Market Overview

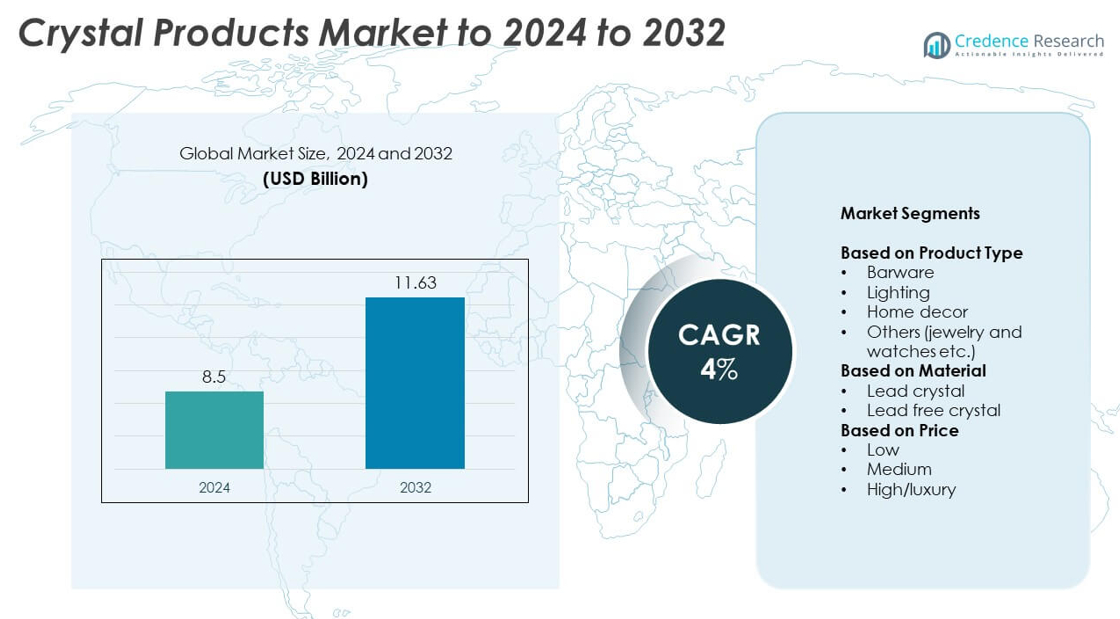

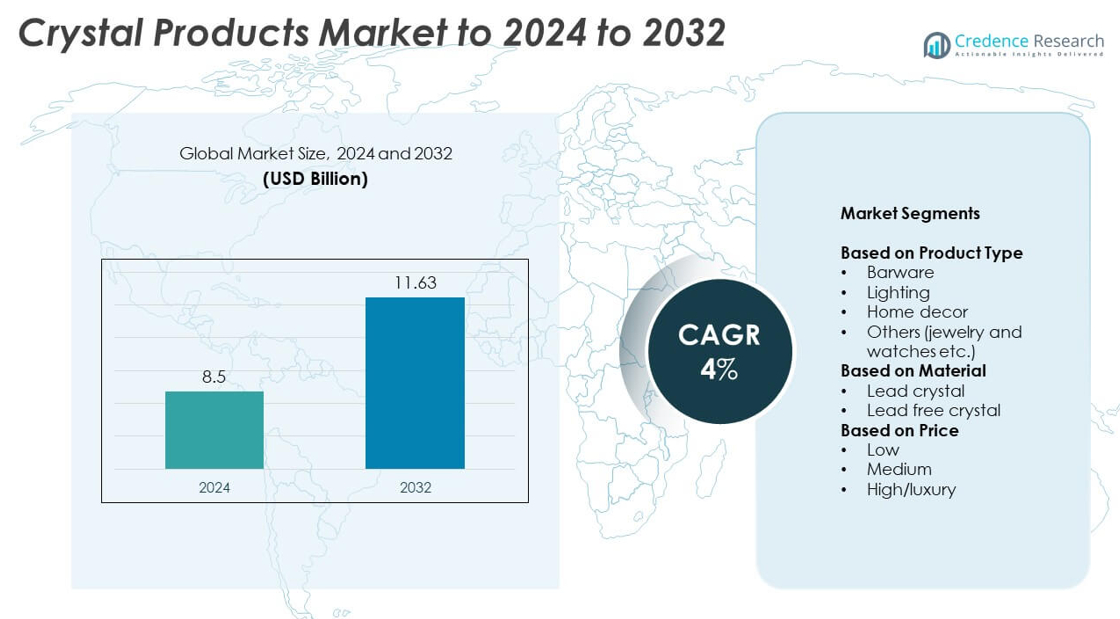

Crystal Products Market size was valued USD 8.5 Billion in 2024 and is anticipated to reach USD 11.63 Billion by 2032, at a CAGR of 4% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Crystal Products Market Size 2024 |

