits and vegetables. Companies invest in R&D to meet sustainability standards and improve efficiency ratios.

- For instance, polymer-sulfur and polymer-coated nitrogen fertilizers offered by ICL Group show effective inertness in soil after nutrient release, supporting extended nutrient availability and minimizing leaching. This technology was highlighted in UK trials for maintaining soil nutrient levels for longer crop uptake periods compared to standard formulations.

Integration of Digital Platforms in Fertilizer Application Management

Digital agriculture tools are transforming how fertilizers are planned and applied across the UK. Farmers now use AI-driven mapping, IoT sensors, and automated dosing systems to guide application timing. The UK Granular Nitrogen Fertilizers Market gains from this digital integration that promotes accuracy and traceability. Data-driven insights help optimize nitrogen efficiency and reduce excess usage. Agri-tech firms collaborate with fertilizer producers to offer integrated farm solutions. This combination of agronomy and analytics improves yield predictability. The trend supports better farm economics and environmental compliance.

- For instance, smart farming platforms using IoT-connected soil sensors and cloud-based analytics—similar to those advanced by Tyndall National Institute—enable farmers to analyze real-time soil conditions and develop optimal fertiliser strategies, reducing nutrient excess and improving traceability for regulatory compliance in the UK.

Growing Focus on Eco-Friendly and Bio-Based Fertilizer Options

The market is witnessing a strong push toward bio-based nitrogen fertilizers and environmentally safe alternatives. Manufacturers are developing organic-coated granules that reduce carbon footprints and improve soil biodiversity. The UK Granular Nitrogen Fertilizers Market benefits from consumer and regulatory pressure for sustainable inputs. Farmers show growing interest in renewable-source fertilizers and microbial-enhanced products. Research institutions are partnering with companies to explore natural nitrogen fixation solutions. The trend aligns with the UK’s long-term agricultural emission reduction targets. This shift supports both productivity and environmental preservation.

Expansion of Local Manufacturing and Distribution Networks

Domestic fertilizer production and regional distribution channels are expanding to meet rising demand. The UK Granular Nitrogen Fertilizers Market benefits from enhanced logistics and localized blending facilities. Improved infrastructure reduces dependence on imports and stabilizes supply chains. Companies are setting up regional depots to ensure timely delivery during peak farming seasons. Local partnerships strengthen accessibility for rural farmers. Investments in warehousing and transportation networks improve overall market efficiency. The expansion also supports price competitiveness and long-term growth stability.

Market Challenges Analysis:

Environmental Regulations and Nitrogen Runoff Concerns

Stringent environmental regulations related to nitrogen emissions and runoff remain a major concern for producers. The UK Granular Nitrogen Fertilizers Market faces pressure from policies targeting nitrate pollution in water bodies. Compliance costs rise due to strict environmental audits and testing requirements. Farmers must balance productivity with environmental responsibility, making adoption challenging for smaller farms. Limited access to precision tools further increases application inefficiency. Companies must invest in low-emission formulations to meet evolving standards. The challenge also influences fertilizer pricing and margins across distribution chains.

Volatility in Raw Material Prices and Supply Chain Disruptions

Fluctuating costs of natural gas, ammonia, and other key raw materials affect production economics. The UK Granular Nitrogen Fertilizers Market experiences price instability driven by global energy trends. Supply chain disruptions caused by trade constraints and geopolitical issues limit steady fertilizer availability. Small distributors face challenges maintaining inventory levels during demand peaks. Rising transportation costs further add pressure to profit margins. Manufacturers must adopt strategic sourcing to ensure cost control. Supply uncertainty continues to hinder smooth market operations and long-term planning.

Market Opportunities:

Development of Sustainable and High-Efficiency Fertilizer Solutions

Growing interest in sustainable agriculture creates strong opportunities for innovation in fertilizer technology. Companies in the UK Granular Nitrogen Fertilizers Market can expand through bio-based and smart-release formulations. Demand is high for products offering higher nutrient uptake and reduced environmental impact. Collaborations with research institutions will enhance innovation and certification processes. Government funding for sustainable agri-tech boosts investment potential. There is strong potential for export-oriented production targeting European markets with green standards.

Integration of Digital Platforms for Precision Fertilizer Management

Expanding use of digital tools in agriculture opens opportunities for service-linked fertilizer products. The UK Granular Nitrogen Fertilizers Market can leverage data-driven agronomic solutions to enhance field performance. Cloud-based platforms, satellite imaging, and soil analytics improve real-time nutrient monitoring. Farmers adopting such solutions achieve better yield forecasting and resource management. Integration of advisory apps and subscription-based farm services strengthens customer engagement. This trend enables companies to expand market reach while supporting efficient and sustainable fertilizer use.

Market Segmentation Analysis:

By Type

The UK Granular Nitrogen Fertilizers Market is segmented into ammonium nitrate, urea, calcium ammonium nitrate (CAN), urea ammonium nitrate (UAN), and others. Urea holds a dominant share due to its high nitrogen content and cost efficiency. Ammonium nitrate remains preferred for its fast nutrient release, supporting immediate plant growth. CAN offers balanced performance with reduced leaching risk, gaining traction among environmentally conscious farmers. UAN is expanding use in liquid-compatible systems, improving operational flexibility. The “others” category includes specialty blends developed for niche crop applications and specific soil conditions.

- For instance, scientific reports show that nitrate-based fertilizers used by UK farmers demonstrate up to 90% lower ammonia emission losses versus urea-based alternatives, providing a reliable solution for environmental compliance and crop performance in regional arable trials.

