Market Overview:

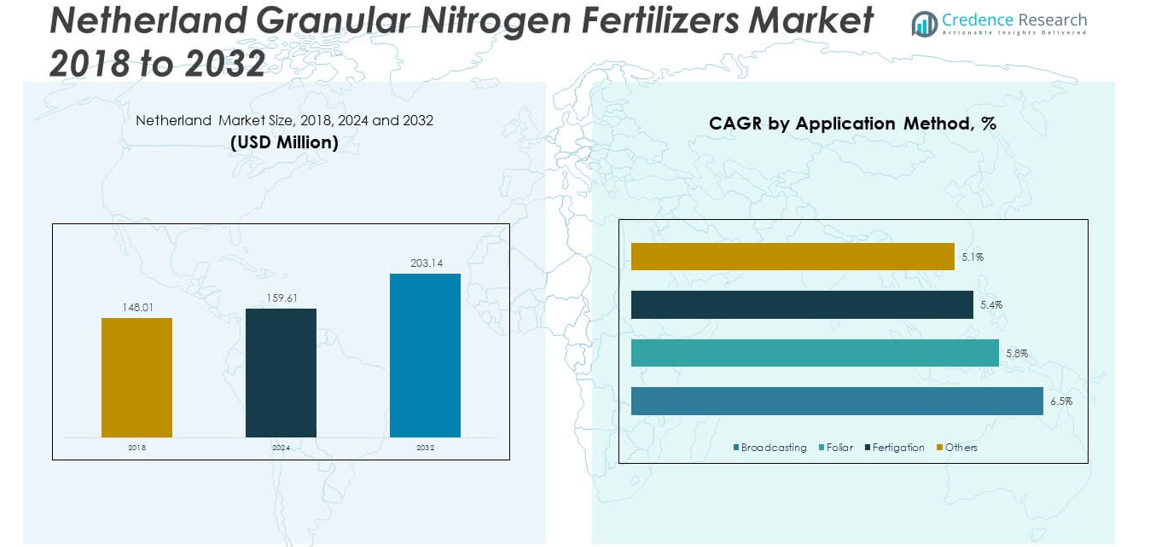

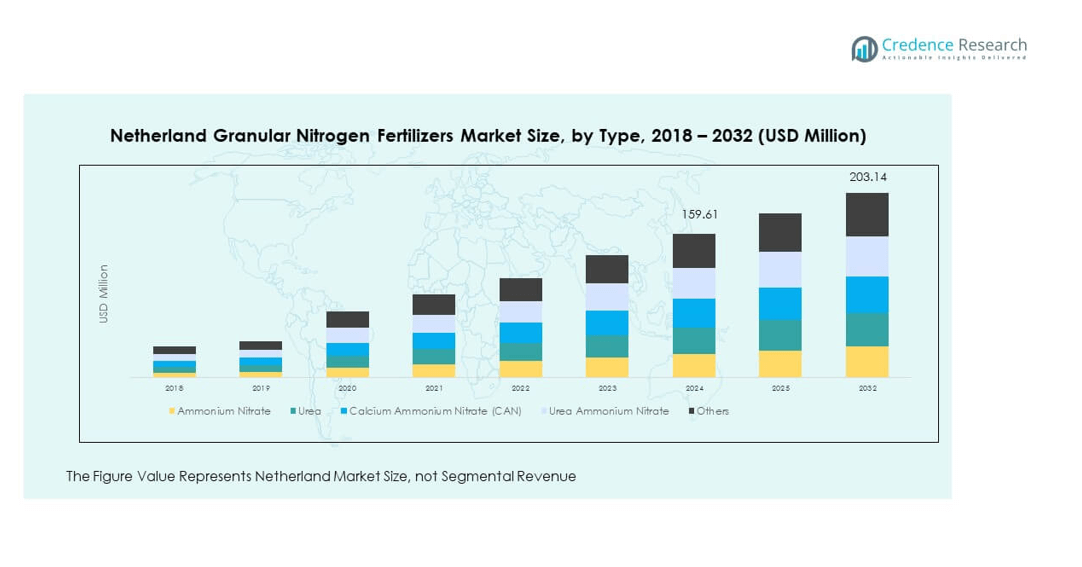

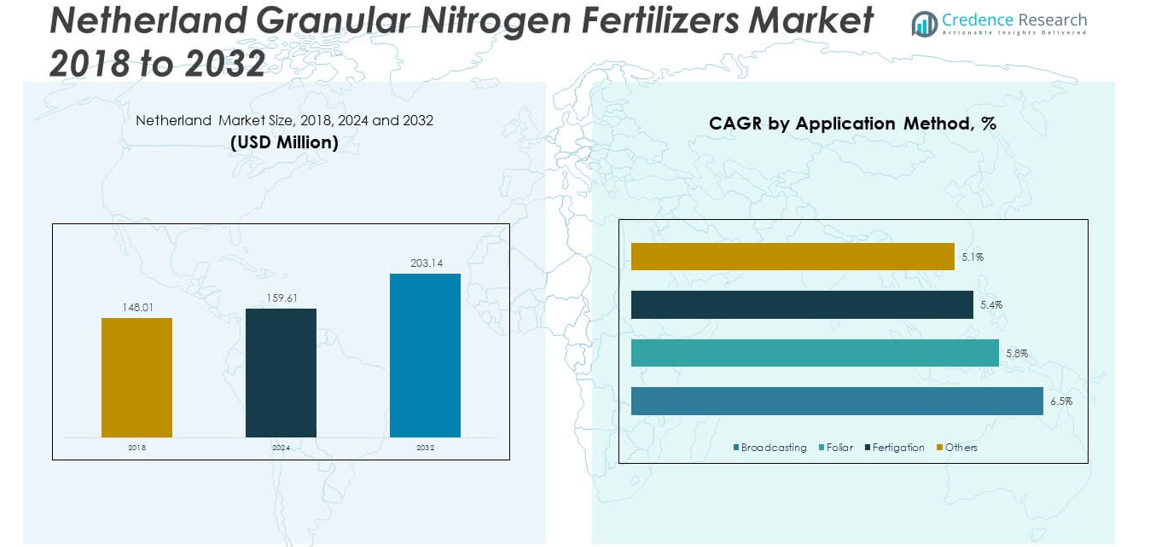

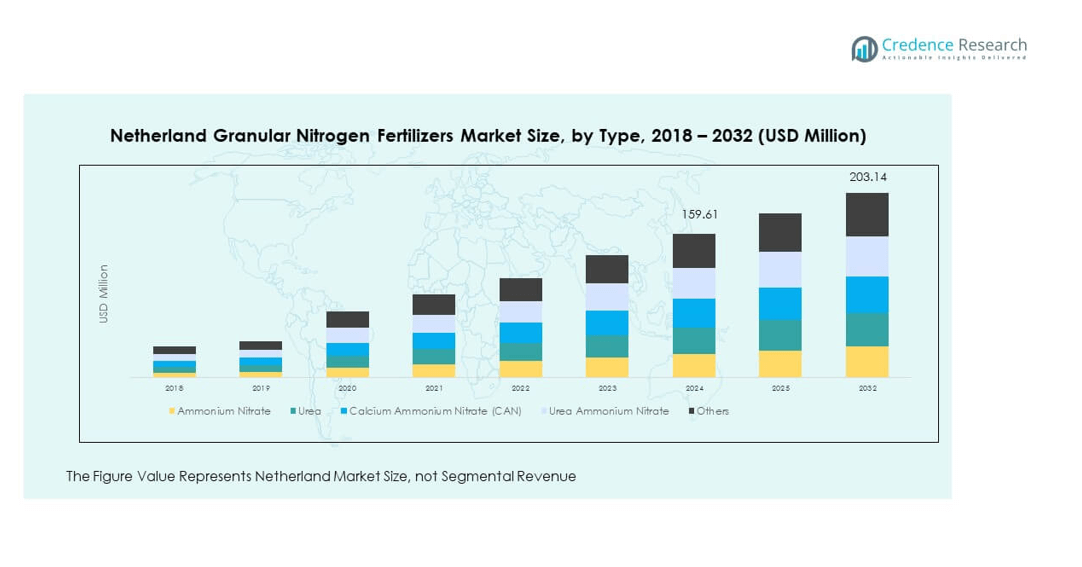

The Netherland Granular Nitrogen Fertilizers Market size was valued at USD 148.01 million in 2018, grew to USD 159.61 million in 2024, and is anticipated to reach USD 203.14 million by 2032, at a CAGR of 3.06% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Netherland Granular Nitrogen Fertilizers Market Size 2024 |

USD 159.61 million |

| Netherland Granular Nitrogen Fertilizers Market, CAGR |

3.06% |

| Netherland Granular Nitrogen Fertilizers Market Size 2032 |

USD 203.14 million |

Growing adoption of precision agriculture and sustainable farming practices is fueling market expansion. Dutch farmers emphasize high-yield crops, driving steady demand for granular nitrogen fertilizers. Government policies promoting balanced nutrient use and soil fertility management support continued growth. The shift toward controlled-release and environmentally friendly fertilizer formulations further boosts market penetration across greenhouse and open-field applications.