USD 8.5 Billion |

| Crystal Products Market, CAGR |

4% |

| Crystal Products Market Size 2032 |

USD 11.63 Billion |

The crystal products market is led by major players such as Swarovski, Waterford, Baccarat, Lalique, Bormioli Rocco, Dartington Crystal, Lucaris, and Crystal Bohemia. These companies dominate through a combination of craftsmanship, premium quality, and innovative design. They focus on expanding product portfolios across luxury home décor, tableware, and lighting segments to cater to rising consumer demand for aesthetic and personalized items. North America leads the global market with a 34% share, driven by strong purchasing power and a mature luxury retail sector. Europe follows with 29%, supported by its deep-rooted crystal manufacturing heritage and growing tourism-driven demand.

Market Insights

- The crystal products market was valued at USD 8.5 Billion in 2024 and is projected to reach USD 11.63 Billion by 2032, expanding at a CAGR of 4% during the forecast period.

- Growing demand for luxury home décor, gifting products, and premium tableware drives global market expansion, supported by rising disposable incomes and urban lifestyle upgrades.

- The market trends highlight increasing adoption of sustainable, lead-free crystals and personalized designs enhanced through advanced cutting and engraving technologies.

- Competition remains strong as global brands focus on product differentiation, craftsmanship, and online retail expansion, while smaller players face high production costs and limited scalability.

- Regionally, North America leads with a 34% share, followed by Europe with 29% and Asia Pacific with 25%; within product types, barware dominates with 38% of the market due to strong consumer preference for luxury dining and entertainment accessories.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product Type

The barware segment dominated the crystal products market in 2024 with a 38% share. Rising consumer preference for premium glassware in restaurants, hotels, and luxury homes drives this dominance. Growth in gifting culture and increasing household spending on aesthetic tableware further enhance segment expansion. Manufacturers are introducing hand-cut and laser-engraved crystal barware to meet rising demand for customized products. The lighting segment follows, supported by the growing trend of decorative crystal chandeliers in commercial and residential spaces, reflecting luxury and sophistication in interior design.

- For instance, Moser confirms its luxury crystal is lead-free (0%), positioning it as a non-toxic alternative to traditional lead crystal.

By Material

Lead crystal held the largest market share of 56% in 2024, driven by its superior clarity and brilliance. Its popularity in fine dining, luxury lighting, and collectible products continues to support dominance. The material’s refractive properties make it ideal for intricate designs and high-end decorative pieces. However, environmental concerns and consumer shift toward non-toxic materials are driving growth in lead-free crystal products. Manufacturers are adopting sustainable production methods to align with global health and environmental safety standards, gradually increasing the adoption of eco-friendly alternatives.

- For instance, In a 2016 factory visit, it was noted that Riedel’s machine-production lines could make approximately 91,000 pieces per day.

By Price

The high or luxury segment accounted for 47% of the market in 2024, leading the price-based segmentation. Demand for handcrafted crystal pieces, designer collections, and limited-edition decor items drives segment growth. Consumers in premium income groups and hospitality sectors increasingly favor luxury crystal brands for exclusivity and artistic craftsmanship. Additionally, global expansion of luxury retail outlets and online luxury marketplaces has strengthened distribution. While medium-priced products serve the mid-tier consumer base, the luxury segment remains the key growth contributor due to brand prestige and gifting demand.

Key Growth Drivers

Rising Demand for Luxury Home Décor

Growing consumer preference for luxury home décor products drives crystal product adoption. Increasing disposable income and urbanization encourage investment in aesthetic interior designs. Crystal-based lighting, vases, and decorative pieces enhance premium interiors, boosting residential and commercial demand. The expansion of online luxury retail platforms also fuels accessibility and awareness, supporting market penetration across emerging economies.