By Application Method

The market is categorized by application method into broadcasting, foliar, fertigation, and others. Broadcasting remains the most common practice due to simplicity and wide coverage efficiency. Foliar applications are increasing due to their quick nutrient uptake and ability to correct mid-season deficiencies. Fertigation shows strong growth, supported by precision agriculture and irrigation system integration. The segment delivers better nutrient efficiency and aligns with sustainable farming goals. Other methods are used for targeted or specialized crops requiring controlled dosing.

By End-User

Based on end-user, the market is segmented into agriculture, horticulture, and landscaping and turf. Agriculture leads due to extensive cereal, oilseed, and root crop cultivation across the UK. Horticulture exhibits steady expansion driven by rising demand for fruits, vegetables, and ornamental plants. Landscaping and turf applications are supported by urban greenery programs and sports infrastructure maintenance. Each end-user segment continues to adopt improved fertilizer solutions to enhance yield and maintain soil vitality.

Segmentation:

By Type:

- Ammonium Nitrate

- Urea

- Calcium Ammonium Nitrate (CAN)

- Urea Ammonium Nitrate (UAN)

- Others

By Application Method:

- Broadcasting

- Foliar

- Fertigation

- Others

By End-User:

- Agriculture

- Horticulture

- Landscaping and Turf

Regional Analysis:

England – Dominant Regional Contributor

England holds the largest share of the UK Granular Nitrogen Fertilizers Market, accounting for nearly 57% of the total revenue in 2024. The region’s dominance stems from its extensive agricultural base, particularly in cereal and oilseed cultivation. Strong government support for sustainable crop management practices and precision farming has accelerated adoption of granular nitrogen fertilizers. High demand for efficient fertilizers among large-scale farms enhances market stability. Fertilizer producers maintain robust distribution networks across key agricultural zones in East Anglia, Yorkshire, and the Midlands. Continuous investment in soil health improvement and yield optimization ensures England’s leadership in both production and consumption.

Scotland – Expanding Through Sustainable Agriculture Practices

Scotland represents about 21% of the UK Granular Nitrogen Fertilizers Market share, supported by its growing adoption of modern nutrient management techniques. The region benefits from government-led programs promoting balanced fertilizer use to protect water quality. Farmers are increasingly investing in slow-release and low-emission formulations suited to cooler climates and diverse soil conditions. It continues to expand its market presence through innovation in granule coating and eco-friendly blends. Regional cooperatives and agri-retailers play a vital role in extending accessibility across remote farming areas. The trend toward sustainable livestock feed crops and rotational farming further strengthens fertilizer demand.

Wales and Northern Ireland – Emerging Regional Growth Hubs

Wales and Northern Ireland together account for around 22% of the UK Granular Nitrogen Fertilizers Market in 2024. Both regions are experiencing steady growth driven by modernization of small and medium-sized farms. In Wales, increased focus on pasture management and silage crop productivity supports rising fertilizer adoption. Northern Ireland benefits from its strong agri-export orientation and integration with advanced nutrient monitoring systems. Expansion of distribution infrastructure and advisory support services improves market accessibility. Rising investments in research on nitrogen efficiency and environmental compliance sustain regional growth momentum. These factors position both regions as promising contributors to the UK’s long-term agricultural nutrient demand.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Yara International ASA

- ICL Group (Israel)

- ADM Agriculture Ltd. (USA)

- LAT Nitrogen (Germany)

- CF Fertilisers UK Ltd.

- Thomas Bell & Sons Ltd.

- Law Fertilisers Ltd.

- GreenBest Ltd.

Competitive Analysis:

Competition in the UK Granular Nitrogen Fertilizers Market is intense. Major players invest heavily in R&D to produce advanced formulations. It faces rivalry from both global multinationals and local specialty firms. Companies differentiate through product innovation, distribution strength, and service support. Some firms secure long-term contracts with large farms to lock demand. Price competition remains strong in commodity-grade segments. Consolidation by acquisitions and alliances intensifies competitive pressure. Market entrants must ensure clear differentiation to capture share.

Recent Developments:

- In June 2025, Yara International ASA completed significant upgrades at its UK fertilizer plant, boosting production efficiency and supporting expanded output of granular nitrogen fertilizers for the UK market. This investment underscores Yara’s commitment to UK agriculture and improved local supply.

- ICL Group continues to supply and develop specialty granular nitrogen fertilizers for the UK, maintaining its focus on high-quality NPK formulations tailored for British soil and crops. ICL’s innovation pipeline includes next generation fertilizer technologies and ongoing collaboration with UK partners announced across 2025.

- LAT Nitrogen, following its acquisition by AGROFERT in 2023 and rebranding, remains a leading supplier across Europe, including the UK. In 2025, LAT has not announced a major UK partnership or local product launch, but the company maintains its export presence with tailored CAN and NPK fertilizers, adjusting strategies based on broader European market conditions.

- CF Fertilisers UK Ltd, a subsidiary of CF Industries, has adjusted its UK operations by closing its ammonia plant at Billingham with plans to continue ammonium nitrate fertilizer production using imported ammonia as of July 2023 and through 2025. The company remains committed to UK supply of granular nitrogen fertilizers, leveraging imports for cost competitiveness.

Report Coverage:

The research report offers an in-depth analysis based on by type, application method, and end-user. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Growth will favor specialty and controlled-release formulations.

- Digital tools will guide precise nitrogen application.

- Demand for ecofriendly fertilizers will rise.

- Partnerships with agritech firms will increase.

- Regional distribution networks will expand further.

- Farmers will prefer blended, custom nutrient mixes.

- Regulations will push low-emission fertilizer solutions.

- Biobased nitrogen sources will gain pilot deployments.

- Export potential into Europe will attract investment.

- Data services bundled with fertilizer sales will grow.