Regionally, the Netherlands remains a leading producer and consumer due to its intensive agricultural model. The western provinces, with strong horticulture and floriculture activities, show significant fertilizer consumption. Emerging adoption in northern regions is driven by expanding cereal and vegetable cultivation. Proximity to major European fertilizer producers also strengthens domestic supply chains, enhancing availability and price competitiveness in the Dutch market.

Market Insights:

- The Netherland Granular Nitrogen Fertilizers Market was valued at USD 148.01 million in 2018, increased to USD 159.61 million in 2024, and is projected to reach USD 203.14 million by 2032, growing at a CAGR of 3.06% during the forecast period.

- The Western Netherlands leads with 42% market share due to its dense greenhouse, horticulture, and floriculture sectors supported by advanced irrigation and export-oriented production.

- The Eastern and Southern regions collectively account for 36% share, driven by diversified farming, strong cooperatives, and investments in controlled-release fertilizers, while the Northern Netherlands, holding 22%, is the fastest-growing region supported by digital agriculture adoption and crop diversification.

- By type, Urea dominates the market with around 35% share, attributed to its high nitrogen content and cost efficiency for large-scale crop use.

- Calcium Ammonium Nitrate (CAN) follows with approximately 27% share, favored for its balanced nutrient delivery and compatibility with precision farming practices.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Agricultural Productivity Needs Supporting Fertilizer Demand

The Netherlands maintains one of the world’s highest agricultural output per hectare, driving the consistent demand for nitrogen-based fertilizers. Farmers focus on maintaining high soil fertility levels to ensure crop consistency and export quality. The growth of intensive vegetable, cereal, and horticulture cultivation strengthens the adoption of granular nitrogen fertilizers. It provides steady nutrient availability, helping farmers meet strict yield targets. Increasing food demand from domestic and export markets reinforces fertilizer consumption. Modern irrigation systems enhance nutrient absorption, improving efficiency. The government’s focus on maximizing land productivity through precision farming also supports market expansion.

- For instance, Yara International ASA supplies Dutch farmers with advanced precision tools such as the N-Sensor, which allows real-time adjustment of nitrogen doses and has been shown to improve nitrogen-use efficiency by up to 15% in field trials reported by the company.

Shift Toward Environmentally Responsible Fertilizer Applications

Strict environmental regulations in the Netherlands push farmers toward adopting efficient nitrogen fertilizers. Authorities emphasize reducing ammonia and nitrate emissions to protect water bodies and air quality. This encourages a shift toward controlled-release and slow-acting fertilizer products. The Netherland Granular Nitrogen Fertilizers Market benefits from this transition due to its compatibility with sustainable farming methods. It helps reduce nutrient losses while maintaining crop health and yield quality. Farmers also prefer these fertilizers for easier handling and uniform application. Environmental certification programs further motivate agribusinesses to select eco-friendly inputs. This shift aligns with the European Green Deal goals for sustainable agriculture.

- For instance, following strict environmental regulations, ICL Group introduced the eqo.x® fully biodegradable coating technology in 2025. This technology enables granular nitrogen fertilizers to achieve up to a 30% reduction in nitrogen leaching compared to conventional urea, directly supporting Dutch efforts to comply with EU nitrogen emission standards.

Expansion of Greenhouse and Horticultural Production Driving Demand

The Netherlands’ leadership in greenhouse farming accelerates fertilizer usage across high-value crops. Granular nitrogen fertilizers support precision nutrient management in horticulture and floriculture sectors. Greenhouse operators prioritize consistent growth cycles and product quality, relying on nutrient-efficient fertilizer formulations. It enhances root development, flower yield, and overall plant health. The rising demand for vegetables, fruits, and ornamental plants further boosts consumption. Advanced greenhouse technologies require balanced nutrient delivery, favoring granular nitrogen types. Strong export-oriented horticultural production also reinforces market stability. These factors ensure steady fertilizer demand in controlled-environment agriculture systems.

