Market Overview:

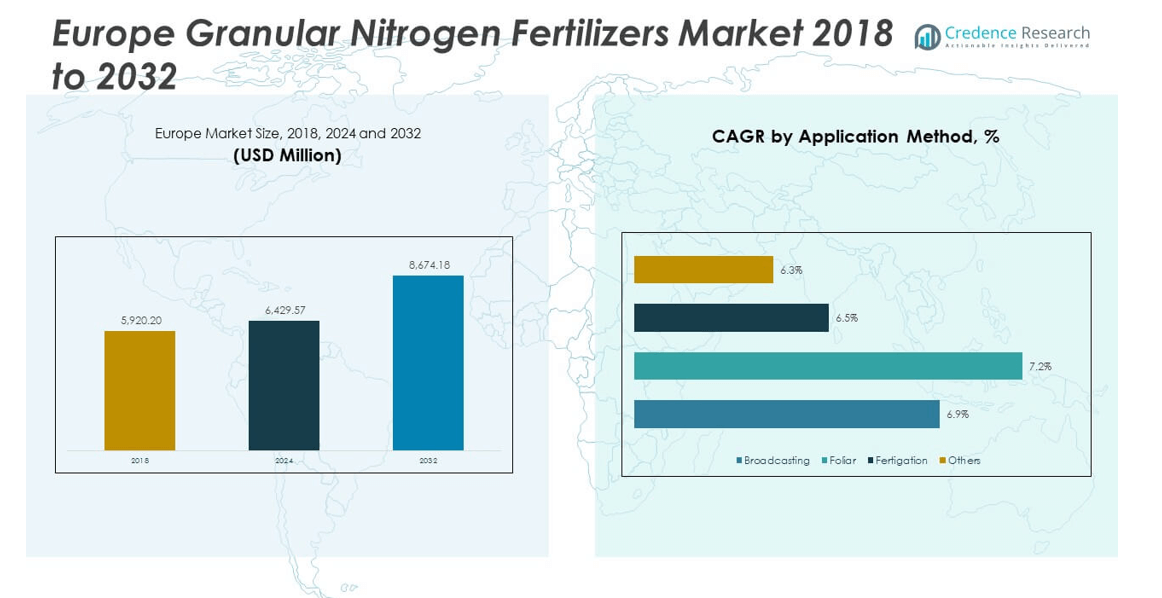

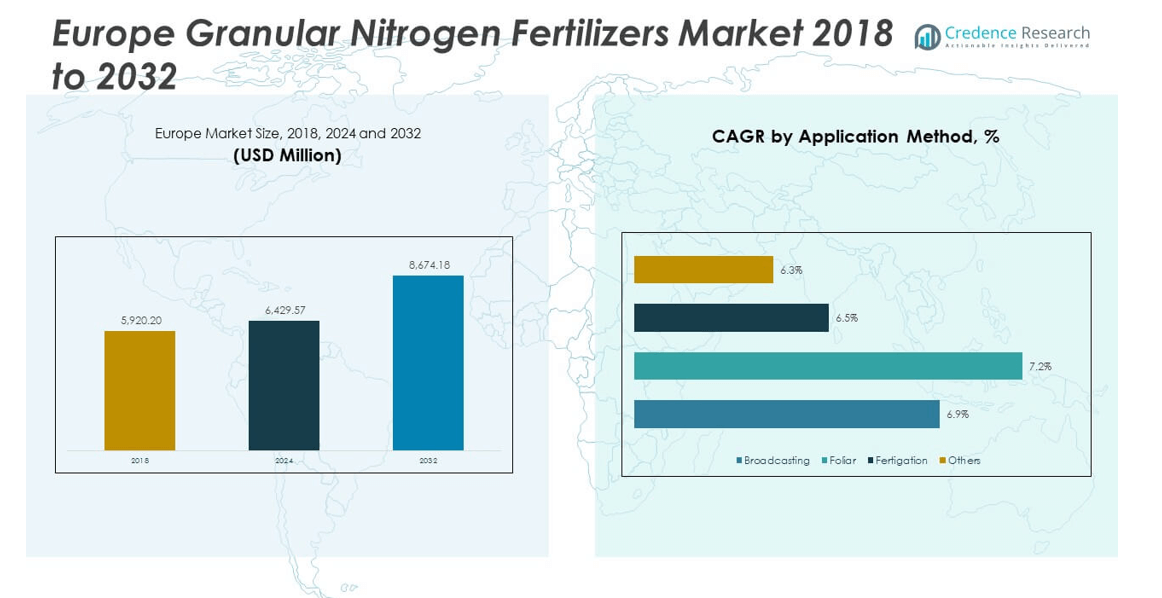

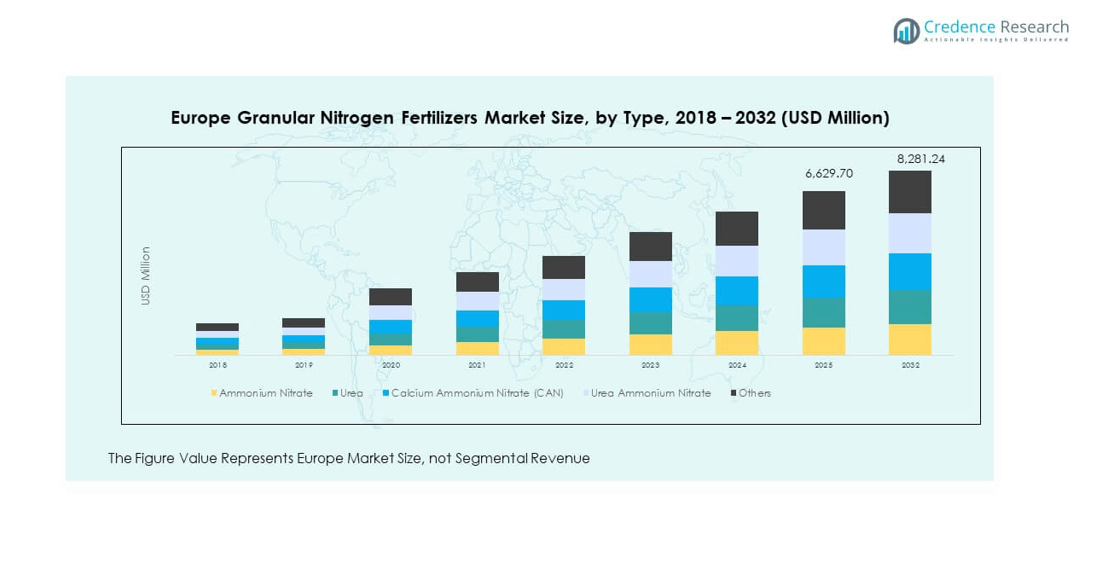

The Europe Granular Nitrogen Fertilizers Market size was valued at USD 5,920.20 million in 2018, grew to USD 6,429.57 million in 2024, and is anticipated to reach USD 8,674.18 million by 2032, at a CAGR of 3.76% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Europe Granular Nitrogen Fertilizers Market Size 2024 |

USD 6,429.57 million |

| Europe Granular Nitrogen Fertilizers Market, CAGR |

3.76% |

| Europe Granular Nitrogen Fertilizers Market Size 2032 |

USD 8,674.18 million |

The market is driven by the growing demand for enhanced crop yield and soil fertility across the agricultural sector. Rising population and shrinking arable land are pushing farmers toward nitrogen-based fertilizers that improve crop productivity. The adoption of precision farming technologies and controlled-release formulations further supports demand. Government initiatives promoting sustainable agricultural practices and balanced fertilizer use continue to strengthen the market outlook.

