Market Overview

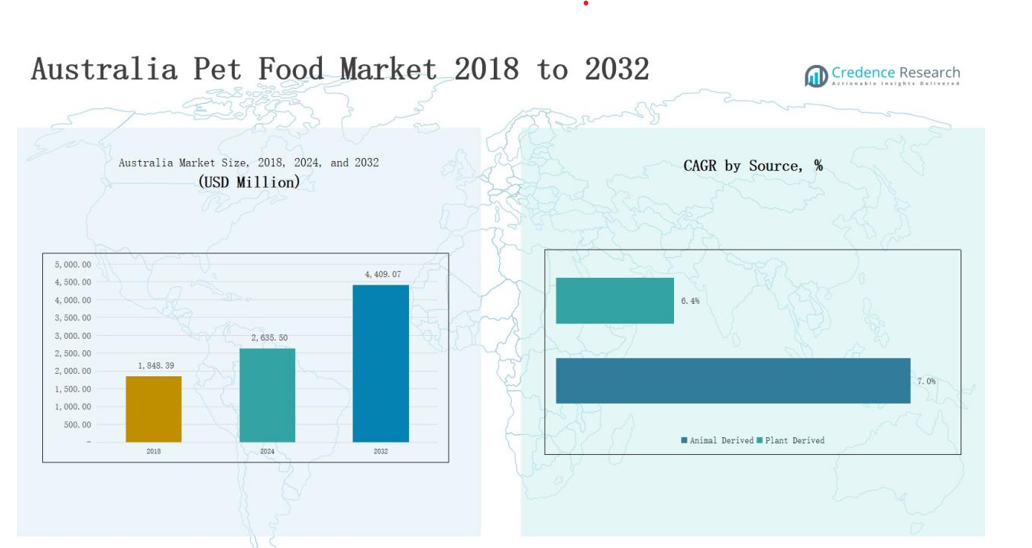

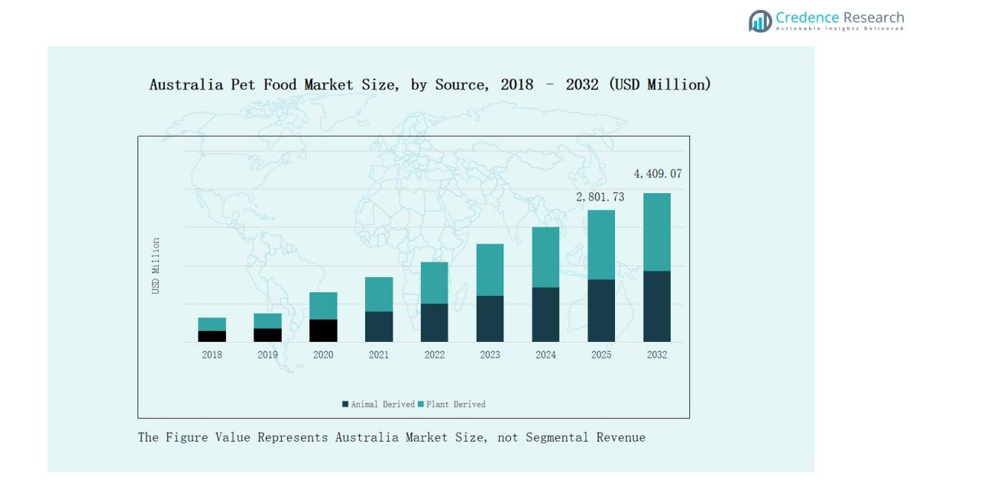

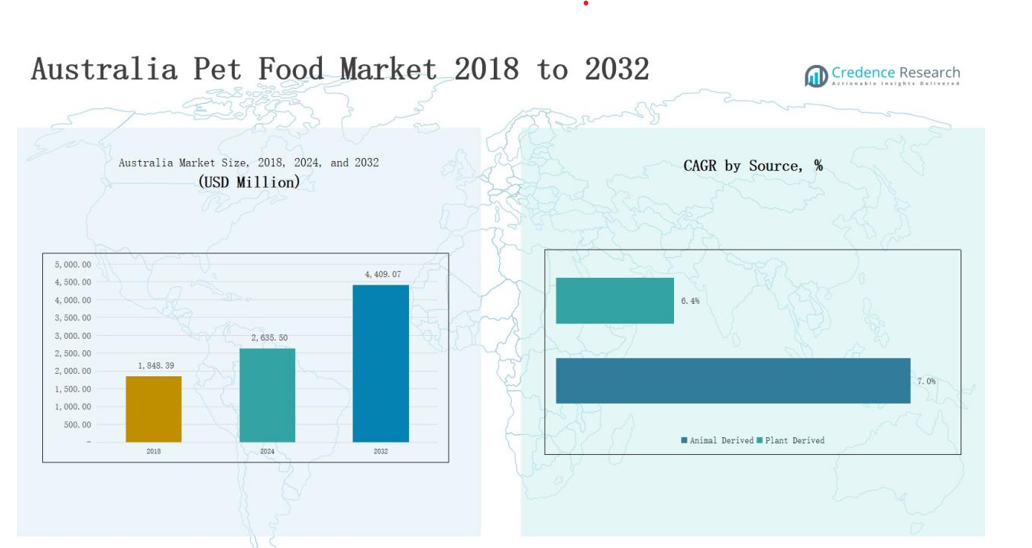

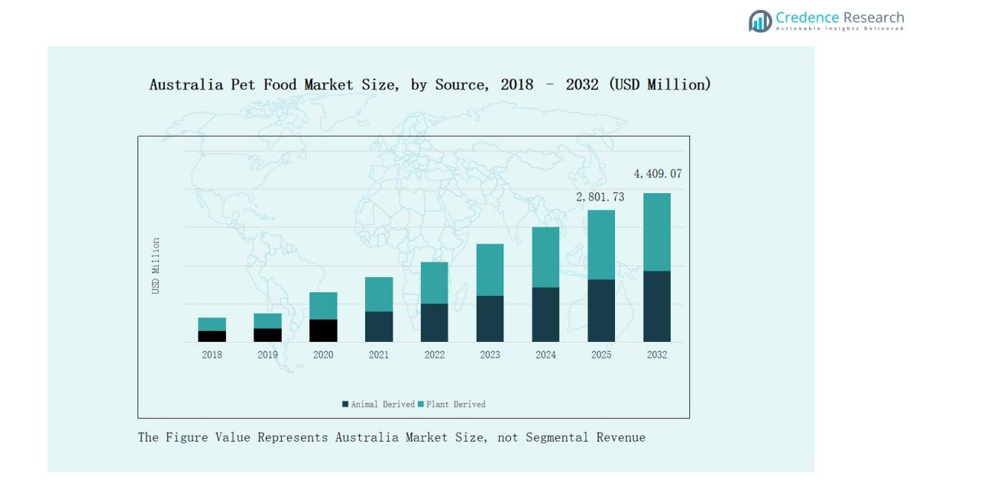

Australia Pet Food Market size was valued at USD 1,848.39 million in 2018, increased to USD 2,635.50 million in 2024, and is anticipated to reach USD 4,409.07 million by 2032, growing at a CAGR of 6.79% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Australia Pet Food Market Size 2024 |

USD 2,635.50 million |

| Australia Pet Food Market, CAGR |

6.79% |

| Australia Pet Food Market Size 2032 |

USD 4,409.07 million |

The Australia Pet Food Market is dominated by leading players such as Mars, Incorporated, Nestlé Purina PetCare, Hill’s Pet Nutrition, and Unicharm Corporation, which maintain strong market positions through premium product portfolios and wide distribution networks. Local manufacturers, including MG Group, Perfect Companion Group Co., and Affinity Petcare, contribute to market growth by offering affordable, regionally sourced, and nutritionally balanced products. These companies focus on innovation, sustainability, and functional formulations to meet evolving consumer preferences. New South Wales emerged as the leading region in 2024, capturing a 29% market share, driven by high pet ownership, premiumization trends, and advanced retail infrastructure.