Government Policies Promoting Balanced Nutrient Management

Dutch government programs encourage optimized fertilizer use to improve efficiency and reduce environmental impact. Policies under the Common Agricultural Policy (CAP) support nutrient monitoring and precision fertilization. It strengthens the adoption of smart farming systems using soil sensors and digital mapping tools. These measures help farmers track nitrogen levels and minimize wastage. The Netherland Granular Nitrogen Fertilizers Market benefits from this data-driven approach. Government-backed sustainability grants and advisory services promote responsible nutrient practices. Strong research initiatives in Wageningen and other institutes improve fertilizer formulations. This policy environment ensures long-term stability and modernization within the fertilizer sector.

Market Trends:

Integration of Digital Farming Technologies for Precision Fertilization

Dutch farmers increasingly integrate precision farming tools for nutrient optimization. Technologies such as GPS mapping, drone imaging, and variable-rate applicators enhance fertilizer placement. It reduces nitrogen runoff and maximizes plant uptake. The Netherland Granular Nitrogen Fertilizers Market gains from the adoption of these digital solutions. Farmers use analytics platforms to predict soil nutrient needs and adjust application timing. Integration with farm management software ensures resource efficiency and yield improvement. Startups and agri-tech firms collaborate with cooperatives to promote precision agriculture. This digital transformation is reshaping fertilizer distribution and application methods across Dutch farmlands.

- For instance, Haifa Group launched Haifa Soluble DUO fertilizers in the Netherlands in February 2025. Dutch greenhouse growers, who manage over 9,800 hectares of protected crops, have adopted this product to increase calcium supply without excessive nitrogen, supporting up to 10% improvements in tomato yields and reducing nitrogen losses through targeted fertigation.

Rising Adoption of Controlled-Release and Enhanced Efficiency Fertilizers

Sustainability goals are driving the replacement of traditional fertilizers with advanced controlled-release formulations. These products release nutrients gradually, minimizing leaching losses and emissions. Manufacturers invest in polymer-coated and sulfur-coated granules that offer steady nutrient supply. It ensures crop uniformity and better yield outcomes. The Netherland Granular Nitrogen Fertilizers Market witnesses strong growth from this shift. Farmers appreciate reduced labor frequency and improved nutrient efficiency. Industry players also innovate bio-based coating materials for eco-compliance. The growing preference for these high-performance fertilizers strengthens long-term adoption across Dutch farms.

Increased Use of Blended and Customized Fertilizer Solutions

Farmers are moving toward customized nutrient blends that match soil composition and crop needs. Fertilizer manufacturers provide tailored nitrogen-phosphorus-potassium (NPK) combinations with added micronutrients. It enhances nutrient balance and reduces application frequency. The Netherland Granular Nitrogen Fertilizers Market benefits from growing awareness of soil-specific solutions. Companies use digital soil testing to design precise formulations. Crop consultants play a major role in recommending fertilizer blends based on seasonal data. This customization trend supports sustainable nutrient management. It aligns fertilizer performance with regional agronomic conditions, ensuring consistent productivity.

Growing Investments in Research and Circular Economy Fertilizers

Research institutions and private firms invest in eco-innovative fertilizers derived from recycled sources. Technologies for nutrient recovery from wastewater and animal manure are gaining traction. It reduces dependence on synthetic nitrogen imports and supports circular economy goals. The Netherland Granular Nitrogen Fertilizers Market is transforming under this innovation wave. It promotes collaboration between agri-tech companies and universities to scale pilot projects. Policy support for low-carbon fertilizers attracts private investment. Farmers increasingly adopt these sustainable alternatives for compliance and brand value. The research-driven approach enhances environmental performance and resource conservation.

Market Challenges Analysis:

Stringent Environmental Regulations and Emission Control Pressures

The Netherlands faces strict environmental standards under EU nitrogen directives, creating compliance challenges for fertilizer producers and farmers. Regulators demand reduced nitrate leaching and ammonia emissions from farmlands. This pressure limits excessive nitrogen application and increases monitoring costs. The Netherland Granular Nitrogen Fertilizers Market encounters constraints in balancing productivity with environmental safety. It drives higher investment in emission control technology and certification. Many small farmers find compliance expensive, affecting profitability. Frequent policy revisions create operational uncertainty for distributors. Meeting dual goals of high yield and sustainability remains a complex challenge across the Dutch agricultural sector.