Western European countries dominate the market due to advanced farming infrastructure, higher adoption of nutrient management practices, and strong presence of fertilizer manufacturers. Germany, France, and the Netherlands lead the region, driven by large-scale crop production and technological advancements in fertilizer application. Eastern Europe is emerging rapidly, supported by growing agricultural modernization, increasing investment in agro-inputs, and supportive government policies promoting fertilizer efficiency.

Market Insights:

- The Europe Granular Nitrogen Fertilizers Market was valued at USD 5,920.20 million in 2018, grew to USD 6,429.57 million in 2024, and is projected to reach USD 8,674.18 million by 2032, expanding at a CAGR of 3.76% during the forecast period.

- Western Europe held the largest share at 45%, driven by advanced farming systems, precision agriculture adoption, and strong regulatory support for sustainable fertilizer use.

- Southern Europe captured 27%, led by intensive horticulture, vineyards, and fruit production, while Eastern Europe followed with 28%, supported by agricultural modernization programs.

- The fastest-growing region is Eastern Europe, driven by expanding grain cultivation, improving irrigation infrastructure, and increased investment in agro-input efficiency.

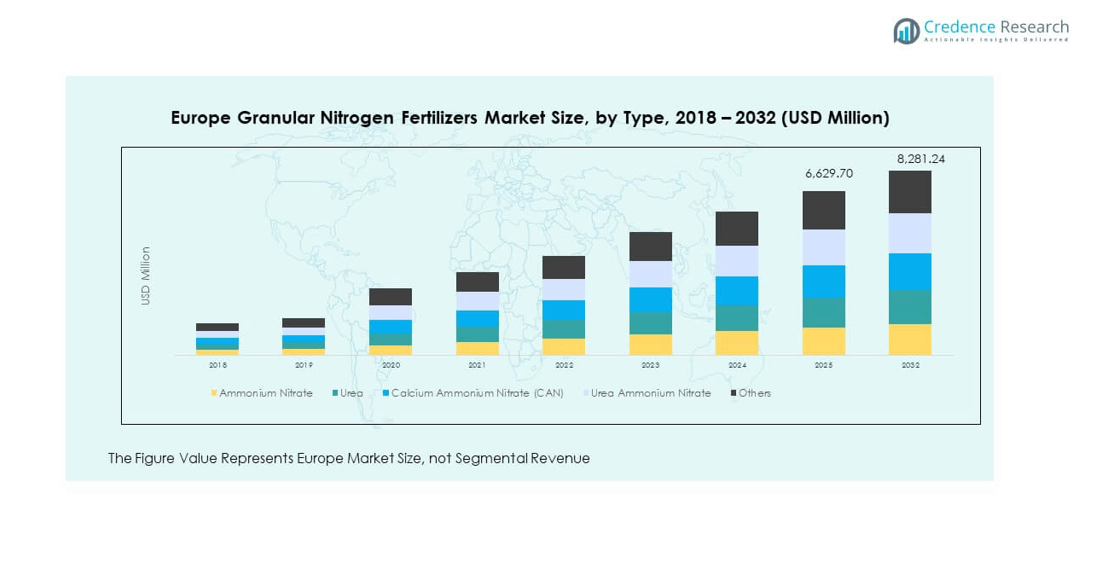

- By type, Urea held the largest segment share (about 40%) due to its high nitrogen concentration and affordability, followed by Calcium Ammonium Nitrate (CAN) at roughly 25%, favored for its soil-enhancing balance and crop versatility.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Focus on Crop Productivity and Nutrient Efficiency Across Europe

The Europe Granular Nitrogen Fertilizers Market is driven by the growing need for higher agricultural output to meet food demand. Farmers are focusing on maximizing yield from limited land resources, promoting nitrogen-rich fertilizers. It plays a vital role in enhancing crop growth and photosynthetic activity. The rising adoption of intensive farming methods has amplified nitrogen fertilizer usage. Governments across the region encourage nutrient balance through sustainable agriculture programs. Demand for fertilizers offering long-lasting nutrient release is increasing. Farmers prefer granular formulations for their convenience and uniform application benefits. This trend continues to strengthen market adoption across all crop segments.