Market Insights

- The Australia Pet Food Market was valued at USD 1,848.39 million in 2018 and is projected to reach USD 4,409.07 million by 2032, growing at a CAGR of 6.79%.

- Dry pet food led the market in 2024 with a 54% share, driven by convenience, affordability, and increasing demand for nutrient-enriched kibbles among dog and cat owners.

- Animal-derived products dominated with a 63% share due to high protein content, better digestibility, and strong consumer preference for traceable, ethically sourced ingredients.

- Dog food remained the largest pet type segment in 2024, capturing 59% of the market, supported by high dog ownership and rising demand for breed-specific, fortified diets.

- New South Wales emerged as the leading region with a 29% market share, supported by urban pet ownership, premiumization trends, and advanced retail and online distribution networks.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

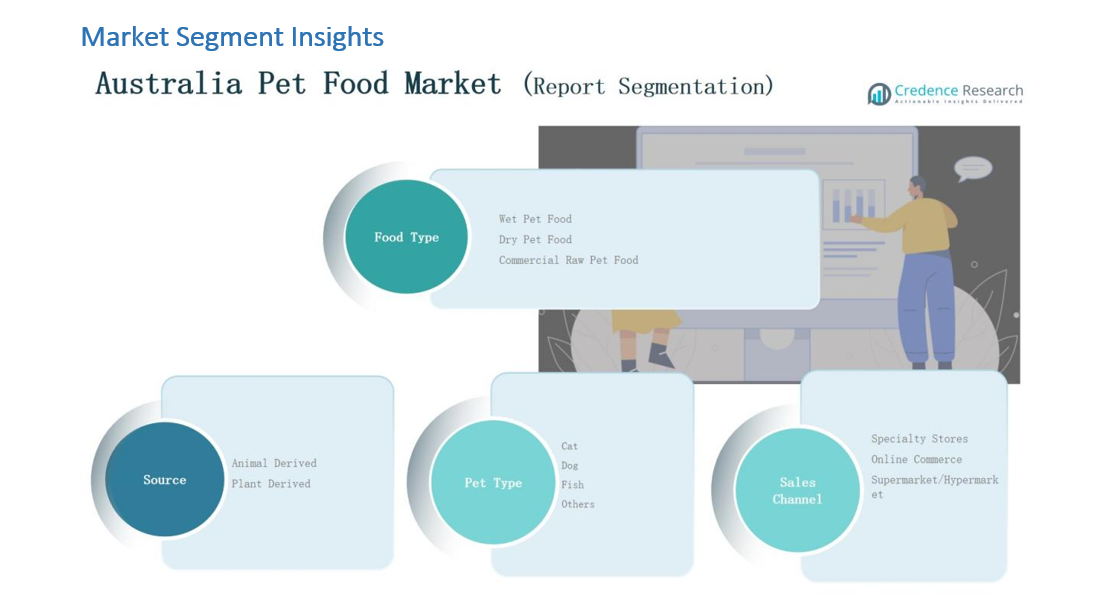

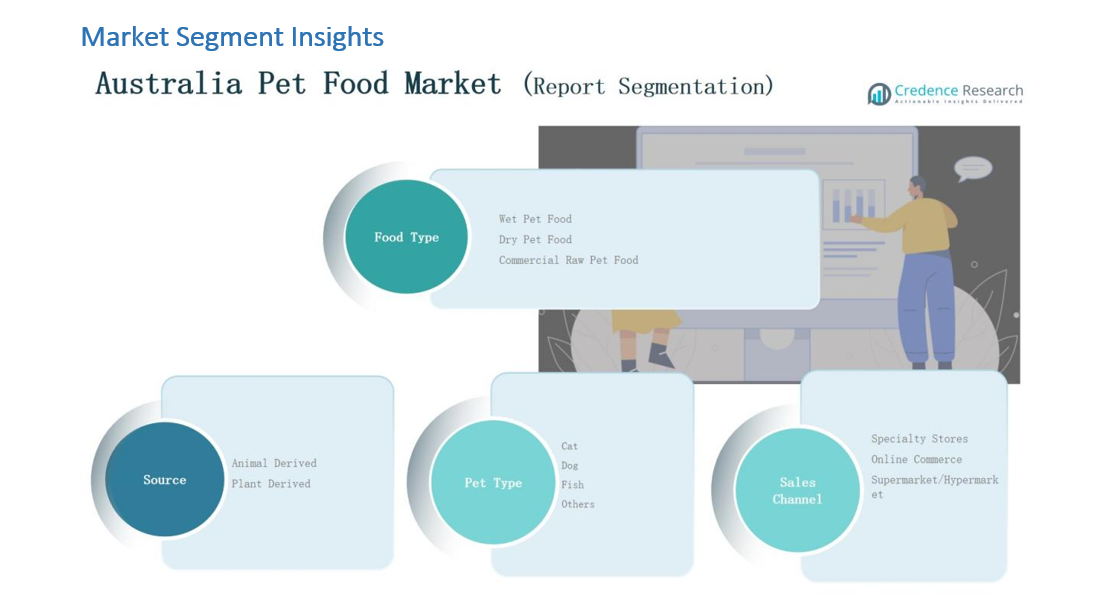

Market Segment Insights

By Food Type

Dry pet food dominated the Australia Pet Food Market in 2024 with a 54% share. Its strong adoption stems from easy storage, long shelf life, and cost efficiency for pet owners. High demand among busy households and growing preference for convenient feeding options strengthen its position. Increasing production of nutrient-enriched dry kibbles and brand innovation in flavor and formulation continue to drive segment growth, especially among dog and cat owners seeking balanced daily diets.

- For instance, Mars Petcare Australia introduced its Advance Healthy Weight Dog Kibble formulated with controlled calorie levels and natural fibers to address obesity in pets.

By Source

Animal-derived pet food led the Australia Pet Food Market in 2024, accounting for a 63% share. The dominance results from high protein content, better digestibility, and natural palatability preferred by pets. Expanding use of poultry, beef, and fish-based ingredients enhances nutritional appeal. Manufacturers increasingly promote traceable, ethically sourced animal proteins, aligning with consumer demand for quality and transparency. Growth in premium and grain-free product categories further supports this segment’s sustained market leadership.