Volatility in Raw Material Prices and Global Supply Chain Disruptions

Nitrogen fertilizer production relies on inputs like natural gas and ammonia, both prone to price fluctuations. Energy price volatility in Europe directly impacts fertilizer costs. The Netherland Granular Nitrogen Fertilizers Market experiences uncertainty due to unpredictable supply chains and import dependence. It strains profit margins and end-user affordability. Geopolitical tensions and logistics delays disrupt fertilizer imports from key producing regions. Local manufacturers face rising energy bills, increasing operational burdens. Price-sensitive farmers reduce fertilizer purchases during high-cost periods, affecting market stability. This volatility challenges long-term planning for both producers and distributors.

Market Opportunities:

Development of Bio-Based and Sustainable Nitrogen Fertilizers

Growing interest in green chemistry and sustainability creates opportunities for bio-based fertilizer development. Companies invest in organic nitrogen sources derived from waste or renewable materials. The Netherland Granular Nitrogen Fertilizers Market gains from this transition toward eco-certified products. It helps meet emission targets and consumer expectations for sustainable agriculture. Partnerships between biotechnology firms and fertilizer producers support innovation. Government incentives for low-carbon manufacturing attract research funding. These initiatives open pathways for competitive and environmentally friendly nitrogen products.

Expansion of Export Opportunities and Precision Agriculture Solutions

Dutch expertise in precision agriculture strengthens its position in fertilizer technology exports. Local companies develop advanced granular nitrogen formulations suited for European and global markets. It enhances international trade prospects and revenue growth. Farmers adopting smart systems create demand for complementary digital solutions. Equipment manufacturers and agri-tech firms collaborate on integrated fertilization platforms. The Netherland Granular Nitrogen Fertilizers Market benefits from this ecosystem synergy. Expansion into emerging agricultural markets across Eastern Europe and Africa presents strong growth potential.

Market Segmentation Analysis:

By Type

Ammonium nitrate and urea dominate the Netherland Granular Nitrogen Fertilizers Market due to their high nitrogen concentration and cost efficiency. Calcium Ammonium Nitrate (CAN) is gaining preference for its balanced nutrient release and soil health benefits. Urea Ammonium Nitrate supports precision agriculture, offering controlled nutrient availability. The “Others” segment includes innovative formulations designed for eco-friendly farming practices. It benefits from ongoing product development focused on improving nitrogen-use efficiency and reducing environmental impact. The growing focus on sustainable soil management further enhances demand for advanced fertilizer blends across the Netherlands.

- For instance, Dutch farms are rapidly integrating digital technologies, and more than 2,800 enterprises now employ GPS-guided spreaders and precision agriculture platforms. Industry collaborations have resulted in up to 20% more nitrogen being absorbed by crops, with a measurable decrease in field nitrogen losses documented in trial programs.

By Application Method

Broadcasting remains the leading application method due to its suitability for large-scale field crops and ease of use. Fertigation is expanding rapidly, supported by the Netherlands’ advanced irrigation infrastructure and greenhouse systems. Foliar application is favored in horticulture for quick nutrient absorption and plant recovery. The “Others” category includes specialized methods used in niche crops and controlled environments. It enables precise nutrient delivery and reduces wastage, aligning with sustainability targets. Integration of modern equipment enhances accuracy and operational efficiency in fertilizer application.

- For instance, fertigation with specialized formulas provided by suppliers such as Haifa Group is widely used in Dutch greenhouses. Fertigation dramatically increases the efficiency of nitrogen uptake compared to traditional soil application methods (up to 95% efficiency compared to 30-50% for soil application). Separately, current data suggests that the Netherlands has over 10,000 hectares under cultivation in greenhouses.

By End User

Agriculture represents the largest end-user segment, driven by high crop yield targets and export-oriented production. Horticulture follows closely, supported by strong demand for ornamental plants, fruits, and vegetables. Landscaping and turf management sectors utilize granular nitrogen fertilizers to maintain soil fertility and plant aesthetics. It ensures consistent growth and nutrient balance across diverse applications. Government support for sustainable agriculture and modern horticultural practices continues to reinforce market growth.