- For instance, Yara’s green ammonia-based fertilizers were deployed across 1,600 hectares by German cereal producers in the 2023/24 season; this project, in partnership with Bindewald & Gutting Milling Group, enabled contract farmers to reduce the grain’s CO₂ footprint by up to 30% compared to conventional fertilizer, as confirmed by Yara’s 2025 corporate releases.

Expanding Adoption of Controlled-Release and Environmentally Sustainable Fertilizer Formulations

The market benefits from the growing acceptance of controlled-release nitrogen fertilizers that minimize nutrient losses. These products provide better nitrogen use efficiency while reducing leaching and greenhouse gas emissions. The shift toward eco-friendly solutions aligns with Europe’s sustainability and green deal objectives. Fertilizer manufacturers are introducing slow-release technologies to support long-term soil health. It creates opportunities for innovation within the fertilizer industry. Environmental concerns have pushed both regulators and producers toward low-emission formulations. Research initiatives support the use of biodegradable coatings in granular fertilizers. This transformation helps reduce environmental impact while maintaining productivity levels.

- For instance, the adoption of coated urea formulations by leading producers has been shown to reduce nitrogen leaching and decrease nitrous oxide emissions under field conditions. Recent reviews and market analysis confirm that the effectiveness of these controlled-release fertilizers is highly dependent on specific factors like soil type and climate.

Government Policies Encouraging Sustainable and Precision Agriculture Practices

Government initiatives promoting sustainable agriculture significantly drive the demand for granular nitrogen fertilizers. Various subsidy programs support the adoption of efficient fertilizer types that minimize waste. It helps farmers align with environmental targets while maintaining yield levels. Precision farming technologies enable accurate fertilizer distribution, enhancing nitrogen uptake efficiency. This integration reduces operational costs and improves soil nutrient balance. The European Union’s CAP reforms further strengthen responsible fertilizer management. Fertilizer manufacturers are investing in precision application tools and digital monitoring systems. Such supportive frameworks ensure long-term stability for fertilizer producers and users alike.

Increasing Research Investments and Technological Innovation in Fertilizer Formulation

Ongoing research in nitrogen stabilization and coating materials strengthens the market. Manufacturers are developing advanced formulations to improve nutrient retention and reduce volatilization. It encourages farmers to adopt premium-grade granular fertilizers for better efficiency. Research institutions in Germany, France, and the Netherlands drive innovation through public-private collaborations. Enhanced nitrogen management technologies are emerging to match soil and crop requirements. The integration of AI and IoT systems in agriculture promotes data-driven fertilizer application. Companies focus on formulating fertilizers compatible with these smart systems. Continuous R&D ensures sustainable growth and environmental compliance for the industry.

Market Trends:

Shift Toward Bio-Based and Low-Emission Nitrogen Fertilizer Production Technologies

The market is witnessing a clear shift toward bio-based fertilizer manufacturing processes. Rising environmental concerns are encouraging the use of renewable ammonia and organic nitrogen sources. It supports the EU’s long-term climate neutrality goals and emission reduction targets. Producers are investing in green hydrogen-based ammonia production to cut carbon output. This movement reshapes fertilizer supply chains across Europe. Demand for fertilizers derived from waste-to-nutrient technologies is also growing. Consumers and policymakers both favor sustainable sourcing of fertilizers. This trend fosters collaboration among energy, agricultural, and chemical industries.

- For instance, Fertiberia’s Puertollano plant in Spain, supplied by Iberdrola’s green hydrogen project, reduced natural gas needs by over 10% on a continuous operational basis after the 2025 adoption of solar-powered electrolysis for green ammonia generation; this process established Fertiberia as the first large-scale European producer of emission-free ammonia for fertilizer.

