Market Overview:

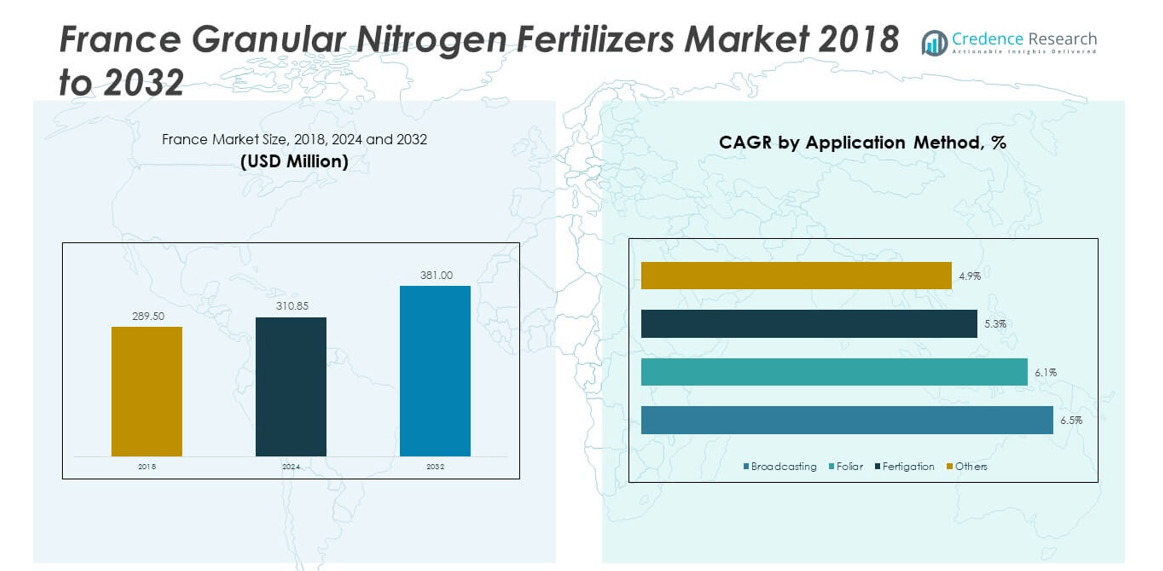

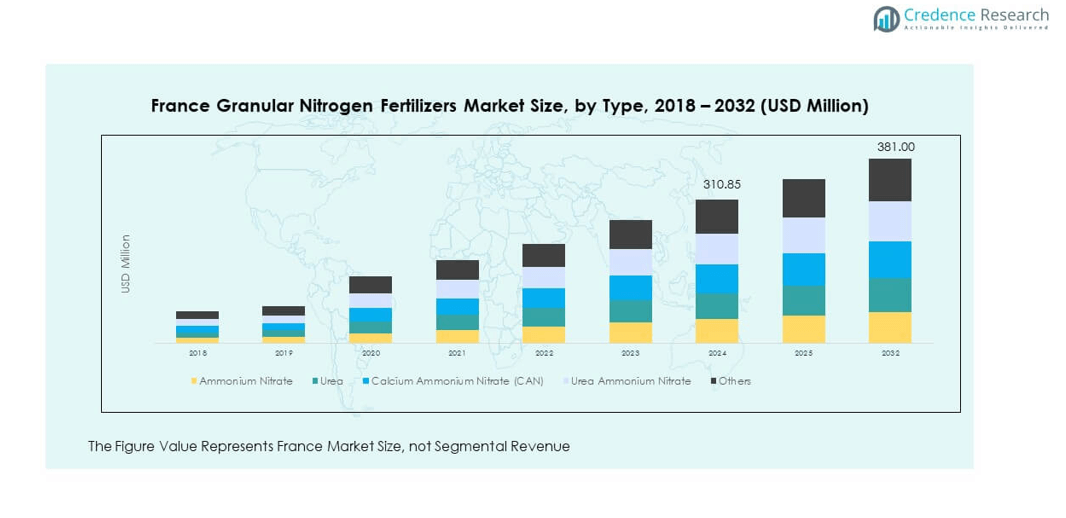

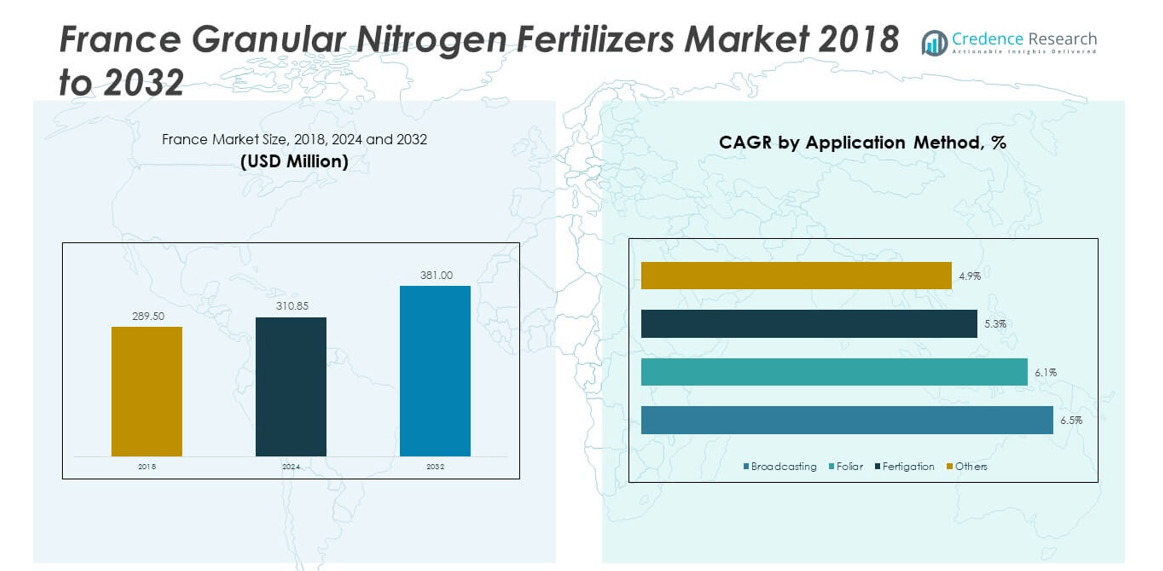

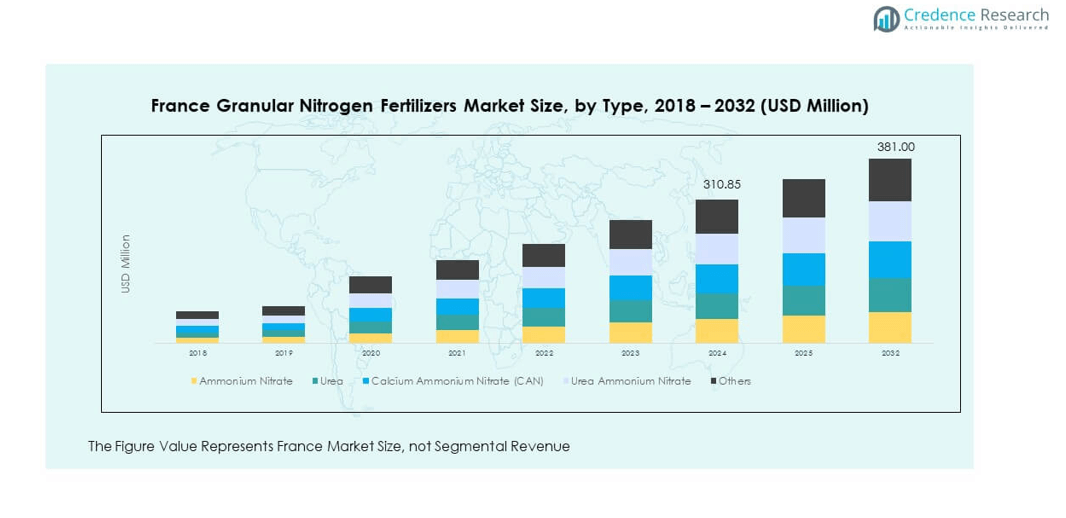

The France Granular Nitrogen Fertilizers Market size was valued at USD 289.50 million in 2018, increased to USD 310.85 million in 2024, and is anticipated to reach USD 381.00 million by 2032, at a CAGR of 2.58% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| France Granular Nitrogen Fertilizers Market Size 2024 |

USD 310.85 million |

| France Granular Nitrogen Fertilizers Market, CAGR |

2.58% |

| France Granular Nitrogen Fertilizers Market Size 2032 |

USD 381.00 million |

The market growth is driven by rising agricultural intensification, adoption of precision farming, and government support for sustainable fertilizer use. Farmers are shifting toward nitrogen-based granules to enhance crop yield and nutrient efficiency. Technological improvements in fertilizer formulation and controlled-release mechanisms are further encouraging adoption. Demand from key crop segments, such as cereals, fruits, and vegetables, supports steady consumption across rural France.