- For instance, Preciosa Lighting installed its “Pearl Wonder” installation in the Broadway Ballroom at the New York Marriott Marquis. This project consists of eight fixtures, with each being approximately 40 meters in length. These fixtures utilize a total of 4,250 hand-blown, triplex-opal spheres, each measuring 12 centimetres in diameter.

Expanding Hospitality and Gifting Sectors

Hotels, resorts, and event venues increasingly use crystal tableware, lighting, and decorative pieces to elevate guest experience. The hospitality sector’s focus on luxury aesthetics has raised global demand. Similarly, gifting occasions such as weddings, anniversaries, and corporate events promote personalized crystal products. The integration of engraving and customized designs enhances product appeal, strengthening sales in premium retail channels.

- For instance, Waterford’s city-centre facility in Ireland melts over 750 tonnes of crystal annually and serves visitors at its experience centre.

Innovation in Design and Manufacturing Technology

Advanced manufacturing technologies, including laser cutting and 3D crystal engraving, are transforming product appeal. These innovations improve precision, durability, and artistic value, attracting high-end buyers. Brands are focusing on blending traditional craftsmanship with modern techniques to cater to evolving consumer preferences. This technological shift supports consistent quality and enables mass customization, expanding product offerings across global markets.

Key Trends and Opportunities

Shift Toward Sustainable and Lead-Free Crystals

Growing environmental awareness is promoting lead-free crystal production. Consumers are increasingly opting for eco-friendly alternatives that maintain brilliance without harmful materials. Manufacturers are investing in green production processes and recycled materials to align with global sustainability goals. This shift presents a major opportunity for brands to attract health-conscious and environmentally aware customers.

- For instance, RCR Cristalleria Italiana specifies its Eco-Crystal is 100% recyclable, aligning with greener material trends.

Growth of Online and Omnichannel Retailing

Digitalization is reshaping the crystal products market. Premium crystal brands are expanding through e-commerce platforms and omnichannel strategies, enhancing product reach. Online stores offer detailed customization, secure delivery, and wider product visibility. The convenience of digital shopping, coupled with immersive virtual showrooms, strengthens consumer engagement and drives cross-border sales.

- For instance, Daum regularly issues numbered limited editions, such as a centerpiece limited to 125 pieces and vases limited to 375 pieces—supporting customization and exclusivity.

Rising Popularity of Personalized Luxury Products

Consumers increasingly favor unique, custom-designed crystal pieces reflecting personal taste and exclusivity. Brands offering engraving and bespoke options experience higher brand loyalty. This trend is especially strong in corporate gifting and event décor segments. The personalization movement allows manufacturers to charge premium prices while differentiating their collections in a competitive market.

Key Challenges

High Production Costs and Energy Consumption

Crystal production involves complex processes requiring high temperatures and skilled craftsmanship, increasing operational costs. Energy-intensive melting and cutting stages raise production expenses and limit scalability. Small manufacturers struggle to maintain profitability under these conditions. The reliance on skilled labor also increases production lead time, posing a significant cost management challenge.

Rising Competition from Alternative Materials

The market faces increasing competition from glass, acrylic, and ceramic substitutes. These materials offer similar aesthetic appeal at lower prices, attracting cost-sensitive consumers. Innovations in synthetic glass designs also reduce the visual difference between real and imitation crystal. Such competition pressures manufacturers to differentiate through quality, craftsmanship, and branding to sustain market share.

Regional Analysis

North America

North America held a 34% share of the global crystal products market in 2024. The region’s dominance stems from strong consumer preference for luxury home décor and premium dining products. The United States leads due to high purchasing power and an established hospitality industry. Demand for crystal barware and lighting products continues to grow, driven by upscale restaurants and interior design trends. Expanding e-commerce and personalized gifting options further enhance regional sales. Manufacturers are also focusing on sustainable and lead-free crystal variants to align with growing environmental awareness across North American consumers.

Europe

Europe accounted for 29% of the crystal products market share in 2024, driven by a rich tradition of glassmaking and craftsmanship. Countries such as France, Germany, and Italy remain major producers and exporters of luxury crystal goods. The region benefits from a well-established retail network and strong demand for decorative and collectible crystal items. Growth in luxury tourism and hospitality continues to support high-end product sales. European brands are focusing on combining artisanal techniques with modern design trends, maintaining the region’s stronghold in the global premium crystal industry.