Growing Integration of Digital Agriculture Platforms and Smart Application Systems

Technological integration plays a key role in improving fertilizer efficiency and field productivity. Farmers across Europe are increasingly using satellite data, sensors, and AI tools. It allows accurate determination of nutrient requirements and reduces wastage. Granular nitrogen fertilizers are being customized for precision delivery systems. Companies are introducing sensor-linked spreaders and digital advisory platforms. This innovation enhances decision-making and yield optimization. The push toward smart agriculture ensures sustainability and cost savings. The adoption of digital tools continues to redefine fertilizer management practices.

- For instance, Yara’s AtFarm™ digital platform, integrated with John Deere’s Operations Center™, enabled European growers to achieve up to 7% average yield increase and 14% fertilizer nitrogen input reduction through real-time crop nutrient mapping and sensor-linked variable rate application, according to Yara’s agronomic trial results from 2023–2024.

Rising Popularity of Specialty Blends Tailored for Diverse Crop and Soil Conditions

The market experiences rising demand for specialty nitrogen formulations catering to local crop needs. Manufacturers are producing blends optimized for wheat, maize, and horticultural crops. It improves nutrient absorption and soil compatibility. Customized granular fertilizers address micronutrient deficiencies in specific regions. The availability of region-specific variants increases product adoption. Strong collaboration between agronomists and fertilizer firms drives tailored product design. Farmers benefit from improved yield consistency and reduced input costs. The expansion of specialty blends enhances the competitiveness of European fertilizer suppliers.

Sustainability Certifications and Eco-Labelling Influencing Buyer Preferences

Sustainability certification is becoming a major trend influencing procurement across Europe. Buyers prioritize products with verified environmental compliance. It encourages companies to obtain certifications under ISO and EU sustainability frameworks. Eco-labelling boosts transparency and consumer trust in agricultural supply chains. Regulatory emphasis on responsible sourcing supports this development. Fertilizer producers are adapting packaging and labeling strategies to highlight eco-benefits. This practice strengthens brand reputation and market positioning. Certification-based marketing continues to drive competitive differentiation across Europe.

Market Challenges Analysis:

High Raw Material Costs and Dependence on Volatile Energy Prices Impacting Profit Margins

The Europe Granular Nitrogen Fertilizers Market faces cost challenges linked to energy and raw material price fluctuations. Ammonia and natural gas prices significantly influence production economics. It pressures manufacturers to adjust pricing or absorb losses. High energy costs in Europe reduce competitiveness compared to other regions. Supply chain disruptions further strain fertilizer availability and cost stability. Producers are exploring alternative feedstocks to reduce dependency on conventional fuels. Import reliance adds exposure to geopolitical instability. Managing these costs remains a critical challenge for sustainable profitability.

Environmental Regulations and Rising Pressure for Emission Reduction Compliance

Strict European environmental policies create operational hurdles for fertilizer producers. Nitrogen runoff and greenhouse gas emissions are under tight regulation. It compels companies to redesign production and application processes. Compliance with EU Emission Trading System adds cost burdens. Stricter nutrient management rules demand advanced product innovation. Some smaller producers face challenges meeting these technical standards. Continuous adaptation requires capital-intensive upgrades and skilled workforce training. Balancing productivity with ecological responsibility remains a persistent challenge.

Market Opportunities:

Advancement in Green Ammonia and Renewable Nitrogen Fertilizer Technologies

The transition toward green ammonia opens growth opportunities across the market. Producers are investing in renewable hydrogen-based systems to achieve low-carbon operations. It aligns with Europe’s clean energy and decarbonization goals. The integration of renewable inputs supports both environmental and economic sustainability. Research funding from the EU accelerates adoption of carbon-neutral fertilizers. Companies focusing on sustainable innovation will gain a strong competitive edge. Collaboration with energy providers enhances supply chain resilience. This trend is expected to transform fertilizer production dynamics across the continent.