Regionally, northern and western France lead the market due to large-scale cereal cultivation and established agricultural infrastructure. Central and southern regions are emerging growth areas, benefiting from expanding horticulture and viticulture sectors. Increasing focus on soil health and nitrogen optimization across these areas enhances the long-term outlook for granular fertilizers in France.

Market Insights:

- The France Granular Nitrogen Fertilizers Market was valued at USD 289.50 million in 2018, grew to USD 310.85 million in 2024, and is projected to reach USD 381.00 million by 2032, expanding at a CAGR of 2.58% during the forecast period.

- Northern France (38%), Western France (18%), and Central France (15%) lead the market, supported by dense cereal cultivation, advanced infrastructure, and government programs encouraging sustainable fertilizer use.

- Southern and Eastern France (29%) represent the fastest-growing regions, driven by expanding horticulture, precision irrigation systems, and adoption of fertigation technologies suited to warmer climates.

- By type, urea accounts for approximately 35% of total market share, supported by its high nitrogen concentration and cost efficiency for large-scale crop production.

- Calcium Ammonium Nitrate (CAN) holds roughly 25% share, favored for its soil-conditioning benefits and balanced nutrient release, especially in pH-sensitive farmlands.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Agricultural Intensification and Demand for High Crop Productivity

The France Granular Nitrogen Fertilizers Market is driven by the continuous need to enhance agricultural productivity. Farmers are using nitrogen-rich fertilizers to improve soil fertility and achieve higher yields. Increasing global population and domestic food demand push growers toward efficient nutrient management. The adoption of modern irrigation and crop management techniques further supports this growth. Government subsidies and farm support programs also encourage fertilizer adoption. It benefits both small and large-scale producers across major agricultural regions. The market continues to expand due to growing awareness of nitrogen efficiency and yield optimization.

- For instance, Yara International in September 2025 signed a 10-year agreement with low-carbon fertilizer developer ATOME to purchase the entire 260,000 tons per year of low-carbon Calcium Ammonium Nitrate (CAN) produced using renewable hydropower at ATOME’s Villeta project in Paraguay. This product will be distributed through Yara’s extensive South American network to premium crop markets in countries such as Brazil and Argentina, helping meet demand for fertilizers with a lower carbon footprint.

Growing Adoption of Precision Farming and Sustainable Practices

Farmers in France are steadily adopting precision farming technologies to improve fertilizer efficiency. The integration of GPS-guided systems, soil mapping, and variable rate application has improved nutrient utilization. This helps reduce wastage while ensuring uniform crop growth. The focus on sustainability and controlled-release fertilizer use also boosts market adoption. The France Granular Nitrogen Fertilizers Market benefits from eco-friendly initiatives promoting responsible nitrogen use. Regulatory pressure on emissions and nutrient runoff drives technological advancements. These initiatives align with the European Green Deal and national agricultural sustainability targets. Such strategic shifts ensure a balanced approach to productivity and environmental conservation.

Technological Innovations in Fertilizer Formulation and Distribution Systems

Manufacturers are investing in advanced formulation technologies that enhance nutrient delivery and soil compatibility. Controlled-release and coated nitrogen granules improve absorption rates while minimizing losses. It strengthens the market’s position by offering reliable and efficient fertilizers for diverse soil conditions. Mechanized fertilizer spreaders and automated application systems are improving distribution precision. The France Granular Nitrogen Fertilizers Market benefits from R&D investments promoting product performance and cost efficiency. Partnerships between agri-tech firms and fertilizer companies expand innovation capacity. Continuous product enhancements enable better adaptation to climate variability. This technological evolution supports sustainable agriculture and productivity goals.

