Market Overview

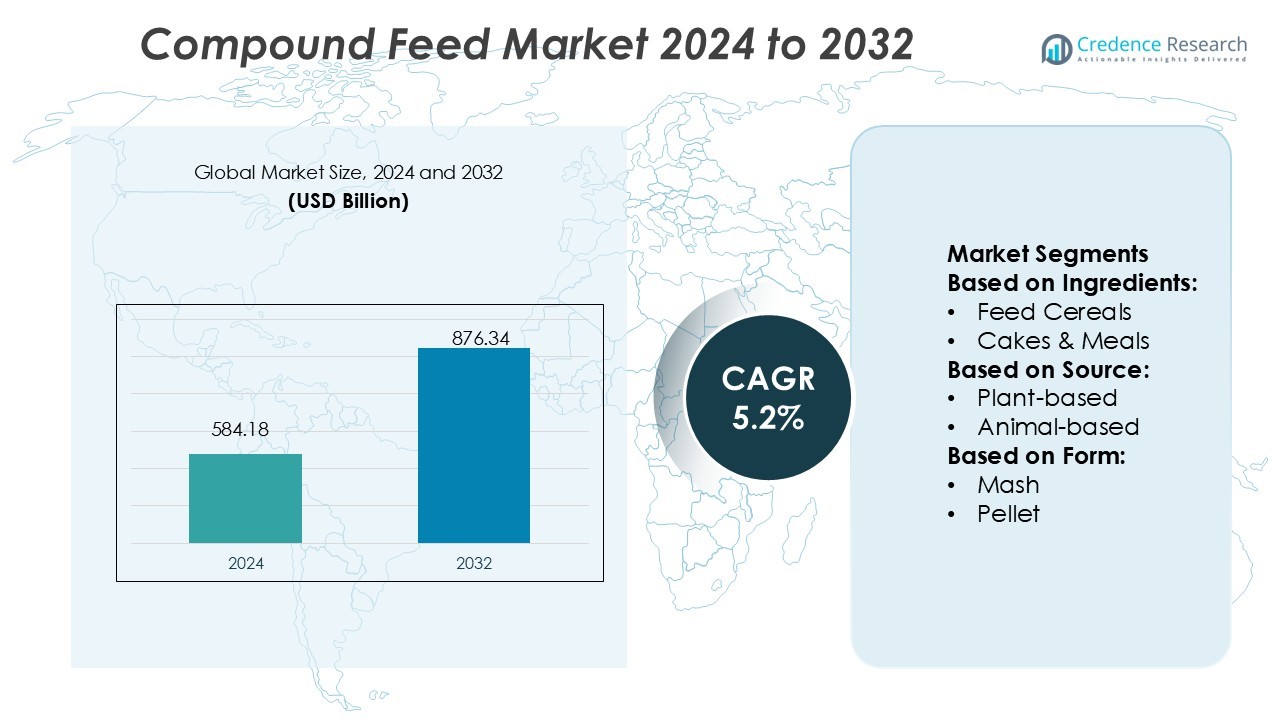

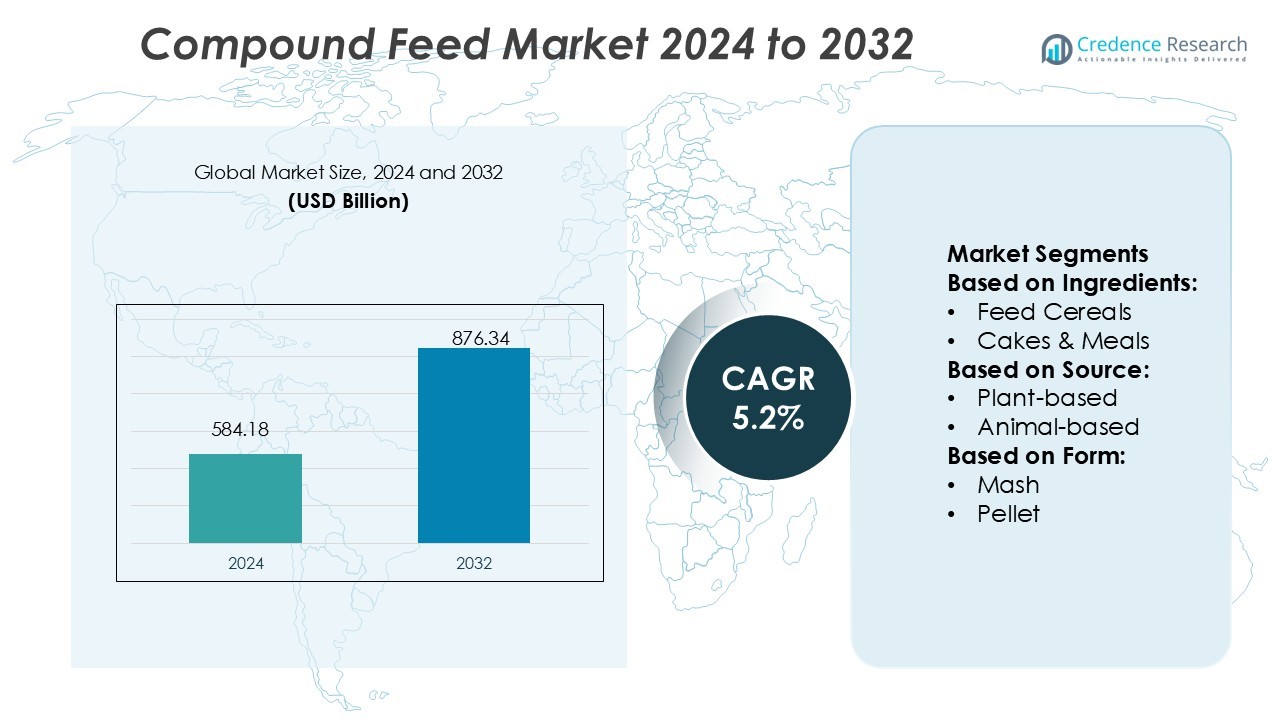

Compound Feed Market size was valued USD 584.18 billion in 2024 and is anticipated to reach USD 876.34 billion by 2032, at a CAGR of 5.2% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Compound Feed Market Size 2024 |

USD 584.18 Billion |

| Compound Feed Market, CAGR |

5.2% |

| Compound Feed Market Size 2032 |

USD 876.34 Billion |

The Compound Feed Market is driven by key players such as Cargill Incorporated, Archer Daniels Midland Company (ADM), Charoen Pokphand Group, Land O’ Lakes, Alltech, Guangdong Haid Group, Roquette, Kent Nutrition Group, Feed One Co., and Indian Broiler Group Pvt Ltd. These companies focus on innovation in feed formulation, sustainable ingredient sourcing, and advanced animal nutrition solutions to strengthen their global presence. Strategic expansions, technological integration, and R&D investments remain central to their growth strategies. Asia-Pacific leads the global Compound Feed Market with a 38% share in 2024, driven by high livestock production, strong government support, and rapid adoption of advanced feed technologies across major economies such as China, India, and Vietnam.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Compound Feed Market was valued at USD 584.18 billion in 2024 and is projected to reach USD 876.34 billion by 2032, registering a CAGR of 5.2% during the forecast period.

- Market growth is driven by rising livestock production and growing demand for high-quality meat, dairy, and aquaculture products worldwide.

- Technological advancements in feed formulation, precision nutrition, and automation are enhancing feed efficiency and reducing production costs.

- Asia-Pacific leads the global market with a 38% share, followed by Europe and North America, supported by large-scale poultry and cattle farming.

- The feed cereals segment dominates with a 43% share due to its high nutritional value and cost-effectiveness, while major players such as Cargill, ADM, and Charoen Pokphand Group focus on sustainable sourcing, R&D investments, and digital feed management to strengthen their global competitiveness.

Market Segmentation Analysis:

By Ingredients