Rising Demand for Smart Agriculture and Precision Fertilizer Application Solutions

The adoption of precision farming offers major opportunities for granular nitrogen fertilizers. Farmers are increasingly using GPS-enabled spreaders and smart sensors for efficient use. It improves yield outcomes and minimizes fertilizer wastage. Demand for intelligent fertilizer systems supports long-term market expansion. Partnerships between agritech firms and fertilizer manufacturers are increasing. Governments support this digital transformation through funding and subsidies. The combination of data analytics and automation enhances productivity. These developments position Europe as a leader in smart nutrient management.

Market Segmentation Analysis:

By Type

The Europe Granular Nitrogen Fertilizers Market is segmented by type into ammonium nitrate, urea, calcium ammonium nitrate (CAN), urea ammonium nitrate (UAN), and others. Urea dominates due to its high nitrogen content and cost efficiency across large-scale farming operations. Ammonium nitrate maintains steady demand owing to its fast nutrient release and compatibility with various crops. CAN is gaining preference for its balanced composition that improves soil stability. UAN shows growing adoption in modern farming due to its ease of handling and efficient nutrient absorption. Other niche fertilizers cater to specialized crop and soil needs.

- For instance, recent experimentation and remote-sensing research in Northern Sweden indicates that precise nitrogen management using advanced granular formulations can boost barley yields by mapping homogeneous yield zones, with satellite data confirming yield improvements for CAN-based blends; CAN fertilizer trials also report up to 22% greater uptake rates compared to standard urea in technical summaries from Swedish field studies.

By Application Method

The market is categorized by application method into broadcasting, foliar, fertigation, and others. Broadcasting remains the most widely used method due to its simplicity and adaptability for large agricultural areas. Foliar application is expanding due to its rapid nutrient uptake and yield enhancement. Fertigation is gaining traction in precision and sustainable farming systems, offering controlled nutrient release and reduced wastage. Other methods serve specific crop patterns and localized soil conditions.

- For instance, field research monitoring tomato crops in Italy found fertigation with optimized nitrogen rates (125–200 kg per hectare) led to higher nitrogen efficiency and faster harvest times compared to broadcasting, supporting adoption of fertigation as the preferred method in precision European horticulture; findings were published in peer-reviewed technical studies in 2024–2025.

By End-User

By end-user, the market includes agriculture, horticulture, and landscaping and turf. Agriculture leads the segment due to high fertilizer consumption in cereal, oilseed, and vegetable production. Horticulture follows, driven by rising fruit and vegetable cultivation. Landscaping and turf usage is increasing across urban development and sports facilities, creating steady demand for slow-release nitrogen fertilizers. It continues to benefit from expanding green infrastructure initiatives across Europe.

Segmentation:

By Type

- Ammonium Nitrate

- Urea

- Calcium Ammonium Nitrate (CAN)

- Urea Ammonium Nitrate (UAN)

- Others

By Application Method

- Broadcasting

- Foliar

- Fertigation

- Others

By End-User

- Agriculture

- Horticulture

- Landscaping and Turf

By Country

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Rest of Europe

Regional Analysis:

Western Europe – Dominant Market with Advanced Agricultural Infrastructure

Western Europe accounts for the largest share of the Europe Granular Nitrogen Fertilizers Market, capturing nearly 45% of the total regional revenue in 2024. The region’s dominance stems from advanced farming systems, high fertilizer adoption rates, and established agricultural cooperatives. Countries such as Germany, France, and the Netherlands drive market demand through modernized cultivation and precision farming practices. Farmers in these nations focus on maximizing soil productivity through balanced nitrogen management. It benefits from strong supply networks and government programs supporting sustainable fertilizer usage. Environmental policies encouraging controlled-release and low-emission fertilizers further enhance product penetration. Continuous technological adoption ensures market stability and steady revenue growth across the region.