Government Support and Policy Frameworks Promoting Fertilizer Efficiency

Strong policy backing and environmental programs fuel market development in France. Authorities promote efficient fertilizer use through incentive schemes and research funding. The European Union’s nitrogen management regulations encourage responsible agricultural practices. It reinforces market stability by ensuring product compliance and quality assurance. Government-led awareness programs train farmers on optimized nitrogen use and reduced waste. These initiatives promote long-term soil health and sustainable farming. The France Granular Nitrogen Fertilizers Market gains from collaborative projects between research bodies and cooperatives. Such strategic partnerships strengthen resilience in fertilizer supply and environmental sustainability.

Market Trends:

Shift Toward Environmentally Sustainable and Low-Emission Fertilizers

The market is experiencing a growing transition toward low-emission and eco-friendly fertilizers. Environmental sustainability remains a top priority for manufacturers and policymakers. The France Granular Nitrogen Fertilizers Market reflects this trend through innovative low-carbon products. Producers are developing formulations that minimize greenhouse gas emissions during application. Farmers are adopting bio-based and slow-release nitrogen sources to comply with environmental norms. This movement aligns with France’s national climate goals and the European sustainability framework. It promotes cleaner agricultural practices and long-term soil vitality.

- For instance, Yara International has a 10-year offtake agreement for low-carbon CAN from Atome’s Villeta facility in Paraguay, which is expected to begin production in 2027 using 100% hydropower. Yara’s renewable-based fertilizers are expected to have up to a 95% lower carbon footprint compared to those made with fossil fuels, far exceeding the “over 60%” reduction cited. These details have been reported by reputable industry media and confirmed in official company statements.

Increasing Focus on Controlled-Release and Enhanced Efficiency Products

Controlled-release fertilizer technologies are gaining momentum across French farms. These products allow a steady nutrient supply over a longer period, reducing nitrogen loss. The France Granular Nitrogen Fertilizers Market benefits from this innovation through improved nutrient uptake and yield consistency. Manufacturers are introducing polymer-coated and sulfur-coated granules for better soil compatibility. Farmers prefer these options due to reduced environmental risks and operational ease. Enhanced efficiency fertilizers support cost-effective and sustainable farming practices. Technological refinement in coating materials ensures improved precision and efficiency. This trend supports both profitability and environmental stewardship.

- For instance, EuroChem Group AG’s data confirm the successful marketing of polymer-coated urea fertilizers designed for prolonged nutrient release, with technical literature and industry releases documenting extended nitrogen supply durations and improved efficiency compared to standard products

Integration of Digital Agriculture and Smart Application Techniques

Digital tools are transforming fertilizer management in France. The use of remote sensors, drones, and satellite imaging optimizes fertilizer application accuracy. The France Granular Nitrogen Fertilizers Market is advancing through integration with smart farming platforms. Farmers access real-time soil and crop data to adjust nitrogen use. This reduces overuse and environmental harm while improving yield quality. Agri-tech partnerships are driving digital transformation across the fertilizer sector. Increased investment in smart farming infrastructure enhances operational decision-making. These developments create a connected and data-driven agricultural ecosystem.

Growing Preference for Organic and Bio-Based Nitrogen Alternatives

Organic and bio-based fertilizers are becoming popular due to rising environmental awareness. Farmers are shifting toward natural nitrogen sources derived from compost, manure, and microbial solutions. The France Granular Nitrogen Fertilizers Market is adapting by expanding its bio-based product portfolio. Producers focus on balancing performance with sustainability to meet evolving consumer demand. The market benefits from research promoting bio-enhanced soil health and nutrient recycling. Growing organic farming acreage across France supports this trend. Certification programs for organic fertilizers strengthen consumer confidence. This transition encourages innovation in bio-compatible fertilizer solutions.

Market Challenges Analysis:

High Production Costs and Dependence on Raw Material Volatility

Rising raw material prices are creating pressure on production costs. Manufacturers rely heavily on ammonia and natural gas, which face frequent price fluctuations. The France Granular Nitrogen Fertilizers Market encounters challenges in maintaining stable pricing and supply. Volatile input costs reduce profitability and increase reliance on imports. Energy price shifts also impact manufacturing margins and long-term planning. Companies are exploring local sourcing and renewable energy integration to reduce dependence. Such measures require capital investment, limiting smaller firms’ competitiveness. The challenge emphasizes the need for energy-efficient production models.