By Pet Type

Dog food remained the leading category in the Australia Pet Food Market in 2024, capturing a 59% share. The dominance is supported by the country’s high dog ownership rate and spending on premium canine nutrition. Pet owners favor specialized formulations for different breeds and life stages, driving demand for fortified and high-protein diets. Growing awareness of pet wellness, coupled with availability of customized and vet-recommended products, continues to strengthen dog food’s market position.

- For instance, Royal Canin introduced its Breed Health Nutrition range, offering tailored dry food blends with adjusted protein and micronutrient levels for popular breeds such as Labradors and Border Collies.

Key Growth Drivers

Rising Pet Humanization and Premiumization

Pet owners in Australia increasingly treat pets as family members, fueling demand for high-quality food. This shift drives spending on premium, natural, and organic pet food brands. Consumers seek products offering better nutrition, functional benefits, and human-grade ingredients. Premiumization trends also extend to customized diets and veterinarian-formulated recipes. The growing influence of emotional attachment and lifestyle integration further supports market expansion across both urban and suburban households.

- For instance, Ivory Coat offers a grain-free pet food range made with natural ingredients and no artificial preservatives, colors, or flavors, catering to pets needing superior nutrition and health benefits.

Expanding Online and Specialty Retail Channels

The rapid growth of online platforms and specialty pet stores enhances accessibility to diverse product lines. E-commerce adoption allows consumers to explore tailored, subscription-based, and imported pet food brands conveniently. Pet retailers invest in digital marketing and direct-to-consumer models to strengthen loyalty and brand recognition. The surge in mobile app usage and online promotions further drives sales growth, particularly for premium and wellness-focused pet food products in Australia.