Feed cereals dominated the Compound Feed Market with a 43% share in 2024. This dominance stems from high nutrient density, affordability, and widespread availability of corn, wheat, and barley. The segment’s growth is driven by increasing livestock production and the rising use of fortified cereal blends for better feed conversion efficiency. Cakes and meals follow closely, supported by expanding oilseed processing industries, while supplements and animal by-products contribute to improved animal health and productivity through enhanced nutrient absorption and digestibility.

- For instance, Cargill recently opened a new retail feed facility in Granger, Washington, which can produce and package 120,000 tons of animal feed annually, utilizing advanced systems like AI-based bag sealing assurance, ultra-low tolerance mixing, and full automation across production lines.

By Source

Plant-based feed sources accounted for a dominant 61% share of the Compound Feed Market in 2024. The demand is primarily driven by sustainability goals and the lower cost of plant-derived proteins such as soybean, corn, and wheat bran. These ingredients ensure balanced amino acid content and support efficient livestock weight gain. In contrast, animal-based feeds continue to serve niche segments, providing essential nutrients like omega-3 fatty acids, but face limitations due to fluctuating raw material prices and strict regulatory norms in several regions.

- For instance, Haid Group holds more than 200 patents covering areas like plant protein processing, enzyme hydrolysis, and feed additive technologies, highlighting its innovation in animal nutrition and health.

By Form

Pellet form feed led the market with a 52% share in 2024, supported by its uniform texture, improved digestibility, and ease of storage and transport. The segment’s popularity is growing among commercial poultry and cattle producers due to reduced wastage and consistent nutrient distribution. Mash and crumble forms retain steady demand in small-scale and starter feed applications, where flexibility and affordability are key. The adoption of pelleted feeds is further driven by automated feeding systems that improve operational efficiency in large-scale livestock farms.