Southern Europe – Growing Market Driven by Horticulture and Specialty Crops

Southern Europe represents a significant growth hub, holding about 27% of the market share in 2024. Countries including Italy, Spain, and Greece lead fertilizer usage due to extensive horticulture, vineyards, and fruit cultivation. The region experiences increasing demand for granular nitrogen fertilizers suitable for diverse soil conditions and intensive farming systems. It benefits from expanding irrigation infrastructure and the adoption of fertigation practices. Government initiatives promoting nutrient-efficient farming techniques continue to support market expansion. Local producers are investing in blends tailored to Mediterranean crops to enhance yield and quality. Rising focus on high-value crops strengthens fertilizer consumption across this subregion.

Eastern and Northern Europe – Emerging Regions with Expanding Agricultural Reforms

Eastern and Northern Europe together account for nearly 28% of the regional market in 2024, supported by expanding arable land and government-backed modernization programs. Russia, Poland, and Ukraine show strong fertilizer demand driven by large-scale grain cultivation. It is witnessing rapid adoption of granular nitrogen products to improve soil fertility and yield efficiency. Northern European countries such as Denmark and Sweden promote sustainable and organic farming practices, fostering the use of eco-friendly nitrogen formulations. Investments in advanced production facilities enhance supply reliability and cost competitiveness. The shift toward climate-resilient agricultural inputs strengthens long-term market prospects. Growing international trade partnerships continue to position these regions as emerging fertilizer growth centers within Europe.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

Competitive Analysis:

Major global fertilizer firms dominate the Europe Granular Nitrogen Fertilizers Market through strong production capacities, distribution networks, and R&D investments. Yara International, EuroChem, and K+S lead with broad product portfolios and regional presence. It competes via cost efficiency, advanced formulations, and strategic alliances. Niche players focus on specialty blends and regional markets to secure footholds. Aggressive pricing strategies and differentiation in low-emission products define competition. Players continually invest in technology to reduce production costs and comply with stricter regulations.

Recent Developments:

- In July 2024, PepsiCo Europe and Yara International ASA announced a long-term partnership to provide European farmers with crop nutrition programs aimed at decarbonizing the food value chain. This collaboration includes equipping farmers across multiple countries with Yara’s advanced crop nutrition products and precision farming digital tools, supporting the transition to more sustainable practices in the granular nitrogen fertilizers sector of Europe.

- In August 2025, ICL Group Ltd. (through Boulby Mine in the UK) entered a collaboration with Landhandel Peters in Germany to launch a new fertilizer blending plant tailored for German growers. This facility delivers high-quality controlled-release fertilizers, including granular and specialized nitrogen products, supporting precision and sustainability goals for European farmers.

- In July 2023, Borealis AG completed the sale of its entire nitrogen fertilizer business, including all relevant production assets in Austria, Germany, and France, to AGROFERT, a.s. The deal was valued at EUR 810 million and is set to strengthen AGROFERT’s fertilizer manufacturing capabilities across Europe, ensuring stability in supply and advancing technical innovation in the nitrogen fertilizers market.

- In January 2025, K+S AG debuted its new C:LIGHT potassium and magnesium granular fertilizers, which feature up to 90% lower CO₂ emissions than traditional products, giving K+S significant competitive and sustainability advantages in serving the granular fertilizer market in Europe.

Report Coverage:

The research report offers an in-depth analysis based on segment classification by type, application method, and end-user. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Growth in precision agriculture will boost demand for granular nitrogen solutions

- Development of low-carbon and green nitrogen technologies will reshape offerings

- Increased regulation on emissions will push adoption of advanced formulations

- Stronger government support for sustainable practices will favor fertilizer use

- Expansion of horti and off-season crops will widen application scope

- Integration with digital platforms and IoT will differentiate products

- Trade liberalization may reduce cost barriers for imports and exports

- Infrastructure improvements in Eastern Europe will open growth corridors

- Adoption of fertigation methods will shift demand toward specialized granules

- Rising awareness among farmers about nutrient efficiency will drive uptake