- For instance, Woolworths has partnered with specialty pet food brands to strengthen its direct-to-consumer model, using online platforms to drive engagement and sales growth in premium pet food segments across Australia.

Increasing Focus on Health and Functional Nutrition

Australian consumers are prioritizing pet wellness through balanced and functional nutrition. The demand for products addressing digestion, immunity, and coat health continues to grow. Manufacturers innovate with ingredients like probiotics, omega fatty acids, and antioxidants. Rising veterinary awareness encourages owners to choose science-backed formulas. This health-oriented shift expands product diversity and fosters higher market value within both dry and wet food categories.

Key Trends & Opportunities

Growth of Sustainable and Ethical Pet Food Products

Consumers are increasingly drawn to pet food brands emphasizing sustainability, traceability, and eco-friendly sourcing. The adoption of recyclable packaging, plant-based proteins, and low-carbon manufacturing methods is rising. Ethical concerns over animal welfare and environmental footprint push manufacturers toward transparency in ingredient sourcing. This creates opportunities for companies offering certified, cruelty-free, and sustainable pet food alternatives in the Australian market.

- For instance, Open Farm, newly introduced in Australia, ensures all meat and animal products meet Certified Humane Standards, auditing every partner farm for humane animal care and sustainable practices, and partners with TerraCycle for the first pet food bag recycling program in the country.

Innovation in Customized and Functional Pet Diets

Personalized nutrition is gaining traction as pet owners seek targeted dietary solutions. Brands are developing age-, breed-, and health-specific products supported by digital nutrition tools and data insights. Functional diets with added supplements like glucosamine or taurine attract health-conscious consumers. This trend opens strong growth potential for manufacturers offering tailored meal plans through online platforms and subscription-based models.

- For instance, PawCo Foods partnered with Harvard’s Data Analytics Group in 2025 to enhance its AI-powered platform for creating highly customized canine nutrition plans, reflecting a growing trend toward precision in pet diet formulation.

Key Challenges

Rising Ingredient and Production Costs

Volatile prices of meat, grains, and essential additives significantly affect manufacturing margins. Import dependence for certain raw materials adds further cost pressure. Companies face difficulty maintaining affordability without compromising product quality. Managing logistics and inflationary trends remains critical to sustaining profitability across the pet food supply chain in Australia.

Increasing Market Competition and Brand Saturation

The Australian pet food market faces growing competition from international and domestic players. Numerous premium and private-label brands compete on quality, price, and innovation. Differentiating products amid similar claims becomes challenging. Smaller manufacturers struggle to maintain shelf visibility and distribution reach against established market leaders with broader portfolios.

Regulatory Compliance and Quality Standards

Strict safety, labeling, and nutritional regulations create operational challenges for producers. Ensuring compliance with Australian and international standards requires regular testing and documentation. Frequent updates in pet food safety laws increase production complexity. Manufacturers must invest in quality control systems and traceability frameworks to maintain market credibility and consumer trust.

Regional Analysis

New South Wales

New South Wales led the Australia Pet Food Market in 2024 with a 29% share. The state’s dominance is driven by high urban pet ownership and strong consumer preference for premium products. Sydney’s concentration of affluent households supports spending on organic and specialized diets. It benefits from advanced retail networks, online penetration, and product availability. Growing awareness of pet health and local manufacturing expansion continue to strengthen the region’s market position across both dry and wet food categories.

Victoria

Victoria accounted for a 25% share of the market in 2024, supported by rising pet adoption and lifestyle changes. Melbourne’s growing pet-friendly culture boosts demand for nutritionally rich and premium pet foods. The presence of regional manufacturing facilities ensures steady supply and competitive pricing. Local retailers emphasize wellness-focused products, enhancing customer loyalty. It continues to witness growing investment in sustainable and natural ingredient formulations, aligning with evolving consumer expectations.