Key Growth Drivers

Rising Livestock Production and Meat Consumption

Growing global demand for meat and dairy products is fueling livestock production, directly boosting compound feed consumption. Rising incomes, urbanization, and changing dietary habits in emerging economies are key contributors. Poultry and swine sectors account for major feed demand, while aquaculture feed is gaining momentum. The drive to enhance animal productivity and ensure consistent nutrient intake supports the widespread use of scientifically formulated compound feed across regions.

- For instance, Kent Nutrition Group’s Product Development Center (PDC) sits on almost 800 acres and comprises five species- and life-stage-specific research units, enabling large-scale, controlled feeding trials.

Technological Advancements in Feed Formulation

Innovations in feed formulation, precision nutrition, and enzyme integration are transforming the compound feed industry. Advanced feed additives such as probiotics, amino acids, and enzymes help optimize feed conversion ratios, reducing feed costs. Automation in feed mills and data-driven monitoring systems improve quality consistency and production efficiency. These advancements enable manufacturers to deliver nutrient-balanced feed tailored to specific livestock requirements, enhancing overall animal health and profitability.

- For instance, CP Foods partnered with VEGA in 2024 to install radar sensor systems across 14 feed factories in Thailand, Vietnam, the Philippines, and Cambodia, enabling real-time monitoring of raw material levels in silos to avoid stockouts and overflows.

Government Support and Sustainable Feed Practices

Government policies promoting sustainable livestock farming and feed efficiency are driving market growth. Subsidies for feed production, investments in R&D, and sustainable sourcing initiatives encourage adoption of compound feed. The focus on reducing methane emissions and improving nutrient utilization aligns with environmental goals. Companies are increasingly using eco-friendly ingredients, such as plant-based proteins and insect meal, to meet sustainability standards and consumer expectations for responsible food production.

Key Trends & Opportunities

Shift Toward Functional and Specialty Feed Additives

There is a growing trend toward incorporating functional additives like probiotics, prebiotics, and enzymes to enhance gut health and immunity. Producers are investing in customized formulations for poultry, dairy, and aquaculture to improve performance and reduce antibiotic dependency. The rise of organic and non-GMO feed options also presents opportunities for niche growth. This shift reflects the industry’s move toward precision nutrition and health-focused animal diets.

- For instance, Alltech published a meta-analysis covering 25 studies across 11 countries and 10,307 broiler birds showing that inclusion of their yeast cell wall extract Mycosorb® under mycotoxin stress improved survivability and performance while reducing carbon footprint.

Digitalization and Smart Feed Management

Feed manufacturers are adopting digital tools for production optimization, inventory management, and predictive analytics. IoT-enabled sensors and AI-based systems help track feed quality and animal performance in real time. These technologies reduce resource wastage and enhance operational efficiency. The integration of automation in feed mills, combined with cloud-based monitoring, provides significant opportunities for scaling productivity and ensuring consistent quality across global operations.

- For instance, Givaudan’s Taste & Wellbeing division delivers a large volume of unique natural flavor and functional ingredient formulations, supporting its leadership in the naturals space. The company manages over 300,000 customer briefs and submissions annually across its business units.

Key Challenges

Volatility in Raw Material Prices

Fluctuating prices of raw materials such as corn, soybean, and fishmeal pose major challenges for feed manufacturers. Supply chain disruptions, climate variability, and trade restrictions further intensify cost pressures. These price swings impact profitability and hinder stable feed pricing for farmers. Companies are adopting ingredient diversification and long-term sourcing contracts to mitigate these risks and maintain market stability.

Regulatory Constraints and Environmental Concerns

Stringent feed safety and environmental regulations limit ingredient flexibility and increase compliance costs. Regions like Europe and North America enforce strict controls on antibiotic usage, waste management, and emission levels. Meeting these standards requires continuous investment in sustainable practices and product innovation. Balancing profitability with compliance and sustainability remains a key challenge for compound feed producers worldwide.

Regional Analysis

North America

North America held a 24% share of the global Compound Feed Market in 2024, supported by large-scale livestock farming and strong demand for high-quality meat and dairy products. The United States leads the region with advanced feed manufacturing technologies and widespread adoption of precision nutrition practices. Rising awareness of animal health and sustainable farming further drives feed innovation. Canada and Mexico contribute steadily through expanding poultry and swine production. Growing investments in automated feed mills and nutritional research continue to enhance productivity and competitiveness across the region.