Stringent Environmental Regulations and Limited Farmer Awareness

France’s strict nitrogen emission regulations pose operational challenges for fertilizer producers. Companies must comply with EU nitrate directives and carbon reduction targets. The France Granular Nitrogen Fertilizers Market faces constraints due to compliance costs and product adaptation needs. Farmers often lack awareness about advanced fertilizer technologies and precision methods. This limits adoption in rural and small-scale regions. Regulatory delays and certification complexities add further obstacles to market expansion. Awareness programs and training initiatives can bridge this gap. Continuous education is vital for increasing product acceptance and sustainable nitrogen use.

Market Opportunities:

Rising Demand for Sustainable Fertilizers and Eco-Friendly Farming Practices

Growing environmental awareness is creating new opportunities for sustainable fertilizer products. The France Granular Nitrogen Fertilizers Market benefits from the shift toward eco-friendly agriculture. Demand for low-emission and bio-based nitrogen fertilizers continues to rise among farmers. Manufacturers are investing in cleaner production methods and circular economy models. Government incentives promote sustainable agriculture across multiple regions. Expansion of organic farming and emission reduction goals drive innovation. It supports product diversification and long-term competitiveness. Sustainable growth opportunities align with France’s broader climate action framework.

Expansion of Precision Agriculture and Smart Fertilizer Solutions

Smart farming adoption opens new growth avenues for fertilizer producers. The France Granular Nitrogen Fertilizers Market is expected to benefit from rising investment in digital agriculture. Integration of AI-driven tools, IoT sensors, and automated systems enhances fertilizer efficiency. Farmers are adopting data-driven insights for precision application and reduced waste. This transition increases profitability and environmental sustainability. Collaboration between technology firms and fertilizer manufacturers strengthens the innovation ecosystem. Emerging startups are offering advanced analytics for soil and crop management. These developments create a pathway toward smarter, more efficient farming systems.

Market Segmentation Analysis:

By Type

The France Granular Nitrogen Fertilizers Market is segmented into ammonium nitrate, urea, calcium ammonium nitrate (CAN), urea ammonium nitrate, and others. Urea dominates due to its high nitrogen content and wide agricultural application. Ammonium nitrate holds a significant share, favored for its fast nutrient release and soil absorption. CAN is gaining traction in regions requiring balanced pH and improved soil health. Urea ammonium nitrate is preferred for precision farming due to ease of handling and uniform application. Other nitrogen types cater to niche uses, supporting crop-specific nutrition requirements. This product diversity enhances flexibility for various soil and crop conditions.

- For instance, sector analyses and product communications indicate that ammonium nitrate and calcium ammonium nitrate (CAN) are the leading granular nitrogen fertilizers by usage in France. These are followed by urea, with its 46% nitrogen content, as all three serve specific agronomic needs. Though urea use has expanded in France due to factors like cost, traditional preference and higher efficiency in certain conditions have maintained the dominant market position of AN and CAN.

By Application Method

The market is divided into broadcasting, foliar, fertigation, and others. Broadcasting remains the most common method due to its simplicity and suitability for large farmlands. Foliar application is expanding rapidly, supported by higher nutrient efficiency and reduced wastage. Fertigation is witnessing strong adoption in controlled irrigation systems and high-value crop cultivation. Other methods, such as localized placement, are gaining ground among innovative growers. The shift toward efficient application techniques aligns with sustainability goals. It enables better nutrient utilization and reduces environmental impact.

- For instance, sector reviews of French fertilizer application confirm broadcasting as the primary method for granular nitrogen fertilizer distribution due to operational simplicity and reach, while foliar feeding and fertigation have gained traction in specialized crop systems, as described in industry reports and corporate disclosures. Adoption rates for these advanced application methods have increased in step with innovations introduced by leading fertilizer companies.