Queensland

Queensland captured a 19% share of the market in 2024, driven by the state’s expanding pet population and outdoor lifestyle. Higher disposable incomes and increasing awareness of animal nutrition support steady growth. The availability of local brands offering regionally sourced ingredients boosts trust among consumers. It benefits from e-commerce expansion and greater rural market penetration. Growth in premium and grain-free product categories continues to drive its long-term demand potential.

Western Australia

Western Australia represented a 15% share in 2024, with Perth serving as a key consumption hub. Urbanization, along with a steady rise in pet ownership, supports strong market expansion. Consumers prioritize convenience-oriented and health-specific food products. It also benefits from the presence of emerging distributors and online sales platforms. The growing focus on sustainable packaging and regionally produced ingredients strengthens consumer engagement and brand preference.

South Australia and Others

South Australia and other smaller territories collectively held an 12% share in 2024. These regions are witnessing gradual growth driven by increasing awareness of pet nutrition. Expanding access to premium products through retail chains supports adoption. Pet ownership growth across suburban and semi-rural areas strengthens market participation. It continues to gain traction from promotional activities, private-label introductions, and rising veterinary recommendations for balanced nutrition solutions.

Market Segmentations:

By Food Type

- Wet Pet Food

- Dry Pet Food

- Commercial Raw Pet Food

By Source

- Animal Derived

- Plant Derived

By Pet Type

By Sales Channel

- Specialty Stores

- Online Commerce

- Supermarket/Hypermarket

By Regon

- New South Wales

- Victoria

- Queensland

- Western Australia

- South Australia

- Others

Competitive Landscape

The Australia Pet Food Market is highly competitive, characterized by the presence of global leaders and strong domestic brands. Key companies such as Mars, Incorporated, Nestlé Purina PetCare, Hill’s Pet Nutrition, and Unicharm Corporation dominate through established distribution networks and broad product portfolios. These players focus on premiumization, innovation, and sustainability to strengthen brand loyalty. Local producers such as MG Group and Perfect Companion Group Co. emphasize affordability and regionally sourced ingredients to attract value-conscious consumers. Companies increasingly invest in R&D to develop functional and breed-specific formulations that meet growing pet wellness trends. E-commerce and specialty retail expansion have intensified competition, driving strategic partnerships and private-label offerings. The market continues to evolve toward natural, grain-free, and customized nutrition segments, prompting players to adopt advanced packaging, marketing, and transparency initiatives to sustain growth and market leadership across the Australian pet food sector.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Players

- Unicharm Corporation

- Mars, Incorporated

- Nestlé Purina PetCare

- Hill’s Pet Nutrition

- General Mills, Inc.

- Jeil Feed

- United Petfood

- Landini Giuntini S.p.A.

- Affinity Petcare

- MG Group

- Perfect Companion Group Co.

- Other Key Players

Recent Developments

- In July 2024, Real Pet Food Co. launched Billy + Margot Insect Single Protein + Superfoods Australia’s first pet food using black soldier fly (BSF) protein, after securing the nation’s first import permit for BSF meal.

- On February 19, 2025, Colgate-Palmolive acquired Care TopCo Pty Ltd, the owner of Prime100, integrating it into its Hill’s Pet Nutrition division to enter Australia’s fresh pet food segment.

- In October 2024, Mars Petcare announced that its Wodonga facility would become Australia’s first large-scale pet food plant powered entirely by renewable steam and electricity by 2026.

Report Coverage

The research report offers an in-depth analysis based on Food Type, Source, Pet Type, Sales Channel and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for premium and organic pet food will continue to rise across urban regions.

- Online retail and subscription-based pet food delivery will expand rapidly.

- Manufacturers will invest more in sustainable sourcing and recyclable packaging.

- Growth in functional and health-focused formulations will drive product innovation.

- Private-label pet food brands will gain stronger presence in supermarkets.

- Local production will increase to reduce dependence on imported raw materials.

- Customized and breed-specific diets will attract health-conscious pet owners.

- Partnerships between pet food companies and veterinary clinics will strengthen brand credibility.

- The popularity of plant-based and alternative protein pet food will grow steadily.

- Marketing focused on transparency and ingredient traceability will shape consumer loyalty.