Asia Pacific

Asia Pacific captured 25% of the market share in 2024, emerging as one of the fastest-growing regions. Rising disposable incomes and expanding urban lifestyles in China, Japan, and India drive crystal product demand. Growing adoption of luxury home décor and increasing wedding and gifting activities contribute to market expansion. Domestic manufacturers are introducing affordable yet premium-quality crystal goods, making them accessible to middle-income consumers. The growth of online retail channels and a shift toward eco-friendly materials further strengthen the market outlook across the Asia Pacific region.

Latin America

Latin America held an 8% share of the crystal products market in 2024, supported by growing interest in premium interior products. Countries such as Brazil and Mexico are seeing higher consumer spending on home décor and lifestyle goods. The region’s expanding hospitality sector also contributes to increased use of decorative crystal lighting and tableware. However, import dependency and fluctuating economic conditions limit large-scale adoption. Manufacturers are targeting affluent urban consumers and luxury hotels through exclusive retail partnerships to enhance their market presence in this emerging region.

Middle East and Africa

The Middle East and Africa accounted for 4% of the global market share in 2024. Rising investments in luxury hospitality, tourism, and real estate developments drive demand for crystal lighting and decorative accessories. Wealthy consumer segments in the UAE, Saudi Arabia, and South Africa favor high-end crystal pieces for aesthetic interiors. Luxury retail expansion and increased availability of international brands support regional growth. However, the market remains concentrated in premium urban centers. Continued infrastructure development and rising lifestyle spending are expected to support gradual market expansion across the region.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Market Segmentations:

By Product Type

- Barware

- Lighting

- Home decor

- Others (jewelry and watches etc.)

By Material

- Lead crystal

- Lead free crystal

By Price

By Geography

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Competitive Landscape

The crystal products market features prominent players such as Swarovski, Bormioli Rocco, Dartington Crystal, Lalique, Ravenscroft Crystal, Lucaris, Waterford, Baccarat, Anchor Hocking, Saint-Louis, Williams-Sonoma, Crystal Bohemia, Lladro, La Opala, MCM, Asfour Crystal, and NDK. The market is characterized by intense competition, with companies focusing on design innovation, premium quality, and brand differentiation. Manufacturers are investing in advanced production techniques such as precision cutting, 3D engraving, and lead-free compositions to meet evolving consumer preferences. Sustainability, personalization, and craftsmanship remain central to competitive strategies, especially in luxury and gifting segments. Several firms are expanding through e-commerce and omnichannel retailing to strengthen global reach and customer engagement. Collaborations with designers and interior brands enhance aesthetic appeal and diversify product portfolios. Overall, competitive rivalry continues to intensify as global and regional producers emphasize exclusivity, quality, and sustainability to maintain their share in the evolving crystal products industry.

Key Player Analysis

- Swarovski

- Bormioli Rocco

- Dartington Crystal

- Lalique

- Ravenscroft Crystal

- Lucaris

- Waterford

- Baccarat

- Anchor Hocking

- Saint-Louis

- Williams-Sonoma

- Crystal Bohemia

- Lladro

- La Opala

- MCM

- Asfour Crystal

- NDK

Recent Developments

- In 2025, NDK announced the launch of differential output crystal oscillators with frequencies of 156.25 MHz and 312.5 MHz to support next-generation optical communication from 800G to 1.6T.

- In 2024, MCM introduces a limited-edition Swarovski Crystal fragrance with a redesigned bottle featuring about 1,100 hand-applied Swarovski crystals. Only 150 bottles are available globally.

- In 2023, Asfour Crystal showcased its creations at Gewan Island in Qatar, a prominent project in the Middle East.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Material, Price and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for luxury and decorative crystal products will continue to rise in premium households.

- Manufacturers will focus on lead-free and sustainable crystal materials to meet eco regulations.

- Advancements in laser engraving and 3D cutting will enhance design precision and creativity.

- Online retail and virtual showrooms will become major sales channels for global brands.

- Personalized and custom-designed crystal pieces will gain strong traction among consumers.

- Growth in hospitality and tourism sectors will boost use of crystal décor and tableware.

- Partnerships between artisans and designers will expand product innovation and variety.

- Emerging markets in Asia and the Middle East will experience rapid adoption of luxury crystal goods.

- Increased gifting culture will drive steady demand across corporate and personal segments.

- Integration of digital marketing and social media influence will strengthen brand visibility worldwide.