Segmentation:

By Type

- Ammonium Nitrate

- Urea

- Calcium Ammonium Nitrate (CAN)

- Urea Ammonium Nitrate

- Others

By Application Method

- Broadcasting

- Foliar

- Fertigation

- Others

By End User

- Agriculture

- Horticulture

- Landscaping and Turf

Regional Analysis:

Western Netherlands – Leading Agricultural Hub with 42% Market Share

The western region dominates the Netherland Granular Nitrogen Fertilizers Market with a 42% share, driven by its concentration of greenhouse farming, horticulture, and floriculture industries. Provinces such as South Holland and North Holland maintain dense agricultural activity supported by advanced irrigation and soil management systems. Farmers in this region prioritize high-quality fertilizers to sustain intensive crop cycles and export-oriented production. It benefits from proximity to major ports like Rotterdam, ensuring efficient import and distribution of fertilizer products. The region’s strong focus on precision agriculture and sustainability standards strengthens fertilizer adoption. Rising demand for high-value crops like tomatoes, peppers, and flowers continues to reinforce the dominance of this agricultural hub.

Eastern and Southern Netherlands – Expanding Crop Diversification and Fertilizer Utilization

The eastern and southern regions collectively hold around 36% market share, supported by expanding cereal, vegetable, and fruit cultivation. These areas exhibit growing fertilizer consumption due to increasing adoption of controlled-release and balanced nutrient formulations. It benefits from supportive agricultural policies promoting soil fertility and nitrogen efficiency. Farmers in Gelderland and North Brabant are investing in advanced application technologies, such as fertigation and variable-rate systems. Strong regional cooperatives and agribusiness networks enhance accessibility to premium fertilizer solutions. Expanding mixed farming systems create steady demand for nitrogen inputs across different soil types. The balance between intensive and sustainable practices positions these regions for stable growth.

Northern Netherlands – Emerging Agricultural Region with 22% Market Share

The northern provinces, including Friesland, Groningen, and Drenthe, account for about 22% of the national market share. These areas are rapidly modernizing agricultural practices, supported by government investments in soil health and climate-resilient farming. The Netherland Granular Nitrogen Fertilizers Market in this region benefits from the increasing focus on crop diversification and precision-based fertilizer management. It shows rising adoption of slow-release fertilizers suited for variable climatic conditions. Local farmers emphasize efficiency and cost optimization to enhance profitability in open-field agriculture. Infrastructure improvements and digital agriculture programs support consistent fertilizer use. The region’s emerging role in sustainable production makes it a potential growth frontier for future expansion.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

Competitive Analysis:

The Netherland Granular Nitrogen Fertilizers Market is moderately consolidated, with a mix of multinational and regional producers competing through innovation, distribution networks, and sustainable formulations. Companies focus on advanced fertilizer technologies to improve nitrogen-use efficiency and environmental compliance. It features strong competition from players emphasizing controlled-release products and precision farming solutions. Local suppliers strengthen their position through partnerships with cooperatives and digital agriculture platforms. Research collaborations and government-supported projects further stimulate competitive advantage. Continuous investment in eco-friendly and bio-based fertilizers defines the evolving market landscape.

Recent Developments:

- In February 2025, Haifa Group (North West Europe) launched Haifa Soluble DUO in the Netherlands during the HortiContact event in Gorinchem. This new water-soluble fertilizer enables growers to increase calcium input without adding excess nitrogen, supporting sustainable cropping strategies in accordance with evolving Dutch and EU fertilizer regulations.

- In June 2023, Grupo Fertiberia completed the acquisition of Van de Reijt, a well-known Netherlands-based fertilizer wholesaler with significant logistics assets, including maritime bulk terminals. This acquisition strengthens Fertiberia’s logistics capability and distribution network for granular and other fertilizers throughout the Benelux region, enhancing its market presence and driving further expansion into Central and Northern Europe.

Report Coverage:

The research report offers an in-depth analysis based on type, application method, and end-user segments. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The market will expand steadily due to precision farming and sustainable agriculture adoption.

- Greenhouse and horticultural crop expansion will strengthen fertilizer consumption.

- Manufacturers will focus on nitrogen-efficient and low-emission fertilizer technologies.

- Digital monitoring systems will enhance application accuracy and yield management.

- Bio-based fertilizer innovations will open new opportunities for eco-certified products.

- Strategic alliances between research institutes and producers will boost innovation.

- Regulatory pressure will accelerate adoption of controlled-release formulations.

- Export potential for advanced Dutch fertilizer technologies will increase.

- Investment in circular economy fertilizer production will gain momentum.

- Rising consumer demand for sustainable food supply chains will sustain fertilizer use.