Europe

Europe accounted for a 27% share of the Compound Feed Market in 2024, driven by stringent regulations promoting animal welfare and sustainable agriculture. Major producers such as Germany, France, and the Netherlands dominate regional output. The region focuses heavily on reducing antibiotic use and increasing organic feed adoption. Technological advancements in feed processing and ingredient traceability are strengthening supply chains. Growing demand for specialty feed formulations tailored to dairy cattle and poultry continues to support steady market expansion despite regulatory challenges and fluctuating raw material costs.

Asia-Pacific

Asia-Pacific led the Compound Feed Market with a dominant 38% share in 2024, fueled by rapid growth in livestock and aquaculture production. China, India, and Vietnam are key contributors, driven by urbanization, rising income levels, and growing meat consumption. Feed manufacturers are expanding production capacity and adopting advanced feed formulations to meet diverse nutritional requirements. Government initiatives supporting food security and sustainable farming also strengthen market growth. Expanding poultry and aquaculture industries, combined with rising feed exports, make Asia-Pacific the most dynamic region in the global market.

Latin America

Latin America represented an 8% share of the global Compound Feed Market in 2024, primarily driven by Brazil, Argentina, and Mexico. The region benefits from abundant raw materials, such as soybean meal and corn, making feed production cost-effective. Expanding cattle and poultry farming industries, coupled with growing meat exports, are supporting feed demand. Government incentives for livestock productivity improvement and the adoption of fortified feed formulations further contribute to market growth. However, challenges like limited infrastructure and price fluctuations in feed grains remain key barriers to expansion.

Middle East & Africa

The Middle East & Africa captured a 3% share of the Compound Feed Market in 2024, with increasing investments in modern livestock production. Countries such as Saudi Arabia, South Africa, and Egypt are focusing on improving feed self-sufficiency and reducing import dependency. Rapid population growth and rising meat consumption are key demand drivers. Feed producers are introducing nutrient-enriched formulations to enhance livestock performance in arid conditions. Despite infrastructural limitations and fluctuating feed costs, ongoing investments in sustainable agriculture and feed technology continue to boost regional growth potential.

Market Segmentations:

By Ingredients:

- Feed Cereals

- Cakes & Meals

By Source:

By Form:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Compound Feed Market is characterized by strong competition among leading players including Cargill Incorporated, Guangdong Haid Group, Kent Nutrition Group, Land O’ Lakes, Charoen Pokphand Group, Feed One Co., Alltech, Indian Broiler Group Pvt Ltd, Roquette, and Archer Daniels Midland Company (ADM). The Compound Feed Market is highly competitive, driven by continuous innovation, capacity expansion, and sustainability initiatives. Companies are focusing on optimizing feed efficiency through advanced formulations, digital monitoring, and precision nutrition. The market is witnessing increased investments in automation and data-driven feed production to improve quality control and reduce operational costs. Sustainability remains a key priority, with producers adopting plant-based proteins, eco-friendly additives, and traceable ingredient sourcing. Strategic partnerships, mergers, and acquisitions are common as companies aim to expand their global footprint and strengthen distribution networks. This competitive environment encourages continuous improvement in nutritional value, cost efficiency, and product differentiation.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In July 2025, Cargill, Incorporated, has reached an agreement to sell its Malaysian animal feed subsidiary, Cargill Feed Sdn Bhd, to CAB Cakaran Corporation Berhad.The acquisition enables CAB to integrate feed production into its poultry operations, reducing its dependence on external feed suppliers.

- In March 2025, Indian Poultry Alliance (IPA), a subsidiary of the Allana Group, has acquired Kwality Animal Feeds Pvt. Ltd. for Rs. 300 crore with an additional Rs. 200 crore metric tons of annual pelleting capacity and a 12-state distribution footprint.

- In September 2024, The Hershey Company declared a new addition to its Kit Kat lineup: Kit Kat Vanilla. The brand’s new flavor features crisp wafers enrobed in vanilla-flavored crème. It is now available in standard and king sizes at retailers nationwide.

- In April 2024, according to the company, Glanbia PLC is growing its better nutrition platforms by acquiring Flavor Producers LLC from Aroma Holding Co., LLC. for an initial plus deferred consideration.

Report Coverage

The research report offers an in-depth analysis based on Ingredients, Source, Form and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The compound feed market will expand with growing global demand for meat and dairy products.

- Precision nutrition and smart feed technologies will improve feed efficiency and animal performance.

- Sustainable and plant-based feed ingredients will gain higher adoption across all livestock sectors.

- Investments in automation and digital monitoring will enhance production accuracy and consistency.

- Government initiatives supporting food security and animal welfare will strengthen market stability.

- Rising demand for aquaculture and poultry feed will drive innovation in feed formulations.

- Functional additives such as probiotics and enzymes will replace antibiotic-based growth promoters.

- Strategic collaborations between feed producers and farmers will improve supply chain integration.

- Climate-resilient feed solutions will become a major focus to address raw material volatility.

- Expansion in emerging economies will create new opportunities for local and global feed manufacturers.