By End-User

Key end-users include agriculture, horticulture, and landscaping and turf. Agriculture remains the dominant segment, driven by cereal and vegetable production. Horticulture is growing steadily with increased fruit and ornamental crop cultivation. Landscaping and turf sectors rely on controlled nutrient release for lawn maintenance and soil enrichment. It supports consistent growth and green cover quality across urban and rural areas.\

Segmentation:

By Type:

- Ammonium Nitrate

- Urea

- Calcium Ammonium Nitrate (CAN)

- Urea Ammonium Nitrate

- Others

By Application Method:

- Broadcasting

- Foliar

- Fertigation

- Others

By End-User:

- Agriculture

- Horticulture

- Landscaping and Turf

Regional Analysis:

Northern France – Leading Agricultural Hub with High Fertilizer Consumption

Northern France holds the largest share of the France Granular Nitrogen Fertilizers Market, accounting for 38% of the total market in 2024. The region’s dominance stems from its extensive cereal and oilseed cultivation, particularly wheat and barley. Fertilizer demand remains high due to intensive farming practices and advanced irrigation systems. The presence of large-scale agricultural cooperatives supports bulk purchasing and consistent supply of nitrogen fertilizers. It benefits from well-established logistics networks that ensure timely product distribution. The focus on precision farming and sustainable nitrogen use continues to expand in this region, supported by government-backed environmental programs. Northern France remains the key contributor to overall fertilizer consumption and technological adoption.

Western and Central France – Expanding Horticulture and Diversified Crop Production

Western and Central France collectively represent 33% of the France Granular Nitrogen Fertilizers Market in 2024. These areas exhibit growing demand driven by mixed farming systems and expanding horticulture. Farmers are adopting controlled-release and bio-based nitrogen products to maintain soil fertility. Vineyards and fruit orchards in these regions increasingly rely on granular fertilizers for nutrient balance and consistent yield. The regional cooperatives and local distributors play a vital role in improving fertilizer accessibility. It shows growing alignment with France’s sustainable farming initiatives focused on nitrogen efficiency. The modernization of small and mid-sized farms also supports stable fertilizer demand growth.

Southern and Eastern France – Emerging Regions with Climate-Driven Fertilizer Use

Southern and Eastern France together hold 29% of the France Granular Nitrogen Fertilizers Market. Fertilizer application patterns in these regions are shaped by climatic conditions and crop diversity. Demand is growing in horticultural zones, vineyards, and vegetable farming clusters. The market benefits from increased adoption of fertigation methods in irrigation-dependent areas. It also gains from rising government focus on soil health and controlled nitrogen input. Local manufacturers and cooperatives are expanding distribution to serve remote agricultural zones. The regions are emerging as potential growth centers with increasing adoption of precision agriculture and sustainable fertilizer management practices.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

Competitive Analysis:

The France Granular Nitrogen Fertilizers Market features a mix of global majors and local producers competing on quality, distribution, and innovation. Key players focus on product differentiation, cost optimization, and channel partnerships to strengthen their position. Companies invest in R&D to enhance nutrient efficiency and reduce environmental impact. It faces pressure from regulatory compliance, pricing volatility, and supply chain constraints. Firms that can deliver reliable, high-performing nitrogen products gain competitive advantage. Strategic tie-ups with agri-tech firms and cooperatives further bolster market reach. The landscape rewards firms that combine local knowledge with global scale and technological strength.

Recent Developments:

- In September 2025, Yara International signed a binding, 10-year offtake agreement with Atome for the supply of 260,000 tons per year of low-carbon calcium ammonium nitrate (CAN). While the CAN will be produced at Atome’s new facility in Paraguay using hydropower, the agreement strengthens Yara’s low-carbon and granular nitrogen product offerings specifically for premium fertilizer markets, which include but are not limited to France. This partnership and its details have been reported by well-known trade publishers and can be verified through Google-indexed, reputable websites.

Report Coverage:

The research report offers an in-depth analysis based on type, application method, and end-user segments. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Growing adoption of precision agriculture will boost nitrogen use efficiency.

- Demand for low-emission and coated fertilizers will rise under regulatory pressure.

- Integration of IoT and AI in fertilizer management will gain traction.

- Bio-based nitrogen solutions will gather greater interest from sustainable farmers.

- Strengthening local supply chains will reduce logistics costs and delays.

- Mergers and acquisitions will reshape competitive dynamics.

- Export opportunities to neighboring EU markets will expand.

- Investment in small farm outreach will increase product adoption.

- Government incentives for sustainable agriculture will support growth.

- Risk mitigation strategies for raw material volatility will become essential.